Social Security for expatriates: A guide for U.S. expats and retirees abroad

If you're considering life abroad or already enjoying it, Social Security benefits can provide a reliable financial foundation wherever you call home. Many American expats and retirees rely on Social Security payments to support their lives overseas, but understanding the rules and processes is essential for a smooth experience.

In this guide, we'll explore the key aspects of Social Security for American expats and retirees, from eligibility requirements to managing payments abroad. We'll also touch on tax obligations, compliance, and tips for keeping your U.S. residency status active—a handy piece of the puzzle for receiving benefits without a hitch.

To determine your eligibility for Social Security benefits while living abroad, it's important to understand the rules based on citizenship and your country of residence.

Eligibility for Social Security benefits abroad

To determine your eligibility for Social Security benefits while living abroad, it’s important to understand the rules based on citizenship and your country of residence.

Eligibility for U.S. citizens

- General eligibility: U.S. citizens can usually receive Social Security benefits like retirement, disability, or survivor benefits while living in most foreign countries. However, payments are restricted for specific nations, including Cuba and North Korea, but unpaid benefits can be received later if you move to a country where payments are allowed.

- Duration of stay: You’re considered to be living outside the United States if you are absent from the 50 states, the District of Columbia, Puerto Rico, or other U.S. territories for 30 consecutive days or more.

- Direct Deposit: Benefits can be deposited electronically into U.S. banks or into banks in countries with international direct deposit agreements with the U.S. This system helps ensure consistent payments, regardless of where you live.

- Annual Questionnaires: Every one to two years, the Social Security Administration (SSA) sends questionnaires to confirm continued eligibility for benefits abroad. Not responding can result in a pause in payments until eligibility is verified.

Eligibility for non-U.S. citizens

- Country-specific rules: Non-U.S. citizens may qualify for benefits based on their U.S. work history, but eligibility depends on both their country and the type of benefit they’re claiming. Rules vary widely, so checking specifics is recommended.

- Totalization agreements: For those who’ve worked in multiple countries, totalization agreements allow combining credits from each nation to qualify for benefits, filling in coverage gaps. These agreements apply to specific countries and are especially beneficial if work credits in one country alone are insufficient for benefits.

- Payment restrictions: Non-citizens can face additional limitations on benefits abroad, with allowances differing based on the person’s home country and any agreements with the U.S.

Special considerations

- Supplemental Security Income (SSI): SSI benefits are unavailable outside the U.S. If an SSI recipient leaves the U.S. for over 30 days, their benefits stop and won’t resume until they return and stay in the U.S. for at least 30 consecutive days.

- Countries with Special Conditions: Some countries require in-person verification every six months at a U.S. embassy or consulate to continue receiving benefits. This step helps confirm eligibility but may be inconvenient in some locations.

For personalized verification, the Payments Abroad Screening Tool on the SSA website allows U.S. citizens and non-citizens to check whether their benefits will continue in their specific country. This tool is useful to confirm if any restrictions apply to your country of residence.

Receiving Social Security benefits while living abroad

Once you’ve confirmed your eligibility, you can focus on the logistics of receiving Social Security payments in a foreign country. Here’s how the SSA ensures you get your benefits abroad, including what to expect with direct deposits, annual verification, and country-specific requirements.

Direct deposit options

Social Security payments can be deposited electronically into a U.S. bank account or into an international bank account in countries with an agreement for international direct deposits with the U.S. This is the most reliable and convenient method, as it avoids delays often associated with mailed checks and ensures payments are automatically credited in either U.S. dollars or the local currency, depending on the country.

To set up international direct deposit, you’ll need to confirm that your country participates in this service. The SSA’s list of supported countries is available on their website and includes popular expat destinations such as Canada, the U.K., and most of Western Europe.

Currency exchange considerations

When payments are deposited internationally, they are converted to the local currency based on the current exchange rate. Keep in mind that exchange rates fluctuate, which can impact the amount you receive. It’s wise to monitor these rates and consider exchange fees to understand your net amount each month.

Payment schedule and timing

For beneficiaries abroad, Social Security benefits follow a regular payment schedule, generally on the second, third, or fourth Wednesday of each month. If you’ve set up international direct deposit, payments usually clear within 1–2 days, though delays may occur depending on your local bank’s processing times.

Annual verification of eligibility

To ensure that you continue receiving payments, the SSA requires beneficiaries living abroad to complete eligibility questionnaires every one to two years. These forms, sent by mail, confirm that you still qualify for benefits. Failure to respond can result in a temporary suspension of payments until the SSA can verify your eligibility. Be sure to update your mailing address with the SSA if you change locations abroad to avoid missing these forms.

Country restrictions and special requirements

While most countries allow seamless receipt of Social Security benefits, some locations have specific requirements. In restricted countries (e.g., Cuba and North Korea), SSA payments are withheld until you move to a country where payments are allowed. For non-restricted but higher-risk countries, the SSA may require recipients to appear periodically at a U.S. embassy to verify their identity and residency status.

The importance of maintaining a U.S. residential address

For Americans living abroad, having a reliable U.S. residential address is essential. This address serves as a key part of your financial and legal presence back home, making it easier to manage Social Security, banking, and tax requirements. Here’s why keeping a U.S. address matters and the best ways to secure one while you’re abroad, especially through services that cater to expats like SavvyNomad.

Why a U.S. address matters

- Social Security compliance: Although you can receive Social Security benefits outside the U.S., having an official U.S. address streamlines communication with the Social Security Administration (SSA). The SSA may need to verify your eligibility and respond to life updates such as marital status, so a U.S. address helps ensure you don’t miss important documents. This address also ensures that updates reach you on time to avoid any delays or interruptions in benefit payments.

- Banking and financial services: Most U.S. banks require a permanent residential address on file for account holders. Regulations under the Patriot Act prevent many financial institutions from accepting mail forwarding addresses, meaning a reliable U.S. address is necessary for maintaining or opening accounts, credit cards, and other financial products. Without a valid U.S. address, expats may struggle with maintaining their accounts or receiving tax forms, statements, and updates.

- Tax filings and residency: A valid mailing address (U.S. or foreign) is required on your U.S. tax return, and a stable address helps you receive IRS notices and make full use of expat benefits like the Foreign Earned Income Exclusion and relevant credits.

Methods for maintaining a U.S. address

- Domicile services by SavvyNomad: SavvyNomad offers a permanent U.S. residential street-address service tailored for expats and digital nomads. This service provides a bona fide address in a tax-friendly state like Florida or South Dakota, along with supporting documentation (such as lease and utility-style proofs) that can be used as part of a broader plan to establish domicile there. These states do not tax personal income, so successfully changing domicile to one of them can reduce state-level tax exposure on Social Security and other retirement income, depending on your overall situation.

This solution helps retirees, digital nomads, and long-term travelers maintain a legitimate address and organized documentation that many banks, the SSA, and other institutions can work with, though each institution ultimately applies its own rules and may reach its own decision. SavvyNomad’s service is designed to support compliance with U.S. requirements, including address and documentation needs related to Social Security and banking, but does not itself guarantee eligibility, approval, or any particular tax outcome.

- Mail forwarding services: Mail forwarding services offer scanning, storage, and forwarding options that are helpful for managing physical mail. However, these services come with drawbacks:

- Limitations with banking and legal compliance: Many banks won’t accept mail forwarding addresses as official residential addresses due to regulations. This can hinder your ability to open or maintain accounts.

- Lack of legal domicile support: Mail forwarding services don't meet the criteria for a legal domicile address required by many states, limiting their effectiveness for tax benefits and Social Security compliance.

- Using a family or friend’s address: Although cost-effective, using a family member or friend’s address has limitations. The primary downside is that banks and financial institutions often require an official document proving residency, which a family address can’t provide if questioned by the bank. This lack of formal documentation can complicate interactions with U.S.-based institutions, potentially affecting your ability to maintain or open accounts.

Tax implications of receiving Social Security benefits abroad

Receiving Social Security benefits while living abroad involves important tax considerations, as U.S. citizens remain subject to federal tax obligations on these payments, and some foreign countries may also tax them.

U.S. federal tax obligations for Social Security benefits abroad

Taxability based on income

Social Security retirement benefits are subject to U.S. federal income tax, regardless of where you reside. The IRS applies federal taxes based on your combined income, which includes adjusted gross income (AGI), nontaxable interest, and half of your Social Security benefits.

Here’s how taxes apply:

- Single filers: If your combined income is between $25,000 and $34,000, up to 50% of Social Security benefits may be taxed. For combined income above $34,000, up to 85% of benefits may be subject to tax.

- Married filing jointly: For combined income between $32,000 and $44,000, up to 50% of benefits may be taxable, while income above $44,000 may result in up to 85% of benefits being taxed .

Foreign Earned Income Exclusion (FEIE) does not apply

Many expats qualify for the FEIE on foreign wages, allowing them to exclude up to a certain amount of foreign-earned income from U.S. taxes.

However, Social Security benefits are considered U.S.-sourced income and do not qualify for the FEIE, meaning they are always subject to U.S. taxes regardless of where you live.

State tax implications and the benefits of domicile in no-tax states

In addition to federal taxes, state income tax can impact Social Security benefits, particularly for those domiciled in a state with high income taxes. Moving your domicile to a no-income-tax state can help expats avoid these extra costs, especially if you plan to live abroad for extended periods or retire overseas.

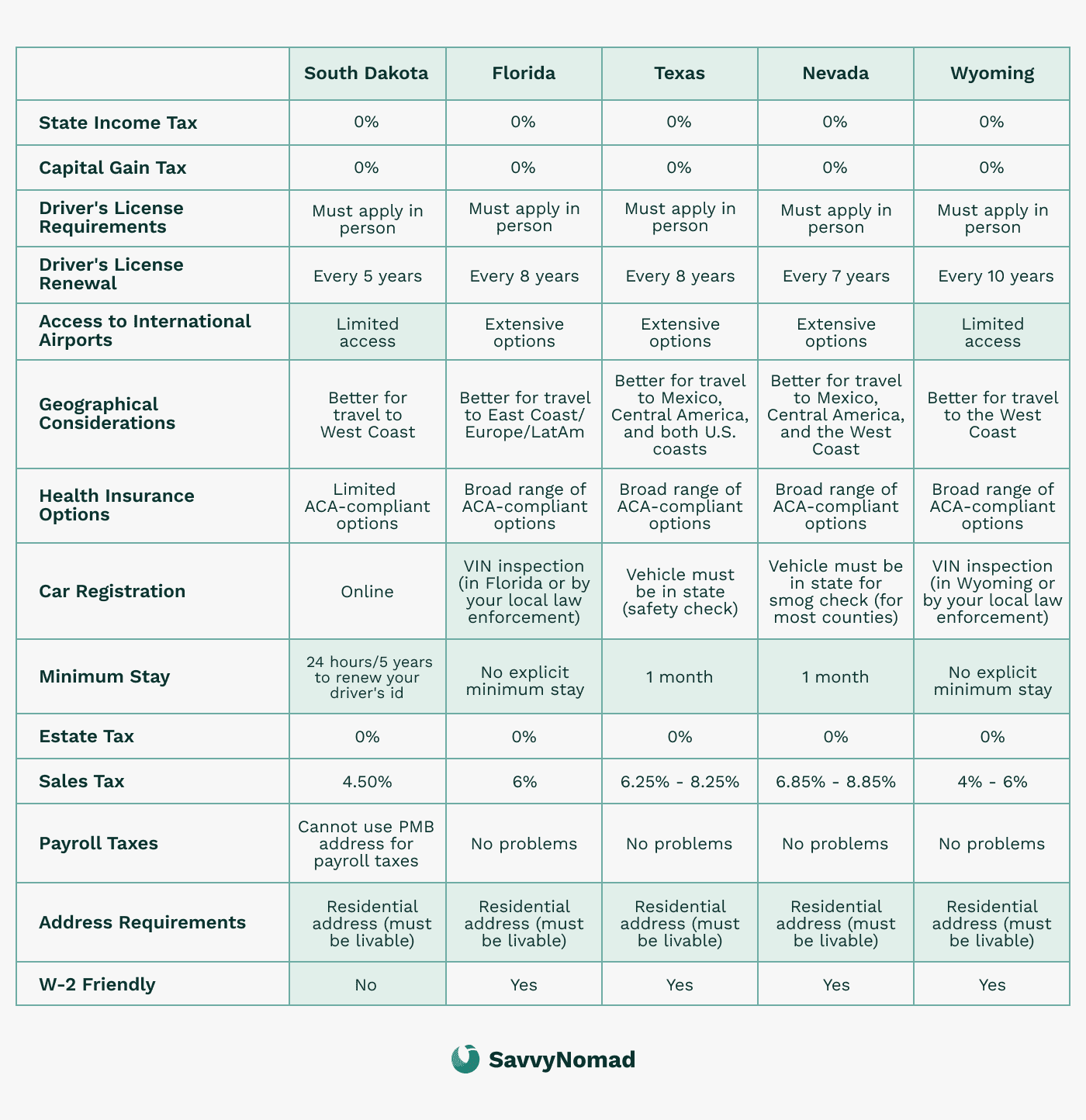

States with no income tax

The U.S. has nine states that do not levy a broad tax on wage and salary income: Florida, South Dakota, Texas, Nevada, Washington, Alaska, Wyoming, New Hampshire, and Tennessee. New Hampshire and Tennessee have repealed their prior taxes on interest and dividends, and Washington does not tax wages but does impose a separate capital-gains excise tax on certain long-term gains.

Establishing domicile in one of these states generally means you won’t owe state income tax on Social Security and most other retirement benefits, which can lead to substantial savings over time, subject to each state’s specific rules.

Legal domicile requirements

To establish and maintain a domicile in a no-tax state, you must prove a primary, ongoing connection to that state. Many expats use domicile services, like those provided by SavvyNomad, to help them establish and document legal residence in a no-tax state, supporting their efforts to stay organized and potentially reduce state-level tax exposure while abroad. Actual tax treatment and compliance determinations always depend on the rules applied by the relevant states and agencies.

By choosing a no-income-tax state as your legal domicile, you reduce your overall tax burden, keeping more of your Social Security benefits and other income. This strategy is especially advantageous for expats, allowing them to manage U.S. tax obligations effectively and prevent unnecessary payments.

Foreign tax implications

Potential for double taxation

In addition to U.S. federal taxes, some countries may also tax Social Security benefits, depending on their tax laws. Countries like Canada and Germany partially tax Social Security income, while others may have exemptions or full taxes in place. This dual taxation can significantly increase your tax liability unless mitigated by an international tax treaty.

Tax treaties to reduce double taxation

The U.S. has tax treaties with several countries that outline how Social Security benefits should be taxed, coordinating the social security system of the U.S. with that of the host country. These treaties typically provide either a credit or exemption to prevent double taxation, specifying whether benefits are taxed by the U.S., the host country, or both.

For example, the U.S.-Canada and U.S.-U.K. treaties have provisions that reduce or eliminate double taxation on Social Security benefits. It’s essential to check the treaty between the U.S. and your country of residence to understand any applicable tax relief measures.

Totalization agreements to avoid dual Social Security contributions

Beyond tax treaties, the U.S. has Totalization Agreements with around 30 countries that help prevent dual Social Security contributions for U.S. citizens working abroad. These agreements ensure that you only pay Social Security taxes to one country at a time, depending on your employment status and the terms of the agreement.

This reduces the financial strain of paying into two systems and can help you qualify for benefits by combining credits earned in both countries. These agreements don’t affect the taxation of benefits but play a role in simplifying contributions while you work abroad.

Here is the full list of countries with Totalization Agreements: Australia, Austria, Belgium, Brazil, Canada, Chile, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Japan, Luxembourg, Netherlands, Norway, Poland, Portugal, Slovak Republic, Slovenia, South Korea, Spain, Sweden, Switzerland, United Kingdom, Uruguay.

Strategies to minimize tax liability

- Foreign Tax Credit (FTC): If you pay taxes on Social Security benefits to your host country, you may be eligible for the Foreign Tax Credit. The FTC allows you to offset U.S. tax liability dollar-for-dollar based on the amount of foreign tax paid on the same income, helping to reduce the burden of dual taxation.

- Review tax treaty benefits: Reviewing applicable tax treaties is crucial for maximizing tax efficiency. Treaties vary by country, so understanding the specifics of your location’s agreement with the U.S. can reveal exemptions, credits, or provisions that reduce tax burdens on Social Security benefits.

Receiving Social Security benefits while living abroad

Once you’ve confirmed eligibility, understanding the logistics of receiving Social Security benefits abroad can help you manage your finances smoothly.

The Social Security Administration (SSA) provides multiple options to ensure payments reach you, including direct deposit into U.S. or foreign bank accounts, along with additional requirements for certain countries.

Direct deposit options

- U.S. bank deposits: Social Security payments can be deposited directly into a U.S. bank account, even if you’re living outside the country. This option often offers a reliable way to access your benefits, as U.S.-based accounts are recognized and regulated by the SSA. You can then manage your funds from abroad, using international banking services or transferring money as needed.

- International direct deposit agreements: For expats residing in countries with international direct deposit agreements, Social Security benefits can be deposited directly into a local bank account. This method often reduces the hassle of transferring funds internationally and minimizes exchange fees. SSA maintains a list of countries that support international direct deposit, which includes popular expat destinations in Western Europe, Canada, Japan, and Australia.

- Currency exchange considerations: When payments are deposited into a foreign account, they are converted to the local currency based on current exchange rates. Currency fluctuations and potential exchange fees from the local bank can impact the amount received. Monitoring exchange rates and choosing low-fee accounts can help maintain the value of your Social Security income.

Payment schedule and timing

- Standard payment schedule: Social Security payments are typically disbursed on the second, third, or fourth Wednesday of each month, depending on your birth date. International direct deposits may take an additional 1–2 days to clear due to processing times in foreign banks, so planning for slight delays can be helpful.

- Managing potential delays: For expats relying on timely access to funds, setting up a buffer in case of delays can be helpful. Even minor disruptions, such as banking holidays or processing slowdowns, can temporarily affect cash flow. Having a backup fund or alternate financial arrangements can add a layer of security.

Annual verification of eligibility

To maintain compliance and ensure continued payments, SSA requires beneficiaries living abroad to complete eligibility questionnaires periodically. The SSA typically sends these forms every one to two years to verify current contact details and eligibility status. Not responding to these questionnaires can result in a temporary suspension of benefits until verification is completed, so keeping your address updated with SSA is essential.

Country-specific restrictions and requirements

- Restrictions in certain countries: Social Security benefits cannot be sent to certain countries, including Cuba and North Korea, due to U.S. regulations. Beneficiaries residing in restricted countries may have payments held until they relocate to an approved country. Other countries may require special verification procedures, such as appearing at a U.S. embassy to confirm eligibility every six months.

- Payments Abroad Screening Tool: The SSA’s Payments Abroad Screening Tool can help verify country-specific requirements, indicating if there are any restrictions or additional steps needed to receive benefits in your location. Checking this tool before relocating can provide clarity on payment logistics and help avoid disruptions.

Special considerations for Supplemental Security Income (SSI) and Social Security benefits abroad in restricted countries

While U.S. Social Security benefits are generally accessible to American expats, certain considerations and restrictions may apply, particularly with programs like Supplemental Security Income (SSI) and in cases involving specific restricted countries.

Here’s what you need to know about managing these complexities.

Supplemental Security Income (SSI) restrictions abroad

- SSI benefits unavailable outside the U.S.: Unlike standard Social Security benefits, Supplemental Security Income (SSI) cannot be collected outside of the United States. This program provides income to qualified individuals who are elderly, blind, or disabled, with limited resources, but U.S. law mandates that recipients must reside within the U.S. If an SSI recipient leaves the U.S. for over 30 days, their benefits are suspended and only resume once they’ve returned and stayed in the U.S. for at least 30 consecutive days .

- Alternatives for SSI recipients: For Americans relying on SSI who wish to live abroad, exploring other support mechanisms is essential, as SSI benefits will not be available outside the U.S. This may involve accessing local disability or support programs in the host country or planning financial resources to compensate for the loss of SSI payments.

Country-specific restrictions for Social Security benefits

- Restricted countries: Due to U.S. regulations, Social Security benefits cannot be paid directly to beneficiaries residing in certain restricted countries, including Cuba and North Korea. Payments to beneficiaries in these nations are typically suspended until the recipient relocates to an approved country. For individuals in other countries with high restrictions, such as Vietnam or Cambodia, the SSA may require additional steps to verify eligibility and secure continued payments .

- Verification procedures in high-risk countries: In specific countries, the SSA may require beneficiaries to regularly verify their eligibility by appearing in person at a U.S. embassy or consulate, often every six months. These verification checks are designed to confirm continued eligibility and ensure payments are correctly disbursed. These in-person requirements may vary based on the country and the SSA’s policies regarding benefit distribution .

- Payments Abroad Screening Tool: To navigate these restrictions, the SSA offers a Payments Abroad Screening Tool that provides tailored guidance on receiving Social Security benefits in your country of residence. Using this tool can clarify any restrictions or special procedures required for your specific location, ensuring continued access to your Social Security benefits wherever possible.

Practical tips for managing Social Security benefits as an expat

While receiving Social Security benefits abroad is straightforward in many cases, navigating local banking systems, managing tax obligations, and maintaining compliance with U.S. requirements can require extra planning. Here are some practical tips to help American expats effectively manage their Social Security benefits while living abroad.

Set up a reliable direct deposit system

- Choose the best banking option: Consider whether to have benefits deposited directly into a U.S. bank account or into an international account in your country of residence (if it’s a participating country). U.S. accounts often provide stable access, while international accounts can minimize currency conversion fees if you plan to use the funds primarily abroad.

- Plan for currency exchange: If you choose to have benefits deposited into an international account, monitor exchange rates and consider currency conversion fees. Exchange rates fluctuate, potentially affecting the amount received in your local currency. Choosing banks with favorable exchange rates and low fees can help maximize your income.

Maintain compliance with U.S. requirements

- Respond to SSA questionnaires: The Social Security Administration (SSA) periodically sends questionnaires to verify the eligibility of beneficiaries living abroad. Missing these questionnaires can lead to benefit suspension, so keep your mailing address updated and respond promptly to any SSA communication.

- File U.S. tax returns: Even while living abroad, U.S. citizens must file an annual federal tax return if income meets filing thresholds. Social Security benefits are generally included in your taxable income calculation, so staying current with IRS filing requirements is essential. Additionally, expats may benefit from using tax credits, such as the Foreign Tax Credit, to offset potential double taxation.

Protect against potential delays

- Create a financial buffer: International direct deposits may occasionally experience delays, particularly if local banking holidays or administrative processes affect processing times. Maintaining an emergency fund in a U.S. or international account can provide peace of mind in case payments are temporarily delayed .

- Check SSA’s Payments Abroad Screening Tool: The Payments Abroad Screening Tool on the SSA’s website can help you confirm eligibility and identify any country-specific requirements or restrictions. Using this tool before moving or during international stays can help you understand logistical and compliance factors affecting your benefits.

Understand local tax and residency rules

- Research tax treaties and totalization agreements: U.S. tax treaties and totalization agreements with many countries may help reduce double taxation on Social Security benefits and simplify contributions to Social Security systems. Understanding these agreements in your host country can ensure you’re not overpaying on taxes or contributions .

- Work with a tax professional familiar with expat rules: Managing taxes across two countries can be complex, and tax obligations may vary based on your residency status and local laws. A tax professional with expertise in expat taxation can provide valuable guidance on claiming deductions, credits, and understanding treaty benefits that apply to Social Security benefits abroad.

Totalization agreements and Social Security

Understanding international agreements

Totalization Agreements are bilateral social security agreements between the United States and other countries designed to eliminate dual Social Security taxation and provide better protection for workers who have split their careers between the two nations.

These agreements ensure that workers who have paid Social Security taxes in both countries can receive benefits from one or both countries, depending on their eligibility.

By coordinating the social security systems of the two countries, these agreements help prevent workers from paying Social Security taxes in both countries on the same earnings, thus avoiding double taxation.

Impact on Social Security benefits

Totalization Agreements can significantly impact Social Security benefits for expats. For instance, if you have worked in both the United States and a foreign country, you may be eligible to receive Social Security benefits from both countries.

However, the amount of benefits you receive may be influenced by the agreement. In some cases, the agreement may allow you to receive benefits from only one country, while in other cases, you may be able to receive benefits from both countries.

Understanding how Totalization Agreements affect your Social Security benefits is crucial to ensure you receive the maximum amount of benefits you are eligible for. These agreements can fill in coverage gaps, making it easier to qualify for benefits by combining work credits from both countries.

Key reporting requirements for expats

Necessary documentation and deadlines

As an expat, it’s crucial to report certain changes to the Social Security Administration (SSA) to ensure you receive your Social Security benefits correctly. Here are some necessary documentation and deadlines to keep in mind:

- Change of address: If you move to a new address, you must report the change to the SSA within 10 days. You can do this by contacting the SSA’s Office of Earnings & International Operations (OEIO) or by using the SSA’s online services.

- Change in employment status: If you start or stop working, you must report the change to the SSA within 10 days. You can do this by contacting the OEIO or by using the SSA’s online services.

- Change in marital status: If you get married, divorced, or become widowed, you must report the change to the SSA within 10 days. You can do this by contacting the OEIO or by using the SSA’s online services.

- Annual reporting: If you receive Social Security benefits, you must report your income and any changes in your employment status to the SSA annually. You can do this by contacting the OEIO or by using the SSA’s online services.

Failure to report these changes can result in overpayments, which must be repaid. It’s essential to keep the SSA informed of any changes to ensure you receive your Social Security benefits correctly. Staying proactive with these reporting requirements helps avoid disruptions in your benefit payments and ensures compliance with SSA regulations.