Do expats from Colorado still need to pay state taxes?

Have you moved out of Colorado and are now living in another state or even abroad? You might be wondering if you still owe taxes to Colorado.

In the United States, most states, including Colorado, have an income tax.

But what happens to this tax obligation if you move away?

TLDR:

-You weren’t a resident (no Colorado domicile, and you didn’t keep a permanent place of abode in CO for >6 months), and

-You had no Colorado-source income (most interest/dividends and nonresident retirement income aren’t Colorado-source).

You likely owe Colorado taxes if:

- You were a resident (Colorado domicile, or a permanent place of abode in CO + >6 months), or

- You earned Colorado-source income (e.g., wages for work performed in CO, CO rentals/real estate, business income apportioned to CO, or gains from selling CO property).

If you left Colorado and moved abroad:

- Moving abroad alone doesn’t end Colorado residency. If Colorado remains your domicile, Colorado can tax your worldwide income even while you live overseas.

- To stop Colorado taxation, sever Colorado ties (license, voter reg, home/lease, homestead, mailing address, etc.) and establish a new domicile either in another state or in a foreign country.

- Colorado does not offer a resident credit for foreign income taxes. So if you stay Colorado-domiciled while paying foreign tax, you can face double taxation.

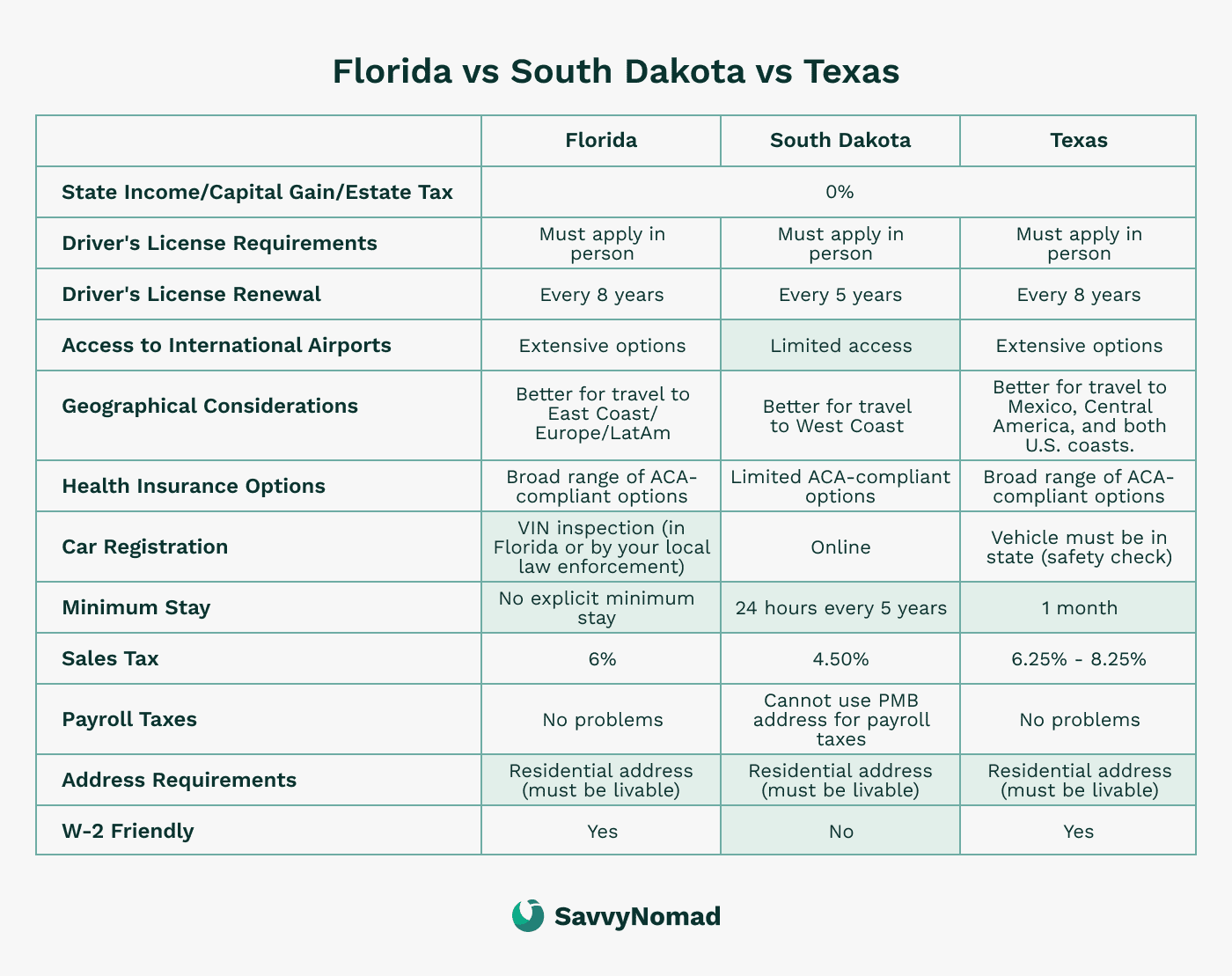

- The clean, U.S.-systems-friendly route many expats choose is to establish domicile in a no-income-tax state (e.g., Florida) to remove state income tax and reduce audit friction.

Understanding Colorado's tax residency rules

Colorado’s tax residency rules are essential for anyone who has moved out of the state or is considering doing so. These rules help determine whether you need to continue paying state taxes after relocating. The distinction between residency and domicile plays a crucial role in this determination.

Residency vs. Domicile

Colorado treats you as a resident if you are domiciled in Colorado or you maintain a permanent place of abode in Colorado and spend more than six months of the tax year in the state.

Residency refers to living in Colorado for part or all of the tax year. There are two primary categories of residents for tax purposes:

- Full-Year Residents: Individuals who live in Colorado for the entire tax year (January 1 to December 31). Full-year residents are required to file a Colorado tax return and pay taxes on all income, irrespective of where it was earned .

- Part-Year Residents: Those who live in Colorado for only part of the tax year. Part-year residents must file a Colorado tax return and pay taxes on income earned while they were residents. This involves completing the Colorado Individual Income Tax Return (DR 0104) and the Part-Year Resident Tax Calculation Schedule (DR 0104PN).

Domicile, on the other hand, is the place you consider your permanent home. It is possible to live abroad and still have Colorado as your domicile. Key factors that indicate domicile include maintaining a Colorado driver’s license, voter registration, and owning a primary residence in the state .

Tax obligations for Colorado expats

Full-Year Residents: Expats who maintain their status as full-year residents of Colorado must continue to file a state tax return and pay taxes on all their income, regardless of its source.

Part-Year Residents: Those who live in Colorado for only part of the year are required to file taxes on the income earned during their residency. They need to complete specific tax forms to determine the taxable portion of their income.

Non-Residents with Colorado Domicile: If Colorado remains your domicile, you are generally treated as a Colorado resident. You file as a nonresident only after you end Colorado domicile (and then you’re taxed only on Colorado-source income). They are taxed only on Colorado-sourced income, such as rental income from properties located in Colorado. To avoid double taxation, expats can prove their non-residency by demonstrating they have severed significant ties with Colorado.

Establishing Non-Residency

To establish non-residency and avoid Colorado taxes, expats must demonstrate they have severed their ties with Colorado.

Actions that support non-residency include:

- Not maintaining a Colorado driver’s license

- Not voting in Colorado

- Not owning a primary residence in the state

- Filing a nonresident tax return.

What constitutes Colorado-sourced income?

Understanding what constitutes Colorado-sourced income is essential for nonresidents and part-year residents to accurately determine your tax obligations.

Colorado-sourced income is any income derived from activities or assets within the state.

Here are some key categories to consider:

- Wages and Salaries: Money earned for services performed in Colorado.

- Business Income: Income from business activities conducted in Colorado.

- Real Estate: Rental income from property located in Colorado.

- Capital Gains: Profits from the sale of real estate or tangible property in Colorado.

- Interest & dividends (nonresidents): Generally not Colorado-source unless the intangible is employed in a business in Colorado. Merely holding stock in a Colorado company or an account at a Colorado bank does not make the income Colorado-source for a nonresident.

- Retirement income (nonresidents): Not Colorado-source under 4 U.S.C. §114. Pensions, IRAs, annuities, and similar “retirement income” received by nonresidents cannot be taxed by Colorado.

Why should you move domicile to a state with zero state income tax?

Avoidance of estate tax

Colorado does not impose a state-level estate or inheritance tax. The primary tax reasons Colorado expats move domicile are (1) to a no-income-tax state to eliminate state tax on worldwide income once residency is severed, and (2) to reduce audit friction with a clear, low-tax domicile.

If estate tax planning is relevant, that is a federal issue and depends on federal thresholds.

How to leave Colorado tax residency?

Here are the key steps to help you transition:

1) Establish new residency

- Secure a Residential Address: Obtain a residential address in your new state. This is important for establishing a new domicile. Consider using a domicile service that helps you obtain a residential street address (typically via a lease or license), set up separate mail-forwarding, and organize the documentation needed to support your new residency. Banks and state agencies make their own decisions, and no specific outcome is guaranteed.

- File a Declaration of Domicile if required: Some states require you to file a declaration to confirm your new domicile. This usually involves signing an affidavit stating that you intend to make the new state your permanent home.

Reference guides may provide additional help for specific states:

2) Sever ties with Colorado

- Sell or rent out property: If you own property in Colorado, consider selling it or renting it out. Ownership of property in Colorado can indicate ongoing ties to the state.

- Transfer IDs and registrations: Update your driver’s license and vehicle registration to your new state. This shows your commitment to your new domicile.

- Voter registration (if you are eligible): If you are eligible, you may register to vote in your new state. Voter registration is one supporting indicator of domicile—not determinative on its own. For eligibility and procedures, follow guidance from election officials in both states.

- Update personal documents: Change your address on all identification cards, medical records, insurance policies, financial documents, and other important records.

3) Inform relevant parties

- Inform your employer: Notify your employer about your new residency. This affects how your income is taxed and helps establish your new domicile.

- Notify the IRS: Inform the IRS of your address change using Form 8822. Extend this notification to all personal and professional entities.

- Update all personal and professional entities: Inform banks, investment accounts, insurance companies, and other relevant entities about your change of address.

4) Keep detailed records

- Maintain documentation: Keep receipts, bills, lease agreements, and other legal documents that prove your new residency. Detailed records are essential if your residency status is questioned.

- Document your movements: Document your time spent in and out of Colorado. This includes travel records, utility bills, and any other documents showing your physical presence in your new state.

5) Be prepared for audit

If the Colorado Department of Revenue questions your residency status, be prepared to provide comprehensive proof that you have permanently moved out of Colorado.

- Proof of permanent move: Be ready to provide extensive documentation showing you have permanently moved out of Colorado. This includes all paperwork proving you have established a new domicile and severed ties with Colorado.

- Respond to inquiries: If the Colorado Department of Revenue questions your residency status, respond promptly and thoroughly with all necessary documentation to avoid potential penalties.

Tax benefits and exemptions for expats from Colorado

Living abroad as an expat comes with various tax benefits and exemptions that can help reduce your overall tax burden.

Here are some of the key tax advantages available:

Foreign Earned Income Exclusion (FEIE)

The Foreign Earned Income Exclusion (FEIE) allows U.S. taxpayers residing abroad to exclude a certain amount of their foreign-earned income from U.S. federal income tax.

For the 2024 tax year, this exclusion amount is up to $126,500.

To qualify, you must pass either:

- Bona Fide Residency Test: You qualify if you are a resident of a foreign country for an uninterrupted period that includes an entire tax year.

- Physical Presence Test: You qualify if you are physically present in a foreign country for at least 330 full days during a 12-month period.

Foreign Tax Credit (FTC)

The FTC allows you to credit foreign taxes paid on income subject to U.S. federal tax, avoiding double taxation.

This credit can significantly reduce your U.S. tax liability, especially if you live in a country with high tax rates.

Foreign Housing Exclusion (FHE)

The Foreign Housing Exclusion (FHE) allows eligible taxpayers to reduce their U.S. federal taxable income by certain housing costs, such as rent, utilities (excluding telephone), and other reasonable expenses associated with housing abroad. Because Colorado starts from your federal taxable income, the federal FHE generally carries through into your Colorado calculation as well.

The amount you can exclude is limited to a base amount plus housing expenses exceeding 16% of the FEIE limit.