Understanding the 183-day rule in California: Do expats still owe state taxes?

Navigating California’s tax laws as an expatriate is complicated due to the state’s detailed rules on residency and taxation. Determining legal residency involves more than just spending time in California; it requires demonstrating intent and having a permanent domicile elsewhere.

Whether you’re living abroad or maintaining ties to California, the distinction between being considered a resident, nonresident, or part-year resident carries significant financial implications.

TLDR:

If you haven't established a new domicile in another state, you may still be considered a California resident for tax purposes (even if you haven’t been there all year).

Understanding residency status in California

Understanding residency status in California is essential for determining tax obligations for income tax purposes. California categorizes individuals into three groups based on residency: residents, nonresidents, and part-year residents, each with distinct tax implications.

Resident

Residents are those who are in California for other than a temporary or transitory purpose or are domiciled in California but outside the state for a temporary or transitory purpose.

This encompasses all income, regardless of where it's earned, because California considers the state as the primary place of connection or domicile for the taxpayer.

Nonresident

Nonresidents, on the other hand, are individuals who do not meet the criteria to be considered residents.

For example, income from rental properties in California is taxable, even if the property owner lives outside the state.

Part-year resident

Part-year residents are individuals who have been residents of California for only a portion of the year.

This distinction is crucial for understanding tax obligations during the period of residency and nonresidency within the tax year.

Determining residency status involves evaluating several factors to assess the strength of one's ties to California compared to other locations. Key factors include the amount of time spent in California, the location of the principal residence, the state of vehicle registration, a state where professional licenses are maintained, and the location of social ties, among others.

No single factor is decisive; rather, the overall situation and intent to make California a permanent home play significant roles in establishing residency status.

For those who moved abroad

If California was your last state of residency before moving abroad, you might still have tax filing obligations to consider, even if you no longer live there. California employs a concept called "domicile" to determine tax residency.

California’s ‘Safe Harbor’ rule for expats

California’s "Safe Harbor" rule provides a significant tax relief avenue for expats, specifically for those working abroad under an employment contract.

Here's a breakdown of how it works:

Eligibility

Expatriates who move abroad for at least 546 consecutive days under an employment contract may not be considered state residents for tax purposes, as long as they don't spend more than 45 days per year in California during this period. This exemption applies regardless of other connections they might retain to the state.

Exceptions to the rule

However, there are exceptions where California will still consider an individual as a resident despite meeting the above criteria:

1. If the individual has intangible income exceeding $200,000 during any year the employment contract is in effect.

2. If the principal purpose of moving abroad is to avoid California state income tax.

Spouses and domestic partners

The rule also extends to the spouse or Registered Domestic Partner of the individual covered by the Safe Harbor, considering them as nonresidents while accompanying the individual outside California for at least 546 consecutive days.

Any return visits to California that do not exceed a total of 45 days in any tax year covered by the employment contract are considered temporary.

Income consideration

It's important to note that the type of income can affect your tax obligations. While the Safe Harbor rule offers relief from being considered a state resident for tax purposes, certain types of income sourced from California may still be taxable by the state.

This includes but is not limited to, wages and salary earned in California before moving abroad, rental income from real estate owned in California, and profits from the sale of real estate in California.

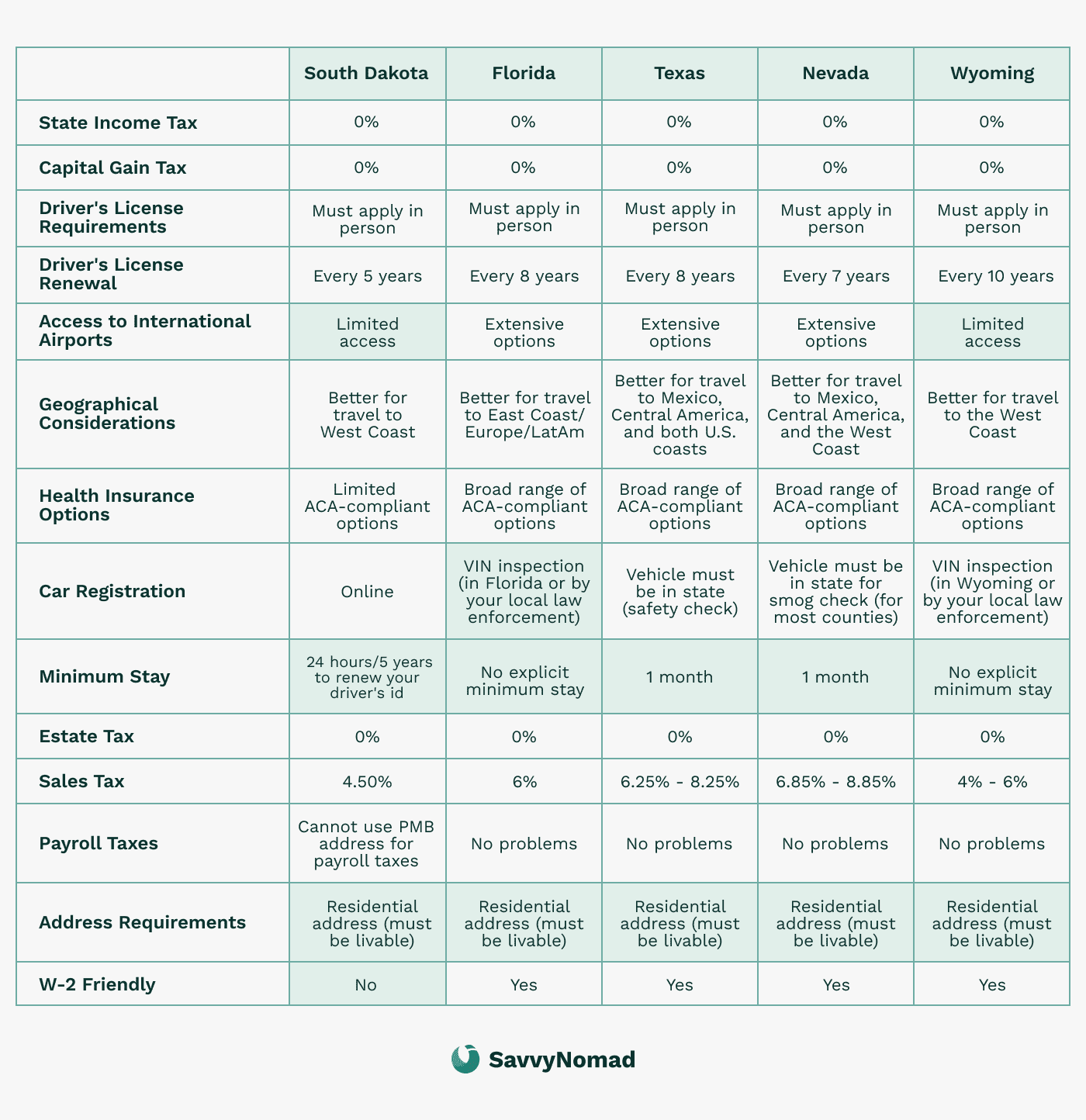

Why should you move domicile to a state with zero state income tax?

State income tax savings

For retirees and high-income individuals from California, moving to states without income taxes, such as Florida, Texas, or Nevada, can offer significant financial advantages. Without the burden of state income taxes, you can keep more of your earnings, allowing for greater investment opportunities or an enhanced lifestyle.

Inheritance tax benefits

States like Florida and Texas lack a state income tax and do not impose state estate taxes. This can considerably reduce the tax burden on your estate, ensuring that more wealth is passed on to your heirs. This is especially advantageous for individuals with substantial assets who wish to maximize the inheritance for their beneficiaries.

Flexibility and mobility

Relocating your domicile to a no-income-tax state enhances your flexibility and mobility, allowing you to travel and live in various locations without worrying about high state tax bills. This is ideal for high-income earners with business interests in multiple states or countries and for retirees who desire to spend their later years exploring new places.

Moreover, the absence of state income taxes simplifies your tax filing process. You will only need to file federal taxes, reducing the complexity and potential for errors in your tax returns, making financial management more straightforward.

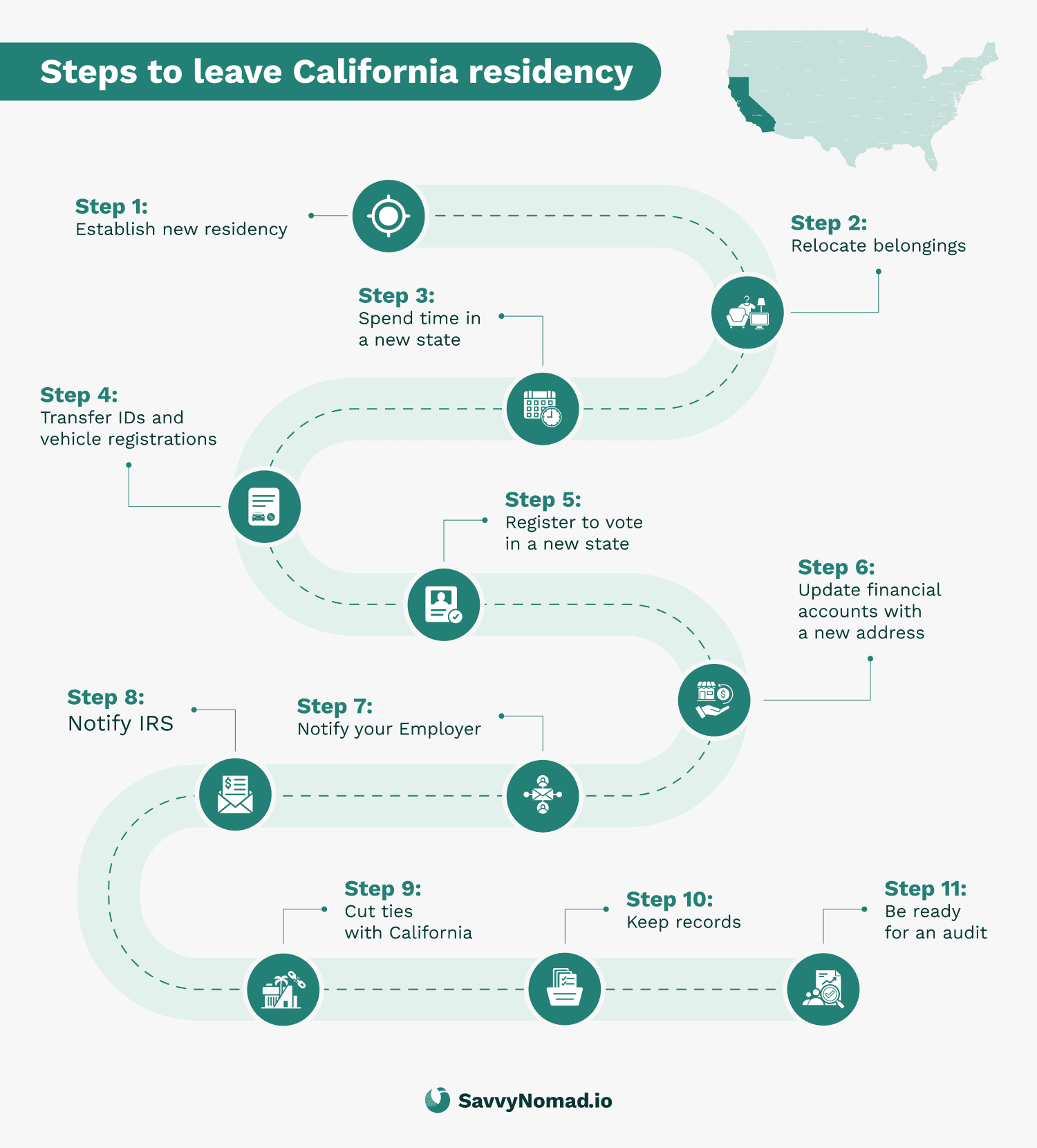

How to leave California tax residency?

Changing your California State residency involves several calculated steps to ensure a clear-cut transition.

1) Establish new residency

Secure a residential address in the new state. Determining legal residency involves various factors, emphasizing that residents must demonstrate intent and have a permanent domicile elsewhere.

If you buy a home, you may want to look into available credits, like Florida’s homestead exemption. You may want to consider filing a Declaration of Domicile with the state, as suggested in Savvy Nomad’s domicile guides.

This is especially useful for digital nomads or expats looking for tax benefits in a state like Florida.

2) Transfer IDs and registrations

Swiftly update your driver's license and vehicle registration.

3) Register to vote

Voter registration in your new state.

4) Update documents

Ensure all identification, medical, insurance, and financial documents reflect your new address.

5) Notify your employer

It’s important to notify your employer of your residency change. This can also help convert some of your income from being “California-sourced.”

6) Notify IRS

Inform the IRS of your address change using Form 8822. Extend this notification to all personal and professional entities.

7) Keep records

Document all relocation actions diligently.

8) Acknowledge key factors

California considers multiple factors for domicile status, including home, time spent, business ties, location of valuables, and family location. Make sure you feel confident on as many of these as you can.

9) Anticipate an audit

Be audit-ready with comprehensive proof of your move’s permanence.

California-sourced income and tax obligations

Understanding California-sourced income

California-sourced income refers to any income earned from sources within the state, such as employment, real estate, or businesses. For California expats, understanding what constitutes California-sourced income is crucial for tax purposes.

The Franchise Tax Board (FTB) considers several factors to determine whether income is sourced in California. These factors include the location of the employer, the type of work performed, and the location of the real estate or business generating the income.

For instance, if you own rental property in California, the rental income is considered California-sourced. Similarly, if you perform work for a California-based company, even if you do so remotely, that income may also be considered California-sourced. Understanding these nuances can help you determine your tax obligations accurately.

Tax implications for expats

As a California expat, you may still be subject to California state income tax on your California-sourced income, even if you are no longer a resident. This can include various types of income, such as:

- Employment in California: If you work for a California-based employer, your wages may be subject to state income tax.

- Real estate rentals in California: Rental income from properties located in California is taxable by the state.

- Businesses operating in California: Income from businesses that operate within California is considered California-sourced.

- Investments in California-based companies: Dividends and other income from investments in California-based companies may also be subject to state income tax.

Understanding your tax obligations is essential to avoid unexpected liabilities and penalties. Consulting with a tax professional can help you navigate the complexities of California-sourced income and ensure compliance with state tax laws.

Tax planning for California expats

Withholding and deductions

Effective tax planning is essential for California expats to manage their tax obligations efficiently. One key aspect of tax planning is understanding withholding and deductions on your California-sourced income.

Withholding refers to the amount of taxes that are automatically deducted from your income by your employer or other payers. Deductions, on the other hand, are specific expenses that can reduce your taxable income.

To minimize your tax liability, it’s important to be aware of the withholding and deduction options available to you. Here are some key considerations:

- Withholding on California-sourced income: Ensure that the correct amount of tax is being withheld from your California-sourced income. This can help you avoid underpayment penalties and a large tax bill at the end of the year.

- Deductions for business expenses: If you have a business that operates in California, you may be eligible to deduct certain business expenses. These can include costs related to running your business, such as office supplies, travel expenses, and professional fees.

- Deductions for mortgage interest and property taxes: If you own real estate in California, you may be able to deduct mortgage interest and property taxes on your state tax return. These deductions can significantly reduce your taxable income.

Tax benefits and exemptions for expats from California

Living abroad as an expat comes with various federal tax benefits and exemptions that can help reduce your overall tax burden. Here are some of the key federal tax advantages available:

Foreign Earned Income Exclusion (FEIE)

The FEIE allows U.S. taxpayers living abroad to exclude a certain amount of their foreign-earned income from U.S. federal income tax.

For the tax year 2024, this exclusion amount is up to $126,500.

To qualify, you must pass either:

- Bona Fide Residency Test: You qualify if you are a resident of a foreign country for an uninterrupted period that includes an entire tax year.

- Physical Presence Test: You qualify if you are physically present in a foreign country for at least 330 full days during a 12-month period.

Foreign Tax Credit (FTC)

The FTC helps you avoid double taxation by allowing you to take credit for foreign taxes paid on income that is also subject to U.S. federal tax.

This credit can significantly reduce your U.S. tax liability, especially if you reside in a country with high tax rates.

Foreign Housing Exclusion (FHE)

The FHE allows you to exclude certain housing expenses from your federal taxable income, including rent, utilities (excluding telephone), and other reasonable expenses related to housing abroad.

The amount you can exclude is limited to a base amount plus housing expenses exceeding 16% of the FEIE limit.

Filing California state taxes from abroad

Filing California state taxes from abroad requires understanding your residency status, identifying California-sourced income, understanding filing requirements, and utilizing digital filing options.

Here's a step-by-step guide based on information from various sources:

1. Determine your residency status:

California categorizes individuals as residents, part-year residents, or nonresidents for income tax purposes, which directly affects their tax obligations.

Your status affects your tax obligations:

- Residents are taxed on all income, regardless of where it was earned.

- Part-year residents are taxed on all income earned while living in California and on California-sourced income when living elsewhere.

- Nonresidents are taxed only on their California-sourced income

2. Identify California-sourced income

If you still receive income from California sources, such as wages before moving, rental income, or business income, you are generally required to file a California tax return. Notably, certain types of income, like investment income and retirement plan distributions, may not be taxable for non-residents.

3. Understanding Filing Requirements

- Residents and Part-Year Residents must file if their income is above a certain threshold or they wish to claim certain credits.

- Nonresidents must file to report California-sourced income. The Safe Harbor rule may exempt certain expats from being considered residents for tax purposes if they are abroad for 546 consecutive days under an employment contract, with specific exceptions.

4. Use digital filing options

The Franchise Tax Board offers online services such as CalFile for free electronic filing, which can simplify the process for expatriates.

Ensure that all necessary documentation, including income statements and records of days spent in California, is gathered, if applicable.

However, if you live outside the U.S. on April 15th, you may be granted an automatic two-month extension to file your return and pay any amount due without requesting an extension. This extension typically pushes the deadline to June 15th.

It's important to note that if you owe taxes, interest may accrue on any unpaid amounts from the original April 15th deadline, even if you file later. Therefore, to minimize interest and penalties, it's advisable to estimate and pay any owed taxes by April 15th.

For those needing more time beyond the automatic extension period, you can request an additional extension, which usually extends the filing deadline to October 15th.

Remember, this extension is for filing your tax return, not an extension to pay taxes owed.

Penalties for non-compliance with California state tax laws

Non-compliance with California state tax laws can lead to various penalties and fees.

Typically, you receive penalties and fees when you do not meet requirements. For example, when you:

- Don’t file on time

- Don’t pay on time

- Don’t pay enough estimated tax

- Don’t have enough taxes withheld from your paycheck

- Don’t pay electronically when you're required

- Make a dishonored payment (bounced check, insufficient funds)

Penalties can range from a percentage of unpaid taxes to specific amounts for late filings and payments, with maximum limits applied.

You can check the penalty reference chart for more detailed information.

FAQ

What triggers the California residency audit?

The California Franchise Tax Board (FTB) uses residency audits to determine the correct amount of a taxpayer's California income tax obligation by ascertaining whether a taxpayer is a California resident, a non-resident, or a part-year resident.

Residency audits focus on a taxpayer's legal status with California based on lifestyle rather than financial and business matters.

The FTB is known for rigorously monitoring the line between residents and nonresidents, and it is up to the taxpayer to prove they are not California residents to be exempt from audits.

Common triggers for residency audits include:

1. Information returns: Residency audits are often triggered by documents going to Sacramento with a nonresident's name and address on it, such as Form 1098, 1099, K-1, or W-2. These forms report distributions, income, or other financial information, and if the FTB receives them for a nonresident, it may initiate an audit to clarify the taxpayer's residency status.

2. Second homes in California: Nonresidents who own second homes in California, especially those purchased with a mortgage, may attract attention from the FTB. Mortgage lenders may send Form 1098 Mortgage Interest Statements to Sacramento with the nonresident's name, social security number, and address on it. If the borrower hasn't filed a California tax return and the FTB sends a "4600 Notice" asking for an explanation, failing to respond satisfactorily may lead to a full audit.

3. Temporary or transitory purpose: California residency law defines a resident as someone who is in the state for anything else other than a temporary or transitory purpose or domiciled in California but physically outside the state for a temporary or transitory purpose.

The FTB uses this broad definition to determine residency status, and if a taxpayer is deemed to be in the state for a non-temporary purpose, they may be subject to a residency audit.

4. Lifestyle factors: The FTB examines a taxpayer's lifestyle to determine residency, including where the taxpayer spends their time, what they are doing while in California, what assets they own and where, what organizations they belong to and why, what goods and services they purchase, and the location of their gym or other personal activities.

These factors help the FTB decide if a taxpayer has sufficient contacts with California to confer residency, making all their income from whatever source taxable by California.

Does California have an exit tax?

Yes, California has an exit tax known as the California Exit Tax. This one-time tax is imposed on individuals and businesses that decide to move out of California. It is part of the larger California wealth tax and targets the wealth of state residents.

Real estate within California is still subject to state taxes, even if it's exempt from the exit tax. Both individuals and businesses leaving California are subject to this tax, designed specifically for those moving out of the state, not those relocating within California.

The exit tax was created to close a loophole in capital gains tax, ensuring that gains are taxed even if the individual has moved to another state.

Does California have a 183-day rule?

California does not have a specific 183-day rule like some other states.

Instead, California uses a more complex residency determination process that considers various factors beyond just the number of days spent in the state. The California Franchise Tax Board (FTB) evaluates residency based on whether an individual is present in California for a purpose other than temporary or transitory or is domiciled in California but outside the state for a temporary or transitory purpose.

Residency in California is determined by a combination of factors, including the amount of time spent in California compared to outside the state, location of family, principal residence, driver's license, vehicle registration, professional licenses, voter registration, bank accounts, financial transactions, healthcare providers, and more.

What is the residency test in California?

California determines residency based on a combination of factors, not just the number of days spent in the state.

The Franchise Tax Board (FTB) examines various aspects of a taxpayer's life to determine residency, including the location of residential real property, the state where the taxpayer's spouse and children reside, the state where the taxpayer's children attend school, the state where the taxpayer claims the homeowner's property tax exemption, telephone records, the number of days spent in California versus other states, and the location where the taxpayer files their tax returns.

The FTB looks for the strongest factors indicating whether a taxpayer is a resident or not, and the taxpayer must prove they no longer live in California to avoid being considered a resident for tax purposes.