Guide to U.S. expat taxes in Germany

Living in Germany as a U.S. citizen brings exciting opportunities, but also some complex tax responsibilities. Even though you’re outside the U.S., you’re still expected to report your income to the IRS. Understanding these tax requirements can be confusing, but knowing the essentials can help you stay compliant and even find ways to reduce your tax liability.

U.S. federal tax obligations for expats

As a U.S. citizen living in Germany, you’re still required to report your income to the IRS each year. The U.S. taxes its citizens on their worldwide income, no matter where they live. Here’s a breakdown of what you need to know about your federal tax obligations while residing in Germany.

Overview of worldwide income

The U.S. tax system mandates that citizens and resident aliens report all income from global sources. This includes:

- Employment Income: Salaries, wages, bonuses, and commissions earned in Germany or any other country.

- Self-Employment Income: Earnings from freelance work or business operations conducted abroad.

- Investment Income: Interest, dividends, capital gains, and rental income from both U.S. and foreign sources.

Regardless of where the income is earned or where you reside, it must be reported to the Internal Revenue Service (IRS).

Filing requirements and thresholds

The requirement to file a U.S. tax return depends on your filing status, age, and gross income. For the tax year 2024, the thresholds are as follows:

- Single Filers: Must file if gross income is at least $13,850.

- Married Filing Jointly: Must file if combined gross income is at least $27,700.

- Married Filing Separately: Must file if gross income is at least $5.

- Head of Household: Must file if gross income is at least $20,800.

These thresholds are subject to annual adjustments for inflation. It’s crucial to verify the current year’s thresholds to ensure compliance.

Key tax exclusions and credits

To alleviate the burden of double taxation, the IRS provides several provisions:

Foreign Earned Income Exclusion (FEIE)

The FEIE allows qualifying U.S. expats to exclude a certain amount of foreign-earned income from U.S. taxation. For 2023, this exclusion amount is up to $126,500.

To qualify, you must meet one of the following tests:

- Physical Presence Test: You were physically present in a foreign country for at least 330 full days during a 12-month period.

- Bona Fide Residence Test: You are a bona fide resident of a foreign country for an uninterrupted period that includes an entire tax year.

To claim the FEIE, file Form 2555 with your U.S. tax return.

Foreign Tax Credit (FTC)

If you pay Germany income tax, the FTC lets you offset U.S. taxes with Germany taxes paid, reducing or eliminating double taxation. You can claim this by filing Form 1116.

Foreign Housing Exclusion

If you incur housing expenses while living abroad, you may qualify for the Foreign Housing Exclusion. This allows you to exclude certain housing costs from your income, provided they exceed a base amount. Eligible expenses include rent, utilities (excluding telephone), and residential parking.

The exclusion is subject to limitations based on the location and the number of qualifying days. To claim this exclusion, complete Form 2555 along with your tax return.

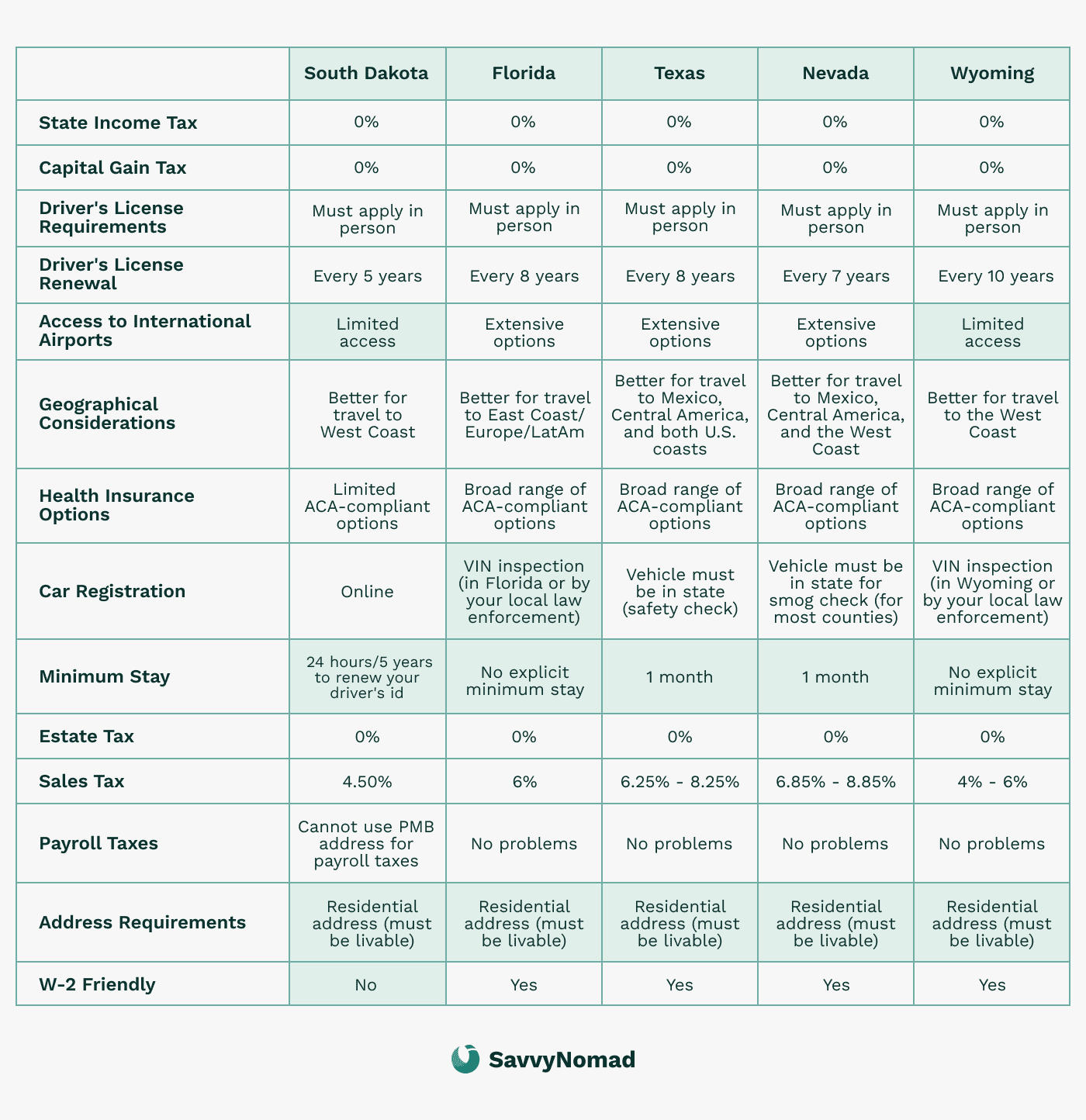

State tax obligations for the U.S. expats in Germany

For U.S. citizens living in Germany, understanding state tax obligations can be essential, especially if you recently moved from a U.S. state with its own income tax.

Unlike federal tax, state tax residency is governed by each individual state’s laws, which means some states may still consider you a resident for tax purposes even after you’ve moved abroad.

Here’s what U.S. expats in Germany need to know about managing and potentially avoiding state tax obligations.

Determining state domicile

Each U.S. state has its own rules for establishing and ending tax residency, and these rules vary widely. The concept of domicile—where your permanent home is located—plays a major role in determining state tax residency. Even if you spend most of your time outside the U.S., a state may consider you a resident if you retain strong connections to it, such as property, family ties, or financial accounts.

To avoid ongoing state tax obligations, it’s often necessary to formally sever ties with your previous state of residence.

Here’s a breakdown of states by tax treatment:

States with no tax on worldwide income for non-residents

These states provide favorable tax treatment for expats, as they do not impose taxes on global income if you can establish non-resident status:

- Colorado

- Connecticut

- Delaware

- Massachusetts

- Minnesota

- Missouri

- North Dakota

- Oregon

- Pennsylvania

- Virginia

- West Virginia

Expats from these states may not need to take significant steps to maintain their non-resident status once they relocate. This group of states offers considerable savings by not taxing worldwide income, making them favorable options for expats.

States that tax worldwide income but offer FEIE

These states tax worldwide income but provide some relief to expats by allowing a Foreign Earned Income Exclusion (FEIE). For the 2024 tax year, the FEIE lets expats exclude up to $126,500 of foreign-earned income from state income tax.

- Alabama

- Arizona

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Maine

- Michigan

- Ohio

- Oklahoma

- Rhode Island

- South Carolina

- Utah

- Vermont

While these states tax global income, expats can reduce their tax liability with the FEIE, which allows them to exclude a significant portion of their foreign earnings.

States that tax worldwide income with no FEIE

These states tax worldwide income but do not provide a Foreign Earned Income Exclusion, resulting in higher potential tax burdens for expats, as there is no mechanism to offset foreign-earned income:

- Arkansas

- Indiana

- Kentucky

- Louisiana

- Maine

- Maryland

- Mississippi

- Montana

- Nebraska

- New Mexico

- North Carolina

- Wisconsin

Expats domiciled in these states face more significant tax liabilities on their global income due to the lack of FEIE, which makes establishing domicile elsewhere more appealing.

States with the highest tax burden for expats

Some states impose the most stringent tax policies on expats, including high income tax rates and no exclusions for foreign-earned income. If you’re domiciled in one of these states, relocating your domicile to a more tax-friendly state can lead to substantial savings.

These states have high income tax rates and tax worldwide income with no exclusions, making them the least favorable for expats in terms of tax savings.

Steps to reduce state tax obligations

If you plan to avoid state tax obligations, especially from states that tax worldwide income without providing relief, consider these steps:

- Establish domicile in a tax-friendly state: Moving your official residence to a state with no income tax, like Florida, Nevada, Texas, or South Dakota, can significantly reduce your tax burden.

- Update official documents: Cancel voter registration, update your driver’s license, and transfer financial accounts to reflect your new domicile.

- File a final tax return in your previous state: This signals the end of your tax residency and helps prevent future state tax liabilities.

Additional U.S. reporting requirements – FATCA and FBAR

For U.S. citizens living abroad, meeting U.S. tax obligations involves more than just filing an annual tax return. If you have foreign bank accounts or substantial financial assets, you may also be required to file additional reports with the IRS and FinCEN (Financial Crimes Enforcement Network) under FATCA (Foreign Account Tax Compliance Act) and FBAR (Foreign Bank Account Report). These requirements apply even if you are a resident of Germany, and non-compliance can lead to severe penalties. Here’s a guide to FATCA and FBAR reporting for U.S. expats in Germany.

FATCA (Foreign Account Tax Compliance Act)

The Foreign Account Tax Compliance Act, or FATCA, was introduced to help the IRS prevent tax evasion by U.S. citizens using foreign accounts. FATCA requires U.S. taxpayers to report certain foreign assets to the IRS. Here’s what you need to know about FATCA and its requirements:

Who needs to file under FATCA?

If you have foreign assets that exceed certain thresholds, you’ll need to report them on Form 8938, which is submitted along with your regular tax return. For single filers living abroad, the threshold is $200,000 on the last day of the tax year or $300,000 at any point during the year. For married couples filing jointly, the thresholds are doubled.

What needs to be reported?

Reportable assets under FATCA include foreign bank accounts, investment accounts, foreign stocks, and even certain pensions. Generally, any financial assets held outside the U.S. should be reviewed to determine if they need to be reported.

How to file FATCA (form 8938?

If you meet the reporting threshold, you’ll complete Form 8938 and submit it with your regular tax return (Form 1040). The form requires details like account numbers, maximum account values, and the financial institution’s location.

FBAR (Foreign Bank Account Report)

The Foreign Bank Account Report (FBAR) is another requirement for U.S. citizens with overseas accounts. While FATCA applies based on the value of financial assets, the FBAR requirement is specifically tied to foreign bank accounts. Here’s a breakdown:

Who needs to file FBAR?

If the combined balance of all your foreign bank accounts exceeds $10,000 at any point during the year, you’re required to file an FBAR. This rule applies even if you just temporarily crossed the $10,000 threshold. For instance, if you have two accounts—one with $5,000 and another with $6,000—you would need to file an FBAR, as the combined balance is over $10,000.

How to file the FBAR (fincen form 114)?

The FBAR is filed separately from your tax return and is submitted online through the Financial Crimes Enforcement Network (FinCEN). The form, FinCEN Form 114, requires you to report details about each foreign account, including the bank name, account number, and maximum balance during the year.

Important deadlines and penalties

The FBAR filing deadline is April 15, but there is an automatic extension until October 15 for those who miss the initial deadline. Be mindful of FBAR filing, as the penalties for not reporting eligible accounts can be severe, with fines starting at $10,000 for each unreported account.

Understanding the difference between FATCA and FBAR

While FATCA and FBAR both aim to provide the IRS with information about foreign financial accounts, they have distinct differences:

- Different thresholds: FATCA requires reporting if your foreign assets exceed $200,000 as a single filer, while FBAR applies if the total balance in all foreign accounts exceeds $10,000.

- Different filing locations: FATCA reporting (Form 8938) is filed with your federal tax return, whereas the FBAR is filed separately through FinCEN.

- Types of assets reported: FATCA requires reporting a broader range of foreign financial assets, while FBAR focuses only on foreign bank accounts.

Why do FATCA and FBAR matter for U.S. expats?

Failing to file FATCA and FBAR can result in significant penalties, so it’s essential to understand whether you’re required to report these assets. While it may seem like an extra step, filing these forms can help ensure compliance with IRS regulations and avoid unnecessary fines. If you have foreign bank accounts or financial assets, it’s a good idea to consult a tax professional to ensure you’re meeting all reporting requirements.

U.S.-Germany tax treaty

The U.S.-Germany Tax Treaty is designed to prevent U.S. citizens living in Germany from being taxed twice on the same income. This treaty defines which country has the primary right to tax various types of income, provides options for tax credits and exemptions, and helps clarify social security obligations. Here’s how the treaty can benefit you as a U.S. expat in Germany.

Purpose of the U.S.-Germany tax treaty

The primary objectives of the treaty are to:

- Avoid Double Taxation: Ensure that U.S. citizens living in Germany aren’t taxed on the same income by both countries.

- Prevent Fiscal Evasion: Establish clear measures to combat tax evasion and ensure accurate tax reporting.

- Clarify Tax Jurisdiction: Define which country has taxing rights over specific income types to simplify tax obligations for expats.

For U.S. expats, the treaty is valuable because it reduces tax rates on certain income types, allows you to apply German taxes as credits on your U.S. return, and defines residency and tax rights clearly.

Key treaty provisions

The U.S.-Germany Tax Treaty includes specific guidelines for different types of income. Here’s how each is treated under the treaty:

- Employment Income: Income from employment is generally taxed only in the country where the work is performed. For example, if you work and live in Germany, Germany has the primary right to tax your salary. However, if you also earn employment income from the U.S., it may still be subject to U.S. taxation, though you may qualify for credits or exclusions to avoid double taxation.

- Dividend and Interest Income:

- Dividends: Both countries may tax dividends, but the source country’s withholding tax is limited to 15% if the beneficial owner is a resident of the other country.

- Interest: Interest income is generally taxed only in the country of residence of the beneficial owner, with certain exceptions for interest on specific financial products.

- Capital Gains: Capital gains from the sale of personal property, such as stocks, are typically taxed only in the country of residence. If you are a German resident, Germany has the primary right to tax your capital gains. However, capital gains on U.S.-based property, such as real estate, may still be subject to U.S. tax, though credits can be applied to avoid double taxation.

Social Security Agreement (Totalization Agreement)

The U.S.-Germany Totalization Agreement coordinates social security systems between the two countries to ensure that U.S. expats in Germany don’t have to pay into both the U.S. and German social security systems at the same time. This agreement helps eliminate duplicate social security contributions and protects eligibility for benefits.

- U.S.-Based Employment: If you’re a U.S. citizen working temporarily in Germany for a U.S.-based employer, you may remain covered under U.S. Social Security for up to five years, meaning you’ll be exempt from German social security contributions during that period.

- German-Based Employment: If you work for a German employer, you’ll contribute to the German social security system, and these contributions count toward German benefits. Contributions in Germany can be combined with U.S. Social Security credits if needed to qualify for benefits in either country.

- Combining Credits: The agreement allows U.S. expats to combine credits from both systems to qualify for Social Security benefits in either the U.S. or Germany, depending on where they need additional credits.

Example: If you worked in the U.S. for five years and then in Germany for another five years, your credits could be combined to meet the minimum eligibility for U.S. Social Security benefits.

Claiming treaty benefits

To take advantage of treaty benefits, U.S. expats in Germany need to file additional forms with the IRS:

- Form 8833 (Treaty-Based Return Position Disclosure): This form is required if you’re claiming treaty benefits that reduce or eliminate U.S. tax on income earned in Germany.

- Form 1116 (Foreign Tax Credit): To avoid double taxation on income taxed by both the U.S. and Germany, use this form to claim a credit for German taxes paid. This is especially useful for income such as dividends, interest, and capital gains.

Residency and Tie-Breaker Rules

The tax treaty also includes residency and “tie-breaker” rules to resolve cases where you might be considered a resident of both the U.S. and Germany. Here’s how these rules work:

- Permanent Home: Priority is given to the country where you maintain a permanent home.

- Center of Vital Interests: If you have permanent homes in both countries, the country where your personal and economic ties are stronger (center of vital interests) will determine residency.

- Habitual Abode: If residency still isn’t clear, the country where you habitually live will be considered your primary tax residence.

These rules help avoid residency conflicts and simplify which country has taxing rights over your income.

Germany tax obligations for U.S. expats

When living in Germany as a U.S. citizen, it’s important to understand Germany’s tax obligations, especially if you qualify as a German resident. German tax residency means that you are generally required to pay taxes on your worldwide income, including income earned from U.S. sources. Below is a comprehensive guide to German tax residency, income tax rates, and additional obligations for U.S. expats in Germany.

Determining tax residency in Germany

Germany considers you a tax resident if you meet specific criteria, even if you’re a U.S. citizen. Here are the main ways Germany defines tax residency:

- 183-Day Rule: You’re considered a German tax resident if you spend 183 days or more in Germany within a calendar year.

- Habitual Abode and Intent to Reside: Even if you don’t meet the 183-day requirement, Germany may classify you as a resident if your primary living, social, and economic ties are in Germany. For example, if you have a main home, a job, or family in Germany, this is a strong indicator of residency.

Once you’re classified as a German tax resident, you’ll need to pay taxes on all income earned worldwide, regardless of its source.

German income tax rates

Germany’s tax system is progressive, meaning that the rate increases as your income rises. Here are the income tax brackets for the 2024 tax year:

- Up to €11,604: 0% (tax-free allowance)

- €11,605 to €66,760: Progressive rates, starting at 14% and gradually increasing up to 42%

- €66,761 to €277,825: 42%

- Over €277,825: 45%

For income within the €11,605 to €66,760 bracket, the tax rate starts at 14% and rises gradually. The gradual increase is applied through a formula, which means that the rate doesn’t jump abruptly but increases with each additional euro of income within this range until it reaches 42% at the top of the bracket.

For example:

- If your income is around €20,000, you might face an effective rate closer to 20%.

- For income of €50,000, the effective rate might be closer to 30%.

- At €66,760, the marginal rate is 42%, which means income beyond this amount will be taxed at 42%.

Germany’s progressive tax model aims to ensure that individuals with higher incomes pay a proportionally higher rate.

Additional surcharges and taxes

- Solidarity Surcharge: Germany applies a solidarity surcharge of 5.5% on the amount of income tax owed. This surcharge was initially introduced to fund development in certain regions and remains in effect.

- Church Tax: If you’re a registered member of an officially recognized church, you may also need to pay church tax. The rate is typically 8% or 9% of your income tax, depending on the federal state. This tax applies to individuals registered with Protestant, Catholic, and some other recognized religious organizations in Germany.

Types of income taxed in Germany

As a German resident, you’ll be taxed on various types of income, including:

- Employment Income: Wages and salaries are taxed progressively according to the income tax brackets mentioned above.

- Self-Employment Income: Income from self-employment is also subject to progressive tax rates, with deductions allowed for business-related expenses.

- Investment Income: Interest, dividends, and capital gains are generally taxed at a flat rate of 26.375% (including the solidarity surcharge).

- Rental Income: Income from property rentals, whether in Germany or abroad, is subject to German tax. You may be able to deduct certain expenses related to maintaining rental properties.

Example: If you’re earning dividend income from U.S.-based investments while residing in Germany, Germany will apply a 26.375% tax rate. Under the U.S.-Germany tax treaty, some of these earnings may be eligible for a reduced withholding rate or exemption from double taxation.

Social Security contributions

If you’re employed or self-employed in Germany, you’ll typically be required to contribute to the German social security system, which provides healthcare, unemployment, and pension benefits. Social security contributions are generally split between the employer and employee:

- Pension Insurance: 18.6% of gross income, shared equally between employee and employer.

- Health Insurance: Approximately 14.6% of income, with half paid by the employee and half by the employer.

- Unemployment Insurance: 2.4% of income, shared equally.

- Long-Term Care Insurance: Around 3.05%, also split between employer and employee.

Totalization Agreement: Fortunately, Germany and the U.S. have a Totalization Agreement to prevent double social security contributions. If you qualify for U.S. Social Security coverage, you may be exempt from German social security contributions, and vice versa. This agreement can help you avoid paying into both systems if you qualify under either one.

German tax filing process for U.S. expats

If you’re a U.S. expat living in Germany and qualify as a German tax resident, you’ll need to file a German tax return, even if you also file one in the U.S. Germany has its own tax filing rules, deadlines, and procedures, and understanding them can help you stay compliant and avoid penalties. Here’s a step-by-step guide to the German tax filing process for U.S. expats.

Filing requirements and deadlines

In Germany, the tax year follows the calendar year (January 1 to December 31). The tax filing requirements for German residents generally depend on income sources and residency status:

- Employment Income: If you earn only employment income in Germany and your employer withholds income tax, you may not be required to file. However, many expats choose to file to claim deductions or ensure they receive any eligible refunds.

- Self-Employment or Additional Income: If you have self-employment income, investment income, rental income, or foreign income, you must file a German tax return.

- Married Couples: Married couples can file jointly or separately. Filing jointly is often beneficial, as it allows for income splitting, which may reduce the tax rate on combined income.

Deadlines:

- Standard Filing Deadline: The deadline for filing your German tax return is July 31 of the following year.

- Extended Deadline with a Tax Advisor: If you use a certified tax advisor, the deadline extends to February 28 of the second following year (for example, February 28, 2025, for the 2023 tax year).

If you miss the filing deadline, late fees may apply. Extensions are generally not available unless you use a tax advisor.

Documents needed for filing

To file your German tax return, gather the following documents:

- Income Statements (Lohnsteuerbescheinigung): If you’re employed, your employer will issue this form showing your total earnings and tax withholdings for the year.

- Bank Statements: Records of interest, dividends, and investment income.

- Self-Employment Records: Income and expense records if you’re self-employed.

- Proof of Expenses and Deductions: Documentation for any tax-deductible expenses, such as housing costs, education expenses, and healthcare costs.

- Foreign Income Records: Any income from outside Germany, as Germany taxes residents on worldwide income.

Keeping well-organized records throughout the year can make the filing process smoother and help you claim any available deductions.

How to file your German tax return

There are several options for filing your German tax return, depending on your comfort level with the language and the complexity of your financial situation:

- Use ELSTER (Electronic Tax Declaration): ELSTER is Germany’s online tax filing system, available for free on the official tax office website. While it’s widely used, ELSTER is primarily in German and may not be ideal for non-German speakers or those with complex tax situations.

- Hire a German Tax Advisor (Steuerberater): If you have multiple income sources, foreign investments, or complex deductions, working with a tax advisor can be beneficial. A certified Steuerberater will guide you through the filing process, help you maximize deductions, and ensure compliance with German tax regulations.

- Use Tax Software: Certain German tax software options, like Taxfix or Wundertax, are available in English and can help simplify the filing process. These tools are generally designed for standard filings and may not accommodate complex situations.

Tax deductions and credits for U.S. expats in Germany

Germany offers several tax deductions and credits that can help reduce your tax liability:

- Standard Deductions: Germany provides a standard allowance (Grundfreibetrag) for all residents, which is a tax-free amount on your income.

- Work-Related Deductions: Expenses like commuting costs, work equipment, and professional training can often be deducted.

- Healthcare Costs: Medical expenses, including health insurance premiums, are partially deductible.

- Charitable Contributions: Donations to registered German charities may be tax-deductible.

- Family-Related Deductions: Families can benefit from child allowances, education cost deductions, and special tax benefits for single parents.

These deductions can help lower your taxable income and may result in a tax refund if you’ve overpaid through payroll withholdings.

Hiring a German tax advisor

If your financial situation is complex or you’re not comfortable with German tax rules, hiring a tax advisor (Steuerberater) is highly recommended. A German tax advisor can:

- Ensure you’re maximizing deductions and tax credits.

- Help you navigate residency rules and the reporting of worldwide income.

- Represent you if there are any issues with the German tax office (Finanzamt).

Tax advisors are particularly helpful for U.S. expats dealing with both U.S. and German tax obligations, as they can offer guidance on tax treaty benefits and the coordination of foreign tax credits.