How to become a Florida resident without living there?

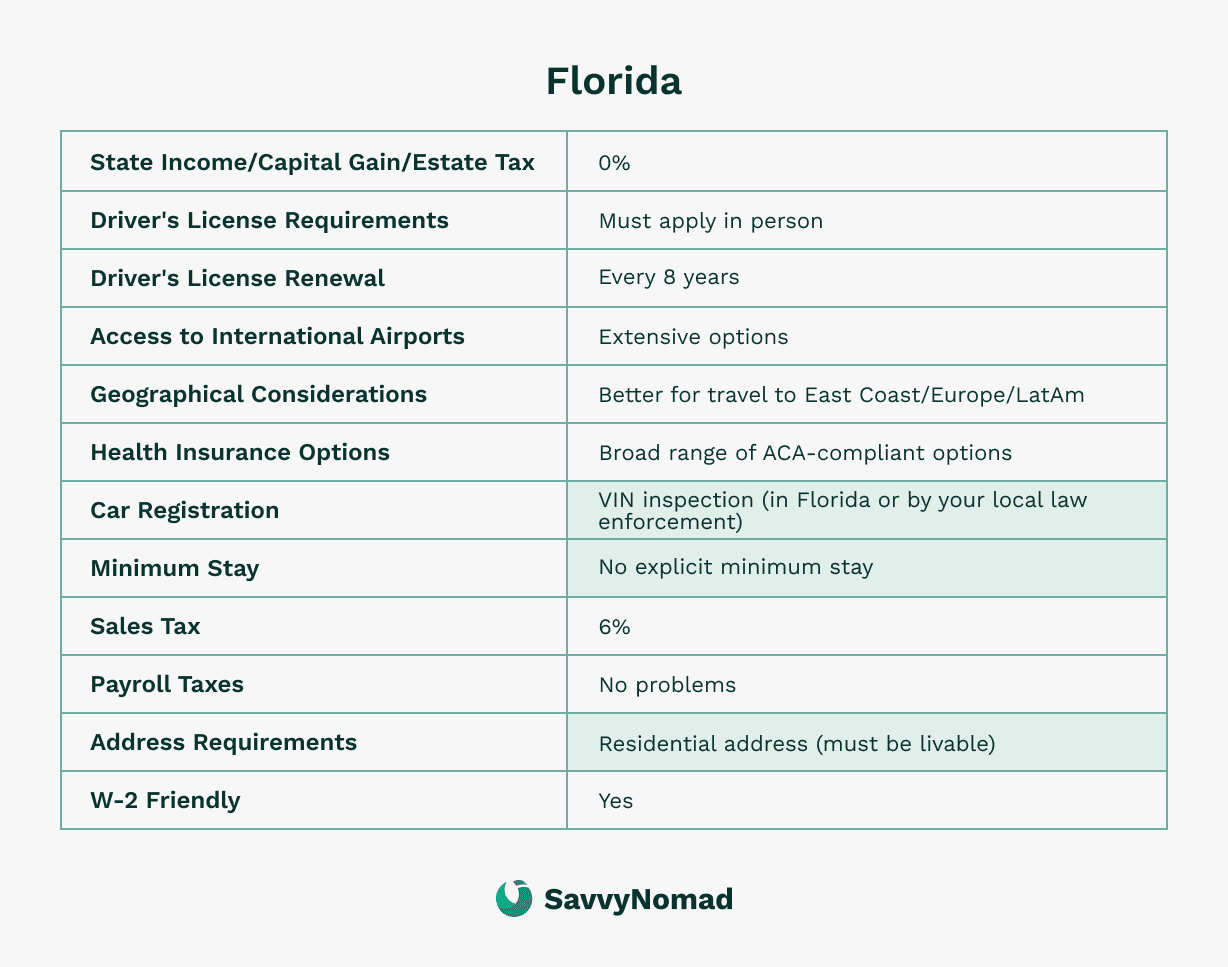

Establishing Florida residency can be life-changing for American expats, digital nomads, and retirees living abroad. With zero state income tax, favorable estate and asset protection laws, and straightforward residency requirements, Florida offers a highly attractive domicile option for U.S. citizens who don’t reside in the United States full-time.

But how exactly do you become a legal resident of Florida if you’re traveling the globe or settled in another country?

Residency requirements for expats and digital nomads

- Get a Florida residential street address. This is the anchor for everything else. SavvyNomad provides a bona fide Florida residential street address (with lease/utility-bill documentation) that can typically be used to support DMV, banking, insurance, and other paperwork tied to your domicile. Acceptance of any given document always depends on the specific agency or institution, and the address by itself doesn’t establish domicile or guarantee any particular tax or legal outcome.

- Obtain a FL driver’s license or ID—new residents must do this within 30 days of establishing residency. You’ll bring identity docs and two proofs of Florida residential address (e.g., lease, utility/bank/credit-card statement, voter card, etc.).

- Register your vehicle(s) in Florida (if you own any). If the car is out of state, a VIN verification (Form HSMV 82042) can be completed by acceptable officials where the car sits.

- File a Declaration of Domicile in your county’s clerk office; it’s notarized, recorded, and becomes strong, portable proof of intent.

- Register to vote in Florida and use that registration going forward.

- Update your federal and financial footprint: file IRS Form 8822 (change of address) and switch your address on banks, brokerages, insurance, payroll, etc., to Florida. (The IRS link is already in the main guide.)

Can I live abroad and qualify for Florida residency?

Yes. Florida doesn’t use a fixed 183-day rule or statutory minimum day count to define domicile. Instead, residency is a factual determination based on intent and objective ties like your home, records, and where you say you intend to live.

Your job is to keep your paper trail consistent with Florida as your permanent home (license, voter registration, Declaration of Domicile, financial accounts, mailing address) while you travel, and to avoid creating stronger “primary home” facts in another state that taxes personal income.

The 183-day myth (and how other states trap nomads)

Florida has no state income tax and no 183-day tax-residency rule. The 183-day concept belongs to other states (e.g., NY, MA, MN) that can claim you if you cross their day threshold and keep significant ties there.

Your protection is twofold: (1) build Florida ties above, and (2) avoid spending 183+ days or maintaining “primary home” facts in any taxing state you pass through. Keep simple logs (travel calendar, plane tickets, phone location history) in case a prior state challenges you.

Tie-breakers that help (especially for long-term travelers)

- Use Florida for voting, driver/vehicle, banks/insurance, and professional services when practical.

- Keep important U.S. mail flowing to your Florida address.

- If you ever own U.S. real estate, your principal residence should be in Florida (homestead where applicable).These are the kinds of objective facts Florida and other jurisdictions look at when deciding where you “really” live.

How to get Florida residency as an expat or digital nomad?

Establishing a domicile in Florida involves several steps to demonstrate your intent to make the state your legal home.

While Florida evaluates residency holistically, certain actions are especially significant. According to Florida’s statutes, such as Fla. Stat. Ann. §196.015, actions like filing a Declaration of Domicile, obtaining a Florida driver’s license, registering your vehicle, and registering to vote are primary indicators demonstrating your intent to reside in Florida permanently.

It is important to obtain a Florida driver's license within a specific timeframe to avoid potential penalties.

It is also crucial to understand that, although Florida has no state income tax, residents still have tax obligations and must pay taxes accordingly. Utility bills can serve as proof of residency, helping to demonstrate your primary location and intent to change your domicile to Florida.

Addressing these steps explicitly and promptly strengthens your residency status, clearly differentiating your new domicile from your former state. The Declaration of Domicile must be filed with the county's Circuit Court to serve as evidence of your intent to reside in Florida permanently.

Here’s a structured breakdown of the process:

Updating your address with the Social Security Administration is also essential to ensure accurate records and maintain benefits.

1) Secure a Florida address

The cornerstone of establishing a domicile is securing a residential address in Florida, either rented or owned. If renting a true apartment or home that will sit empty for an extended period is beyond your means or seems like overkill, a specialized residential-address or domicile service that provides a bona fide Florida street address can be a practical alternative.

However, make sure the address is a real physical street address (not just a P.O. box or generic virtual mailbox) and that it’s suitable for your intended uses (DMV, banks, voter registration, etc.), since different agencies apply their own rules about what they will accept.

SavvyNomad can provide a Florida residential street address and supporting documentation, plus guidance on common forms and filings, to make the transition smoother—while recognition of your residency always remains up to Florida agencies, other states, and any financial institutions involved.

2) Obtain a Florida driver’s license

It’s important to get a Florida driver’s license or state ID. The act of surrendering your former state’s driver’s license is a simple yet significant outward demonstration of your intention to establish roots in Florida.

Obtaining a Florida driver's license within 30 days of moving is crucial for establishing legal residency and fulfilling state requirements.

If you have a vehicle with an out-of-state lienholder, you will need to contact them to facilitate the transfer of the vehicle title to Florida.

3) Register your vehicle(s) in Florida

If you own any cars or boats, registering them in Florida is crucial to demonstrate long-term intent to domicile. This step also means that you must get new Florida vehicle insurance from a Florida-licensed insurance agent.

4) File a declaration of domicile

Filing a Florida declaration form (Florida Declaration of Domicile) in your new county is a recognized but not mandatory way to show your domicile has changed to Florida. The Declaration of Domicile must be filed with the local Clerk of the Circuit Court.

Signing this form (under oath, before a notary public) is especially beneficial when you want to establish Florida as your primary home for legal purposes, such as taxes and estate planning.

It is essential to visit the local circuit clerk to submit this documentation or send it via mail, as the clerk plays a crucial role in verifying residency claims and facilitating the legal residency process.

The document must be recorded in the public records of the Florida county where you reside.

5) Voter registration

Register as a voter in Florida. This is a significant leap that shows your intent and willingness to integrate into the state’s social and legal fabric.

6) File IRS Form 8822

Finally, it is important to update your federal records by filing Form 8822 with the IRS.

This form officially notifies the IRS of your change of address, helping keep your state and federal documentation consistent and helping you continue to receive important correspondence about your federal taxes.

Filing the form in a timely manner supports your overall domicile position for tax purposes, even though the IRS and state authorities still apply their own rules when reviewing your situation.

7) Update financial accounts

Update the address on your bank and investment accounts, making them your new Florida address. Additionally, transferring your bank accounts to Florida-based institutions can reinforce your claim to Florida residency and demonstrate your commitment to the state.

8) Maintain Florida as your primary place of residence

Florida has no clear-cut minimum number of days you must spend in Florida to make it your domicile. However, designating it as your primary residence in third-party and official records bolsters your intent to make Florida your home base on a go-forward basis. It is also crucial to keep important documents, such as mortgage documents, insurance policies, and identification papers, in Florida to fulfill residency requirements.

Each step forms a stitch in a larger legal and financial fabric, demonstrating that while you travel around the country and wider world as a nomad, Florida is still where you call home. Although the process requires an investment of time and resources, the benefits of a well-documented Florida domicile can be well worth it for many people.

Why choose Florida?

Florida consistently ranks among the more favorable states for establishing residency, especially for American expats, digital nomads, and retirees who don’t maintain a permanent U.S. residence. By selecting Florida as your official domicile, you can access meaningful financial and legal advantages that often fit well with a global lifestyle:

No state income tax

Florida doesn’t tax personal income, including wages, pensions, investments, Social Security benefits, or foreign-earned income at the state level. This advantage can result in substantial annual state-tax savings compared with higher-tax states, particularly for expatriates and retirees who draw income from abroad or from retirement accounts, depending on their overall situation.

No estate or inheritance taxes

Unlike many other states, Florida does not impose estate or inheritance taxes. This makes the state especially attractive to retirees and high-net-worth individuals looking to protect their wealth for future generations.

Strong asset protection laws

Florida’s legal environment strongly favors asset protection. It provides safeguards for homes, retirement accounts, and certain investments, making it a popular domicile choice for expats and nomads who are focused on financial security.

Clear and flexible residency requirements

Florida recognizes your legal domicile based primarily on intent and documentation, not simply the number of days spent in-state. Providing the required documentation is crucial for establishing residency.

This flexibility suits many digital nomads and expats who frequently travel or live abroad, offering a clear pathway to legal residency without requiring constant physical presence, though additional documentation may be needed to support your residency claim and outcomes are always based on your specific facts.