Taxes for an Americans Living in South Korea: U.S. Expat Guide 2025

Moving to South Korea is an exciting adventure, but as a U.S. citizen, it comes with unique tax responsibilities. One important aspect to consider is your income tax liabilities, especially in the context of the Alternative Minimum Tax (AMT) system in South Korea.

Even though you’re living abroad, the U.S. still requires you to report your income and file an annual tax return. On top of that, you may also have tax obligations in South Korea.

U.S. federal tax obligations for expats

As a U.S. citizen, you’re required to report your worldwide income to the IRS, no matter where you live. Understanding and managing your tax bill is crucial for U.S. expats in South Korea to stay compliant and help minimize tax obligations.

While this might sound overwhelming, there are several tax benefits available to expats that can significantly reduce or eliminate your U.S. tax liability.

Overview of worldwide income

The U.S. tax system mandates that citizens and resident aliens report all income from global sources. This includes:

- Employment Income: Salaries, wages, bonuses, and commissions earned in South Korea or any other country.

- Self-Employment Income: Earnings from freelance work or business operations conducted abroad.

- Investment Income: Interest, dividends, capital gains, and rental income from both U.S. and foreign sources.

Regardless of where the income is earned or where you reside, it must be reported to the Internal Revenue Service (IRS).

Filing requirements and thresholds

The requirement to file a U.S. tax return depends on your filing status, age, and gross income. For the tax year 2024, the thresholds are as follows:

- Single Filers: Must file if gross income is at least $13,850.

- Married Filing Jointly: Must file if combined gross income is at least $27,700.

- Married Filing Separately: Must file if gross income is at least $5.

- Head of Household: Must file if gross income is at least $20,800.

These thresholds are subject to annual adjustments for inflation. It’s crucial to verify the current year’s thresholds so you stay compliant with your U.S. filing obligations.

Key tax exclusions and credits

To alleviate the burden of double taxation, the IRS provides several provisions:

Foreign Earned Income Exclusion (FEIE)

The FEIE allows qualifying U.S. expats to exclude a certain amount of foreign-earned income from U.S. taxation. For 2023, this exclusion amount is up to $126,500.

To qualify, you must meet one of the following tests:

- Physical Presence Test: You were physically present in a foreign country for at least 330 full days during a 12-month period.

- Bona Fide Residence Test: You are a bona fide resident of a foreign country for an uninterrupted period that includes an entire tax year.

To claim the FEIE, file Form 2555 with your U.S. tax return.

Foreign Tax Credit (FTC)

The FTC lets you offset U.S. taxes by claiming a dollar-for-dollar credit for income taxes paid to South Korea. This can help reduce your income tax liability by claiming credits for taxes paid to South Korea.

This is especially helpful if South Korean taxes are higher than U.S. taxes. To claim the FTC, file Form 1116 with your return.

Foreign Housing Exclusion

If you incur housing expenses while living abroad, you may qualify for the Foreign Housing Exclusion. This allows you to exclude certain housing costs from your income, provided they exceed a base amount. Eligible expenses include rent, utilities (excluding telephone), and residential parking.

The exclusion is subject to limitations based on the location and the number of qualifying days. To claim this exclusion, complete Form 2555 along with your tax return.

Example: If you earn $90,000 in South Korea and pay $20,000 in rent, you may be able to exclude your entire income using the FEIE and the Foreign Housing Exclusion.

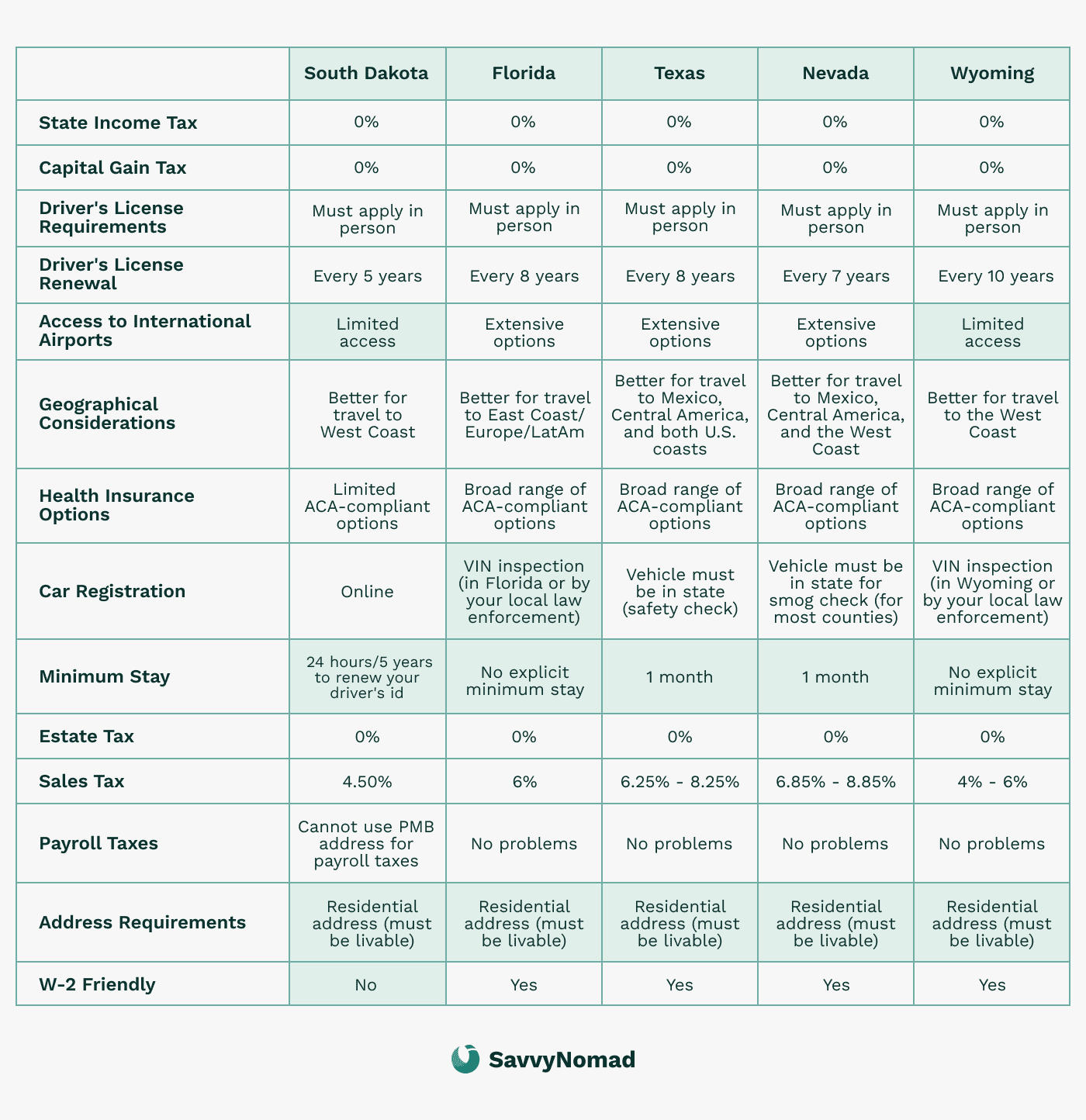

State tax obligations for the U.S. expats in South Korea

While living in South Korea, your U.S. federal tax obligations don’t go away, but what about state taxes?

For some U.S. expats, state taxes can still be an issue depending on where you lived before moving abroad. Some states may continue to consider you a resident for tax purposes unless you take specific steps to sever ties. Here’s what you need to know to manage state tax obligations while living in South Korea.

Determining state domicile

State tax obligations depend on whether your previous state of residence considers you a tax resident. Generally, your state of domicile—your permanent home—determines whether you owe state taxes. If you’ve moved to South Korea but still maintain strong ties to your former state, such as owning property or holding a driver’s license, you may still be considered a tax resident.

To avoid ongoing state tax obligations, it’s often necessary to formally sever ties with your previous state of residence.

Here’s a breakdown of states by tax treatment:

States with no tax on worldwide income for non-residents

These states provide favorable tax treatment for expats, as they do not impose taxes on global income if you can establish non-resident status:

- Colorado

- Connecticut

- Delaware

- Massachusetts

- Minnesota

- Missouri

- North Dakota

- Oregon

- Pennsylvania

- Virginia

- West Virginia

Expats from these states may not need to take significant steps to maintain their non-resident status once they relocate. This group of states offers considerable savings by not taxing worldwide income, making them favorable options for expats.

States that tax worldwide income but offer FEIE

These states tax worldwide income but provide some relief to expats by allowing a Foreign Earned Income Exclusion (FEIE). For the 2024 tax year, the FEIE lets expats exclude up to $126,500 of foreign-earned income from state income tax.

- Alabama

- Arizona

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Maine

- Michigan

- Ohio

- Oklahoma

- Rhode Island

- South Carolina

- Utah

- Vermont

While these states tax global income, expats can reduce their tax liability with the FEIE, which allows them to exclude a significant portion of their foreign earnings.

States that tax worldwide income with no FEIE

These states tax worldwide income but do not provide a Foreign Earned Income Exclusion, resulting in higher potential tax burdens for expats, as there is no mechanism to offset foreign-earned income:

- Arkansas

- Indiana

- Kentucky

- Louisiana

- Maine

- Maryland

- Mississippi

- Montana

- Nebraska

- New Mexico

- North Carolina

- Wisconsin

Expats domiciled in these states face more significant tax liabilities on their global income due to the lack of FEIE, which makes establishing domicile elsewhere more appealing.

States with the highest tax burden for expats

Some states impose the most stringent tax policies on expats, including high income tax rates and no exclusions for foreign-earned income. If you’re domiciled in one of these states, relocating your domicile to a more tax-friendly state can lead to substantial savings.

These states have high income tax rates and tax worldwide income with no exclusions, making them the least favorable for expats in terms of tax savings.

Steps to reduce state tax obligations

If you plan to avoid state tax obligations, especially from states that tax worldwide income without providing relief, consider these steps:

- Establish domicile in a tax-friendly state: Moving your official residence to a state with no income tax, like Florida, Nevada, Texas, or South Dakota, can significantly reduce your tax burden. Establishing domicile in a tax-friendly state can significantly reduce your tax bill.

- Update official documents: Cancel voter registration, update your driver’s license, and transfer financial accounts to reflect your new domicile.

- File a final tax return in your previous state: This signals the end of your tax residency and helps prevent future state tax liabilities.

Additional U.S. reporting requirements – FATCA and FBAR

As a U.S. citizen living in South Korea, reporting your income to the IRS is only part of your tax responsibilities. If you hold foreign financial assets, you may also need to comply with FATCA (Foreign Account Tax Compliance Act) and FBAR (Foreign Bank Account Report) requirements. These rules are designed to help the U.S. government monitor foreign accounts and promote proper tax reporting.

FATCA (Foreign Account Tax Compliance Act)

The Foreign Account Tax Compliance Act, or FATCA, was introduced to help the IRS prevent tax evasion by U.S. citizens using foreign accounts. FATCA requires U.S. taxpayers to report certain foreign assets to the IRS. Here’s what you need to know about FATCA and its requirements:

Who needs to file under FATCA?

If you have foreign assets that exceed certain thresholds, you’ll need to report them on Form 8938, which is submitted along with your regular tax return. For single filers living abroad, the threshold is $200,000 on the last day of the tax year or $300,000 at any point during the year. For married couples filing jointly, the thresholds are doubled.

What needs to be reported?

Reportable assets under FATCA include foreign bank accounts, investment accounts, foreign stocks, and even certain pensions. Generally, any financial assets held outside the U.S. should be reviewed to determine if they need to be reported.

How to file FATCA (form 8938?

If you meet the reporting threshold, you’ll complete Form 8938 and submit it with your regular tax return (Form 1040). The form requires details like account numbers, maximum account values, and the financial institution’s location.

FBAR (Foreign Bank Account Report)

The Foreign Bank Account Report (FBAR) is another requirement for U.S. citizens with overseas accounts. While FATCA applies based on the value of financial assets, the FBAR requirement is specifically tied to foreign bank accounts. Here’s a breakdown:

Who needs to file FBAR?

If the combined balance of all your foreign bank accounts exceeds $10,000 at any point during the year, you’re required to file an FBAR. This rule applies even if you just temporarily crossed the $10,000 threshold. For instance, if you have two accounts—one with $5,000 and another with $6,000—you would need to file an FBAR, as the combined balance is over $10,000.

How to file the FBAR (fincen form 114)?

The FBAR is filed separately from your tax return and is submitted online through the Financial Crimes Enforcement Network (FinCEN). The form, FinCEN Form 114, requires you to report details about each foreign account, including the bank name, account number, and maximum balance during the year.

Important deadlines and penalties

The FBAR filing deadline is April 15, but there is an automatic extension until October 15 for those who miss the initial deadline. Be mindful of FBAR filing, as the penalties for not reporting eligible accounts can be severe, with fines starting at $10,000 for each unreported account.

Understanding the difference between FATCA and FBAR

While FATCA and FBAR both aim to provide the IRS with information about foreign financial accounts, they have distinct differences:

- Different thresholds: FATCA requires reporting if your foreign assets exceed $200,000 as a single filer, while FBAR applies if the total balance in all foreign accounts exceeds $10,000.

- Different filing locations: FATCA reporting (Form 8938) is filed with your federal tax return, whereas the FBAR is filed separately through FinCEN.

- Types of assets reported: FATCA requires reporting a broader range of foreign financial assets, while FBAR focuses only on foreign bank accounts.

Why do FATCA and FBAR matter for U.S. expats?

Failing to file FATCA and FBAR can result in significant penalties, so it’s essential to understand whether you’re required to report these assets. While it may seem like an extra step, filing these forms can help you stay compliant with IRS regulations and avoid unnecessary fines.

If you have foreign bank accounts or financial assets, it’s a good idea to consult a tax professional to confirm you’re meeting all reporting requirements.

U.S.-South Korea tax treaty

The U.S.-South Korea Tax Treaty helps U.S. expats avoid being taxed twice on the same income. It outlines which country has the primary right to tax various types of income, sets reduced rates for certain income sources, and coordinates social security contributions.

Understanding this treaty can simplify your tax obligations and help you take advantage of available benefits.

Purpose of the U.S.-South Korea tax treaty

The main objectives of the tax treaty are to:

- Prevent Double Taxation: Help you avoid being taxed on the same income by both countries.

- Define Tax Rights: Establish clear rules on which country has taxing authority over specific types of income.

- Facilitate Compliance: Make it easier to fulfill tax obligations in both countries while avoiding unnecessary payments.

By using the treaty, you can align your U.S. and South Korean tax filings to avoid paying more than you owe.

For U.S. expats, the treaty helps lower the risk of double taxation by allowing foreign tax credits, setting reduced tax rates on specific income types, and establishing residency and income allocation rules.

Key treaty provisions

The U.S.-South Korea Tax Treaty includes specific rules for different types of income. Here’s how it applies to common scenarios for expats:

- Employment Income: Income from employment is generally taxed in the country where the work is performed. If you’re living and working in South Korea, your salary will be taxed there. However, you still need to report this income on your U.S. tax return. You can use the Foreign Earned Income Exclusion (FEIE) or Foreign Tax Credit (FTC) to reduce or eliminate U.S. taxes on this income.

- Dividend and Interest Income:

- Dividends: South Korea may impose withholding tax on dividends paid to U.S. residents, but the treaty limits the rate to 15%.

- Interest: Interest income is generally taxed only in the country where the recipient resides, meaning the U.S. has the primary taxing right for U.S. citizens living in South Korea.

- Capital Gains: Gains from selling personal property, such as stocks, are usually taxed in your country of residence (South Korea if you’re a resident). However, U.S. citizens may still need to report capital gains on their U.S. tax return and can use foreign tax credits to offset double taxation.

- Pensions and Retirement Income: Under the U.S.–South Korea tax treaty, many private pensions are generally taxable in the country where you reside, while Social Security and other public pensions are taxable only in the country that pays them. The treaty is structured to reduce double taxation, but you may still need to use foreign tax credits or other relief so the same income isn’t effectively taxed twice.

Social Security Agreement (Totalization Agreement)

In addition to the tax treaty, the U.S. and South Korea have a Totalization Agreement to prevent double contributions to social security systems and ensure benefits eligibility.

- U.S.-Based Employment: If you’re working temporarily in South Korea for a U.S.-based employer, you may remain covered under the U.S. Social Security system and be exempt from South Korea’s National Pension contributions for up to five years.

- South Korean-Based Employment: If you’re employed by a South Korean company, you’ll contribute to South Korea’s National Pension System. Under the agreement, these contributions can count toward future pension benefits.

Combining Credits: If you don’t have enough years of contributions in one country to qualify for benefits, the agreement may allow you to combine your credits from both systems to meet eligibility requirements.

Example: If you worked in the U.S. for six years and in South Korea for four years, you could combine credits to meet the 10-year minimum required for U.S. Social Security benefits.

Claiming treaty benefits

To take advantage of the tax treaty, U.S. expats may need to file specific forms with the IRS:

- Form 1116 (Foreign Tax Credit): Use this form to claim credits for taxes paid to South Korea on income also taxable by the U.S., helping to avoid double taxation.

- Form 8833 (Treaty-Based Return Position Disclosure): This form is required if you’re claiming treaty benefits to reduce or eliminate your U.S. tax liability on income earned in South Korea.

Residency and tie-breaker rules

The treaty also includes “tie-breaker” rules to help determine tax residency if both countries consider you a resident. Here’s how the treaty resolves conflicts in residency status:

- Permanent Home: Priority is given to the country where you maintain a permanent home.

- Center of Vital Interests: If you have permanent homes in both countries, the country where you have stronger personal and economic ties (center of vital interests) takes precedence.

- Habitual Abode: If neither of the above determines residency, the country where you habitually reside is considered your primary tax residence.

These tie-breaker rules help avoid conflicts over tax residency and make your tax obligations clearer.

South Korea tax obligations for U.S. expats

If you’re living and working in South Korea, you’ll likely have to pay taxes there as well. South Korea’s tax system operates independently of the U.S., which means you must follow their rules if you’re considered a tax resident.

The Alternative Minimum Tax (AMT) system in South Korea is designed so that certain individuals and corporations pay at least a minimum level of tax based on their income tax liabilities.

Here’s what you need to know about South Korean tax residency, income tax rates, and other obligations.

Determining tax residency in South Korea

Your tax obligations in South Korea depend on whether you’re considered a resident or non-resident. The rules for tax residency are as follows:

- Resident: You’re a tax resident if:

- You live in South Korea for 183 days or more within a calendar year, or

- You maintain a permanent home or primary economic ties in South Korea.

Residents are taxed on their worldwide income, including income from the U.S. or other countries.

- Non-Resident: If you stay in South Korea for less than 183 days and don’t have a permanent home there, you’re only taxed on income earned within South Korea.

South Korean income tax rates

South Korea uses a progressive tax system, which means your tax rate increases as your income rises. Here are the 2024 income tax brackets:

- Up to KRW 14 million: 6%

- KRW 14 million to KRW 50 million: 15%

- KRW 50 million to KRW 88 million: 24%

- KRW 88 million to KRW 150 million: 35%

- KRW 150 million to KRW 300 million: 38%

- Above KRW 300 million: higher brackets apply, with the top national rate currently 45% (plus local income tax, typically 10% of the national tax).

Example: If you earn KRW 60 million in South Korea, your income is taxed at progressively higher rates. You pay:

- 6% on the first KRW 14 million,

- 15% on the next KRW 36 million,

- 24% on the portion above KRW 50 million.

Types of income taxed in South Korea

South Korea taxes various types of income, including:

- Employment Income: Wages earned from a South Korean employer are taxed at the progressive rates above.

- Self-Employment Income: Self-employed individuals pay income tax on their profits, with deductions allowed for business expenses.

- Investment Income: Dividends, interest, and capital gains are subject to taxes. Certain capital gains (e.g., on real estate) may have additional reporting requirements.

- Rental Income: If you own property in South Korea and rent it out, you must report and pay taxes on rental income.

Important Note: Tax treaties between South Korea and the U.S. can affect how investment and rental income is taxed.

Social Security contributions

If you’re employed in South Korea, you’ll likely need to contribute to the country’s National Pension System and National Health Insurance (NHI):

- National Pension Contributions:

- Employees contribute 4.5% of their monthly salary.

- Employers match this with an additional 4.5%.

- Health Insurance Contributions:

- Employees contribute approximately 7.1% of their income (split equally with the employer).

- Self-employed individuals are responsible for the full amount.

Contributions to South Korea’s pension system may qualify for benefits later, and the U.S.-South Korea Totalization Agreement can help avoid double contributions (more on this in the tax treaty chapter).

Filing deadlines and tax year in South Korea

South Korea’s tax year follows the calendar year (January 1 to December 31). Filing requirements depend on your residency status and income sources:

- Annual Tax Return Deadline: May 31 of the following year.

- Withholding Tax: Employers typically withhold taxes from your paycheck, which reduces your need to make separate payments. Self-employed individuals may need to make quarterly estimated payments.

Taxable income in South Korea

Taxable income in South Korea encompasses various types of earnings, including employment income, business income, investment income, and capital gains. Understanding how each category is taxed can help you manage your tax obligations effectively.

South Korean tax filing process for U.S. expats

As a U.S. citizen residing in South Korea, it’s essential to understand and comply with the local tax filing process to help you adhere to South Korean tax laws. Whether you’re earning a salary, running a business, or investing, following the guidelines set by the National Tax Service (NTS) is crucial. Here’s a comprehensive overview of the tax filing process, including deadlines, required documents, and available deductions.

Filing requirements and deadlines

South Korea’s tax year aligns with the calendar year, running from January 1 to December 31.

The obligation to file a tax return depends on your residency status:

- Residents: Required to report and pay taxes on their worldwide income, including earnings from outside South Korea.

- Non-Residents: Taxed only on income sourced from South Korea.

Key Deadlines:

- Annual Tax Return: Must be filed between May 1 and May 31 of the following year.

- Withholding Tax: Employers typically withhold taxes from your paycheck, reducing the need for separate payments.

- Quarterly Payments for Self-Employed Individuals: Self-employed individuals may need to make estimated tax payments throughout the year.

Documents needed for filing

Gathering the right documents can make the filing process smoother. Here are some key documents you’ll need for your South Korean tax return:

- Income Statements (Payment Summaries): Your employer will issue this summary, showing your total earnings and tax withheld for the year.

- Bank Statements and Investment Records: Documentation of interest, dividends, and other investment income.

- Self-Employment Records: Income and expense records if you’re self-employed, including receipts for any business-related expenses.

- Foreign Income Records: Documentation of any income earned outside South Korea, including rental income, dividends, and interest from non-South Korean sources.

- Proof of Deductions: Keep records for any expenses you’re claiming as deductions, such as work-related expenses, healthcare costs, or charitable donations.

Keeping these records organized throughout the year can simplify tax time and help you claim all eligible deductions.

How to file your South Korean tax return

- Online Through Hometax: The NTS provides an online portal called Hometax, where you can file your taxes, make payments, and access tax records. The system is primarily in Korean, so you might need assistance if you’re not familiar with the language.

- Hire a Tax Professional: A certified tax agent in South Korea can guide you through the process, help you stay compliant, and help you claim all eligible deductions.

- Employer Assistance: If you’re employed, your company may handle most of the filing for you, especially if your income comes entirely from your employer.

Tax deductions and credits for U.S. expats in South Korea

South Korea offers several tax deductions and credits that can lower your taxable income:

- Standard Deductions: Everyone is eligible for basic deductions, and additional allowances are available for dependents.

- Work-Related Expenses: Costs for commuting, work supplies, or training can be deducted.

- Charitable Donations: Donations to registered South Korean charities are tax-deductible.

- Education Costs: Tuition fees for dependent children may be deductible.

Rental Costs: If you’re renting, you might qualify for a deduction, depending on your financial situation.