Do expats from Ohio still owe Ohio state income taxes?

Navigating Ohio’s tax laws can be complex, particularly for residents who move abroad. Ohio, like many states, has specific regulations determining when individuals must pay state taxes, even if they no longer reside within its borders.

These rules hinge on the concepts of residency and domicile, making it crucial for expats to understand their tax obligations.

For Ohio expats, understanding state tax obligations is essential to avoid unexpected financial burdens. Even after moving abroad, under certain conditions you must continue paying Ohio state taxes.

TLDR:

Ohio tax law requires you to file a state income tax return if you are domiciled in the state, regardless of whether you are a resident or not.

This means that even if you no longer live in Ohio but maintain your domicile there, you are still required to report, and pay taxes on, your worldwide income.

Understanding Ohio's tax residency rules

Ohio's tax obligations for residents living abroad are determined by residency status, which can be categorized into three main types: Resident, Nonresident, or Part-Year Resident. Each status has its own criteria and tax implications.

Resident

Definition: An individual is considered a resident if Ohio is their domicile, meaning it's their permanent legal residence. Temporary absences from the state do not change this status.

Tax Implications: Ohio imposes state income tax on all income of resident individuals, even if that income is earned outside of Ohio or the United States. In other words, residents are taxed on their worldwide income, wherever and how generated.

Nonresident

Definition: Nonresidents are individuals who do not meet the criteria for being considered residents. They may work in Ohio or earn income from Ohio sources but live elsewhere.

Tax Implications: Nonresidents are taxed only on income earned from Ohio sources, such as wages for work performed in the state or income from property located in Ohio.

- Have a residence outside Ohio for the entire year.

- Not hold Ohio as their domicile.

- Spend no more than 212 “contact periods” in Ohio during the tax year (for most individuals, the calendar year). (More on this later)

- Have no significant contacts that create an Ohio domicile.

- File an affidavit of non-Ohio domicile (more on this later as well).

Part-Year Resident

Definition: This status applies to individuals who move to or from Ohio during the tax year. It covers those who change their permanent home from Ohio to another location or vice versa.

Tax Implications: Part-Year Residents are taxed on all income received while they were Ohio residents and on Ohio-source income received only during the portion of the year they were nonresidents.

Ohio’s ‘Contact Period’ rule

Ohio has specific guidelines for determining residency for income tax purposes, and one of the most important factors is the number of “contact periods” you spend in the state. In December 2014, House Bill 494 (HB 494) introduced an important change that increased the allowable number of contact periods from 182 to 212. This means you can now spend up to 212 “contact periods” in Ohio without being considered a resident for state income tax purposes.

But what exactly is a “contact period,” and how does it impact expats?

A “contact period” is defined by Ohio law as any instance in which an individual spends a portion of two consecutive days in the state. For example, if you maintain a primary residence outside Ohio, such as in Florida, but return to Ohio for part of two consecutive days (e.g., Monday and Tuesday), you’ve been in Ohio for parts of two days, but accumulated only one “contact period.”

- If you travel to Ohio and spend part of Monday and Tuesday in the state, that counts as one contact period.

- However, if you spend part of Monday and Wednesday in Ohio, without being in the state on Tuesday, neither Monday nor Wednesday counts as a “contact period.”

The rule focuses on overnight stays. Therefore, if you live outside of Ohio but regularly visit for short periods that span two consecutive days, you could accumulate multiple contact periods.

Why the 212 contact periods matter for expats

Before HB 494 was passed, the threshold was set at 182 contact periods, meaning roughly half the year. Now, with the new threshold of 212 contact periods, expats and non-residents with ties to Ohio have more flexibility. You can spend more time in Ohio without being classified as a resident for state tax purposes, provided you stay within this limit.

For expats who maintain connections to Ohio — such as family, property, or business interests — this is a crucial update. You can now spend a significant portion of the year in Ohio while maintaining tax residency in another state, like Florida, and avoid Ohio state income taxes.

What constitutes Ohio-sourced income?

Ohio-sourced income is essential in determining tax obligations for nonresidents and part-year residents. This includes, but is not limited to:

- Employment Income: Wages or salaries earned while working in Ohio.

- Business Income: Earnings from operations conducted within Ohio, whether through ownership of a business or as a partner in a partnership.

- Property Income: Rental income or proceeds from the sale of real estate located in Ohio.

Why should Ohio expats change domicile to a state with zero state income taxes?

State income tax savings

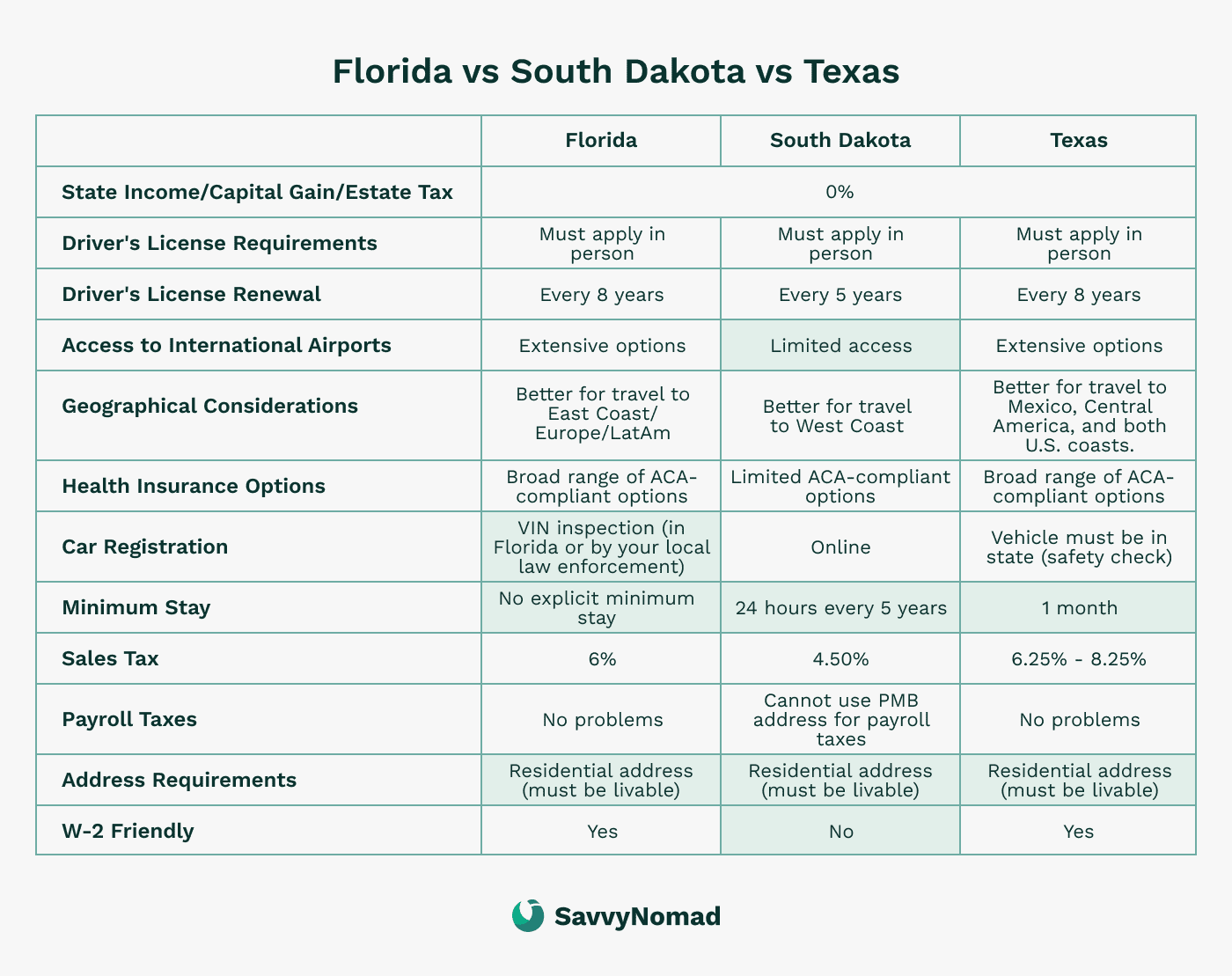

For retirees and high-income individuals from Ohio, moving to a state without income taxes, such as Florida, Texas, or Nevada, can offer significant financial advantages. Without the burden of state income taxes, you can keep more of your earnings, allowing for greater investment opportunities or an enhanced lifestyle.

Inheritance tax benefits

States like Florida and Texas not only lack a state income tax but also do not impose state estate taxes. This can considerably reduce the tax burden on your estate, ensuring that more wealth is passed on to your heirs. This is especially advantageous for individuals with substantial assets who wish to maximize their beneficiaries’ inheritances.

Flexibility and mobility

Relocating your domicile to a no-income-tax state enhances your flexibility and mobility, allowing you to travel and live in various locations without worrying about high state tax bills. This is ideal for high-income earners with business interests in multiple states or countries and for retirees who want to spend their later years exploring new places.

Moreover, the absence of state income taxes simplifies your tax filing process. You need file and pay only federal taxes, reducing the complexity and potential for errors in your tax returns, making the management of your financial affairs more straightforward.

How to change your tax residency from Ohio to another state?

When you decide to relocate to another country or state, changing your Ohio residency status requires a series of deliberate steps to ensure a smooth transition.

Here’s a step-by-step guide to help you navigate this process:

1) Establish new residency

Secure a residential address in your new location. This is the first step in establishing your new domicile. While you’re at it, establish relationships with professionals (lawyers, financial advisors, physicians, and dentists, even veterinarians if appropriate) in your new location.

Consider filing a Declaration of Domicile in your new state, publicly declaring, under oath under penalty of perjury, your intent to make it your permanent home.

Reference guides like Savvy Nomad’s domicile guides may provide additional help for specific states:

2) Transfer IDs and registrations

Update your driver's license and vehicle registration promptly to reflect your new address, establishing your presence in the new state.

3) Register to vote

Register to vote in your new location; doing so demonstrates your commitment to your new domicile.

4) Update documents

Ensure all personal documents, such as identification cards, medical records, insurance policies, and financial documents, are updated with your new address. This consistency is important for establishing your new residency status.

5) Notify your employer

Inform your employer about your residency change. This is particularly important if your move affects how your income is taxed, potentially shifting some of it away from being classified as "Ohio-sourced."

6) Notify the IRS

Inform the IRS of your address change using Form 8822. Extend this notification to all personal and professional entities.

7) Keep records

Maintain detailed records of all your relocation actions, including receipts, bills, and legal documents. These records can be invaluable, especially if your residency status is questioned.

8) Anticipate an audit

Be audit-ready with comprehensive proof of your move’s permanence.

Tax benefits and exemptions for Ohio expats

Living abroad as an expat comes with various federal tax benefits and exemptions that can help reduce your overall tax burden. Here are some of the key federal tax advantages available:

Foreign Earned Income Exclusion (FEIE)

The FEIE allows U.S. taxpayers living abroad to exclude a certain amount of their foreign-earned income from U.S. federal income tax.

For the tax year 2024, this exclusion amount is up to $126,500.

To qualify, you must pass either:

- Bona Fide Residency Test: You qualify if you are a resident of a foreign country for an uninterrupted period that includes an entire tax year.

- Physical Presence Test: You qualify if you are physically present in a foreign country for at least 330 full days during a 12-month period.

Foreign Tax Credit (FTC)

The FTC helps you avoid double taxation by allowing you to credit foreign taxes paid against U.S. federal taxes on the same income.

This credit can significantly reduce your U.S. tax liability, especially if you reside in a country with high tax rates.

Foreign Housing Exclusion (FHE)

The FHE allows you to reduce your federal taxable income by the amount you paid for certain housing expenses, such as rent, utilities (excluding telephone), and other reasonable expenses related to housing abroad. The amount of the reduction is limited to a base amount plus housing expenses exceeding 16% of the FEIE limit.

Filing Ohio state taxes from abroad

Filing Ohio state taxes from abroad involves several critical steps to ensure compliance and avoid penalties. Understanding your residency status, identifying Ohio-sourced income, and utilizing digital filing options are key components of this process.

1. Determine your residency status

- The first step is to determine whether Ohio considers you a resident, a nonresident, or a part-year resident for the tax year. This status significantly influences your tax filing obligations.

- Residents must report all income, regardless of where it is earned, while nonresidents only report Ohio-sourced income. Part-year residents report only income earned or received while they were Ohio residents.

2. Identify Ohio-sourced income

Ohio-sourced income includes:

- Wages and salaries for services performed in Ohio.

- Business income from activities conducted in Ohio.

- Rental income from property located in Ohio.

- Capital gains from the sale of real estate or tangible property in Ohio.

3. Understand filing requirements

- For Residents: If you were a resident of Ohio for any part of the year and are required to file a federal tax return, you must likely file a state return as well.

- For Nonresidents: You must file Form IT-203 if your Ohio-sourced income exceeds your Ohio standard deduction or if you wish to claim a refund of Ohio state income taxes withheld from your pay. Additional filing requirements apply if you want to claim certain refundable or carryover credits or had a net operating loss for Ohio state personal income tax purposes.

- For Part-Year Residents: You must file an Ohio state tax return reporting all income received while a resident and any Ohio-sourced income received while a nonresident.

4. Filing deadlines and forms

- The typical deadline for filing Ohio state taxes is April 15. Nonresidents and part-year residents should use Form IT-203, Nonresident and Part-Year Resident Income Tax Return.

- Gather all necessary documentation, including income statements and records of days spent in Ohio, if applicable.

5. Digital filing options

- Ohio offers e-filing services that simplify the tax filing process for expatriates. These digital platforms guide you through filing, ensuring you meet Ohio state requirements.

- Utilizing e-filing services can streamline the process, reduce errors, and expedite the processing of your tax return.

6. Paying estimated taxes

- If you anticipate owing taxes, you might need to make estimated tax payments throughout the year. This can help avoid penalties for underpayment when you file your tax return.

- Estimated tax payments can be made online through the Ohio Department of Taxation’s website.

7. Extensions and penalties

- If you need more time to file, you can request an extension, typically pushing the filing deadline to October 15. However, this extension is for filing your tax return, not for paying any taxes owed.

- Interest may accrue on any unpaid amounts from the original April 15 deadline, even if you file later. Therefore, to minimize interest and penalties, it is advisable to estimate and pay any taxes owed by April 15. Even if you cannot pay your taxes in full on April 15, you should file your return, and pay what you can, by April 15. Otherwise, you will be penalized for both failing to file your return and failing to pay your taxes.

Consequences of non-compliance with Ohio tax laws

Failing to adhere to Ohio's tax obligations carries serious implications for expatriates and former residents. Understanding these consequences underscores the importance of maintaining compliance with state tax laws.

1. Financial penalties

- Late Filing Penalty: If you fail to file your Ohio tax return by the deadline, you may incur a late filing penalty. This penalty is typically a percentage of the unpaid taxes and increases with the length of the delay.

- Late Payment Penalty: Taxes that are not paid by the due date are subject to a late payment penalty. This penalty is generally 5% of the unpaid tax for each month or part of a month the tax remains unpaid, up to a maximum of 25%.

- Underpayment Penalty: If you underreport your income or underpay your taxes, Ohio may impose penalties and interest on the amount underpaid. This can significantly increase your tax liability.

2. Interest charges

- Unpaid taxes accrue interest from the original due date of the return until the taxes are paid in full. The interest rate is determined by the Ohio Department of Taxation and is subject to change annually.

- Interest on unpaid taxes can add a substantial amount to your overall tax liability, making timely payment crucial.

3. Legal sanctions

- In severe cases, such as intentional tax evasion, the repercussions can extend beyond financial penalties to include legal action. Ohio may pursue criminal charges against individuals who wilfully evade state tax laws.

- Convictions for tax evasion can result in significant fines, imprisonment, or both, depending on the severity of the offense.

4. Collection actions

- Ohio may take collection actions against individuals who fail to pay their taxes. These actions can include wage garnishments, bank account levies, and liens on property.

- Collection actions can disrupt your financial stability and impact your credit rating, making it difficult to secure loans or other financial services.

5. Audits and assessments

- The Ohio Department of Taxation may audit your tax returns to ensure compliance. Residency audits can be triggered by various factors, such as high income or significant changes in domicile status.

- During an audit, you may be required to provide extensive documentation to prove your residency status and income sources. Failure to provide adequate proof can result in additional tax assessments and penalties.