Do expats from Wisconsin still need to pay state taxes?

Expatriates from Wisconsin face complex tax considerations when living abroad. Determining if one still owes state taxes hinges on factors like residency status and the source of income.

For instance, maintaining a home in Wisconsin, being domiciled in the state, or earning income from within the state could require filing tax returns and paying state taxes.

This article aims to clarify the scenarios under which expats may still be liable for Wisconsin state taxes, helping them navigate compliance and optimize their tax obligations effectively.

TLDR:

Wisconsin tax law requires that you file a state tax return if you are domiciled in the state, regardless of whether you are a resident or not.

This means that even if you no longer live in Wisconsin but maintain your domicile there, you must still file and pay taxes on your worldwide income.

The penalties often start at 5% of the unpaid tax for each month the tax remains unpaid, with a cap of 25% of the total unpaid tax.

Additionally, interest is charged on the unpaid tax from the due date until the tax is paid in full.

Understanding Wisconsin's tax residency rules

Definition of tax residency in Wisconsin

In Wisconsin, tax residency is primarily determined based on domicile and physical presence.

A person is considered a resident for tax purposes if Wisconsin is their primary home—the place where they intend to return after absences.

Distinction between residents, nonresidents, and part-year residents

- Residents are taxed on their worldwide income, irrespective of where it is earned, because they have established Wisconsin as their primary home or domicile.

- Nonresidents only owe taxes on income that is sourced from within Wisconsin. This includes wages earned in the state or income from Wisconsin properties.

- Part-year residents have both resident and nonresident statuses during the same tax year—usually due to moving into or out of the state. They are taxed on all income received while they were residents and only on Wisconsin-sourced income during the period they were nonresidents.

- Expatriates from Wisconsin who still consider the state their domicile are required to pay state taxes on their worldwide income. Wisconsin law mandates that if the state remains your domicile—essentially your permanent home or the place to which you intend to return—you must file a state tax return, regardless of your current country of residence. This ensures that all global income is appropriately reported and taxed under Wisconsin law.

Key factors determining residency status

Several factors influence one's residency status for Wisconsin tax purposes:

- Physical presence: Spending more than 183 days in Wisconsin during the tax year generally establishes residency.

- Domicile: Having a permanent home in Wisconsin that one intends to use as a primary residence.

- Intent to return: Plans to return to Wisconsin after traveling or living elsewhere suggest that Wisconsin remains the domicile.

Why should Wisconsin expats move domicile to a state with zero state income tax?

State income tax savings

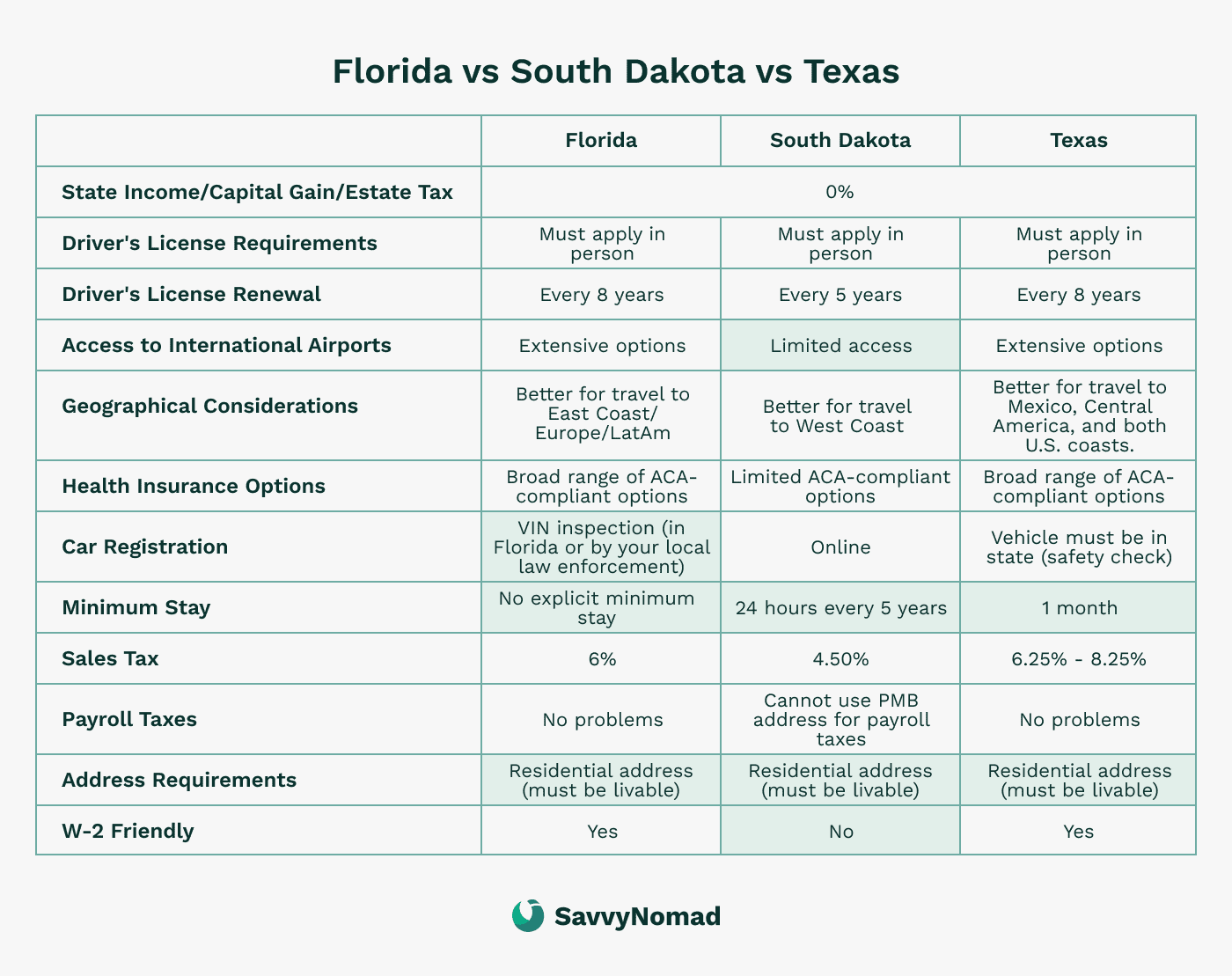

For retirees and high-income individuals from Wisconsin, moving to states without income taxes such as Florida, Texas, or Nevada can offer significant financial advantages. Without the burden of state income taxes, you can keep more of your earnings, allowing for greater investment opportunities or an enhanced lifestyle.

Inheritance tax benefits

States like Florida and Texas not only lack a state income tax but also do not impose state estate taxes. This can considerably reduce the tax burden on your estate, ensuring that more wealth is passed on to your heirs. This is especially advantageous for individuals with substantial assets who wish to maximize the inheritance for their beneficiaries.

Flexibility and mobility

Relocating your domicile to a no-income-tax state enhances your flexibility and mobility, allowing you to travel and live in various locations without worrying about high state tax bills. This is ideal for high-income earners with business interests in multiple states or countries and for retirees who desire to spend their later years exploring new places.

Moreover, the absence of state income taxes simplifies your tax filing process. You will only need to file federal taxes, reducing the complexity and potential for errors in your tax returns and making financial management more straightforward.

How to leave Wisconsin tax residency?

To change your residency status in Wisconsin, several important steps must be followed carefully to ensure a smooth transition.

1) Establish new residency

To establish residency in a new state, it is important to obtain a residential address within the state.

You may want to consider filing a Declaration of Domicile with the state, as suggested in Savvy Nomad’s domicile guides.

2) Transfer IDs and registrations

Swiftly update your driver's license and vehicle registration.

3) Register to vote

Voter registration in your new state.

4) Update documents

It is important to update your identification, medical, insurance, and financial documents with your new address.

Double-check to make sure that all the necessary documents reflect the correct address.

This will help you avoid any confusion or delay in receiving important information or services.

5) Notify your employer

It is important to notify your employer of any change in residency, as this can affect the portion of your income that is considered "Wisconsin-sourced".

6) Notify IRS

Inform the IRS of your address change using Form 8822. Extend this notification to all personal and professional entities.

7) Keep records

Document all relocation actions diligently.

8) Anticipate an audit

Be audit-ready with comprehensive proof of your move’s permanence.

Tax benefits and exemptions for Wisconsin expats

Living abroad as an expat comes with various federal tax benefits and exemptions that can help reduce your overall tax burden. Here are some of the key federal tax advantages available:

Foreign Earned Income Exclusion (FEIE)

The FEIE allows U.S. taxpayers living abroad to exclude a certain amount of their foreign-earned income from U.S. federal income tax.

For the tax year 2024, this exclusion amount is up to $126,500.

To qualify, you must pass either:

- Bona Fide Residency Test: You qualify if you are a resident of a foreign country for an uninterrupted period that includes an entire tax year.

- Physical Presence Test: You qualify if you are physically present in a foreign country for at least 330 full days during a 12-month period.

Foreign Tax Credit (FTC)

The FTC helps you avoid double taxation by allowing you to take credit for foreign taxes paid on income that is also subject to U.S. federal tax.

This credit can significantly reduce your U.S. tax liability, especially if you reside in a country with high tax rates.

Foreign Housing Exclusion (FHE)

The FHE allows you to exclude certain housing expenses from your federal taxable income, including rent, utilities (excluding telephone), and other reasonable expenses related to housing abroad.

The amount you can exclude is limited to a base amount plus housing expenses exceeding 16% of the FEIE limit.

Filing Wisconsin state taxes from abroad

When filing state taxes from abroad, Wisconsin expatriates should familiarize themselves with several important procedures and digital tools provided by the Wisconsin Department of Revenue to ensure compliance and streamline the process.

Procedures and requirements for filing tax returns as an expat

Wisconsin expatriates must first determine their residency status—resident, nonresident, or part-year resident—as this impacts their tax obligations. Residents are taxed on all income, while nonresidents and part-year residents are only taxed on Wisconsin-sourced income.

Expatriates filing from abroad should use Form 1NPR for nonresident and part-year resident tax returns. All filers should ensure they report their global income and any Wisconsin-sourced income accurately.

Required Forms

- Primary form: Use Form 1NPR for nonresident or part-year resident filings.

- Supporting documents: Include federal income tax return and any relevant schedules.

Digital filing options

Wisconsin has transitioned to a new electronic filing system called WisTax, which has replaced the previous e-file system. This platform requires filers to upload electronic copies of federal Form 1040, W-2s, and other necessary tax documents.

For those unable to use WisTax, the state recommends using third-party software or filing on paper.

It's important to gather all income information and documents before filing, and expatriates can consult the WisTax common questions for further guidance on the electronic filing process.

Deadlines and extensions

- Standard deadline: April 15.

- Automatic extension: Two-month extension for expats, new deadline June 15.

- Payment due: Taxes owed by April 15, despite filing extension.

Consequences of non-compliance with Wisconsin tax laws

Failing to comply with Wisconsin's tax obligations can lead to several serious consequences, including financial penalties, interest charges, legal actions, and potential damage to one's reputation.

Here's a detailed breakdown:

Financial penalties and interest

If you fail to file or pay taxes on time, Wisconsin imposes penalties that can significantly increase the amount owed.

The interest rates can vary but are designed to compound over time, substantially adding to the tax liability.

Legal repercussions

More severe cases of non-compliance, such as tax evasion, can lead to criminal charges. Depending on the severity of the offense, these may include fines and even imprisonment.

The state can also enforce tax collection through liens or levies on property, which can further complicate financial situations.