Tax deadlines for U.S. expats in 2025

Navigating U.S. tax obligations while living abroad can be a complex and daunting task for American expatriates. With various deadlines to remember, forms to file, and ever-changing tax laws to consider, staying compliant is essential to avoid unnecessary penalties and optimize your financial situation.

This comprehensive guide provides crucial information on the important tax deadlines for U.S. expats in 2025, highlights key changes in tax laws affecting the 2024 tax year, and offers insights into the Foreign Earned Income Exclusion (FEIE).

Additionally, we delve into state tax considerations that could significantly impact your overall tax burden, helping you make informed decisions while living overseas.

TLDR:

• June 17, 2025: Automatic two-month extension for expats living abroad.

• October 15, 2025: Additional extension available with IRS Form 4868.

• Estimated tax payments due: April 15, June 17, September 16, 2025, and January 15, 2026.

• FBAR deadline: April 15, 2025, with an automatic extension to October 15, 2025.

Key tax deadlines for U.S. expats in 2025

Tax filing deadlines

- April 15, 2025: This is the standard deadline to file your 2024 U.S. federal tax return.

- June 17, 2025: U.S. citizens living abroad are granted an automatic two-month extension, moving the filing deadline to this date (extended from June 15 due to it falling on a weekend).

Extensions:

- October 15, 2025: If you need more time beyond June 17, you can request an additional extension by filing IRS Form 4868. This extension allows you to file your tax return by October 15, 2025.

- December 16, 2025: In certain circumstances, you may request a further extension to December 16, 2025. This additional extension is not automatic and requires a written request explaining the need for more time.

Estimated tax payments

If you expect to owe at least $1,000 in taxes for the 2024 tax year after subtracting withholding and refundable credits, you're required to make quarterly estimated tax payments. The due dates for these payments in 2025 are:

- 1st Quarter: April 15, 2025

- 2nd Quarter: June 17, 2025

- 3rd Quarter: September 16, 2025

- 4th Quarter: January 15, 2026

Making timely estimated tax payments helps avoid underpayment penalties.

FBAR and FATCA deadlines

FBAR (Foreign Bank Account Report):

- Deadline: April 15, 2025, with an automatic extension to October 15, 2025.

- Requirement: If you have foreign financial accounts totaling over $10,000 at any time during the year, you must file FinCEN Form 114 electronically through the BSA E-Filing System.

FATCA (Foreign Account Tax Compliance Act):

- Deadline: Aligns with your federal tax return deadlines, including extensions.

- Requirement: Form 8938 must be filed if you have specified foreign financial assets exceeding certain thresholds (which vary based on filing status and residency).

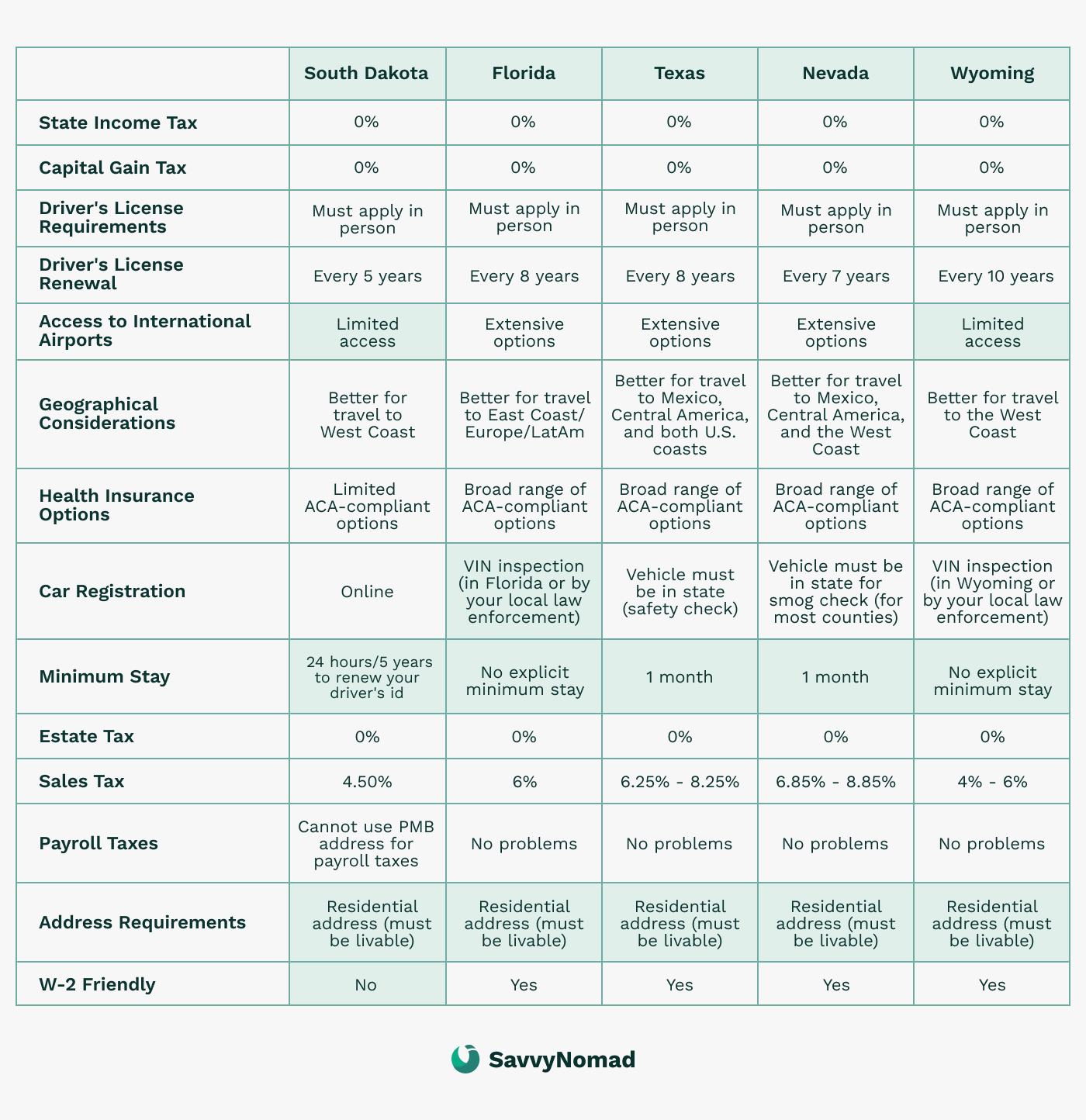

State tax considerations for U.S. expats

While federal taxes are a primary concern for U.S. expats, state taxes can also significantly impact your overall tax burden. Understanding your state tax obligations is crucial for effective financial planning.

Here’s how different states handle taxation for expatriates:

If you’re domiciled in a zero income tax state

If your domicile—or your last state of residency before moving abroad—is one of the states with no state income tax, you’re generally not required to pay state income tax while living abroad.

These states are:

- Alaska

- Florida

- Nevada

- South Dakota

- Texas

- Washington

- Wyoming

Being domiciled in a zero-income tax state simplifies your tax obligations, as you won’t owe state income tax on your earnings, regardless of where you live or work abroad.

States that don’t tax non-residents even if domiciled there

Some states do not tax individuals considered non-residents for tax purposes, even if they maintain domicile there. This means that if you’ve moved abroad and meet the state’s criteria for non-residency, you generally won’t be subject to state income tax on your worldwide income.

States in this category include:

Important Considerations:

- Residency vs. Domicile: While you may still be domiciled in the state, establishing non-residency for tax purposes typically involves meeting specific criteria, such as spending less than a certain number of days in the state and severing significant ties.

- Maintain Documentation: Keep thorough records proving your non-residency status to present to state tax authorities if needed.

- Key Takeaway: If you establish non-residency while being domiciled in these states, you generally won’t owe state income tax on your foreign-earned income.

States that tax domiciled Americans on worldwide income

Several states tax residents on their worldwide income regardless of where they live or earn their income.

If you’re domiciled in one of these states, you may be subject to state income tax even while living abroad.

- Alabama

- Arizona

- Arkansas

- California

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Michigan

- Mississippi

- Montana

- Nebraska

- New Mexico

- New York

- North Carolina

- Ohio

- Oklahoma

- Rhode Island

- South Carolina

- Utah

- Vermont

- Virginia

- Wisconsin

Characteristics of these states:

- Strict residency rules: These states have stringent definitions of residency and domicile, making it challenging to break tax ties.

- Worldwide income taxation: Residents are taxed on all income, including foreign-earned income, often without the benefit of exclusions like the federal Foreign Earned Income Exclusion (FEIE).

What this means for expats:

- Potential double taxation: You may face state taxes on top of federal taxes, increasing your overall tax liability.

- Limited relief: Many of these states do not allow for the FEIE or a foreign tax credit at the state level.

- Complex compliance: Navigating tax obligations in these states can be complicated and may require professional assistance.

How to move domicile to states with zero taxes?

SavvyNomad specializes in providing comprehensive domicile services for American expats seeking to optimize their tax situation while living abroad.

By helping you establish residency in tax-friendly states like Florida, SavvyNomad enables you to legally reduce or eliminate state income tax obligations.

Our services include:

- Residence Address and Proof: Providing a legitimate residential address and the necessary documentation to establish domicile.

- Driver’s License Assistance: Guiding you through the process of obtaining a state driver’s license, a key step in establishing residency.

- Tax Forms and IRS Notifications: Assisting with all required state and federal tax forms and notifying the IRS of your change in domicile.

- Voter Registration: Helping you register to vote in your new state, further solidifying your residency status.

- CPA Support: Offering professional support from Certified Public Accountants experienced in expat taxation to ensure compliance and optimize tax benefits.

- Mail Forwarding Services: Managing your mail to keep you connected, no matter where you are in the world.

By leveraging SavvyNomad’s expertise, you can navigate the complexities of changing your domicile with ease, ensuring all legal requirements are met.

This strategic move can lead to substantial tax savings and simplify your overall tax obligations, allowing you to focus on enjoying your life abroad.

Foreign Earned Income Exclusion for 2025

Exclusion amount

For the 2024 tax year (filed in 2025), the Foreign Earned Income Exclusion (FEIE) amount is set at $126,500, an increase from $120,000 in 2023.

This adjustment accounts for inflation and allows qualifying expats to exclude a higher amount of foreign-earned income from U.S. taxation.

Eligibility requirements

To qualify for the FEIE, you must meet one of the following tests:

- You are a bona fide resident of a foreign country or countries for an uninterrupted period that includes an entire tax year.

- Establishing residency involves demonstrating intent to stay, such as obtaining residency permits, leasing or purchasing a home, and integrating into the local community.

- You are physically present in a foreign country or countries for at least 330 full days during any consecutive 12-month period.

- The 330 days do not need to be consecutive but must fall within a 12-month frame.

Key changes in tax laws affecting expats for 2024

Increase in Foreign Earned Income Exclusion (FEIE)

The FEIE has increased to $126,500 for the 2024 tax year. This increase helps expatriates reduce their taxable income and potentially lower their U.S. tax liability, mitigating the risk of double taxation on foreign-earned income.

Adjustments to standard deductions

Standard deduction amounts have increased for the 2024 tax year:

- Single filers: $13,850

- Married filing jointly: $27,700

- Head of household: $20,800

These adjustments may affect your overall taxable income and should be considered when planning your tax strategy.

Child Tax Credit increase

The Child Tax Credit has been increased to $1,600 per qualifying child under 17 years old. This enhancement can provide significant tax savings for expat families who meet the eligibility criteria, potentially resulting in a larger refund or reduced tax liability.

Automatic filing extensions

U.S. expatriates receive an automatic two-month extension to file their tax returns, moving the deadline to June 17, 2025 (adjusted due to April 15 falling on a weekend). If additional time is needed, expats can file for an extension until October 15, 2025.

Final opportunity for stimulus payments

The year 2024 marks the last chance for eligible expats to claim uncollected COVID-19 stimulus payments by filing their U.S. tax returns. This includes potential refunds that could amount to thousands of dollars, depending on individual circumstances and number of dependents.

Important tax forms for expats

Form 1040: U.S. Individual Income Tax Return

The primary form for reporting your income, deductions, credits, and tax liability.

Form 2555: Foreign Earned Income Exclusion

- Used to claim the FEIE and exclude up to $126,500 of foreign-earned income.

- Requires information on residency status and foreign income details.

Form 1116: Foreign Tax Credit

Allows you to claim a credit for taxes paid to a foreign country, reducing your U.S. tax liability.

Schedule B: Interest and Ordinary Dividends

- Used to report interest and dividend income.

- Part III requires disclosure of foreign accounts and trusts.

Form 8938: Statement of Specified Foreign Financial Assets

Required under FATCA for reporting specified foreign financial assets if they exceed certain thresholds.

FBAR Filing Requirements

FinCEN Form 114

Must be filed if the aggregate value of foreign financial accounts exceeds $10,000 at any time during the year.

Deadline

Due by April 15, 2025, with an automatic extension to October 15, 2025.

Penalties for non-compliance

Failure to file the FBAR can result in significant penalties, including fines up to $10,000 per violation for non-willful violations, and higher penalties or criminal charges for willful violations.

Consequences of missing deadlines

- Late Filing Penalties: The IRS may impose penalties for failing to file tax returns or required forms by the deadline, including extensions.

- Interest on Unpaid Taxes: Interest accrues on any unpaid tax from the original due date (April 15, 2025) until the date of payment.

- Impact on Benefits and Exclusions: Missing deadlines may result in the loss of eligibility for certain benefits, such as the FEIE, potentially increasing your tax liability.