Florida Residency: Guide for Digital Nomads

The digital age fuels the nomadic lifestyle, blurring the lines between work and wanderlust. Yet, even if you don’t own or rent in the states anymore, traveling freely from AirBnb to Vrbo, there is still something tethering you back home —your legal domicile.

A domicile is more than a residence—it's a legal home base. This concept is pivotal for taxation, voting, and legal matters. Even if you live on a boat in the Atlantic, if you have US citizenship, that means you have a legal domicile in one of the fifty states.

Florida, with its warm climate and friendly policies, is a haven for digital nomads. Its appeal goes beyond its beaches, extending to the ease of establishing it as your domicile.

In the chapters ahead, we'll decode the legal nuances between domicile and residency, delve into Florida's benefits, and guide you step-by-step in making the Sunshine State your legal harbor while you continue to roam the globe.

TLDR:

Understanding the law on domicile and residency

"Domicile" and "residency" might seem like synonyms, but in the legal and financial world, they're as different as night and day.

Knowing the difference isn't trivial for a digital nomad;: it's crucial. It can shape your bank balance, legal status, and tax obligations.

Domicile vs. Residency: distinguishing the two

Domicile is your legal anchor, the core around which your legal existence revolves. It's a long-term commitment to a specific locale that establishes a formal bond between you and that particular jurisdiction.

Conversely, residency is transient, representing your current living situation. For example, someone with multiple homes or who frequently travels could also have multiple residencies. And, while you can have multiple residencies, you can have only one domicile.

Florida domicile vs. Tax residency

Tax residency operates on a different wavelength—it's a snapshot of your current and intended long-term situation, heavily influenced by where you've spent your time during the tax year and where you intend to call home for the long term.

However, because “intent” is unobservable, things like the source of your income and the number of days you've lived in a state play a significant role in demonstrating your intent to make a specific location your tax residency (a/k/a your domicile).

Dual residency and its implications

It's possible to wear the resident tag in more than one state, a scenario dubbed as dual residency. However, the catch is that because you can have only one legal domicile, only one of these legal residencies willmake the cut.

There is no simple rule for determining where your domicile is, and getting “tax residency” isn’t as simple as just getting a driver’s license in that state.

It hinges on where you spend most of your time, where you exercise your voting rights, and the location of your primary residence.

Other factors that play a key role in determining your domicile are things like:

- Where your kids go to school (if you have them);

- Where your dog’s veterinarian is (this was actually the deciding factor in one court case);

- Where you go to the dentist;

- Where most of your valuable assets are; and

- Where your bank, attorney, and insurance carriers believe you are.

Understanding domicile, residency, and tax residency is crucial for making informed decisions on legal roots, tax obligations, and global travel. Mastery of this knowledge helps in leveraging the benefits of nomad-friendly domiciles like Florida.

Benefits of establishing domicile in Florida

The Sunshine State, with its favorable legal and financial framework, practically beckons to digital nomads everywhere to establish it as their domicile.

Here are the advantages that come with making Florida your legal home:

Financial perks:

• No state income tax

Florida joins the elite circle of nine states in the U.S. that say goodbye to state income tax. This can pay major dividends, particularly for those with hefty income streams.

There is a reason wealthy “snowbirds” are known to leave New York for the winter and migrate to Florida – and it’s not the weather.

• Estate tax benefits

With no estate or inheritance taxes to its name, Florida opens up avenues for wealth preservation across generations. It’s a gesture that resonates with a future-forward financial narrative. While nothing protects you from federal estate taxes, domiciling in Florida means there is no additional state estate tax tacked on top.

• Asset protection

In addition, the state is known for robust asset protection laws that shield assets from potential liabilities and financial predators. These laws provide a solid wall of defense against creditor claims targeting personal assets, which is ideal for entrepreneurs, business owners, and professionals with significant legal exposure.

The Florida Homestead Exemption is a cornerstone of asset protection. This exemption protects an unlimited amount of value in a person's home, making it creditor-proof.

Florida's constitution restricts creditors from touching the equity in your homestead property, irrespective of its value. However, this protection extends only to the primary residence, and certain conditions apply.

• Financial privacy

Establishing a domicile in Florida is also a stride toward financial privacy. The jurisdiction of your license, registration, and financial correspondences can be pivotal in preserving your financial confidentiality.

Florida's financial allure is unmistakable. It promises financial serenity and flexibility to digital nomads in particular.

It's a blend of legal ease and financial freedom that sets the stage for a thriving nomadic lifestyle, unburdened by the heavy hand of excessive taxation or asset vulnerabilities.

Nomad-friendliness:

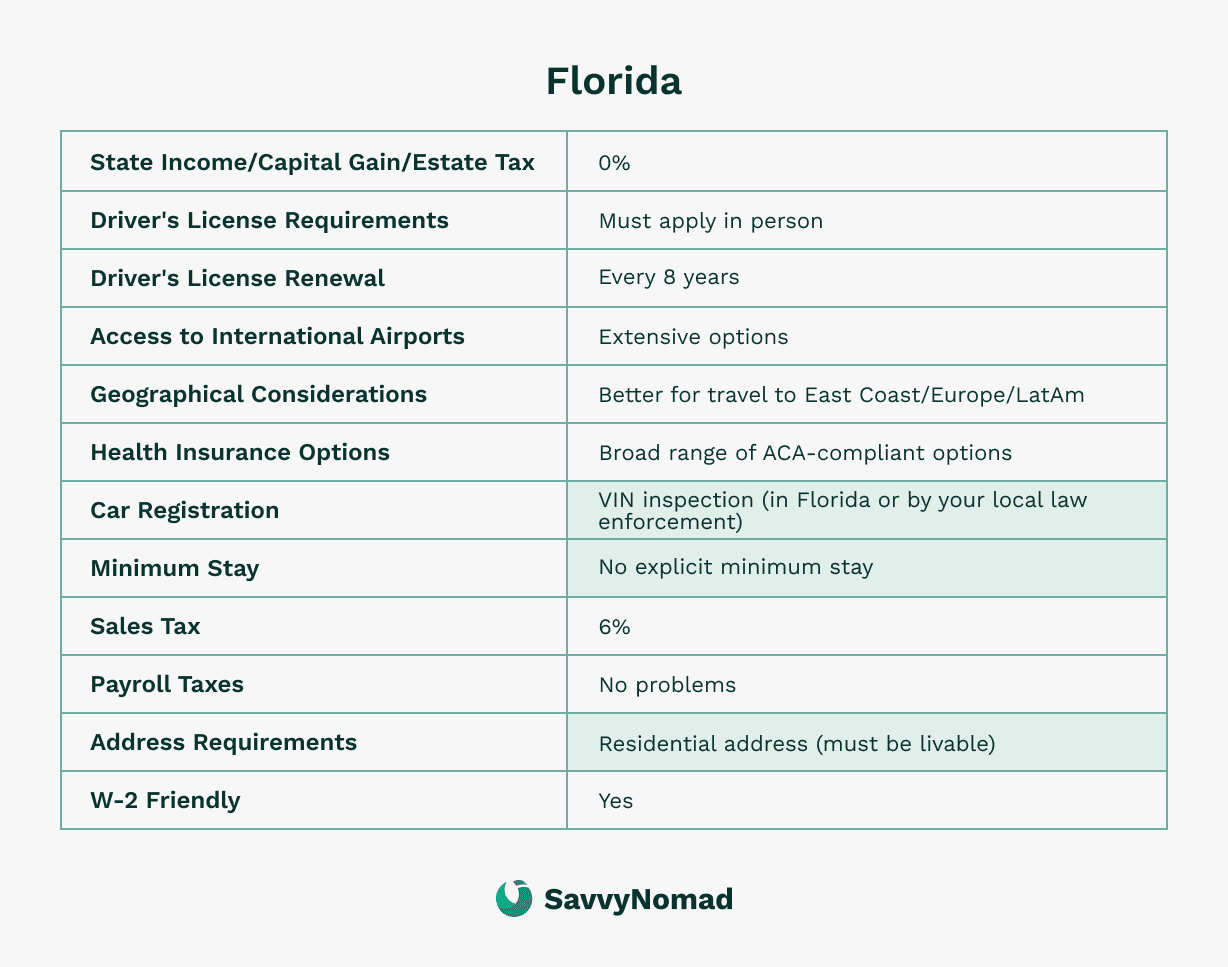

• Ease of establishing legal residency

To make Florida your domicile, you’ll need a Florida driver's license, a Declaration of Domicile, and, if you own a vehicle, Florida vehicle registration (which also requires Florida vehicle insurance).

To prove your real intention to permanently settle in Florida, it is recommended that you obtain a permanent address within the state and inform your employer and other important institutions about your relocation.

Additionally, you may want to register to vote in Florida and start using the state's professionals for any needs you have, such as going to the dentist, seeing doctors, hiring attorneys, etc. This will establish your connection to the state and help demonstrate your intent to make Florida your permanent home.

• Health insurance options

The breadth of ACA-compliant health insurance options in Florida outstrips that of South Dakota and many other nomad-friendly states, providing you with good options for health coverage moving forward.

• Geographical advantages

If your travels frequently take you to the East Coast, Europe, the Caribbean or Central or South America, Florida’s geographical location will be a big plus. Its international airports are gateways to many destinations, offering some of the widest arrays of flight options around.

The decision to drop anchor in Florida offers more than just financial advantages; it's a holistic approach to embracing the nomadic lifestyle. It aligns with not just the wallets of digital nomads but also aligns well with their lifestyle and healthcare requirements, making Florida a compelling case for your domicile.

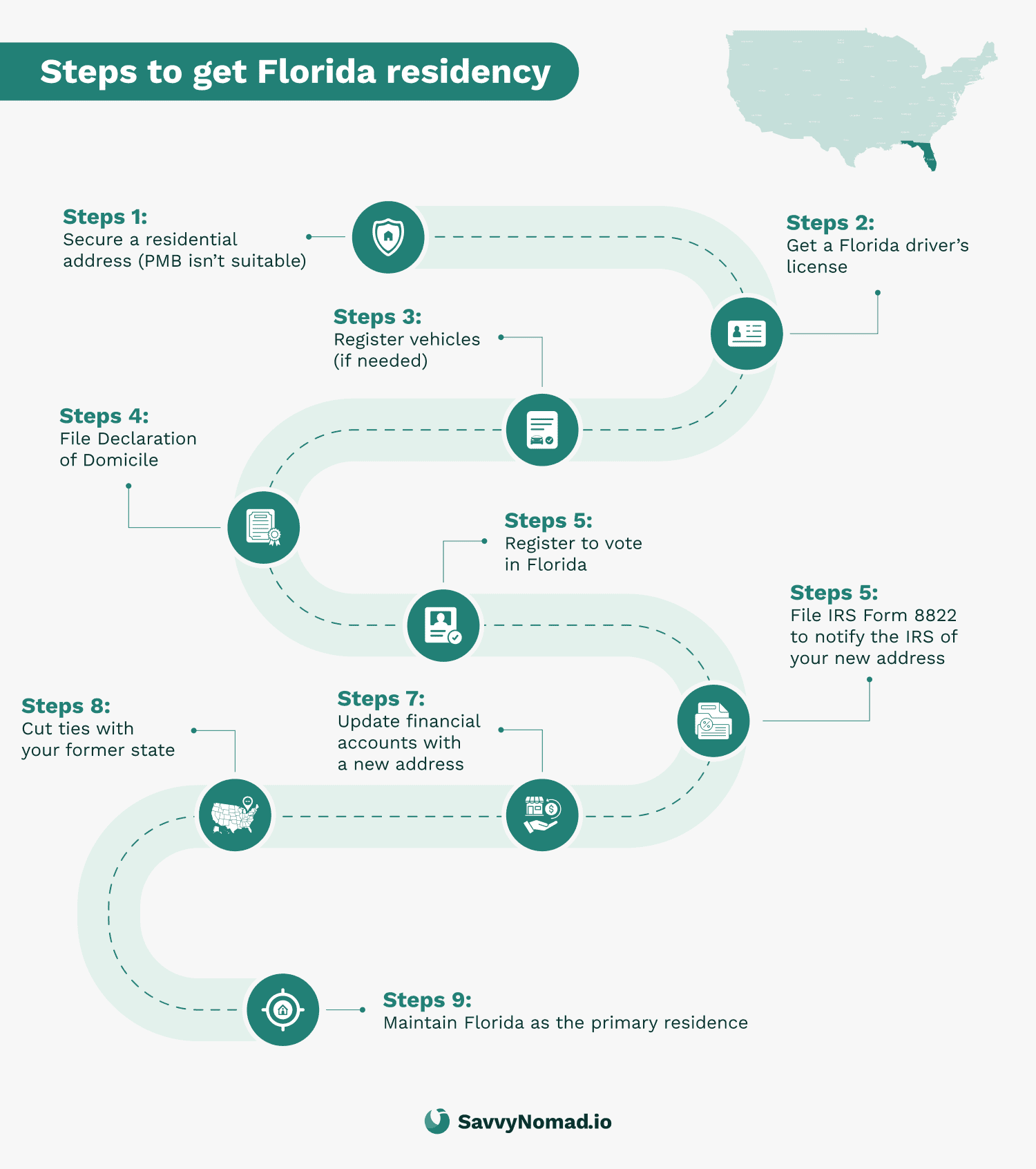

Steps to establishing domicile in Florida

Establishing a domicile in Florida involves several steps to demonstrate your intent to make the state your legal home.

Here's a structured breakdown of the process:

1) Secure a Florida address

The cornerstone of establishing a domicile is securing a residential address in Florida, eitherr rented or owned. If renting a true apartment or home that will sit empty for an extended period is beyond your means or seems like overkill, a mail-forwarding service address is a viable alternative.

However, ensure the mailbox you rent is not just a PO box but a bona fide physical address. If you don’t know, the company’s support staff should be able to answer this question for you.

2) Obtain a Florida driver’s license

It’s important to get a Florida driver's license or state ID. The act of surrendering your former state’s driver’s license is a simple yet significant outward demonstration of your intent to put down roots in Florida.

3) Register your vehicle(s) in Florida

If you own any cars or boats, registering them in Florida is very important to show long-term intent to domicile. This step also means that you must get new Florida vehicle insurance from a Florida-licensed insurance agent.

4) File a declaration of domicile

Filing a Florida declaration form (Florida Declaration of Domicile) in your new county is a recognized but not mandatory way to show your domicile has changed to Florida.

Signing this form (under oath, before a notary public) is especially beneficial when you want to clearly establish Florida as your primary home for legal purposes, such as taxes and estate planning.

5) Voter registration

Register as a voter in Florida. This is a significant leap that shows your intent and willingness to integrate into the state’s social and legal fabric.

6) File IRS Form 8822

Finally, it is important to update your federal records by filing Form 8822 with the IRS.

This form officially notifies the IRS of your change of address, ensuring consistency across your state and federal documentation and that you continue to receive important correspondence about your federal taxes.

Filing the form in a timely manner is crucial in affirming your new domicile for tax purposes.

7) Update financial accounts

Update the address on your bank and investment accounts, making them your new Florida address.

8) Maintain Florida as your primary place of residence

Florida has no clear-cut minimum number of days you must spend in Florida to make it your domicile. However, designating it as it your primary residence in third-party and official records bolsters your intent to makeFlorida your home base on a go-forward basis.

Each step forms a stitch in alarger legal and financial fabric, demonstrating that while you travel around the country and wider world as a nomad, Florida is still where you call home. Although the process requires an investment of time and resources, the benefits awaiting you at the end will surely make it all worthwhile.

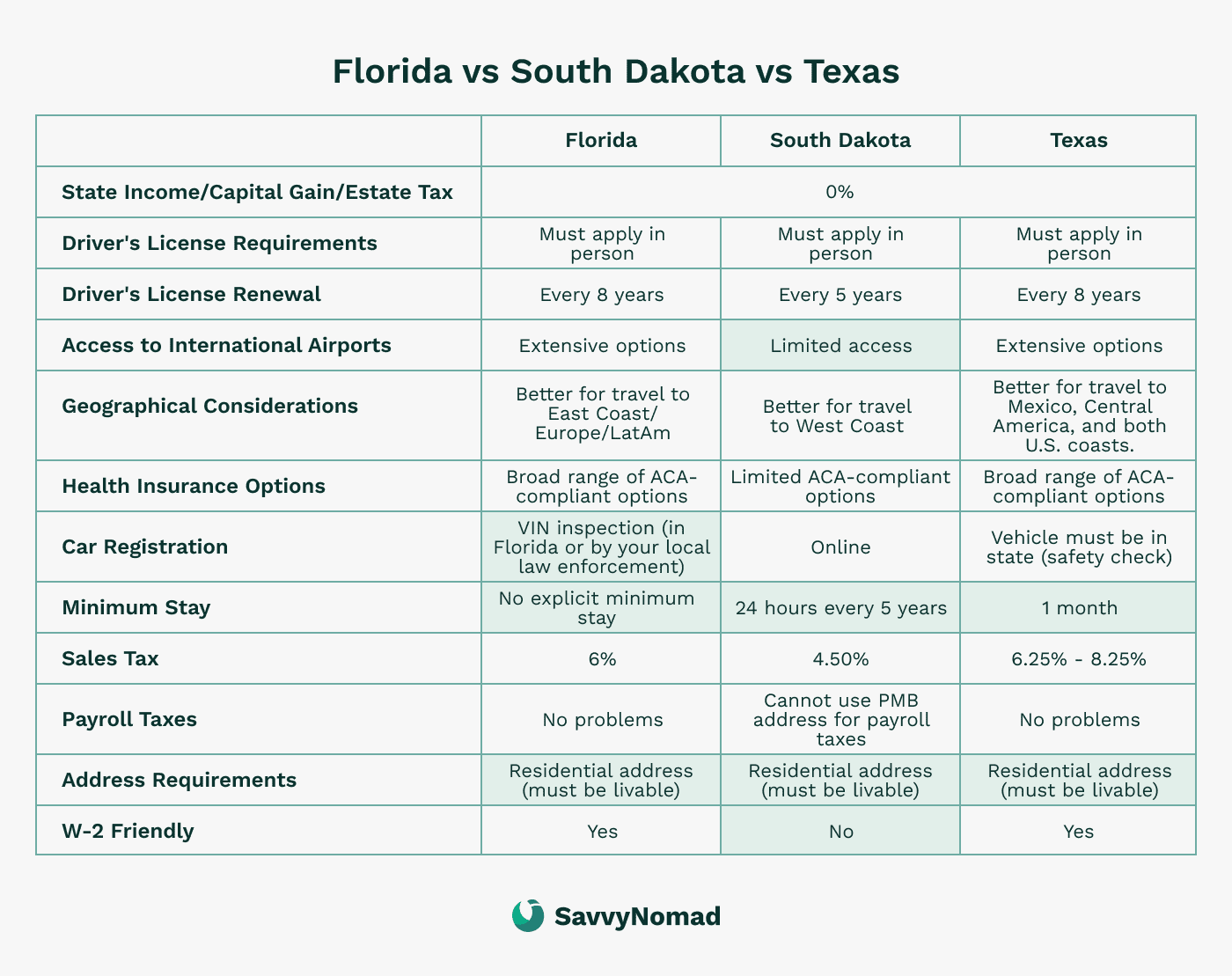

Florida vs South Dakota vs Texas Domiciles

Florida, Texas, and South Dakota all offer a sanctuary from state income tax. The importance of this, and its value to your future savings and financial freedom, can’t be overstated. When you combine this with city and local taxes, consistent across almost every other state in the US, you could be saving more than 20% of your annual income.

• No state income tax

Florida, Texas, and South Dakota all offer a sanctuary from state income tax. The importance of this and its value to your future savings and financial freedom can’t be downplayed. When you combine this with city and local taxes, consistent across almost every other state in the US, you could be saving over 20% of your annual income.

• Ease of establishing domicile

In terms of legal barriers and residency requirements to officially domicile in Florida and South Dakota, it’s incredibly simple. That said, Texas isn’t much more work, either.

South Dakota expedites its residency requirements: stay in South Dakota for just one night (with a receipt from a hotel or campground as proof), and, together with your personal mailbox address, that’s enough proof to get your South Dakota driver’s license.

• Estate tax

The lack of estate taxes in these states carries important consequences for legacy planning, preserving more wealth for future generations.

• Asset protection laws

Florida and Texas have strong asset protection laws, with South Dakota having favorable laws, just not quite as pronounced.

• Geographical advantages

Geographically, Florida caters well to nomads who spend most of their time on the East Coast, Europe, the Caribbean, or Central or South America. Texas is more centrally based, putting it further out of the way unless you’re coming from Mexico.

On the other hand, South Dakota doesn’t really have a leg up in any direction.

• Health insurance options

Florida has a wider menu of ACA-compliant health insurance options available than does South Dakota, which can potentially carry significant weight, depending on your circumstances.

• Vehicle registration and inspection

In terms of convenience, Texas clearly loses in this department. By requiring an in-state safety inspection annually, frequent travelers could face an annual road trip back to Texas.

Although the state does have a deferral process that allows you to push this off until you’re back in the state with your vehicle (e.g., for RVers), relying on a deferral for multiple consecutive years is uncharted territory.

In South Dakota, on the other hand, it’s about as easy as possible to register your vehicle. You can basically do the entire process online without needing to have the vehicle within the state. Fill out some forms, get the title to the county treasurer’s office, and that’s about it.

Florida is a middle ground. You don’t need to have your vehicle within the state of Florida to get it registered, but you do need to have the VIN physically inspected by a law enforcement officer, military police officer, or a DMV examiner, either in Florida or in your county.

FAQ

What are two proofs of residency in Florida?

Florida drivers who are applying for a driver's license must present two proofs of address. For a standard driver's license (what 99% of residents want), you can use any two items of mail with your name and Florida address on them (even junk mail). In fact, these two proofs don't even need to be pieces of mail – they can be digital invoices that you have simply printed out.

Some commonly used items are listed below:

- Recent cellular or landline telephone bill (must be dated within the last 30 to 60 days)

- Current Florida voter registration card

- A recent lease or rental agreement for the residence with a term of 6 months or greater in the name of the driver (must be dated within the last 6 months)

- Florida vehicle and vessel registration or title

- Current homeowner’s insurance policy or bill

- Current utility bill

- Recent internet service provider bill (must be dated within the last 30 to 60 days)

- Latest property tax bill

- Mortgage deed for property in Florida

- Latest W-2 form or 1099 form (must be dated within the last 6 months)

- Recent bank statement (must be dated within the last 60 days)

- Recent credit card statement (must be dated within the last 60 days)

- Latest military orders or documents

- Recent pay stub (must be dated within the last 60 days)

- Recent official government documents (must be dated within the last 60 days)

Who needs to file a declaration of domicile in Florida?

Any person who lives in Florida and intends to make it their permanent home can file a Declaration of Domicile.

This legal document is particularly useful for those moving to Florida from another state or country. It serves as a formal declaration, signed under oath before a notary public, of their intent to maintain Florida as their primary and permanent residence.

What is the 183-day rule in Florida?

Florida does not use the 183-day rule to determine residency. It's a standard used by other states to define your tax residence as the state in which you spend more than half of the year (meaning at least 183 days).

To establish residency in Florida, you need only demonstrate an intent to make Florida your permanent home.

However, the state you're leaving could challenge your claim of Florida residency by invoking the 183-day rule, if you spent at least 183 days in that state.

How long must you live in Florida to apply for a driver’s license?

To apply for a driver's license in Florida, you must establish residency in the state. As a new Florida resident, you must apply for a valid Florida driver's license within 30 days of establishing residency.

What is the fastest way to become a resident of Florida?

Digital nomads and expats who want to establish Florida residency quickly can use a domicile service like SavvyNomad.io. This service provides a street address in Florida that satisfies legal requirements as a residential address.

To establish residency, you must secure a residential address in the state, obtain a Florida driver's license or state ID, register vehicles, file a Declaration of Domicile, register to vote, and update the address on your financial accounts.

Can you have more than one residence in Florida?

Yes, it is possible to have more than one residence in Florida. While an individual can have multiple residences, they can have only one domicile, which is considered their permanent home.

Each residence serves as a place of residence, but only one can be designated as the domicile, which is legally significant in determining residency status and tax obligations.

Is Florida a dual residency state?

Florida is not a dual residency state.

Federal law does not recognize dual residency meaning individuals must establish legal resident status in only one state, regardless of how many properties they own.

While individuals can own multiple residences, only one can be designated as their domicile, which is their permanent home.

Conclusion

Establishing a domicile in a state that aligns with your financial and lifestyle goals requires thorough consideration and planning. Florida, with its tax-friendly policies, ease of establishing domicile, reasonable vehicle registration process, and geographical advantages, presents a compelling option for digital nomads and remote workers.

Florida's lack of state income tax, favorable asset protection laws, and absence of estate tax are significant financial benefits. The straightforward process of establishing domicile, coupled with its geographical location, makes it an attractive choice for those who frequently travel to the East Coast, Europe, or Central or South America.

Choosing where to establish domicile is a significant and highly personal choice with far-reaching financial and legal implications. It's advisable to consult with legal and tax professionals to understand the implications of your personal circumstances on this decision.