How to leave the US?

More and more Americans are moving abroad, and there are plenty of good reasons. Some want a lower cost of living, better healthcare, or a slower pace of life. Others are attracted by the affordable cost of high-quality healthcare and overall cost of living in countries like Panama and Portugal, which also offer lenient residency requirements and appealing lifestyles.

At the same time, moving abroad isn’t just about the positives. It comes with challenges like visa paperwork, cultural adjustments, and financial planning. But with the right preparation, it can be one of the most rewarding decisions you ever make.

This guide walks you through everything you need to know about leaving the US. We’ll cover where to go, visa options, cost of living, job opportunities, and life as an expat. Whether you’re a retiree, a remote worker, or someone looking for a fresh start, you’ll find useful information to help you make the right choice.

Choosing the right country

Before picking a country, think about what’s most important to you. When considering the best country for Americans to relocate to, factors such as lower living costs, a warm climate, and a strong healthcare system are crucial. Your priorities will help narrow down your options.

Here are some key questions to ask yourself:

- Cost of living – Can you afford to live comfortably there?

- Visas and residency – How easy is it to get a long-term visa?

- Work and income – Will you need a job, or do you have savings or remote income?

- Language – Do you need an English-speaking country, or are you open to learning a new language?

- Culture and lifestyle – Do you prefer a big city, a beach town, or somewhere quiet?

- Safety and healthcare – Is the country safe? Does it have good medical care?

Best countries for different needs

Here’s a quick look at some of the best countries depending on what you’re looking for:

- Easiest visas → Mexico, Portugal, Panama, Thailand

- Cheapest cost of living → Philippines, Mexico, Vietnam, Colombia

- Best for remote workers → Portugal, Costa Rica, Spain, Thailand

- Best for retirees → Mexico, Panama, Portugal, Costa Rica

- Best for job opportunities → Canada, Germany, Australia, New Zealand

Each country has pros and cons, so take your time to research what fits your needs. Visa requirements and residency laws vary in different countries, making it essential to understand the specific regulations for each destination. In the next chapter, we’ll dive deeper into visas and residency options.

Visas and residency

How long can you stay?

Every country has its own rules for how long Americans can stay without a visa. Most allow 90 days on a tourist visa, but if you want to stay longer, you’ll need a residency visa. Some countries make this easy, while others have strict requirements.

Here’s a breakdown of the easiest long-term visa options based on your situation.

Easiest visas to get

Retirement visas (for those with pension or savings)

These visas are designed for retirees who can prove a steady income. Many countries offer low-cost residency in exchange for a guaranteed pension or savings.

Mexico – Temporary Resident Visa

- Income Requirement: Around $2,500–$4,500 per month (varies by consulate) OR savings of $69,000 USD

- Stay Length: 1 year (renewable for up to 4 years), then apply for permanent residency

- Tax Benefits: No local taxes on foreign income unless you become a tax resident

Panama – Pensionado Visa

- Income Requirement: $1,000 per month pension (additional $250 per dependent)

- Stay Length: Permanent residency from day one (no renewals required)

- Key Benefit: Huge discounts on healthcare, utilities, and travel

Costa Rica – Pensionado Visa

- Income Requirement: $1,000 per month (covers spouse and minor children too)

- Stay Length: 2 years (renewable), can apply for permanent residency after 3 years

- Healthcare: Must enroll in Costa Rica’s public health system (Caja)

Thailand – Retirement Visa (O-A Visa)

- Age Requirement: 50+ years old

- Income Requirement: $24,000 in a Thai bank OR $1,850 per month income

- Stay Length: 1 year (renewable annually), must report address every 90 days

- Healthcare: Mandatory health insurance covering at least $50,000 USD

Philippines – Special Resident Retiree’s Visa (SRRV)

- Income Requirement: $800/month pension OR $10,000 deposit in a local bank

- Stay Length: Permanent residency from day one (no renewals required)

- Key Benefit: Duty-free import of personal goods and exemption from some local taxes

Digital nomad and remote work visas

If you work online, some countries offer visas specifically for remote workers. These allow you to live abroad while working for a foreign company.

Portugal – D7 Visa (Passive Income Visa)

- Income Requirement: $870/month (higher if bringing dependents)

- Stay Length: 2 years, renewable for 3 more years

- Citizenship: Eligible for Portuguese citizenship after 5 years

- Tax Benefit: Can apply for Portugal’s Non-Habitual Resident (NHR) tax program

Spain – Non-Lucrative Visa (NLV)

- Income Requirement: $2,500 per month (plus $7,200 per dependent)

- Stay Length: 1 year, then renewable for 2-year periods

- Work Restriction: Cannot work for a Spanish company, but remote work for foreign employers is tolerated

- Citizenship: Eligible for Spanish citizenship after 10 years

Costa Rica – Digital Nomad Visa

- Income Requirement: $3,000 per month ($4,000 for families)

- Stay Length: 1 year, can be renewed for one additional year

- Tax Benefit: No Costa Rican taxes on foreign income

Thailand – Long-Term Resident (LTR) Work Visa

- Income Requirement: $80,000 per year (exceptions for lower earners with Master’s degrees)

- Stay Length: 10 years (issued as 5+5 years)

- Key Benefit: Work authorization for remote employment and fast-track immigration lanes

Work and skilled migration visas

For professionals looking for a job abroad, these visas allow long-term employment in a foreign country.

Working holiday visas are also an excellent option for those wanting to work and travel in a different country, providing opportunities to gain international experience while managing finances and exploring visa requirements for longer stays outside the USA.

Canada – Express Entry (Skilled Worker Visa)

- Eligibility: Based on age, education, work experience, and English/French proficiency

- Processing Time: 6 months or less after invitation

- Key Benefit: Fast-track to permanent residency and later citizenship

Germany – EU Blue Card

- Salary Requirement: $60,000 per year (lower for in-demand fields like IT, engineering, and healthcare)

- Stay Length: 4 years, leads to permanent residency after 21 months with German proficiency

- Key Benefit: Spouses get automatic work authorization

Australia & New Zealand – Skilled Migration Visas

- Eligibility: Points-based system (age, work experience, English, education)

- Stay Length: Australia’s 189 visa = permanent residency from day one, New Zealand’s = 2 years, then PR

- Key Benefit: Direct path to citizenship in both countries

Investment and business visas

For those with capital to invest, these visas offer a fast-track to residency through various avenues, including real estate investments.

Panama – Friendly Nations Visa

- Investment Requirement: $200,000 real estate purchase OR bank deposit

- Stay Length: 2-year provisional residency, then permanent residency

- Tax Benefit: No taxes on foreign income

Portugal – Golden Visa (Updated Rules)

- Investment Requirement: €500,000 in a business or fund (real estate option is now closed)

- Stay Length: 2-year residency permit, renewable every 2 years

- Citizenship: Eligible for Portuguese citizenship after 5 years

What’s the best option for you?

- If You’re Retiring, choose a Pensionado Visa or a low-cost residency option in Mexico, Panama, Costa Rica, or the Philippines.

- If You Work Remotely, look at Digital Nomad Visas in Portugal, Spain, Thailand, or Costa Rica.

- If You Want a Job Abroad, explore Skilled Work Visas in Canada, Germany, Australia, or New Zealand.

- If You Want to Invest, Panama and Portugal offer business and investment residency options.

Financial planning for moving abroad

How much money do you need?

Relocating abroad requires meticulous financial planning, encompassing various factors such as cost of living, taxes, healthcare, and banking regulations, all of which differ by country.

Before making the move, it’s essential to estimate your budget and devise a strategy for managing your finances overseas.

Key costs to consider:

- Visa and Residency Fees: Application fees, legal assistance, translations, and residency renewals.

- Housing Costs: Rent or property purchase, security deposits, utilities.

- Daily Expenses: Groceries, dining out, transportation, internet, phone plans.

- Healthcare: Public versus private insurance, out-of-pocket medical expenses.

- Travel Expenses: Flights back home, potential visa runs.

- Banking and Taxes: Currency exchange, international transfers, tax obligations in both countries.

Cost of living in different regions

Your budget will largely depend on your destination. Below is a general overview of monthly costs for a comfortable lifestyle (excluding rent):

- Cheapest ($700–$1,500/month): Mexico, Colombia, Thailand, Vietnam, Philippines.

- Mid-Range ($1,500–$3,000/month): Portugal, Spain, Panama, Costa Rica, Malaysia.

- Expensive ($3,000+/month): Canada, Germany, Australia, New Zealand.

When planning to relocate from the USA, it's important to consider that most countries have specific visa laws that restrict foreigners from overstaying and working.

Tip: Utilize cost of living calculators like Numbeo or Expatistan to compare expenses before deciding on your new location.

Housing: renting vs. buying

Renting:

- Many expatriates opt to rent initially to familiarize themselves with the area.

- Some countries require substantial security deposits (e.g., several months’ rent in advance).

- Short-term rentals through platforms like Airbnb or local expat communities can be beneficial during the initial transition period.

Buying property:

- Certain countries permit foreign property ownership, while others impose restrictions.

- Residency visas, such as Portugal’s Golden Visa, offer real estate investment as a pathway to citizenship.

- Property taxes and maintenance costs differ; thorough research of local regulations is advisable before purchasing.

Banking and managing finances abroad

Maintaining a U.S. bank account

- U.S. Address Requirement: Due to regulations like the USA PATRIOT Act, most U.S. banks require a standard residential street address on file. Traditional mail-forwarding services or P.O. boxes are often not accepted as your primary customer address.

You can use a specialized domicile or residential-address service that provides a bona fide U.S. residential street address to support bank and brokerage CIP/KYC checks. Acceptance still varies by institution and policies can change, so it’s not a guarantee of approval.

Alternatively, some banks may allow you to use the address of a trusted family member or friend, often with proof of residence such as a utility bill or lease agreement.

Utilizing a domicile service that provides a compliant residential address can be a viable solution. Alternatively, the address of a trusted family member or friend may suffice, though banks may require proof of residence, such as utility bills or lease agreements.

- Choosing an Expat-Friendly Bank: Select banks that support international customers, offering low foreign transaction fees, minimal service charges, and robust online banking platforms. Responsive customer support capable of handling inquiries from abroad is also essential.

- Setting Up Digital Statements and Alerts: Opt for paperless statements and activate email or text notifications to monitor account activity and detect any unusual transactions promptly.

- Utilizing Online and Mobile Banking: Familiarize yourself with your bank’s digital tools to manage accounts remotely, including monitoring balances, transferring funds, and paying bills.

Opening a local bank account

- Some countries require proof of residency to open a local account.

- A local account can help avoid foreign transaction fees and currency exchange issues.

- It simplifies the payment of local expenses, such as rent and utilities.

Transferring money internationally

- Services like Wise, Revolut, and PayPal often offer more favorable exchange rates and lower fees compared to traditional banks.

- Avoid high fees associated with conventional banks when moving money between countries.

Understanding taxes as an expatriate

As a U.S. citizen living abroad, it’s imperative to comprehend your tax obligations to both the United States and your host country.

The U.S. taxes its citizens on worldwide income, irrespective of residence, necessitating annual tax filings. However, provisions exist to mitigate double taxation.

U.S. tax regulations for expats

- Foreign Earned Income Exclusion (FEIE): For the 2023 tax year, eligible expats could exclude up to $120,000 of foreign-earned income from U.S. taxation. The exclusion amount is indexed for inflation each year (for example, $126,500 for 2024 and $130,000 for 2025 – check current IRS guidance for the latest limits). Qualification requires meeting either the Physical Presence Test—being outside the U.S. for at least 330 full days within a 12-month period—or the Bona Fide Residence Test, which involves establishing permanent residence in a foreign country for an entire tax year.

- Foreign Tax Credit (FTC): This credit allows U.S. taxpayers to offset taxes paid to a foreign government against their U.S. tax liability on the same income, effectively reducing double taxation. It’s particularly beneficial when the foreign tax rate is higher than the U.S. rate.

- Foreign Bank Account Report (FBAR): U.S. persons with foreign financial accounts exceeding an aggregate value of $10,000 at any time during the calendar year must file FinCEN Form 114. This is a separate requirement from the tax return and carries significant penalties for non-compliance.

State tax obligations

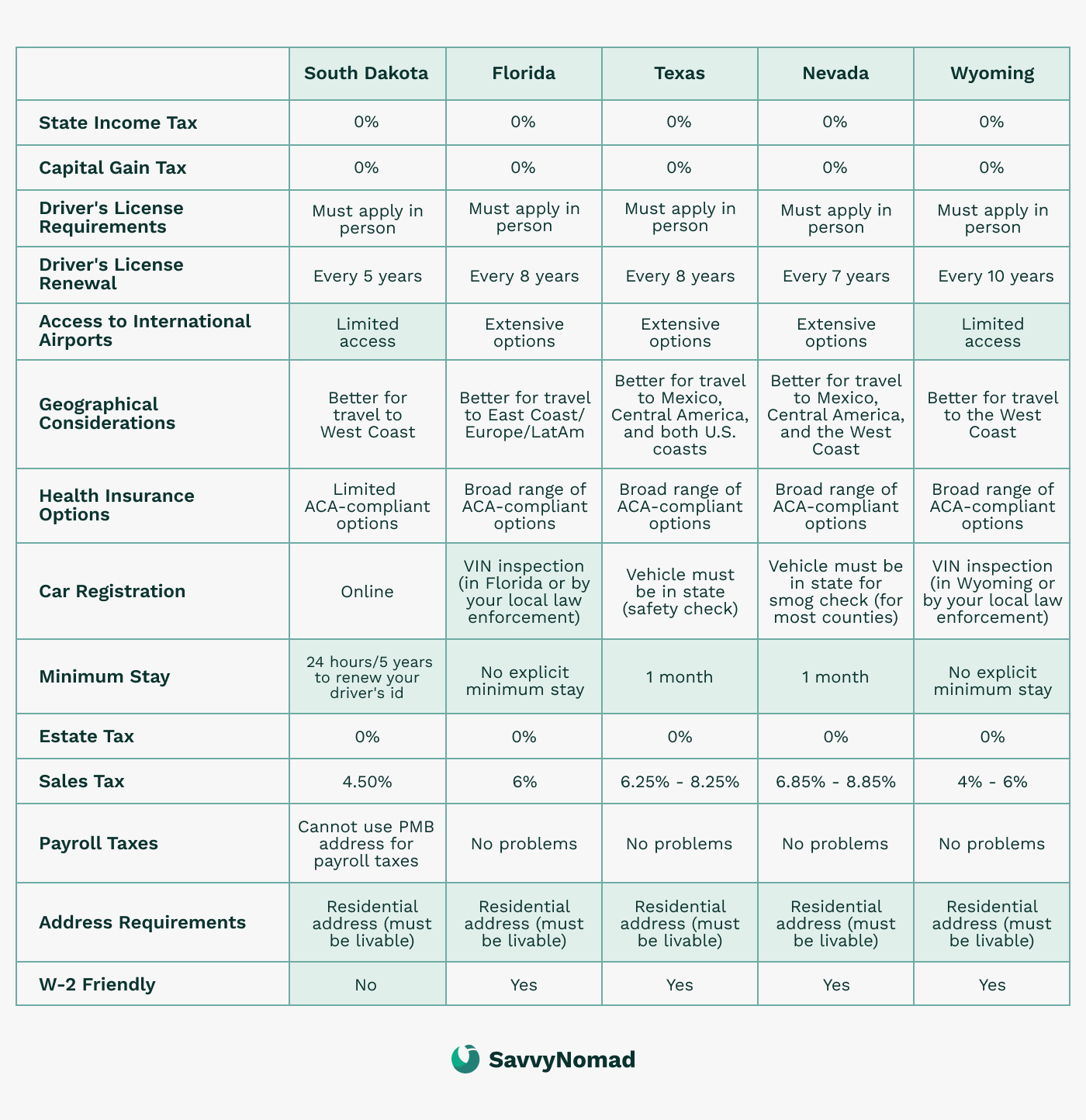

When moving abroad, it’s crucial to address your state tax obligations, as some states have strict residency rules and may still consider you a tax resident if you maintain significant ties, such as property ownership, voter registration, or dependents residing in the state.

To avoid unnecessary state tax liability, it's advisable to formally establish residency in a no-tax state before moving abroad.

Best states for expats:

- Florida: Offers no state personal income tax and relatively straightforward residency procedures for many people. Services like SavvyNomad can provide a bona fide Florida residential street address and help you organize documentation as part of a broader plan to establish domicile, but they don’t by themselves determine your residency status or tax outcomes.

- South Dakota: Also lacks a state personal income tax and offers a relatively streamlined process for vehicle registration and residency establishment. Recent legislative changes have increased physical-presence expectations and tightened rules on using personal mailboxes for voting and payroll purposes.

States to avoid:

- California: Known for its aggressive tax policies, California may continue to tax former residents who maintain substantial connections to the state. Severing all significant ties is crucial to terminate tax obligations.

- New York: This state employs a stringent statutory residency test and may consider you a resident for tax purposes if you spend 183 days or more in New York and maintain a permanent place of abode.

- Virginia: Virginia presumes continued residency—and thus tax liability—if you have domiciliary ties, such as property ownership or active voter registration, unless clear evidence indicates permanent relocation.

Steps to change domicile:

- Sever ties with your previous state: To reduce the risk that your former state continues to treat you as a resident, cancel voter registrations, sell or rent out property where appropriate, and wind down other significant connections that point to that state as your primary home.

- Establish residency in a no-tax state: Before moving abroad, take steps to become a resident of a state without personal income tax. This typically involves establishing a residential address there (not just a mailing address), obtaining a driver’s license, registering to vote if you’re eligible, and actually treating that state as your long-term home under its rules.

By proactively managing your state residency status, you can minimize tax liabilities and simplify your financial obligations while living abroad.

Local tax obligations abroad

Even if you qualify for the Foreign Earned Income Exclusion (FEIE) or Foreign Tax Credit (FTC), you may still be required to file and pay taxes in your new country of residence.

Each country has different tax rules, which generally fall into three categories:

Territorial tax systems

Countries like Panama, Costa Rica, Thailand, and Malaysia tax only income earned inside their borders. Foreign-sourced income, such as U.S. remote work or Social Security, is not taxable in these countries.

Worldwide taxation

Countries such as the U.S., Germany, Spain, and Australia tax residents on their global income, meaning that even if you earn money in other countries, you may still owe local taxes.

Special tax incentives for expats

Some countries offer expat-friendly tax programs that provide significant reductions on foreign-earned income:

- Portugal’s Non-Habitual Resident (NHR) program: Allows new residents to pay zero tax on certain types of foreign income for 10 years (though this is being phased out in 2024).

- Italy’s Flat Tax Regime: Qualifying expats can pay a flat €100,000 tax on all foreign income, regardless of amount.

- Greece’s 50% Tax Reduction: Expats working in Greece may only have to pay tax on half of their income for up to seven years.

Self-employment and business taxes

If you own a business or work as a freelancer while living abroad, additional tax considerations apply:

Self-employment tax

- If you’re self-employed, the U.S. still requires you to pay self-employment taxes (Social Security and Medicare) of 15.3% on your net earnings, even if you qualify for the FEIE.

- If you live in a country with a totalization agreement (like Canada, the UK, or Germany), you may only have to pay into that country’s system instead of the U.S..

Incorporating a business abroad

- Some expats choose to register their business in a tax-friendly country to avoid high U.S. self-employment taxes. However, the IRS has strict rules for Controlled Foreign Corporations (CFCs), which may still require reporting and taxation under GILTI (Global Intangible Low-Taxed Income) rules.

- Popular destinations for business incorporation among expats include Estonia, the UAE, and Singapore, which offer low corporate tax rates and simple business structures.

Tax treaties and double taxation agreements

The U.S. has tax treaties with over 60 countries, which can help reduce double taxation and provide clarity on how income is taxed between both countries. However, tax treaties do not exempt U.S. citizens from filing a U.S. tax return.

The Foreign Tax Credit (FTC) generally eliminates most double taxation, but consulting a tax professional experienced in expat taxes is crucial to optimize your tax situation.

Avoiding tax pitfalls

Many new expats unknowingly violate tax laws due to a lack of preparation. Here are common mistakes and how to avoid them:

- ❌ Failing to file a U.S. tax return: Even if you owe no U.S. taxes, failing to file can result in penalties and potential audits.

- ❌ Not filing FBAR or FATCA forms: The IRS and U.S. Treasury require reporting of foreign bank accounts and financial assets if they exceed certain thresholds.

- ❌ Misunderstanding local tax residency laws: Some countries automatically consider you a tax resident after 183 days in a calendar year, requiring full tax compliance.

- ❌ Not factoring in state taxes: Leaving the U.S. doesn’t automatically end your state tax obligations, so you need to establish a clear exit from high-tax states.

Healthcare: insurance and medical expenses

Public healthcare

- Many countries offer low-cost or free public healthcare to legal residents.

- Residency visas often require proof of private insurance before allowing access to public systems.

- Countries like Spain, Portugal, and Canada provide universal healthcare for residents, though wait times for non-urgent procedures can be long.

Private health insurance

- In countries where public healthcare is not available to expats, private insurance is necessary.

- Private insurance can give access to better hospitals, English-speaking doctors, and shorter wait times.

- International health insurers like Cigna, Allianz, and SafetyWing provide expat-friendly policies that cover multiple countries.

Medicare and retiring abroad

- Medicare does not cover medical expenses outside the U.S.

- Retirees often use international health insurance or enroll in local public healthcare programs (e.g., Costa Rica’s Caja system).

- Some Medicare Advantage plans allow treatment in U.S. territories like Puerto Rico and Guam, but standard Medicare requires returning to the U.S. for coverage.

Preparing for the move

Once you’ve chosen your destination, secured your visa, and planned your finances, it’s time to prepare for the actual move. This includes organizing documents, deciding what to pack, arranging travel logistics, and setting up your new life abroad. Proper planning will make your transition smoother and minimize stress.

Documents you need before leaving

Moving abroad requires handling a lot of paperwork. Make sure to gather, update, and digitally store copies of the following:

- Passport – Ensure it’s valid for at least six months beyond your departure date. Some countries require longer validity.

- Visa and Residency Papers – Print multiple copies of your visa approval letter or residency permit. For Americans, a working holiday visa is an accessible option that allows you to work and travel simultaneously without needing a job offer, though age restrictions apply.

- Birth Certificate and Marriage Certificate – Required for dependent visas, family reunification, or banking. Some countries require them to be apostilled.

- Driver’s License and International Driving Permit (IDP) – Some countries allow you to drive on a U.S. license for a few months, but an IDP is often required.

- Social Security Card and Tax Documents – Needed for tax filing, banking, and Social Security benefits.

- Health Records and Prescriptions – Bring vaccination records and any prescriptions, especially if some medications are restricted in your destination country.

- Financial Documents – Bank statements, proof of income (if required for residency), and investment details.

Scan and store all documents in cloud storage and carry a USB backup in case of internet issues.

What to pack and what to leave behind

Shipping everything overseas is expensive and usually unnecessary. Bring essentials and buy the rest locally.

What to pack:

- Important documents

- Medications (three- to six-month supply with a doctor’s note)

- Electronics and power adapters (many countries use 220V instead of 110V)

- Clothing suited to the climate

- Bank cards and at least $500–$1,000 in local currency for arrival expenses

- Basic toiletries and small essentials that may be hard to find locally

What to leave behind:

- Furniture and large items (renting a furnished place is easier than shipping)

- Appliances (voltage differences may make U.S. appliances unusable)

- Most clothing (buy local styles suited to the climate)

- Heavy books (use Kindle or audiobooks)

- Excess shoes (some countries have different sizing, but bring extras only if needed)

Check airline baggage limits. Many international flights allow two free checked bags for long-haul travel. Overweight baggage fees can be expensive, so pack wisely.

Shipping vs. buying locally

For long-term moves, shipping may seem like a good option, but it is usually costly and slow.

- International shipping can take six to twelve weeks and cost thousands of dollars.

- Customs fees may apply, even for personal items.

- Alternatives like checking extra luggage or using services like SendMyBag or DHL Express can be more affordable.

Best things to ship: important documents, specialty electronics, sentimental items, or anything expensive to replace.

Not worth shipping: furniture, large appliances, clothing, and most everyday household items.

If staying for six months or longer, check local Facebook groups or expat marketplaces for secondhand furniture and home goods.

Housing: where to stay first

Before committing to a long-term lease, rent short-term for the first few weeks or months while you get settled.

Short-term housing options

- Airbnb and Vrbo – Flexible but can be expensive

- Serviced apartments – More space and amenities than hotels

- Hostels and guesthouses – Budget-friendly with monthly rental discounts

- Expat and local rental websites – Useful for finding long-term leases

Signing a lease abroad

- Many long-term rental contracts require six months to one year minimum.

- Some landlords require proof of income, residency status, or a local bank account.

- Security deposits range from one to three months’ rent.

- Furnished rentals can help avoid buying furniture immediately.

In popular expat cities, local Facebook groups often have listings from other expats and locals.

Healthcare: signing up for insurance

Short-term (first few months)

- Travel insurance covers emergency medical care but usually not routine doctor visits.

- Some countries require proof of private insurance before granting residency.

Long-term (after residency)

- Some residency visas allow access to public healthcare after a waiting period.

- If public healthcare is not available, private insurance is essential.

- Private insurance is usually cheaper than U.S. insurance, but pre-existing conditions may not be covered immediately.

Research which hospitals or clinics in your new country have English-speaking doctors before you move.

Setting up a bank account abroad

Many countries require proof of residency to open a local bank account.

- Check banking requirements – Some banks require a local address, visa, or proof of employment.

- Bring required documents – Usually includes passport, proof of residency, and a tax ID if applicable.

- Consider an international bank – HSBC, Citibank, and other global banks may allow account setup before moving.

- Use a multi-currency account – Wise (formerly TransferWise) and Revolut allow holding multiple currencies and make currency exchange cheaper.

If you can’t open a local account immediately, use a U.S. bank that reimburses foreign ATM fees, like Charles Schwab or Fidelity.

Final checklist before moving

- Confirm visa approval and entry requirements (some countries require proof of onward travel).

- Notify banks and credit card companies that you’re moving abroad to avoid flagged transactions.

- Set up a U.S. address: For banking and legal documentation, consider a residential-address or domicile service or, in some cases, a family member’s residential address. For general mail only, a virtual mailbox can be useful, but many banks and state agencies won’t accept it as your primary residence address.

- Back up all important documents digitally.

- Make a plan for taxes (consult an expat tax professional if needed).

- Book your first month of accommodation before arriving.

Adjusting to life abroad

Visit before you move

Moving to a new country is a big decision, and it’s important to experience a place firsthand before committing. Visiting before you relocate allows you to get a feel for daily life, explore different neighborhoods, and see if the culture suits you.

Many people choose a country based on what they’ve read online, but reality can be very different. Spending a few weeks or months traveling through potential destinations helps you avoid making a costly mistake.

Why visit first?

- You can test whether the climate, food, and lifestyle match your expectations.

- You’ll see if you feel comfortable in the local culture.

- You can explore different cities and neighborhoods to find the best fit.

- You’ll have a chance to talk to locals and expats about real-life experiences.

If you can’t visit before moving, consider a trial stay of three to six months before fully committing to permanent residency or selling all your belongings back home.

Settling in

Once you’ve chosen your destination and made the move, the first few months will be about adjusting to a different culture, language, and way of life. Understanding how to navigate daily life, meet new people, and deal with homesickness will help make the process smoother.

Handling culture shock

Culture shock happens when the differences between your home country and your new country feel overwhelming. This is normal and usually happens in four stages:

- Honeymoon Stage – Everything feels new and exciting. You love exploring, trying new foods, and experiencing a different culture.

- Frustration Stage – Small annoyances start to build up. Language barriers, bureaucracy, and different social norms can feel exhausting.

- Adjustment Stage – You begin to adapt and feel more comfortable in your daily life. You learn how things work and feel less like an outsider.

- Acceptance Stage – You feel at home in your new country, even if some things still feel unfamiliar. You have a routine and a support system.

To ease culture shock:

- Stay open-minded – Accept that things are different, not worse or better—just different.

- Learn the local customs – Understand how people greet each other, what’s considered polite, and what to avoid.

- Give yourself time – Adjusting can take months. Be patient with yourself.

- Find familiar comforts – Whether it’s a favorite meal, TV show, or hobby, having something familiar can help you feel more at ease.

Building a social life

Making friends in a new country takes effort, but it’s essential for feeling at home.

Ways to meet people:

- Expat groups – Join local expat communities on Facebook, Meetup, or Internations. Many cities have regular social events for newcomers.

- Language exchange groups – If you’re learning the language, these can be a great way to meet locals and practice speaking.

- Co-working spaces – If you work remotely, these spaces are excellent for networking and making friends.

- Local hobbies and sports – Whether it’s yoga, hiking, or dance classes, joining a local activity is a natural way to meet people.

- Volunteering – Helping out at a local charity or event can introduce you to people with shared interests.

If social anxiety or shyness is a concern, start with one-on-one meetups or online conversations before attending larger gatherings.

Learning the language

Even if you move to a country where English is widely spoken, learning the local language will make your life easier and help you connect with people.

Best says to learn:

- Take a class – Many cities offer language schools for expats.

- Use language apps – Duolingo, Babbel, and Pimsleur can help with vocabulary and pronunciation.

- Practice daily – Even if you’re not fluent, use simple phrases when shopping or ordering food.

- Hire a tutor – A private tutor can speed up your learning and help with specific challenges.

- Immerse yourself – Watch local TV shows, listen to music, and try reading in the language.

Don’t worry about being perfect—locals appreciate the effort, even if you make mistakes.

Navigating daily life

Public transportation:

- Learn how the buses, trains, or metro system work.

- Get a transit card or app for easier payments.

- Be aware of rush hours and safety tips specific to the city.

Grocery shopping:

- Local markets may have fresh and cheaper options compared to supermarkets.

- Some foods from home may be hard to find—look for international stores.

- Learn the names of common ingredients if labels are not in English.

Healthcare:

- Register with a local doctor or healthcare provider.

- Know where the nearest hospital or clinic is in case of an emergency.

- If using private insurance, find out which hospitals accept your plan.

Paying bills and managing money:

- Learn how to pay for utilities, rent, and internet (direct deposit, cash, or online).

- Keep some local currency on hand—some places may not accept credit cards.

- Be aware of local banking hours and any foreign transaction fees.

Long-term life abroad

After settling in, you’ll need to decide if you want to stay long-term or move elsewhere. Some expats love their new country, while others realize it’s not the right fit.

Reasons to stay

- You feel comfortable and have built a stable routine.

- You have financial security or a long-term work permit.

- You’ve built a strong social network.

- You enjoy the culture, safety, and healthcare system.

Reasons to move on

- Visa or financial challenges make it hard to stay.

- You struggle with homesickness or social isolation.

- The job market, lifestyle, or cost of living doesn’t fit your needs.

- You’re ready for a new challenge in another country.

Upgrading your residency

If staying long-term, transitioning from a temporary visa to permanent residency or citizenship is worth considering.

- Permanent Residency: Many countries grant it after 2–5 years of living there.

- Citizenship: Some countries offer citizenship after 5–10 years, often requiring a language test.

Countries with easy paths to permanent residency

- Portugal – Permanent residency after 5 years, citizenship after 5 years.

- Panama – Friendly Nations Visa offers permanent residency after 2 years.

- Mexico – Apply for permanent residency after 4 years.

- Spain – Permanent residency after 5 years, citizenship after 10 years.

Financial stability abroad

Living abroad long-term requires financial planning to sustain your lifestyle and prepare for the future.

- Banking: Decide whether to keep most funds in a U.S. account or a local bank.

- Retirement: Check if you can contribute to a U.S. retirement account while abroad.

- Earning Income: Remote work, freelancing, or investing in local property or business can provide stability.

- Currency Exchange: Use Wise, Revolut, or OFX to avoid high fees.

Maintaining ties to the U.S.

Even if you live abroad permanently, some U.S. ties remain important:

- Taxes – U.S. citizens must file a tax return no matter where they live.

- Social Security & Medicare – Check if your benefits can be received abroad.

- Voting – U.S. citizens can vote via absentee ballots.

- Mailing Address – Maintain a reliable U.S. mailing address. For official documents and banking, that usually means a residential street address (through a domicile / residential-address service or a family member). A virtual mailbox can be handy for scanning and forwarding mail, but many banks and state agencies will not accept it as your primary residence address.

Planning your next move

If your first destination isn’t the right fit, it’s okay to relocate again.

- Signs It’s Time to Move: You’re unhappy with the job market, lifestyle, or visa situation.

- How to Move Smoothly: Visit the new country first, update legal documents, and transfer funds efficiently.

- Keep a Flexible Mindset: Many expats move multiple times before finding their ideal home.

Staying abroad vs. returning home

At some point, every expat faces the question: Should I stay abroad forever, or return home? Some settle permanently in their new country, while others move back for family, career, or personal reasons. There’s no right answer—only what works best for you.

Reasons to stay abroad

- You enjoy a lower cost of living and better quality of life.

- You’ve built a strong social network and career.

- The healthcare and safety are better than in your home country.

- You feel more at home abroad than where you grew up.

Reasons to return home

- You miss family and close friends.

- Job opportunities or career growth may be better in your home country.

- You want to retire with familiar healthcare and benefits.

- Cultural differences never fully felt comfortable.

Planning a permanent stay abroad

If you decide to stay long-term, make sure your residency, finances, and legal status are in order.

- Upgrade to Permanent Residency or Citizenship – This provides security and avoids visa renewals.

- Plan for Retirement – Check if local pension systems, Social Security, or international retirement plans will support you.

- Consider Long-Term Healthcare – Enroll in public or private healthcare to ensure coverage in old age.

- Integrate Fully – Learn the language, establish deep social ties, and embrace the culture.

Planning a return home

Moving back can be as challenging as moving abroad. Prepare for reverse culture shock and financial adjustments.

- Plan Your Finances – Re-establish a U.S. bank account and credit history before returning.

- Find Housing Before Moving – Renting or buying a home takes time, so plan ahead.

- Prepare for Career Changes – Some employers may not value overseas experience, so be ready to explain your skills.

- Expect Cultural Adjustment – Things at home may feel different than you remember, and it can take time to readjust.

Making the right decision

There’s no universal answer—some expats stay abroad forever, while others return home and feel grateful for the experience. The key is evaluating what makes you happiest and choosing a path that aligns with your personal and financial goals.