Foreign Earned Income Exclusion in 2025: IRS Form 2555

Living and working abroad offers unique opportunities for U.S. citizens and residents. However, this lifestyle presents specific tax challenges (and opportunities). The Foreign Earned Income Exclusion (FEIE) is crucial in this context.

FEIE is an IRS provision for Americans abroad. In 2023, eligible individuals can exclude up to $120,000 of their foreign-earned income from U.S. federal taxes, an increase from $112,000 in 2022.

However, FEIE does not cover all foreign income. Instead, the benefits depend on individual circumstances and must be claimed on a federal income tax return.

In the following sections, we’ll break down each aspect of FEIE to help U.S. citizens and residents abroad understand their tax responsibilities.

What is FEIE?

The Foreign Earned Income Exclusion (FEIE) is a vital tax provision for U.S. citizens and resident aliens who live and work outside the United States.

Established by the IRS, FEIE allows these individuals to exclude a certain amount of their foreign-earned income from U.S. federal income tax. To qualify for FEIE, maintaining a foreign tax home is essential, as it relates to the Bona Fide Residence Test and the criteria that determine eligibility.

This provision is crucial for those seeking to mitigate the financial burden of dual taxation - being taxed in both their country of residence and the U.S. This is because the US is the only country that taxes based on citizenship, not residency.

FEIE and the 2023 Tax Year

For the 2023 tax year, the FEIE limit is $120,000. The increase is an attempt to adjust for inflation and keep the FEIE relevant for Americans working abroad. It offers significant tax relief, easing their financial burden.

Eligibility for FEIE: Physical Presence Test

For U.S. nomads and expats, leveraging the Foreign Earned Income Exclusion (FEIE) in 2023 requires meeting specific criteria. These include the type of income, citizenship or residency status, and an uninterrupted period that includes physical presence or bona fide residency abroad.

1. Foreign earned income

Eligibility for FEIE hinges on earning income abroad. This income must be from employment or self-employment outside the U.S., including self-employment income. The FEIE covers this foreign-earned income specifically.

2. Citizenship or residency status

U.S. citizens and green card holders working in foreign countries can use the FEIE. It’s a requirement to have a tax home in a foreign country or countries to qualify for the FEIE.

3. Physical Presence Test

One key criterion is the Physical Presence Test. This requires being in a foreign country for at least 330 full days in 12 months. These days don't need to be consecutive However, they should include part of the tax year in question.

Key points of the Physical Presence Test:

- Counting Full Days: A full day is defined as a period of 24 consecutive hours, starting and ending at midnight, spent in a foreign country. Days spent traveling to and from the United States or over international waters do not count as full days in a foreign country.

- Travel Considerations: Individuals can move between different foreign countries without losing full days. However, if travel between countries takes 24 hours or more and is not within a foreign country, those days will not count towards the 330-day total.

- Transit Through the U.S.: If you are in transit between two foreign points and are physically present in the U.S. for less than 24 hours, this time is not counted as time in the U.S.

- Exceptional Circumstances: The minimum time requirement of 330 days can be waived if an individual must leave a foreign country due to war, civil unrest, or similar adverse conditions. The IRS provides specific waiversin such cases.

What is not considered:

- The test does not depend on the type of residence established, intentions of returning to the U.S., or the nature and purpose of the stay abroad. However, these factors might be relevant for the Tax Home Test, which will be discussed later in this article.

Bona Fide Residence Test for FEIE

Understanding the Bona Fide Residence Test is equally important for U.S. expats and nomads seeking the Foreign Earned Income Exclusion (FEIE). This test is for those looking to establish a more permanent residence in a foreign country and includes an entire tax year to qualify.

Establishing Bona Fide Residence

To pass this test, you must be a bona fide resident of a foreign country for an entire tax year (January 1st to December 31st for the majority of taxpayers). Bona fide residence requires more than just living abroad for a year; it is an even stronger commitment to residing in that country.

Eligibility criteria

The test is for U.S. citizens and residents who are also citizens or nationals of countries with a U.S. income tax treaty. It assesses whether you've established residence in a foreign country indefinitely or for an extended period. If you are looking to pass the residency test, then establishing permanent quarters for you (and your family) is crucial.

Determining factors

Key factors in determining bona fide residency include:

- Your intention or purpose for staying in the foreign country.

- Your activities in that country.

- Payment of taxes to that country.

The IRS evaluates these factors based on Form 2555, Foreign Earned Income.

Residency for part of a year

Once you establish bona fide residency for a full tax year, you qualify for that year, and this continues until you no longer meet the required criteria and leave your foreign residence.

Impact on FEIE eligibility:

This test covers a wider range of exclusions due to extended stays and considers a deeper integration into the foreign country. It's vital for expats who move abroad for long-term residence rather than short-term work.

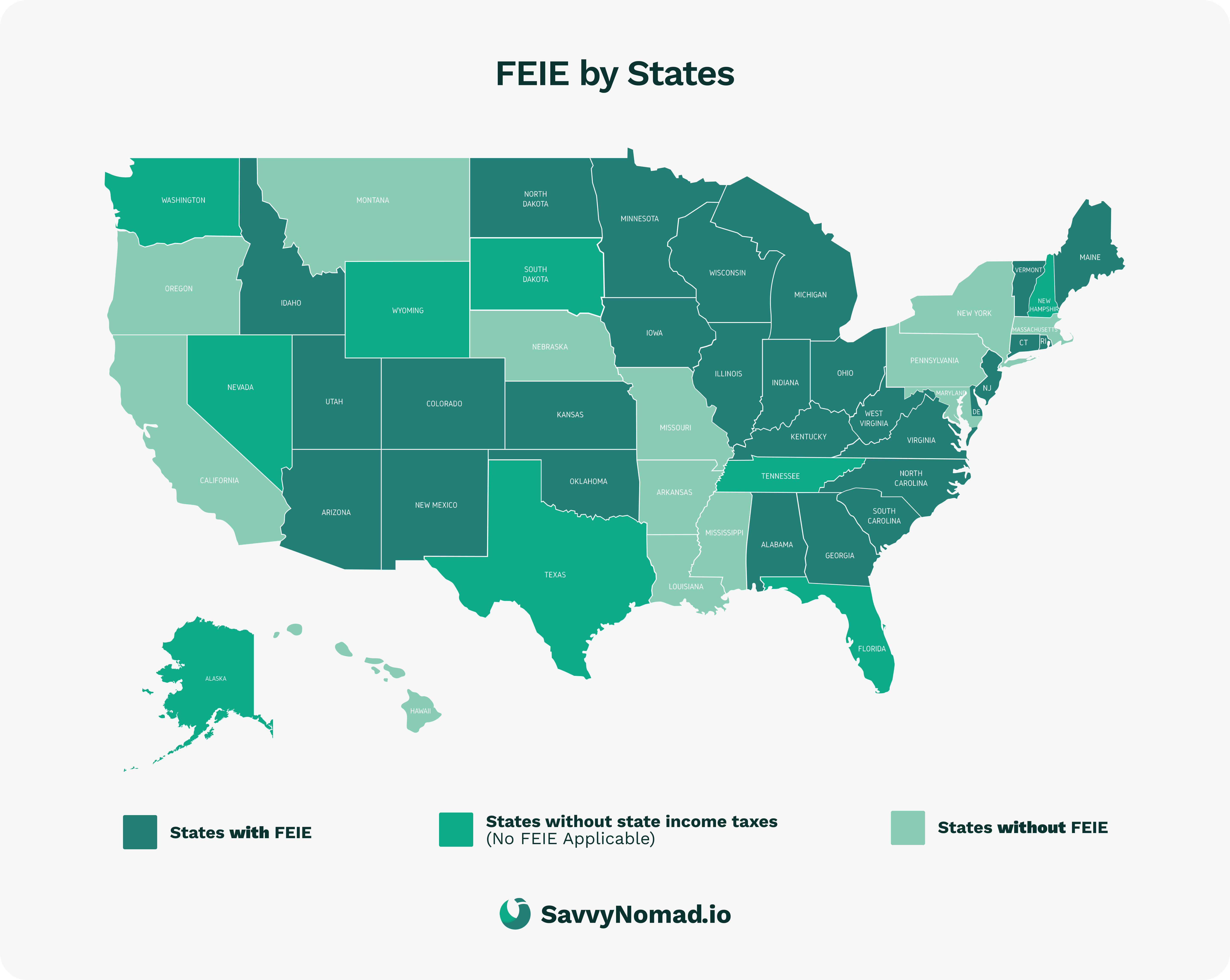

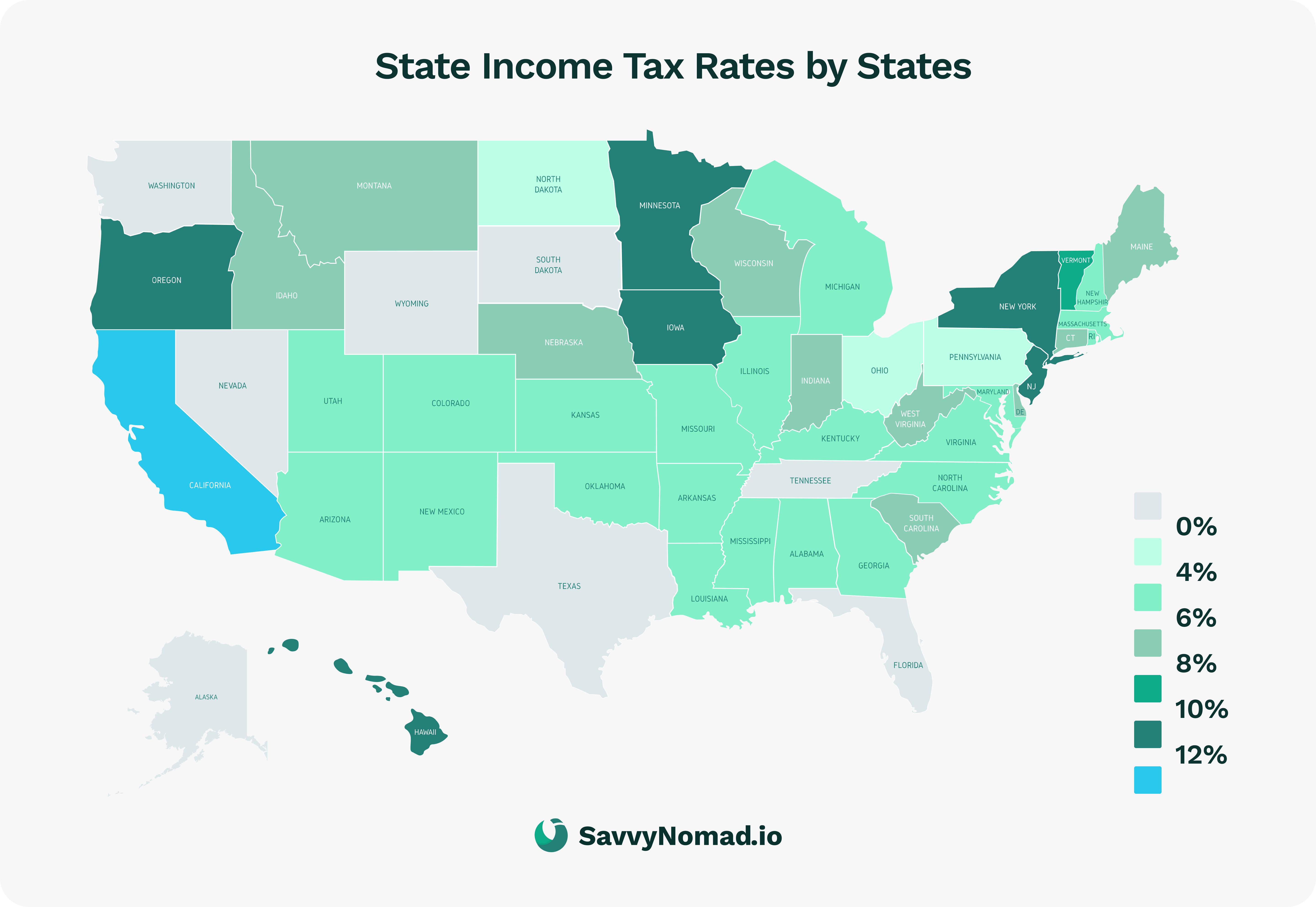

FEIE financial analysis: Understanding federal and state tax implications

The FEIE is, of course, crucial for U.S. expats and nomads in managing federal income tax.

However, the impact of foreign-earned income on your state income taxes is equally significant, especially in states like California and New York, while the impact on states like Florida, South Dakota, and Texas is a breeze.

Impact on federal and state income taxes

Federal income tax

The FEIE allows eligible individuals who qualify for the foreign earned income exclusion to exclude up to $120,000 of foreign-earned income from their U.S. federal income tax, resulting in tens of thousands of dollars in federal tax savings.

States with FEIE:

- Alabama

- Colorado

- Delaware

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Maine

- Michigan

- Minnesota

- New Mexico

- North Carolina

- Ohio

- Oklahoma

- Rhode Island

- South Carolina

- Utah

- Vermont

- Virginia

- West Virginia

- Wisconsin

States without FEIE:

- Arkansas

- California

- Connecticut

- Hawaii

- Louisiana

- Massachusetts

- Maryland

- Mississippi

- Missouri

- Montana

- Nebraska

- New Jersey

- New York

- Oregon

- Pennsylvania

States with No State Income Tax (No FEIE Applicable):

- Alaska

- Florida

- Nevada

- *New Hampshire (No general state income tax on earned income)

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Detailed Examples of Tax Savings

Single Expat from New York Earning $100,000:

- Foreign Earned Income: $100,000

- FEIE: $100,000 (excluded from federal tax)

- Federal Tax Bill: $0

- Estimated State Tax for New York: $6,000 (6% of $100,000)

- Total state and federal income taxes: $6,000

Expat Couple from New York with a Combined Income of $200,000:

- Combined Foreign Earned Income: $200,000

- FEIE for Each: $120,000

- Federal Tax Bill: $0 (no federal income tax owed)

- Estimated State Tax for New York: $12,000 (6% of $200,000)

- Total state and federal income taxes: $12,000

Single Expat from Florida with an Income of $100,000:

- Foreign Earned Income: $100,000

- FEIE: $120,000

- Taxable Income for Federal Tax: $0

- Federal Tax Bill: Calculated on $0

- State Tax: $0 (no state income tax in Florida).

- Total state and federal income taxes: $0

Common misconceptions and mistakes regarding FEIE

Navigating the Foreign Earned Income Exclusion (FEIE) can be tricky for U.S. expats. Understanding common misconceptions and mistakes is key to informed decision-making and U.S. tax compliance.

Common misconceptions:

1. No need to file a U.S. tax return

It's a myth that if your income is below the FEIE limit, you don't need to file a tax return. All U.S. citizens and residents must file, regardless of income level. The FEIE allows excluding certain income from taxation but doesn't negate the filing requirement.

2. Not reporting foreign-earned income

Failing to report foreign earned income, even if you qualify for the FEIE, is a mistake. All worldwide income must be reported on your tax return, and self-employed individuals must still pay self-employment tax unless protected by a totalization agreement.

3. Overlooking other tax benefits

Relying solely on the FEIE might mean missing out on other benefits. The Foreign Tax Credit (FTC) and tax-deductible IRA contributions are examples of benefits that could be advantageous alongside or instead of the FEIE.

4. Misunderstanding FEIE limitations

The FEIE has specific limitations. It's only for foreign-earned income and not for investment or rental income. If revoked, you can't use it again for five years without IRS approval.

5. Misunderstanding what is foreign earned income

Many nomads living abroad think that if they earn money from a US-based company, they cannot qualify for FEIE. It's not true. Living abroad and earning money from a US-based company is considered foreign-earned income.

Common mistakes:

1. Failing to file FEIE Form 2555 timely

To claim the FEIE, timely filing of Form 2555 is crucial. It must accompany your income tax return, filed typically by April 15th, with potential extensions to June 15th. Late filing can result in losing the FEIE for that year.

2. Revoking the FEIE without understanding consequences

If you revoke the FEIE, you can't claim it for the next five years without IRS approval. A statement must be attached to your return in the first year you don't claim the exclusion.

3. Neglecting future tax implications

Consider long-term plans when claiming the FEIE. Future possibilities of revoking the FEIE should be weighed to avoid unexpected tax liabilities and compliance issues.

Understanding when and how to revoke the FEIE

Revoking the Foreign Earned Income Exclusion (FEIE) is a significant decision with substantial implications, particularly due to the restrictive five-year rule.

Revoking the FEIE

To revoke the FEIE, you must attach a statement to your current or amended tax return. This statement must specify the choices you're revoking, such as excluding foreign-earned income and/or foreign housing amounts.

The 5-Year rule

Upon revocation, you cannot use the FEIE for the next five tax years without IRS permission. During this period, you are ineligible to claim the FEIE unless you obtain specific approval.

Requesting IRS approval

To use the FEIE within the five years after revocation, you need an IRS ruling. This requires applying to the IRS's Associate Chief Counsel (International). The process is complex, often necessitating professional help, and the IRS charges a fee for these rulings.

Factors considered by the IRS

The IRS considers various factors in its decision, including:

- Your period of residence in the U.S.

- Moves between countries with differing tax rates.

- Changes in the tax laws of your foreign country of residence.

- Changes in your employment status.

Cost and complexity

Revoking the FEIE and then seeking IRS approval to reclaim it is costly and time-consuming. Additionally, approval is not assured.

Given these complexities, it's crucial to thoroughly evaluate your future tax residency and income situation before revoking the FEIE. Consulting with a tax professional is highly recommended to understand the full impact of this decision and its long-term consequences. This ensures informed decision-making that aligns with your financial and residency plans.

Application process for the Foreign Earned Income Exclusion

Applying for the Foreign Earned Income Exclusion (FEIE) involves a structured process:

Qualification and preparation

Establish Eligibility: Confirm that you and your income qualify for the FEIE. This involves ensuring you meet either the bona fide residence test or the physical presence test and that you have foreign-earned income.

Filing IRS Form 2555

File IRS Form 2555 and Form 1040 each year. It's important to adhere to the same filing deadlines and extension rules for Form 1040.

Form details:

- Part I: Fill in your details and your employer's details.

- Part II or III: Complete based on whether you are using the Bona Fide Residence Test (Part II) or the Physical Presence Test (Part III).

- Part IV: Enter your foreign-earned income amounts and expenses, which should correspond with those on Form 1040.

- Part V and VI: These parts are for claiming the Foreign Housing Exclusion or Deduction, if applicable.

- Parts VII, VIII, and IX: For exclusion calculations using the figures from the previous sections.

Additional considerations

- Tax Specialist Consultation: Due to the complexities involved in the FEIE and its implications on your tax situation, it is often advisable to seek assistance from an expat tax specialist. They can provide valuable planning advice and ensure the form is filled out correctly.

- Understanding the Details: It's crucial to understand the types of income that qualify as foreign earned income, the specific rules regarding your tax home, and the tests for physical presence or bona fide residence.

FAQ

What foreign income is taxable in the US?

U.S. citizens and resident aliens are taxed on their worldwide income, which includes all forms of income such as wages, unearned income, and tips, irrespective of where they live or earn their income.

This encompasses income from foreign trusts and bank accounts. Even if a taxpayer qualifies for tax benefits like the Foreign Earned Income Exclusion or the Foreign Tax Credit, which can reduce or eliminate U.S. tax liability, an income tax filing is still mandatory. Additionally, there's a requirement to report foreign financial accounts exceeding $10,000 at any time during the year through FinCEN Form 114, known as FBAR

How much foreign income is tax-free in the USA?

For the tax year 2023, U.S. citizens or resident aliens living abroad may qualify to exclude up to $120,000 of their foreign earnings from U.S. income tax. This exclusion amount is adjusted annually for inflation.

What is the foreign-earned income exclusion for dual citizens?

If you're a dual citizen living and working outside the U.S., you may qualify for the FEIE if you meet either the Bona Fide Residence Test or the Physical Presence Test. For 2023, it is $120,000. This means that if your foreign earned income falls within these limits, it could be excluded from U.S. federal taxation, potentially reducing your U.S. tax to zero, although you may still be liable for taxes in the foreign country as well as state income tax.

Can you claim foreign income exclusion and foreign tax credit?

Yes, U.S. expats can claim both the Foreign Tax Credit (FTC) and the Foreign Earned Income Exclusion (FEIE), but not for the same income. This is particularly common for those whose earnings exceed the FEIE threshold. An expat could exclude a portion of their earned income under the FEIE and use the FTC for any passive income, such as income from rental properties or investments, thus potentially maximizing savings on their U.S. tax bill.

Should I take foreign earned income exclusion or foreign tax credit?

Deciding between the Foreign Earned Income Exclusion (FEIE) and the Foreign Tax Credit (FTC) can significantly impact your tax liability as a U.S. expat. Here are key considerations:

Tax Credits vs. Deductions: Tax credits like the FTC reduce your income tax directly, while deductions such as the FEIE lower your taxable income.

Foreign Tax Credit: The FTC is a dollar-for-dollar credit on the taxes paid to another country, preventing double taxation. It's beneficial if you pay more taxes abroad than you would owe in the U.S., and it can be applied to both active and passive income.

Foreign Earned Income Exclusion: The FEIE allows you to exclude your earned income up to a certain limit from U.S. taxation. For 2021, the limit was $108,700; for 2022, it was $112,000; for 2023, it is $120,000.

It's recommended to assess the FTC first due to its broader applicability and less stringent limitations than the FEIE. The FTC can be applied to more types of income, and unused credits can be carried forward for future tax years or carried back. The FEIE, once claimed, must be consistently claimed each year unless revoked, which bars you from claiming it again for five years.

Do all states allow foreign-earned income exclusion?

Many states, such as California, do not recognize the Foreign Earned Income Exclusion (FEIE). If you qualify for the FEIE on your federal tax return, you may still be liable for state income tax on your worldwide income.

The following states currently allow FEIE: Alabama, Colorado, Delaware, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Maine, Michigan, Minnesota, New Mexico, North Carolina, Ohio, Oklahoma, Rhode Island, South Carolina, Utah, Vermont, Virginia, West Virginia, and Wisconsin.

Do green card holders have to pay taxes on foreign income?

U.S. citizens must report and possibly pay taxes on foreign property in several circumstances:

Rental income

If you own foreign real estate and rent it out, you must report the rental income on your U.S. federal tax return (Form 1040). Deductions applicable to U.S. rental properties, like mortgage interest and repairs, can also be applied to foreign rental properties and must be reported in U.S. dollars.

Capital gains tax

Selling foreign real estate may result in a capital gains tax obligation. U.S. citizens are taxed on worldwide capital gains. If the property qualifies as a primary residence, a significant deduction may be available. Otherwise, standard capital gains rates apply.

Foreign real estate ownership

Generally, if you own foreign real estate as an individual and not through a foreign entity, you may not need to report it unless you rent it out. However, if owned through a foreign entity, you must report it on Form 8938 if it exceeds certain value thresholds dictated by the Foreign Account Tax Compliance Act (FATCA).

Foreign bank accounts

Foreign property owners may also need to report foreign bank accounts associated with the property if the total value exceeds $10,000 at any time during the tax year through the FBAR reporting mechanism.

Do green card holders have to pay taxes on foreign income?

Yes, green card holders must report their worldwide income to the IRS, regardless of where they currently live. This includes income earned from foreign sources.

U.S. tax law operates on a system of citizenship-based taxation. All U.S. citizens and green card holders must declare their global income annually using IRS Form 1040.

This system is enforced through mechanisms like the Foreign Account Tax Compliance Act (FATCA), which mandates international financial institutions to report the financial activities of U.S. persons to the IRS.

How does the IRS track foreign accounts?

The Internal Revenue Service (IRS) employs several methods to track foreign accounts, mainly through the Foreign Account Tax Compliance Act (FATCA):

FATCA reporting by foreign financial institutions

FATCA, enacted in 2010, is one of the primary tools the IRS uses. Under this act, foreign financial institutions must report information to the IRS.

This includes the identities of their U.S. account holders, their social security numbers, account numbers, balances, and income details such as interest and dividends earned on the accounts.

Mandatory reporting by U.S. taxpayers

FATCA also mandates that certain U.S. taxpayers with financial assets outside the United States report these assets to the IRS through Form 8938, known as the Statement of Specified Foreign Financial Assets.

This requirement is in addition to the preexisting obligation to report foreign financial accounts through Form TD F 90.22-1, known as the Report of Foreign Bank and Financial Accounts (FBAR). Non-compliance with these reporting requirements can lead to serious penalties.

Global network and agreements

The IRS has established ties with over 110 countries and more than 300,000 financial institutions globally under FATCA. This extensive network allows the IRS access to information regarding U.S. citizens' foreign income and accounts, thereby enabling them to track underreported foreign income effectively.

How does the IRS find out about foreign income?

The IRS discovers foreign income through several methods:

FATCA reporting

The Foreign Account Tax Compliance Act (FATCA) requires foreign financial institutions to report information about financial accounts held by U.S. taxpayers, or by foreign entities in which U.S. taxpayers hold a substantial ownership interest. This includes details about income earned in these accounts, such as interest and dividends.

Information returns filed by taxpayers

U.S. taxpayers with foreign income must file various forms, depending on their circumstances. This includes the Report of Foreign Bank and Financial Accounts (FBAR), Form 8938 (Statement of Specified Foreign Financial Assets), and other types of foreign income like Form 3520 for foreign trusts and Form 5471 for certain foreign corporations. These forms disclose foreign income and assets to the IRS.

Tax treaties and international agreements

The U.S. has tax treaties and information-sharing agreements with many countries. These treaties allow for the exchange of taxpayer information, including information about foreign income earned by U.S. taxpayers.

Whistleblower information

Sometimes, the IRS obtains information about foreign income through whistleblowers who report non-compliance by other taxpayers.

Automatic exchange of information

Under FATCA and other international agreements, there is an automatic exchange of financial information between the U.S. and other countries, which can reveal foreign income sources.

Investigations and audits

The IRS may also discover foreign income during the course of audits and investigations, which can be triggered by discrepancies in taxpayer filings or other indications of unreported income.

What happens if you don't report foreign income to the IRS?

Failing to report foreign income to the IRS can lead to serious consequences:

Penalties and fines

There are significant financial penalties for not reporting foreign income. The exact amount can vary depending on the type and amount of unreported income, and whether the failure to report was negligent or willful. Penalties can be a percentage of the unreported income or a set dollar amount, and they can accumulate for each year the income was not reported.

Interest charges

In addition to penalties, interest on the unpaid tax and penalties starts accruing from the due date of the tax return until the date the tax is paid.

Criminal charges

In severe cases, particularly if non-reporting is deemed willful, it can lead to criminal prosecution. This can include charges of tax evasion or fraud, which can result in prison sentences in addition to financial penalties.

Statute of Limitations:

Normally, the IRS has a three-year window to audit a tax return. However, if you omit more than 25% of your income on your tax return, the IRS has six years to challenge your return. In cases of fraud or failure to file a return, there is no statute of limitations, meaning the IRS can audit your tax return at any time.

Loss of passport

For serious cases involving large amounts of unpaid taxes, U.S. taxpayers may face revocation or denial of their passports.

Additional compliance actions

The IRS may take further compliance actions, such as placing liens on property or garnishing wages to recover owed taxes.

I’ve written this guide to help others and save them some time googling.

That said, this is not tax or financial advice, and you should always consult an expert regarding your circumstances.