Do expats from Hawaii still need to pay state taxes?

Navigating Hawaii's tax laws can be particularly challenging for expatriates. The state's tax system intricately ties to an individual’s residency status, impacting how much tax you owe after moving abroad.

Understanding these rules is crucial for managing tax liabilities effectively and avoiding potential penalties. Whether you're living overseas or planning to move, grasping your residency status and its implications on your tax obligations is essential.

This article will guide you through the complexities of Hawaii's tax requirements for expatriates, helping ensure you remain compliant while living abroad.

TLDR:

Hawaii tax law requires that you file a state tax return if you are domiciled in the state, regardless of whether you are a resident or not.

This means that even if you no longer live in Hawaii but maintain your domicile there, you are still required to file and pay taxes on your worldwide income.

Failure to file a Hawaii state tax return can result in a penalty of 5% of the tax due, assessed monthly and potentially reaching up to 25% of the balance owed.

Understanding Hawaii's tax residency rules

Defining residency in Hawaii

Hawaii's tax laws categorize individuals into three main groups: residents, nonresidents, and part-year residents, each carrying distinct tax implications.

- Residents: Residents are individuals who either reside in Hawaii for a substantial part of the year or consider it their permanent home. They are subject to taxation on their worldwide income.

- Nonresidents: Nonresidents are individuals who do not meet the residency criteria. They are only taxed on income earned within Hawaii.

- Part-year residents: Part-year residents are individuals who have resided in Hawaii for only a portion of the tax year. They are taxed on income earned both within and outside Hawaii during the period of residency.

- For expats who moved abroad: Even after relocating abroad, Hawaii may still consider you a resident for tax purposes under certain circumstances, primarily determined by your domicile status. Hawaii determines tax residency based on domicile, which refers to your permanent legal residence. If Hawaii was your last domicile before moving abroad and you haven't established a new one elsewhere, you may still be subject to Hawaii state taxes.

Scenarios where you might still be liable for Hawaii state taxes despite living abroad:

1. Maintaining ties to Hawaii: If you retain significant ties to Hawaii, such as property ownership, business interests, or family connections, the state may consider you a resident for tax purposes.

2. Intangible income: Even if you're physically absent from Hawaii, income generated from Hawaii sources, such as rental income from Hawaiian properties, may still be taxable by the state.

3. Intent to return: If you maintain a clear intent to return to Hawaii, the state may consider you a resident for tax purposes, regardless of your current place of residence.

Why should Hawaii expats move domicile to a state with zero state income tax?

State income tax savings

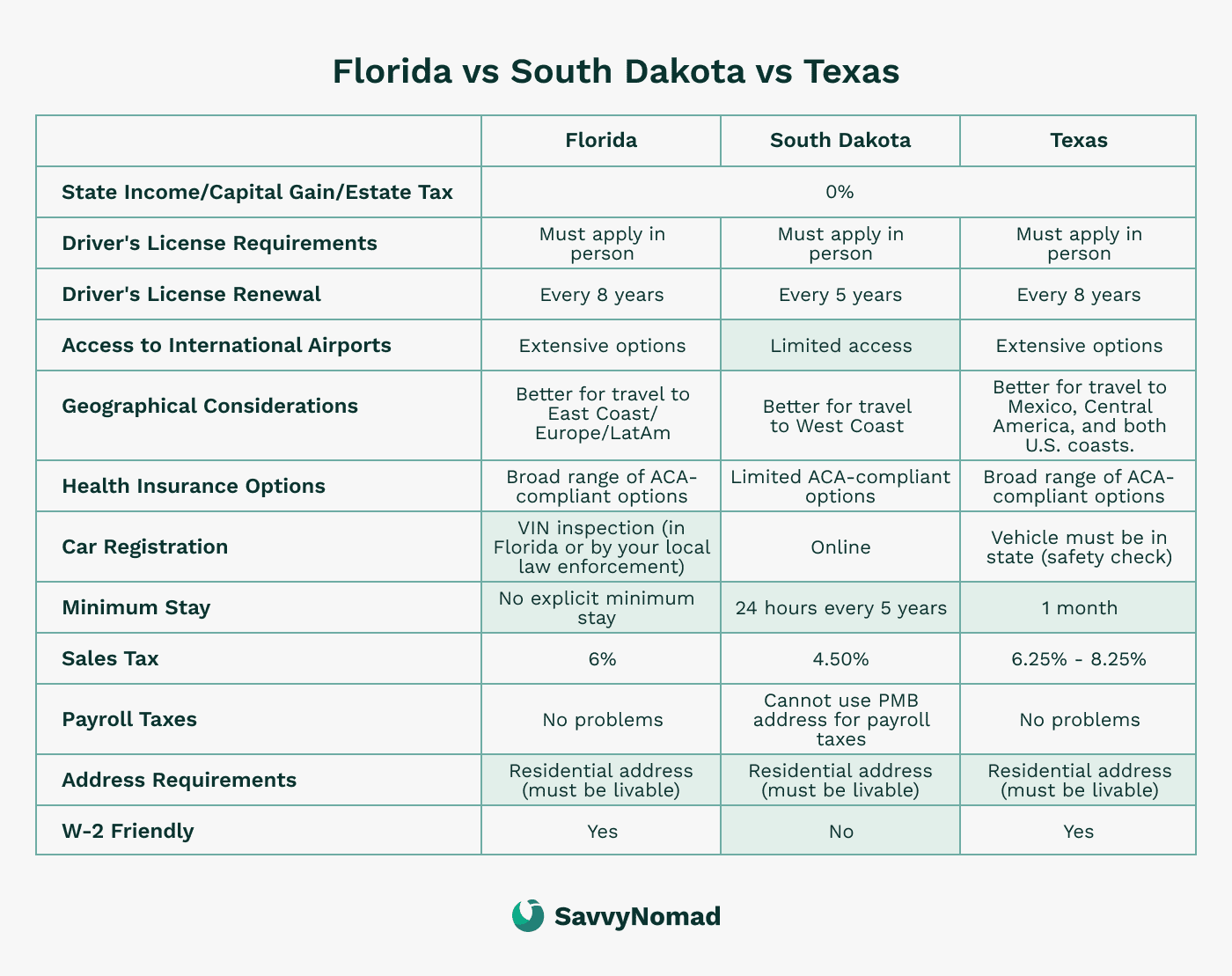

For retirees and high-income individuals from Hawaii, moving to states without income taxes such as Florida, Texas, or Nevada can offer significant financial advantages. Without the burden of state income taxes, you can keep more of your earnings, allowing for greater investment opportunities or an enhanced lifestyle.

Inheritance tax benefits

States like Florida and Texas not only lack a state income tax but also do not impose state estate taxes. This can considerably reduce the tax burden on your estate, ensuring that more wealth is passed on to your heirs. This is especially advantageous for individuals with substantial assets who wish to maximize the inheritance for their beneficiaries.

Flexibility and mobility

Relocating your domicile to a no-income-tax state enhances your flexibility and mobility, allowing you to travel and live in various locations without worrying about high state tax bills. This is ideal for high-income earners with business interests in multiple states or countries and for retirees who desire to spend their later years exploring new places.

Moreover, the absence of state income taxes simplifies your tax filing process. You will only need to file federal taxes, reducing the complexity and potential for errors in your tax returns, making financial management more straightforward.

How to leave Hawaii tax residency?

To change your Hawaii State residency, you must follow several steps carefully to ensure a smooth transition.

1) Establish new residency

It is important to secure a residential address in the new state. Filing a Declaration of Domicile with the state is also recommended, as suggested in our domicile guides.

2) Transfer IDs and registrations

Swiftly update your driver's license and vehicle registration.

3) Register to vote

Register for voting in your new state. In most of the states you can do this online.

4) Update documents

It is important to update all your identification, medical, insurance, and financial documents with your current address to avoid delays in receiving important information or services.

5) Notify your employer

It's important to inform your employer about your change of residency, which can help in converting some of your income from "Hawaii-sourced".

6) Notify IRS

Inform the IRS of your address change using Form 8822. Extend this notification to all personal and professional entities.

7) Keep records

Document all relocation actions diligently.

8) Anticipate an audit

Be audit-ready with comprehensive proof of your move’s permanence.

Tax benefits and exemptions for Hawaii expats

Living abroad as an expat comes with various federal tax benefits and exemptions that can help reduce your overall tax burden. Here are some of the key federal tax advantages available:

Foreign Earned Income Exclusion (FEIE)

The FEIE allows U.S. taxpayers living abroad to exclude a certain amount of their foreign-earned income from U.S. federal income tax.

For the tax year 2024, this exclusion amount is up to $126,500.

To qualify, you must pass either:

- Bona Fide Residency Test: You qualify if you are a resident of a foreign country for an uninterrupted period that includes an entire tax year.

- Physical Presence Test: You qualify if you are physically present in a foreign country for at least 330 full days during a 12-month period.

Foreign Tax Credit (FTC)

The FTC helps you avoid double taxation by allowing you to take credit for foreign taxes paid on income that is also subject to U.S. federal tax.

This credit can significantly reduce your U.S. tax liability, especially if you reside in a country with high tax rates.

Foreign Housing Exclusion (FHE)

The FHE allows you to exclude certain housing expenses from your federal taxable income, including rent, utilities (excluding telephone), and other reasonable expenses related to housing abroad. The amount you can exclude is limited to a base amount plus housing expenses exceeding 16% of the FEIE limit.

Filing Hawaii state taxes from abroad

1. Determine residency and identify Hawaii-sourced income

Determining your residency status is the first step in filing Hawaii state taxes from abroad.

Consider the following factors:

- Evaluate your ties to Hawaii, including property ownership, business interests, and family connections.

- Review your income sources to identify Hawaii-sourced income, such as rental income from Hawaiian properties or income from businesses operating within the state.

- Assess your domicile status to understand whether Hawaii considers you a resident for tax purposes, even if you're living abroad.

2. Required forms and filing procedures

The forms and filing procedures for Hawaii state taxes vary based on your residency status:

- Residents: Hawaii residents must file Form N-11, Hawaii Individual Income Tax Return. They are required to report all worldwide income.

- Nonresidents: Nonresidents must file Form N-15, Hawaii Nonresident and Part-Year Resident Income Tax Return. They only need to report income earned within Hawaii.

- Part-year residents: Part-year residents must also file Form N-15, reporting income earned both within and outside Hawaii during the period of residency.

3. Digital filing options

Hawaii offers digital filing options to streamline the tax filing process for expatriates:

- Utilize the Hawaii Department of Taxation's online platform to file your state taxes online.

- Explore tax preparation software that supports Hawaii state tax filing for expatriates.

Deadlines and extensions

- Standard deadline: April 15.

- Automatic extension: Two-month extension for expats, new deadline June 15.

- Payment due: Taxes owed by April 15, despite filing extension.

Consequences of non-compliance with Hawaii tax laws

Non-compliance with Hawaii tax laws can result in various penalties and actions, as outlined below.

Fines

- Violating Hawaii tax laws can lead to fines of up to $1,000 per day for each day of non-compliance.

- The fines collected are deposited into specific funds, such as the environmental protection and sustainability fund.

Penalties and interest

- Failure to file a Hawaii state tax return can result in a penalty of 5% of the tax due, assessed monthly and potentially reaching up to 25% of the balance owed.

- Interest may also accrue on the unpaid balance, increasing the total amount owed over time.

Asset seizures and wage garnishment

Nonpayment of Hawaii state taxes can lead to severe consequences, including tax liens, wage garnishment, and asset seizures.