U.S Citizen Working in Puerto Rico: Taxes Guide 2025

Living in Puerto Rico as a U.S. citizen comes with unique tax perks and responsibilities. While Puerto Rico offers tax benefits that appeal to many Americans, the IRS still requires you to fulfill certain U.S. federal tax obligations. In this guide, we’ll break down what you need to know to stay compliant and make the most of these income taxes benefits.

U.S. federal tax obligations for expats

As a U.S. citizen residing in Puerto Rico, you’re subject to specific federal tax requirements. While Puerto Rico offers tax benefits that appeal to many Americans, the Internal Revenue Service (IRS) still requires you to fulfill certain U.S. federal tax obligations.

The U.S. requires all citizens to report global income, regardless of residence. However, under Section 933 of the Internal Revenue Code, bona fide residents of Puerto Rico can exclude Puerto Rico-sourced income from U.S. federal taxation. This means income earned within Puerto Rico is generally exempt from U.S. federal taxes, but income from U.S. or other foreign sources remains taxable.

Filing requirements and thresholds

Your obligation to file a U.S. federal tax return depends on your income level, age, and filing status. For example, for the tax year 2024:

- Single filers: Must file if gross income is at least $13,850.

- Married filing jointly: Must file if combined gross income is at least $27,700.

- Married filing separately: Must file if gross income is at least $5.

These thresholds are subject to annual adjustments, so it’s essential to verify the current figures each year.

I’ll answer as a renowned expert in U.S. expatriate taxation, focusing on how U.S. tax credits and exclusions apply to American citizens living in Puerto Rico.

Tax credits and exclusions for U.S. citizens living in Puerto Rico

Living in Puerto Rico as a U.S. citizen offers unique tax advantages, thanks to certain credits and exclusions. However, since Puerto Rico is a U.S. territory—not a foreign country—tax rules here differ slightly from those for U.S. citizens living in other countries.

Below, we’ll break down the primary exclusions and credits available to Puerto Rican residents, including the Foreign Earned Income Exclusion (FEIE), the Puerto Rico-Sourced Income Exclusion (under Section 933 of the Internal Revenue Code), and the Foreign Tax Credit (FTC).

Foreign Earned Income Exclusion (FEIE)

The Foreign Earned Income Exclusion (FEIE) is a provision allowing U.S. taxpayers who live and work abroad to exclude a certain amount of foreign-earned income from U.S. federal income tax. In 2024, this amount is capped at $126,500 per qualifying individual.

However, Puerto Rico residents generally cannot use the FEIE to exclude Puerto Rico-sourced income, since Puerto Rico is classified as a U.S. territory rather than a foreign country. This exclusion applies primarily to U.S. citizens living in foreign countries, but there are still instances when it might be relevant to Puerto Rican residents:

- Foreign Income: If you’re a Puerto Rico resident who also earns income in other foreign countries, you might still qualify to use the FEIE for that foreign income, provided you meet either the Physical Presence Test (330 full days in a foreign country within a 12-month period) or the Bona Fide Residence Test (establishing residency in a foreign country for an entire tax year).

- Eligibility: The FEIE requires filing Form 2555 to exclude foreign-earned income on your federal tax return, but it won’t cover income earned within Puerto Rico.

Example: Suppose you are a Puerto Rican resident who spends part of the year working in a foreign country, earning foreign income. If you meet the FEIE criteria, you can use the exclusion for that foreign-sourced income, but not for income earned within Puerto Rico.

Puerto Rico-sourced income exclusion (Section 933)

A unique benefit for Puerto Rican residents is the Puerto Rico Source Income Exclusion, governed by Section 933 of the Internal Revenue Code. This exclusion allows bona fide residents of Puerto Rico to exclude Puerto Rico source income from U.S. federal income tax. Here’s what you need to know:

Who qualifies: To take advantage of this exclusion, you must qualify as a bona fide resident of Puerto Rico for the entire tax year. The IRS has set specific criteria to establish Puerto Rico residency:

- Physical Presence Test: You must spend at least 183 days in Puerto Rico within a calendar year.

- Tax Home Test: Your principal place of business or employment must be in Puerto Rico.

- Closer Connection Test: You need to demonstrate that Puerto Rico is your main residence, with strong personal, social, and economic ties.

What income qualifies: Only Puerto Rico source income qualifies for this exclusion. For most U.S. citizens residing in Puerto Rico, this includes:

- Wages and self-employment income earned from work done in Puerto Rico.

- Investment income derived from Puerto Rican assets or financial institutions.

- Puerto Rican rental income from properties within the territory.

- Income from sources outside Puerto Rico (such as income from mainland U.S. investments) must still be reported to the IRS and is subject to federal tax.

Example: If you work in Puerto Rico and earn all your income there, you would generally not owe federal income tax on that Puerto Rico source income, as long as you meet the bona fide resident requirements.

Foreign Tax Credit (FTC)

The Foreign Tax Credit (FTC) is another mechanism available to U.S. taxpayers to reduce double taxation on income subject to both U.S. and foreign taxes. Though Puerto Rico is not a foreign country, residents of Puerto Rico may still use the FTC to reduce their U.S. tax liability in certain cases. Here’s how:

When to Use the FTC: The FTC can be claimed if you pay taxes to Puerto Rico on income that’s also taxable by the U.S. federal government. This situation commonly arises for:

- U.S.-Sourced Income: Income from U.S. sources (e.g., U.S.-based investment or rental income) is generally subject to U.S. tax, even for Puerto Rican residents. If Puerto Rico also taxes this income, you can use the FTC to reduce or eliminate double taxation.

- Dual-Sourced Income: In some cases, income may have connections to both Puerto Rico and the U.S., leading to potential dual taxation. The FTC helps mitigate this by allowing you to claim a credit for taxes paid to Puerto Rico on such income.

Claiming the Credit: To claim the FTC, you must file Form 1116 with your U.S. tax return. The form calculates the credit based on taxes paid to Puerto Rico, up to the amount of U.S. tax liability on the same income. It’s crucial to keep records of all taxes paid to Puerto Rico to support your claim.

Example: If you own U.S.-based investments that are subject to Puerto Rican tax, you can use the FTC to offset any U.S. taxes on those investments. This helps reduce or eliminate your federal tax liability for that income.

Foreign Housing Exclusion and Deduction

The Foreign Housing Exclusion allows U.S. citizens abroad to exclude housing costs from their income if they meet the FEIE qualifications. This exclusion covers expenses like rent and utilities, which are typically higher for expatriates living abroad.

However, Puerto Rican residents generally cannot claim the Foreign Housing Exclusion for Puerto Rico-based housing expenses, due to Puerto Rico’s territorial status. Still, the exclusion might apply if you’re a Puerto Rico resident with housing expenses abroad.

Qualifying for Foreign Housing Exclusion

To qualify for this exclusion, you must:

- Meet the criteria for the FEIE (Physical Presence or Bona Fide Residence in a foreign country).

- File Form 2555 with your federal tax return.

Limitations for Puerto Rico Residents: For most bona fide residents of Puerto Rico, housing costs in Puerto Rico are not eligible for the Foreign Housing Exclusion. Only housing costs outside Puerto Rico might qualify, depending on your individual situation.

Example: Suppose you’re a Puerto Rican resident who temporarily relocates to a foreign country for part of the year. You may qualify to use the Foreign Housing Exclusion for housing costs in that foreign country if you also meet the FEIE requirements.

To make the most of these tax credits and exclusions, it’s essential to understand your income sources and residency status. Here’s a quick breakdown:

- Puerto Rico-Sourced Income: Excluded from U.S. federal tax if you’re a bona fide Puerto Rico resident.

- U.S.-Sourced Income: Generally subject to U.S. tax, but you can use the FTC if this income is also taxed by Puerto Rico.

- Foreign Income (Outside Puerto Rico): May be eligible for the FEIE and Foreign Housing Exclusion if earned in a foreign country and you meet the relevant residency tests.

Puerto Rico-specific tax incentives for U.S. expats

Living in Puerto Rico offers unique tax incentives for U.S. citizens, primarily through Acts 20 and 22 (now combined under Act 60 as of 2019). These programs are designed to attract businesses and individuals to Puerto Rico by offering substantial tax savings.

To qualify for these benefits, individuals must obtain a tax exemption decree, which grants significant tax exemptions under Acts 20 and 22. Below, we’ll cover the key incentives, eligibility requirements, and how these benefits might apply to you as a U.S. expat.

Puerto Rico’s Act 20 and Act 22 are now part of the Puerto Rico Incentives Code (Act 60).

Together, they provide powerful tax incentives that include:

- Act 20 (Export Services): This act offers a reduced tax rate on Puerto Rico-sourced income for qualifying businesses that export services outside of Puerto Rico.

- Act 22 (Individual Investors): This act provides significant tax benefits for individual investors who relocate to Puerto Rico, including zero tax on capital gains and other types of investment income sourced within Puerto Rico.

Who can benefit from Act 20 and Act 22 (Act 60)?

These incentives are available to U.S. citizens who establish residency in Puerto Rico and meet specific requirements under each act:

- Act 20 is aimed at business owners who provide services to clients outside Puerto Rico, such as consulting, marketing, or digital services.

- Act 22 targets individual investors, offering tax benefits for capital gains, interest, and dividends sourced in Puerto Rico, which can be particularly beneficial for high-net-worth individuals and active investors.

Act 20: Export Services Incentive

The Export Services Incentive under Act 20 provides a 4% tax rate on Puerto Rico-sourced income for businesses that export services. This incentive is ideal for U.S. expats with service-based businesses. Here’s how it works:

Requirements for eligibility:

- You must operate a service-based business in Puerto Rico, with services directed to clients outside of Puerto Rico.

- Common qualifying services include consulting, financial services, IT, professional services, and creative services.

- The business needs to be registered in Puerto Rico and comply with local employment and operational requirements.

Tax benefits: Qualifying businesses enjoy a 4% corporate tax rate on income sourced within Puerto Rico. Dividends distributed to Puerto Rico–resident owners are generally tax-free in Puerto Rico. For bona fide residents, most Puerto Rico-sourced income is excluded from U.S. federal income tax under Section 933 (with exceptions, such as certain U.S. government wages), so that 4% Puerto Rico tax may be your primary income-tax liability on Puerto Rico-sourced business income, though other U.S. taxes can still apply.

Dividends distributed to company owners are tax-free in Puerto Rico. No federal tax applies to Puerto Rico-sourced income for bona fide residents, so your 4% tax rate could potentially be your only tax liability on income sourced within Puerto Rico.

Example: If you’re a U.S. citizen running a marketing consultancy from Puerto Rico, and all your clients are outside Puerto Rico, you can take advantage of the 4% tax rate on the income you earn from these services.

Act 22: Individual Investor Tax Incentive

The Individual Investor Incentive under Act 22 provides significant tax advantages for individual investors who become bona fide residents of Puerto Rico. This includes zero tax on certain types of investment income.

Eligibility requirements:

- You must qualify as a bona fide resident of Puerto Rico, meeting the 183-day rule and demonstrating that Puerto Rico is your primary tax home.

- You must file an application for the Act 22 decree and pay an initial application fee as well as annual compliance fees.

Tax benefits:

- Capital Gains: U.S. citizens can pay zero tax on Puerto Rico-sourced capital gains realized after moving to Puerto Rico.

- Interest and Dividends: Puerto Rico does not tax certain types of interest and dividends for Act 22 beneficiaries, provided these are Puerto Rico-sourced.

- U.S.-Sourced Investment Income: Investment income earned from U.S. sources remains subject to U.S. federal tax but can still benefit from Act 22 if it qualifies as Puerto Rico-sourced after relocation.

Example: If you’re a U.S. citizen who relocates to Puerto Rico under Act 22 and later sells an asset you acquired after moving, any capital gains on the sale would be tax-free in Puerto Rico.

Residency criteria for tax benefits

To qualify for Act 20 or Act 22 benefits, you must establish Puerto Rican residency and maintain it throughout each tax year. The bona fide residency requirements for Puerto Rico include:

- Physical Presence Test: Spend at least 183 days in Puerto Rico within a tax year.

- Tax Home Test: Establish Puerto Rico as your primary place of business or employment.

- Closer Connection Test: Show that Puerto Rico is the center of your personal, financial, and social life, including having a permanent home and primary banking and social connections in Puerto Rico.

Practical considerations and compliance

While Act 20 and Act 22 (Act 60) offer substantial tax savings, there are compliance and filing requirements to maintain eligibility:

- Annual Reporting: You must submit annual reports to both Puerto Rican tax authorities and the IRS to help you stay compliant with residency and tax obligations.

- Compliance Fees: Expect annual compliance fees for Act 22, which are necessary to maintain your decree.

- Documentation: Keep thorough records of your time spent in Puerto Rico, ties to the territory, and business or investment activities to substantiate your residency.

U.S. state tax obligations for Puerto Rico expats

When relocating to Puerto Rico or other U.S. territories, it’s essential to understand how this move impacts your state tax obligations. Some U.S. states have tax residency laws that can result in continued tax obligations if you don’t properly establish a new domicile.

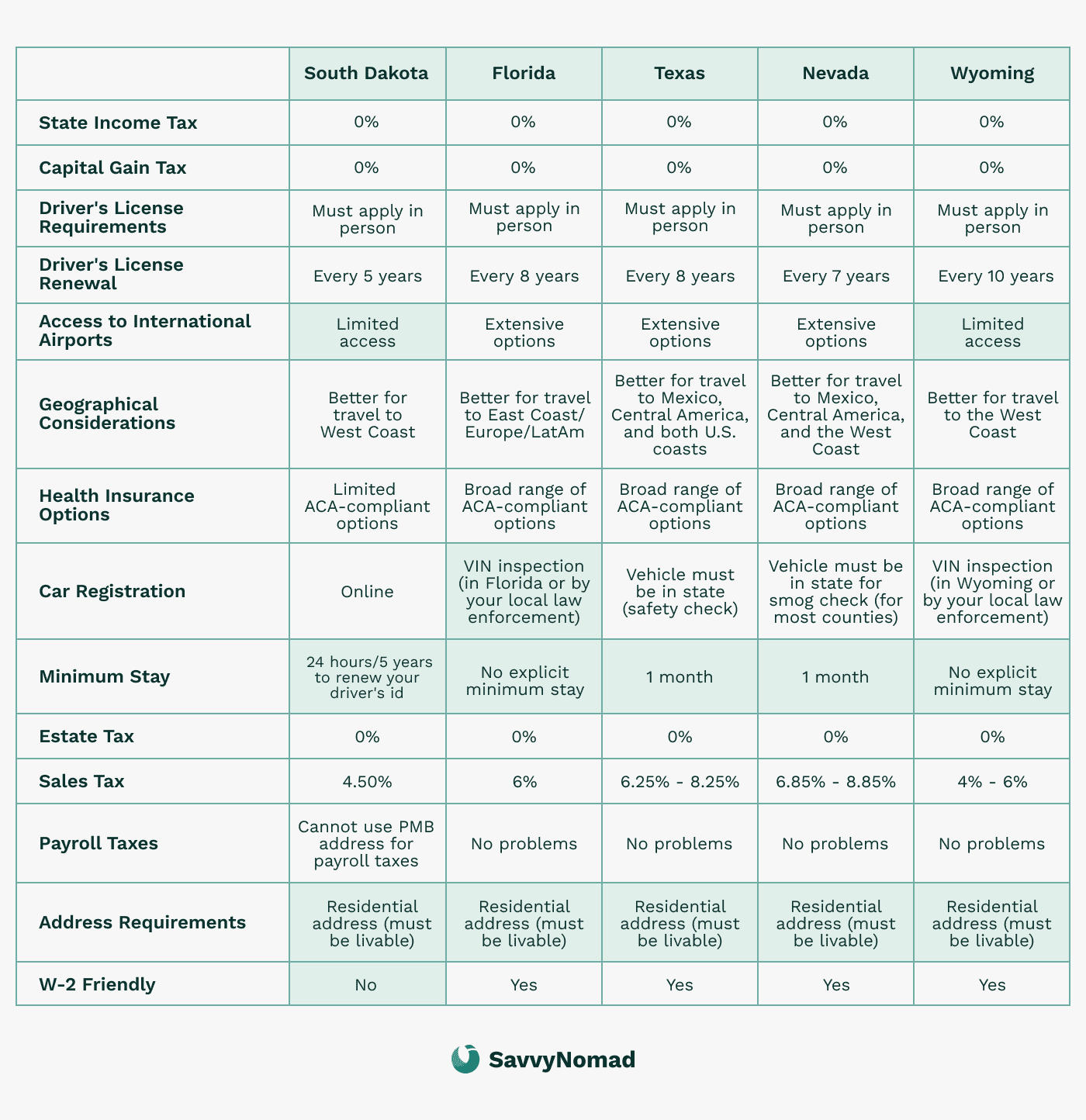

For expats, selecting the right domicile can provide substantial tax savings, especially if you’re moving from a high-tax state. Here’s how domicile works, why it matters, and how to maintain a tax-friendly domicile, such as Florida, while living in Puerto Rico.

Domicile vs. Residency

- Domicile is your permanent, primary home where you intend to return whenever you’re away. It’s more than just where you physically live; it’s a combination of intent and connections.

- Residency generally refers to the state where you currently live and could owe taxes. For tax purposes, states may consider factors like the amount of time spent in the state, ownership of property, or business interests to determine whether you owe taxes.

For U.S. citizens living in Puerto Rico, it’s sometimes possible to become a bona fide resident of Puerto Rico while maintaining domicile in a no-income-tax state such as Florida. This can let you benefit from Puerto Rico’s tax incentives and may reduce or eliminate ongoing state income-tax obligations, but actual outcomes depend on your prior state’s rules and how fully you’ve severed ties there.

Maintaining domicile in Florida while living in Puerto Rico

Florida is a popular domicile choice for expats because it does not have a state income tax, offers strong asset protection laws, and has convenient proximity to Puerto Rico and international travel hubs. To maintain Florida as your domicile while spending significant time in Puerto Rico, consider these steps:

- Obtain a Florida driver’s licence or sttate ID: This is one of the most tangible ways to show Florida as your legal home.

- Voter registration (if you are eligible): If you are eligible, you may register to vote in Florida. Voter registration is one supporting indicator of domicile, not determinative on its own. For eligibility and procedures, consult Florida election officials.

- Own or secure a residential address in Florida: Having a bona fide residential street address is important for Florida domicile. If you are not in Florida year-round, a residential-address service like SavvyNomad’s can help you obtain a residential, non-CMRA Florida street address via a lease/license and organize documentation to support your filings. A residential address can help many banks and brokers complete CIP/KYC, but acceptance varies by institution. The address is provided for documentary and correspondence purposes related to client-direct banking or brokerage verification; it is not for business registration, public listing, or mail forwarding. Banks and state agencies make their own decisions, no specific outcome is guaranteed, and prior-state rules may still apply.

- File a Declaration of Domicile: This formal document, filed in your Florida county, officially states your intent to remain a Florida resident.

- Use a Florida address for taxes and mail: Filing federal taxes from a Florida address and updating your address for banking, insurance, and other official accounts shows you intend to keep Florida as your primary home.

Benefits of domiciling in Florida or other tax-free states

States like Florida, Texas, and Nevada don’t impose a personal state income tax, which can provide a meaningful financial advantage for some expats. By establishing and maintaining domicile in one of these states and properly exiting your prior state, you may avoid ongoing state income tax on your worldwide income, including income earned while living in Puerto Rico, although prior-state and source-income rules can still create state filing obligations.

Some key benefits of domiciling in a tax-free state like Florida include:

- No State Income Tax: These states generally do not tax personal income, including many capital gains, dividends, and retirement distributions, which can reduce your overall state-tax burden depending on your situation.

- Asset Protection: Florida offers strong laws to protect personal assets, including homestead protection from creditors.

- Convenient Proximity: Florida’s major international airports and connections to Puerto Rico make it a practical choice for frequent travelers.

Example: If you’re a U.S. citizen who lives most of the year in Puerto Rico, owns property in Florida, holds a Florida driver’s license, and, if eligible, is registered to vote in Florida, those facts can support a case that Florida is your domicile. Combined with properly severing ties to any prior high-tax state, this may allow you to pair Puerto Rico’s federal tax advantages with a no-income-tax domicile, but state tax authorities ultimately make their own residency determinations.Challenges of domiciling in high-tax states

High-tax states like California, New York, and New Jersey have more restrictive tax residency rules, and breaking ties with these states can be challenging. Many high-tax states impose ongoing tax obligations on former residents if they believe you have not fully severed ties.

These states often look at various indicators, such as:

- Ownership of property in the state

- Business interests or partnerships

- Family ties and physical presence

- Use of services like medical providers or storage facilities within the state

If you’re relocating to Puerto Rico from a high-tax state, take extra steps to show that you have transferred your permanent residence to Puerto Rico or a tax-free state. Otherwise, you may risk being considered a resident for tax purposes and could face tax liabilities on your worldwide income.

Steps to sever ties with high-tax states

If you’re moving from a high-tax state and want to establish domicile in Florida or Puerto Rico, consider the following actions to sever ties:

- Sell or lease out property: If you own property in your previous state, selling or leasing it to unrelated parties can help establish that you no longer reside there.

- Identification and voter registration (if you are eligible): Update your driver’s license to your new domicile and, if you are eligible to vote there, consider updating your voter registration and cancelling registration in your former state. Voting records are one supporting factor in domicile, not determinative on their own.

- Relocate personal property: Moving personal items to your new domicile and discontinuing services like gym memberships or utilities in the previous state further shows intent to leave.

- Document Changes: Keep a record of each step you take to sever ties with your former state to support your new domicile in the event of an audit.

For U.S. expats in Puerto Rico, choosing the right domicile state can have substantial tax benefits. Florida and other tax-free states are popular choices, as they offer clear financial advantages and are generally easier to maintain as a domicile when living in Puerto Rico.

If you’re relocating from a high-tax state, be proactive in establishing domicile in Florida or Puerto Rico, and thoroughly document your transition to avoid any potential tax liabilities.

Additional U.S. reporting requirements: FATCA and FBAR

For U.S. citizens living abroad, simply filing a U.S. tax return may not be enough to meet all reporting obligations. If you have foreign bank accounts or significant financial assets outside the U.S., the IRS has additional requirements under FATCA (Foreign Account Tax Compliance Act) and FBAR (Foreign Bank Account Report).

These rules apply even if you are a bona fide resident of Puerto Rico, and failing to comply can lead to steep penalties.

FATCA (Foreign Account Tax Compliance Act)

The Foreign Account Tax Compliance Act (FATCA) was enacted to help the IRS track assets held by U.S. citizens in foreign financial institutions. Under FATCA, U.S. taxpayers with substantial foreign financial assets must report these on Form 8938, which is submitted along with their federal tax return. Here are the essentials:

Who must file: You must file under FATCA if your foreign assets exceed certain thresholds:

- Single filers living abroad: Total assets over $200,000 on the last day of the tax year, or $300,000 at any point during the year.

- Married filing jointly: Total assets over $400,000 on the last day of the tax year, or $600,000 at any point during the year.

What needs to be reported: FATCA requires you to report various types of foreign assets, including:

- Bank accounts and brokerage accounts held in foreign financial institutions

- Foreign stocks, bonds, and mutual funds

- Interests in foreign partnerships or foreign trusts

How to file FATCA: To meet FATCA requirements, you’ll need to file Form 8938 along with your U.S. federal tax return (Form 1040). This form includes details such as the account or asset type, maximum account values, and the name of the foreign financial institution.

Example: If you’re a Puerto Rico resident with a foreign bank account in a non-U.S. country, and the balance exceeds $200,000 as a single filer, you will need to file Form 8938 with the IRS.

FBAR (Foreign Bank Account Report)

The Foreign Bank Account Report (FBAR) is another important reporting requirement for U.S. citizens with foreign bank accounts. FBAR rules are enforced by the Financial Crimes Enforcement Network (FinCEN) rather than the IRS, but compliance is still essential for U.S. expats, including those residing in Puerto Rico.

Who must file FBAR: You must file an FBAR if the combined balance of all your foreign bank accounts exceeds $10,000 at any point during the year, even temporarily.

What needs to be reported: FBAR requirements focus on foreign bank accounts specifically, including:

- Checking, savings, and investment accounts held in foreign banks

- Mutual funds or similar pooled accounts

- Certain foreign-issued debit or prepaid card accounts

How to file FBAR: The FBAR is filed separately from your federal tax return and is submitted online through FinCEN’s BSA E-Filing System. You’ll use FinCEN Form 114 to report each account’s maximum balance, account numbers, and the bank’s location.

Example: If you have three foreign accounts, each with a balance below $10,000, but their combined balance exceeds $10,000 at any point during the year, you must file an FBAR and report all three accounts.

Differences between FATCA and FBAR

While FATCA and FBAR have similar goals, they differ in important ways:

- Thresholds: FATCA has higher reporting thresholds based on your filing status, whereas FBAR requires reporting if the combined account balance exceeds $10,000.

- Filing locations: FATCA (Form 8938) is filed with the IRS as part of your tax return, while FBAR (FinCEN Form 114) is filed online through FinCEN.

- Types of assets: FATCA covers a broader range of financial assets, including stocks and investments in foreign partnerships, while FBAR focuses solely on foreign bank accounts.

Penalties for non-compliance

Failing to file FATCA and FBAR reports can result in severe penalties:

- FATCA penalties: Non-filing penalties start at $10,000 for each year of non-compliance, with potential additional fines for continued non-filing.

- FBAR penalties: Fines for failing to file an FBAR start at $10,000 per unreported account and can escalate to larger penalties or criminal charges in cases of willful neglect.

Due to the significant penalties, it’s crucial for U.S. expats with foreign financial accounts to understand these requirements and stay compliant.

Social Security and Puerto Rico

For U.S. citizens living in Puerto Rico, Social Security contributions can be a point of confusion. Because Puerto Rico is a U.S. territory, work that is subject to Social Security and Medicare taxes generally contributes to the same U.S. Social Security system as work performed on the mainland, rather than to a separate foreign system. There is no separate international totalization agreement to consider here; U.S. “totalization agreements” apply to coordination between the United States and foreign countries’ social security systems.

In practice, you usually pay into one system—the U.S. Social Security system—and earnings from covered work in Puerto Rico are recorded on your U.S. Social Security earnings record, just like comparable work in a U.S. state. This helps avoid dual social-security taxation and keeps your eligibility for benefits tied to a single system.

Avoiding Dual Contributions: Under the Totalization Agreement, you contribute to Social Security as you would if you were living in the mainland U.S., without needing to pay into a separate system. This avoids the risk of paying into two Social Security systems and ensures that all contributions go toward your U.S. benefits.

Social Security contributions and coverage

For most U.S. citizens working in Puerto Rico, Social Security contributions are straightforward:

- U.S.-based employment: If you’re working for a U.S.-based company while residing in Puerto Rico, you will continue to pay into the U.S. Social Security system as if you were working in the mainland U.S.

- Self-employment or Puerto Rico-based employment: As a self-employed U.S. citizen or an employee of a Puerto Rico-based company, your Social Security contributions also go toward the U.S. Social Security system. Puerto Rico follows the same contribution rates and reporting standards as the mainland U.S.

Combining Social Security credits

One of the most significant benefits of the Totalization Agreement is that it allows U.S. citizens to combine Social Security credits earned in Puerto Rico with credits from work done on the mainland. This is particularly useful if you have a mixed work history between Puerto Rico and other parts of the U.S. mainland.

- Qualifying for benefits: To qualify for U.S. Social Security benefits, you generally need 40 credits (equivalent to about 10 years of work). If you’ve split your time between Puerto Rico and the mainland U.S., the credits you earn in both locations contribute toward meeting the 40-credit requirement.

- Earnings record: All income earned in Puerto Rico that is subject to Social Security tax will be reflected in your U.S. Social Security earnings record, ensuring your Puerto Rico work counts fully toward your eligibility and benefit calculations.

Example: If you work in Puerto Rico for six years and then move to the mainland U.S. and work for another four years, you would meet the 40-credit requirement, as all credits are pooled into the same system.

Claiming Social Security benefits

When it’s time to claim Social Security benefits, you’ll typically receive benefits based on your earnings record in the U.S. system. Here’s how the process works for Puerto Rico residents:

- Standard U.S. benefits: As a U.S. citizen in Puerto Rico, you are eligible for the same Social Security benefits as a mainland resident, provided you meet the credit and eligibility requirements.

- Medicare enrollment: Puerto Rico residents are eligible for Medicare Part A (hospital insurance) at age 65, but enrollment in Medicare Part B (medical insurance) is not automatic. You’ll need to actively enroll in Part B if you want it.

- Filing your claim: You can apply for Social Security benefits through the Social Security Administration (SSA) offices, either in Puerto Rico or online. Your application will be processed in the same way as it would if you lived on the mainland U.S.

Important considerations for Social Security benefits in Puerto Rico

While the Totalization Agreement simplifies Social Security contributions, there are a few important points to keep in mind:

- Self-employed individuals: Self-employed U.S. citizens in Puerto Rico are required to pay self-employment tax, which contributes to both Social Security and Medicare. This is calculated and filed in the same way as if you were self-employed in the mainland U.S.

- Medicare Part B enrollment: Medicare enrollment rules for Puerto Rico residents differ slightly. Residents are automatically enrolled in Medicare Part A but must manually enroll in Medicare Part B if they wish to have coverage for outpatient services.

Puerto Rico tax obligations for U.S. expats

For U.S. citizens living in Puerto Rico, understanding Puerto Rican tax obligations is essential. Although Puerto Rico is a U.S. territory, its tax system operates independently, meaning that U.S. expats who become bona fide residents are generally subject to Puerto Rican taxes on their worldwide income. Here’s a guide to Puerto Rico’s tax system, residency requirements, and what to expect for filing and paying taxes as an expat in Puerto Rico.

Determining Puerto Rican tax residency

In Puerto Rico, tax residency is based on specific criteria, and it’s important to understand whether you meet these requirements. As a U.S. expat in Puerto Rico, you’re generally considered a Puerto Rican tax resident if you meet one of these conditions:

- Physical Presence: You spend 183 days or more in Puerto Rico within a tax year.

- Closer Connection: You demonstrate that Puerto Rico is the main center of your personal, social, and economic life (e.g., having a home, bank accounts, and close family ties in Puerto Rico).

If you qualify as a bona fide Puerto Rico resident under these conditions, you’ll generally be subject to Puerto Rican tax on your worldwide income and may qualify for Puerto Rico’s tax incentives.

Puerto Rico income tax rates

Puerto Rico has a progressive income tax system similar to the mainland U.S., but with slightly different rates and brackets. For Puerto Rico residents, income tax rates range from 7% to 33%, depending on the amount of income earned. Here’s a quick look at the 2024 income tax brackets:

- Up to $9,000: 0%

- $9,000 to $25,000: 7%

- $25,000 to $41,500: 14%

- $41,500 to $61,500: 25%

- Over $61,500: 33%

Example: If your taxable income in Puerto Rico is $70,000, you will pay 33% on the portion above $61,500, along with lower rates on the amounts within each lower bracket.

Note: These brackets are subject to change, so check the Puerto Rico Department of Treasury’s website or consult a tax professional each year to stay updated.

Taxation of Different Types of Income in Puerto Rico

Puerto Rico has specific rules for taxing various types of income, similar to the U.S. but with some notable differences:

- Employment Income: Taxed progressively based on the total amount earned within the tax year.

- Self-Employment Income: Subject to the same progressive tax rates, with potential deductions available for business expenses.

- Investment Income and Capital Gains: Investment income is generally taxed as regular income. However, Puerto Rico’s Act 22 (now part of Act 60) provides tax exemptions on capital gains for certain individual investors who meet residency requirements.

- Dividend Income: Dividends received by Puerto Rican residents are taxed at a flat rate of 15%, though Act 22 incentives may exempt Puerto Rico-sourced dividends for qualified investors.

- Interest Income: Interest from Puerto Rican banks and financial institutions is often exempt, while interest from non-Puerto Rican sources may be taxable under Puerto Rican law.

Example: As a Puerto Rico resident, interest income from a Puerto Rican bank could be tax-exempt, while dividends from U.S.-based investments might be subject to tax unless exempted under Act 22.

Filing requirements and deadlines

For residents of Puerto Rico, the tax year follows the calendar year (January to December), and the filing deadline is April 15. Key filing requirements include:

- Puerto Rico Income Tax Return (Form 482): All Puerto Rico residents must file this return if their income meets the threshold.

- Quarterly Estimated Payments: Self-employed individuals or those with non-wage income may need to make estimated payments quarterly to avoid penalties.

Extensions: Puerto Rico provides extensions similar to the mainland U.S., allowing residents to file later if needed. Extensions do not delay payment deadlines, so taxes owed must be paid by April 15 to avoid penalties and interest.

Puerto Rico tax incentives

Puerto Rico offers unique tax incentives that make it an attractive location for U.S. expats, especially under Act 60 (previously Act 20 and Act 22). These incentives include:

- Act 20 (Export Services Incentive): A 4% tax rate on income generated from Puerto Rico-sourced export services, available to service-based businesses that provide services to clients outside of Puerto Rico.

- Act 22 (Individual Investor Tax Incentive): Allows qualified individual investors to pay zero tax on Puerto Rico-sourced capital gains, dividends, and interest, making it a powerful incentive for high-net-worth individuals who move to Puerto Rico.

- Other Incentives under Act 60: Includes incentives for real estate investors, creative industries, agriculture, and manufacturing. These incentives have specific eligibility requirements and require an application process.

Example: If you are a consultant who provides services to clients in the U.S. from Puerto Rico, you could qualify for Act 20’s 4% tax rate on Puerto Rico-sourced income.

Steps to minimize Puerto Rico tax obligations

To make the most of Puerto Rico’s tax benefits, consider these steps:

- Establish Bona Fide Residency: Spend at least 183 days in Puerto Rico each year and show clear personal and economic ties to Puerto Rico to qualify for residency-based tax incentives.

- Apply for Act 20/22 Benefits: If eligible, apply for Act 20 or Act 22 under Act 60, and work with qualified professionals to help you meet the requirements for these tax advantages.

Keep Detailed Records: Track the days you spend in Puerto Rico, maintain thorough financial records, and document any steps you take to meet residency criteria, as these records may be needed to prove eligibility.

Strategies for reducing federal tax liability

As a U.S. citizen living in Puerto Rico, it’s essential to understand the strategies for reducing federal tax liability. By taking advantage of the island’s unique tax incentives and credits, you can minimize your tax burden and maximize your savings.

Investment income and capital gains

Puerto Rico offers significant tax benefits for U.S. citizens, particularly when it comes to investment income and capital gains. Here’s how you can leverage these benefits to reduce your federal tax liability:

- Act 22 (Individual Investors Incentive): Under Act 22, now part of Act 60, qualified individual investors can enjoy zero tax on Puerto Rico-sourced capital gains. This means that if you relocate to Puerto Rico and meet the bona fide resident requirements, you can potentially eliminate federal taxes on capital gains from investments made after your move.

Example: If you invest in Puerto Rican stocks or real estate after becoming a bona fide resident and later sell these assets at a profit, the capital gains from these sales would be exempt from federal tax. 2. Interest and Dividend Income: Act 22 also provides tax exemptions on certain types of interest and dividend income sourced within Puerto Rico. This can significantly reduce your overall tax liability on investment income.

Example: If you receive dividends from Puerto Rican companies or interest from Puerto Rican banks, these earnings may be exempt from federal taxes, provided you meet the residency requirements. 3. Strategic Investment Planning: To maximize these benefits, consider restructuring your investment portfolio to focus on Puerto Rico-sourced assets. This strategic planning can help you take full advantage of the tax exemptions available under Act 22.

By understanding and utilizing these incentives, you can effectively reduce your federal tax liability on investment income and capital gains while living in Puerto Rico.

Self-employment tax and federal taxes

As a self-employed individual in Puerto Rico, you are required to pay self-employment tax on your net earnings from self-employment. However, you can reduce your self-employment tax liability by taking advantage of the island’s tax incentives and credits. Here’s how:

- Act 20 (Export Services Incentive): If your business provides services to clients outside of Puerto Rico, you may qualify for the Act 20 incentive, which offers a reduced tax rate of 4% on Puerto Rico-sourced income. This can significantly lower your overall tax burden.

Example: If you run a consulting business from Puerto Rico and your clients are based in the mainland U.S., you can benefit from the 4% tax rate on your earnings, reducing your federal tax liability.

2. Deductions and Credits:

Make sure you are taking full advantage of all available deductions and credits. This includes business expenses such as office supplies, travel, and professional services, which can reduce your taxable income and, consequently, your self-employment tax.

3. Bona Fide Resident Status: Establishing and maintaining bona fide resident status in Puerto Rico is crucial. This status allows you to exclude Puerto Rico-sourced income from U.S. federal income tax, further reducing your overall tax liability.

Example: By spending at least 183 days in Puerto Rico and demonstrating that it is your primary place of business and residence, you can qualify as a bona fide resident and benefit from the tax exemptions on Puerto Rico-sourced income.

4. Record Keeping: Maintain detailed records of your business activities, expenses, and time spent in Puerto Rico. This documentation is essential for substantiating your claims and helping you stay compliant with both Puerto Rican and U.S. tax laws.

By leveraging these strategies, self-employed individuals in Puerto Rico can effectively reduce their self-employment tax and federal tax liabilities, maximizing their tax savings while enjoying the benefits of living in this unique U.S. territory.