Do expats from Illinois still owe Illinois state taxes?

If you're an expat from Illinois, you might still owe taxes to the State of Illinois, depending on your residency status.

Illinois may consider you still a resident for tax purposes, requiring you to report, and pay state income taxes on, your worldwide income.

Understanding the difference between residency and domicile is crucial for expats. Residency is where you live; domicile is your permanent home. Knowing the difference helps you avoid unexpected tax bills and comply with Illinois tax laws.

TLDR:

If Illinois remains your domicile and you haven’t established residency in a different state, you are considered an Illinois resident for tax purposes and must report, and pay state income taxes on, your worldwide income.

Illinois calculates state income taxes starting with your federal adjusted gross income (AGI), so any foreign income excluded from your federal income tax return (IRS Form 1040) will also be excluded from your Illinois state income tax return.

However, if you are an Illinois resident or have Illinois-sourced income and are required to file a federal income tax return (or want a refund of Illinois tax withheld), you generally must also file an Illinois state return.

The Foreign Earned Income Exclusion (FEIE) allows U.S. taxpayers living abroad to exclude up to $126,500 of foreign-earned income from their U.S. taxable income for the 2024 tax year.

This exclusion only applies to earned income, such as wages and salaries, and does not apply to so-called “passive” income, like interest, dividends, capital gains, and rental income.

To stop being taxed as an Illinois resident on your worldwide income, you generally need to sever most ties with Illinois and establish a new domicile in another state, while managing any ongoing Illinois-sourced income.

Understanding Illinois's tax residency rules

Residency and domicile are critical in determining your Illinois tax obligations. Residency refers to where you live, while domicile is your permanent home, to which you intend to return after any absence. In other words, one can have several residences, but only one domicile.

Resident

Domicile and Tax Status: If Illinois is your domicile, you are considered also a resident for tax purposes. You must pay Illinois state taxes on your worldwide income, including foreign-earned income.

AGI and State Taxes: Illinois calculates state taxes based on your federal adjusted gross income (AGI). Any foreign income excluded from your federal return is therefore also excluded from your Illinois return.

FEIE Benefits and Limitations: The Foreign Earned Income Exclusion (FEIE) allows you to exclude up to $126,500 of foreign-earned income from your U.S. taxable income for the 2024 tax year. This exclusion applies only to earned income like wages and salaries, not to passive income such as interest, dividends, capital gains, or rental income.

Nonresident

Nonresidents do not have Illinois as their domicile and do not maintain significant ties to the state. They are taxed by Illinois only on income originating from Illinois sources, such as wages earned in Illinois or income from property located in the state.

Nonresidents receiving wages and salaries from Illinois employers must comply with specific filing requirements and may benefit from reciprocal agreements with other states.

Part-Year Resident

Part-year residents are taxed on all income earned while they were residents of Illinois. For the periods they were not residents, they are taxed only on Illinois-sourced income.

What constitutes Illinois-sourced income?

Understanding what constitutes Illinois-sourced income is essential for both nonresidents and part-year residents to accurately determine your tax obligations.

Nonresidents and part-year residents must file an Illinois tax return to report Illinois-sourced income and comply with state tax obligations.

Illinois-sourced income refers to any income derived from activities or assets located within the state.

Here are some key categories to consider:

- Wages and Salaries: Money earned for services performed in Illinois.

- Business Income: Income from business activities conducted in Illinois.

- Real Estate: Rental income from property located in Illinois.

- Capital Gains: Profits from the sale of real estate or tangible property in Illinois.

- Dividends and Interest: Dividends paid by Illinois-based companies and interest paid by Illinois financial institutions.

- Pensions and Retirement Plans: Retirement income from Illinois institutions or for services performed in the state.

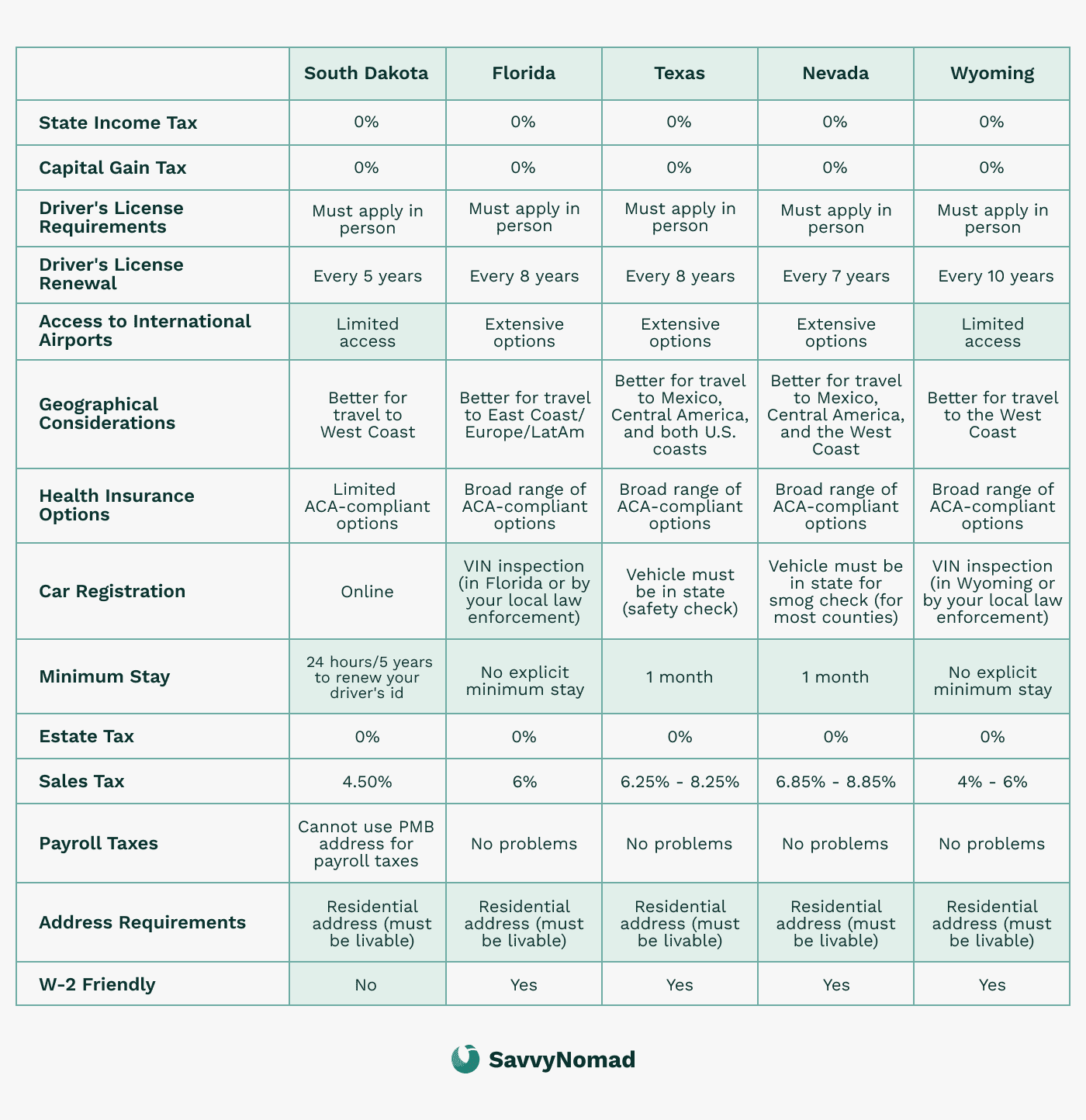

Why should you move your domicile to a state with no state income tax?

State income tax savings

High-income earners and retirees with significant income from investments, pensions, and other sources can benefit greatly from moving to a state with no state income tax, such as Florida, Texas, and Nevada.

This move can result in substantial tax savings, especially for those with high annual incomes, who would otherwise face steep state income tax bills in Illinois.

For individuals living and working overseas, with incomes exceeding the Foreign Earned Income Exclusion (FEIE) limit of $126,500 in 2024, changing their domicile to a state with no-income-tax can be particularly beneficial, as it shields more of their income from state taxes.

Inheritance tax benefits

Changing domicile to a state with no state income tax can offer additional benefits in terms of inheritance and estate taxes.

Although states like Florida, Texas, and Nevada do not have a state income tax, they also have favorable estate tax laws that can provide significant advantages for high-net-worth individuals looking to minimize their tax liabilities upon death.

Flexibility and mobility

Changing domicile to a no-income-tax state enhances flexibility and mobility, allowing individuals to travel or live in multiple locations without worrying about high state tax bills. This is ideal for high-income earners who may have business interests in different states or countries and for retirees hoping to spend their golden years exploring new places.

Moreover, the lack of state income taxes simplifies your tax filing process. You need to file and pay only federal taxes, reducing both the complexity and potential for errors in your tax returns, making the management of your financial affairs more straightforward.

How to end your Illinois tax residency?

Here are the key steps to help you transition from Illinois to a state-tax-free state:

1) Establish new residency

- Secure a Residential Address: Obtain a residential address in your new (tax-free) state. This is the most critical step in establishing a new domicile. You can use a domicile service that provides a residential address, assists with mail forwarding, and helps establish your new residency.

- File a Declaration of Domicile if available: Some states, like Florida, allow you to file a formal declaration, under oath, confirming your intent to make that state your new domicile.

Reference guides may provide additional help for specific states:

2) Sever ties with Illinois

- Sell property: Consider selling or renting out all of the real property you own in Illinois to indicate you no longer have a significant connection to the state.

- Transfer IDs and registrations: Update your driver’s license and vehicle registration to your new state. This demonstrates your commitment to your new domicile.

- Voter registration (if you are eligible): If you are eligible, you may register to vote in your new state. Voter registration is one supporting indicator of your intent to establish residency, not determinative on its own. For eligibility and procedures, follow guidance from election officials in both states.

- Update personal documents: Change your address on all identification cards, medical records, insurance policies, financial documents, and other important records. Establish relationships with professionals (lawyers, financial advisors, doctors, dentists) in your new state.

3) Notify relevant parties

- Inform your employer: Notify your employer about your change of residency. This can affect how your income is taxed and helps establish your new domicile.

- Notify the IRS: Inform the IRS of your address change using Form 8822. Extend this notification to all personal and professional entities.

- Update all personal and professional entities: Inform banks, investment accounts, insurance companies, and other relevant entities about your change of address.

4) Keep detailed records

- Maintain documentation: Keep receipts, bills, lease agreements, and other legal documents that prove your new residency. Detailed records are essential if your residency status is questioned.

- Track your movements: Document your time spent in and out of Illinois. This includes travel records, utility bills, receipts, and any other documents that show your physical presence in your new state.

5) Be prepared for audit

- Proof of permanent move: Be ready to provide comprehensive proof that you have permanently moved out of Illinois, including documentation showing that you have established a new domicile and severed all ties with Illinois.

- Respond to inquiries: If the Illinois Department of Taxation questions your residency status, provide thorough responses and supply all necessary documentation promptly to avoid potential penalties.

Tax benefits and exemptions for expats from Illinois

Living abroad as an expat from Illinois comes with various federal tax credits and other things that can help reduce your overall tax burden.

Expats should be aware of their filing responsibilities with the Internal Revenue Service (IRS) to ensure they claim all eligible federal tax credits and comply with U.S. tax laws.

Here are some of the key federal tax credits available:

Foreign Earned Income Exclusion (FEIE)

The FEIE allows you to exclude a significant portion of your foreign-earned income from U.S. federal income tax.

For the tax year 2024, you can exclude up to $126,500 of foreign-earned income from your U.S. federal taxable income. Because Illinois starts from your federal adjusted gross income, that excluded income is generally not taxed by Illinois either.

To qualify, you must pass either:

- Bona Fide Residency Test: You qualify if you are a resident of a foreign country for an uninterrupted period that includes an entire tax year.

- Physical Presence Test: You qualify if you are physically present in a foreign country for at least 330 full days during a 12-month period.

Foreign Tax Credit (FTC)

The FTC helps you avoid double taxation by giving you a credit against your U.S. federal income taxes for certain foreign income taxes you paid on income that is also subject to U.S. tax.

This is especially beneficial if you live in a high-tax foreign country, as it can significantly reduce your federal tax liability. Illinois generally does not allow a separate credit for foreign income taxes, so some foreign-taxed income may still be subject to Illinois tax depending on how it flows into your federal adjusted gross income.

Foreign Housing Exclusion (FHE)

The FHE allows you to exclude certain housing expenses from your U.S. federal taxable income, including rent, utilities (excluding telephone), and other reasonable expenses related to housing abroad. Because Illinois uses federal adjusted gross income as a starting point, those excluded amounts are generally not taxed by Illinois either.

The amount you can exclude is limited to a base amount plus housing expenses exceeding 16% of the FEIE limit.

Taxation of income

Understanding how different types of income are taxed

In Illinois, most types of income are taxed at the same flat rate (currently 4.95%), but whether and how they’re taxed depends on your residency status and how the income is sourced. Understanding this is crucial for accurate tax planning and compliance. Here’s a breakdown of how different types of income are treated in Illinois.

- Wages and Salaries: Income earned from employment is subject to Illinois state income tax at a rate of 4.95%. Employers withhold this tax and report it on Form IL-W-4. If you are an Illinois resident, you must report and pay state income tax on your wages and salaries, regardless of where they are earned.

- Interest and Dividend Income: Interest and dividend income are also taxed at the same rate of 4.95%. However, if you are a nonresident, you may be exempt from paying Illinois state tax on this type of income, depending on the source and your residency status.

- Capital Gains: Capital gains, whether short-term or long-term, are taxed at the same rate of 4.95%. Nonresidents may be exempt from paying Illinois state tax on capital gains if the gains are not sourced from Illinois.

- Business Income: Business income, including income from sole proprietorships, partnerships, and S-corporations, is taxed at the same rate of 4.95%. Nonresidents are only taxed on business income that is sourced from Illinois.

- Rental Income: Rental income from property located in Illinois is subject to the state income tax rate of 4.95%. Nonresidents must pay Illinois state tax on rental income derived from Illinois properties.

It’s essential to note that Illinois has reciprocal agreements with certain states, which may exempt you from paying Illinois state tax on wages, salaries, tips, and commissions from employers in those states. These agreements are designed to prevent double taxation and simplify tax compliance for individuals who live in one state but work in another.

Social Security and military benefits

Impact on Illinois state taxes

Social Security benefits and military benefits are treated differently for tax purposes in Illinois. Here’s how they are impacted:

- Social Security Benefits: Illinois does not tax Social Security benefits. This means that if you receive Social Security income, you do not need to report it on your Illinois state tax return. However, it’s important to remember that federal taxes may still apply to a portion of your Social Security benefits, depending on your “provisional income.” Provisional income includes half of your Social Security benefits, your adjusted gross income (excluding Social Security benefits), and any tax-exempt interest.

- Military Benefits: Most military pay, including retired pay, is not taxed in Illinois. This includes active duty pay, reserve pay, and retired pay. However, there are exceptions, such as military pay received as a civilian, which may be subject to Illinois state tax. Nonresidents are not required to report military pay to Illinois, further reducing their tax liability.

It’s essential to note that while Illinois does not tax Social Security benefits, federal taxes may still be owed on a portion of these benefits. Understanding these nuances can help you better manage your tax obligations and plan for your financial future.

Retirement income and Illinois tax

Retirement income can come from various sources, including pensions, annuities, and retirement accounts like IRAs and 401(k)s. In Illinois, retirement income is generally exempt from state income tax, providing significant tax relief for retirees.

Here’s a closer look at how retirement income is treated for tax purposes in Illinois:

- Pensions and Annuities: Income from pensions and annuities is not subject to Illinois state income tax. This includes both private and public pensions, as well as annuities from insurance companies and other financial institutions.

- Retirement Accounts (IRAs and 401(k)s): Distributions from retirement accounts such as IRAs and 401(k)s are also exempt from Illinois state income tax. This exemption applies to both traditional and Roth accounts, making Illinois a tax-friendly state for retirees.

- Social Security Benefits: As mentioned earlier, Social Security benefits are not taxed by Illinois, further reducing the tax burden on retirees.

By understanding these exemptions, retirees can better plan their finances and potentially save a significant amount on state taxes. It’s always a good idea to consult with a tax professional to ensure you are taking full advantage of the available tax benefits and exemptions.

Filing Illinois state taxes from abroad

When filing Illinois state taxes from abroad, it's essential to determine your residency status and use the appropriate forms:

- Form IL-1040: This is the primary form for filing your Illinois individual income tax return. If you are a full-year resident, you will report all income, regardless of where it is earned.

- Schedule NR: This form is for nonresidents and part-year residents. It helps calculate the tax owed based on income earned while in Illinois and income from Illinois sources, while excluding income earned while in other states or overseas.

Deadlines

- Standard Deadline: April 15. The deadline for filing Illinois state taxes is the same as the federal tax deadline. This is the due date for both filing your return and, importantly, for paying any taxes owed.

- Automatic Extension for Expats: June 15. If you are living outside the U.S. on April 15, you may receive an automatic two-month extension to file your return and pay any amount due without requesting an extension, extending the deadline to June 15. However, interest on any unpaid taxes will accrue from the original April 15 deadline.

- Additional Extension: October 15. You can request a further extension by filing Form 502E, Application for Extension of Time to File Personal Income Tax Return, typically extending the deadline to October 15. Importantly, this extension is only an extension of time to file your return, not for paying any taxes owed. Interest on any unpaid taxes will continue to accrue from the original April 15 deadline.

- Payment Deadlines: Regardless of filing extensions, any taxes owed must be paid by April 15 to avoid interest and late payment penalties. If you file an extension, ensure that your payment is postmarked by the due date to avoid additional charges, including a separate penalty for failure to timely file your tax return.

Consequences of non-compliance with Illinois state tax laws

- Late Filing Penalty: 5% of the unpaid tax per month, up to a maximum of 25%.

- Late Payment Penalty: 0.5% of the unpaid tax per month, up to a maximum of 25%.

- Interest Charges: Interest is charged on any unpaid tax from the original due date until the tax is paid in full, compounded daily without limit.

Audits and Assessments

Illinois may conduct residency audits to verify your residency status and ensure proper tax compliance. During an audit, you must provide extensive documentation, such as proof of domicile and detailed financial records. Failure to provide adequate documentation can result in additional tax assessments and penalties.