Nevada residency for nomads: benefits and requirements

Nevada, a state celebrated for its wild city life and serene desert vistas, is becoming increasingly popular as a place of residence – for nomads and stay-at-homes alike.

Its unique combination of urban excitement and peaceful natural beauty (yes, Las Vegas is surrounded by beautiful natural red rock) offers a diverse living experience.

In this article, we’ll delve into the numerous benefits of making Nevada your legal home. We highlight the financial perks, including the absence of state income tax and the lifestyle advantages that appeal to people from professionals and entrepreneurs to retirees.

Understanding the benefits and requirements of Nevada residency, including the concept of legal residence, is key to making an informed decision about whether Nevada is the right choice for your next domicile.

Benefits of Nevada residency

In particular, Nevada offers several compelling advantages as a residency choice for digital nomads, full-time RVers, liveaboards, and expats.

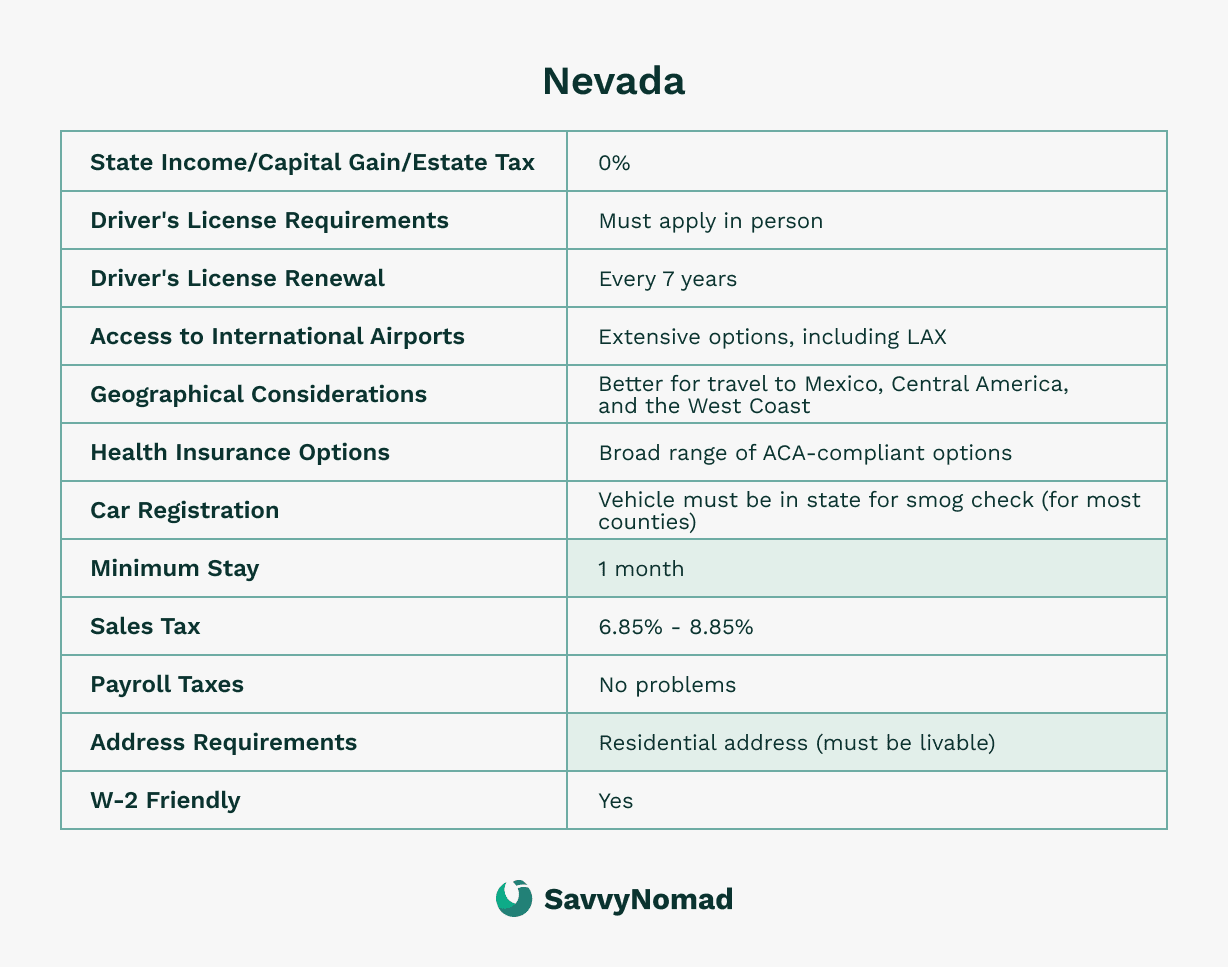

In short, Nevada presents a good balance between financial benefits and privacy considerations:

• No personal or corporate income tax

This can translate into meaningful savings for both individuals and businesses. The absence of these taxes is often especially beneficial for those with fluctuating and international incomes.

• Privacy protections

Nevada is one of four states that allows the formation of anonymous LLCs, which can be important for digital nomads who prioritize confidentiality and privacy in their professional and personal affairs.

Moreover, privacy is increasingly favored as “overemployment " (simultaneously holding down multiple 9-5 work-from-home full-time jobs) becomes increasingly popular.

• Incorporation and mail forwarding services

Services for incorporation and mail forwarding are readily available in major Nevada cities like Las Vegas, Reno, and Carson City. These services are key for digital nomads and expats who need a reliable way to manage their business and personal affairs from outside the state (or country).

• Cost-effective business setup

Certain business entities, like home-based sole proprietorships, can be set up for a minimal cost, which is advantageous for those starting new ventures or maintaining small-scale operations.

Critical considerations in changing state residency

It's important for digital nomads to navigate the nuances of state residency carefully. States like California, South Carolina, New Mexico, New York, and Virginia are known to aggressively use any slight connection to tax former residents, making it more challenging to cut ties completely.

This stark contrast with states like Nevada, which do not impose state income tax, provides a more straightforward and financially beneficial path for establishing residency.

This ease of transition is a key factor for digital nomads and expats, who often require flexibility and simplicity in managing their tax obligations and residency status.

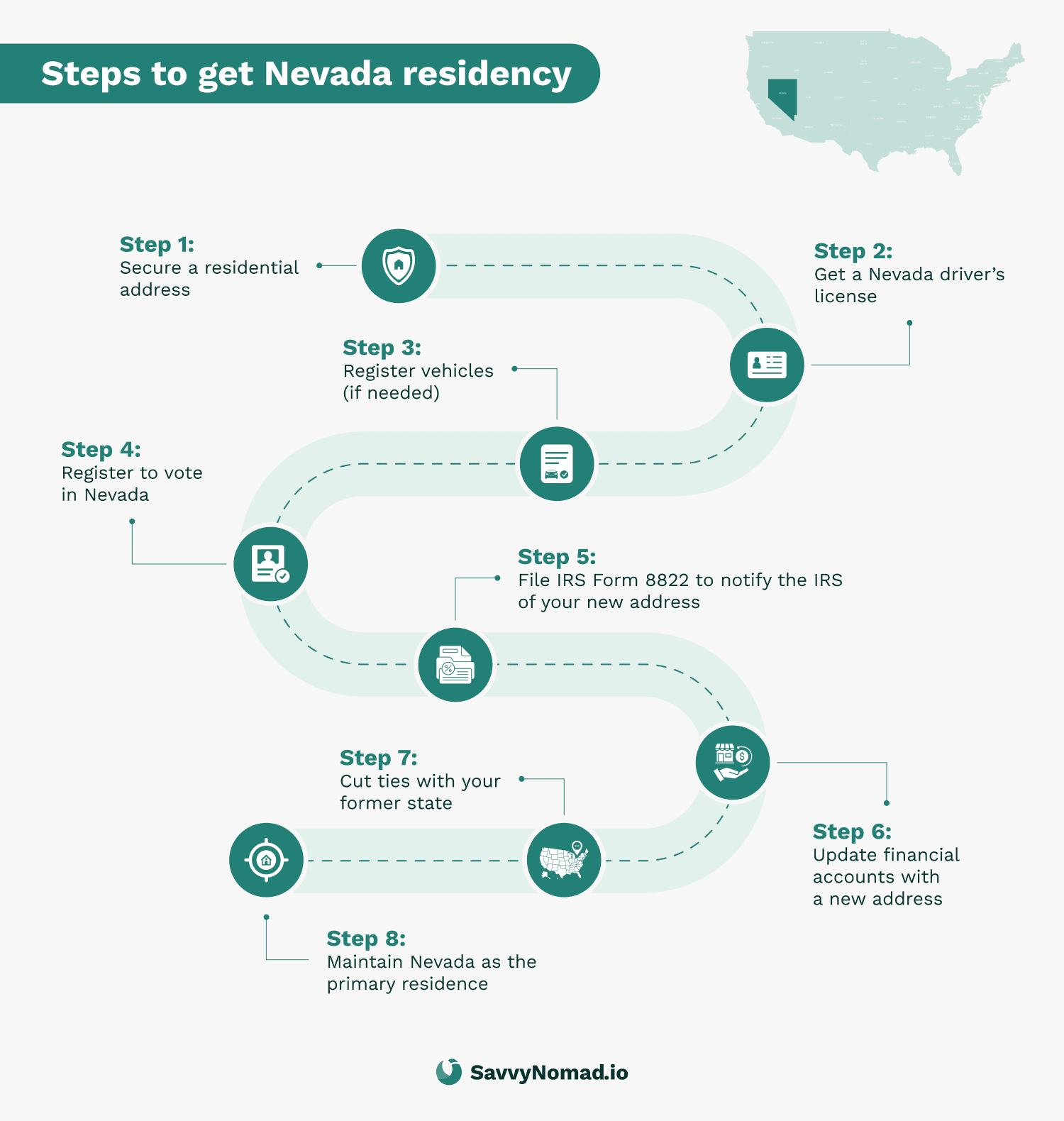

Steps to establish residency in Nevada

To establish legal residency in Nevada as a digital nomad or expat, you’ll need to follow a series of steps that demonstrate your intent to make Nevada your permanent home, even if you don’t physically reside there year-round.

Here's a breakdown of the key steps:

- Residential address: Obtaining a residential address in Nevada is required. This can be a property you own or rent, or even a hotel, RV park, hotel, or campground, provided you can show a stay receipt for at least 30 consecutive days.

- Obtain a Nevada driver's license: Present proof of residency for at least 30 consecutive days and identification, including documents showing your Nevada residential address, at the Nevada DMV.

- Register your vehicle in Nevada: This requires proof of Nevada-specific vehicle insurance. Depending on the county of your residence, you may need to have a smog check within the state, which can be a long road trip from your former residence. Moreover, this is required annually. The more populous counties, like Clark County (home of Las Vegas), require smog checks. Smaller counties do not.

- Register to vote in Nevada: This is an important step in strengthening your legal ties to, and intent to reside in, Nevada. You can register to vote online or in person at your local county clerk’s office. Voter registration allows you to participate in elections and is a strong supporting indicator of Nevada residency, but it’s considered together with many other factors and does not, by itself, decide your tax status.

- Provide additional proof of residency: Use additional documents, such as utility bills, lease agreements, mortgage statements, and employment records, as proof of residency.

- Sever ties with your former state: Actions include selling property, closing state-specific bank accounts, and updating official documents to reflect your Nevada residency.

- File Form 8822 with the IRS: Inform the IRS of your change of address by filing Form 8822 so that the IRS has your current address, which is important for receiving tax refunds and correspondence.

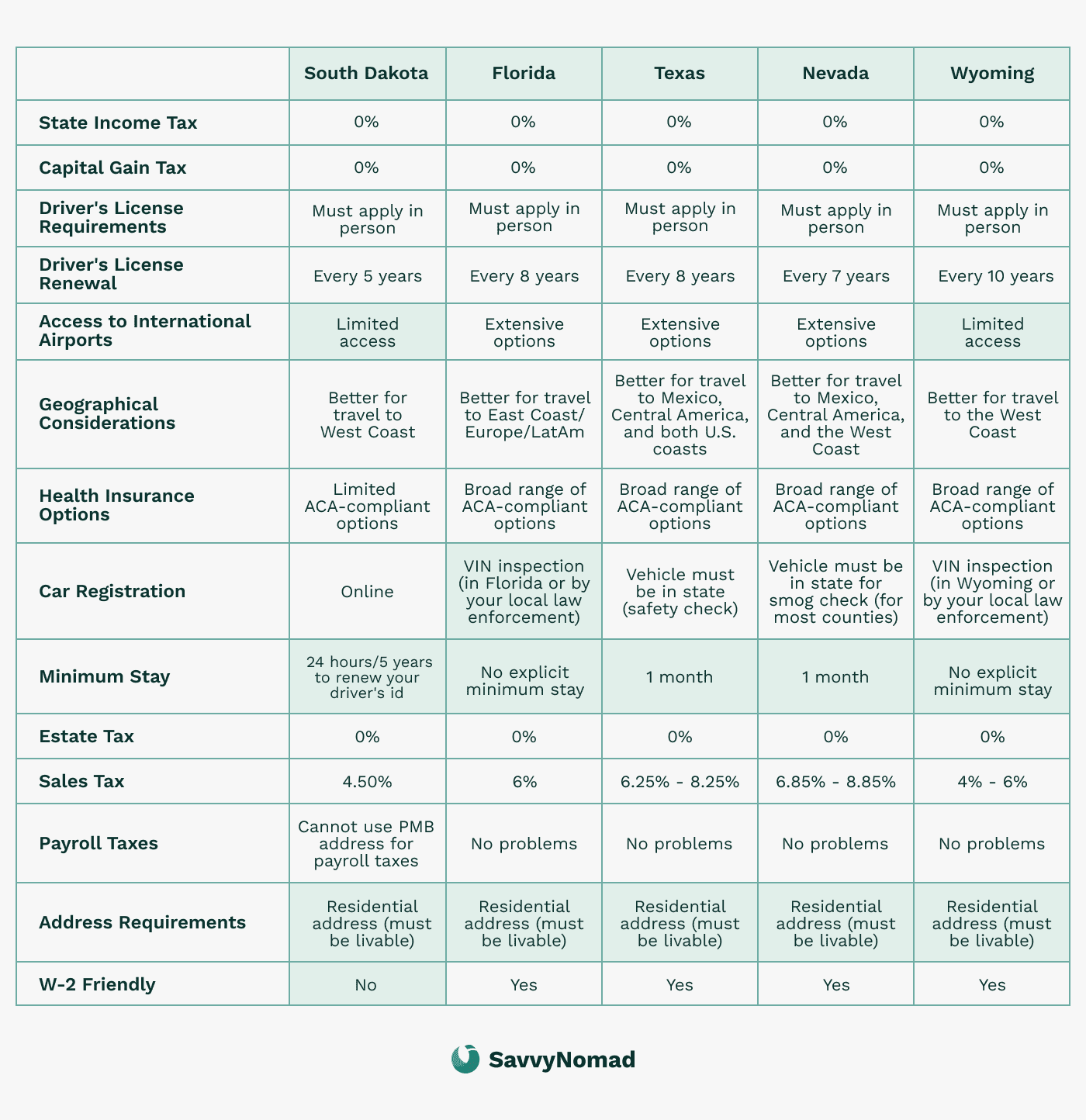

Comparison with other states

Nevada

Pros of Nevada domicile:

- No state personal income tax and no traditional ad valorem property tax on registered vehicles, plus competitive vehicle taxes structured as registration and governmental services fees, can provide a meaningful financial advantage.

- Centrally located to many Western states, convenient for nomads spending time in the region.

- If you are outside of the major counties, the cost of auto insurance can be low.

- Vehicle registration costs are based on MSRP and age, which may benefit owners of older vehicles.

- Availability of affordable mail forwarding services that offer additional services.

Cons of Nevada domicile:

- Residency establishment requires a 30-day stay in a campground or RV park.

- Auto insurance rates can be high in major counties because Nevada is a 24-hour state.

- For newer vehicles, registration fees can be higher compared to other states.

- Annual smog checks are required for vehicle registration, depending on your county of residence.

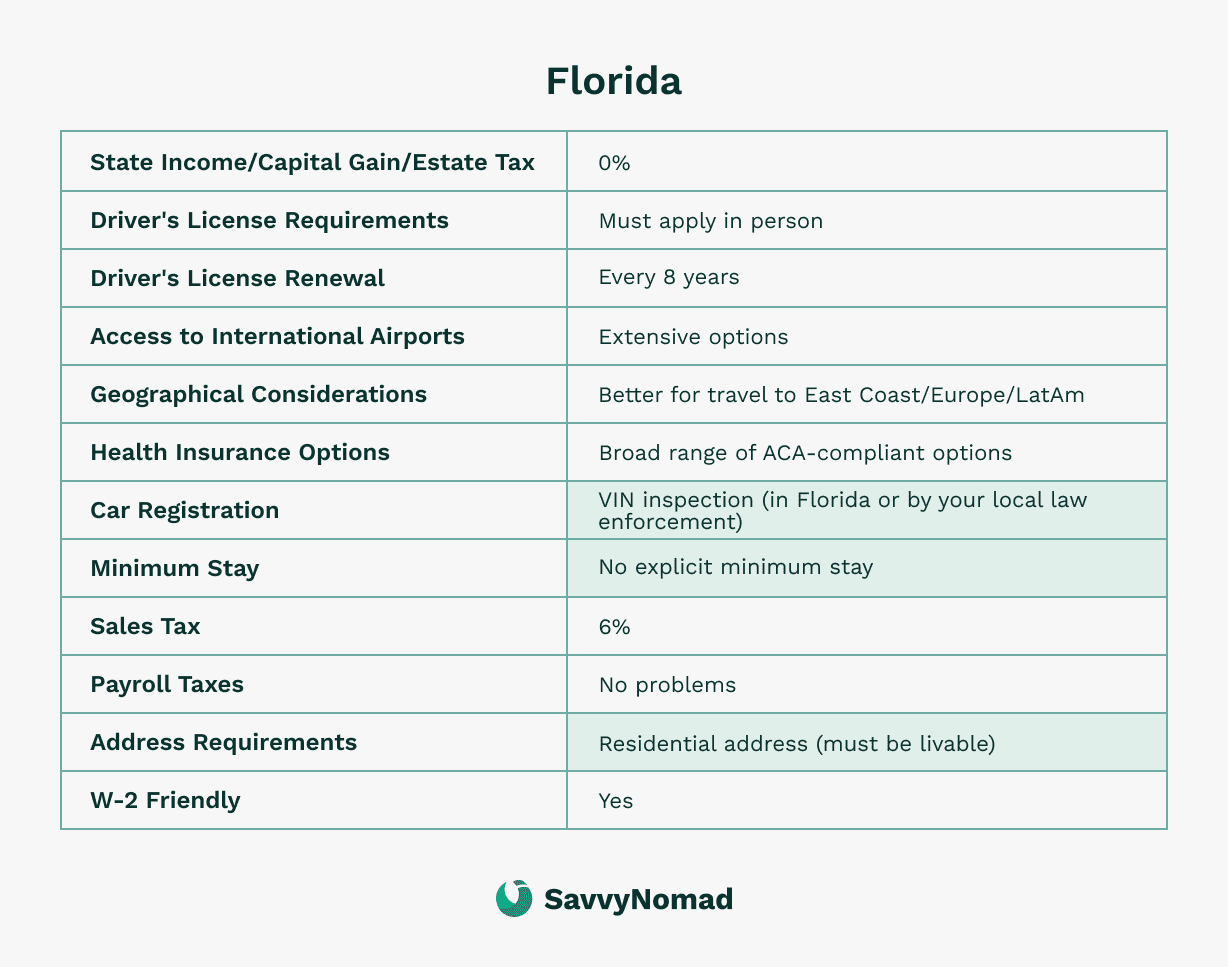

Florida

Pros of Florida domicile:

- No state income or estate tax.

- Strong asset protection laws are favorable for safeguarding personal wealth.

- Simplified domicile establishment process, including driver's license and vehicle registration.

- Broad range of health insurance options due to a large market, providing varied ACA-compliant plans.

- Geographical proximity to international airports offers better connectivity for global nomads, especially those who frequent Europe.

Cons of Florida domicile:

- A liveable residential address is required to claim residency. Fortunately, you can use services like SavvyNomad to obtain a bona fide residential U.S. street address in Florida and help organize the documentation you’ll need for IDs, banking, and other records as part of a broader domicile plan. This type of service supports your overall move but does not by itself establish residency or guarantee any particular tax outcome.

- Initial physical presence is necessary for certain processes, like applying for your driver's license or registering a vehicle.

- If you do not have your vehicle in Florida and wish to register it, you must drive it to Florida or have the VIN inspected by a member of law enforcement (from any state).

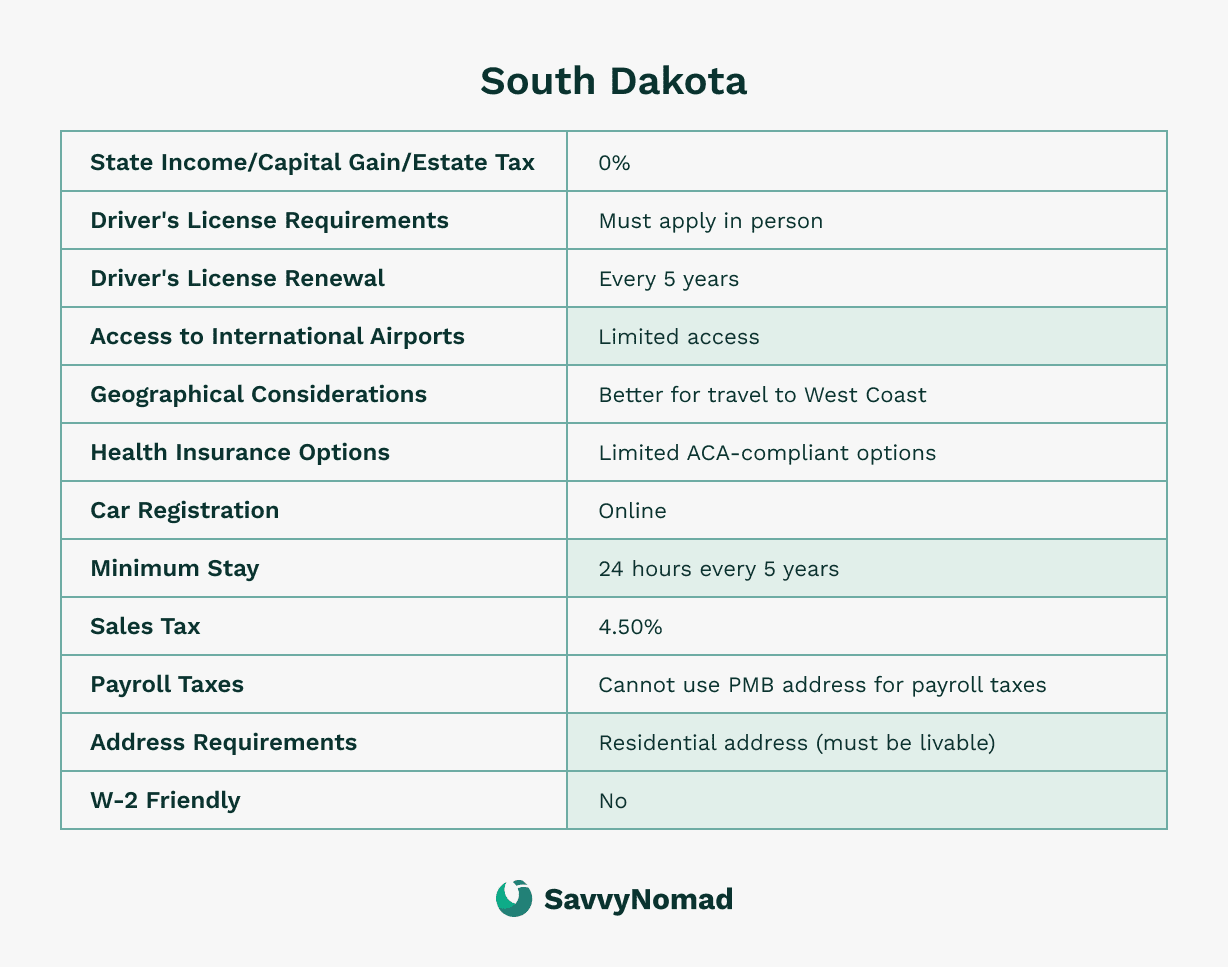

South Dakota

Pros of South Dakota domicile:

- No state personal income tax and no state-level estate or inheritance tax; property taxes are administered locally and are a major revenue source.

- Minimal residency requirements: you only need to stay one night every five years.

- South Dakota is the only state with no income tax where you can register your vehicle online without ever driving it to the state or having the VIN inspected by a member of law enforcement.

- Lower sales tax rate compared to Florida, reducing the cost of purchases.

Cons of South Dakota domicile:

- Cannot use a PMB (Private Mailbox) address for unemployment taxes, which might be a limitation for some nomads. This means that if you are a W-2 employee, you could struggle to find accommodation in South Dakota. Due to this, many nomads and RVers are leaving the state in favor of Florida or Texas.

- Limited access to international airports could be a downside for those frequently traveling abroad.

FAQ

What is the 183-day rule in Nevada?

Many U.S. states that levy income tax use a “183-day rule” as one factor in deciding whether someone is a resident for tax purposes. If you spend at least 183 days in a state during a year, that state may treat you as a resident for tax purposes even if your permanent home is elsewhere.

Nevada itself does not impose a personal income tax, but if you are moving from (or still spending time in) a higher-tax state, that state may apply a 183-day rule or similar test when deciding whether to keep taxing you. Tracking your days in each state is therefore important, especially if you split time between Nevada and a state that does tax personal income.

How do I change my California driver's license to Nevada?

To change your California driver's license to a Nevada license, follow these steps:

- Proof of Identity and Residency: Provide documents proving your identity and Nevada residency. This means at least a receipt for a 30-day stay at a hotel or RV park or a long-term lease somewhere in Nevada.

- Social Security Number: Have your SSN ready.

- Visit a Nevada DMV office: Bring the required documents, including proof of Nevada residency.

- Surrender California License: You must surrender your current license.

- Fees: Be prepared to pay license and transfer fees.

- PDPS Check: Your record will be checked for suspensions or revocations.

What counts as proof of address in Nevada?

When establishing proof of address in Nevada, you will need to present two documents showing your name and your Nevada residential address.

The documents should be originals or certified copies dated within the last 60 days.

Here are the types of documents that are generally accepted:

- Utility bills showing you as the payee, or receipts for rent or the lease of a residence, showing your name as the lessee.

- Bank or credit card statements, employment pay stubs, or documents from a state or federal court that show your name and Nevada address.

- Educational institution records that establish enrollment or an ID card issued by the institution with your address.

- Records from hotels, motels, RV parks, or campgrounds in Nevada showing at least 30 days of consecutive residency.

- Nevada voter registration card, documents from Nevada public assistance programs, or military leave and earnings statements indicating Nevada residency.

- A notarized statements from the owner of a residence confirming your physical residency.

- Insurance documents, medical provider records, tax records (excluding property taxes), and records of paid property taxes or current mortgage documents.

What documents do I need for a Nevada driver's license?

To obtain a Nevada driver's license, you will need to provide several types of documents to the Nevada Department of Motor Vehicles (DMV):

- Proof of Identity: This can include a U.S. birth certificate, a valid U.S. passport, a Certificate of Naturalization or Citizenship, or a valid foreign passport with appropriate immigration documents.

- Proof of Social Security Number (SSN): Acceptable documents include your Social Security card, a W-2 form, or an SSA-1099 form.

- Proof of Nevada Residency: You must provide two documents proving your residency in Nevada. These documents must be original or certified copies and dated within the last 60 days. Examples include utility bills, lease agreements, bank statements, and other official documents showing your name and Nevada address.

Additionally, if you're transferring from another state, you must surrender your current out-of-state driver's license or ID card. If you are under 21, or if required by the DMV, you may need to pass a written knowledge exam. A vision test is also part of the requirements.

Can I have both a California and Nevada driver's license?

You cannot legally have a driver's license in two states simultaneously. In most states, including California and Nevada, you must obtain one from the state where you have declared residency.

If you move to Nevada, you need to surrender your California driver's license and apply for a Nevada one. When you apply for a driver's license in a new state, including Nevada, the state's licensing office will typically check the National Driver Registry to see if any severe offenses on your record would disallow you from obtaining a new license.

It's important to note that specific provisions apply to for military personnel and individuals with international or foreign licenses. However, the average resident would be expected to hold a driver's license only in your state of permanent residence.