Abandonment of California Domicile

The Eagles famously sang, “Welcome to the Hotel California. You can check in any time you like, but you can never leave.”

Were the Eagles right? Just how easy is it to leave California?

Ah, California, the land of sunshine, opportunities, and ... high taxes? The Golden State, while offering a plethora of opportunities, has always been a bit heavy on the wallet, especially when the tax bill arrives.

It's essential to get a grip on residency laws, which are tied to where you lay your head at night, what you intend to make your long-term home, and where you're earning your bread.

It's not just about where you are, but where your connections are – think your bank, your doctor, or even where your pet’s veterinarian is located (yes, this was really a deciding factor in some cases).

Now, let’s delve into the nitty-gritty of making your exit from California as smooth as your last drive down the Pacific Coast Highway.

Understanding California residency

California residency is a nuanced concept that significantly impacts your tax obligations. The California Franchise Tax Board (FTB) employs a multifaceted approach to determine whether you are a resident or non-resident for tax purposes. This determination hinges on several factors, including your domicile, residence, and various connections to the state.

Your domicile is your true, fixed, and permanent home—the place you intend to return to after any temporary or transitory purpose. If California is your domicile, the state considers you a resident, regardless of where you physically reside. On the other hand, your residence is where you live on a day-to-day basis. The FTB examines your lifestyle, such as where you spend most of your time, where your family lives, and where you maintain social and economic ties.

Understanding these distinctions is crucial for anyone contemplating a move to or from California. Your residency status determines whether you owe California taxes on your worldwide income or just on income sourced within the state. Therefore, grasping the intricacies of California residency can help you navigate your tax obligations more effectively.

1) Strategizing the departure

Embarking on a life-altering decision, such as changing your state of residence, is akin to preparing for a long journey. Just as you wouldn't sail into unfamiliar waters without a map, you shouldn’t try to change your legal state of residence unprepared.

In this chapter, we’ll be your compass, guiding you through the maze of logistical and financial considerations that come with detangling yourself from California’s grasp.

Unbinding the California connection:

Preliminary steps

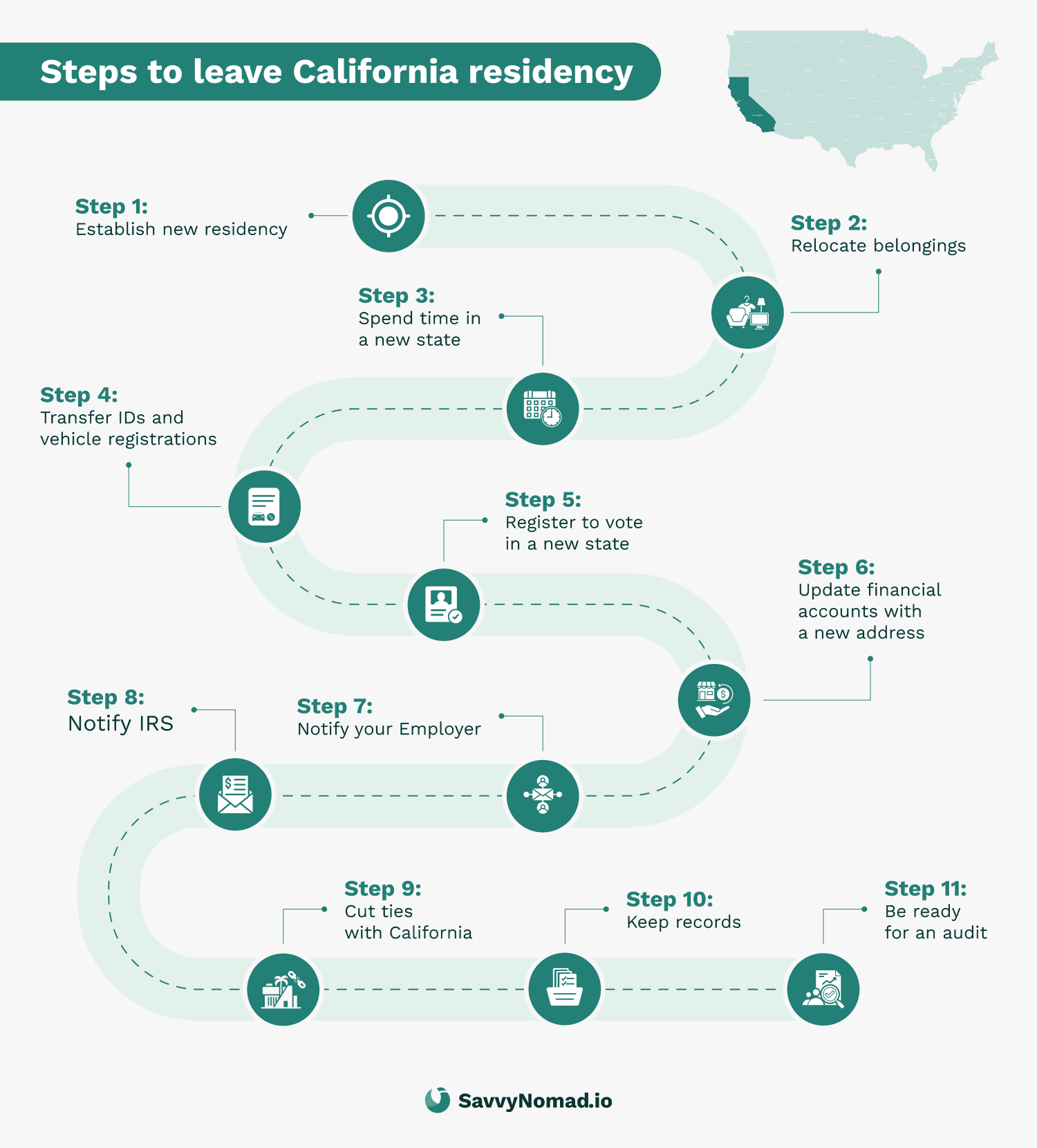

- Severing Ties: It's like breaking up with California; you’ve got to make a clean break. This entails selling your California home (if possible, or at least renting it out. Retaining a home can suggest an intention to return.), buying or renting a new residence in your new state of residence, changing your driver’s license to your new state, registering your car there, notifying the IRS and your employer (if any) of your move, and ensuring your bank and other accounts reflect your new address.

- Documentation: The devil is in the details. Document every step of your residency change, especially the exact date of your move. Ensure this information is consistent across all official documents, and keep them safe for at least five years, especially if California might whisper your name again in the future.

Navigating tax considerations

- Tax Residency Status: When you part ways with California, you'll need to file a specific tax return for the year of your departure. And if California’s charm pulls at your financial strings in the form of ongoing income, you'll have to file nonresident tax returns thereafter.

Finally, nothing calls the attention of the IRS faster than saying you changed residency on January 1 – it’s a little too convenient and often increases your chances of an audit.

- California-Source Income: Earning from afar? California still wants its share. Your income from California sources remains taxable, even as a non-resident. Confused about which portions of your income are “California-sourced?” Talking things over with your tax advisor is a useful exercise.

Residency reconnaissance:

Scouting the new state

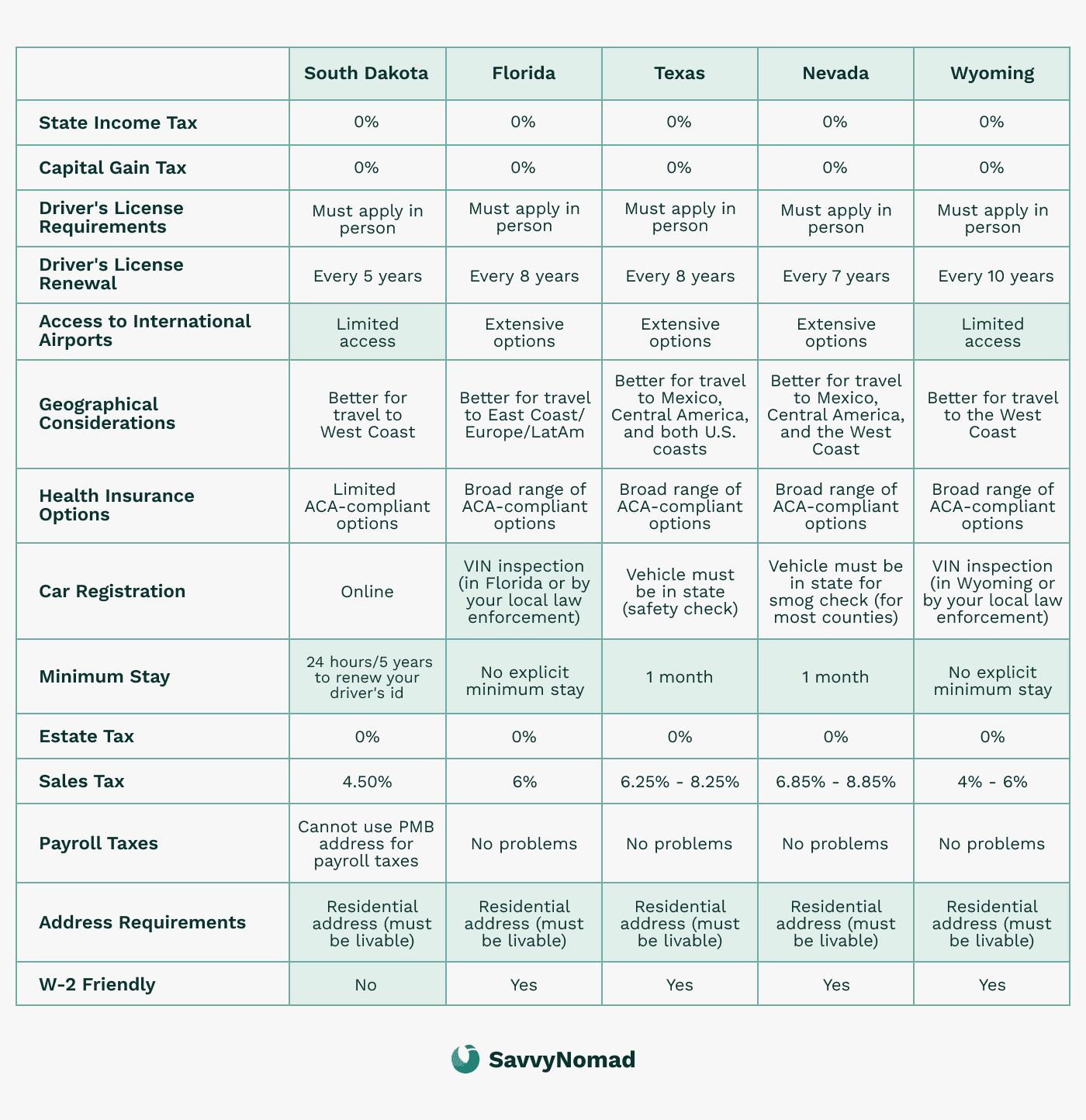

- Tax Benefits: The U.S. is a patchwork of tax laws, with states like South Dakota, Florida, Nevada, and Texas shining as tax havens with no individual state income taxes. This feature makes them a magnet for expats and digital nomads aiming for a lighter tax load.

- Ease of Residency: South Dakota and Florida have rolled out the welcome mat for new residents, making the residency transition a breeze. South Dakota, for instance, has laws specifically tailored for nomads and long-term travelers (although it’s gotten a little less popular due to policy changes in 2023). Similarly, Florida’s friendly policies and tax advantages also offer a soft landing for those seeking a new domicile.

Financial blueprint

- Understanding Your New State’s Tax Landscape: If knowledge is power, understanding the tax landscape of your new state could empower your wallet. Although Texas, South Dakota, and Florida are both tax-friendly and relatively easy to gain residency status in, most other states might have a tax bite that could nibble at your finances.

- Cost of Living: Assessing the cost of living is essential, but if you’re embracing a nomadic lifestyle, the cost of living in a particular state is not likely to be a deal-breaker (after all, you may not be there much): establishing a tax-friendly domicile is even more crucial. Finding a base in a state with favorable tax laws can significantly lighten your tax burden while providing a solid foundation for your nomadic adventures.

2) Executing the residency shift

The journey of transitioning from the Golden State to your chosen haven is akin to stepping onto a new stage. This chapter is your rehearsal room, preparing you for a smooth transition into your new role as a resident of a different state.

Obtaining a driver's license in your new state is a crucial step to demonstrate your intent to make the new location your permanent residence.

Formal termination of California residency:

- Final Formalities: Cutting the California cord is a carefully choreographed dance. At the forefront is selling your California abode or terminating your lease and wrapping up any business operations you have as a resident in the state. That could mean simply notifying your employer of your address change, so that they can start paying unemployment and other payroll taxes to the correct state. It's not just about physical movement; it's about demonstrating your intent to move away from California permanently.

- Tax Residency Status: Tax considerations are crucial when exiting California. When you change your tax residency, you must file a Nonresident or Part-Year Resident income tax return (and pay California taxes) for the year you leave. If you continue to have income from California sources, you must file nonresident tax returns (and pay California taxes) thereafter.

- Factors Supporting Termination of Domicile: To ease the transition, it's advantageous to update your employer or start full-time employment in your new home state, spend fewer days in California post-departure, and move all household items and possessions to your new home. Further, establishing new social relationships, joining local organizations, and changing your voter registration, driver’s license, and professional licensures to your new home state are pivotal steps in this process.

- Legal Abandonment of Domicile: The legal abandonment of your domicile in California is a key step. You must have changed your "real, fixed, permanent residence and primary establishment," and have the intention of returning to your new residence, rather than to California, after temporary absences to legally abandon your domicile in California.

- DMV Requirements: The Department of Motor Vehicles (DMV) in California has specific requirements for out-of-state residents wishing to terminate certain actions. For instance, you may need to complete and return a Declaration Regarding Certificate of Insurance for Non-Resident Driver if all specified conditions apply to you.

3) Nurturing roots in new soil

With the unfamiliar skyline of a new state or perhaps a new country stretching ahead, the adventure of building a new life commences. It's akin to nurturing a plant in new soil; the right conditions and a touch of patience can lead to flourishing growth. This chapter helps you settle into your new home, ensuring the roots you plant today lead to a thriving existence in the days to come.

Regulatory rhythms: Adapting to the legal and regulatory environment of the new state or country

Understanding local laws and regulations:

- Legal landscape: Every region has a unique legal fingerprint. It’s crucial to get acquainted with the laws and regulations that will now govern your daily life. This could range from property laws to local taxes, and even to how your new region regulates your profession.

- Professional regulations: If your profession requires a license to practice, you'll need to understand the licensure requirements in your new state or country. For those transitioning abroad, recognizing the professional credentialing system and any necessary re-certifications is vital.

International considerations for Americans abroad:

- Expat tax obligations: U.S. citizens living abroad are still subject to U.S. tax laws. Understanding your tax obligations as an expat, including the Foreign Earned Income Exclusion, Foreign Tax Credit, and reporting foreign bank accounts, is crucial.

- Healthcare arrangements: Healthcare systems vary significantly across the globe. Familiarizing yourself with the healthcare system of your new country, including what insurance coverage you have as an expat (hint, Medicare doesn’t cover care you receive overseas), is key to ensuring your health and well-being.

- Cultural and legal adaptation: Adapting to the cultural norms and legal systems of a new country is an enriching yet challenging endeavour. From language barriers to differing social norms, the transition abroad is a voyage of discovery.

Financial adaptation:

- Tax adaptation: The tax landscape in your new state or country could be a refreshing change, especially if you've chosen a state like Florida, South Dakota, or Texas, with no income tax. Our guides to these states provide a comprehensive overview of their tax benefits and how to make the most of them. For those moving abroad, understanding the tax treaty, if any, between the U.S. and your new country can offer significant tax advantages.

- Budgeting: The financial circumstances of your new state or country could be vastly different from California. Drafting a new budget reflecting the cost of living in your new locale is a prudent step toward ensuring your financial stability, even as your surroundings change.

The regulatory rhythm of your new state or country could be a melody or a cacophony, depending on how well you adapt to it. The key is to understand, adapt, and integrate into the legal and financial framework of your new home, whether that's within the U.S. or on foreign soil.

4) Maintaining non-resident status

Staying compliant with California tax laws

Maintaining non-resident status requires diligent compliance with California tax laws. This involves filing the appropriate tax returns, paying any required taxes, and keeping meticulous records. As a non-resident, you must report and pay taxes on any California-sourced income, such as rental income or business earnings within the state.

The California Franchise Tax Board (FTB) may conduct a residency audit to verify your non-resident status. During an audit, the FTB will scrutinize your records to ensure you have genuinely severed ties with California. This includes examining your physical presence, financial transactions, and social connections. To prepare for a potential audit, maintain detailed documentation of your move, including lease agreements, utility bills, and travel records.

Engaging a tax professional familiar with California’s residency laws can provide invaluable guidance. They can help you navigate the complexities of maintaining non-resident status and ensure you remain compliant with all tax obligations. By staying vigilant and proactive, you can minimize the risk of a residency audit and avoid unexpected tax liabilities.

5) Post-transition challenges

The transition may be over, but the ripple effects could follow you for some time. This chapter is about navigating the aftershocks of changing your residency from California to another state. Let’s explore what awaits you and how to prepare for it.

Audit anticipations: preparing for potential residency audits

Audit preparedness:

- Documentation: The journey begins with a paper trail. The more comprehensive, the better. Documents demonstrating your physical presence, utility bills, lease agreements in the new state, and evidence that you have severed ties with California, are crucial. It might seem like overkill, but if the California Franchise Tax Board (FTB) comes knocking, this paper trail could be your best friend.

- Professional Guidance: You do not want to navigate a residency audit alone. Engage a tax professional familiar with California's residency audit process to guide you through it, ensuring you're well-prepared for any inquiries.

California Franchise Tax Board (FTB) audit:

- Audit process: An audit by the FTB can be daunting. They may visit any location that was your principal residence or business location in California and review cancelled checks, credit card statements, and bank charges to determine when, and for how long, you were physically present in the state. It's a thorough check to ascertain where your loyalties lie, so to speak.

- Winning a residency dispute: The best defense is a good offense. Preparing for a residency dispute before it happens is crucial. The time you spend documenting your time spent in California, along with other connections to the state, will be time well spent if a dispute arises.

Tax terrain: managing ongoing tax obligations in both states

Understanding tax obligations:

- State income taxes: Even after leaving, if you continue to earn income in California, you might have tax obligations. Proposition 55, for instance, extended a 13.3% tax rate on high earners through 2030. Understanding the nuances of the law, and planning accordingly, is key.

- Property taxes: If you retain property in California, you still have property tax obligations. Ensure they're met timely to avoid any legal entanglements.

Financial planning:

- Budgeting for taxes: Planning for your tax obligations in both states is wise. It’s not just about the present; future tax obligations should also be on your radar.

- Tax professionals: Tax laws can be complex, and having a tax professional who understands the laws of both states can be a valuable asset. They can provide advice and help navigate the complex tax terrain smoothly.

FAQ

What does it mean to be domiciled in California?

Being domiciled in California means establishing a fixed, permanent home in the state with the intent to return to California after any and all temporary absences. It has legal and tax implications, as California may tax you on your worldwide income based on your domicile status.

Is there a California exit tax?

California doesn't have a specific exit tax, but it does scrutinize the tax filings of wealthy individuals who change their residency. For digital nomads and expats, changing residency from California could trigger a review by the state's tax agency.

If you've been a resident in California for at least two of the past five years and have a net worth of $2 million or more, or an average annual net income tax liability of $200,000 or more for the five years before leaving, you might face tax implications.

Can you avoid exit tax?

To avoid the California exit tax, digital nomads and expats should:

- Establish a new domicile: Sever ties with California by selling your home there, or at least renting it out, and moving significant possessions to your new state.

- Update records: Change your voting registration, driver's license, and car registration to your new state.

- Avoid California income: Be cautious with income sourcing, as California will tax certain incomes even after you leave.

- Track your days: Ensure you spend more days in your new state than in California and track your days in and out of California for at least four years thereafter.

Taking each of these steps will help digital nomads and expats demonstrate a clear change in residency, reducing the likelihood of facing the implications of California's exit tax.

What triggers California’s exit tax?

Here are factors that could trigger such tax implications:

- Change of residency: When you change your residency from California, it could trigger a review of your tax situation by the state's tax authorities.

- Retention of significant ties: If you retain significant ties to California, such as a home, other real estate, or significant possessions, doing so might trigger tax implications.

- Income sources in California: If you continue to earn income in California after changing your residency, it may trigger tax implications.

- Sale of assets: The sale of certain assets like California real estate or business assets around the time of your move can trigger tax implications.

- Failure to establish a new domicile: If you fail to establish a new domicile and make a clean break from California, it may trigger tax implications.

For digital nomads and expats, it's crucial to establish a new domicile, sever ties with California, and manage income sources to avoid or minimize exit tax implications.

What triggers a California residency audit?

A California residency audit can be triggered by various activities or circumstances that may raise red flags with the Franchise Tax Board (FTB). Here are some common triggers for a California residency audit:

- Living situation and property ownership: Living in another state while keeping a second home in California could trigger a residency audit. The FTB may find this situation suspicious, especially if other ties to California suggest you may still be a resident for tax purposes.

- Changes in voting and banking: Altering your cell phone plan, registering to vote in your new state, and filing state and federal tax returns with your new out-of-state address are all actions that can signal a change in residency. While these actions alone might not trigger an audit, they could contribute to a broader evaluation of your residency status.

- High income or net worth: High-net-worth or high-income earners are more likely to be audited. The state authorities may notice when such individuals change their domicile and residency and stop paying taxes to California, prompting an audit to verify their residency status.

- Financial and life events: Various financial and life events occurring throughout the year can also trigger state residency audits. For instance, significant financial transactions or changes in employment could be factors the FTB examines when determining residency.

- Third-party tip-offs: The IRS and individual states share information. A tip-off from the IRS or another third party about your residency status or financial activities could trigger a residency audit.

The California residency audit process is comprehensive, and the FTB looks at a multitude of factors to ascertain an individual's true residency status. Understanding these triggers, and being prepared with proof of your residency elsewhere, can help mitigate the risks associated with a residency audit.

Do I have to pay California taxes if I live out of state?

The answer is “sometimes.” Here are conditions under which you owe taxes to California even if you live out of state:

- Income sourced in California: If you earn income in California, such as from rental properties or businesses operating in the state, you are required to pay taxes on that income to California, regardless of where you live.

- Maintaining ties in California: If you maintain significant ties in California, the state may continue to consider you a resident for tax purposes, which could require you to pay taxes on your global income to California.

- Safe Harbor Rule for expats: There's a specific provision for expats known as the 'Safe Harbor' Rule. Expats who are abroad for at least 546 consecutive days under an employment contract are not considered California residents for tax purposes, provided they don't spend more than 45 days per year in California during this period.

- Residency status: If you are deemed a resident, either because you spend significant time in California during the tax year or maintain a domicile there, you may be required to pay taxes to California on all your income, no matter where it was earned.

These rules underscore the importance of clearly establishing non-residency when moving out of California, especially for digital nomads and expats, to avoid unexpected tax liabilities.

How does California know if you're a resident?

California determines residency for tax purposes primarily through two concepts: domicile and presence. Here's how they ascertain if you're a resident:

- Domicile and presence: Domicile is where an individual has a true, fixed, permanent home and principal establishment, with the intention to return when absent. Presence, on the other hand, refers to a factual place of abode of some permanency, more than a mere temporary stay. California may presume residency if an individual spends more than nine months in the state or has other ties indicating a non-temporary or non-transitory purpose. Vacations or brief transactions don't confer residency.

- Employment and business interests: The state in which you are employed, maintain, or own business interests significantly affect your residency status in California. This includes where you hold a professional license or licenses and where you own investment real property.

- Facts and circumstances test: California employs a "facts and circumstances" test, looking at all facts about a taxpayer’s situation to determine residency status. This is often fleshed out with the so-called “Closest Connection Test” which evaluates where you have the closest family, property, employment, and other ties.

- Presence in California for more than nine months: If you are present in California for more than nine months in a taxable year, it creates a rebuttable presumption of California residence. However, the opposite is not true: presence in California for less than nine months does not create a presumption of non-residency.

Can I live in California and not be a resident?

Yes, it's possible to live in California temporarily without being considered a resident for tax purposes. Here's how:

- Contract employment or short-term tasks: You can work in California or be there for a short period to complete a job, a transaction, or do contract work without being considered a resident, provided you are domiciled elsewhere. However, you are still required to pay taxes on income for services performed in California during your stay.

- Less than nine months stay: If you stay in California for less than nine months, you may not be considered a resident. However, staying for more than six months usually creates a presumption of residency, so it's crucial to be cautious about the duration of your stay.

- Maintaining domicile elsewhere: It's essential to maintain your domicile (permanent home) outside California and ensure that your stay in California is for a temporary or transitory purpose, like a vacation or a short-term job.

Do I have to file California taxes if I live abroad?

If you live abroad but are considered a resident of California or have income-producing assets located in the state, you will need to file California taxes. California has stringent tax laws, and its tax regime is among the most rigorous, especially concerning individuals living abroad but having ties to the state.

Here's how it works:

- Residency determination: If you are deemed a resident of California, you must file California taxes even if you live abroad. The state's tax authorities may still consider you a resident based on various factors, such as the maintenance of a California domicile, significant connections to California, or income from California sources.

- Income from California: If you have income-producing assets in California, like rental properties or businesses, you must file and pay California taxes on the income generated by these assets, despite living abroad.

- Global income: Like New York, California requires residents to pay state taxes on income earned worldwide, which means if you're considered a California resident, your global income is subject to California state tax.

- Safe Harbor Rule: However, there's a relief provision known as the 'Safe Harbor' rule for expats. If you move abroad for at least 546 consecutive days under an employment contract, you are not considered a state resident for tax purposes, regardless of the connections you retain to California. This rule could exempt you from filing California taxes while living abroad.

What is the 9-month rule for California residency?

The 9-month rule for California residency provides that if you spend more than nine months in California during any tax year, you are presumed to be a resident. However, this presumption is rebuttable, based on other factors that might indicate you are not a legal resident, despite the extended stay in the state.

What is the 183-day rule in California?

The 183-day rule in California is one of the criteria for determining residency. If you spend more than 183 days in California during a tax year, you may be considered a resident for tax purposes, subjecting you to California state taxes on your worldwide income. This rule emphasizes the significance of physical presence in the state when determining residency status for tax purposes.

What is the 6-month rule in California?

The so-called ‘6-month rule’ is a common misconception about California residency. It's often believed that spending less than six months in California during a calendar year avoids establishing residency. However, it's not that straightforward, as California's residency laws consider more than just the length of your stay.

What is California’s 546-day rule?

Unlike the ‘6-month rule,’ the 546-day rule is an actual provision of California's tax law that provides that individuals who move abroad under an employment contract for at least 546 consecutive days are not considered state residents for tax purposes, provided they don't spend more than 45 days per year in California during this same period. This rule can provide relief from California state taxes for individuals living abroad under such circumstances.

How many people have moved out of CA?

The data concerning the number of people moving out varies from year to year:

- Between April 2020 and July 2022, around 500,000 people left California.

- From 2020 to 2021, approximately 250,000 individuals moved out of the state, according to the most recent data available.

- A broader view shows that from 2010 through 2021, about 7.7 million people moved from California to other states.

- In 2021 alone, about 360,000 people relocated from California to another state or, in some cases, to another country, showing a significant increase from about 275,000 the year before, indicating a rising trend of people leaving the state.

Where are wealthy Californians moving to?

Wealthy Californians are moving to various places in search of a lower cost of living, better business environments, and perhaps a change of scenery. Here are some destinations that are attracting wealthy individuals from California:

- Texas: Texas is a top destination for Californians looking to move, with a significant 13.71% of moving interest directed towards the Lone Star State. Texas's strong economy, affordable housing, and the lack of a state income tax make it an appealing choice for wealthy Californians. Cities like Dallas, Austin, and Houston are among the top choices in Texas for those relocating.

- Florida: Florida is the second most popular state for Californians to move to, capturing 7.49% of the moving interest. Its favorable tax policies, pleasant climate, and diverse communities are among the factors that make it attractive.

- Arizona: Some Californians are also finding a new home in cities like Phoenix, Arizona, which offers a lower cost of living and are in relatively close proximity to California.

- Washington: Seattle, Washington, is another city that has caught the attention of Californians due to its booming tech industry, among other factors.

These states and cities offer a mix of favorable tax policies, thriving job markets, (comparably) affordable housing, and a good quality of life, making them attractive alternatives for wealthy Californians looking to relocate.

Can you be a resident of two states?

Yes, it's possible to be a resident of two states at the same time, though the laws and implications of doing so can vary significantly from state to state. This scenario is commonly referred to as "dual residency."

Here are some aspects of dual residency to consider:

- Tax implications: Dual residency can have complex tax implications. Both states may want to tax your entire income, but many states offer credits for taxes paid to other states.

- Residency determination: Each state has its own rules for determining residency. Common factors include where you spend the most time, where you own property, and where you have stronger ties such as family or business connections.

- Primary and secondary residency: Typically, you'll designate one state as your primary residence (where you spend more than half the year) and the other as your secondary residence. Your primary residence often determines where you pay state income taxes and where you can vote.

- Income allocation: You may need to allocate your income between the two states based on where it was earned. This can get complicated if you earn income in multiple states.

- Tax returns: You'll likely need to file state income tax returns in both states, which can be complex and requires careful record-keeping.

- Vehicle and driver's license registration: You might also face issues with vehicle registration and driver's license if the states have different requirements.

- Estate planning: Dual residency can also impact estate planning, as different states have different laws governing wills, trusts, and estate taxes.