Best and worst U.S. domiciles for American expats

When American citizens move abroad, choosing the right state to keep as their home base, or “domicile,” is important.

This choice can significantly impact their tax situation, affecting how much they pay and to whom. It is crucial to determine state residency for tax purposes, as each state has its own criteria for establishing residency and the implications can be significant, especially for expats.

Key factors affecting tax obligations for expats:

- State Income Tax: Some states have a state income tax, while others don’t. This difference can produce major tax savings for expats.

- Foreign Earned Income Exclusion and Foreign Tax Credit: Some states allow expats to exclude a portion of their foreign-earned income from state taxes, which can reduce their tax burden. Additionally, a small minority of states offer a foreign tax credit, which lets expats offset the taxes they pay to foreign governments against their state tax liability. However, most states do not provide this credit.

- Residency Requirements: Each state has different rules for establishing and maintaining residency. Some states are easier to become a resident of, while others are much more demanding.

- Tax on Worldwide Income: Depending on the state, expats might be taxed on their income from all over the world, not just the income earned within the state.

Group 1: Easy residency, zero-state income tax

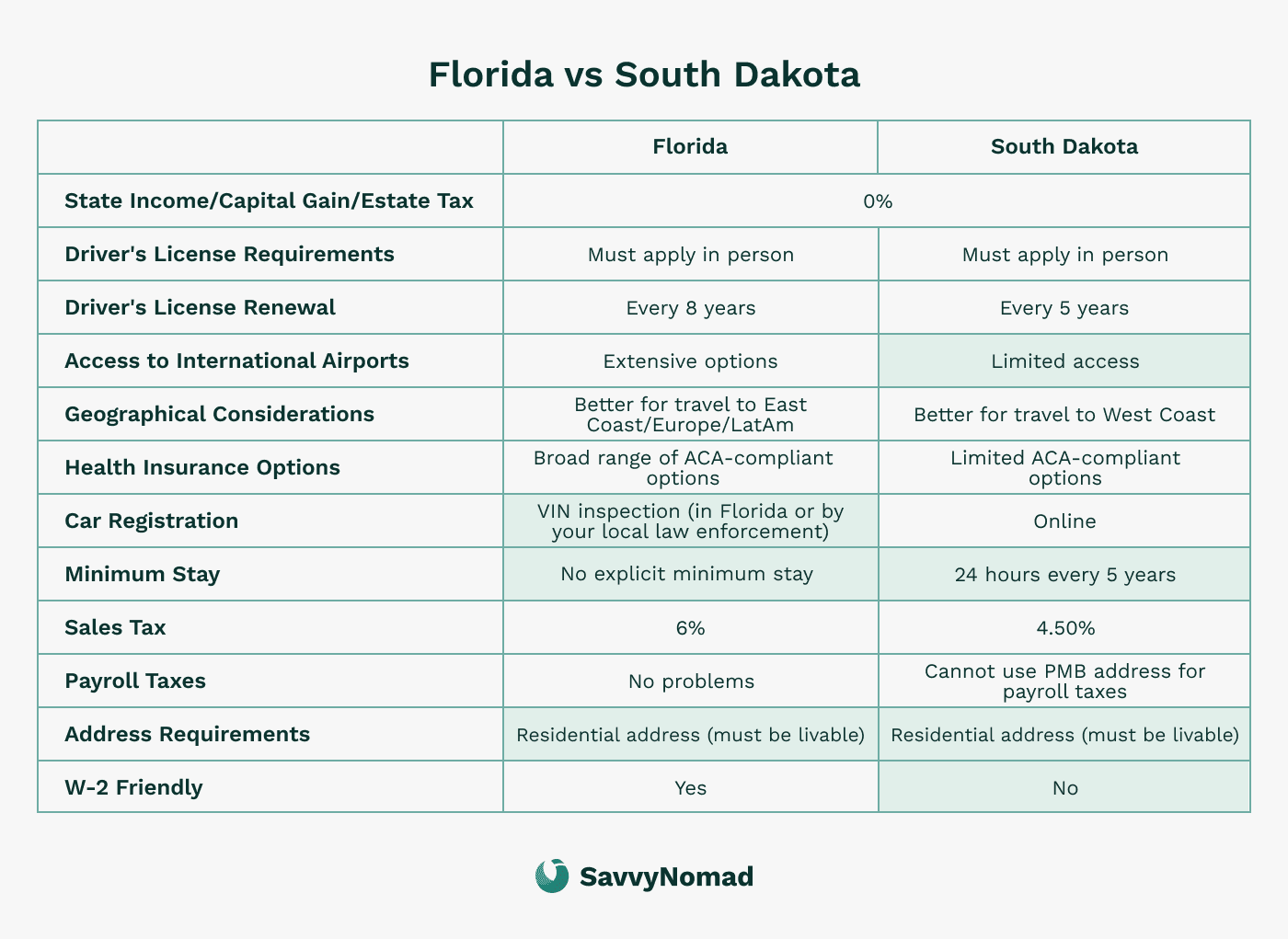

Based on our experience and research, Florida and South Dakota are the best states for expats, because of their straightforward residency requirements and zero-state income tax policies.

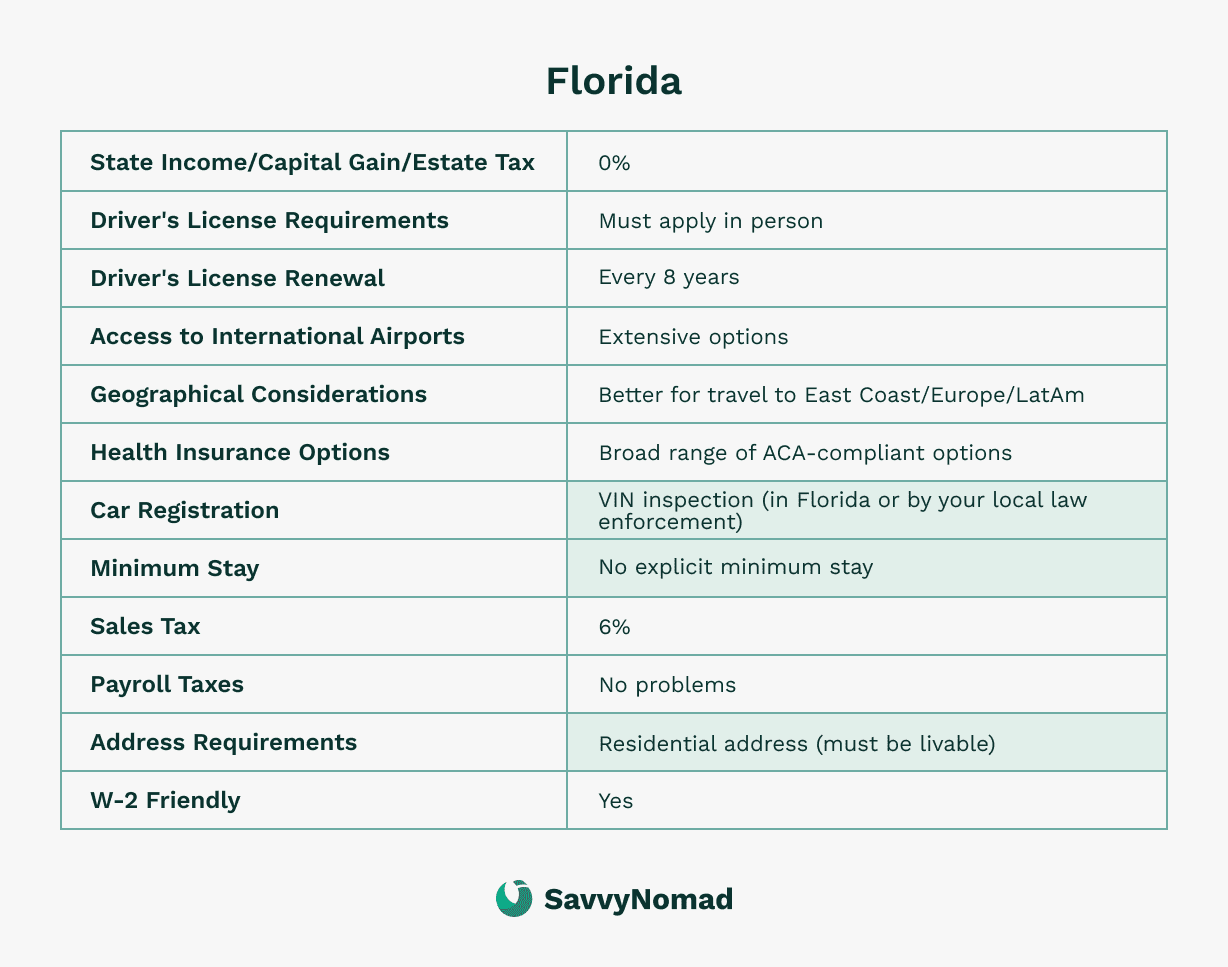

#1 Florida

Pros:

- Vehicle registration: You can register a vehicle out of state.

- Friendly environment: Ideal for retirees, digital nomads, expats, full-time sailors, and military personnel.

- Domicile services: Services like SavvyNomad assist in establishing residency.

- Asset protection: Strong laws that protect personal assets.

- Geographical convenience: Close to major cities and international travel hubs, beneficial for frequent travelers.

Cons:

- Residential address requirement: You need a residential address, which can be cumbersome. However, professional domicile services can mitigate this burden.

- Initial vehicle inspection: Requires a one-time vehicle VIN inspection for registration, but this can be done out of state.

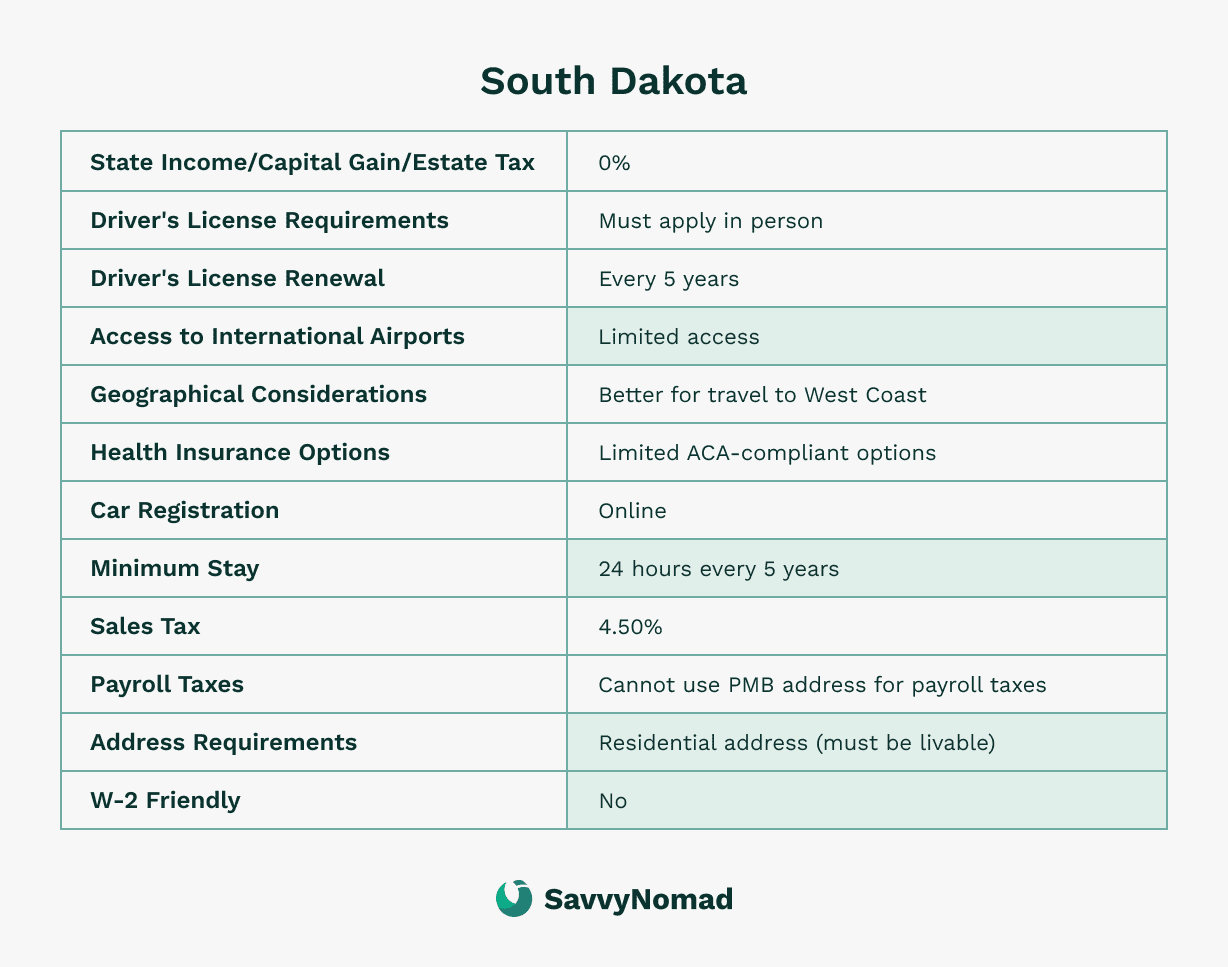

#2 South Dakota

Pros:

- No state income tax: Significant savings on all income.

- Easy vehicle registration: The entire process can be handled online without needing to bring the vehicle to the state.

- Minimal bureaucratic hurdles: The process is straightforward with little red tape.

- Mail-forwarding services: These services help nomads maintain residency without frequent physical presence.

Cons:

- Recent legislative changes: In 2023, South Dakota increased the physical presence requirement and restricted the use of personal mailboxes for voting and payroll purposes.

- Physical presence requirement: Requires proof of at least one overnight stay in the state every 5 years to renew a South Dakota driver’s license.

- Voting restrictions: You need a residential address to vote.

- Payroll tax complications: Personal mailboxes cannot be used for payroll taxes, affecting W-2 employees.

- Less RV-friendly: Recent policy changes have made the state less accommodating for RVers.

- Driver's license renewal: Requires renewal every 5 years with proof of an overnight stay.

Benefits for expats:

- No tax on income: Both states offer significant tax savings by not taxing any income.

- Easy to establish and maintain residency: Each state’s simple procedures and minimal requirements make it readily accessible for expats and digital nomads.

Group 2: Moderate residency requirements, zero-state income tax

Key characteristics:

- No state income tax.

- Minimum stay requirements.

- Less favorable for nomadic lifestyles.

States:

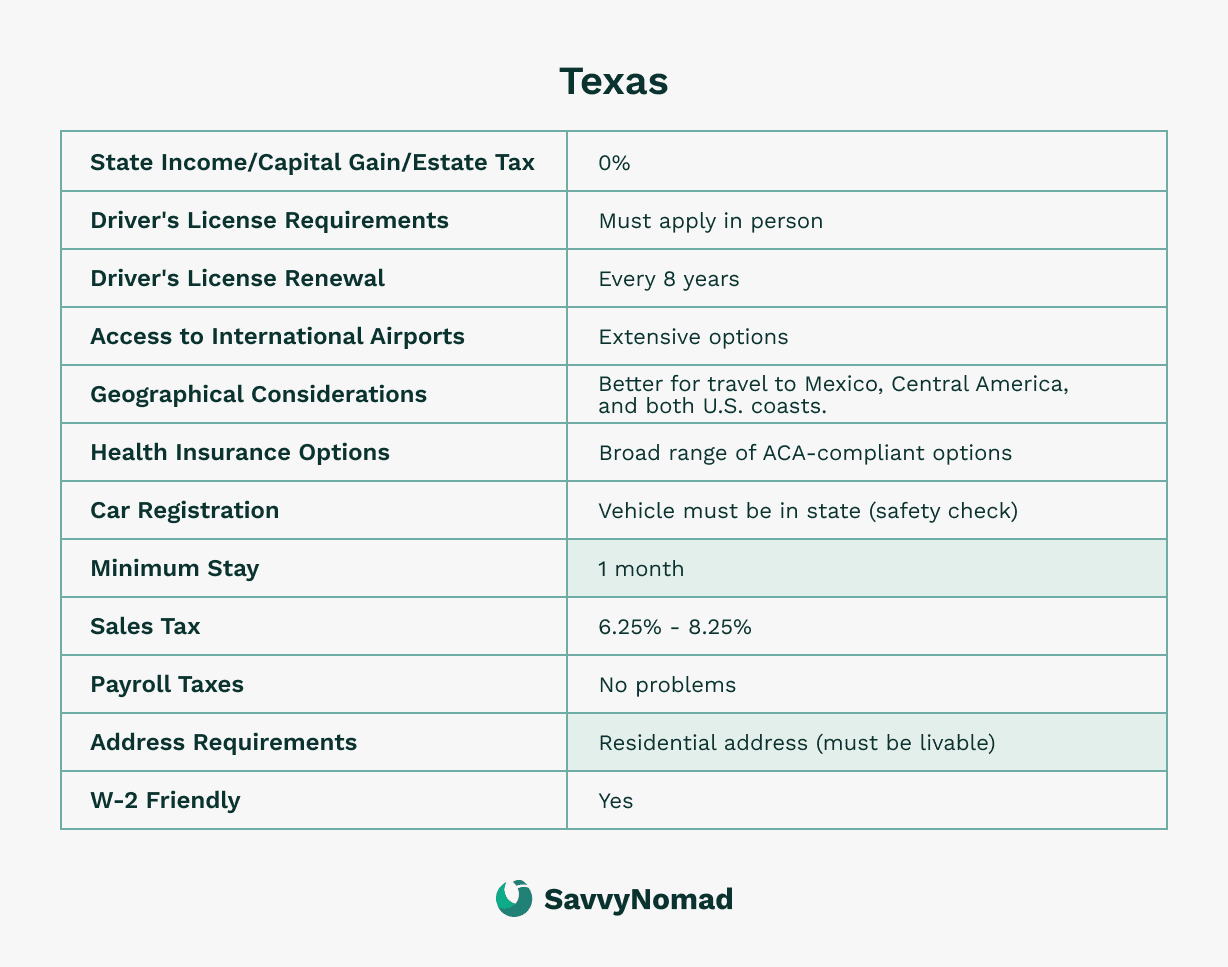

Texas

Pros:

- No state income tax: Significant tax savings on all types of income.

- Driver’s license renewal: Every 8 years.

- Access to international airports: Extensive options, beneficial for frequent travelers.

- Health insurance options: Broad range of ACA-compliant options.

Cons:

- 30-day residency requirement: Must be in the state for 30 days before getting a state ID or driver’s license.

- Car registration: The vehicle must be in the state for a safety check.

- Annual vehicle inspections: Every vehicle registered in Texas requires an annual safety inspection.

- Residential address required: Must have a livable address for residency, which can be restrictive for nomads.

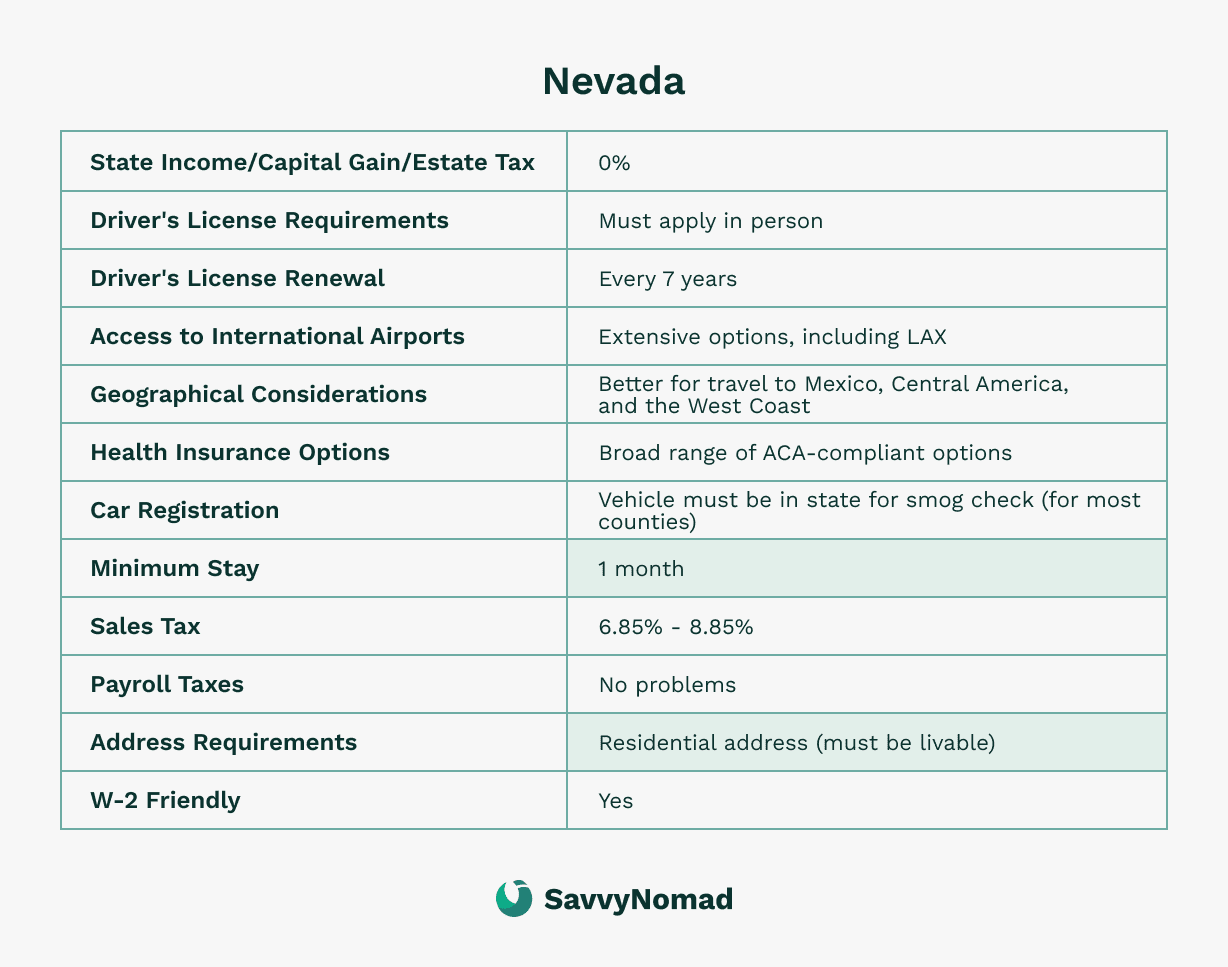

Nevada

Pros:

- No state income tax: Substantial financial benefits.

- Access to international airports: Extensive options, beneficial for frequent travelers.

- Health insurance options: Broad range of ACA-compliant options.

- Driver’s license renewal: Every 7 years.

Cons:

- 30-day stay requirement: Must show a 30-day consecutive stay in the state for residency.

- Residential address required: Must have a livable address for residency.

- Car registration: Vehicle must be in state for smog check (for most counties).

- Annual smog checks: Required for vehicle registration, particularly in populous counties like Clark County.

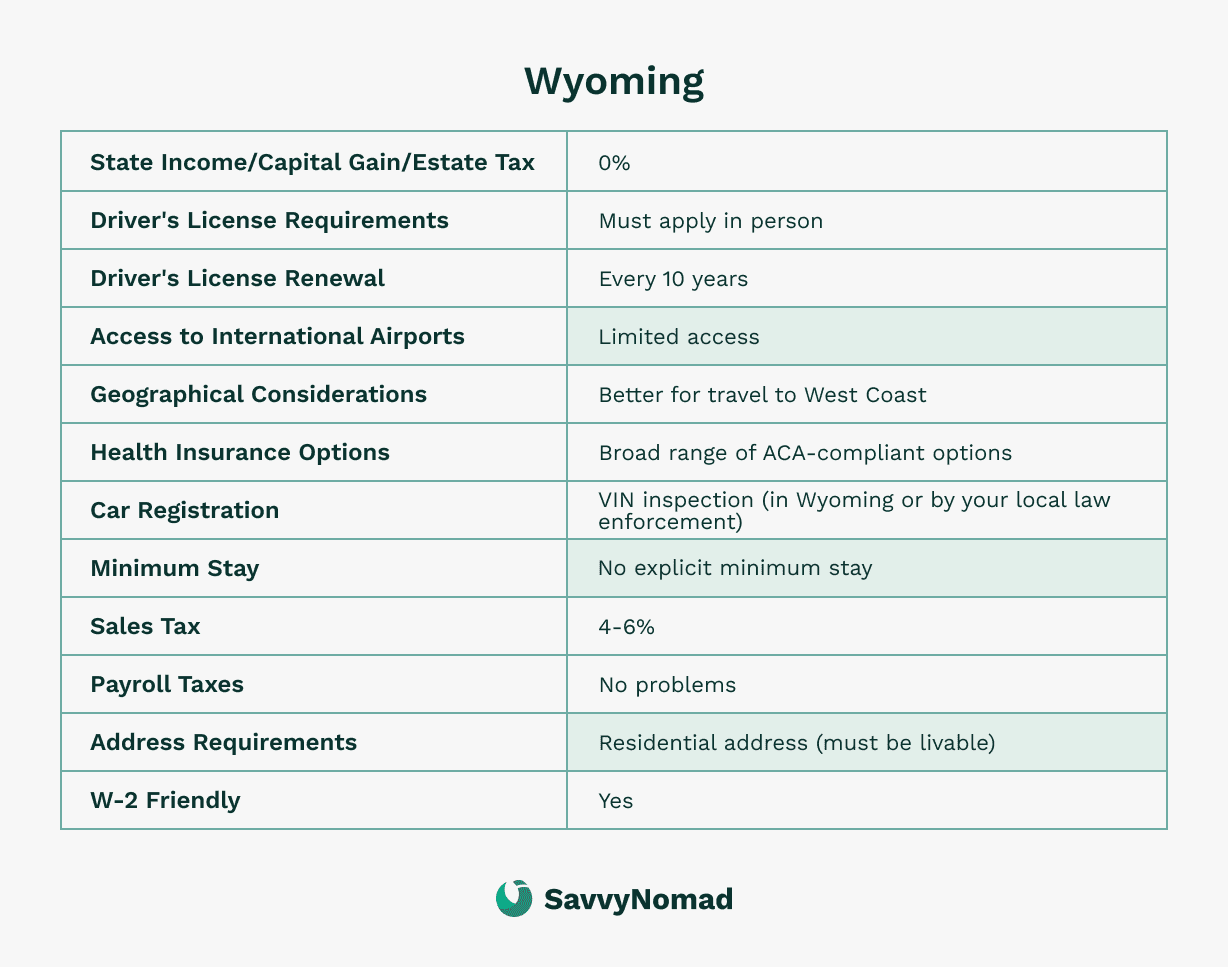

Wyoming

Pros:

- No state income tax: Financially beneficial for all income levels.

- Access to international airports: Limited access, but adequate for occasional travel.

- Health insurance options: Broad range of ACA-compliant options.

- Car registration: VIN inspection required (can be done by local law enforcement).

- Driver’s license renewal: Every 10 years.

Cons:

- Residency challenges: Obtaining a residential street address can be difficult.

- Residential address required: Must have a livable address for residency.

Washington

Pros:

- No state income tax: Saves money on all types of income.

- Access to international airports: Extensive options, beneficial for frequent travelers.

- Health insurance options: Broad range of ACA-compliant options.

- Driver’s license renewal: Every 7 years.

Cons:

- Residency establishment: Requires substantial physical presence to prove residency.

- Vehicle inspections: Periodic emissions testing required in some areas.

- Car registration: Vehicle must be in state for smog check (for most counties).

- Residential address required: Must have a livable address for residency (no personal mail boxes).

Challenges for expats:

- Detailed residency criteria: More stringent requirements for establishing and maintaining residency compared to states with easier processes.

- Annual vehicle inspections: Ongoing requirements for vehicle registration can be inconvenient, especially for those who travel frequently.

- Maintaining residency: Physical presence and paperwork can be burdensome for nomads and expats.

Benefits for expats:

- No tax on income: All these states provide significant tax savings by not taxing any income of any kind, no matter where earned.

- Financial advantages: Potential savings on income tax, estate tax, and business expenses.

Group 3: No tax on worldwide income for non-residents

This section discusses states that do not tax global income for non-residents, providing financial advantages for expats who can maintain non-resident status.

These states offer significant savings by not taxing worldwide earnings, making them appealing options for expats.

If you are from one of these states or it was your last state of residency, you might not need to take additional steps to maintain your domicile status.

However, if you were not previously a resident, it may be more beneficial to explore states listed in Group 1 or Group 2 of this article.

States:

- Colorado

- Connecticut

- Delaware

- Massachusetts

- Minnesota

- Missouri

- North Dakota

- Oregon

- Pennsylvania

- Virginia

- West Virginia

Key characteristics:

- No tax on worldwide income for non-residents: Significant financial savings for expats.

- Potential for significant tax savings: By not paying state taxes on global earnings, expats can maximize their available incomes.

- Favorable residency requirements: Easier to establish non-resident status compared to other states.

Pros:

- Financial Benefits: These states provide significant tax savings by not taxing non-residents on income earned globally.

- Health Insurance Options: Many states in this group offer a broad range of ACA-compliant health insurance options, ensuring expats can access necessary healthcare services.

- Residency Maintenance: Minimal requirements to maintain non-residency status, making it easier for expats to manage their tax obligations.

Cons:

- Residential Address Requirements: All states in this group require a livable address, which may be restrictive for some nomads and expats.

- Vehicle Registration: Periodic inspections and the need for a local address can be cumbersome for those frequently abroad. Some states require emissions or safety checks, adding to the maintenance burden.

Group 4: Worldwide income tax for domiciles with Foreign Earned Income Exclusion

This section focuses on states that tax worldwide income for domiciliaries but allow for a foreign-earned income exclusion (FEIE).

Where allowed, the FEIE typically allows expats to exclude up to $126,500 of their foreign-earned income from state income taxes in 2024.

Key characteristics:

- Worldwide income taxation: These states tax their residents on income earned globally.

- Potential for tax savings: Expats can significantly reduce their taxable income through the FEIE.

- Foreign Earned Income Exclusion (FEIE): Allows expats to exclude a portion of their foreign-earned income from state taxes, up to $126,500 for the 2024 tax year.

States:

- Alabama

- Arizona

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Maine

- Michigan

- Ohio

- Oklahoma

- Rhode Island

- South Carolina

- Utah

- Vermont

Pros:

- Foreign Earned Income Exclusion: These states allow expats to exclude a substantial amount of foreign-earned income from their income subject to state income taxes, reducing the overall state tax liability for expats.

- Comprehensive tax structures: These states have detailed provisions for expats, which can simplify tax planning and compliance.

Cons:

- Worldwide income taxation: Residents are taxed on their global incomes, which can result in higher tax liabilities compared to states with no income tax.

- Exclusion Limit: The foreign earned income exclusion is limited to $126,500 for the 2024 tax year and applies only to earned income. Other types of income, such as interest and capital gains, are still subject to state taxes.

- Complex tax filing requirements: Navigating state tax laws can be complex and may require professional assistance, at a cost.

Group 5: Worldwide income tax for domiciles without Foreign Earned Income Exclusion

This section covers states that tax domiciliaries on worldwide income without offering a foreign earned income exclusion (FEIE).

Expats domiciled in these states face significant tax liabilities on their global incomes, as there is no mechanism to reduce the state tax burden on foreign earnings.

Key characteristics:

- Worldwide income taxation: These states tax their residents on income earned globally.

- High potential tax liability: Expats cannot reduce their taxable income through the FEIE, resulting in higher overall tax liabilities.

- No Foreign Earned Income Exclusion (FEIE): No provisions for excluding to exclude foreign-earned income from state taxes.

States:

- Arkansas

- Indiana

- Kentucky

- Louisiana

- Maine

- Maryland

- Mississippi

- Montana

- Nebraska

- New Mexico

- North Carolina

- Wisconsin

Cons:

- Worldwide income taxation: Residents are taxed on global income, which can result in significantly higher tax liabilities.

- Complex tax filing requirements: Navigating state tax laws without the benefit of FEIE can be complex and may require professional assistance, at some expense.

- No FEIE: Without the foreign-earned income exclusion, expats face higher taxes on their foreign-earned income.

Impact on expats:

- High tax burden: Expats domiciled in these states will face higher tax liabilities on their worldwide income.

- Need for professional assistance: Due to the complexity and potential high cost of compliance, expats may need professional help to manage their tax obligations effectively.

Group 6: Worst possible states for expats

If you are domiciled in one of these states, consider moving your domicile to a state in Group 1 or Group 2.

Because you do not spend time in these high-tax states, you are essentially paying for infrastructure and services that you do not use. Changing your domicile to a state with no income tax or more favorable tax policies can produce substantial financial savings and simplify your tax compliance.

States:

Key characteristics:

- Highest state tax rates: These states have some of the highest state income tax rates in the country.

- Complex tax regulations: These states have detailed and complicated tax filing requirements that can be challenging to navigate.

- Worldwide income taxation: Residents are taxed on their global incomes with no exclusions.

California

- High State Income Tax: California has one of the highest state income tax rates, reaching up to 13.3%.

- Complex Compliance: Detailed tax laws and regulations require extensive documentation and may necessitate professional tax assistance.

- Worldwide Income Taxation: All income earned globally is taxed with no exclusions.

Hawaii

- High State Income Tax: Hawaii’s state income tax rates can go up to 11%.

- Worldwide Income Taxation: Residents are taxed on their global incomes with no exclusions.

- Complex Compliance: Hawaii’s tax laws and regulations are intricate, requiring careful planning and, often, professional assistance to navigate.

New Jersey

- High State Income Tax: New Jersey’s state income tax rates can go up to 10.75%.

- Challenging Compliance: Tax filing in New Jersey is known for its complexity, often requiring professional help to navigate the regulations.

- Worldwide Income Taxation: All income earned globally is taxed with no exclusions.

New York

- High State Income Tax: New York’s state income tax rates can reach up to 10.9%, and when combined with New York City taxes, the total rate can go as high as 14.776%.

- Complex Filing Requirements: New York’s tax laws are intricate and compliance can be difficult without professional assistance.

- Worldwide Income Taxation: All income earned globally is taxed with no exclusions.

Cons:

- High Tax Burden: Expats domiciled in these states face significantly higher tax liabilities on their worldwide income.

- No FEIE: These states do not provide a foreign-earned income exclusion, resulting in no relief for expats from high tax burdens on foreign-earned income.

- Complicated Tax Filing: The tax filing process in these states is complex and can be challenging to manage, often requiring professional tax assistance.