Do expats from Iowa still need to pay state taxes?

Navigating state tax obligations is important for Iowa expatriates to avoid legal and financial pitfalls.

Each state has unique tax laws, and Iowa is no exception. Understanding these rules is essential for Iowans living abroad to ensure compliance and manage their finances effectively.

This article provides an overview of Iowa's specific tax considerations, helping expatriates maintain their fiscal responsibilities while they are away from home.

TLDR:

Iowa tax law requires that you file a state tax return if you are domiciled in the state, regardless of whether you are a resident or not.

This means that even if you no longer live in Iowa but maintain your domicile there, you are still required to file and pay taxes on your worldwide income.

Understanding residency status in Iowa

Resident

A resident is defined as someone who maintains a permanent home in Iowa and spends more than 183 days within the state during the tax year. As a resident, you must pay Iowa state taxes on all income, regardless of where it was earned. This means global income is subject to Iowa taxes if Iowa is your domicile.

Nonresident

Nonresidents are those who do not maintain a permanent home in Iowa and spend fewer than 183 days in the state during the tax year. They are taxed only on their Iowa-source income, which includes earnings from work done in Iowa, income from Iowa-based businesses, or income from property located in Iowa. Nonresidents use the IA 126 form to report only their Iowa income.

Part-Year Resident

Part-year residents are individuals who either move to or from Iowa during the tax year and are hence considered residents for part of the year and nonresidents for the remainder. This category requires individuals to file taxes as residents when they lived in Iowa and as nonresidents when they did not, allowing them to adjust their taxable income based on where it was earned during the year.

Expatriates

Iowa expatriates must pay state taxes on worldwide income if Iowa remains their domicile in the US, defined as the primary home or the place with the closest connections.

Why should you move domicile from Iowa to a state with zero state income tax?

State income tax savings

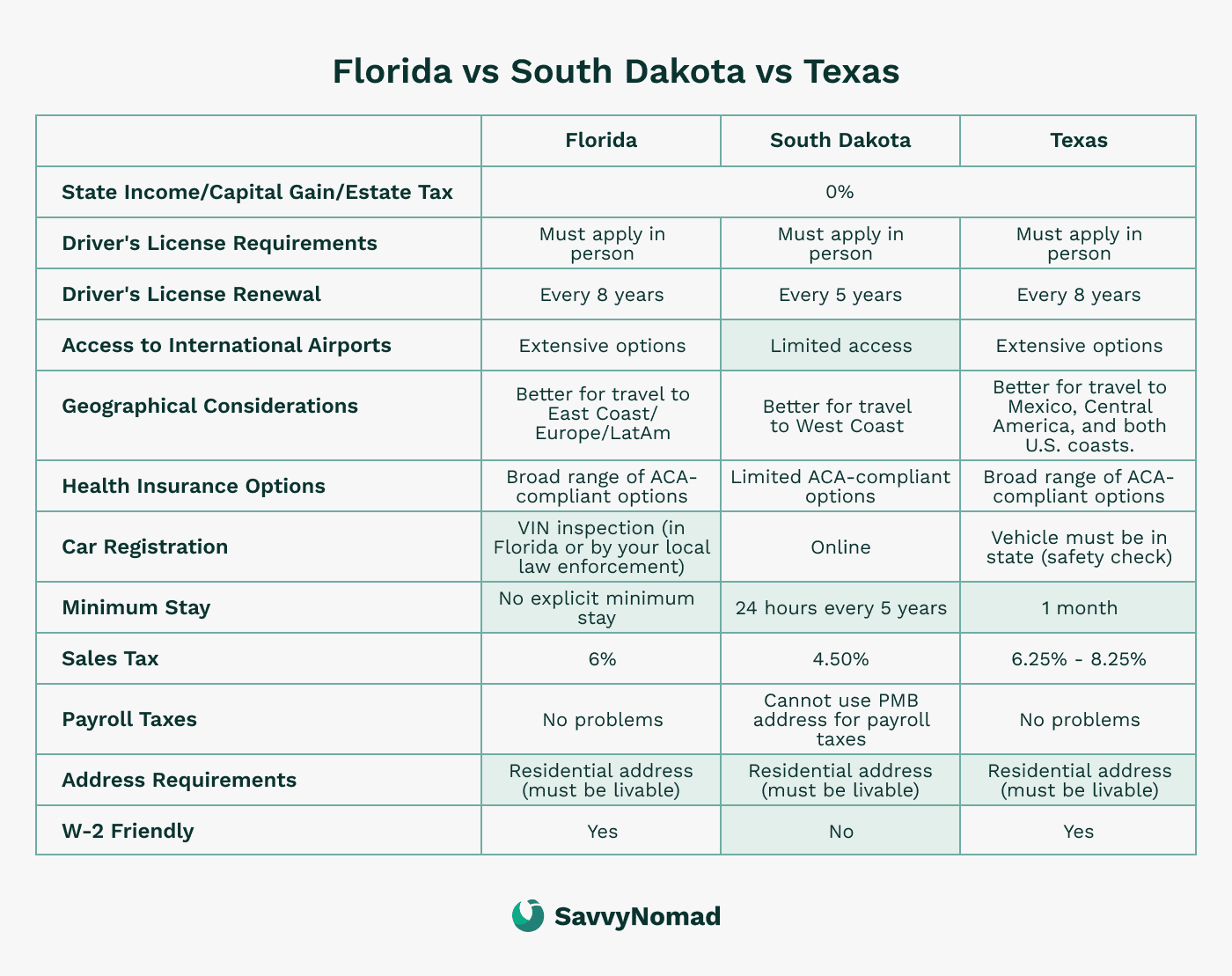

For retirees and high-income individuals from Iowa, moving to states without income taxes such as Florida, Texas, or Nevada can offer significant financial advantages. Without the burden of state income taxes, you can keep more of your earnings, allowing for greater investment opportunities or an enhanced lifestyle.

Inheritance tax benefits

States like Florida and Texas not only lack a state income tax but also do not impose state estate taxes. This can considerably reduce the tax burden on your estate, ensuring that more wealth is passed on to your heirs. This is especially advantageous for individuals with substantial assets who wish to maximize the inheritance for their beneficiaries.

Flexibility and mobility

Relocating your domicile to a no-income-tax state enhances your flexibility and mobility, allowing you to travel and live in various locations without worrying about high state tax bills. This is ideal for high-income earners with business interests in multiple states or countries and for retirees who desire to spend their later years exploring new places.

Moreover, the absence of state income taxes simplifies your tax filing process. You will only need to file federal taxes, reducing the complexity and potential for errors in your tax returns and making financial management more straightforward.

How to leave Iowa tax residency?

Changing your Iowa State residency involves several calculated steps to ensure a clear-cut transition.

1) Establish new residency

Secure a residential address in the new state. You may want to consider filing a Declaration of Domicile with the state, as suggested in Savvy Nomad’s domicile guides.

2) Transfer IDs and registrations

Swiftly update your driver's license and vehicle registration.

3) Register to vote

Voter registration in your new state.

4) Update documents

Make sure that all identification, medical, insurance, and financial documents show your new address.

5) Notify your employer

It's important to inform your employer about your change of residency, which can help in converting some of your income from "Iowa-sourced".

6) Notify IRS

Inform the IRS of your address change using Form 8822. Extend this notification to all personal and professional entities.

7) Keep records

Document all relocation actions diligently.

8) Anticipate an audit

Be audit-ready with comprehensive proof of your move’s permanence.

Tax benefits and exemptions for expats from Iowa

Living abroad as an expat comes with various federal tax benefits and exemptions that can help reduce your overall tax burden.

Here are some of the key federal tax advantages available:

Foreign Earned Income Exclusion

The FEIE allows U.S. taxpayers living abroad to exclude a certain amount of their foreign-earned income from U.S. federal income tax.

For the tax year 2024, this exclusion amount is up to $126,500.

To qualify, you must pass either:

- Bona Fide Residency Test: You qualify if you are a resident of a foreign country for an uninterrupted period that includes an entire tax year.

- Physical Presence Test: You qualify if you are physically present in a foreign country for at least 330 full days during a 12-month period.

Foreign Tax Credit

The FTC helps you avoid double taxation by allowing you to take credit for foreign taxes paid on income that is also subject to U.S. federal tax.

This credit can significantly reduce your U.S. tax liability, especially if you reside in a country with high tax rates.

Foreign Housing Exclusion (FHE)

The FHE allows you to exclude certain housing expenses from your federal taxable income, including rent, utilities (excluding telephone), and other reasonable expenses related to housing abroad.

The amount you can exclude is limited to a base amount plus housing expenses exceeding 16% of the FEIE limit.

Filing Iowa state taxes from abroad

Filing Iowa state taxes from abroad requires understanding residency status, identifying Iowa-sourced income, filing requirements, and using digital filing options.

Here's a step-by-step guide based on information from various sources:

1. Determine your residency status:

Iowa categorizes individuals as residents, part-year residents, or nonresidents for tax purposes.

Your status affects your tax obligations:

- Residents are taxed on all income, regardless of where it was earned.

- Part-year residents are taxed on all income earned while living in Iowa and on Iowa-sourced income when living elsewhere.

- Nonresidents are taxed only on their Iowa-sourced income

2. Identify Iowa-sourced income

If you are still receiving income from Iowa sources, such as wages before moving, rental income, or business income, you are generally required to file an Iowa tax return. It's important to note that certain types of income, such as investment income and retirement plan distributions, may not be taxable for non-residents.

3. Understanding Filing Requirements

Residents, Part-Year Residents and Expats must file if their income is above a certain threshold or they wish to claim certain credits.

4. Use digital filing options

Ensure all necessary documentation, including income statements and records of days spent in Iowa, is gathered, if applicable.

The general deadline for filing Iowa state taxes is April 15th, aligning with the federal tax deadline.

However, if you live outside the U.S. on April 15th, you may be granted an automatic two-month extension to file your return and pay any amount due without requesting an extension. This extension typically pushes the deadline to June 15th.

It's important to note that if you owe taxes, interest may accrue on any unpaid amounts from the original April 15th deadline, even if you file later. Therefore, to minimize interest and penalties, it's advisable to estimate and pay any owed taxes by April 15th.

For those needing more time beyond the automatic extension period, you can request an additional extension, which usually extends the filing deadline to October 15th.

Remember, this extension is for filing your tax return, not an extension to pay taxes owed.