Domicile in South Dakota: Guide for digital nomads

In a world ruled by Wi-Fi and laptops, being a digital nomad isn't just a trend; it's a lifestyle. But as you roam freely, you realize there's something you can't escape: the intricacies of domicile and residency.

These aren't just words; they're factors that dictate your financial dues, legal rights, and even personal freedoms. Enter South Dakota: your potential haven for all things domicile, designed with digital wanderers in mind.

What's in a name: South Dakota resident domicile vs. SD residency?

Think of domicile as your home base, the place you always return to no matter where you wander. It's not just an address; it's a legal anchor that affects your rights and responsibilities.

Residency, though, is more like a pitstop—a place you're at for now but might leave next month. These aren't just semantics; the difference between the two can affect everything from your legal status to your tax bill.

Why establishing a domicile in South Dakota matters to digital nomads?

Choosing your domicile isn't like picking a Netflix show; it's a strategic move affecting your wallet and legal standing. South Dakota makes this choice easier. Imagine a laid-back state about how often you need to be there and offers you tax breaks. If you're living the digital nomad life, South Dakota is like the VIP section you didn't know you needed.

Advantages of establishing domicile in South Dakota

Think of South Dakota as a haven, custom-built to make your digital nomadic life not just possible but a breeze. This isn't by accident; it's by design. The state's laws and financial perks are a love letter to those who choose a life of movement and freedom.

Below are some of the key advantages that make South Dakota an attractive choice for digital nomads:

1) Financial benefits

- No state inheritance or estate tax: South Dakota does not impose a state inheritance or estate tax, so most “death tax” issues are driven by federal rules or the laws of other states involved, rather than South Dakota itself.

- Local property taxes, but no state-level property tax: South Dakota does not levy a separate state property tax, but counties and municipalities do tax real estate to fund local services, so homeowners should still budget for annual property-tax bills.

- No state income tax: One of the most compelling financial benefits of establishing a domicile in South Dakota is the absence of state personal income tax. That means income earned from employment, pensions, dividends, interest, and capital gains generally isn’t subject to state income tax, which can provide meaningful savings compared with higher-tax states depending on your situation.

- Low vehicle registration and insurance costs: Vehicle registration is relatively low in South Dakota, and individuals may also find insurance premiums more affordable due to the state’s lower accident rates and cost of living.

2) Nomad-friendly residency requirements

When you're a digital nomad, "residency requirements" can sound like a buzzkill. South Dakota gets it. The state has rolled out the red carpet for you, cutting red tape along the way. Whether you're a full-time RVer or can't stay put, South Dakota's lax rules make it a cinch to establish legal residency.

3) Privacy laws in South Dakota

In South Dakota, privacy isn't an afterthought; it's a promise. The state's laws are wired to offer a shield of anonymity, giving you that rare sense of security in an increasingly open world. For digital nomads, this isn't just a perk; it's a lifeline.

Understanding the law on domicile and residency

"Domicile" and "residency" might seem like synonyms, but in the legal and financial world, they're as different as night and day. Knowing this difference isn't trivial for a digital nomad; it's crucial. It can shape your bank balance, legal status, and tax obligations.

Domicile vs. Tax residency

A different set of rules plays tax residency. It's not about where you see your future; it's about where you are now—or, more precisely, where you've been during the tax year. Factors like the number of days you've spent in a state or where your paycheck comes from can define your tax residency.

What is the beauty of a tax-friendly domicile like South Dakota?

When your tax residency lines up with your domicile in a tax-friendly state like South Dakota, you may see simpler filings and potential state-tax savings compared with remaining tied to a higher-tax state.

Dual residency and its implications

You can be a resident in more than one state, a situation known as dual residency. But here's the catch: you can only claim legal residency, or domicile, in one.

The rules?

They're based on where you clock most of your time, where you cast your vote, and where your main home is. Dual residency may sound exotic, but it can become a legal and tax maze. South Dakota, with its straightforward criteria, can be your get-out-of-jail-free card.

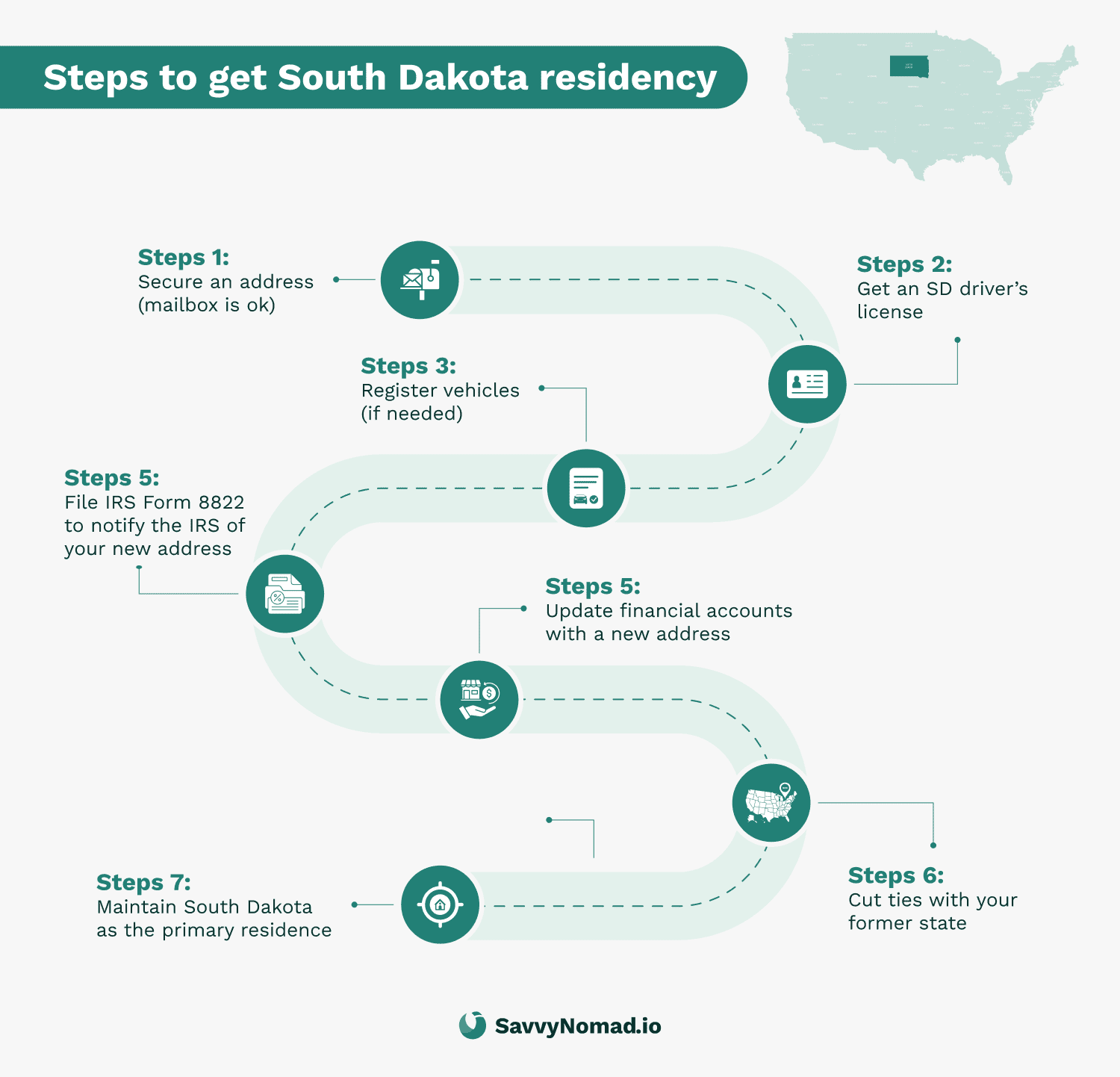

Procedure to establish domicile in South Dakota

Setting up domicile in South Dakota is far from a labyrinth. It's a straightforward journey that allows digital nomads to plant legal roots without limiting their wanderlust.

Here’s a step-by-step breakdown of the process:

1. Obtaining a South Dakota address

The first step is to secure a South Dakota address. For full-time travelers this is often a personal mailbox (PMB) or mail-forwarding address; others may lease a property or use the address of a friend or family member who actually lives in the state.

A PMB or mailing address can support residency and driver’s-license paperwork, but by itself it does not guarantee that every agency (or another state) will treat you as a South Dakota resident, and some uses, such as payroll and voter registration, have additional rules.

2. Collecting and submitting documentation

Gather all necessary documentation, including:

- South Dakota driver’s license: Visit a South Dakota Department of Public Safety office to apply for a driver’s license. Ensure you have all the required documentation, such as proof of identity, Social Security number, and South Dakota address.

- Vehicle registration: If you own a vehicle, register it in South Dakota. The process involves providing proof of ownership, insurance, and your South Dakota address.

- Insurance: Ensure your vehicle insurance reflects your South Dakota address and complies with the state’s insurance requirements.

- Other documentation: Collect documents that prove your residency, such as utility bills, rental agreements, or bank statements reflecting your South Dakota address2.

3. Vehicle registration in South Dakota

If you own anything that goes vroom, register it in South Dakota. This isn't just a legal must-do; it's another strong bond to your South Dakotan home base.

4. Obtaining a South Dakota driver's license

One of your key milestones is getting a South Dakota driver's license. A trip to the South Dakota Department of Public Safety is in order, but it's a small step with a big payoff. Your shiny new driver's license isn't just a piece of plastic; it's concrete proof of your intent to make South Dakota your legal base.

By following this roadmap, digital nomads can unlock a domicile that syncs with their lifestyle and financial dreams. South Dakota has made the process as smooth as possible, cutting down the usual stumbling blocks that come with setting up a legal residence, especially for those who live life in the fast lane.

Living as a South Dakota resident

South Dakota’s reputation as a nomad-friendly state comes partly from the fact that it doesn’t require year-round physical presence to keep things like a driver’s license or mailing address, which can make it appealing for digital nomads.

However, specific rules apply for things like voting, payroll, and how other states view your residency.

Duration of stay required in South Dakota

You don’t need to set up camp in South Dakota for long to complete the basics. For full-time travelers using the state’s Residency Affidavit process, getting a South Dakota driver’s license typically requires an overnight stay documented by a hotel or campground receipt, plus a qualifying South Dakota address.

If you’re an RVer, many parts of vehicle registration can be handled remotely once you have your South Dakota address and paperwork in place. Just keep in mind that newer laws now require 30 consecutive days in a single in-state dwelling to qualify for voting in South Dakota state elections, so one night is no longer enough for local voting rights.

Establishing residency while living in an RV

If you live the RV full-time, South Dakota could be your ideal legal home base. The steps are straightforward: secure a physical address in the state, get that South Dakota driver's license, and register your RV in South Dakota.

Registering a vehicle as a non-resident

Even if you're not planning to be a South Dakotan resident, you can still register your vehicle there. You must show proof of ownership, insurance, and an in-state address. With low registration fees and zero state income tax, it's a pretty tempting offer.

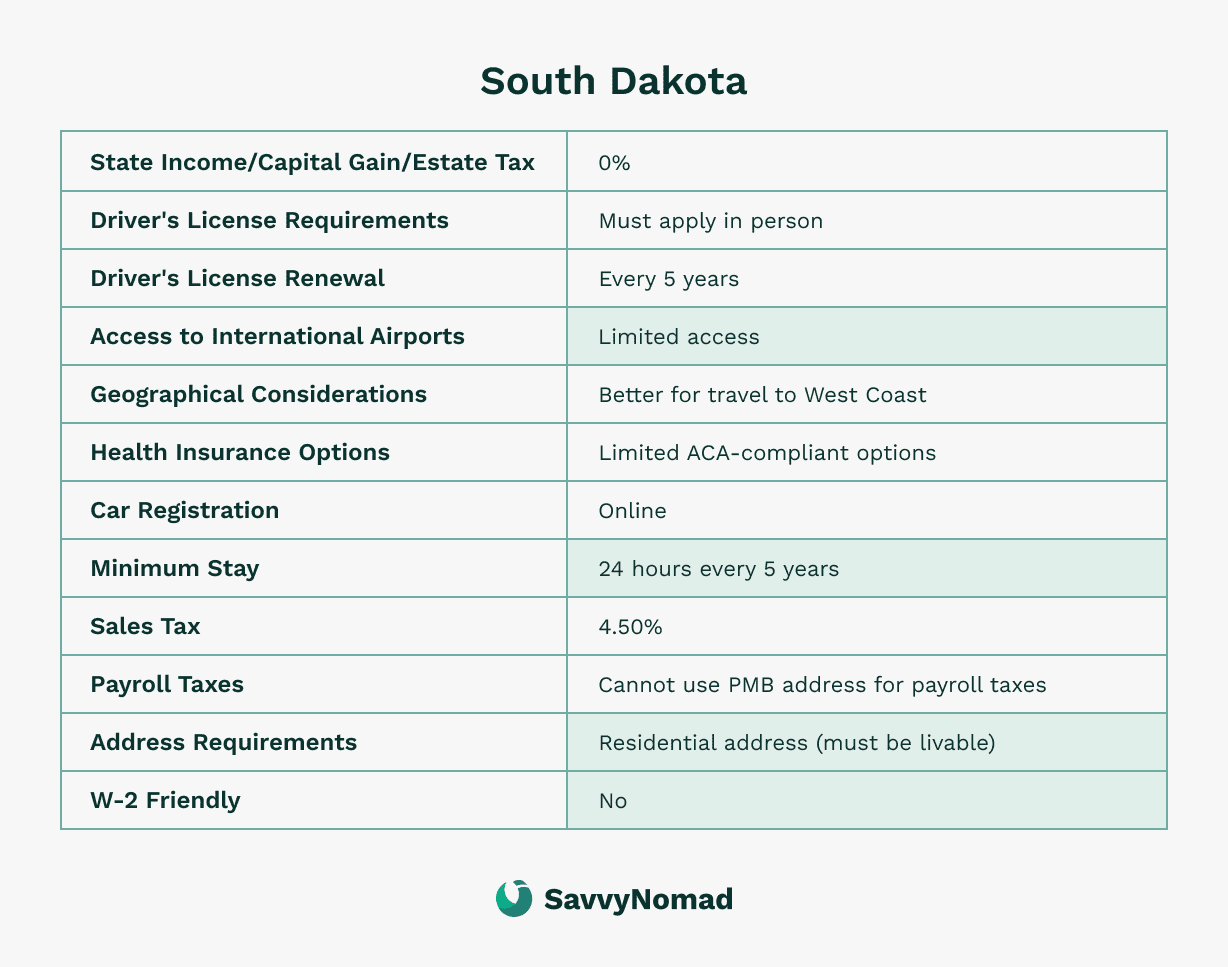

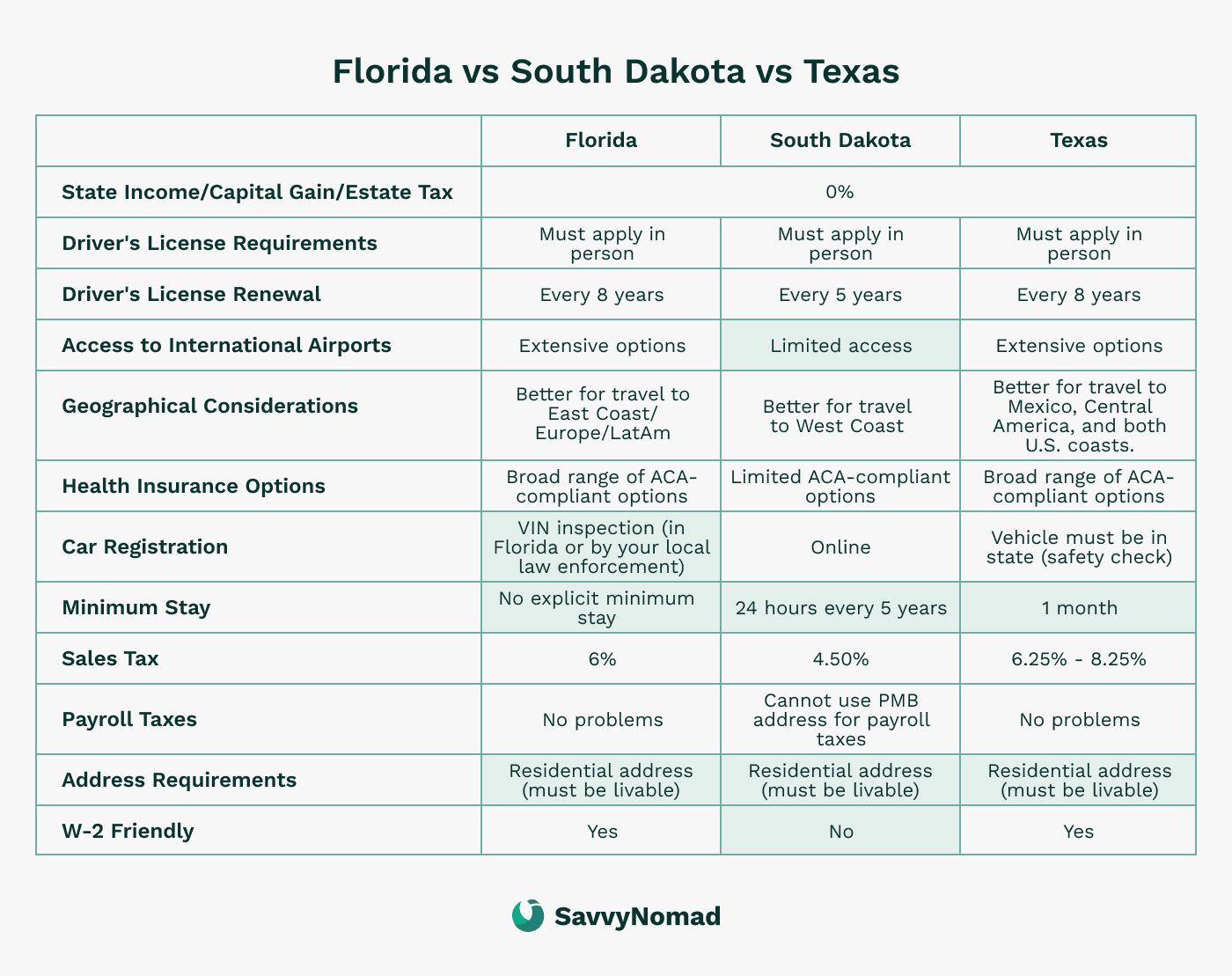

Comparison of South Dakota residency with other options

When considering establishing a domicile, it's prudent to compare South Dakota's offerings with those of other states. States like Florida, Texas, and Nevada are often cited alongside South Dakota due to their nomad-friendly policies.

Here's a comparative analysis:

Ease of establishing residency

South Dakota and Florida stand out due to their straightforward processes and minimal physical presence requirements, which make them particularly appealing to digital nomads and full-time RVers.

The ease with which one can establish a legal home in either state, coupled with the less stringent demands for physical presence, makes the leading choices for those whose lifestyle involves constant movement.

Texas, on the other hand, is the only state among these three popular destinations that has explicit duration requirements (30 days, compared to 1 night with South Dakota).

Tax benefits

Like South Dakota, Texas and Florida do not have state personal income tax, which can be a significant financial benefit for many residents. South Dakota also has no state-level inheritance or estate tax, while property taxes are imposed at the local level rather than by the state, so homeowners should still expect annual local property-tax bills.

This extra layer of tax relief amplifies South Dakota's appeal, offering a more comprehensive financial cushion for residents, especially those whose lifestyle is characterized by mobility and change.

Vehicle registration and insurance costs

South Dakota's low vehicle registration and insurance costs provide a financial respite compared to many other states. While Texas and Florida also offer competitive rates, South Dakota's low cost of living generally translates to lower insurance premiums.

This is another financial feather in South Dakota's cap, offering another cost-saving advantage that complements the nomadic lifestyle.

Privacy laws

South Dakota’s privacy and asset-protection laws were not written specifically for digital nomads, but they’re often used by people who value discretion, including some nomads and full-time travelers. They can offer a higher degree of anonymity and security than you’ll find in many other states, depending on how you structure your affairs.

In South Dakota, the privacy laws are specifically designed to accommodate the unique lifestyle of digital nomads, offering a measure of anonymity and security that could be less emphasized in other states.

Nomad-friendly policies

South Dakota’s nomad-friendly policies can make it easier for digital nomads to establish a legal domicile. The state’s approach to residency requirements is more flexible than many others.

For example, there is a Residency Affidavit process for full-time travelers that lets them document an in-state mailing address and brief physical presence (typically an overnight stay) for driver’s-license and ID purposes.

That said, newer laws impose stricter physical-presence standards for voting and limit the use of personal mailbox addresses for payroll and unemployment, so you can’t literally spend “virtually no time” in the state for every purpose.

Payroll taxes

The one area where South Dakota clearly loses (and Florida wins) is related to South Dakota’s recent stance on using a personal mailbox address for payroll purposes.

Basically, according to a recent policy change in 2023, you cannot use a personal mailbox address for payroll purposes.

Instead, unemployment tax must be paid to the state where the company that employs you is headquartered or the state in which the work was actually performed.

If you travel through many states, paying unemployment taxes to all of those states doesn’t seem very appealing, and trying to collect unemployment seems even less appealing.

In fact, the numbers show that more RVers and nomads are starting to prefer Florida over South Dakota. Both states allow you to register your vehicle online (with Texas, you’ll need to plan a road trip) and have very nomad-friendly policies.

FAQ

This section addresses some frequently asked questions regarding establishing domicile in South Dakota, providing concise answers to common queries.

How do I prove residency in South Dakota?

Proof of residency can be established through documents like a South Dakota driver's license, vehicle registration, utility bills, rental agreements, or bank statements reflecting a South Dakota address.

Can I register my car in South Dakota as a non-resident?

Yes, non-residents can register their vehicles in South Dakota by providing proof of ownership, insurance, and an in-state address.

What are the tax benefits of living in South Dakota?

South Dakota does not have a state personal income tax or a state inheritance or estate tax, which can lead to meaningful state-tax savings compared with higher-tax states. Property taxes are still charged at the local level on real estate, so homeowners should factor in county and municipal property-tax bills.

How long must I live in South Dakota to be considered a resident?

South Dakota requires a minimal physical presence to establish a domicile. In fact, the only requirement is to spend one night there. How do I establish a domicile in South Dakota?

Establishing domicile involves securing a South Dakota address, gathering necessary documentation such as a driver’s license and vehicle registration, fulfilling the state’s minimal residency requirements (spending one day in South Dakota), and having the intent to make South Dakota your permanent home.

How do I establish a domicile in South Dakota?

Establishing a domicile involves securing a South Dakota address, gathering necessary documentation such as a driver's license and vehicle registration, and fulfilling the state's minimal residency requirements.

How do I set up a domicile in South Dakota while living in an RV?

Secure a physical address in South Dakota, obtain a South Dakota driver’s license, and register your RV in the state to establish domicile.

Does getting mail at an address establish residency?

Receiving mail at a South Dakota address can be part of establishing residency, but it's essential to fulfill other requirements like obtaining a driver’s license and registering a vehicle in the state.

Can I be a resident of one state and my spouse another?

It's possible, but it may complicate tax and legal situations. It's advisable to consult with a legal professional to understand the implications.

Can I have a dual residency in South Dakota?

You can have dual residency, but you can only claim legal domicile in one state at a time.

What are the easiest states to establish residency in?

Florida, South Dakota, Texas, and Nevada are often cited as some of the easier states for many nomads to establish residency because of relatively lenient residency requirements and straightforward processes, although the details and best choice still depend heavily on your personal facts and goals.