A Simple Guide to California Residency Rules

Understanding California’s residency laws is crucial whether you're moving to the state, leaving, or living abroad as an expat.

Your residency status affects your state tax responsibilities, eligibility for in-state tuition, and legal considerations. California's residency laws are complex, so this guide will clarify what it means to be a resident, how residency is defined, and the factors that determine your tax obligations.

We'll also address special rules for expats and those splitting time between California and another state, helping you confidently manage your residency status.

Defining California residency: what you need to know

In California, understanding the difference between residency and domicile is key to knowing where you stand. The state looks at more than just where you spend your time—it cares about your intent and where your life is centered. Let’s break it down:

What qualifies you as a California resident?

California considers you a resident if you’re present in the state for more than a temporary or transitory purpose. But what does that mean? If you’re here for an extended period, working, living, or making California your home base—even if you spend some time out of state—you might be classified as a resident.

Here are some common factors the state looks at:

- Physical presence: If you spend a significant amount of time in California (over 6 months), it's a strong sign you may be a resident.

- Intent: If you intend to stay in California, meaning you’ve set up your life here (e.g., you bought or rent a home, registered to vote, or obtained a California driver’s license), the state might view you as a resident.

- Domicile vs. Residency: Domicile refers to the place you consider your permanent home, while residency is where you are currently living. It’s possible to be domiciled in California but not physically live here, and the state might still consider you a resident for tax purposes.

What makes you a non-resident?

On the flip side, you’re considered a non-resident if your presence in California is brief, for business or vacation, or if you’ve established your life in another state or country.

However, even as a non-resident, you might still owe taxes on income earned within the state, like from property rentals or a job based in California.

Can you be a resident of two states?

California is very strict about this: they don't generally allow dual residency. If you're maintaining significant ties to California, the state might still claim you as a resident even if you're trying to establish residency elsewhere.

This means you may have to prove you’ve severed ties with California if you want to avoid being taxed as a resident.

Determining residency status: key factors California considers

Now that we’ve defined what it means to be a California resident, let’s dive deeper into the factors that the state uses to determine your residency status. It’s not just about how many days you spend in California—the state looks at the bigger picture to decide where your “life” is really based.

The physical presence test: does the 183-day rule apply?

You may have heard of the “183-day rule,” which is often mentioned when discussing residency. In some states, spending more than 183 days (or about six months) in the state automatically makes you a resident. However, California doesn’t have a hard-and-fast 183-day rule. Instead, the state looks at the total time spent in California combined with other factors.

While spending more than 183 days in California could trigger a closer look, you won’t automatically become a resident just because you crossed that line. What really matters is your intent and how connected your life is to the state. If California is your home base, even if you spend less than 183 days here, you might still be considered a resident.

California’s 546-day foreign-employment safe harbor (temporary nonresident rule)

Suppose you’re absent from California under an employment contract for at least 546 consecutive days, and your visits back to California are 45 days or fewer in each calendar year. In that case, California generally treats you as a temporary nonresident for that assignment.

The rule is respected in practice when followed precisely, but documentation is everything.

This safe harbor does not change your California domicile—it only protects you during the foreign assignment, and it’s best suited for defined 18–24-month projects where you plan to return afterward.

Eligibility checklist (must meet all):

- You are outside California under an employment contract.

- Your absence lasts ≥546 consecutive days.

- Your California visits total ≤45 days per calendar year during that period.

Documentation to keep (audit-ready):

- Signed employment contract covering the foreign assignment.

- Flight/passport records showing continuous foreign presence.

- Foreign housing lease/deed (or similar) for the assignment period.

Common audit pitfalls:

- Short breaks or gaps that interrupt the 546-day continuity.

- Inconsistent travel logs or missing third-party proof.

- Exceeding the 45-day CA-visit limit in any calendar year.

Not for indefinite moves:

This safe harbor does not end domicile. If your move becomes long-term or open-ended, consider ending California domicile by establishing a new domicile in another state or abroad; once you’ve re-domiciled elsewhere, you no longer need contract or day-count tracking.

Intent to remain: Are you really planning to stay?

One of the most important factors in determining residency is your intent to remain in California. Even if you’re spending time elsewhere, if California is where you plan to return after your travels or temporary stays out of state, you could be considered a resident.

Here’s how California evaluates your intent:

- Voter registration: If you’re registered to vote in California, it’s a strong signal that you treat it as home. It’s only one factor, though — a supporting indicator, not determinative on its own.

- Driver’s license: If you have a California driver’s license, it shows you intend to remain in the state.

- Home ownership: Owning or renting a house in California is a big indicator that you consider it home.

- Family and financial ties: If your family lives in California or your financial accounts and investments are based there, that’s another sign of intent to stay.

To be considered a non-resident, you need to show that your ties to California are temporary and that you’ve taken steps to establish a permanent life elsewhere.

Temporary or transitory presence: just passing through?

You’re considered a non-resident if you’re in California for a temporary or transitory purpose. This means your time here is short-term, like a business trip, vacation, or a temporary assignment.

However, even if you’re here temporarily, it’s important to be cautious. If you take steps that suggest you’re settling down—like getting a lease, registering a car, or enrolling your kids in school—the state might argue that your presence is no longer “temporary” and that you’re becoming a resident.

How long do you have to live in California to establish residency?

There’s no set number of days that automatically makes you a resident in California, but typically, if you spend 6 months or more in the state and take steps that show you intend to make California your home, you could be considered a resident.

To start obtaining California residency, you should follow general guidelines such as securing a place to live, registering your vehicle, and getting a California driver's license.

On the flip side, if you’re trying to establish residency for benefits like in-state tuition, you’ll need to show that you’ve lived in California for at least one year with the intent to remain.

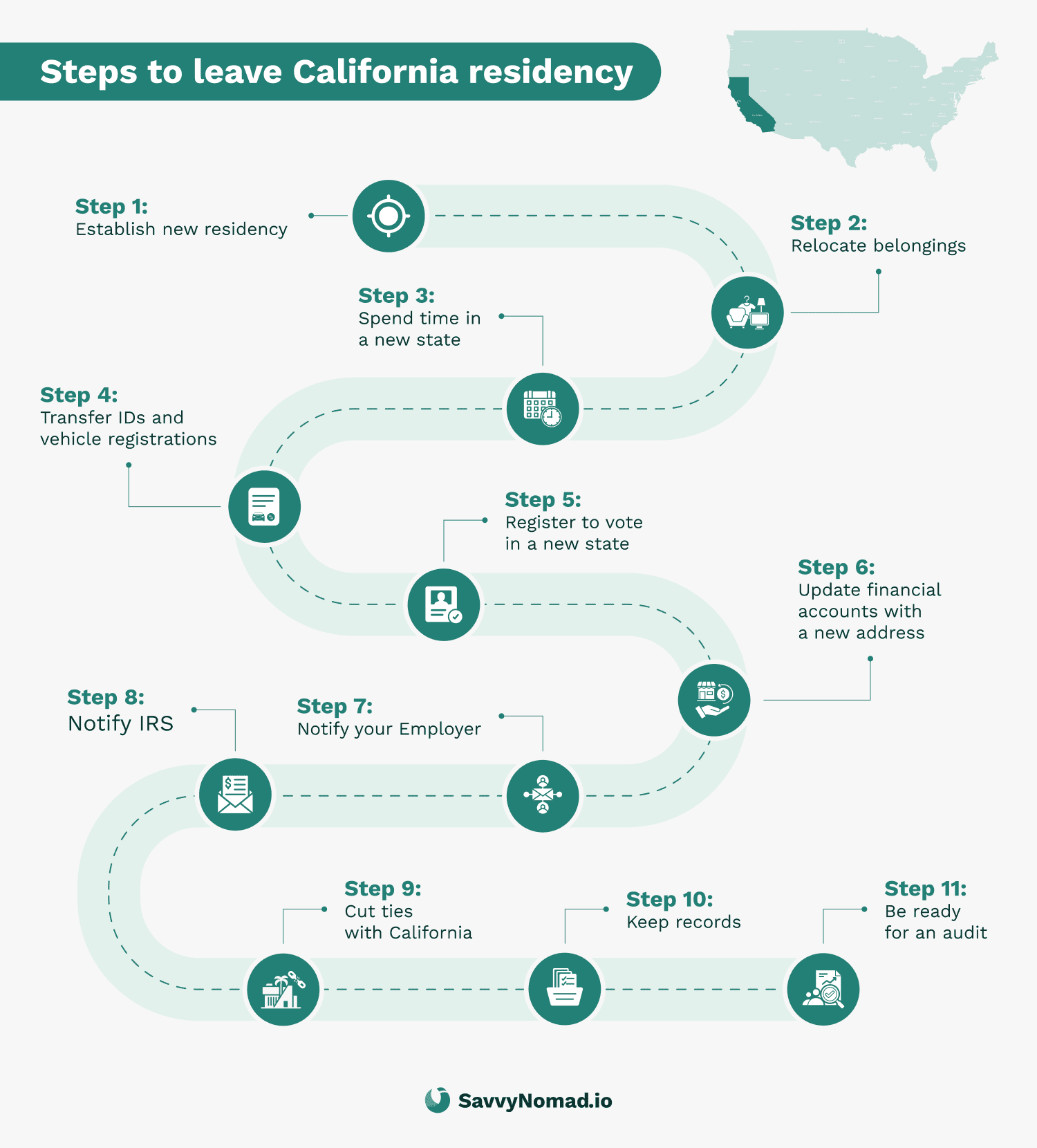

How to leave California residency?

To stop being treated as a California resident for tax purposes, you generally need either (1) to qualify under a narrow temporary nonresident rule (like the 546-day foreign-employment safe harbor), or (2) to end California domicile by establishing a new domicile in another U.S. state or in a foreign country. In practice, California will look at the full pattern of your facts — no single step or checklist guarantees a particular outcome.

For most long-term movers, ending domicile elsewhere is simpler to defend than tracking days under a temporary nonresident rule—and once your new domicile is established, you no longer need contract or day-count tracking.

1) Establish new residency

There are two clean exit paths from California:

A) Re-domicile to another U.S. state (commonly a Category 3 state with clear exit mechanics or no income tax—e.g., Florida). This route is widely used by expats because these states often offer predictable nonresident rules or lower/no income tax, which can make defending a new domicile more straightforward once it is actually established in practice.

B) Establish foreign domicile (for open-ended moves abroad). This is viable, but it’s more documentation-intensive than a Florida move and is examined closely by California (and New York). Expect to show immigration status (visa/residency permit), a foreign lease/deed, a foreign tax ID/certificate, and banking/ID changes that reflect an intent to remain abroad.

By contrast, re-domiciling to Florida (or another Category 3 state) provides predictable nonresident mechanics with less international paperwork.

Which should you pick?

- Going to another U.S. state (e.g., Florida) is usually easier and more predictable for long-term movers; it avoids immigration hurdles and international documentation while giving you clear nonresident mechanics or no income tax.

- Going foreign is viable when your life is truly shifting abroad—but be ready for more documentation and closer scrutiny. Once foreign (or state) domicile is established, you don’t need safe-harbor day tracking.

To terminate your residency in California and move to a different state, the first step is to secure a residential address in your new location. Whether you decide to buy or lease a home, it’s essential to show that you have made a permanent move.

For instance, some states, like Florida, offer property tax credits, such as the homestead exemption, which can help demonstrate your intent to establish residency.

Filing a Declaration of Domicile is another key step, as it formalizes your intent to make the new state your permanent home.

2) Relocate your belongings

Move your personal and valuable possessions out of California to your new home. Keep detailed records, including receipts for moving services or storage facilities, as these will be essential proof of your relocation.

Remember, California may scrutinize your move, so having documented evidence that you’ve moved your belongings out of the state will support your claim of terminating residency.

3) Spend time in your new state

The more time you spend in your new state, the easier it will be to show that you’ve genuinely moved. While some people may only visit long enough to get a driver’s license, it’s best to spend as much time as possible in your new state to solidify your status.

California can challenge your claim if you regularly return to the state, so prioritize time spent in your new state to demonstrate that you’ve made it your home.

4) Transfer IDs and registrations

Immediately update your driver’s license and vehicle registration to your new state. California views these as significant indicators of residency, and keeping your California driver’s license can imply that you still consider it home.

Make sure to complete this step as soon as possible after relocating to show that you’ve committed to your new state.

5) Register to vote

Register to vote in your new state and cancel your California voter registration. Voter registration is a strong supporting indicator of residency, but it’s considered together with many other factors — it doesn’t, by itself, decide your tax status.

6) Integrate into the community

Engaging in local activities and building relationships in your new state helps reinforce your commitment to living there. Join local organizations, find professionals like doctors or dentists, and become involved in the community.

This integration is more than just social—it serves as proof that you’ve fully transitioned your life to your new state.

7) Update all documents

Make sure that your identification, medical records, insurance policies, and financial documents reflect your new address. This includes updating your address with banks, credit cards, and insurance companies.

By consistently using your new state address on all official documents, you reinforce your claim that you’re no longer a California resident.

8) Notify your employer

Inform your employer of your move and ensure your payroll reflects your new state residency. You should also file Form 8822 with the IRS to notify them of your address change. This step is crucial for both federal and state tax purposes.

Ensure that all other personal and professional entities (like accountants or financial advisors) are also informed of your relocation.

9) Notify the IRS

In addition to notifying your employer, formally update your address with the IRS by filing Form 8822. This is an important step in documenting your move for tax purposes and helps avoid confusion during tax filing.

Extend this notification to any other financial institutions or government agencies that require an updated address.

10) Keep records

Document every step of your relocation carefully. Keep receipts, contracts, utility bills, and legal documents that show you’ve moved your residence, established domicile in a new state, and severed ties with California.

These records will be essential if you ever need to prove to the California Franchise Tax Board (FTB) that your move is permanent.

11) Acknowledge key factors

The FTB considers multiple factors when determining your residency, including where your home is, the amount of time spent in each location, your business ties, and where your family and personal belongings are located.

Make sure you feel confident about where you stand on these factors. For instance, if you still own a home in California, ensure it’s rented out or treated as a secondary property, not your primary residence.

12) Anticipate an audit

Be prepared for a possible residency audit by the FTB. They may challenge your claim of non-residency, especially if you have significant ties to California.

To be audit-ready, keep thorough documentation of your move, including records of your new home, financial activity in your new state, and evidence that you’ve severed ties with California.

Methodically following these steps can help you build a stronger factual record to support a non-resident position and may reduce the risk of California challenging your status after you move, but no particular tax or residency outcome is guaranteed.

Residency for American expats: navigating California rules while abroad

If you're an American expat who's left California to live overseas, it's important to understand how California residency laws still apply to you. Just because you're living outside the country doesn't necessarily mean you're off the hook for California taxes. Here's what you need to know.

Retaining California domicile while living abroad

Even if you’re living abroad, California can still consider you a resident for tax purposes if you haven’t officially changed your domicile. Domicile is your permanent home—the place you intend to return to after being away. If California is your domicile, you may still be required to file state taxes, even if you’ve spent most or all of the year abroad.

To be classified as a non-resident, you’ll need to show that your move abroad is permanent or that you have established a new domicile in another country. This requires more than just spending time away—you’ll need to sever ties to California, like changing your driver’s license, selling or renting out your home, and updating your voter registration.

Tax obligations for expats: California taxes on worldwide income

California has a reputation for being aggressive when it comes to collecting taxes from its residents. If you’re a California resident living abroad, you’re still subject to California taxes on your worldwide income—not just income earned within the state. This includes wages, investment income, and any other sources of revenue, even if they come from outside the U.S.

You’ll also need to keep up with reporting requirements, like filing the California state tax return and possibly paying estimated taxes throughout the year. If you’ve retained ties to California (like owning property or having a California mailing address), the state might argue that you’re still a resident.

Changing domicile to another state

If you’re serious about cutting ties with California to avoid being taxed as a resident, you’ll need to take active steps to change your domicile. This means establishing a new permanent home in another state or country. Here’s how you can demonstrate this change:

- Sell or rent out your California property: Keeping a home in California can indicate that you plan to return.

- Move your financial accounts: Relocate your banking and investment accounts to your new state or country.

- Update legal documents: Change your driver’s license, voter registration, and mailing address to reflect your new residence.

It’s also a good idea to keep thorough records and documentation to show that your move is permanent, especially if the state ever questions your non-residency status.

Special considerations for expats moving abroad

While moving abroad may help reduce your overall U.S. tax burden, California can still challenge your non-residency status if you haven’t adequately cut ties. Here are a few additional tips for expats:

- Be cautious with short visits to California: Spending too much time in California, even for vacations or family visits, could raise a red flag.

- Avoid maintaining significant financial or social ties: Anything that suggests California is still your primary home (like keeping close family or business ties) could affect your residency status.

Residency for education purposes: establishing in-state tuition eligibility

California residency isn’t just about taxes—it also affects students who want to qualify for in-state tuition at public universities. For federal income tax purposes, dependent children of military members can be considered residents if they are dependents for tax purposes, linking tax status to residency determination.

The rules for establishing residency for tuition purposes are different from those related to tax residency, and universities have their own set of criteria to determine whether you’re eligible for lower tuition rates.

For students under 24, there is a financial independence requirement, which involves proving total self-sufficiency for one year prior to the residency determination. Let’s break it down.

To qualify for in-state tuition, you must be a permanent resident or have a specific immigration status that allows you to establish residency. Additionally, you need to be physically present in California for at least 366 days and demonstrate intent to make the state your permanent home. The residence determination date is crucial as it serves as a benchmark for demonstrating physical presence and intent to remain in California.

The process of resident classification involves meeting various residency requirements within specified time frames to be officially recognized as a California resident for tuition purposes. Achieving resident status has significant implications for in-state tuition and financial aid eligibility, as it determines whether you qualify for lower tuition rates and certain financial benefits.

Criteria for in-state tuition eligibility

To qualify for in-state tuition, you typically need to prove that you’ve lived in California for at least one year before the academic year begins. But it’s not just about time—universities look for clear signs that you’ve made California your permanent home.

Here’s what institutions may consider:

- Physical presence: You need to have lived in California for at least 12 months before the school term starts. You also need to show that you’ve been present in the state for non-educational purposes, meaning that you didn’t move to California solely to attend school.

- Intent to remain in California: Universities will look at actions that demonstrate your commitment to staying in California long-term. This includes registering to vote, getting a California driver's license, and paying state income taxes.

Financial independence requirements for students

If you’re an undergraduate student under the age of 24, schools may also require you to show financial independence to qualify for in-state tuition. This means you need to prove that you’re not financially dependent on your parents, especially if your parents live out of state.

Financial independence criteria might include:

- Showing that you’ve been self-supporting for a certain period of time

- Filing California state tax returns as an independent taxpayer

- Not being claimed as a dependent on your parents’ tax returns

Graduate students usually have a little more flexibility, but they still need to prove that they intend to remain in California after completing their studies.

Impact of immigration status on residency for tuition

Immigration status can also affect whether you qualify for in-state tuition. Students with certain visas may not be eligible to establish residency. However, under California’s AB 540 law, some undocumented students who meet specific criteria can qualify for in-state tuition rates, even if they’re not U.S. citizens or permanent residents.

Eligible students must:

- Have attended a California high school for at least three years

- Graduate from a California high school or receive an equivalent diploma

- File an affidavit with the university stating that they will apply for legal residency as soon as they’re eligible

Evidence of residency for students

To prove residency for tuition purposes, you’ll need to provide the university with documentation. Here are some common forms of proof:

- Lease agreements or mortgage statements showing that you’ve lived in California for at least one year

- Utility bills or other records that demonstrate physical presence in the state

- California voter registration, driver’s license, or state ID

- California tax returns or employment records

Keep in mind that universities may ask for additional evidence if there’s any question about whether your move to California was temporary or solely for education.

Tax implications of residency: what you owe as a California resident, non-resident, or part-year resident

Your residency status plays a huge role in determining how much tax you owe in California. Whether you’re a full-year resident, a part-year resident, or a non-resident, the state will tax you differently depending on where your income comes from and how long you’ve been in California.

Full-year residents: taxation of worldwide income

If you’re classified as a full-year resident of California, the state taxes you on your worldwide income. This means you must report all income you earn, no matter where it comes from—whether it’s wages from a California employer, investment income from outside the state, or income from abroad.

Key points to remember:

- California taxes all of your income, regardless of whether it’s earned inside or outside the state.

- You’ll need to file a California tax return and report your full income for the year, even if a portion of it was earned while you were traveling or working in another state.

- Credits may be available to help avoid double taxation if you’ve paid income taxes to another state or country.

Non-residents: taxation of California-sourced income

If you’re a non-resident but you earn income that’s tied to California, you’re still on the hook for California taxes—but only on income earned within the state.

Here’s how it works:

- California-sourced income includes things like wages from a job in California, income from California rental properties, or earnings from a California business.

- As a non-resident, you don’t need to report income earned in other states or countries.

- You’ll file a California Nonresident or Part-Year Resident Income Tax Return (Form 540NR) to report and pay taxes on your California income.

Part-year residents: how to allocate income

If you move into or out of California during the year, you’ll be considered a part-year resident. This means you’ll need to report:

- All income you earned while you were a resident of California, including worldwide income.

- California-sourced income for the portion of the year you were a non-resident.

When filing your California tax return, you’ll use Form 540NR to report income for the months you were a California resident and allocate any non-resident income from California sources accordingly.

Avoiding double taxation: credits and deductions

If you’re a California resident earning income in another state or country, you might be worried about paying taxes twice—once to California and once to the other state or country. Fortunately, California offers tax credits to help offset double taxation.

Here’s how you can avoid double taxation:

- State-to-state credits: If you’ve paid taxes on income to another state, you can claim a credit for those taxes on your California return.

- Foreign income: If you’ve paid taxes to a foreign country, California may allow you to claim credits for foreign taxes, as long as you’ve already included that income on your California return.

It’s important to keep careful records of any taxes paid to other states or countries to claim these credits and avoid paying more than you owe.

Factors considered by the California Franchise Tax Board (FTB): how the state determines your residency

The California Franchise Tax Board (FTB) is the agency that determines your residency status for California tax purposes. They use a variety of factors to decide whether you’re a full-time resident, part-year resident, or non-resident, and understanding these factors can help you avoid any surprises when it comes to your tax bill. Let’s look at the key things the FTB evaluates.

Time spent inside vs. outside California

One of the most important factors the FTB considers is the amount of time you spend in California versus time spent in other states or countries. Although California doesn’t have a strict 183-day rule like other states, the more time you spend in California, the more likely the state will consider you a resident.

- More than 183 days: Spending more than half the year in California can trigger residency, but time alone isn’t the only deciding factor.

- Shorter stays: Even if you spend fewer than 183 days in California, if other factors show that your life is centered in the state, you could still be considered a resident.

Location of family and dependents

Where your family lives is another strong indicator of your residency status. If your spouse, children, or other dependents live in California while you’re working or living elsewhere, the FTB may argue that California is your true home.

- Family ties: If your family is based in California and you return to them after temporary absences, the state might view this as a sign of residency.

- Separation: On the other hand, if you’ve relocated your family out of state and taken steps to sever your California ties, this could help establish non-residency.

Property ownership and principal residence

Owning property in California, especially if it’s your principal residence, is another major factor. Even if you only spend part of the year in California, owning a home that’s considered your main residence can make you a resident in the state’s eyes.

- Owning vs. renting: Owning a house can carry more weight than renting, but even leasing a home can suggest residency if it’s where you primarily live.

- Vacation homes: Owning a vacation home in California may not automatically make you a resident, but if you spend substantial time there and keep personal items, it can contribute to your residency determination.

State of driver’s license and vehicle registration

Where your driver’s license is issued and where your vehicles are registered are strong indicators of residency. California residents are required to have a California driver’s license and register their vehicles in the state.

- California driver’s license: If you hold a California driver’s license, it signals to the state that you consider California your home.

- Vehicle registration: Registering your car in California can be a sign of residency. If your car is registered in another state but you’re driving it regularly in California, the state may question your status.

Voter registration and participation

Being registered to vote in California or regularly participating in California elections is a clear signal that you consider yourself a resident.

- Voter registration: If you’re registered to vote in California, this suggests that you consider it your permanent home.

- Voting in other states: Registering to vote in another state can help demonstrate that you’ve changed your domicile and intend to make that state your home.

Financial and social ties

The FTB will also look at where your financial and social ties are based. This includes where you bank, where you receive mail, and where you participate in community or social activities.

- Banking and investments: Having significant financial accounts or investments in California can indicate residency, especially if you maintain those accounts while living elsewhere.

- Community involvement: If you’re a member of clubs, organizations, or religious groups in California, the state might see this as evidence that your life is centered in California.

Burden of proof for taxpayers

It’s important to note that the burden of proof is on the taxpayer to show that they are not a California resident. If the state believes you owe taxes based on residency, you’ll need to provide documentation that supports your claim of non-residency.

- Keeping records: Save documents like lease agreements, out-of-state tax returns, travel records, and utility bills to demonstrate your primary residence is outside California.

- Avoiding audits: Taking proactive steps to sever your California ties (like changing your mailing address, voter registration, and driver’s license) can help you avoid a residency audit.