How to Move to Colombia from the U.S.

Considering trading the hustle of American life for Colombia's vibrant culture, stunning landscapes, and affordable living?

You’re not alone.

This beautiful country in South America is a great country that has rapidly become one of the most popular destinations for U.S. expats, digital nomads, retirees, and entrepreneurs looking to enjoy an exceptional quality of life at a fraction of the cost.

Colombia's diverse geography, from the Caribbean coast to the Andean region, adds to its appeal for newcomers.

However, making a move to another country comes with challenges—from navigating visas and residences to understanding taxes and financial planning. Fortunately, Colombia offers flexible immigration paths designed specifically for digital nomads, retirees, students, and investors.

In this guide, we’ll walk you through the essential steps to smoothly relocate from the United States, simplifying your planning process, reducing surprises, and empowering you to make informed decisions every step of the way.

Begin with a tourist visa

Before diving into residency or visa applications, visiting Colombia as a tourist is highly recommended. As a U.S. passport holder, you can enter Colombia visa-free and stay up to 90 days, with an easy extension of another 90 days (totaling up to 180 days per year). This approach allows you to:

- Experience life firsthand without immediate commitment.

- Explore different cities and regions—including big cities like Bogotá and Medellín, coastal cities like Santa Marta, and other cities across the country—to see where you might want to live permanently.

- Build an understanding of practical daily life, from local banking to transportation.

Most expats prioritize safety, housing options, and location when choosing a city, and exploring both city centers and other areas can help you find the best fit.

This initial tourist stay will inform your decisions about longer-term residency and helps ensure you select the most appropriate visa later on. The experience will also help you compare the largest cities and other cities to make an informed decision.

Choosing the right Colombian visa

To live long-term in Colombia, you’ll need to secure an appropriate visa. Colombia offers multiple visa types, each with specific visa requirements and eligibility criteria tailored to different purposes, financial situations, and lifestyles.

Selecting the correct visa is crucial because it determines your rights, obligations, and pathway toward permanent residency or even citizenship.

Here’s a clear breakdown of the most popular visa categories for U.S. expats. Each visa category has its own purpose, duration, and requirements:

Temporary visas are available for work, study, or family reasons, and are typically valid for up to three years. The temporary visa for work (work visa) often requires an employment contract with a Colombian company or, in some cases, a multinational company operating in Colombia. Other temporary visas include those for students and family members, each with their own specific requirements.

For retirees, the retirement visa is a popular option, which requires proof of a minimum income to qualify.

After holding certain temporary visas for a required period, you may become eligible to apply for a resident visa, which grants broader rights and a longer-term stay in Colombia.

Digital Nomad Visa (Visa V Nómadas Digitales)

The Digital Nomad Visa is ideal for remote workers and freelancers earning income from outside Colombia. It’s specifically designed to attract digital professionals who wish to live and work remotely in Colombia.

- Income Requirement: Proof of steady monthly income of at least three times the Colombian legal monthly minimum wage. In 2025 that’s about COP 4.27M per month (roughly USD $1,050–$1,100, depending on exchange rates). This threshold is tied to the minimum wage and is updated periodically, so always confirm the current amount before applying.

- Validity: Up to 2 years.

- Renewal: Renewable as long as conditions remain met.

- Advantages: Allows remote work legally in Colombia without local employment obligations.

Pensioner Visa (Visa M Pensionado)

Colombia is an attractive retirement destination due to its low cost of living and favorable climate. The Pensioner Visa, also known as the retirement visa, is aimed at individuals receiving stable pension income from outside Colombia.

- Minimum Income Requirement: Pension payments equaling at least three times Colombia’s minimum monthly wage are required for eligibility. In recent years that has worked out to roughly USD $900–$1,000 per month, but the exact figure moves as Colombia’s minimum wage and FX rates change, so always check the latest threshold.

- Validity: Typically granted for up to 3 years.

- Renewal: Renewable indefinitely, provided the pension requirements continue to be met.

- Advantages: Stable long-term residency with straightforward renewal requirements.

Student Visa (Visa V Estudiante)

The Student Visa is a visa category within Colombia's temporary visas, designed for individuals who wish to enroll in higher education programs, formal language courses, or recognized educational institutions in Colombia.

- Requirement: Enrollment confirmation from an accredited Colombian institution.

- Validity: This temporary visa is typically valid for the duration of the study program, usually 1 year, and is renewable annually based on enrollment.

- Renewal: Renewable upon continuous enrollment and satisfactory progress.

- Advantages: Opportunity to immerse yourself culturally while improving language skills or obtaining a Colombian degree.

Investment and Business Visas (Visa M Inversionista / Visa M Empresario)

Colombia encourages foreign investment and entrepreneurship by offering dedicated visas for those who invest locally or start businesses. These visas support the growth of the Colombian economy by attracting foreign investment and entrepreneurship.

Investment Visa (M Inversionista):

- Requirement: Significant investment, typically around 350 times the Colombian minimum wage (~USD $85,000–$90,000+) in real estate or business ventures.

- Validity: 3 years, renewable.

- Advantages: Provides a clear path toward permanent residency after five years.

Business Owner Visa (M Empresario):

- Requirement: Incorporation and operation of a Colombian business; establishing a Colombian company is a requirement for this visa, and typically involves investment in business activities sufficient to demonstrate economic impact and job creation.

- Validity: Usually 1–3 years, renewable based on business performance.

- Advantages: Ideal for entrepreneurs planning to establish a lasting presence and potentially employ local talent.

Marriage or Family Visas (Visa M Cónyuge or Dependiente)

Family visas allow spouses, domestic partners, and dependents of a Colombian citizen or legal resident to live in Colombia.

- Requirement: Marriage certificate or documented proof of domestic partnership.

- Validity: Generally valid for up to 3 years.

- Renewal: Renewable and can lead to permanent residency or citizenship after certain conditions and time frames are met.

- Advantages: Simplified residency route for family reunification.

Selecting the best sisa for your situation

Choosing the right visa category depends on your income sources, planned activities, length of stay, and long-term goals. Selecting the correct visa category is essential for a smooth transition. For instance:

- Digital professionals with remote income streams might favor the Digital Nomad Visa.

- Retirees seeking comfort and affordability will likely prefer the Pensioner Visa.

- Entrepreneurs and investors aiming at long-term commitments benefit from Investment or Business Visas.

It’s crucial to evaluate your individual circumstances and consult with immigration professionals familiar with Colombian immigration laws. Always refer to official sources for up to date information on visa requirements and processes. Proper selection ensures your smooth transition and maximizes your long-term residency options in Colombia.

Visa application process for Colombia

Once you’ve identified the right Colombian visa, the next stage is understanding the application process. Meeting visa requirements, including having a valid passport with sufficient validity and blank pages for stamps, is essential for a successful application.

Applying for a visa involves several steps, careful preparation, and precise documentation.

Here’s a straightforward guide to help you navigate the process smoothly:

Step 1: Prepare necessary documentation

Each visa type has specific document requirements, but there are several universal documents needed for nearly all applications:

- Valid U.S. Passport: Ensure your passport has at least six months validity remaining and blank pages for stamps.

- Passport Photos: Recent color passport-sized photos with white background.

- Proof of Financial Resources: Bank statements, pension documents, income statements, or evidence of investments depending on your visa type.

- Criminal Background Check: Issued by the FBI or local state police, typically requiring apostille certification.

- Health Insurance: Proof of international or local health insurance coverage valid in Colombia.

- Application Forms: Completed online through Colombia’s official Ministry of Foreign Affairs platform.

For specific visa categories, additional documents might include:

- Work Visa: Employment contract or job offer letter from a Colombian or foreign employer, demonstrating a formal employment relationship.

- Digital Nomad: Proof of remote employment or freelance contracts and regular income statements.

- Pensioner Visa: Official pension documentation verifying monthly pension income.

- Student Visa: Letter of acceptance from an accredited educational institution in Colombia.

- Investment or Business Visa: Evidence of business registration, investment certificates, proof of capital investment, or business plans.

- Marriage/Family Visa: Official marriage certificates or domestic partnership documentation, often requiring apostille certification and official translations.

Step 2: Online application submission

Colombia uses an online visa application system operated by the Ministry of Foreign Affairs:

- Create an account at the official visa portal.

- Fill out the electronic visa application form, uploading clear scans of all required documents.

- Verify all details carefully; errors or incomplete information can delay or complicate your application.

Step 3: Pay visa fees

After submitting the application, you’ll be required to pay two fees:

- Visa Application Fee (Study Fee): A non-refundable fee paid upfront, typically around USD $50–$60 depending on visa type.

- Visa Issuance Fee: Charged only if your visa is approved, generally around USD $150–$300, again varying by visa type.

Payment is usually processed online via credit or debit card through the official Colombian visa portal.

Step 4: Attend visa interview (if requested)

While many applicants receive visas without interviews, some cases might require a brief online or in-person interview at a Colombian consulate, particularly if the authorities seek further clarification or verification of documents.

Step 5: Receive visa approval and E-Visa

Upon approval:

- Colombia issues an electronic visa (E-Visa), emailed directly to you.

- Print the E-Visa and keep both printed and digital copies readily available during travel and upon arrival.

Step 6: Obtain colombian Migrant ID Card (Cédula de Extranjería)

Once you arrive in Colombia with your approved visa, you must register at Migración Colombia within 15 calendar days:

- Present your printed E-Visa, passport, and address information in Colombia.

- Receive your Cédula de Extranjería (Foreigner’s ID card), a mandatory document for banking, contracts, and daily administrative tasks in Colombia.

Visa renewal and extensions

Most Colombian visas are renewable or extendable as long as the original conditions remain valid:

- Apply for renewal before your visa expires to avoid complications or overstays.

- Renewal typically requires updated documents proving you still meet visa criteria.

Professional support

Though Colombia’s visa process is straightforward, minor errors or omissions can cause delays. If your situation is complex or you prefer professional guidance, consider engaging a reputable immigration lawyer or service experienced with Colombian immigration law.

Careful planning and attention to detail at each step of the process will make your transition smoother and can help you get off to a strong start in your new life in Colombia.

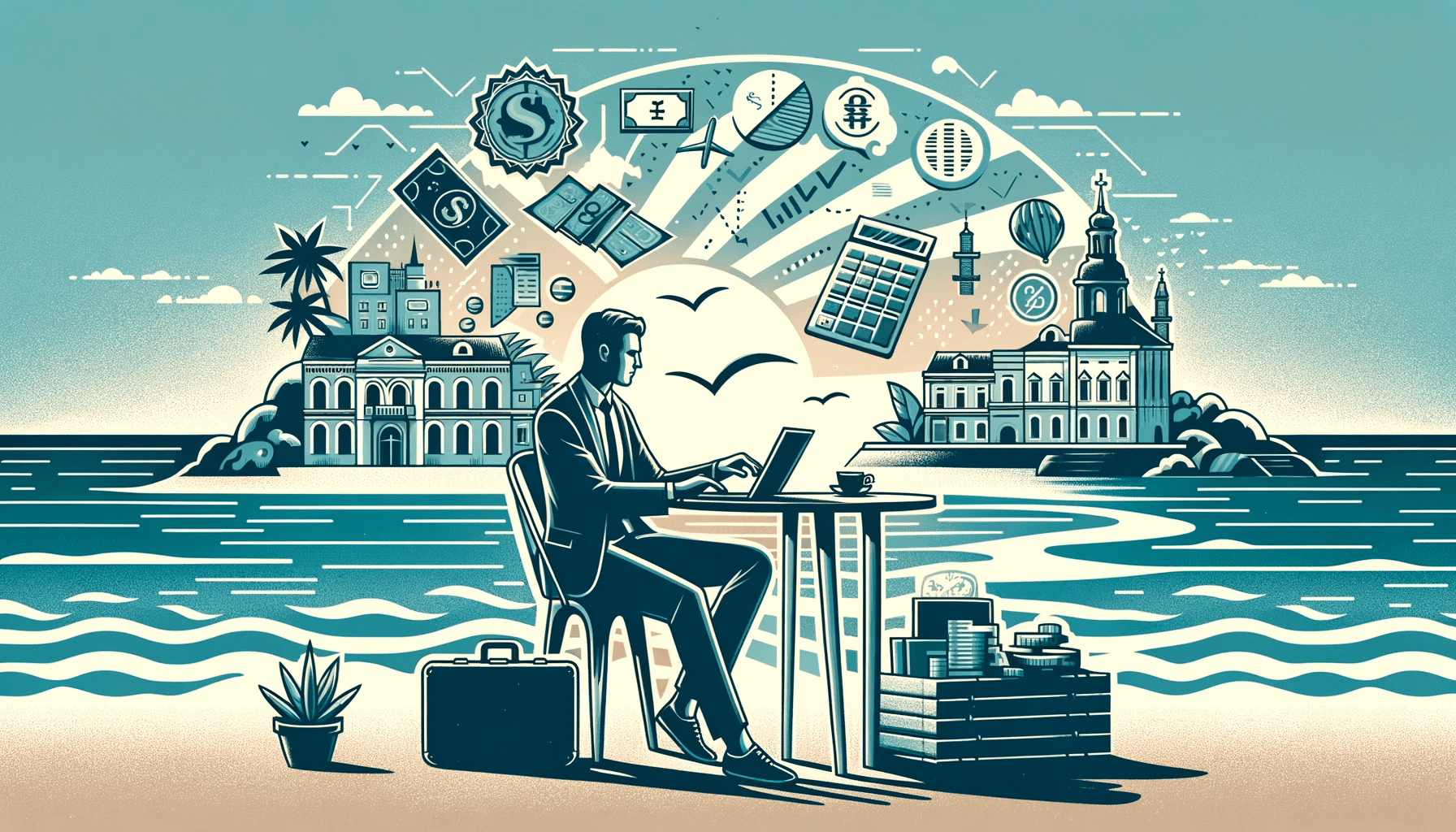

Taxes in Colombia for US expats

Relocating to Colombia offers an appealing lifestyle and cost of living—but also introduces serious tax considerations. Once you become a Colombian tax resident, you may be subject to Colombia's tax system and the country's tax laws, which can require you to pay taxes on your global income, including U.S. pensions, investments, and employment earnings.

Meanwhile, U.S. citizens are required to report income and potentially pay taxes to the IRS no matter where they reside. This chapter breaks down what to expect on both sides.

Colombian taxes for residents

Colombia considers you a tax resident if you spend more than 183 days (consecutive or not) in the country within any rolling 365-day period. After that, you are taxed on your worldwide income, not just Colombian-sourced income.

Income tax rates

Colombia uses a progressive tax structure based on UVT (Unidad de Valor Tributario), adjusted annually. For 2025:

- 0% on income below COP 46 million ($11,500 USD)

- 19% on COP 46M–111M

- 28% on COP 111M–249M

- 39% on income above COP 249M (~$62,000+ USD)

Taxation of foreign pensions

Colombia taxes foreign pensions, including U.S. Social Security and private retirement funds:

- The first 1,000 UVT (~COP 49.8M or ~$12,600 USD) per year is exempt.

- Amounts above that are taxed at the same progressive rates listed above.

This applies to all tax residents, regardless of the country of pension origin.

Wealth tax

Colombian tax residents must also pay a wealth tax if their global net worth exceeds 72,000 UVT (~COP 3.6 billion or ~$900,000 USD). The rates are 0.5%–1.5%, depending on the size of the asset base.

Both Colombian and foreign-held assets are included.

Social Security contributions in Colombia

If you earn income in Colombia, you are generally required to contribute to Colombia’s social security system. This includes:

Pension Fund:

- 16% of salary or 40% of gross self-employment income.

- Employers pay 12%, employees pay 4%.

- Self-employed individuals must pay the full 16%.

Health Insurance:

- 12.5% total; employees pay 4%, employers 8.5%.

- Self-employed must pay the full 12.5%.

Labor Risk Insurance (ARL):

- Required for employees; paid by the employer.

- Self-employed may optionally contribute depending on occupation.

These are mandatory contributions for any local employment or income-generating activity within Colombia.

U.S. Federal tax obligations

As a U.S. citizen, your federal tax obligations continue regardless of residency abroad. You must report all global income annually to the IRS, including income earned in Colombia from employment, pensions, and investments.

Foreign Earned Income Exclusion (FEIE)

Suppose you qualify under either the Physical Presence Test (330+ days abroad annually) or the Bona Fide Residence Test. In that case, you can exclude up to the annual FEIE limit of foreign earned income (such as salaries or self-employment earnings) from U.S. taxation — for example, $126,500 for 2024 and $130,000 for 2025, with the cap indexed for inflation going forward. Passive income like pensions, dividends, and capital gains does not qualify for FEIE.

Foreign Tax Credit (FTC)

The FTC allows you to credit income taxes paid to Colombia against U.S. tax liabilities. In many cases, the combined effect is that you effectively pay at least the higher of the two countries’ rates on a given slice of income, once FEIE and FTC are taken into account. If Colombian taxes are higher, you’ll usually pay there first and then claim a corresponding credit in the U.S., subject to the FTC’s limits and basket rules.

U.S. Social Security taxes

Self-employed expats remain subject to U.S. self-employment tax (15.3%), even if they live and work entirely in Colombia. Because there is no Social Security agreement (“totalization agreement”) between the U.S. and Colombia, self-employed individuals may end up paying Social Security contributions to both countries.

U.S. State tax obligations while living abroad

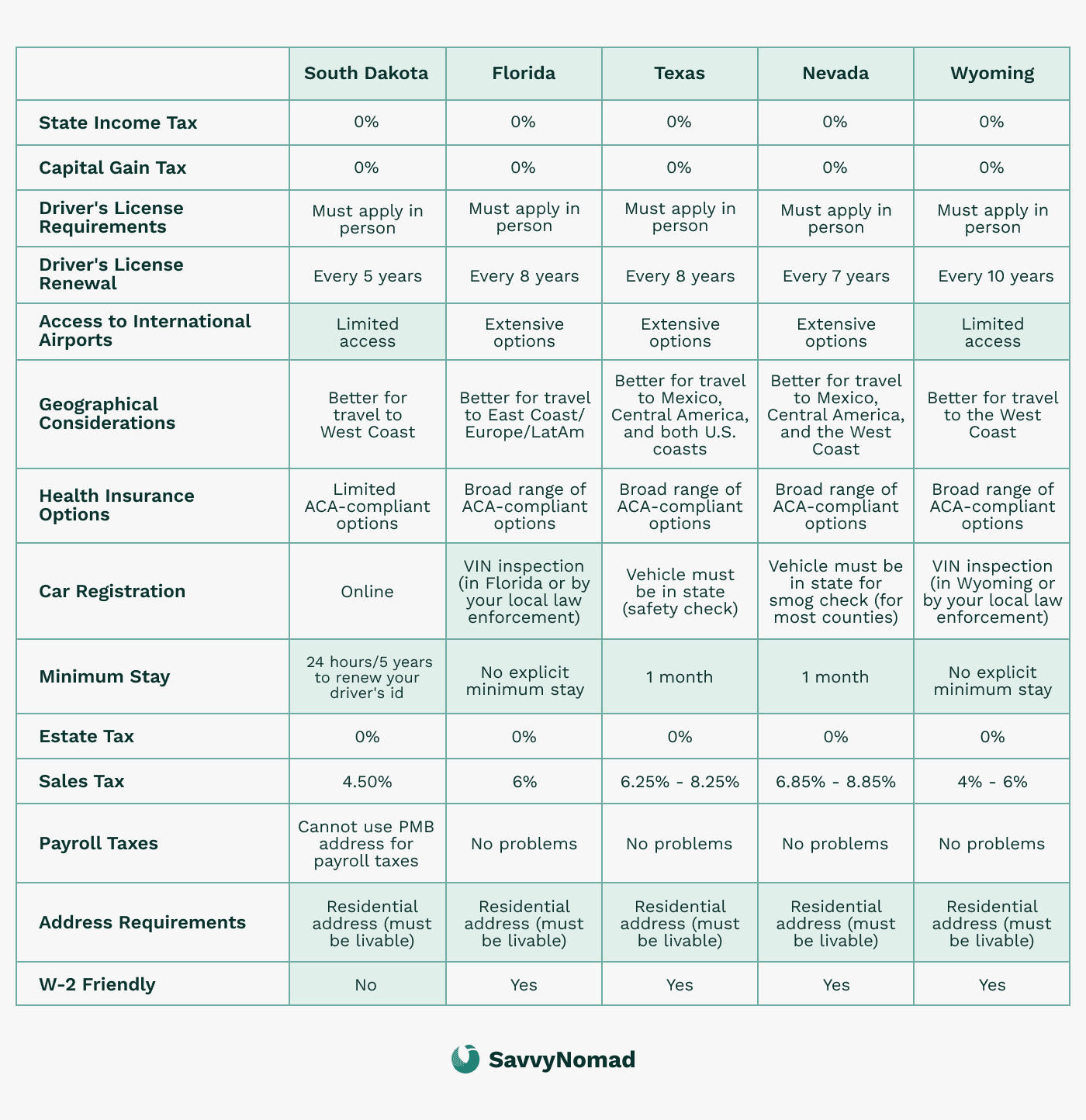

Your previous U.S. state may also continue taxing your worldwide income after you move abroad. State tax residency hinges on the concept of domicile—your permanent home or state of residence for tax purposes.

- High-tax states like California, New York, New Jersey, Hawaii, and Pennsylvania have strict residency rules and do not recognize the federal FEIE. This means they may continue taxing your global income even after you move overseas, especially if you maintain ties such as a home, driver’s license, voter registration, or bank accounts.

- States without a broad tax on wage income — such as Florida, Texas, Nevada, South Dakota, Wyoming, Tennessee, Washington, and New Hampshire — generally stop taxing your personal earned income once you are no longer a resident there, though you can still owe tax on in-state–source income (and, in Washington’s case, certain long-term capital gains). Many expats formally change their domicile to one of these states before relocating overseas to reduce ongoing state-level tax exposure, but you still have to meet each state’s specific residency rules.

- Middle-ground states (e.g., Virginia, Georgia, North Carolina) vary but generally align with federal rules and often recognize the FEIE. However, these states still evaluate domicile factors to determine residency.

To clearly terminate residency in a high-tax state consider the following:

- Move official documents (driver’s license, voter registration) to a zero-tax state.

- Close or transfer financial accounts and property ownership.

- Limit time spent physically in your former state.

Without taking these measures, you risk continued tax exposure, including potential state-level taxation on your Colombian income.

Establishing residency and practical considerations in Colombia

After securing your Colombian visa and arriving in the country, the next crucial steps involve establishing your everyday life and official residency. Navigating practical requirements—such as housing, banking, healthcare, and understanding local culture—is key to a successful and comfortable transition.

For integration, it is important to speak Spanish, as nearly all Colombians use it as their primary language, though in larger cities, many people also speak English, especially in professional and educational settings.

Colombia’s culture and social values share many similarities with those of many South American countries, reflecting regional customs and traditions. Immersing yourself in Colombian culture—through local customs, music, dance, and social values—will greatly enhance your experience as an expat.

Here’s what you need to know:

Finding housing and obtaining proof of residency

To establish formal residency, you’ll need proof of a permanent address, essential for banking, contracts, healthcare enrollment, and other official services.

Housing options:

- Rental properties: Usually require a local guarantor or deposit equivalent to several months’ rent. Airbnb or short-term rentals offer flexibility while you explore longer-term solutions.

- Buying property: Foreigners can freely buy real estate, often streamlining residency proof and long-term stability.

Once you have a fixed address, request a utility bill or formal lease agreement, which serves as official residency proof.

Registering your visa and getting a Cédula de Extranjería

The Cédula de Extranjería is your Colombian foreign resident ID card, essential for daily administrative tasks. Obtain it within 15 calendar days of your arrival:

- Visit your local Migración Colombia office.

- Provide passport, printed e-visa, proof of residency (e.g., lease or utility bill).

- Your biometric data (photo and fingerprints) will be collected, and you’ll receive the physical ID card typically within 1–2 weeks.

Opening a Colombian bank account

A local bank account simplifies daily life, allowing you to pay bills, receive income, and manage finances easily within Colombia:

- Most banks require your Cédula de Extranjería, proof of address, and a reference letter from your foreign bank or local resident.

- Popular Colombian banks offer digital banking options, including Bancolombia, Davivienda, and Banco de Bogotá.

- Foreign banks like Scotiabank and BBVA also operate locally.

Accessing healthcare and insurance

Colombia’s healthcare system ranks among the best in Latin America. As a resident, you can access quality healthcare through public (EPS) or private providers.

- EPS (Entidades Promotoras de Salud): Mandatory, affordable public healthcare system covering basic medical needs. Enrollment typically requires your cédula and monthly contribution based on your declared income.

- Private health insurance: Offers broader access to private hospitals, specialists, shorter waiting times, and additional benefits. Premiums depend on age, health history, and coverage level.

Many expats use a combination—EPS for general coverage and private insurance for specialized care.

Driving and transportation

If you plan to drive in Colombia:

- A U.S. driver’s license is accepted temporarily (usually up to 6 months).

- Eventually, you’ll need a Colombian driver’s license, obtainable through local transit agencies after taking required exams.

- Colombia offers excellent public transportation in major cities, and taxis and ride-sharing apps (Uber, Cabify, Didi) are widely available and affordable.