Do expats from Nebraska still need to pay state taxes?

When you move abroad from Nebraska, you might wonder if you still need to pay state taxes. Even if you no longer live in Nebraska, you could still have to pay state taxes depending on certain conditions.

Knowing your tax responsibilities is crucial to avoid unexpected bills and penalties. Understanding whether you need to file Nebraska state taxes can help you stay compliant with the law and manage your finances effectively while living abroad.

TLDR:

If Nebraska remains your domicile, you are considered a Nebraska resident for tax purposes and must file state taxes on your worldwide income.

To avoid this, you must sever all ties with Nebraska, such as selling property, transferring your driver’s license, and registering to vote in your new state.

Understanding Nebraska's tax residency rules

Nebraska defines residents, nonresidents, and part-year residents for tax purposes as follows:

Resident

An individual is considered a resident of Nebraska if their domicile (permanent home) is in Nebraska or if they maintain a permanent place of abode in Nebraska and spend more than six months of the tax year in the state.

If you maintain Nebraska as your domicile, you are subject to Nebraska state taxes on your worldwide income. This means that even if you live abroad, as long as Nebraska is your domicile, you are required to file and pay Nebraska state taxes.

Nonresident

Nonresidents do not have a domicile or significant presence in Nebraska. They are only taxed on income derived from Nebraska sources, such as wages for work performed in the state, business income from Nebraska operations, or rental income from property located in Nebraska.

Part-Year Resident

This status applies to individuals who moved to or from Nebraska during the tax year. Part-year residents are taxed on all income earned while a resident of Nebraska and on Nebraska-sourced income during periods of nonresidency

What constitutes Nebraska-sourced income?

Understanding what constitutes Nebraska-sourced income is essential for nonresidents and part-year residents to accurately determine your tax obligations.

Nebraska-sourced income refers to any income derived from activities or assets located within the state.

Here are some key categories to consider:

- Wages and Salaries: Money earned for services performed in Nebraska.

- Business Income: Income from business activities conducted in Nebraska.

- Real Estate: Rental income from property located in Nebraska.

- Capital Gains: Profits from the sale of real estate or tangible property in Nebraska.

- Dividends and Interest: Dividends from Nebraska-based companies and interest earned from Nebraska financial institutions.

- Pensions and Retirement Plans: Retirement income from Nebraska institutions or for services performed in the state.

Why should Nebraska expats move domicile to a state with zero state income tax?

State income tax savings

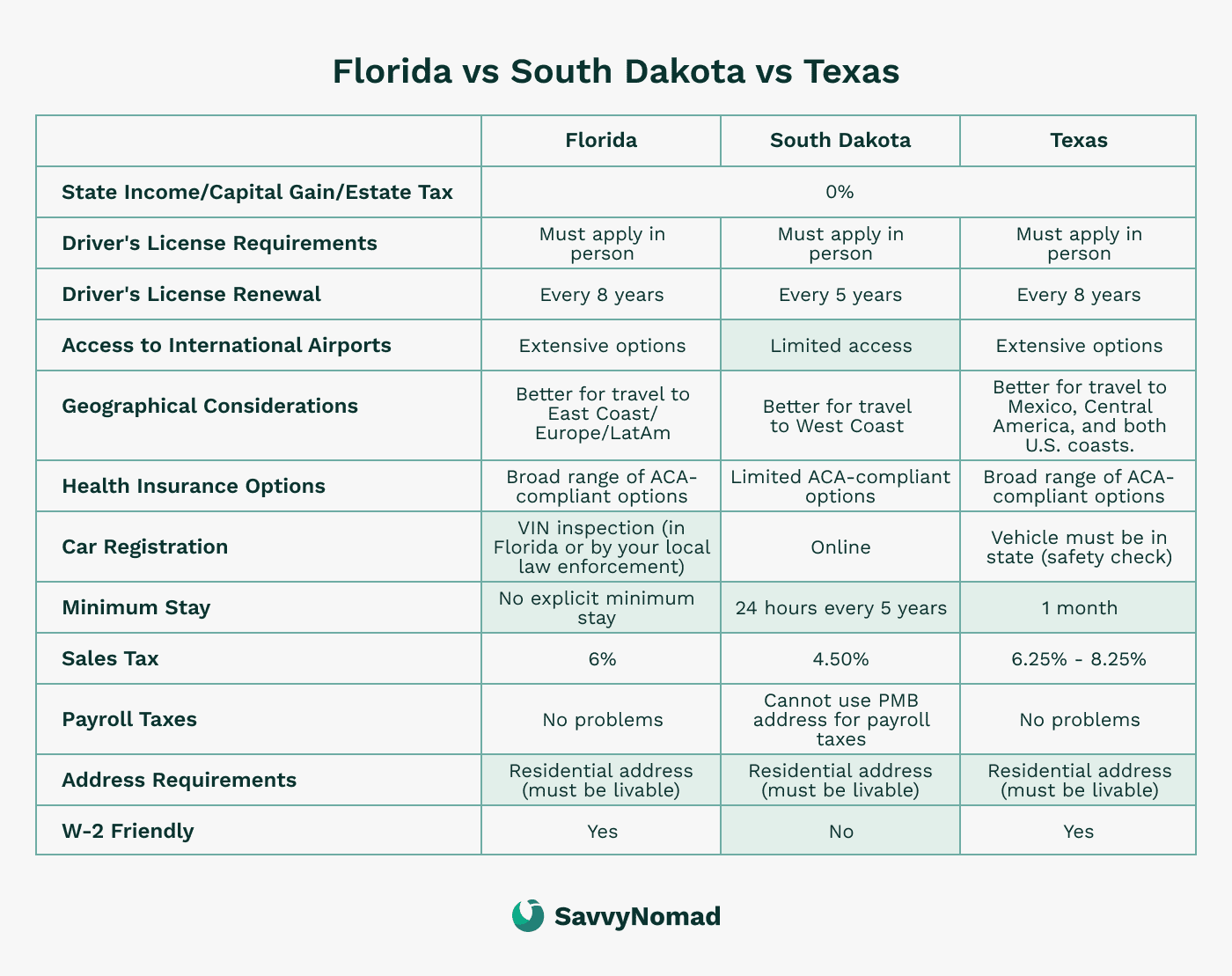

For retirees and high-income individuals from Nebraska, moving to states without income taxes such as Florida, Texas, or Nevada can offer significant financial advantages.

Without the burden of Nebraska state income taxes, you can keep more of your earnings, allowing for greater investment opportunities or an enhanced lifestyle.

Inheritance tax benefits

States like Florida and Texas not only lack a state income tax but also do not impose state estate taxes. This can considerably reduce the tax burden on your estate, ensuring that more wealth is passed on to your heirs.

This is especially advantageous for individuals from Nebraska with substantial assets who wish to maximize the inheritance for their beneficiaries.

Flexibility and mobility

Relocating your domicile from Nebraska to a no-income-tax state enhances your flexibility and mobility, allowing you to travel and live in various locations without worrying about high state tax bills.

This is ideal for high-income earners from Nebraska with business interests in multiple states or countries and for retirees who desire to spend their later years exploring new places.

Moreover, the absence of state income taxes simplifies your tax filing process. You will only need to file federal taxes, reducing the complexity and potential for errors in your tax returns, making financial management more straightforward.

How to leave Nebraska tax residency?

Here are the key steps to help you transition:

1) Establish new residency

- Secure a Residential Address: Obtain a residential address in your new location. This is the first and most critical step in establishing a new domicile.

- File a Declaration of Domicile if required: Some states, like Florida, require a formal declaration to confirm your new domicile.

Reference guides may provide additional help for specific states:

2) Transfer IDs and registrations

As soon as possible, update your driver’s license and vehicle registration to reflect your new address as soon as possible. This helps demonstrate your commitment to your new domicile.

3) Register to vote

Register to vote in your new state and, if necessary, cancel your voter registration in Nebraska. Voter registration is a significant factor in establishing your new residency and showing your intent to remain there.

4) Update documents

Update your address on all your personal documents, including identification cards, medical records, insurance policies, and financial documents.

5) Notify your employer

Notify your employer about your change of residency, particularly if it affects your tax withholding. This can help shift some of your income classification away from being Nebraska-sourced.

6) Notify IRS

Inform the IRS of your address change using Form 8822. Extend this notification to all personal and professional entities.

7) Keep records

Maintain detailed records of all the actions you take to establish your new residency. These can include receipts, bills, and legal documents that can be used as evidence if your residency status is questioned.

8) Cut all ties with Nebraska

If you own property in Nebraska, consider selling it. Keeping property in Nebraska can be a strong indicator that you have not abandoned your Nebraska domicile.

Close any Nebraska-based bank accounts and memberships. Open new accounts in your new state.

9) Be prepared for audit

Be prepared to provide proof of your move’s permanence. Documentation showing that you have established a new domicile and severed ties with Nebraska is essential in the event of an audit.

Tax benefits and exemptions for expats from Nebraska

Living abroad can offer several tax benefits and exemptions that can help reduce your overall tax burden. Here are some of the key tax benefits available to expats from Nebraska:

Foreign Earned Income Exclusion (FEIE)

The FEIE allows you to exclude a significant portion of your foreign-earned income from U.S. federal income tax.

For the tax year 2023, you can exclude up to $120,000 of foreign-earned income.

To qualify, you must pass either:

- Bona Fide Residency Test: You qualify if you are a resident of a foreign country for an uninterrupted period that includes an entire tax year.

- Physical Presence Test: You qualify if you are physically present in a foreign country for at least 330 full days during a 12-month period.

Foreign Tax Credit (FTC)

The FTC helps you avoid double taxation on income taxed both abroad and in the U.S. This credit allows you to deduct the taxes paid to a foreign country from your U.S. federal tax liability on a dollar-for-dollar basis. This is especially beneficial if you live in a high-tax country

Foreign Housing Exclusion (FHE)

This benefit allows you to exclude or deduct certain housing expenses incurred while living abroad. The amount you can exclude is limited to a base amount plus housing expenses exceeding 16% of the FEIE limit.

Filing Nebraska state taxes from abroad

Here are the key forms you might need:

- Form 1040N: Nebraska Individual Income Tax Return. This form is for residents and part-year residents who must report their income and calculate their tax liability.

- Schedule I: Nebraska adjustments to income for Nebraska residents, nonresidents, and partial-year residents.

- Schedule II: Credit for tax paid to another state for full-year residents only.

- Schedule III: Computation of Nebraska Tax for nonresidents and partial-year residents only.

- Form 1040XN: Amended Nebraska individual income tax return for correcting previously filed returns.

Deadlines and Extensions

- General Deadline: April 15, aligning with the federal tax deadline.

- Automatic Extension: Expats may receive an automatic two-month extension to file, extending the deadline to June 15.

- Additional Extension: You can request a further extension to October 15, but this only extends the filing deadline, not the payment deadline. Interest on unpaid taxes will accrue from April 15.

Consequences of non-compliance with Nebraska state tax laws

- Late Filing Penalty: 5% of the unpaid tax per month, up to a maximum of 25%.

- Late Payment Penalty: 0.5% of the unpaid tax per month, up to a maximum of 25%.

- Interest Charges: Interest is charged on any unpaid tax from the original due date until the tax is paid in full, compounded daily.

Audits and Assessments

Nebraska may conduct residency audits to verify your residency status and ensure proper tax compliance. During an audit, you must provide extensive documentation, such as proof of domicile and detailed financial records. Failure to provide adequate documentation can result in additional tax assessments and penalties.