Guide to U.S. expat taxes in France

Living in France as an American? C’est magnifique! But when it comes to taxes, things can get tricky. Even though you’re living the expat dream, the U.S. still wants to know about your income. And France? They’ve got tax rules of their own.

U.S. federal tax obligations for expats

As a U.S. citizen, you’re required to report your worldwide income to the IRS, no matter where you live. While this might sound overwhelming, there are several tax benefits available to expats that can significantly reduce or eliminate your U.S. tax liability.

Overview of worldwide income

The U.S. tax system mandates that citizens and resident aliens report all income from global sources. This includes:

- Employment Income: Salaries, wages, bonuses, and commissions earned in France or any other country.

- Self-Employment Income: Earnings from freelance work or business operations conducted abroad.

- Investment Income: Interest, dividends, capital gains, and rental income from both U.S. and foreign sources.

Regardless of where the income is earned or where you reside, it must be reported to the Internal Revenue Service (IRS).

Filing requirements and thresholds

The requirement to file a U.S. tax return depends on your filing status, age, and gross income. For the tax year 2024, the thresholds are as follows:

- Single Filers: Must file if gross income is at least $13,850.

- Married Filing Jointly: Must file if combined gross income is at least $27,700.

- Married Filing Separately: Must file if gross income is at least $5.

- Head of Household: Must file if gross income is at least $20,800.

These thresholds are subject to annual adjustments for inflation. It’s crucial to verify the current year’s thresholds to ensure compliance.

Key tax exclusions and credits

To alleviate the burden of double taxation, the IRS provides several provisions:

Foreign Earned Income Exclusion (FEIE)

The FEIE allows qualifying U.S. expats to exclude a certain amount of foreign-earned income from U.S. taxation. For 2023, this exclusion amount is up to $126,500.

To qualify, you must meet one of the following tests:

- Physical Presence Test: You’ve spent at least 330 full days in France (or another foreign country) during any 12-month period.

- Bona Fide Residence Test: You’ve spent at least 330 full days in France (or another foreign country) during any 12-month period.

To claim the FEIE, file Form 2555 with your U.S. tax return.

Foreign Tax Credit (FTC)

If you pay French income taxes, you can use the FTC to reduce your U.S. tax bill. The credit works dollar-for-dollar, meaning every dollar you pay to France reduces what you owe to the U.S.

Foreign Housing Exclusion

If you incur housing expenses while living abroad, you may qualify for the Foreign Housing Exclusion. This allows you to exclude certain housing costs from your income, provided they exceed a base amount. Eligible expenses include rent, utilities (excluding telephone), and residential parking.

The exclusion is subject to limitations based on the location and the number of qualifying days. To claim this exclusion, complete Form 2555 along with your tax return.

Example: If you earn $90,000 in France and pay $20,000 in rent, you may be able to exclude your entire income using the FEIE and the Foreign Housing Exclusion.

State tax obligations for the U.S. expats in France

Federal taxes are one thing, but what about state taxes? If you’ve moved to France, do you still owe taxes to the state you lived in before? The answer depends on whether you’ve officially cut ties with your former state.

Determining state domicile

State tax obligations depend on whether your previous state of residence considers you a tax resident. Generally, your state of domicile—your permanent home—determines whether you owe state taxes. If you’ve moved to France but still maintain strong ties to your former state, such as owning property or holding a driver’s license, you may still be considered a tax resident.

To avoid ongoing state tax obligations, it’s often necessary to formally sever ties with your previous state of residence.

Here’s a breakdown of states by tax treatment:

States with no tax on worldwide income for non-residents

These states provide favorable tax treatment for expats, as they do not impose taxes on global income if you can establish non-resident status:

- Colorado

- Connecticut

- Delaware

- Massachusetts

- Minnesota

- Missouri

- North Dakota

- Oregon

- Pennsylvania

- Virginia

- West Virginia

Expats from these states may not need to take significant steps to maintain their non-resident status once they relocate. This group of states offers considerable savings by not taxing worldwide income, making them favorable options for expats.

States that tax worldwide income but offer FEIE

These states tax worldwide income but provide some relief to expats by allowing a Foreign Earned Income Exclusion (FEIE). For the 2024 tax year, the FEIE lets expats exclude up to $126,500 of foreign-earned income from state income tax.

- Alabama

- Arizona

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Maine

- Michigan

- Ohio

- Oklahoma

- Rhode Island

- South Carolina

- Utah

- Vermont

While these states tax global income, expats can reduce their tax liability with the FEIE, which allows them to exclude a significant portion of their foreign earnings.

States that tax worldwide income with no FEIE

These states tax worldwide income but do not provide a Foreign Earned Income Exclusion, resulting in higher potential tax burdens for expats, as there is no mechanism to offset foreign-earned income:

- Arkansas

- Indiana

- Kentucky

- Louisiana

- Maine

- Maryland

- Mississippi

- Montana

- Nebraska

- New Mexico

- North Carolina

- Wisconsin

Expats domiciled in these states face more significant tax liabilities on their global income due to the lack of FEIE, which makes establishing domicile elsewhere more appealing.

States with the highest tax burden for expats

Some states impose the most stringent tax policies on expats, including high income tax rates and no exclusions for foreign-earned income. If you’re domiciled in one of these states, relocating your domicile to a more tax-friendly state can lead to substantial savings.

These states have high income tax rates and tax worldwide income with no exclusions, making them the least favorable for expats in terms of tax savings.

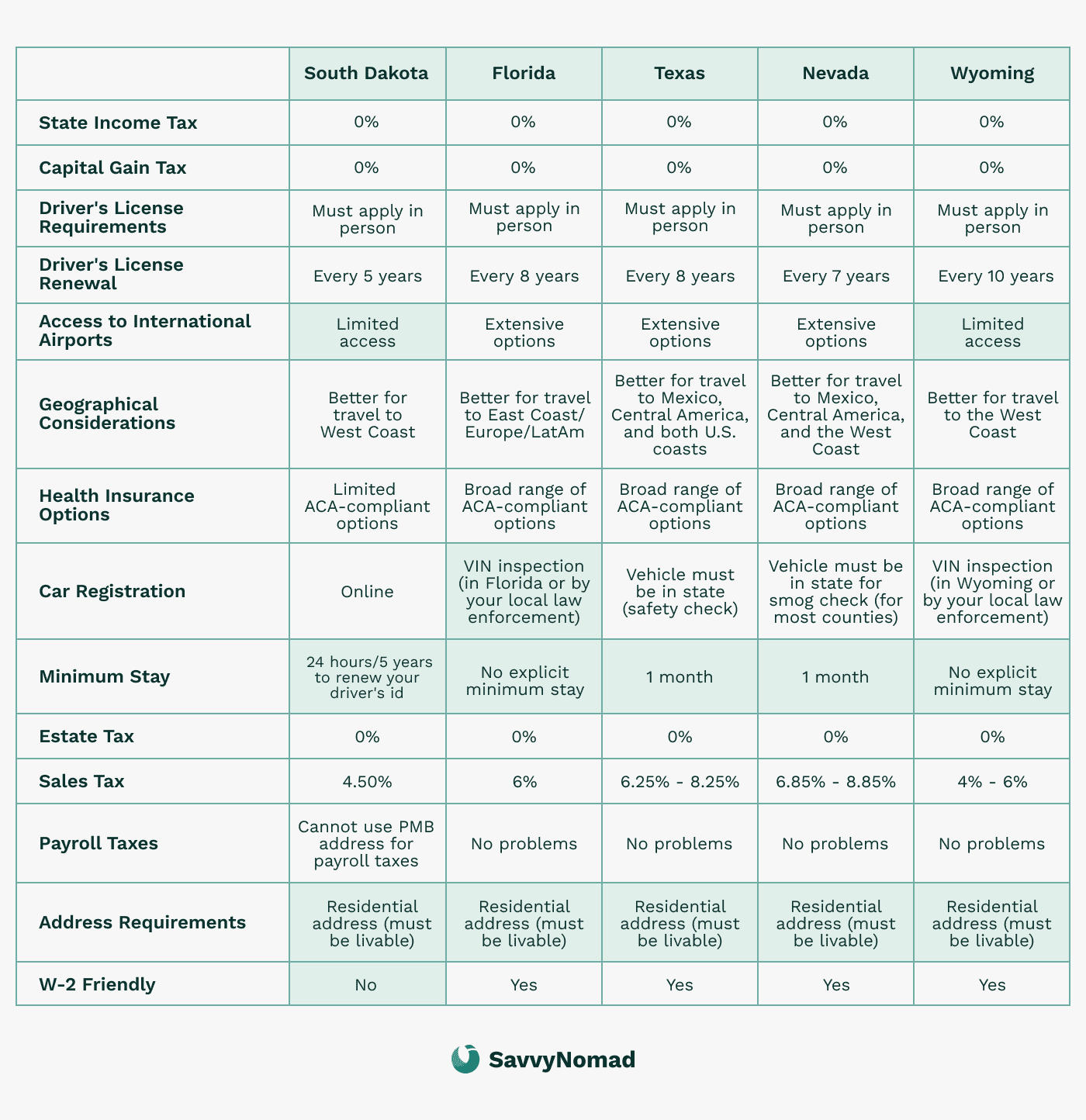

Steps to reduce state tax obligations

If you plan to avoid state tax obligations, especially from states that tax worldwide income without providing relief, consider these steps:

- Establish domicile in a tax-friendly state: Moving your official residence to a state with no income tax, like Florida, Nevada, Texas, or South Dakota, can significantly reduce your tax burden.

- Update official documents: Cancel voter registration, update your driver’s license, and transfer financial accounts to reflect your new domicile.

- File a final tax return in your previous state: This signals the end of your tax residency and helps prevent future state tax liabilities.

Additional U.S. reporting requirements – FATCA and FBAR

Living abroad comes with some extra paperwork, especially when it comes to foreign accounts and assets. As a U.S. expat in France, you might need to file additional forms with the IRS and other agencies to stay compliant. While it may seem like a hassle, understanding these requirements can save you from steep penalties.

FATCA (Foreign Account Tax Compliance Act)

The Foreign Account Tax Compliance Act, or FATCA, was introduced to help the IRS prevent tax evasion by U.S. citizens using foreign accounts. FATCA requires U.S. taxpayers to report certain foreign assets to the IRS. Here’s what you need to know about FATCA and its requirements:

Who needs to file under FATCA?

If you have foreign assets that exceed certain thresholds, you’ll need to report them on Form 8938, which is submitted along with your regular tax return. For single filers living abroad, the threshold is $200,000 on the last day of the tax year or $300,000 at any point during the year. For married couples filing jointly, the thresholds are doubled.

What needs to be reported?

Reportable assets under FATCA include foreign bank accounts, investment accounts, foreign stocks, and even certain pensions. Generally, any financial assets held outside the U.S. should be reviewed to determine if they need to be reported.

How to file FATCA (form 8938?

If you meet the reporting threshold, you’ll complete Form 8938 and submit it with your regular tax return (Form 1040). The form requires details like account numbers, maximum account values, and the financial institution’s location.

FBAR (Foreign Bank Account Report)

The Foreign Bank Account Report (FBAR) is another requirement for U.S. citizens with overseas accounts. While FATCA applies based on the value of financial assets, the FBAR requirement is specifically tied to foreign bank accounts. Here’s a breakdown:

Who needs to file FBAR?

If the combined balance of all your foreign bank accounts exceeds $10,000 at any point during the year, you’re required to file an FBAR. This rule applies even if you just temporarily crossed the $10,000 threshold. For instance, if you have two accounts—one with $5,000 and another with $6,000—you would need to file an FBAR, as the combined balance is over $10,000.

How to file the FBAR (fincen form 114)?

The FBAR is filed separately from your tax return and is submitted online through the Financial Crimes Enforcement Network (FinCEN). The form, FinCEN Form 114, requires you to report details about each foreign account, including the bank name, account number, and maximum balance during the year.

Important deadlines and penalties

The FBAR filing deadline is April 15, but there is an automatic extension until October 15 for those who miss the initial deadline. Be mindful of FBAR filing, as the penalties for not reporting eligible accounts can be severe, with fines starting at $10,000 for each unreported account.

Understanding the difference between FATCA and FBAR

While FATCA and FBAR both aim to provide the IRS with information about foreign financial accounts, they have distinct differences:

- Different thresholds: FATCA requires reporting if your foreign assets exceed $200,000 as a single filer, while FBAR applies if the total balance in all foreign accounts exceeds $10,000.

- Different filing locations: FATCA reporting (Form 8938) is filed with your federal tax return, whereas the FBAR is filed separately through FinCEN.

- Types of assets reported: FATCA requires reporting a broader range of foreign financial assets, while FBAR focuses only on foreign bank accounts.

Why do FATCA and FBAR matter for U.S. expats?

Failing to file FATCA and FBAR can result in significant penalties, so it’s essential to understand whether you’re required to report these assets. While it may seem like an extra step, filing these forms can help ensure compliance with IRS regulations and avoid unnecessary fines.

If you have foreign bank accounts or financial assets, it’s a good idea to consult a tax professional to ensure you’re meeting all reporting requirements.

France tax obligations for U.S. expats

Living in France offers a rich cultural experience, but it also introduces new tax responsibilities. As a U.S. expat, it’s essential to understand your obligations under the French tax system to ensure compliance and avoid potential penalties.

Determining tax residency in France

France considers you a tax resident if you meet any of the following criteria:

- Permanent Home: Your main residence (foyer) is in France. This includes where your family resides, even if you spend significant time abroad for work.

- Professional Activity: Your principal place of work is in France, regardless of where your employer is based.

- Center of Economic Interests: Your primary economic activities or investments are in France.

If you satisfy any of these conditions, France regards you as a tax resident, obligating you to report your worldwide income.

French income tax rates

France employs a progressive income tax system, with rates for 2024 as follows:

- Up to €10,777: 0%

- €10,778 to €27,748: 11%

- €27,749 to €78,570: 30%

- €78,571 to €168,994: 41%

- Over €168,994: 45%

Example: If you earn €50,000, your tax calculation would be:

- 0% on the first €10,777

- 11% on the next €16,971 (€10,778 to €27,748)

- 30% on the remaining €22,252 (€27,749 to €50,000)

Social Security contributions

In addition to income tax, France imposes social contributions on various types of income:

- Salaried Income: Subject to social security contributions, typically around 7.5% to 9.2%.

- Investment Income: Generally subject to a flat tax rate of 30%, which includes both income tax and social charges.

Filing deadlines and tax year in France

French tax returns are typically due by late May or early June, depending on whether you file online or on paper. It’s crucial to adhere to these deadlines to avoid penalties.

U.S.-France tax treaty

The U.S.-France Tax Treaty exists to make life easier for expats by preventing double taxation and clarifying which country gets to tax what. If you’re an American living in France, this treaty is your ally, ensuring you don’t pay more than your fair share.

Purpose of the U.S.-France tax treaty

The main objectives of the tax treaty are to:

- Prevent Double Taxation: Ensure you aren’t taxed on the same income by both countries.

- Define Tax Rights: Establish clear rules on which country has taxing authority over specific types of income.

- Facilitate Compliance: Make it easier to fulfill tax obligations in both countries while avoiding unnecessary payments.

By using the treaty, you can align your U.S. and Francen tax filings to avoid paying more than you owe.

For U.S. expats, the treaty helps lower the risk of double taxation by allowing foreign tax credits, setting reduced tax rates on specific income types, and establishing residency and income allocation rules.

Key treaty provisions

Employment Income:

- Income from working in France is primarily taxed in France.

- You’ll still report this income on your U.S. tax return but can offset it using the Foreign Tax Credit (FTC) or Foreign Earned Income Exclusion (FEIE) to avoid U.S. taxes.

Dividends and Interest:

- France imposes withholding taxes on dividends (typically capped at 15% under the treaty) and interest.

- The treaty allows you to claim these taxes as credits on your U.S. tax return.

Capital Gains:

- Gains from selling property or investments are usually taxed in your country of residence.

- For U.S. citizens living in France, French tax rules apply, but gains on U.S. property must still be reported to the IRS.

Pensions and Social Security:

- Pensions are generally taxed in the country where you reside.

- U.S. Social Security benefits may be exempt from French taxation under specific conditions outlined in the treaty.

Social Security Agreement (Totalization Agreement)

In addition to the tax treaty, the U.S. and France have a Totalization Agreement to coordinate social security contributions. This agreement prevents you from paying into both systems and ensures your contributions count toward benefits in both countries.

- If You Work for a U.S.-Based Employer: You’ll remain under the U.S. Social Security system for up to five years and won’t have to contribute to France’s system.

- If You Work for a French Employer: You’ll pay into the French social security system, and these contributions can count toward future retirement benefits.

Example: If you worked in the U.S. for 8 years and in France for 7, the agreement allows you to combine those years to qualify for benefits.

Claiming treaty benefits

To take advantage of the tax treaty, U.S. expats may need to file specific forms with the IRS:

- Form 8833 (Treaty-Based Return Position Disclosure): This form is required if you’re claiming treaty benefits to reduce or eliminate your U.S. tax liability on income earned in France.

- Form 1116 (Foreign Tax Credit): Use this form to claim credits for taxes paid to France on income also taxable by the U.S., helping to avoid double taxation.

Residency and tie-breaker rules

The treaty also includes “tie-breaker” rules to help determine tax residency if both countries consider you a resident. Here’s how the treaty resolves conflicts in residency status:

- Permanent Home: Priority is given to the country where you maintain a permanent home.

- Center of Vital Interests: If you have permanent homes in both countries, the country where you have stronger personal and economic ties (center of vital interests) takes precedence.

- Habitual Abode: If neither of the above determines residency, the country where you habitually reside is considered your primary tax residence.

These tie-breaker rules help avoid conflicts over tax residency and ensure that your tax obligations are clear.

France tax filing process for U.S. expats

Filing taxes in two countries might sound intimidating, but with the right approach, it doesn’t have to be. As a U.S. expat in France, you’ll likely need to file tax returns in both countries. This chapter walks you through the process step-by-step.

Tax Year and Deadlines:

- France’s tax year runs from January 1 to December 31.

- Filing deadlines vary based on how you file:

- Paper Filing: Usually due by mid-May.

- Online Filing: Deadlines are in late May or early June, depending on your location.

What You’ll Need to File:

- Income statements (e.g., salary slips or freelance invoices).

- Bank and investment statements for any interest, dividends, or capital gains.

- Proof of deductions (e.g., rent payments, charitable donations).

How to File:

- Online via Impôts.gouv.fr: France’s online tax portal is user-friendly and available in French.

With Professional Help: Hiring a French tax advisor can simplify the process, especially if your finances are complex.