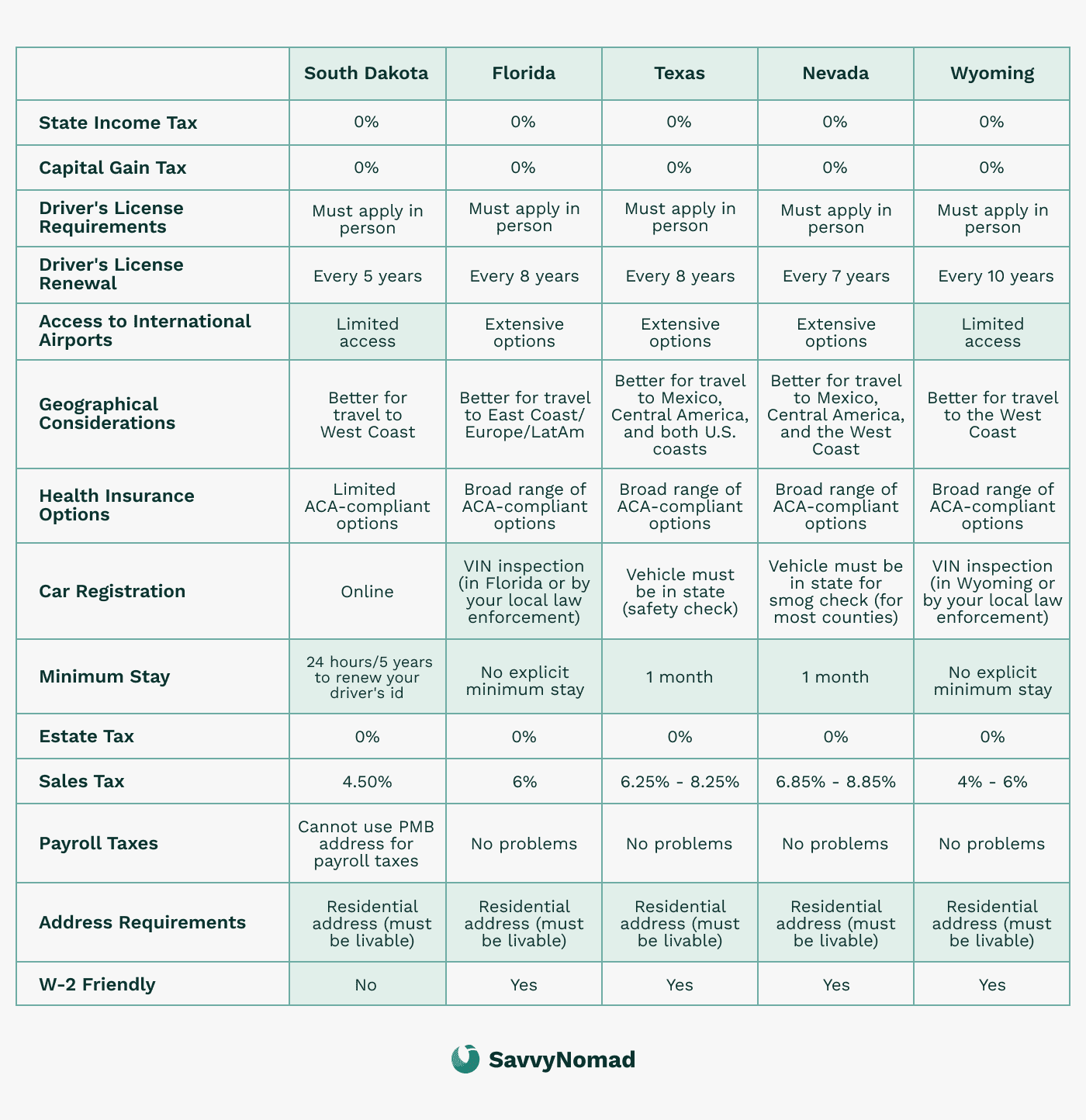

5 Easiest State to Establish Residency

In a world in which mobility is increasingly valued, the concept of residency takes on new dimensions, especially for digital nomads and expatriates. That’s right, all citizens (including expats) technically have a state of residence, actually, ‘domicile’.

Domicile is more than just a place to live; it’s a legal designation with significant implications for one’s finances, taxes, and legal standing. Establishing domicile correctly is crucial to avoid the risk of paying taxes on the full income in multiple states when moving.

Although the terms ‘residence’ and ‘domicile’ are often used interchangeably, they are different in the eyes of the law and the states. You can have multiple residences (a ski-in/ski-out condo in Vail, a beach bungalow in Fiji, and a brownstone in Brooklyn), but only one domicile.

What’s the difference?

Your domicile is your permanent home to which you intend to return after temporary absences. A “residence” can be temporary or permanent, but one always intends to return to one’s domicile and make that location one’s domicile.

As you can see, establishing one’s ‘domicile’ rests almost entirely on intent. Although one’s intent is necessarily unobservable by others, there is much that one can do to demonstrate that intent to others. We’ll be exploring how throughout this book.

For digital nomads and expatriates, the benefits of establishing domicile in a particular state can be significant. Some states offer those domiciled within their borders substantial financial incentives, such as the lack of a personal income tax, which can significantly reduce tax liabilities and boost your take-home income by 5-20%. Other states may appeal more for their lifestyles, offering a supportive community for nomads.

Navigating the complexities of establishing a domicile is increasingly important for those embracing a location-independent lifestyle. This guide explores the five most nomad-friendly states, outlining the unique advantages each one presents for digital nomads and expats.

Understanding residency requirements

Residency requirements are the rules and regulations that determine an individual’s state of residence for tax purposes.

These requirements vary from state to state and can have significant implications for an individual’s tax obligations, including state income tax, vehicle registration, and in-state tuition.

Understanding residency requirements is crucial for individuals who move to a new state, work remotely, or have multiple residences. Each state has its own criteria for what constitutes residency, and meeting these criteria can affect how you pay income taxes and fulfill other state tax obligations.

Establishing domicile

Establishing domicile is a critical aspect of residency requirements. Domicile refers to an individual’s permanent home, where they intend to return and have a true, fixed, and permanent home. To establish domicile, an individual must demonstrate their intention to make a particular state their permanent home.

This can be done by obtaining a driver’s license, registering to vote, and establishing a primary residence in the state. The process of establishing domicile often involves severing ties with your previous state of residence and forming new connections in your new state, such as changing your healthcare providers and updating your mailing address.

Proving residency

Proving residency is essential for individuals who want to establish domicile in a new state. To prove residency, individuals must provide documentation that demonstrates their physical presence in the state.

This can include:

- A driver’s license or state ID

- Voter registration

- Lease or mortgage agreement

- Bank statements

- Utility bills

States may also consider other factors, such as the individual’s employment, education, and family ties, when determining residency. These documents collectively serve as evidence of your intent to make the state your permanent home and can be crucial in situations where your residency status is questioned.

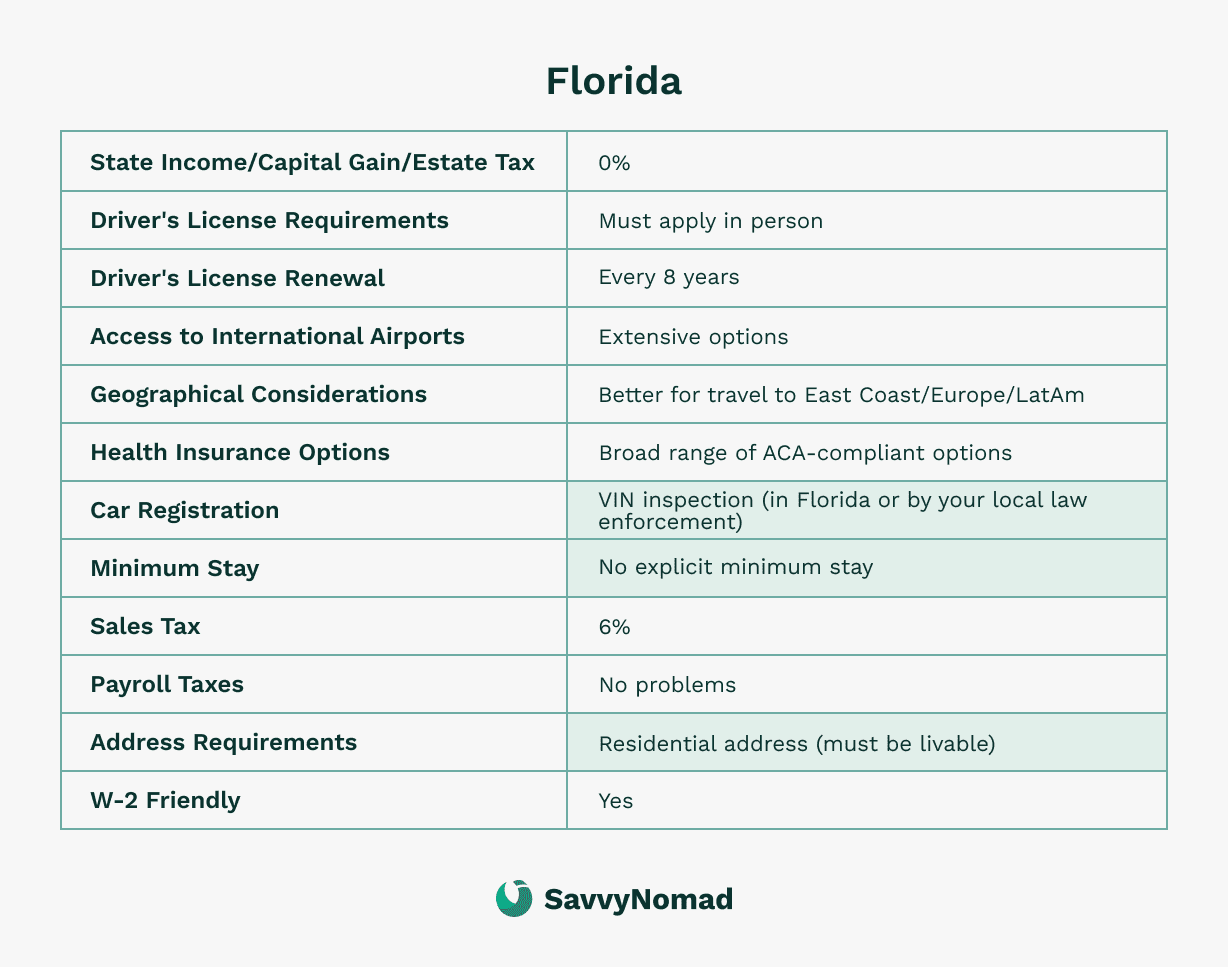

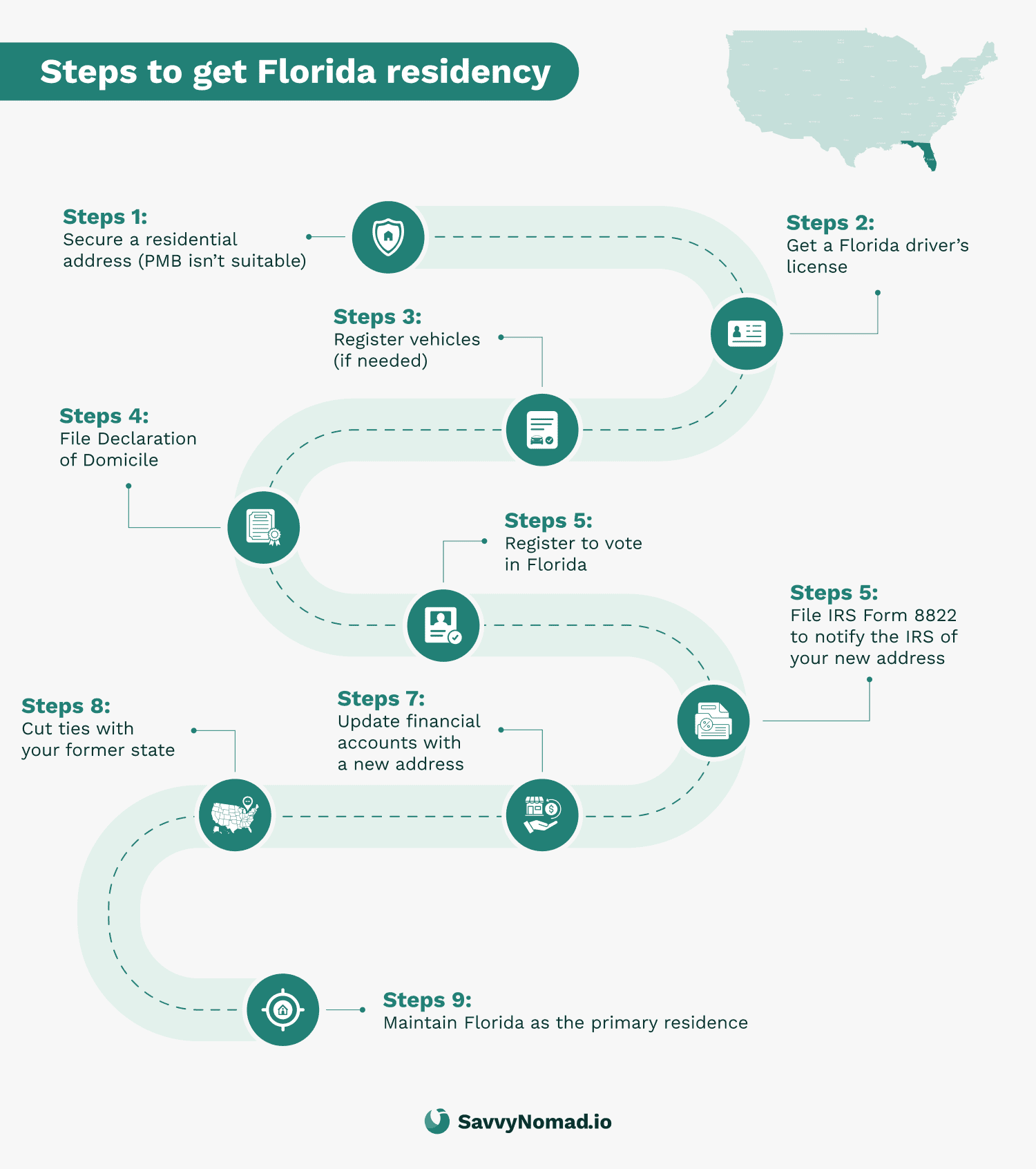

#1 Florida

Florida, the Sunshine State, emerges as a top choice for digital nomads and expatriates looking to establish domicile in the United States.

The state’s allure is a combination of financial benefits, legal advantages, healthcare options, and strategic location, which combine to create an attractive package for those living a mobile lifestyle.

Establishing domicile in Florida can also help avoid out of state tuition fees, providing significant financial savings for students compared to in-state rates.

This is even before considering the myriad discounts available to Florida residents (e.g., cheaper cruises, Disney World tickets, and much more).

Tax and legal benefits

One of Florida’s most appealing features is its lack of a state income tax, which can be a substantial saving. Furthermore, the state’s legal system is designed to protect assets and ensure privacy, offering both peace of mind and financial benefits.

For example, the exemption for the value of a homestead in bankruptcy is unlimited. In other words, a homestead, regardless of value, cannot be used to satisfy one’s creditors in bankruptcy.

Demonstrating legal residency in Florida is relatively simple. The process generally involves (1) securing a permanent residence in the state, (2) acquiring a Florida driver’s license, and (3) registering to vote using your new Florida address (often in that order).

You can also file a Declaration of Domicile with the clerk of courts in the county of your domicile. The Declaration of Domicile, which must be witnessed by a notary public, declares your intent to make Florida your domicile (permanent residence).

While Florida does not have a state income tax, it is still necessary to file a resident tax return if you earn income in another state. This ensures compliance with state tax obligations and can be simplified through reciprocal agreements.

Of course, you must also sever ties with your previous domicile, which may be more difficult if it requires selling the home where you raised your children, for example, and changing your healthcare providers.

Nevertheless, because one can have only one domicile at a time, severing ties with your previous domicile and establishing relationships with service providers in your new domicile are important public indicators of your intent to establish a new domicile.

Healthcare and insurance options

Florida provides a range of health insurance plans that comply with the Affordable Care Act (ACA), offering more flexibility and choice than many other states favored by nomads.

Strategic location

For those who frequently travel to the East Coast or Europe, Florida's geographical positioning is the most ideal of the tax-free states. The state is home to several international airports, making travel convenient and accessible.

Vehicle registration

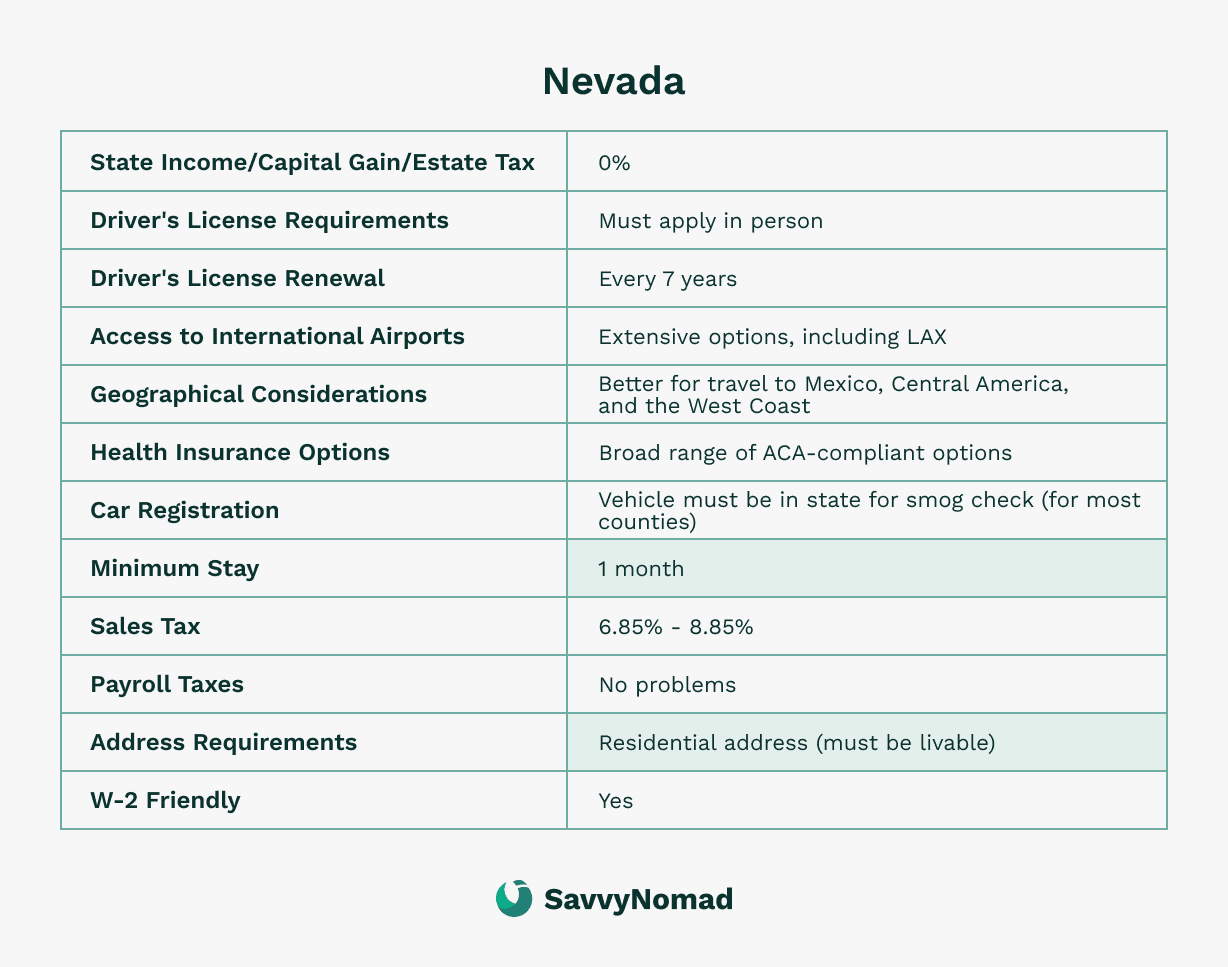

Florida is one of three states with no state income tax, and a vehicle does not need to be registered in the state. Other states, like Texas, require an annual in-state vehicle inspection.

Similarly, Nevada (in most counties, including Clark County – home of Las Vegas) requires an annual in-state smog check of your vehicle.

If you don't plan on spending much time in Nevada (beyond the 183 days a year required to establish Nevada as your domicile), this can be a major inconvenience.

If you do own a vehicle, you can chalk this up to major points in Florida's favor.

Downsides

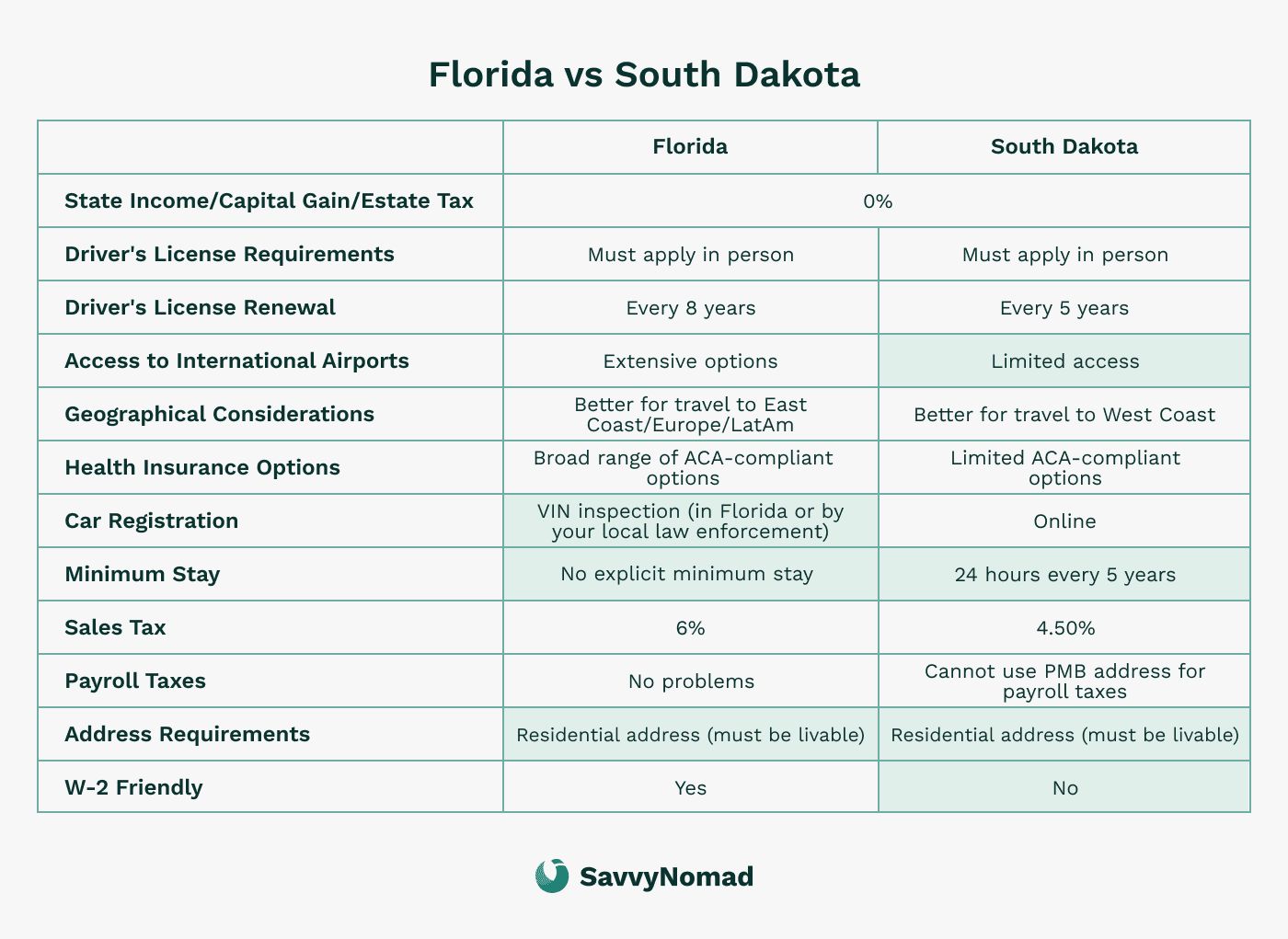

Unlike South Dakota, Florida requires a residential address to apply for a driver's license and to register a vehicle. This means you can’t use a simple mailbox as a residential address but must use a house, apartment, or RV park instead.

Comparative advantage

Compared to other popular states like Texas and South Dakota, Florida's blend of tax benefits, ease of residency establishment, vehicle-friendliness, and geographical convenience are real advantages.

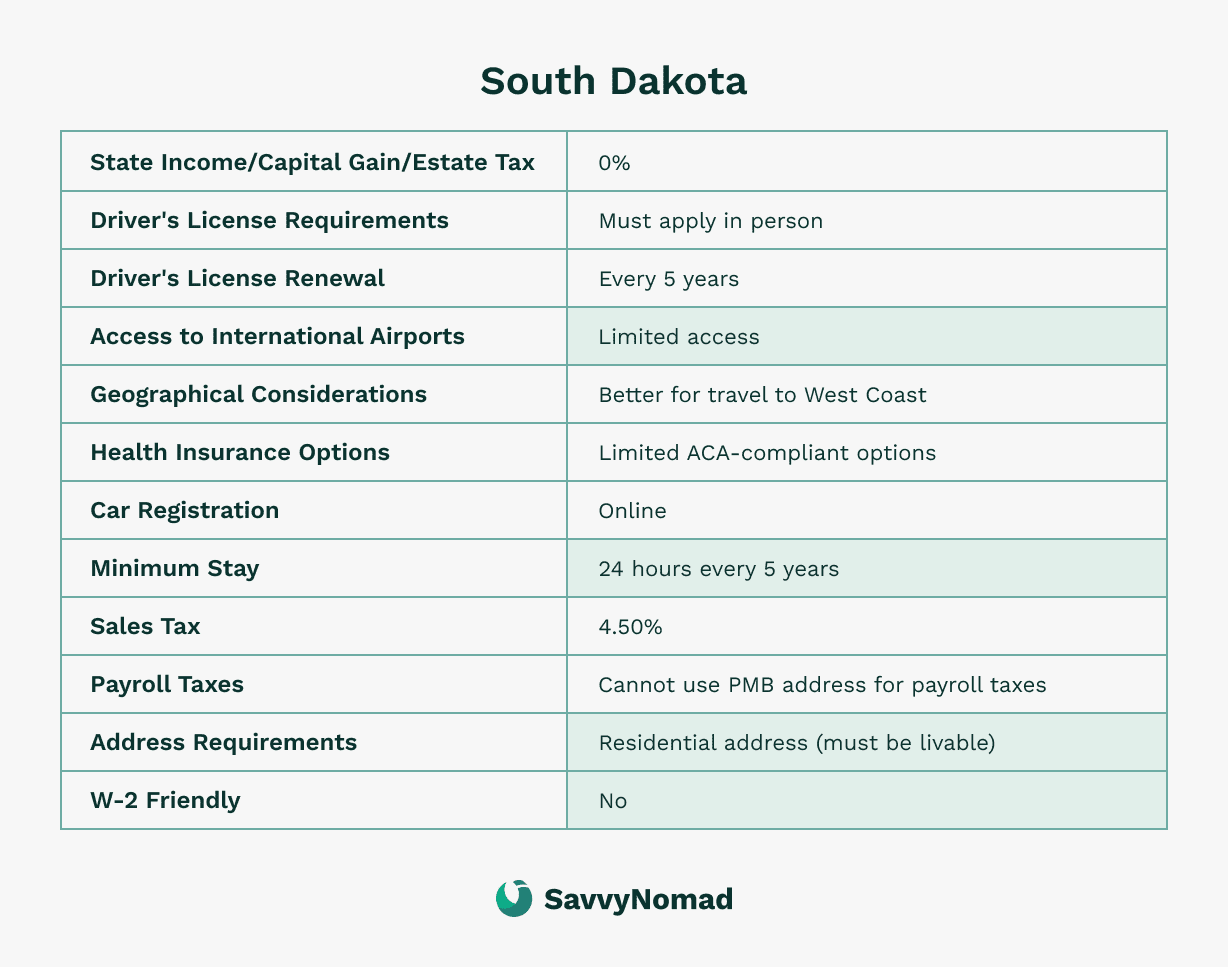

#2 South Dakota

South Dakota has gained recognition as an ideal domicile state for digital nomads, thanks to its simple residency requirements and favorable tax policies. These features combine to create an environment that is both financially and logistically appealing for those living a nomadic lifestyle.

However, some recent controversial policies by the state legislature have made this state increasingly less popular for full-time RVers nomads.

Financial benefits

The state is attractive from a financial standpoint, with no state income tax, no property tax, and no inheritance tax. This tax-friendly environment is very attractive to nomads who want to maximize their tax savings.

Nomad-friendly residency requirements

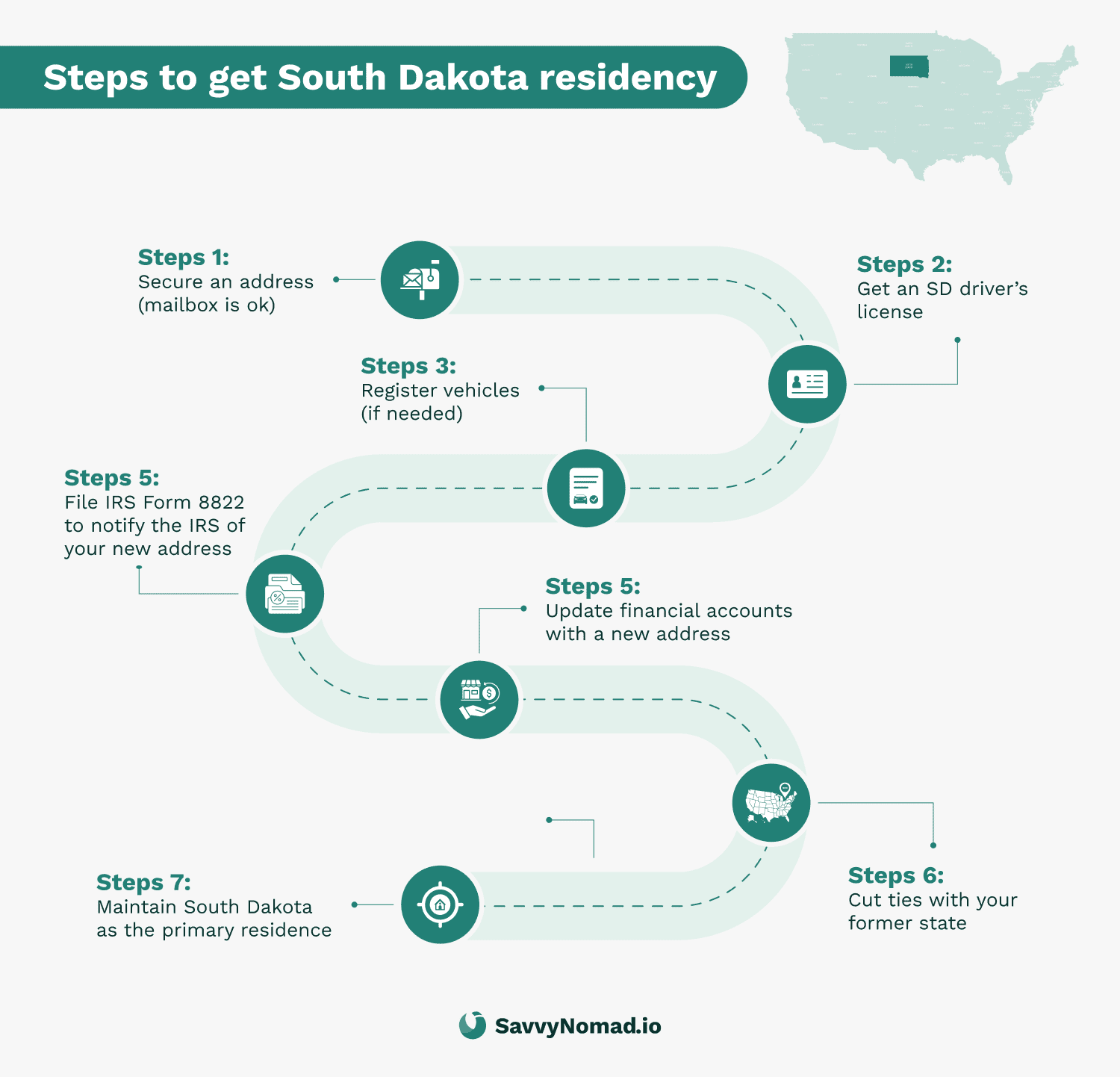

South Dakota’s residency requirements are particularly accommodating to nomads. The state allows individuals to establish residency without the need for prolonged physical presence. In fact, the only requirement is that you renew your South Dakota driver’s license in person every five years.

Residency requirements can vary even within the same state, as different universities and institutions may interpret in-state regulations differently.

Ease of vehicle registration and insurance

South Dakota is also advantageous for nomads who own vehicles or RVs, offering low costs for vehicle registration and insurance. And, South Dakota's vehicle registration is even easier than Florida's.

In both cases, the vehicle need not be physically in the state. However, while Florida does require that you register the vehicle in Florida in person, you can register your vehicle in South Dakota online or through the mail.

Procedural simplicity

The process of establishing a domicile in South Dakota is very straightforward. You must obtain a physical address within the state (which can be a personal mailbox), acquire a South Dakota driver's license, and register any vehicles with the state, all of which can be done with minimal hassle.

Comparative advantages

Compared to other popular states like Florida and Texas, South Dakota offers nomads a unique combination of tax benefits, ease of establishing domicile, and robust privacy laws.

Unlike Florida, you do not need a residential address to get a driver's license or register a vehicle; instead, you can use a personal mailbox address for all these purposes.

These features collectively make it a highly appealing option for the digital nomad community.

Downsides

South Dakota recently passed policies that prevent residents without a residential address (for example, residents with only a personal mailbox) from voting. This means that to vote in South Dakota, you must rent an apartment, a house, or a long-term RV spot within the state.

Nor can a personal mailbox address be used to purchase a firearm.

In addition, the state has also changed its policy regarding payroll taxes, deciding that a personal mailbox address cannot be used for payroll purposes (specifically, for unemployment taxes).

As a result, your employer may be unable to use your personal mailbox address as your official address for payroll purposes, making South Dakota residency challenging for nomads and expats who are employees (who receive a Form W-2) or independent contractors (meaning they receive a Form 1099, rather than Form W-2).

That said, depending on your personal circumstances, South Dakota can still be a leading candidate for domicile.

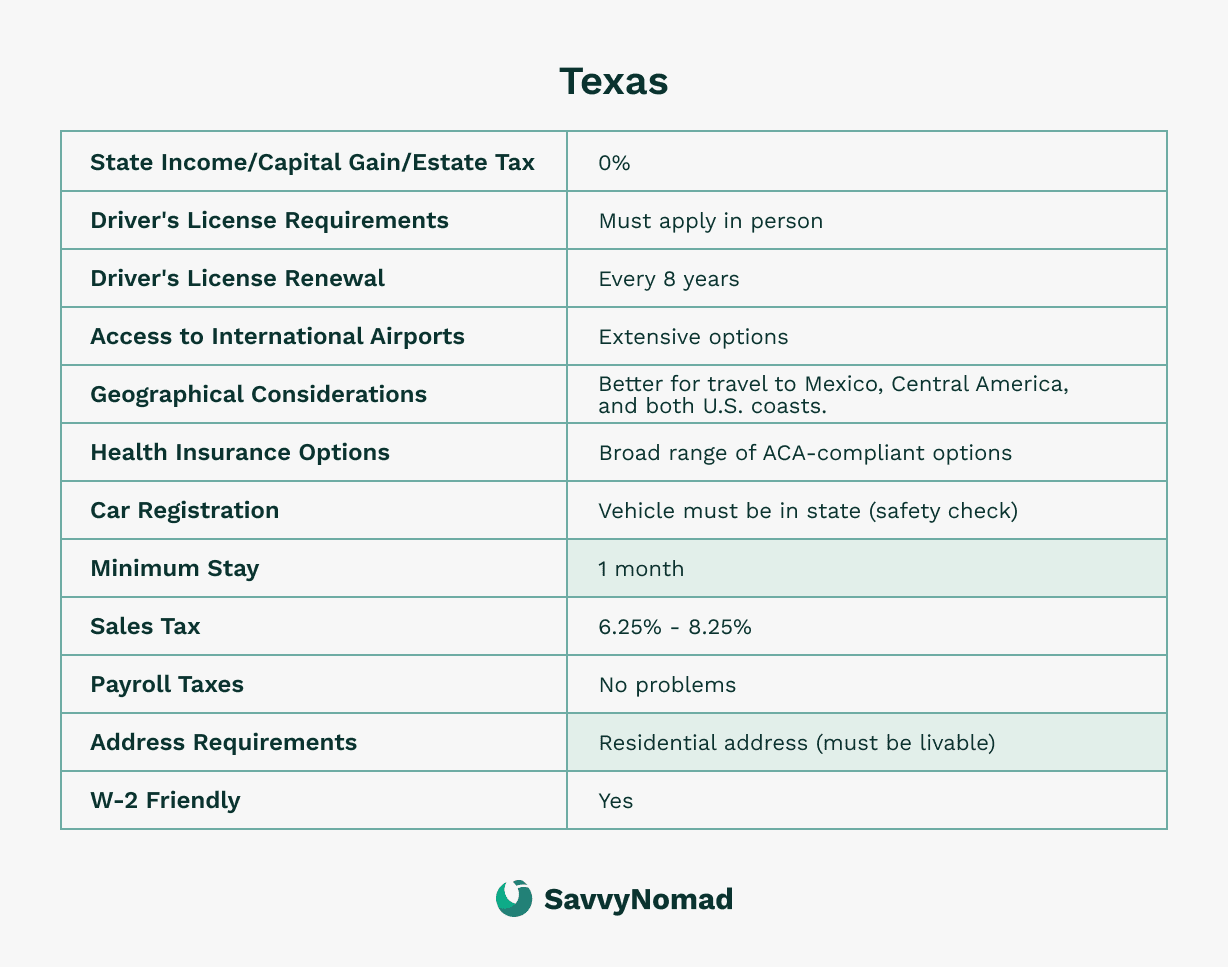

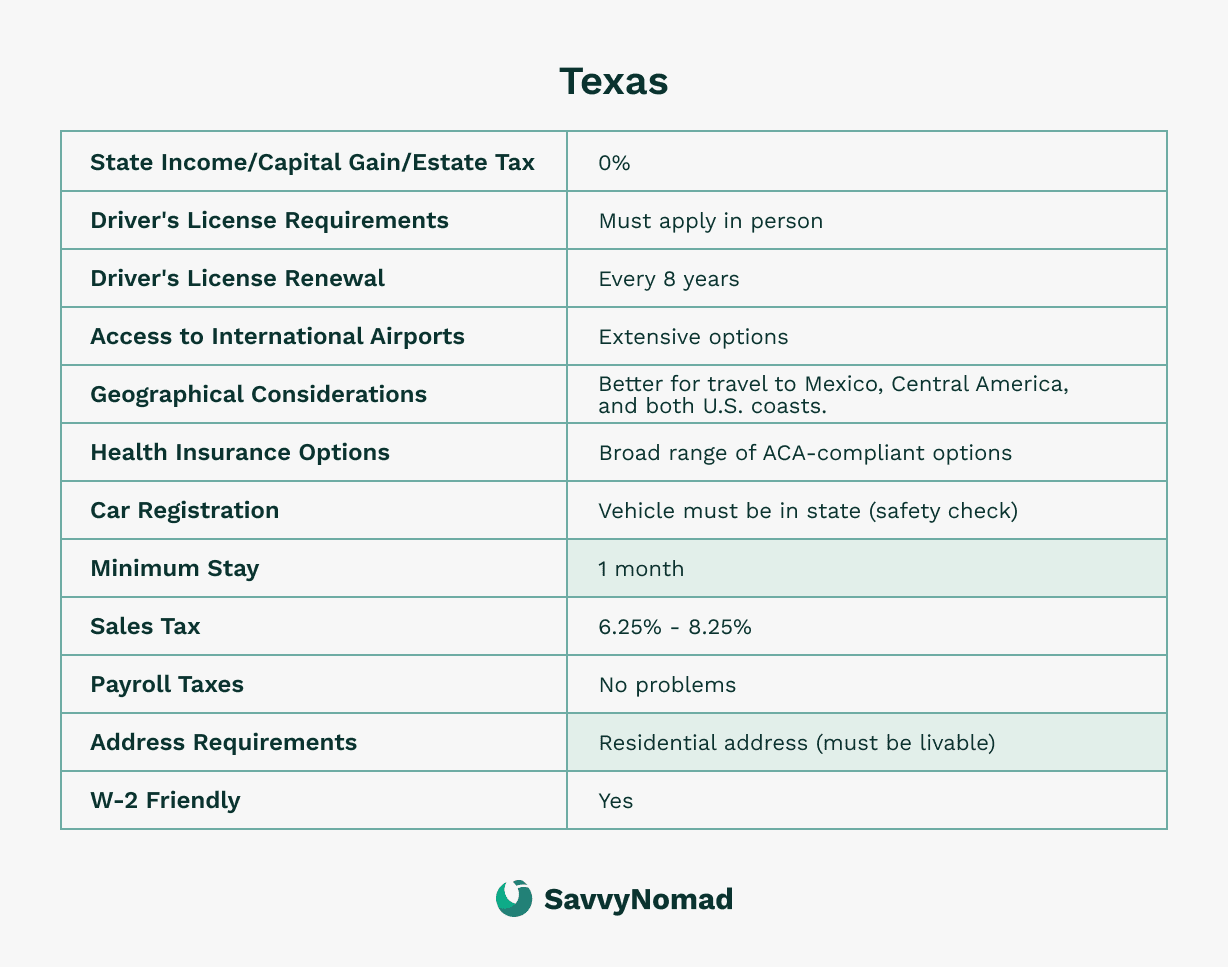

#3 Texas

Texas has also emerged as a favored domicile for digital nomads, thanks to its economic benefits, brazen reputation, and a residency process that aligns well with the nomadic lifestyle. Here's why:

Tax advantages

The state's lack of state income tax, lack of corporate income tax, and lack of estate or inheritance tax make Texas a financially beneficial choice. These tax incentives are basically a prerequisite for any state to be considered by most nomads and expats.

Ease of establishing domicile

Setting up residency in Texas is straightforward, involving steps like getting a Texas driver’s license, registering to vote, and establishing a permanent address in the state.

In contrast, the California State University system has different residency requirements, often making it more feasible to obtain in-state tuition compared to the University of California system.

However, you must physically be in Texas for 30 days before applying for a state ID or driver’s license, meaning the documents you bring to the DMV (apartment lease, change of address form, utility bills) as proof of address should establish your presence in the state for the required 30 days.

Vehicle registration

This is another strike against Texas. Every vehicle registered in Texas must undergo an annual safety inspection.

While it is possible to postpone this, it requires more paperwork every year—and postponing your safety inspection for consecutive years is especially challenging.

Comparative perspective and additional considerations

Compared to other nomad-friendly states like Florida, Texas' biggest downsides include Its 30-day residency requirement before applying for a state ID or driver's license and the difficulties in vehicle registration.

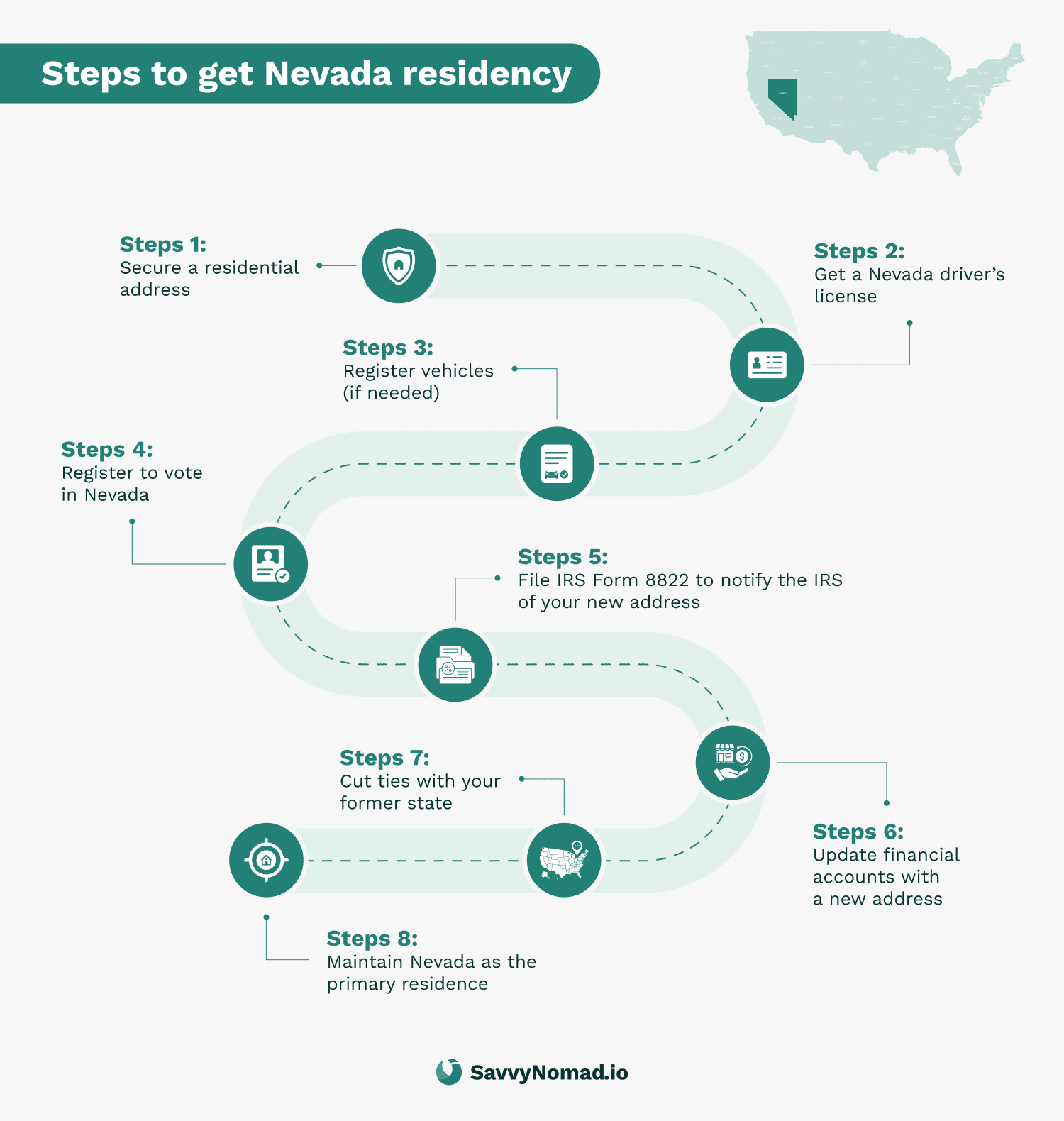

#4 Nevada

Nevada isn't one of the most common states for digital nomads and expats, but it is nonetheless an appealing one.

Establishing residency

The process for establishing residency in Nevada is straightforward, requiring individuals to have a permanent address in the state and obtain a Nevada driver's license or state ID.

The state's definition of a permanent address is notably flexible, accommodating unconventional options like hotels, as long as you can demonstrate 30 consecutive days of residency.

This flexibility is particularly advantageous for nomads, as they are not obligated to remain in the state full-time once residency is established.

Note, however, that your former domicile may argue that you remain domiciled there if you spend more than half the year in that former domicile. It's good practice to keep a calendar and receipts that you can use if your former domicile comes calling.

Tax advantages and asset protection

Economically, Nevada is on par with the other states listed in that it, too, has no state income tax. It also offers strong asset protection, ensuring privacy and confidentiality, and has flexible trust laws.

Practical considerations

Nevada shares many benefits with other popular nomad-friendly states but also presents some unique aspects. To establish residency, a longer stay (30 days) in a campground, hotel, or RV park is required, which can be quite expensive.

Vehicle Registration

On top of that, Nevada (in most counties and all major cities) requires annual emissions tests for vehicle registration, which can make owning a vehicle a major headache unless you spend considerable time within the state.

Also, it's important to be aware that auto insurance rates and vehicle registration fees in Nevada can be higher, particularly for newer vehicles.

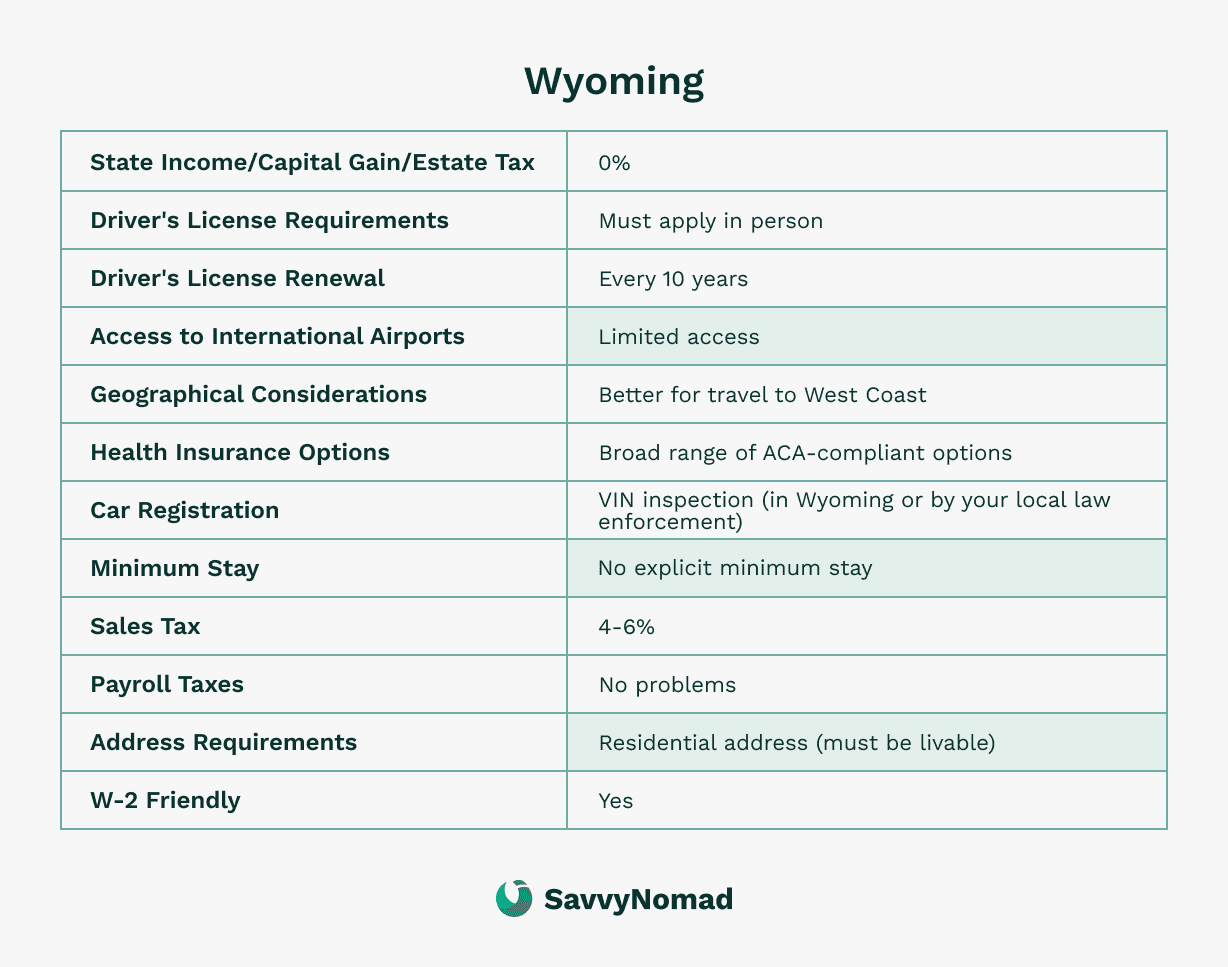

#5 Wyoming

Despite being less popular among individuals than among businesses, Wyoming is increasingly recognized as an attractive destination for digital nomads and expatriates.

Tax and legal benefits

Like the other states we've discussed, Wyoming's tax regime is highly favorable, with no state income tax and a 0% corporate income tax rate.

Additionally, the state's legal system is entrepreneur-friendly, providing asset protection for private business owners, particularly owners of LLCs (Limited Liability Companies).

Ease of establishing domicile

Setting up residency in Wyoming can have its challenges, particularly in obtaining a residential street address, which is required for applying for a driver's license. However, for digital nomads interested in business formation, the state remains an appealing option.

Comparative advantage

Compared to other states popular among digital nomads, like Florida, South Dakota, and Texas, it is much more difficult to establish a domicile in Wyoming and its financial advantages are no more than comparable to other states.

As a result, the challenges involved in establishing a street address might make Wyoming a less preferable option.

Additional considerations

Health insurance and establishing residency

Health insurance is an essential consideration for individuals who are establishing residency in a new state.

Some states offer more flexible health insurance options than others, which can be a significant factor in determining residency. For example, California has a more lenient approach to health insurance, while South Dakota has more restrictive requirements.

Individuals should research the health insurance options available in their desired state of residency and consider how they may impact their overall tax obligations.

In addition to health insurance, individuals should also consider the tax implications of establishing residency in a new state. Some states, such as Florida and Texas, have no state income tax, while others, such as California and New York, have high state income tax rates. Understanding the tax implications of residency can help individuals make informed decisions about their financial and personal lives.

Establishing residency can also have implications for in-state tuition. Some states, such as North Dakota, offer in-state tuition to residents who can demonstrate residency, while others, such as California, have more restrictive requirements. Individuals who are considering establishing residency in a new state should research the in-state tuition options available and consider how they may impact their education and career goals.

Overall, understanding residency requirements is essential for individuals who are considering establishing domicile in a new state. By researching the rules and regulations of their desired state of residency, individuals can make informed decisions about their financial, personal, and educational lives.

FAQ

What is the quickest state in which to become a resident?

Florida and South Dakota are the quickest and easiest states to establish residency, especially for location-independent workers and nomads.

Florida also has no minimum required stay to become a resident, although, again, your former domicile may insist you remain domiciled there (and subject to tax there) if you spend more than half of the year there.

The state offers a clear process for declaring domicile, which can be evidenced by obtaining a driver's license, registering to vote, and demonstrating your intent to reside there permanently, which can be further supported by filing a Declaration of Domicile form with the clerk of court in your new Florida county.

This Declaration of Domicile is not proof that Florida is your new domicile, just more evidence of your intent to make Florida your permanent residence.

You can register your vehicle in South Dakota by mail without an in-state inspection.

What is the best state to establish residency for full-time RVers?

The best state for full-time RVers to establish residency is often considered South Dakota, Texas, or Florida. These states are popular among RVers because of their favorable tax laws (no state income tax), ease of residency, and RV-friendly policies. However, due to recent policy changes, South Dakota has become increasingly unpopular.

To establish residency in South Dakota, you must now provide the Department of Motor Vehicles with a receipt with your name and South Dakota address on it, along with the names and South Dakota addresses of everyone in your family trying to establish residency in South Dakota, to prove that all of you spent one night in hotel, campground, or Airbnb in South Dakota.

Texas also has burdensome annual vehicle safety inspections. This often means that Florida is often the crowd favorite.

Conclusion

Florida and South Dakota stand out as recommended options for establishing residency for digital nomads and expatriates.

South Dakota, known for its favorable tax regime and minimal residency requirements, is particularly attractive for those living a nomadic lifestyle. However, recent policy changes have made South Dakota less appealing for some potential residents.

Florida, with its no state income tax and a straightforward process for legal domicile, sets itself apart as the most popular among nomads. Its strategic location also makes it ideal for frequent travelers.

The primary downside, when compared to South Dakota, is the requirement for a residential address. Fortunately, SavvyNomad can provide you with a residential and mailing address in minutes.