Do expats still need to pay Maryland state taxes?

Maryland expats might still owe state taxes, depending on their residency status. Knowing the rules about residency and domicile can help you avoid unexpected tax bills and help you stay compliant with state laws.

Residency and domicile determine whether you owe Maryland state taxes on your income for income tax purposes. Even if you live abroad full-time, you might be considered a Maryland resident for tax purposes if Maryland is your permanent home. This means you could owe taxes on your worldwide income, including what you earn overseas.

TLDR:

If Maryland remains your domicile and you haven’t established residency elsewhere, you are considered a Maryland resident for tax purposes, even if you rarely set foot in the state during the year, and must file and pay Maryland state taxes on your worldwide income.

Maryland calculates state taxes starting from your federal adjusted gross income (AGI), but some items that are excluded from federal income may have to be added back for Maryland purposes, so federal exclusions don’t always reduce Maryland tax in the same way.

However, if you are a Maryland resident or have Maryland-sourced income and are required to file a federal return (or want a refund of Maryland tax withheld), you generally must also file a Maryland state return, subject to Maryland’s filing thresholds.

The FEIE (foreign earned income exclusion) allows U.S. taxpayers living abroad to exclude up to $126,500 of foreign-earned income from their U.S. taxable income for the 2024 tax year.

This exclusion only applies to earned income, such as wages and salaries, and does not apply to passive income, like interest, dividends, capital gains, and rental income.

To stop being taxed as a Maryland resident on your worldwide income, you generally need to sever most ties with Maryland and establish a new domicile in another state, while managing any ongoing Maryland-sourced income.

Understanding Maryland's tax residency rules

Residency and domicile are critical in determining your Maryland tax obligations. Residency refers to where you live, while domicile is your permanent home, to which you intend to return after any absence.

Resident

If Maryland is your domicile, you are considered a resident for tax purposes. This means you must pay Maryland state taxes on your worldwide income, including foreign earned income. As a resident, you must file a Maryland resident tax return for the full tax year.

Maryland calculates state taxes based on your federal adjusted gross income (AGI), so any foreign income excluded from your federal return will also be excluded from your Maryland return.

However, if you are required to file a federal return, you must also file a Maryland state return.

The FEIE (foreign earned income exclusion) allows U.S. taxpayers living abroad to exclude up to $126,500 of foreign earned income from their U.S. taxable income for the 2024 tax year. However, this exclusion applies only to earned income, such as wages and salaries. It does not apply to passive income, which includes interest, dividends, capital gains, and rental income.

Nonresident

Nonresidents are not domiciled in Maryland and do not maintain significant ties to the state. They are taxed only on income from Maryland sources, such as wages earned while working in Maryland or income from property located in the state. Nonresidents must file a state income tax return for income earned from Maryland sources.

Part-Year Resident

Part-year residents are individuals who move into or out of Maryland during the tax year. They are taxed on all income earned while they were residents of Maryland and on Maryland-sourced income only for the periods during which they were not residents.

What constitutes Maryland-sourced income?

Understanding what constitutes Maryland-sourced income is essential for both nonresidents and part-year residents to accurately determine their tax obligations.

Maryland-sourced income is any income derived from activities or assets located within the state.

Here are some key categories to consider:

- Wages and Salaries: Money earned for services performed in Maryland.

- Business Income: Income from business activities conducted in Maryland.

- Real Estate: Rental income from property located in Maryland.

- Capital Gains: Profits from the sale of real estate or tangible property located in Maryland.

- Dividends and Interest: Dividends from Maryland-based companies and interest paid by Maryland financial institutions.

- Pensions and Retirement Plans: Retirement income from Maryland institutions or for services performed in the state.

Why should you choose to be domiciled in a state with no state income tax?

State income tax savings

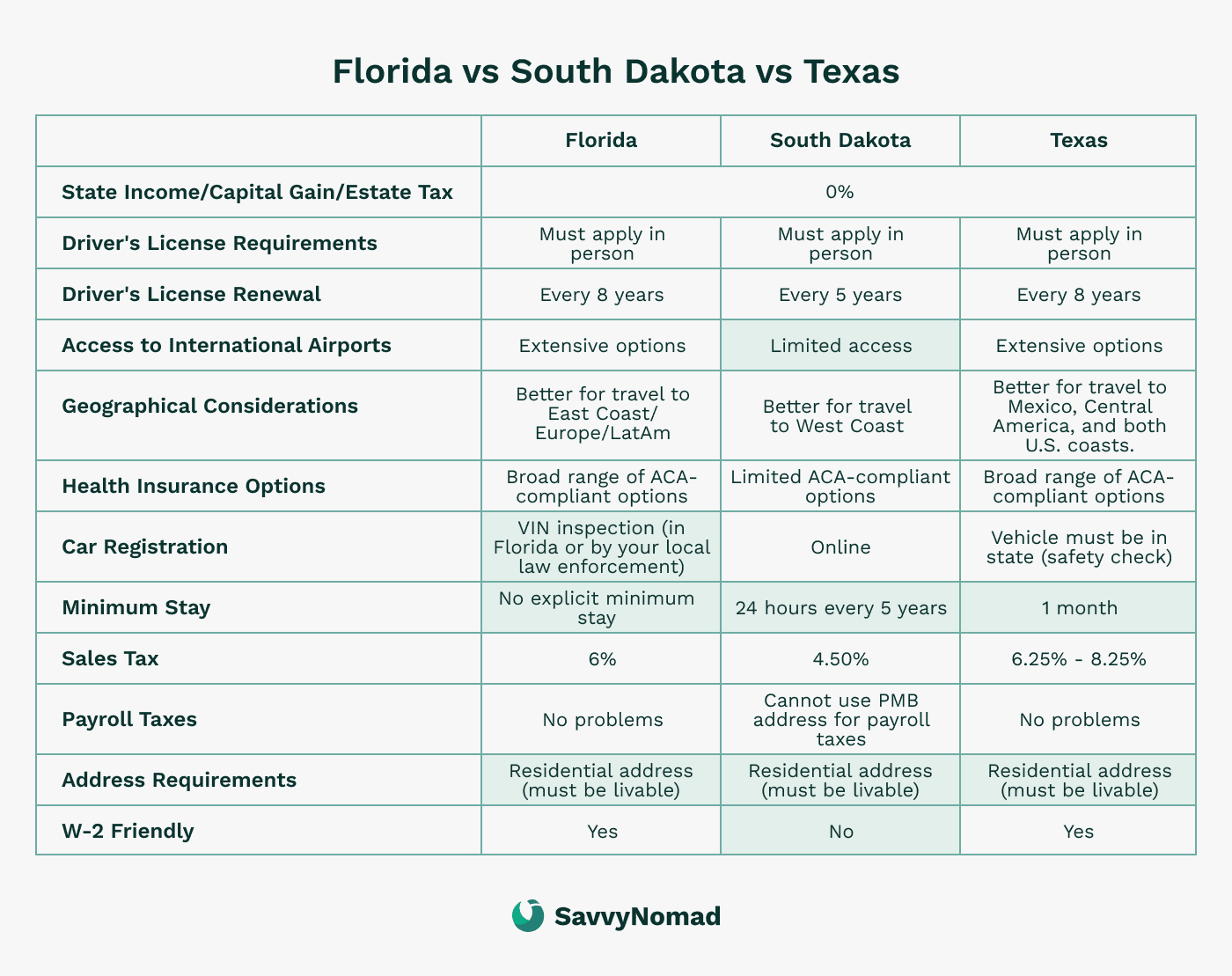

High-income earners and retirees with significant income from investments, pensions, and other sources can benefit greatly from moving to states with no state income tax, such as Florida, Texas, and Nevada.

This move can result in substantial tax savings, especially for those with high annual incomes, who would otherwise face steep state tax bills in Maryland.

For individuals with income exceeding the Foreign Earned Income Exclusion (FEIE) limit of $126,500 in 2024, moving to a no-income-tax state can be particularly beneficial, as it shields even more of their income from state taxes.

Inheritance tax benefits

Moving to a state with no state income tax can provide extra advantages in terms of inheritance and estate taxes. States like Florida, Texas, and Nevada, which do not have a state income tax, also have favorable estate tax laws. This can be very beneficial for high-net-worth individuals who want to reduce the estate and inheritance tax burdens on their families.

Flexibility and mobility

Moving your domicile to a no-income-tax state enhances flexibility and mobility, allowing individuals to travel or live in multiple locations without worrying about high state tax bills. This is ideal for high-income earners with business interests in different states or countries and for retirees looking forward to spending their golden years exploring new places.

In addition, the lack of state income taxes can simplify your tax filing process. In many cases you may only need to file federal taxes, reducing the complexity and potential for errors in your tax returns and making the management of your finances more straightforward, though you could still have filing obligations in other states depending on your situation.

How to leave Maryland tax residency?

Here are the key steps to help you transition:

1) Establish new residency

Secure a Residential Address: Obtain a residential address in your new state. Severing ties with Maryland includes ending any active business involvement in the state. This is the most critical step in establishing a new domicile.

File a Declaration of Domicile if required: Some states, like Florida, allow you to file a formal declaration, under oath, confirming your new domicile

Reference guides may provide additional help for specific states:

2) Sever your ties with Maryland and confirm abandoned Maryland residency

- Sell property: If you own property in Maryland, consider selling it or renting it out. Owning property in Maryland can indicate a continued connection to the state.

- Transfer IDs and registrations: Update your driver’s license and vehicle registration to your new state. This demonstrates your commitment to your new domicile.

- Voter registration (if you are eligible): If you are eligible, you may register to vote in your new state. Voter registration is one supporting indicator of your intent to establish residency, not determinative on its own. For eligibility and procedures, follow guidance from election officials in both states.

- Update personal documents: Change your address on all identification cards, medical records, insurance policies, financial documents, and other important records.

3) Notify relevant parties

- Inform your employer: Notify your employer of your new address. This can affect how your income is taxed and helps establish your new domicile.

- Notify the IRS: Inform the IRS of your address change using Form 8822. Extend this notification to all personal and professional entities.

- Update all personal and professional entities: Inform banks, investment accounts, insurance companies, and other relevant entities of your new address. Establish relationships with medical and dental providers in your new state and join local clubs and associations.

4) Keep detailed records

- Maintain documentation: Keep receipts, bills, lease agreements, and other legal documents that demonstrate your new residency. Detailed records are essential if your residency status is ever questioned.

- Track your movements: Document your time spent in and out of Maryland. This includes travel records, utility bills, and any other documents that show when you were physically present in your new state.

5) Be prepared for audit

- Proof of permanent move: Be ready to provide comprehensive proof that you have permanently moved out of Maryland. This includes all documentation showing, among other things, that you have established a new domicile, severed all ties with Maryland, that your most important possessions are in your new domicile, and how many days you spent in Maryland and in your new domicile.

- Respond to inquiries: If the Maryland Department of Taxation questions your residency status, typically by mail, be sure to respond promptly to avoid potential penalties, providing thorough responses and all necessary documentation.

Tax benefits and exemptions for expats from Maryland

Living abroad as an expat from Maryland comes with various federal tax benefits and exemptions that can help reduce your overall tax burden.

Here are some of the key federal tax advantages available:

Foreign Earned Income Exclusion (FEIE)

The FEIE allows you to exclude a significant portion of your foreign-earned income from U.S. federal income tax.

For the tax year 2024, you can exclude up to $126,500 of foreign-earned income.

To qualify, you must pass either:

- Bona Fide Residency Test: You qualify if you are a resident of a foreign country for an uninterrupted period that includes an entire tax year.

- Physical Presence Test: You qualify if you are physically present in a foreign country for at least 330 full days during a 12-month period.

Foreign Tax Credit (FTC)

The FTC helps you avoid double taxation by allowing you to take a credit (a dollar-for-dollar reduction in your federal taxes) for foreign taxes paid on income that is also subject to U.S. federal tax. This is especially beneficial if you live in a high-tax country.

Foreign Housing Exclusion (FHE)

The FHE allows you to exclude certain housing expenses from your taxable income, including rent, utilities (excluding telephone), and other reasonable expenses related to housing abroad.

The amount you can exclude is limited to a base amount plus housing expenses exceeding 16% of the FEIE limit ($126,500 for the 2024 tax year).

Filing Maryland income tax return from abroad

When filing Maryland state taxes from abroad, it's essential to determine your residency status and then use the appropriate forms:

- Form 502: Maryland Resident Income Tax Return. Use this form if you are considered a full-year resident of Maryland. You must report all income, regardless of where it is earned .

- Form 505: Maryland Nonresident Income Tax Return. Use this form if you are a nonresident or part-year resident. You need to report the income earned only from Maryland sources and only during your period of residency.

- Form 502B: Dependents’ Information. Attach this form if you claim any dependents on your Maryland state tax return.

- Form 502CR: Maryland Personal Income Tax Credits for Individuals. Use this form to claim any applicable tax credits.

- Form 505NR: Maryland Nonresident Income Tax Calculation. Use this form in conjunction with Form 505 to calculate your nonresident tax.

Deadlines

- Standard Deadline: April 15. The deadline for filing Maryland state taxes aligns with the federal tax deadline. This is the due date for both filing your return and, importantly, paying any taxes owed.

- Automatic Extension for Expats: June 15. If you are living outside the U.S. on April 15, you may receive an automatic two-month extension to file your return and pay any amount due without requesting an extension, extending the deadline to June 15. However, interest on any unpaid taxes will accrue from the original April 15 deadline until the taxes are paid.

- Additional Extension: October 15. You can request a further extension by filing Form 502E, Application for Extension of Time to File Personal Income Tax Return, typically extending the deadline to October 15. This extension is for filing your return only, not for paying any taxes owed. Interest on any unpaid taxes will continue to accumulate from the original April 15 deadline until the taxes are paid.

- Payment Deadlines. Regardless of filing extensions, any taxes owed must be paid by April 15 to avoid interest and late payment penalties. If you file an extension, make sure that your payment is postmarked by the due date to avoid additional charges.

Consequences of non-compliance with Maryland state tax laws

- Late Filing Penalty: 5% of the unpaid tax per month, up to a maximum of 25%.

- Late Payment Penalty: 0.5% of the unpaid tax per month, up to a maximum of 25%.

- Interest Charges: Interest is charged on any unpaid tax from the original due date until the tax is paid in full, compounded daily.

Audits and Assessments

Maryland may conduct residency audits to verify your residency status and check for proper tax compliance. During an audit, you must provide extensive documentation, such as proof of domicile and detailed financial records. Failure to adequately document your residency status can result in additional tax assessments and penalties.