Best and worst U.S. domiciles for American expats

When American citizens move abroad, choosing the right state to keep as their home base, or “domicile,” is important.

This choice can significantly impact their tax situation, affecting how much they pay and to whom. It is crucial to determine state residency for tax purposes, as each state has its own criteria for establishing residency and the implications can be significant, especially for expats.

Key factors affecting tax obligations for expats:

- State Income Tax: Some states have a state income tax, while others don’t. This difference can produce major tax savings for expats.

- Foreign Earned Income Exclusion and Foreign Tax Credit: Some states allow expats to exclude a portion of their foreign-earned income from state taxes, which can reduce their tax burden. Additionally, a small minority of states offer a foreign tax credit, which lets expats offset the taxes they pay to foreign governments against their state tax liability. However, most states do not provide this credit.

- Residency Requirements: Each state has different rules for establishing and maintaining residency. Some states are easier to become a resident of, while others are much more demanding.

- Tax on Worldwide Income: Depending on the state, expats might be taxed on their income from all over the world, not just the income earned within the state.

Group 1: Easy residency, zero-state income tax

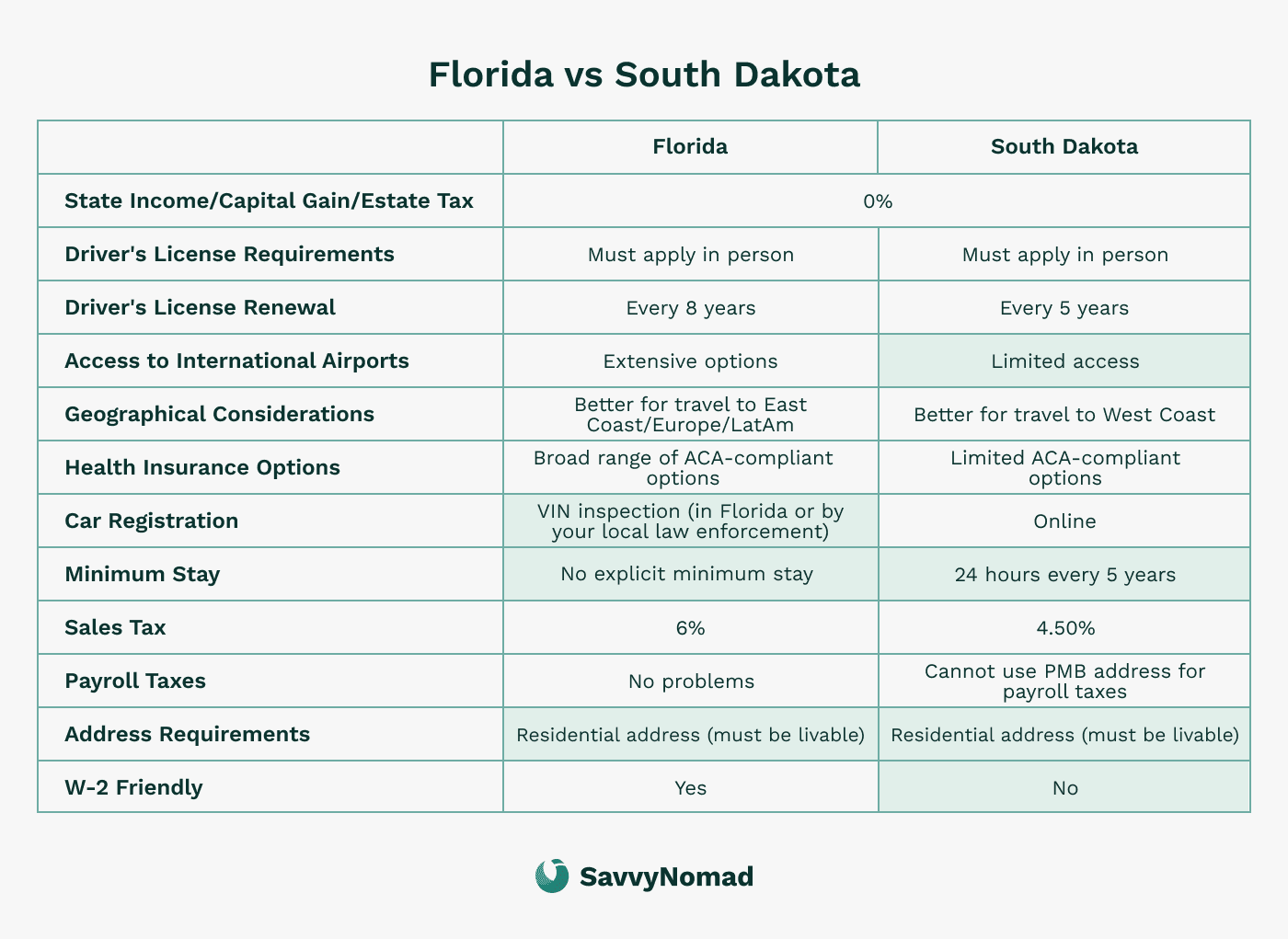

Based on our experience and research, Florida and South Dakota are often the most straightforward options for expats, because of their relatively simple residency requirements and zero state personal income tax policies.

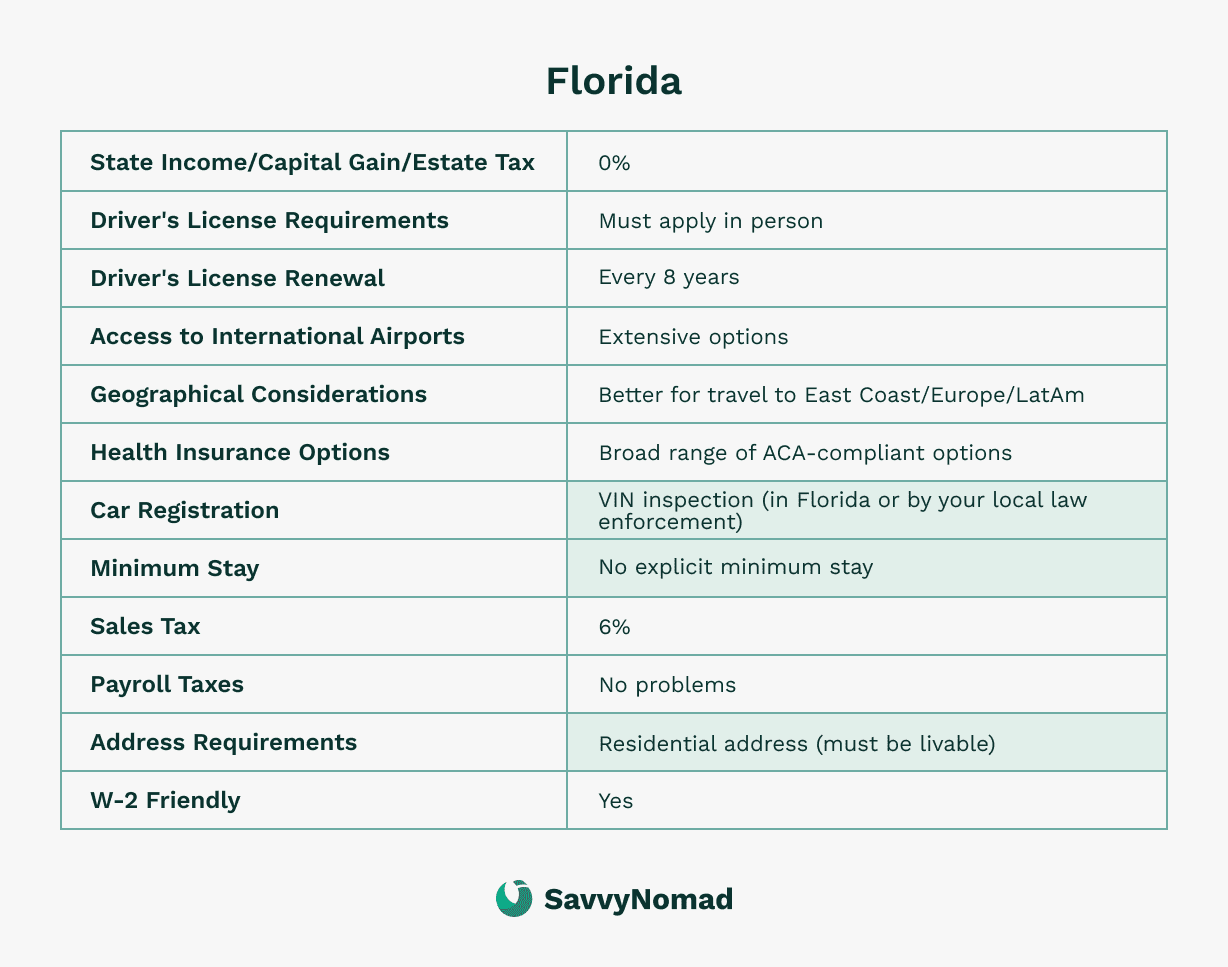

#1 Florida

Pros:

- Vehicle registration: You can maintain Florida domicile even if your vehicle is registered and garaged in another state or country, as long as you follow the registration rules where the vehicle is actually kept.

- Friendly environment: Ideal for retirees, digital nomads, expats, full-time sailors, and military personnel.

- Domicile services: Services like SavvyNomad assist in establishing residency.

- Asset protection: Strong laws that protect personal assets.

- Geographical convenience: Close to major cities and international travel hubs, beneficial for frequent travelers.

Cons:

- Residential address requirement: You need a residential address, which can be cumbersome. However, professional domicile services can mitigate this burden.

- Initial vehicle inspection: Requires a one-time vehicle VIN inspection for registration, but this can be done out of state.

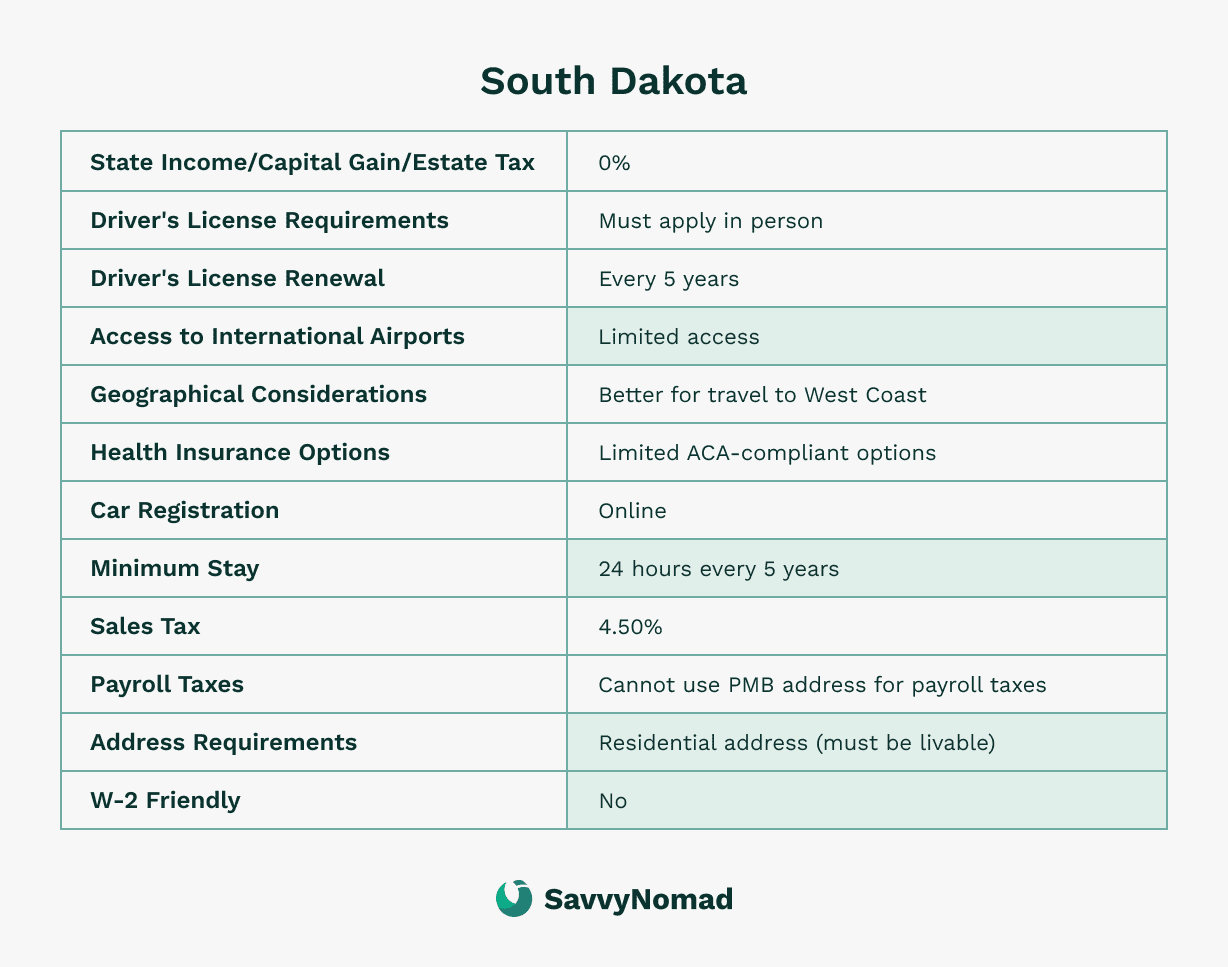

#2 South Dakota

Pros:

- Easy vehicle registration: In many cases, much of the process can be handled remotely without bringing the vehicle to the state, subject to South Dakota’s current registration rules.

- No state personal income tax: This can provide meaningful savings compared with higher-tax states, depending on your income mix and prior state.

- Minimal bureaucratic hurdles: The process is straightforward with little red tape.

- Mail-forwarding services: These services provide a stable mailing address for documents and can support your South Dakota records, but you still need to meet the state’s physical-presence and residency requirements.

Cons:

- Recent legislative changes: In 2023, South Dakota increased the physical presence requirement and restricted the use of personal mailboxes for voting and payroll purposes.

- Physical presence requirement: Requires proof of at least one overnight stay in the state every 5 years to renew a South Dakota driver’s license.

- Voting considerations: Voter registration typically requires a

residential address; requirements vary by jurisdiction—consult election

officials. - Payroll tax complications: In 2023, South Dakota increased physical-presence requirements and limited use of personal mail boxes for certain purposes (e.g., payroll). For voter registration or eligibility, consult election officials

- Less RV-friendly: Recent policy changes have made the state less accommodating for RVers.

- Driver's license renewal: Requires renewal every 5 years with proof of an overnight stay.

Benefits for expats:

- Easy to establish and maintain residency: Each state’s relatively simple procedures and minimal ongoing requirements can make them more accessible for expats and digital nomads who plan carefully.

- No state tax on personal income: Both states can offer substantial savings on state personal income tax compared with higher-tax states, depending on your specific situation.

Group 2: Zero-tax with moderate residency rules

In this group, the states do not impose state income tax but often have stricter residency requirements or other complexities that can make them less suitable for expats.

While these states might still be a good option depending on your personal situation, they generally offer less flexibility than places like Florida or South Dakota.

Establishing domicile typically requires significant steps, such as updating your address with various institutions and taking legal actions to prove your commitment to living in the new state.

States:

- Alaska

- Nevada

- New Hampshire: Interest & Dividends tax repealed Jan 1, 2025.

- Texas

- Tennessee

- Washington: No wage income tax, but a capital-gains excise applies to certain long-term gains.

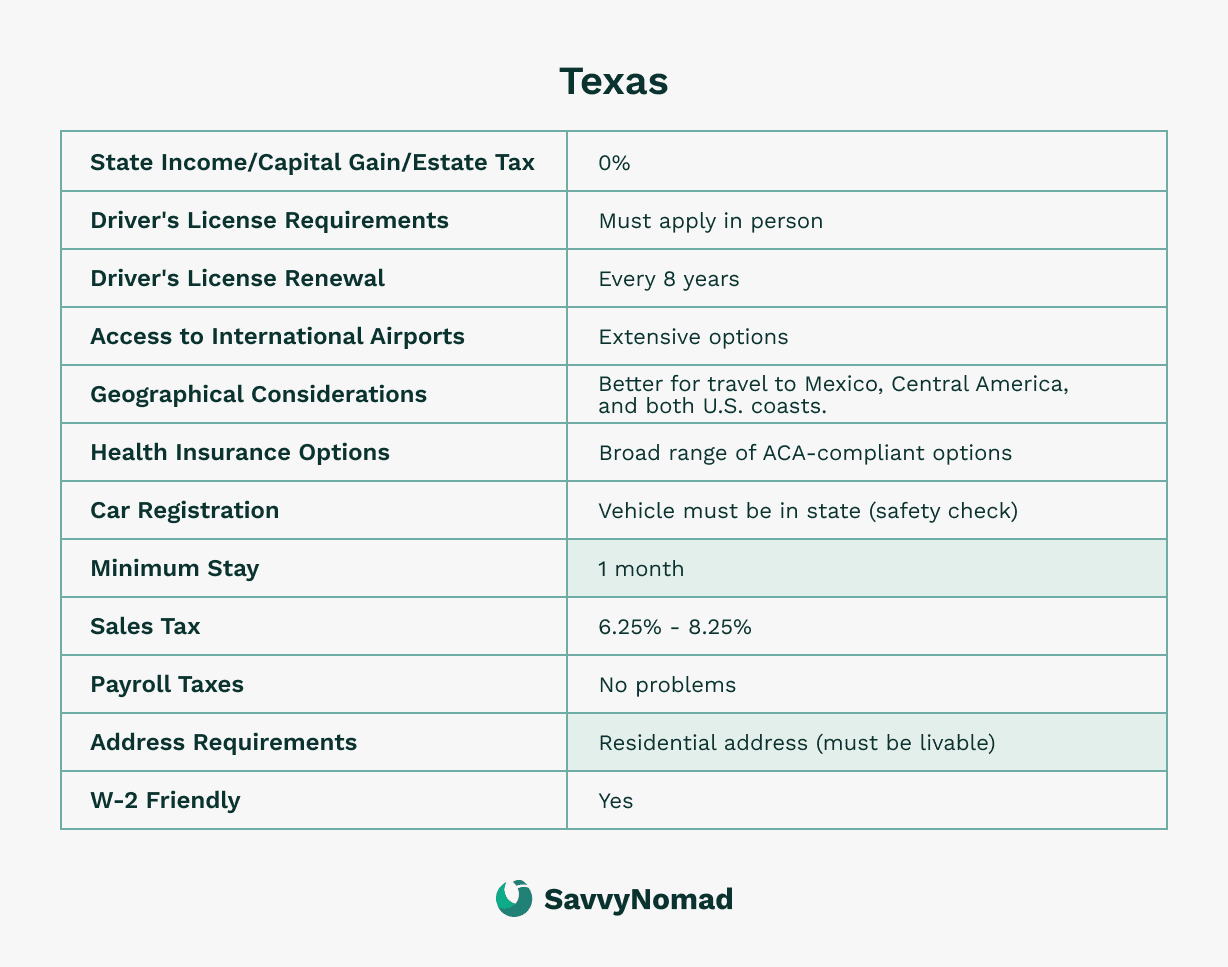

Texas

Pros:

- No state personal income tax: This can provide meaningful savings compared with many higher-tax states, depending on your income mix and prior state.

- Driver’s license renewal: Every 8 years.

- Access to international airports: Extensive options, beneficial for frequent travelers.

- Health insurance options: Broad range of ACA-compliant options.

Cons:

- 30-day residency requirement: Must be in the state for 30 days before getting a state ID or driver’s license.

- Vehicle inspections and emissions: As of 2025, most non-commercial vehicles no longer require an annual state safety inspection to complete registration, but emissions testing remains mandatory in certain counties and commercial vehicles still require inspections.

- Residential address required: Must have a livable address for residency, which can be restrictive for expats.

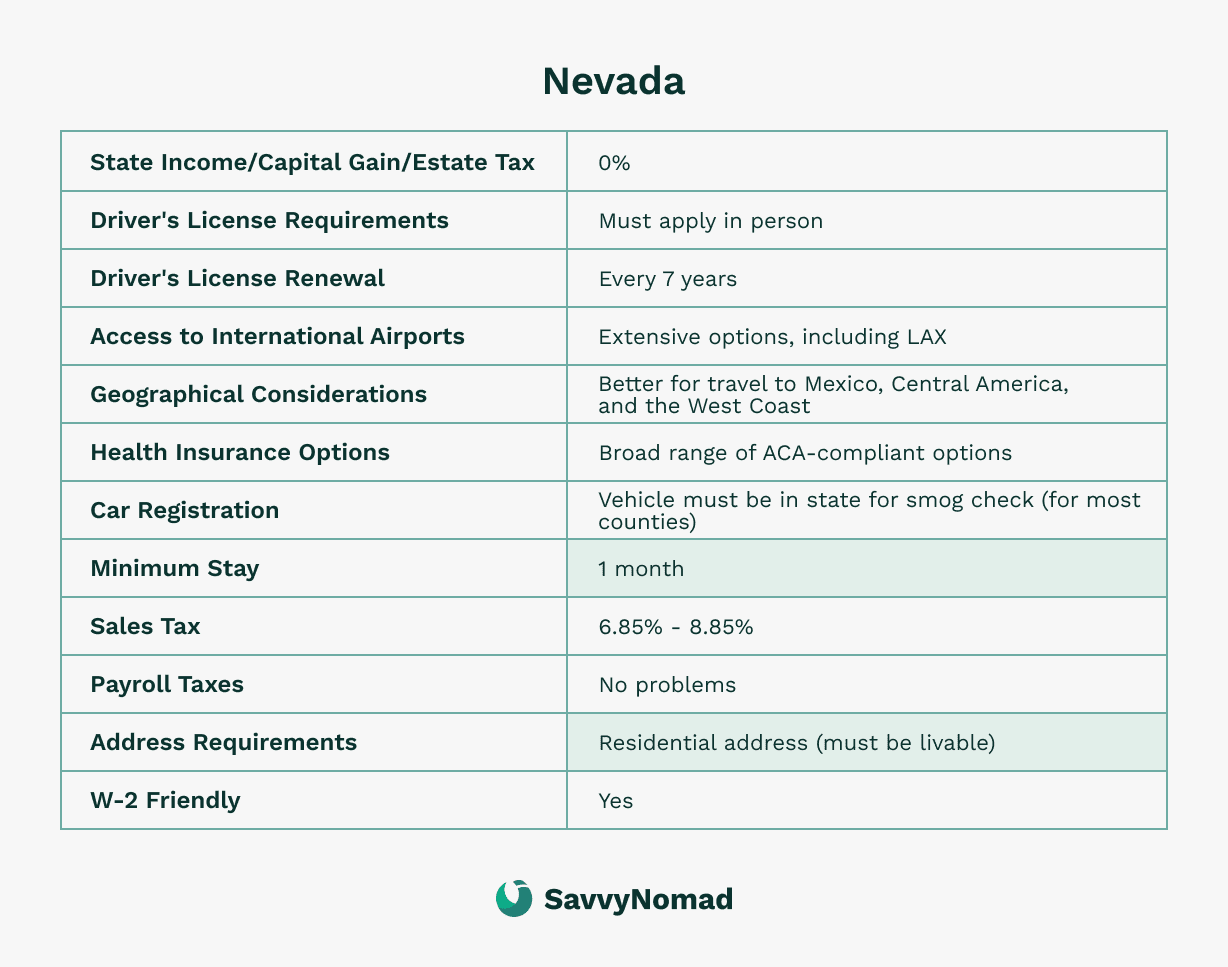

Nevada

Pros:

- No state personal income tax: This can provide substantial state-tax savings compared with higher-tax states, depending on your situation.

- Access to international airports: Extensive options, beneficial for frequent travelers.

- Health insurance options: Broad range of ACA-compliant options.

- Driver’s license renewal: Every 7 years.

Cons:

- 30-day stay requirement: Must show a 30-day consecutive stay in the state for residency.

- Residential address required: Must have a livable address for residency.

- Car registration: Vehicle must be in state for smog check (for most counties).

- Annual smog checks: Required for vehicle registration, particularly in populous counties like Clark County.

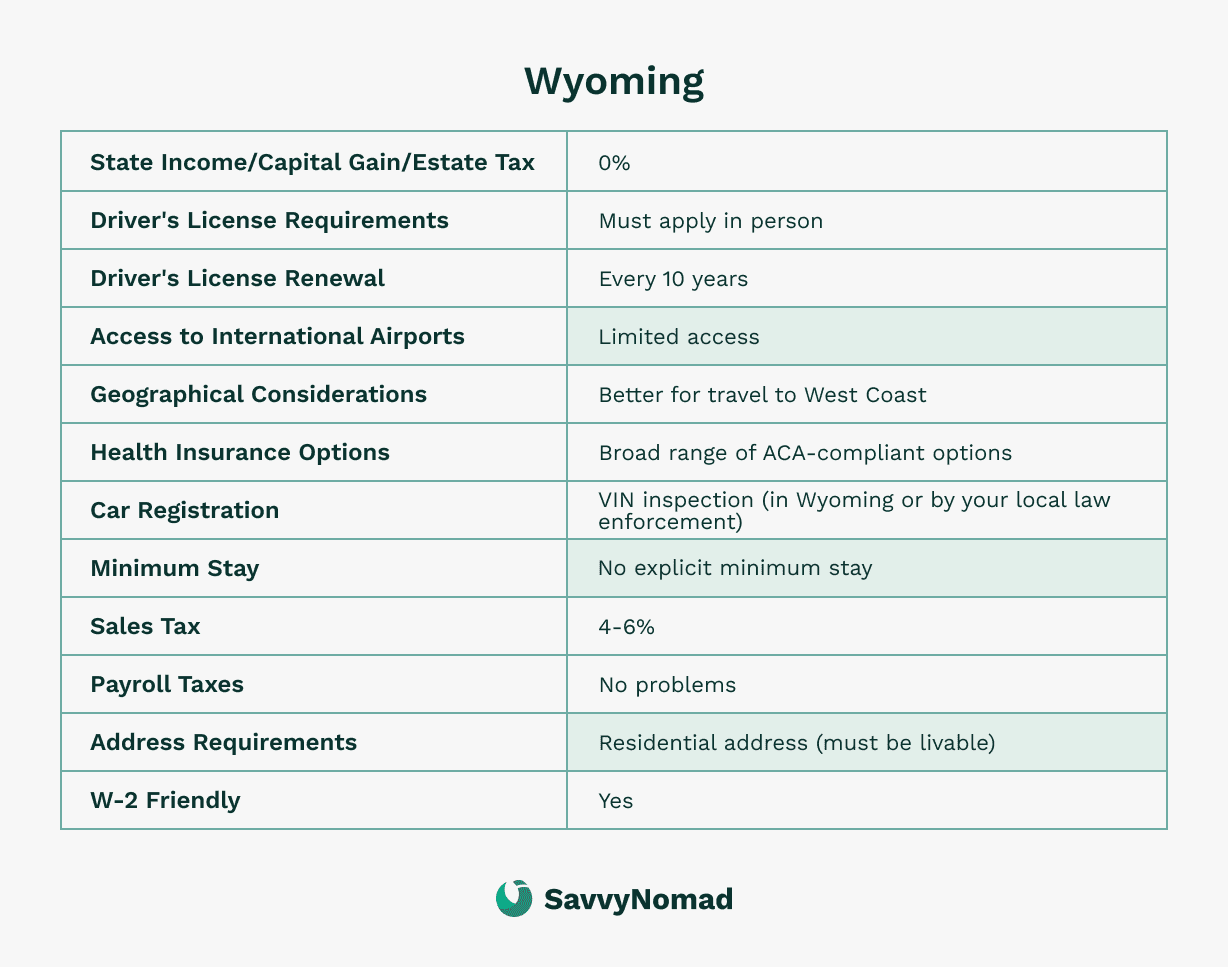

Wyoming

Pros:

- No state income tax: This can be financially beneficial for many taxpayers, especially those coming from higher-tax states.

- Access to international airports: Limited access, but adequate for occasional travel.

- Health insurance options: Broad range of ACA-compliant options.

- Car registration: VIN inspection required (can be done by local law enforcement).

- Driver’s license renewal: Every 10 years.

Cons:

- Residency challenges: Obtaining a residential street address can be difficult.

- Residential address required: Must have a livable address for residency.

Washington

Pros:

- No state income tax: Washington does not tax wage and salary income at the state level, though a capital-gains excise tax applies to certain long-term gains above specific thresholds.

- Access to international airports: Extensive options, beneficial for frequent travelers.

- Health insurance options: Broad range of ACA-compliant options.

- Driver’s license renewal: Every 7 years.

Cons:

- Residency establishment: Requires substantial physical presence to prove residency.

- Vehicle inspections: Periodic emissions testing required in some areas.

- Car registration: Vehicle must be in state for smog check (for most counties).

- Residential address required: Must have a livable address for residency (no personal mail boxes).

Challenges for expats:

- Detailed residency criteria: More stringent requirements for establishing and maintaining residency compared to states with easier processes.

- Annual vehicle inspections: Ongoing requirements for vehicle registration can be inconvenient, especially for those who travel frequently.

- Maintaining residency: Physical presence and paperwork can be burdensome for nomads and expats.

Benefits for expats:

- Financial advantages: Depending on your profile, you may see lower state-level income taxes and, in some cases, additional advantages around estate or business taxes.

- No broad tax on wage income: These states do not levy a traditional state personal income tax on wage and salary income. Some may still tax specific categories (for example, Washington’s capital-gains excise tax on certain long-term gains), but overall they can offer substantial savings on state personal income tax compared with higher-tax states.

Group 3: Clear exit states (objective, documentable nonresident tests)

These states aren’t completely tax-free, but they offer expats clear, rule-based paths to achieve nonresident status—if you carefully follow their tests and maintain thorough records.

Consider them the most reliable non–zero-tax choices for establishing your status.

Ohio

Ohio presumes you’re a nonresident when all of the following are true:

- You have ≤ 212 contact periods in Ohio during the tax year, and

- You maintain your abode outside Ohio, and

- You file the nonresident statement (Form IT NRS). Meet the trio and you get a statutory presumption; miss any element and that presumption can fall away. Keep contemporaneous travel logs and proof of your out-of-state abode.

Pennsylvania

Pennsylvania treats you as a nonresident when all of the following are true:

- ≤ 30 days physically in Pennsylvania during the year, and

- No Pennsylvania abode, and

- An abode elsewhere for the full year. Pennsylvania’s test is strict and documentation-heavy; plan your calendar and housing so the facts line up cleanly.

Documentation to keep (both states): passport stamps/itineraries or app-based day logs; lease/deed and utility proofs for your outside-state abode; copies of Form IT NRS (Ohio) and any PA residency representations; and a one-page summary tying your dates and housing facts to the test you’re relying on.

Group 4: AGI-conforming states (FEIE often passes through for nonresidents)

These states generally start from federal adjusted gross income (AGI), so your federal Foreign Earned Income Exclusion (§911) typically carries through at the state level if you’re treated as a nonresident of that state.

If the state still considers you a resident/domiciliary, it can tax worldwide income (often with its own credit limits and documentation rules).

Keep your residency facts clean: no in-state abode, careful day counts, and consistent addresses across IRS, banking, insurance, payroll, and other records.

States:

- Alabama (Residents can claim a resident Foreign Tax Credit only for certain PTE-level foreign income taxes; strict documentation and “same-income” tie-out required).

- Colorado

- Georgia

- Illinois

- Indiana (Residents can claim a resident Foreign Tax Credit for foreign income taxes (general) with standard “same-income” and documentation tests).

- Iowa (Residents can claim a resident Foreign Tax Credit for foreign income taxes (general); expect routine documentation checks).

- Kansas (Residents can claim a resident Foreign Tax Credit for foreign income taxes (general); normal net-income and tie-out rules apply).

- Kentucky

- South Carolina

- Utah

Group 5: States taxing worldwide income (until domicile ends)

These jurisdictions tax residents on their worldwide income and keep doing so until you truly end domicile and establish a new one elsewhere. In practice, audits hinge on facts and intent—think where you actually live, sleep, work, and keep your life ties.

Keep your residency picture clean: no in-state abode, disciplined day counts, and consistent addresses across IRS, banks/brokerages, insurance, payroll, and key accounts.

States:

- Arkansas

- Arizona (Residents can claim a resident Foreign Tax Credit for foreign income taxes (general); must be a net income tax on the same income and fully documented).

- Connecticut

- District of Columbia

- Delaware

- Idaho

- Louisiana

- Michigan (Residents can claim a resident Foreign Tax Credit for Canadian provincial income taxes only; Canada-only and enforced strictly).

- Maine

- Maryland

- Massachusetts (Residents can claim a resident Foreign Tax Credit for Canadian provincial income taxes only; Canada-only and enforced strictly).

- Minnesota (Residents can claim a resident Foreign Tax Credit for Canadian provincial income taxes only; Canada-only and enforced strictly).

- Missouri

- Mississippi

- Montana (Residents can claim a resident Foreign Tax Credit for foreign income taxes (general), but it is reduced if a federal FTC is also claimed on the same income; examiners often request Form 1116 to verify no double benefit).

- Nebraska

- New Mexico

- North Carolina (Residents can claim a resident Foreign Tax Credit for foreign income taxes (general); must be a net income tax on the same income with complete proof).

- North Dakota

- Oklahoma

- Oregon

- Rhode Island

- Vermont (Residents can claim a resident Foreign Tax Credit for Canadian provincial income taxes only; Canada-only and tightly enforced).

- Virginia (Residents can claim a resident Foreign Tax Credit only for certain foreign pension/retirement income from prior foreign employment; narrow and documentation-heavy).

- West Virginia

- Wisconsin

Foreign domicile (what actually ends domicile abroad)

You can break resident-worldwide exposure by establishing a new domicile outside the U.S., but this is usually more documentation-intensive than relocating to a U.S. no-tax state like Florida. Expect to assemble:

- Immigration status: visa or residency permit approvals.

- Housing: foreign lease/deed in your name.

- Tax presence: local tax ID/certificate and, where applicable, filed returns or assessments.

- Life-admin shifts: banking/ID changes and routine life ties in the new country.

High-scrutiny states closely test intent and facts, so line up your paperwork and keep contemporaneous records (travel logs, housing, employment/contract evidence).

Group 6: Worst possible states for expats

If you are domiciled in one of these states, consider moving your domicile to a state in Group 1 or Group 2.

Because you do not spend time in these high-tax states, you are essentially paying for infrastructure and services that you do not use. Changing your domicile to a state with no income tax or more favorable tax policies can produce substantial financial savings and simplify your tax compliance.

States:

Key characteristics:

- Highest state tax rates: These states have some of the highest state income tax rates in the country.

- Complex tax regulations: These states have detailed and complicated tax filing requirements that can be challenging to navigate.

- Worldwide income taxation: Residents are taxed on their global incomes with no exclusions.

California

- High State Income Tax: California has one of the highest state income tax rates, reaching up to 13.3%.

- Worldwide Income Taxation: All income earned globally is taxed with no exclusions.

- Complex Compliance: Detailed tax laws and regulations require extensive documentation and may necessitate professional tax assistance.

Audits focus on documentation—expect requests for your contract, flight records, and housing leases. This rule does not change domicile; it’s best for clearly defined 18–24-month assignments.

For long or indefinite stints abroad, ending California domicile (e.g., establishing Florida) is usually simpler and more durable.

New York

- High State Income Tax: New York’s state income tax rates can reach up to 10.9%, and when combined with New York City taxes, the total rate can go as high as 14.776%.

- Worldwide Income Taxation: All income earned globally is taxed with no exclusions.

- Complex Filing Requirements: New York’s tax laws are intricate and compliance can be difficult without professional assistance.

- Resident foreign tax credit (Canada-only): New York is one of the Canada-only credit states—resident credits apply to Canadian provincial income taxes (with strict documentation) but not generally to other foreign countries. Have proof of payment, the foreign/provincial return/assessment, and a tie-out of the foreign-taxed income to your NY return lines.

Examiners are strict on day counts and housing and often request passport stamps, travel logs, and employer verification. This safe harbor does not change domicile; it’s best for clearly defined foreign assignments.

For long or indefinite stints abroad, it’s generally simpler to end New York domicile (e.g., to Florida) to avoid ongoing day-count scrutiny.

Hawaii

- High State Income Tax: Hawaii’s state income tax rates can go up to 11%.

- Worldwide Income Taxation: Residents are taxed on their global incomes with no exclusions.

- Complex Compliance: Hawaii’s tax laws and regulations are intricate, requiring careful planning and, often, professional assistance to navigate.

- Resident foreign tax credit (FTC): Hawaii is among the states that allow a resident credit for foreign income taxes (subject to strict sourcing limits and documentation). Examiners expect proof of payment, copies of the foreign return/assessment, translations if needed, and a tie-out of the foreign-taxed income to your Hawaii return lines.

New Jersey

- High State Income Tax: New Jersey’s state income tax rates can go up to 10.75%.

- Challenging Compliance: Tax filing in New Jersey is known for its complexity, often requiring professional help to navigate the regulations.

- Worldwide Income Taxation: All income earned globally is taxed with no exclusions.

Cons:

- High Tax Burden: Expats domiciled in these states face significantly higher tax liabilities on their worldwide income.

- No FEIE: These states do not provide a foreign-earned income exclusion, resulting in no relief for expats from high tax burdens on foreign-earned income.

- Complicated Tax Filing: The tax filing process in these states is complex and can be challenging to manage, often requiring professional tax assistance.