U.S. expat taxes in the UK

Living in the United Kingdom as a U.S. citizen can be an exciting journey filled with new experiences. However, it also comes with some unique tax responsibilities. Unlike most countries, the United States taxes its citizens on worldwide income, meaning that even if you live in the U.K., you’re still required to report your income to the IRS back home.

U.S. federal tax obligations for expats

As a U.S. citizen living in the U.K., you’re still required to report your worldwide income to the IRS each year. This includes any income from jobs, freelance work, investments, or other sources, regardless of where it was earned.

Overview of worldwide income

The U.S. tax system mandates that citizens and resident aliens report all income from global sources. This includes:

- Employment Income: Salaries, wages, bonuses, and commissions earned in UK or any other country.

- Self-Employment Income: Earnings from freelance work or business operations conducted abroad.

- Investment Income: Interest, dividends, capital gains, and rental income from both U.S. and foreign sources.

Regardless of where the income is earned or where you reside, it must be reported to the Internal Revenue Service (IRS).

Filing requirements and thresholds

The requirement to file a U.S. tax return depends on your filing status, age, and gross income. For the tax year 2024, the thresholds are as follows:

- Single Filers: Must file if gross income is at least $13,850.

- Married Filing Jointly: Must file if combined gross income is at least $27,700.

- Married Filing Separately: Must file if gross income is at least $5.

- Head of Household: Must file if gross income is at least $20,800.

These thresholds are subject to annual adjustments for inflation. It’s crucial to verify the current year’s thresholds to ensure compliance.

Key tax exclusions and credits

To alleviate the burden of double taxation, the IRS provides several provisions:

Foreign Earned Income Exclusion (FEIE)

The FEIE allows qualifying U.S. expats to exclude a certain amount of foreign-earned income from U.S. taxation.For 2023, this exclusion amount is up to $126,500.

To qualify, you must meet one of the following tests:

- Physical Presence Test: You were physically present in a foreign country for at least 330 full days during a 12-month period.

- Bona Fide Residence Test: You are a bona fide resident of a foreign country for an uninterrupted period that includes an entire tax year.

To claim the FEIE, file Form 2555 with your U.S. tax return.

Foreign Tax Credit (FTC)

If you pay U.K. income tax, the FTC lets you offset U.S. taxes with U.K. taxes paid, reducing or eliminating double taxation. You can claim this by filing Form 1116.

Foreign Housing Exclusion

If you incur housing expenses while living abroad, you may qualify for the Foreign Housing Exclusion. This allows you to exclude certain housing costs from your income, provided they exceed a base amount. Eligible expenses include rent, utilities (excluding telephone), and residential parking.

The exclusion is subject to limitations based on the location and the number of qualifying days. To claim this exclusion, complete Form 2555 along with your tax return.

State tax obligations for the U.S. expats

Understanding state residency and domicile

Each U.S. state has unique criteria for determining residency and domicile. While you may no longer physically live in your former state, it may still consider you a tax resident if you haven’t made an official change of domicile.

States with strict tax residency rules, like California, New York, and Virginia, may impose ongoing tax obligations on income earned anywhere in the world unless you have clearly cut legal ties and established a new state of residency.

In states like these, moving abroad isn’t always enough to sever residency ties. These states typically consider factors like where you hold a driver’s license, register to vote, own property, and maintain financial or family ties. Without formally establishing domicile in a different state, you could be subject to state income tax even while living abroad.

For U.S. expats residing in UK, it’s essential to understand the tax policies of your last U.S. state of residence. Some states impose tax on worldwide income, making them less favorable for expats, while others have beneficial policies that either do not tax income or offer provisions to reduce the tax burden on expats.

Here’s a breakdown of states by tax treatment:

States with no tax on worldwide income for non-residents

These states provide favorable tax treatment for expats, as they do not impose taxes on global income if you can establish non-resident status:

- Colorado

- Connecticut

- Delaware

- Massachusetts

- Minnesota

- Missouri

- North Dakota

- Oregon

- Pennsylvania

- Virginia

- West Virginia

Expats from these states may not need to take significant steps to maintain their non-resident status once they relocate. This group of states offers considerable savings by not taxing worldwide income, making them favorable options for expats.

States that tax worldwide income but offer FEIE

These states tax worldwide income but provide some relief to expats by allowing a Foreign Earned Income Exclusion (FEIE). For the 2024 tax year, the FEIE lets expats exclude up to $126,500 of foreign-earned income from state income tax.

- Alabama

- Arizona

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Maine

- Michigan

- Ohio

- Oklahoma

- Rhode Island

- South Carolina

- Utah

- Vermont

While these states tax global income, expats can reduce their tax liability with the FEIE, which allows them to exclude a significant portion of their foreign earnings.

States that tax worldwide income with no FEIE

These states tax worldwide income but do not provide a Foreign Earned Income Exclusion, resulting in higher potential tax burdens for expats, as there is no mechanism to offset foreign-earned income:

- Arkansas

- Indiana

- Kentucky

- Louisiana

- Maine

- Maryland

- Mississippi

- Montana

- Nebraska

- New Mexico

- North Carolina

- Wisconsin

Expats domiciled in these states face more significant tax liabilities on their global income due to the lack of FEIE, which makes establishing domicile elsewhere more appealing.

States with the highest tax burden for expats

Some states impose the most stringent tax policies on expats, including high income tax rates and no exclusions for foreign-earned income. If you’re domiciled in one of these states, relocating your domicile to a more tax-friendly state can lead to substantial savings.

These states have high income tax rates and tax worldwide income with no exclusions, making them the least favorable for expats in terms of tax savings.

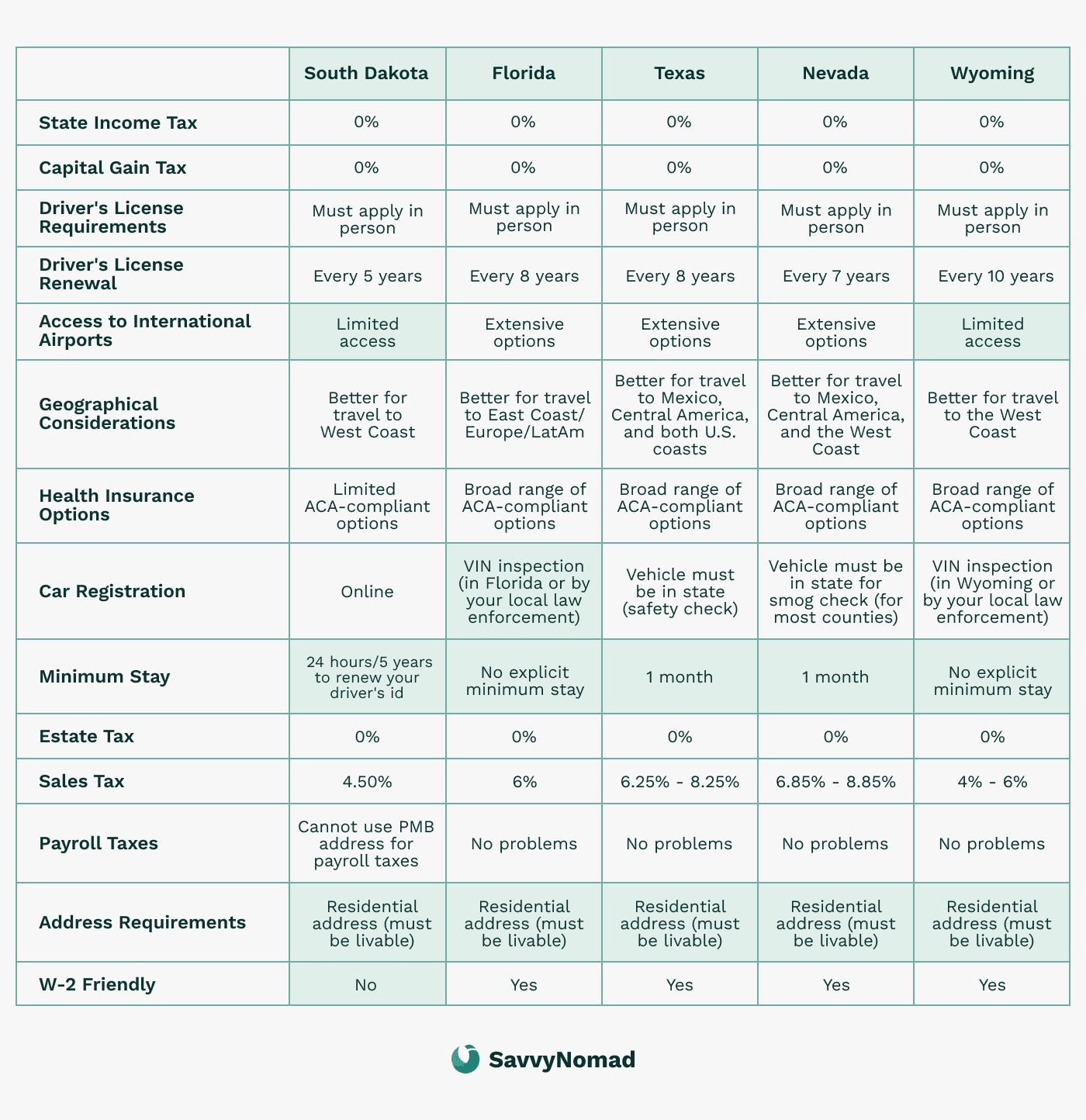

Steps to reduce state tax obligations

If you plan to avoid state tax obligations, especially from states that tax worldwide income without providing relief, consider these steps:

- Establish domicile in a tax-friendly state: Moving your official residence to a state with no income tax, like Florida, Nevada, Texas, or South Dakota, can significantly reduce your tax burden.

- Update official documents: Cancel voter registration, update your driver’s license, and transfer financial accounts to reflect your new domicile.

- File a final tax return in your previous state: This signals the end of your tax residency and helps prevent future state tax liabilities.

Additional U.S. reporting requirements – FATCA and FBAR

For U.S. citizens living abroad, filing a tax return may not be the only reporting requirement. The IRS has additional rules that apply specifically to U.S. citizens with foreign bank accounts or significant financial assets abroad. Two of the main forms to be aware of are related to the Foreign Account Tax Compliance Act (FATCA) and the Foreign Bank Account Report (FBAR). While these forms may sound intimidating, they’re simply tools for the IRS to keep track of U.S. citizens’ overseas finances.

FATCA (Foreign Account Tax Compliance Act)

The Foreign Account Tax Compliance Act, or FATCA, was introduced to help the IRS prevent tax evasion by U.S. citizens using foreign accounts. FATCA requires U.S. taxpayers to report certain foreign assets to the IRS. Here’s what you need to know about FATCA and its requirements:

Who needs to file under FATCA?

If you have foreign assets that exceed certain thresholds, you’ll need to report them on Form 8938, which is submitted along with your regular tax return. For single filers living abroad, the threshold is $200,000 on the last day of the tax year or $300,000 at any point during the year. For married couples filing jointly, the thresholds are doubled.

What needs to be reported?

Reportable assets under FATCA include foreign bank accounts, investment accounts, foreign stocks, and even certain pensions. Generally, any financial assets held outside the U.S. should be reviewed to determine if they need to be reported.

How to file FATCA (form 8938?

If you meet the reporting threshold, you’ll complete Form 8938 and submit it with your regular tax return (Form 1040). The form requires details like account numbers, maximum account values, and the financial institution’s location.

FBAR (Foreign Bank Account Report)

The Foreign Bank Account Report (FBAR) is another requirement for U.S. citizens with overseas accounts. While FATCA applies based on the value of financial assets, the FBAR requirement is specifically tied to foreign bank accounts. Here’s a breakdown:

Who needs to file FBAR?

If the combined balance of all your foreign bank accounts exceeds $10,000 at any point during the year, you’re required to file an FBAR. This rule applies even if you just temporarily crossed the $10,000 threshold. For instance, if you have two accounts—one with $5,000 and another with $6,000—you would need to file an FBAR, as the combined balance is over $10,000.

How to file the FBAR (fincen form 114)?

The FBAR is filed separately from your tax return and is submitted online through the Financial Crimes Enforcement Network (FinCEN). The form, FinCEN Form 114, requires you to report details about each foreign account, including the bank name, account number, and maximum balance during the year.

Important deadlines and penalties

The FBAR filing deadline is April 15, but there is an automatic extension until October 15 for those who miss the initial deadline. Be mindful of FBAR filing, as the penalties for not reporting eligible accounts can be severe, with fines starting at $10,000 for each unreported account.

Understanding the difference between FATCA and FBAR

While FATCA and FBAR both aim to provide the IRS with information about foreign financial accounts, they have distinct differences:

- Different thresholds: FATCA requires reporting if your foreign assets exceed $200,000 as a single filer, while FBAR applies if the total balance in all foreign accounts exceeds $10,000.

- Different filing locations: FATCA reporting (Form 8938) is filed with your federal tax return, whereas the FBAR is filed separately through FinCEN.

- Types of assets reported: FATCA requires reporting a broader range of foreign financial assets, while FBAR focuses only on foreign bank accounts.

Why do FATCA and FBAR matter for U.S. expats?

Failing to file FATCA and FBAR can result in significant penalties, so it’s essential to understand whether you’re required to report these assets. While it may seem like an extra step, filing these forms can help ensure compliance with IRS regulations and avoid unnecessary fines. If you have foreign bank accounts or financial assets, it’s a good idea to consult a tax professional to ensure you’re meeting all reporting requirements.

U.S.-UK tax treaty

For U.S. citizens living in the U.K., the U.S.-U.K. Tax Treaty is a vital tool to help avoid double taxation and clarify tax responsibilities. Here’s how it can help.

Relief from double taxation

A key benefit of the treaty is the ability to reduce or eliminate double taxation, ensuring you’re not taxed twice on the same income.

If you pay U.K. income tax on earnings there, you can apply this amount as a credit on your U.S. tax return, effectively lowering or eliminating your U.S. tax liability on this income.

Residency and tie-breaker rules

The treaty includes tie-breaker rules to help determine tax residency when you could qualify as a resident in both countries. Key considerations include:

- Permanent home: Priority goes to the country where an individual maintains a primary residence.

- Center of vital interests: The country where personal and economic ties are strongest.

- Habitual abode: Where the individual spends the majority of their time.

- Nationality: In cases where other criteria are inconclusive, citizenship can play a role in determining residency.

These rules help U.S. expats in the UK avoid dual residency status, ensuring they are not taxed as residents in both countries.

Taxation of various types of income

The U.S.-UK Tax Treaty provides guidance on how specific types of income are taxed, depending on residency and income source. Key types of income addressed by the treaty include:

- Employment income: Generally taxed in the country where the work is performed, though certain short-term assignments may qualify for tax exemptions.

- Dividends and interest: Reduced withholding tax rates apply. For example, dividends paid by U.S. corporations to UK residents may be taxed at a reduced rate of 5% if the UK shareholder is a corporation owning at least 10% of the voting stock of the U.S. corporation, or 15% for individuals.

- Pensions and Social Security: Special rules apply to pension and Social Security income:

- U.S. Social Security: For a U.S. expat in UK, U.S. Social Security benefits are generally only taxable in the U.S.

- UK Old Age Security (OAS) and UK Pension Plan (CPP): These benefits received by U.S. residents are taxable only in UK.

- Capital gains: Generally taxed in the country of residence. However, gains from the sale of real property and certain other assets may have exceptions.

The savings clause

The savings clause allows the U.S. to continue taxing its citizens on worldwide income, even if they reside in the U.K. While the treaty provides relief, this clause means U.S. citizens must still report worldwide income to the IRS, though they can use credits and exclusions to reduce U.S. taxes on income already taxed in the U.K.

Exchange of information

The U.S. and U.K. share tax information under the treaty to promote compliance and prevent tax evasion. This means that financial data from accounts and income in either country can be shared between the IRS and HM Revenue & Customs (HMRC).

U.S.-UK totalization agreement (social security agreement)

For U.S. citizens working in the U.K., understanding Social Security obligations can be complex. The U.S.-U.K. Totalization Agreement helps prevent double contributions to Social Security systems in both countries and ensures that individuals are eligible for benefits. This agreement has been in effect since 1985, providing a coordinated approach to Social Security for people who divide their careers between the United States and the United Kingdom.

Purpose of the totalization agreement

The main goal of this agreement is to avoid the need to pay into both U.S. and U.K. Social Security systems simultaneously. Without this arrangement, U.S. expats in the U.K. might end up contributing to both Social Security systems, which can be costly. The agreement also ensures that individuals receive benefits based on combined contributions if they’ve worked in both countries.

Avoiding dual contributions

The agreement outlines which country’s Social Security system you should contribute to, based on your specific employment situation:

- Temporary Assignments: If a U.S. employer sends you to the U.K. for a period of five years or less, you can continue paying into U.S. Social Security instead of the U.K. National Insurance system. Similarly, U.K. workers sent temporarily to the U.S. can remain covered by the U.K. system.

- Permanent Assignments or U.K. Employers: If you work for a U.K.-based employer or have a permanent role in the U.K., you typically pay into the U.K. National Insurance system rather than U.S. Social Security.

- Self-Employment: Self-employed U.S. citizens in the U.K. usually contribute to the Social Security system in the country where they reside, meaning contributions would typically go to the U.K. National Insurance if you’re living in the U.K. long-term.

Combining social security credits

The Totalization Agreement allows you to combine work credits from both the U.S. and UK if you need additional credits to qualify for Social Security benefits. This is particularly helpful for individuals who have split their working years between both countries:

- Qualifying for U.S. Social Security Benefits: If you haven’t worked enough years in the U.S. to qualify for Social Security benefits, credits earned in UK can help meet the eligibility requirements.

- Qualifying for UK CPP Benefits: Similarly, if you lack sufficient UK credits to qualify for CPP, U.S. credits can be applied to meet UK requirements.

However, while credits can be combined for eligibility purposes, the benefit amounts will be based on actual contributions to each system, meaning you’ll receive separate benefits from each country rather than a combined payment.

Claiming social security benefits

If you qualify for Social Security benefits in both countries, you can claim benefits from each country independently. Each country will pay benefits based on the contributions made within its system. Here’s how it works:

- U.S. Social Security Benefits: You’ll receive payments based on your contributions to the U.S. Social Security system.

- UK CPP and Old Age Security (OAS): Benefits from UK will be based on contributions to the CPP, with additional eligibility for OAS based on residency.

How to apply for benefits

To apply for benefits under the Totalization Agreement, U.S. citizens in UK can start the process by contacting either the U.S. Social Security Administration (SSA) or Service UK. Both agencies can provide information on eligibility, contributions, and applications for benefits, and they work together to help coordinate cross-border benefits.

U.K. tax obligations for U.S. expats

While living in the U.K. as a U.S. citizen, you’ll need to navigate the U.K. tax system in addition to your U.S. tax obligations. Here’s a straightforward overview of what to expect when paying taxes in the U.K.

Determining U.K. tax residency

Your tax obligations in the U.K. depend on whether you’re considered a tax resident. The U.K. uses the Statutory Residence Test to determine residency status, considering factors such as:

- Days Spent in the U.K.: If you spend 183 days or more in the U.K. in a tax year, you’re usually considered a U.K. resident for tax purposes.

- Personal Ties: Factors like your primary home, family connections, and work location can also impact your residency status.

If you’re classified as a U.K. tax resident, you’re required to report and pay U.K. taxes on worldwide income. If you’re not a U.K. resident, you’re generally only taxed on U.K.-sourced income.

U.K. income tax rates

The U.K. has a progressive tax system where rates increase with income. Here’s a simplified look at the current tax brackets:

- Basic Rate: 20% on income up to £50,270.

- Higher Rate: 40% on income from £50,271 to £150,000.

- Additional Rate: 45% on income over £150,000.

In addition to these rates, you may also pay National Insurance contributions, which are similar to Social Security taxes in the U.S.

Taxation of different types of income

Understanding how various types of income are taxed in the U.K. is essential for proper tax planning:

- Employment Income: Taxed progressively based on your total annual income.

- Self-Employment and Business Income: Taxed at progressive rates, with deductions allowed for eligible business expenses.

- Investment Income:

- Dividends: U.K. dividends have a tax-free allowance, but any dividends over this limit are taxed at rates between 8.75% and 39.35%, depending on your tax bracket.

- Capital Gains: The U.K. taxes capital gains at a lower rate than regular income, with a tax-free allowance for gains up to a certain amount.

- Pensions: U.S. Social Security benefits are generally only taxable in the U.S., but U.K. pensions are taxable in the U.K. as income.

Tax filing requirements and deadlines

The U.K. tax year runs from April 6 to April 5 of the following year. Tax returns are due by:

- October 31 for paper returns, or

- January 31 of the following year for online returns.

If you owe tax, the payment is also due by January 31. Self-employed individuals or those with complex tax situations may need to make advance payments, known as payments on account, to cover future tax liabilities.