Foreign Tax Credit (FTC): IRS Form 1116

Welcome to our definitive guide on the Foreign Tax Credit (FTC) - an indispensable financial tool for U.S. expats and digital nomads traversing the globe.

In the confusing maze of global taxation rules, the FTC stands out as a beacon of relief, enabling American wanderers to offset their foreign income taxes against U.S. tax liabilities.

This guide demystifies the FTC, laying bare its nuances, eligibility, and application processes, making your global adventures economically feasible and tax-efficient.

What is the Foreign Tax Credit (FTC)?

The Foreign Tax Credit is a financial cornerstone for U.S. citizens and resident aliens earning income beyond American shores. This tax provision is a strategic shield against the peril of double taxation — where both the U.S. and a foreign country claim the same income. The FTC can also reduce the taxpayer's federal income tax liability, making it a crucial tool for optimizing tax savings.

The FTC empowers these international taxpayers to offset the taxes they pay abroad against their U.S. tax liabilities. Particularly advantageous in countries with higher tax rates than the U.S., it can substantially reduce, or sometimes entirely remove, the U.S. tax burden.

Purpose and benefits of the FTC

- Combating double taxation: Because the United States is one of the very few countries that tax based on citizenship rather than residence (Eritrea is another), the FTC’s primary role is to reduce the risk that the same income is taxed by both the U.S. and a foreign country. This is critical for the financial well-being of U.S. expatriates and digital nomads, safeguarding them from the financial strain of dual tax liabilities. Tax treaties with foreign countries also play a crucial role in avoiding double taxation by establishing reduced tax rates or exemptions.

- Opening doors globally: The FTC allows Americans to explore and embrace work opportunities worldwide. By easing the tax load, it encourages global mobility and professional growth.

- Streamlining tax compliance: For U.S. citizens living overseas, the FTC simplifies the intricate web of tax compliance. It offers a straightforward route to fulfilling U.S. tax responsibilities while recognizing their international earnings.

Eligibility criteria for the Foreign Tax Credit

To qualify for the FTC, U.S. expats and nomads must meet certain conditions that affirm their tax obligations to foreign governments and help them comply with U.S. tax law.

Here's a rundown of the criteria:

Mandatory tax imposition

First, the foreign income tax must be a mandatory charge by a foreign government or U.S. possession, either paid or accrued by the taxpayer. This criterion separates obligatory payments from voluntary ones.

Nature of the tax

The tax in question must be an income tax or its equivalent. This excludes indirect taxes like VAT or sales tax, except when they substitute for an income tax. Additionally, capital gains are considered unearned income and are not eligible for the Foreign Earned Income Exclusion (FEIE).

Legal tax obligation

The tax must represent a real liability, legally due without the possibility of a significant refund or rebate, which supports the legitimacy of the tax claim.

Source of income

The focus is on income earned outside the U.S. That is, for the income to qualify, the taxpayer must have earned it outside the US.

Limitation of the FTC

The Foreign Tax Credit is limited to the lesser of (1) the foreign income taxes you paid or accrued on the same income, or (2) the U.S. tax on that foreign-source income as computed on Form 1116.

There is no fixed dollar cap for the FTC. Amounts in excess of the limitation can generally be carried back 1 year and carried forward up to 10 years.

If you elect the FEIE for a category of income, you can’t take an FTC on that excluded income.

Specific exclusions

Certain foreign taxes are excluded, such as those paid to sanctioned countries or on income exempt under other U.S. tax provisions (like the Foreign Earned Income Exclusion).

Qualifying foreign taxes

Qualifying foreign taxes are those imposed by a foreign country or U.S. possession on foreign income. To claim the foreign tax credit, the tax must be an income tax or a tax in lieu of an income tax imposed on the taxpayer.

The tax must also be a legal and actual foreign tax liability that is not refundable.

The following types of foreign taxes qualify for the foreign tax credit:

- Income taxes paid to a foreign country or U.S. possession: These are direct taxes on your earnings, whether from wages, dividends, interest, or rental income.

- Taxes on foreign business income and investment income: If you run a business or have investments abroad, the taxes you pay on these earnings can qualify.

- Taxes on foreign source income: This includes any income earned abroad or from foreign investments, so that your global earnings are taken into account.

However, not all foreign taxes qualify for the foreign tax credit. The following types of taxes do not qualify:

- Taxes on income not subject to U.S. taxation: If the income isn’t taxable in the U.S., the foreign taxes paid on it won’t qualify.

- Taxes on income exempt from U.S. taxation: Similar to the above, if the income is exempt under U.S. tax laws, the foreign taxes on it are not eligible.

- Taxes on income not derived from foreign sources: Only taxes on income earned outside the U.S. are considered.

- Refundable taxes: Any foreign tax that can be refunded does not qualify.

- Taxes not imposed on the taxpayer as an individual: The tax must be a personal liability, not a corporate or other entity’s responsibility.

It’s essential to note that the foreign tax credit is distinct from the foreign earned income exclusion (FEIE), which allows you to exclude a portion of your foreign earnings from taxable income. While the FEIE reduces your taxable income, the foreign tax credit provides a dollar-for-dollar reduction of your U.S. tax liability, making it a powerful tool in managing your global tax obligations.

Actual foreign tax liability

The actual foreign tax liability is the amount of foreign taxes paid or accrued on foreign income. To claim the foreign tax credit, taxpayers must have this liability, which must be a legitimate and non-refundable tax.

Calculating the actual foreign tax liability involves determining the foreign taxes incurred, confirming they are paid or accrued on foreign income, and converting them to U.S. dollars using the appropriate exchange rate.

It's important to note that not all foreign taxes qualify for the credit. For example, refundable taxes or taxes incurred without a foreign tax residence do not meet the requirements for the foreign tax credit.

7 Steps to Claim Foreign Tax Credit

Claiming the Foreign Tax Credit requires a clear understanding of the steps and rules.

The steps are as follows:

Step 1: Confirm Eligibility

First, make sure you meet the FTC eligibility criteria.

Step 2: Choose deduction or credit

You can opt for either a deduction or a credit. A deduction lowers the amount of income subject to taxation, while a credit reduces the final tax owed. Foreign income taxes reduce U.S. taxable income when taken as a deduction. Typically the credit is a more beneficial and straightforward way to reduce your U.S. tax.

Step 3: Filling out Form 1116

Electing the credit or deduction requires completing Form 1116. Attach this form to your tax return.

Step 4: Currency conversion

Convert foreign taxes to U.S. dollars using the appropriate exchange rate.

Step 5: Understanding limits

The credit is limited to the smaller of (1) the foreign income taxes you paid or accrued on the same income and (2) the U.S. tax on that foreign source income as computed on Form 1116. It also cannot exceed your total U.S. income tax liability for the year, so it can reduce your federal income tax to zero but cannot by itself create a refund.

Step 6: Handling excess credits

Excess credits can be carried over or back to other tax years.

Step 7: Filing the return

Attach Form 1116 to your federal tax return, keeping an eye on deadlines and extensions, especially as these can sometimes vary for expats.

Foreign Tax Credit carryover and limitations

The Foreign Tax Credit (FTC) offers flexibility for U.S. expats with its carryover and carryback options.

Here's a closer look at how these work:

Carryover and carryback

- Carryback: Excess credit can be applied to the immediate previous tax year, possibly necessitating an amendment to that year's return.

- Carryforward: Remaining credits, after carryback or if you opt not to carry back, can be carried forward for up to 10 years. Post 10 years, any unused credits expire.

FTC limitations

- The FTC applies only to foreign income that is also subjected to U.S. taxation.

- The foreign tax must be a legal, actual liability that is not refundable.

- The credit’s limit is tied to the U.S. tax on the same foreign source income, meaning it cannot generate a U.S. income tax refund.

- It also cannot reduce the U.S. Net Investment Income Tax.

- The FTC can apply to foreign taxes on many types of income, including wages, self employment income, interest, dividends, capital gains, and rental income, while the Foreign Earned Income Exclusion is limited to foreign earned income such as wages and self employment, not to passive or investment income.

Calculating FTC and carryover

Calculating the FTC involves allocating foreign taxes paid to income categories and completing Form 1116 for each type. The credit per category may be limited based on the ratio of taxable foreign income to total taxable income.

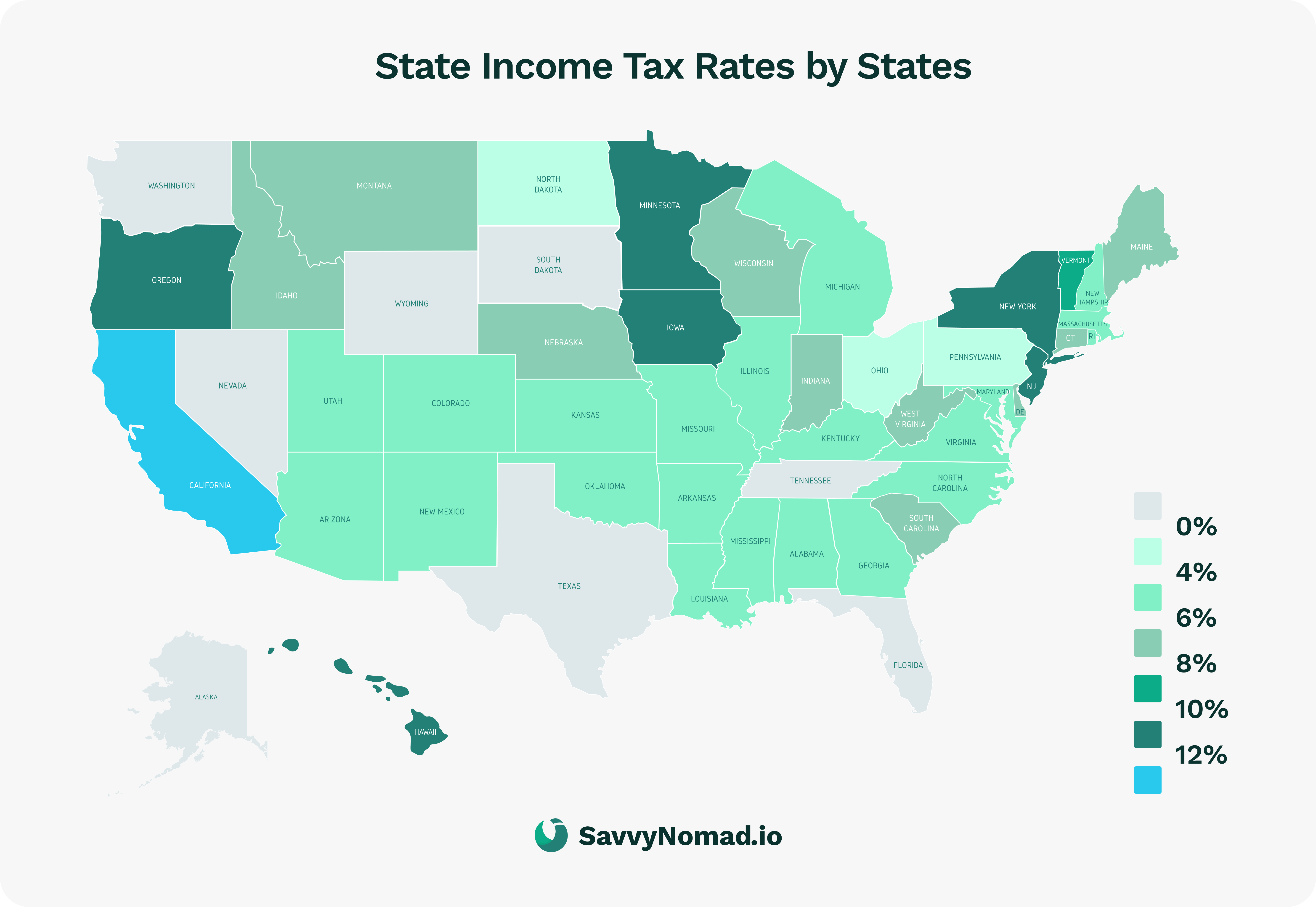

State tax implications

State rules are separate from federal rules. Two questions drive outcomes for expats: (1) Are you a resident for that state’s purposes? (2) If resident, does the state grant a credit for foreign income taxes?

Resident Foreign Tax Credit (FTC) by state (2025)

States fall into three practical buckets:

1) General foreign credit (national-level foreign income taxes allowed):

Arizona; Hawaii; Indiana; Iowa; Kansas; Montana (reduced if you also claim a federal FTC on the same income); North Carolina.

2) Canada-only (strictly enforced):

Massachusetts; Michigan; Minnesota; New York; Vermont.

3) Narrow/limited regimes:

Alabama — limited to certain pass-through entity (PTE)-level foreign income taxes (narrow scope, often scrutinized).

Virginia — limited to foreign pension/retirement income stemming from prior foreign employment.

Note: Other income-taxing states generally do not grant a resident-level credit for foreign income taxes (they usually credit only other U.S. state/local taxes). Confirm facts each year.

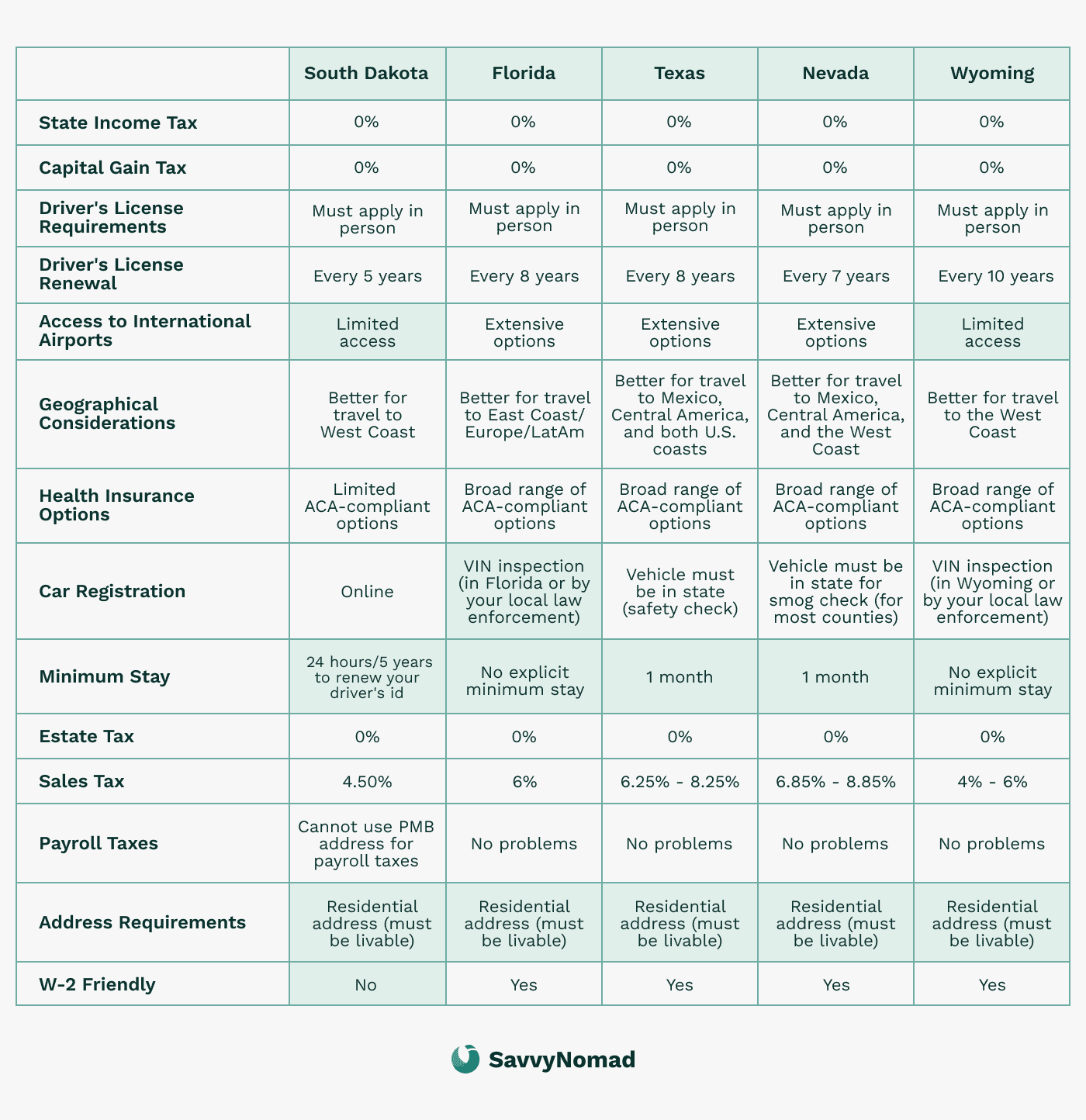

Strategic residency changes for tax advantages

For those planning to move abroad, strategically altering state residency can result in considerable tax benefits.

Transitioning to a state with favorable tax laws for expatriates, such as those without state income tax (e.g., South Dakota, Florida, Texas, Nevada), can lead to significant savings.

However, it's essential to consider ongoing connections to your former state, as maintaining ties (such as property or a physical presence) could affect your tax residency status and obligations.

Establishing non-residency in a tax-friendly state involves specific steps, such as obtaining a driver’s license, registering vehicles, and getting proper insurance in that state.

Examples of the Foreign Tax Credit in practice

Let’s take a look at how the FTC plays out for three American expats with differing circumstances:

Single digital nomad from California earning $85,000:

- Foreign Earned Income: $85,000

- Foreign Taxes Paid: $22,000

- Federal Tax Bill Before FTC: $16,000

- FTC Claimed: $16,000 (capped at the U.S. tax liability on foreign income)

- Federal Tax Bill After FTC: $0

- California State Tax: Assuming a rate of approximately 6%, the estimated state tax would be $5,100.

- Total Savings on Federal Taxes: $16,000.

Expat couple from Virginia with a combined foreign income of $160,000:

- Combined Foreign Earned Income: $160,000

- Total Foreign Taxes Paid: $40,000

- Combined Federal Tax Bill Before FTC: $32,000

- FTC Claimed for Each: $32,000 (matched to U.S. tax liability on foreign income)

- Combined Federal Tax Bill After FTC: $0

- Virginia State Tax: With rates up to 5.75%, the estimated state tax would be approximately $9,200.

- Total Savings on Federal Taxes: $32,000

Remote IT specialist from Florida with an income of $95,000:

- Foreign Earned Income: $95,000

- Foreign Taxes Paid: $25,000

- Federal Tax Bill Before FTC: $18,000

- FTC Claimed: $18,000

- Federal Tax Bill After FTC: $0

- Florida State Tax: $0 (as Florida does not impose a state income tax)

- Total Tax Savings: $18,000, with no additional state tax due.

In these scenarios, we observe how residency and the choice of home state can significantly affect the overall tax obligations of U.S. expats. While the FTC can provide relief at the federal level, state taxes may still be a concern depending on state laws and the individual's residency status.

It’s important for expats from states like California, New York, and Virginia to plan accordingly, as they may still face state tax liabilities despite their international income.

Conversely, Florida residents, like residents from other states with no income tax, can benefit considerably, making their financial picture simpler while abroad.

FAQ

What is the difference between foreign-earned income and foreign tax credit?

The Foreign Earned Income Exclusion (FEIE) allows qualifying U.S. taxpayers to exclude a portion of any foreign income (up to $126,500 in 2024) from their taxable income. To qualify, one must meet residency or physical presence requirements in a foreign country.

The Foreign Tax Credit (FTC) provides a credit for taxes paid to other countries on foreign income, applicable to both earned and unearned income. It directly reduces U.S. tax liability on a dollar-for-dollar basis and can be carried over to other tax years.

Can you claim foreign tax credit and foreign earned income exclusion?

Yes, you can claim both the foreign tax credit and the foreign earned income exclusion, but not on the same income. If you have foreign income that exceeds the foreign earned income exclusion limit, you could claim the exclusion up to that limit and then claim the foreign tax credit on the excess. This strategy can help to mitigate double taxation of the income that goes over the exclusion threshold.

However, you cannot use the foreign tax credit to reduce your U.S. tax on income that you have already excluded under the foreign earned income exclusion. It's important to calculate each tax benefit separately and then decide how to apply them without overlap to comply with U.S. tax regulations.

Do foreign tax credits expire?

Foreign tax credits can be carried forward for up to 10 years or carried back to the previous tax year. If not used within this period, they expire and cannot be applied to U.S. tax liability.

Credits must be used in the current year before tapping into carryovers. It’s best to start with the oldest credits first, as they expire soonest. The carryover helps preserve the benefit of the foreign taxes paid when there is a mismatch between foreign taxes and U.S. tax liability across different years.

Are foreign tax credits non-refundable?

Foreign tax credits are non-refundable, which means they can only reduce your U.S. tax liability to zero. They cannot result in a tax refund or create an overpayment.