How to use a 401(k) and IRA as an American expat

If you’re an American living abroad, managing your finances can get complicated. Juggling different currencies, navigating tax laws, and planning for retirement may seem daunting. However, retirement accounts like a 401(k) or IRA can still be effective tools for your financial future, even from afar.

Social Security alone typically won’t cover retirement living costs, which is why accounts like the 401(k) and IRA are important for growing savings in a tax-friendly way. Yet, U.S. tax laws still apply, meaning you must report your income and comply with tax regulations regarding your retirement accounts, even while living in another country.

Additionally, Roth IRAs offer significant benefits, such as tax-free withdrawals in retirement, making them an attractive option for many expats.

Fortunately, you can navigate these complexities with the right strategies. This guide will help you manage your 401(k) and IRA as an expat—covering topics from rolling over accounts to avoiding double taxation and staying compliant with U.S. and local laws. Let’s get started!

Understanding your options for managing retirement accounts abroad

Managing your retirement savings can feel like a puzzle when you’re living in a foreign country. However, understanding the basics of U.S. retirement accounts—primarily 401(k) and IRA accounts—can help you build a solid foundation for your financial future. Here, we’ll walk through the essential options for managing these accounts and the advantages each can offer, even when you’re far from home.

What are 401(k) and IRA?

Let’s start with the basics. A 401(k) is an employer-sponsored retirement account, meaning that your employer set it up and likely contributed to it alongside your contributions. The money you and your employer put into a 401(k) is typically invested and grows over time, often with tax benefits. If you’re no longer with your employer, you still keep the 401(k), but you’ll have fewer options for managing it directly.

An Individual Retirement Account, or IRA, is a personal retirement account you set up independently, allowing you more control over your investment choices. There are two main types of IRAs: traditional and Roth. With a traditional IRA, contributions may be tax deductible, and you’ll pay taxes on withdrawals in retirement. With a Roth IRA, contributions are made with after-tax money, but qualified withdrawals in retirement are tax-free.

Eligibility for Roth IRA contributions is determined by modified adjusted gross income (MAGI), with specific income limits for making full contributions based on whether you are a single or married taxpayer.

Key benefits of maintaining these accounts as an expat

As an American living abroad, your 401(k) and IRA can still be incredibly valuable. These accounts allow you to save and grow your money in a tax-advantaged way. Here are a few reasons to consider keeping them active:

- Tax Advantages: The tax benefits on these accounts don’t disappear just because you’re living abroad. With a traditional 401(k) or IRA, your money can grow tax-deferred until retirement. If you opt for a Roth IRA, your withdrawals can be tax-free under certain conditions, offering a significant tax exemption on qualified distributions.

- Investment Growth: Both 401(k) and IRA accounts provide a structured way to invest and grow your savings over time. Even as an expat, you can benefit from this growth, mainly if your investments perform well.

- Savings for Future Stability: For many, retirement accounts are essential for maintaining financial security. By actively managing these accounts, you’ll be better prepared for your future, even if you choose to retire outside the U.S.

Limitations of managing these accounts while living abroad

It’s not all smooth sailing, though. Living outside the U.S. does present a few hurdles for managing your retirement accounts:

- Complex Tax Rules: U.S. tax laws still apply to your retirement accounts, and in some cases, your host country’s tax laws might also affect how your money is taxed. Double taxation is a risk if you’re not careful, but certain tax treaties can help reduce this burden.

- Limited Account Access: Some financial institutions may restrict account access for overseas clients, and specific brokers might even limit new investments if you’re residing outside the U.S. This can make it trickier to manage your portfolio or adjust your investments.

- Currency Exchange Issues: Since these accounts are based in U.S. dollars, fluctuating exchange rates could impact how much your retirement savings are worth in your current country of residence.

Importance of maintaining a U.S. residential address and bank account

As an American living abroad, holding onto a U.S. address and bank account might seem unnecessary. But, these can be crucial for keeping your retirement accounts, like your 401(k) and IRA, active and accessible. Here’s why they’re important and how to set them up in a way that works from abroad.

Why does keeping a U.S. address matter?

U.S. financial institutions require a U.S. residential address, primarily due to regulations under the Patriot Act, which mandates verified, physical addresses for account holders. Without a valid U.S. address, your bank or retirement account provider may freeze or close your account, leaving you without access to your funds. Here are some key benefits:

- Account Access and Stability: Banks and retirement account providers are more likely to support your account if a U.S. address is on file. This stability can help you avoid disruptive issues, like account restrictions or closures.

- Compliance and Security: A U.S. address helps you stay compliant with Patriot Act regulations, avoiding any red flags or compliance issues that could trigger an account review or lock.

- Reliable Mail Delivery: Using a U.S. address lets you receive important documents like tax forms, account updates, and legal notices. You can set up mail forwarding or digital access, but having a U.S. address can help you maintain uninterrupted access to critical information.

How a U.S. bank account simplifies managing retirement funds

A U.S. bank account is precious for managing your 401(k) and IRA because it provides:

- Convenient Transactions: 401(k) and IRA providers usually require U.S.-based accounts for contributions or withdrawals. Using a U.S. bank account keeps transactions straightforward and minimizes international wire fees.

- Simplified Tax Filing: If you receive U.S.-based income or tax refunds, a U.S. account helps reduce costly transfer fees and keeps funds in U.S. dollars. This stability avoids exchange rate complications and allows consistent tax return reporting.

- Compliance with U.S. Rules: Since retirement accounts are typically U.S.-dollar-based, having a U.S. bank account ensures compliance with provider requirements, making it easier to handle any withdrawals, deposits, or tax payments.

Options for setting up a U.S. address and bank account

If you’re currently abroad without a U.S. address or bank account, consider these strategies:

Domicile Services: Many expats use specialized domicile services that help them obtain a bona fide U.S. residential street address (typically via a lease or license) and set up separate mail-handling. A residential address can help many banks and brokers complete CIP/KYC, but acceptance varies by institution. Choosing a tax-friendly state can also support long-term stability.

SavvyNomad offers a suite of services designed to help American nomads and expats organize their legal and financial logistics.

Our services include:

- Domicile services: Help you document and support legal residence in states with no income tax, such as Florida or South Dakota.

- Mail handling: Receive and forward your mail, with options for digital scanning and online access.

- Document support: Help you gather and organize information for things like voter registration (if you’re eligible), vehicle registration, and other client-direct filings with government agencies. Voter registration is a supporting indicator of domicile, not determinative on its own.

- Compliance monitoring: Tools and reminders to help you track state-specific residency requirements and stay on top of legal and tax obligations.

- CPA support: Access to independent certified public accountants for tax consultations.

Family or Friend’s Address: Using a trusted relative’s or friend’s address is another option, but be aware that some banks may require proof of residence, like a utility bill, which can complicate matters if you’re not actually living there.

401(k) rollovers to an IRA

For American expats, rolling over a 401(k) into an Individual Retirement Account (IRA) can provide greater control and flexibility, especially when managing retirement savings from abroad. Let’s explore the specific advantages of this option, along with the types of IRAs available and the steps to take to help you have a smooth rollover process.

Additionally, it is important to understand the rules and eligibility criteria to contribute to an IRA for U.S. citizens living abroad, including the necessity of having non-excluded income and the various tax implications involved.

Why consider rolling over a 401(k) into an IRA?

Rolling over a 401(k) to an IRA is a strategic move for many expats, offering several clear benefits that can simplify management and potentially boost your retirement savings.

Key reasons include:

- Wider Investment Options: Most 401(k) plans limit investments to a selection of mutual funds or target-date funds. By contrast, IRAs allow for a broader range of assets, including stocks, bonds, ETFs, and even real estate funds, which can help create a more tailored and diversified portfolio aligned with your goals.

- Lower Costs: Many 401(k) plans have high administrative or fund fees, which can eat into returns. IRAs often come with lower fees, giving you more flexibility in selecting low-cost investment options. However, it’s essential to choose funds carefully in an IRA, as some options may have higher fees than those in a 401(k).

- Greater Control Over Withdrawals: While 401(k)s generally restrict withdrawals before retirement age, IRAs offer more flexibility, including penalty-free withdrawals for certain expenses, such as a first-time home purchase or qualifying education costs. This can be particularly beneficial for expats needing more accessible funds in specific situations .

- Estate Planning and Beneficiary Options: IRAs provide more choices for beneficiaries, like inherited IRAs, which allow non-spouse heirs to withdraw funds over a set time. By contrast, 401(k) distributions to heirs are often paid out in a lump sum, potentially leading to higher taxes.

Understanding your IRA options: traditional vs. roth

When rolling over a 401(k), you can choose between a traditional IRA or a Roth IRA, each with unique tax implications:

- Traditional IRA: Similar to a 401(k), a traditional IRA allows your funds to grow tax-deferred, meaning you’ll pay taxes only upon withdrawal. Rolling into a traditional IRA preserves this benefit, making it a popular choice for those who prefer tax-deferred growth.

- Roth IRA: A Roth IRA involves after-tax contributions, but qualified withdrawals in retirement are tax-free. This is ideal if you expect to be in a higher tax bracket in the future. Be mindful that rolling a traditional 401(k) into a Roth IRA counts as a taxable event, meaning you’ll pay income tax on the amount rolled over. This upfront tax bill is something to consider carefully, especially if your current tax rate is favorable. Additionally, Roth IRAs have income limitations for contributions, based on your modified adjusted gross income. The benefits of tax-free withdrawals in retirement can be significant, but it's important to understand the complexities involved, particularly regarding tax liabilities and eligibility.

Steps for a smooth 401(k) rollover

Here’s a step-by-step approach to effectively manage a 401(k) rollover to an IRA:

- Consult with a Financial Advisor: A financial advisor familiar with U.S. and international tax considerations can help navigate potential pitfalls, particularly regarding taxes on Roth conversions or cross-border tax issues .

- Choose a Suitable IRA Provider: Look for an IRA provider with diverse investment options, low fees, and accessible customer support to simplify account management while living abroad.

- Request a Direct Rollover: A direct rollover transfers funds from your 401(k) directly to your IRA, which is the safest method to avoid taxes and penalties. Indirect rollovers, which involve receiving a check, can trigger withholding taxes and require you to re-deposit funds within 60 days to avoid penalties.

- Manage and Diversify Your IRA Investments: Once your rollover is complete, take time to review and adjust your portfolio. IRAs offer access to a range of investments, making it easier to diversify and align your strategy with your retirement goals.

Tax implications of rolling over a 401(k) to an IRA

Rolling over a 401(k) to an IRA while living abroad can have specific tax implications, especially for U.S. expats managing multiple tax systems. The right approach helps you maintain the tax-deferred status of your funds or even set up tax-free withdrawals in retirement.

U.S. taxation of retirement accounts

As an American living abroad, the IRS continues to tax your 401(k) and Traditional IRA withdrawals as ordinary income, irrespective of your location. Early withdrawals before age 59½ typically incur an additional 10% penalty.

Roth IRA distributions remain tax-free as long as the account meets the five-year holding requirement, regardless of residency.

Double taxation risks and how to avoid them

Double taxation occurs when both the U.S. and your country of residence tax the same retirement income. To prevent this:

- Use U.S. Tax Treaties: Check the tax treaty between the U.S. and your host country. These treaties often clarify which country has taxing rights over your retirement distributions, potentially eliminating or reducing double taxation.

- Foreign Tax Credits (FTC): If you pay foreign taxes on retirement distributions, you can usually claim a credit on your U.S. taxes (using IRS Form 1116). This can help you avoid being taxed twice on the same income, subject to the usual foreign-tax-credit limits and documentation rules.

- State taxes: Many U.S. states continue to tax retirement income if they still consider you a resident based on domicile or statutory tests, even when you live abroad. To reduce the risk of state-tax claims, it’s important to clearly end residency in your prior state—managing factors like property, local accounts, and, if you’re eligible, voter registration—and, where appropriate, establish domicile in a no-income-tax or otherwise favorable state. Voter registration is a supporting indicator of domicile, not determinative on its own.

Tax considerations by IRA type: traditional vs. roth

When rolling over a 401(k) to an IRA, your tax obligations will depend on the IRA type:

- Traditional IRA: With a traditional IRA rollover, you maintain tax-deferred growth without immediate tax liabilities. This works similarly to a 401(k), allowing you to delay taxes until you start making withdrawals in retirement. Traditional IRAs also offer tax deductions on contributions, which can be beneficial depending on your current tax situation and retirement goals. For U.S. citizens living abroad, traditional IRAs can introduce complexities due to foreign tax laws, so it's important to consider these factors.

- Roth IRA: Rolling a 401(k) into a Roth IRA triggers a taxable event since Roth contributions are made with after-tax dollars. You’ll owe income tax on the amount rolled over, but the advantage is that future qualified withdrawals from a Roth IRA are tax-free, making this option particularly appealing if you expect to be in a higher tax bracket in retirement .

Avoiding double taxation as an expat

One of the primary concerns for expats is double taxation—when both the U.S. and your country of residence tax your retirement distributions. Strategies to avoid this include:

- U.S. Tax Treaties: The U.S. has tax treaties with many countries to prevent double taxation. These treaties may offer credits or exemptions that reduce your foreign tax burden on IRA or 401(k) withdrawals .

- Foreign Tax Credits: If your host country taxes your IRA distributions, you may qualify for a U.S. foreign tax credit to offset U.S. tax liabilities. This requires careful documentation and consulting a tax advisor for accurate reporting.

Strategies for minimizing tax liability

Minimizing tax liability is a critical aspect of retirement planning for American expats. By understanding the tax implications of retirement accounts and implementing tax-efficient investment strategies, expats can reduce their tax burden and maximize their retirement savings.

Tax-efficient investment strategies

Tax-efficient investment strategies can help American expats minimize their tax liability and maximize their retirement savings. Some strategies to consider include:

- Invest in Tax-Deferred Accounts: Contributing to tax-deferred retirement accounts, such as a 401(k) or traditional IRA, allows your investments to grow without immediate tax liabilities. This can significantly reduce your taxable income in the short term.

- Tax-Loss Harvesting: Use tax-loss harvesting to offset capital gains. By selling investments at a loss, you can reduce your taxable income and offset gains from other investments.

- Tax-Efficient Investment Vehicles: Invest in tax-efficient vehicles, such as index funds or ETFs, which typically generate fewer taxable events compared to actively managed funds.

- Roth IRA Conversion: Consider a Roth IRA conversion to reduce tax liabilities in retirement. Although you’ll pay income tax on the converted amount now, future qualified withdrawals from a Roth IRA are tax-free, providing significant tax savings in the long run.

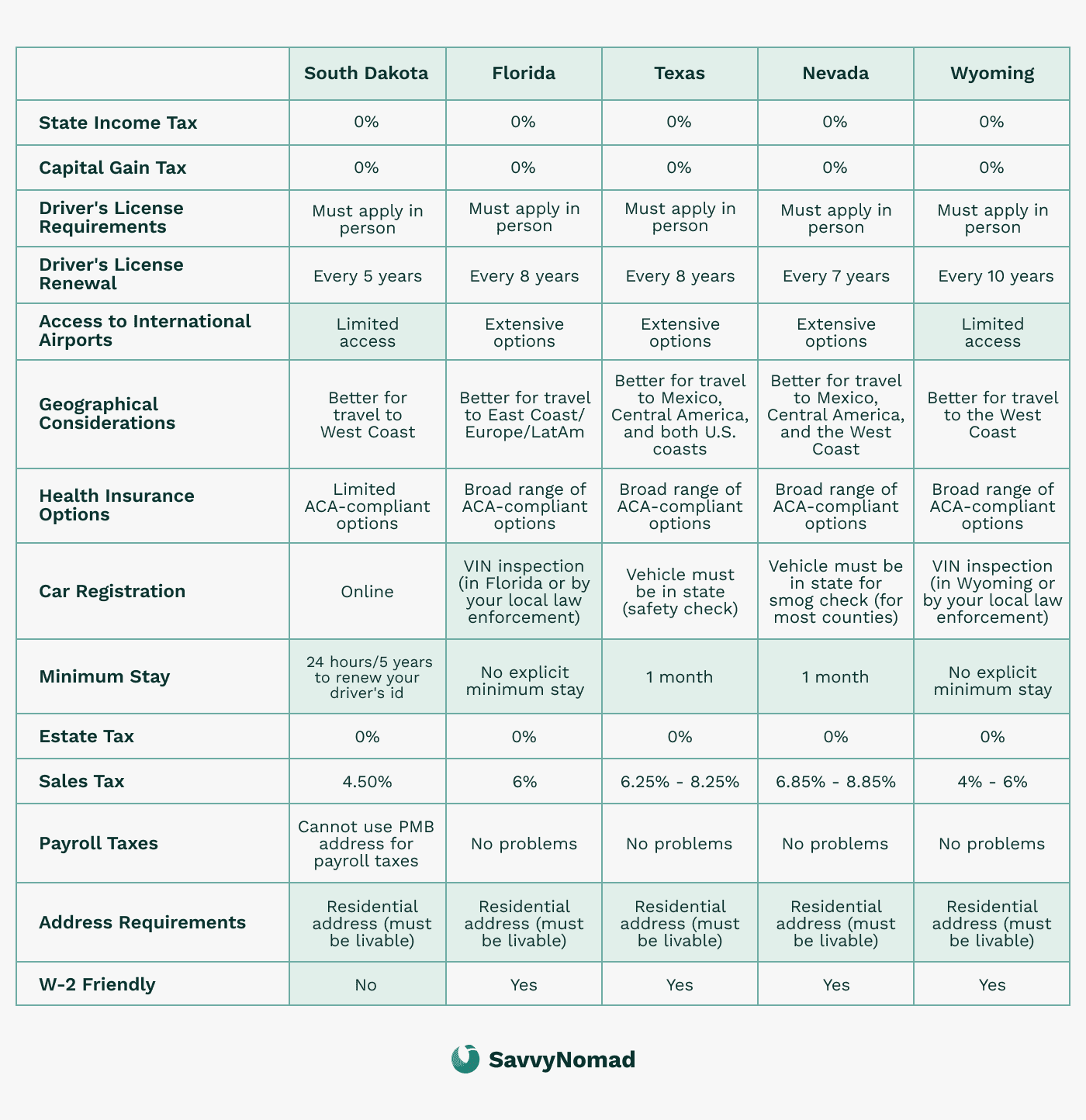

- Consider State Taxes: Many American expats continue to owe state taxes based on their last U.S. state of residence, especially in “sticky” states that tax residents on worldwide income until domicile is clearly ended. Establishing residency in a state with no income tax before moving abroad can reduce state-tax exposure, but you still need to thoroughly sever ties with any high-tax state—such as property, local bank accounts, and, if you’re eligible, voter registration—to reduce ongoing tax risk. Voter registration is a supporting indicator of domicile, not determinative on its own.

By implementing these strategies, American expats can minimize their tax liability and maximize their retirement savings, and support a more secure financial future.

Establishing domicile in a tax-free state before moving abroad

Where you are domiciled within the U.S. has significant tax implications, especially if you plan to live abroad. States like Florida, Texas, and Nevada have no personal state income tax, so if you are domiciled there and not treated as a resident of another state, you generally won’t owe state income tax on distributions from retirement accounts.

Setting up domicile in one of these states can save you from state tax liabilities and simplify your tax situation while abroad.

Here’s how to do it:

- Establish Residency Before Moving Abroad: By legally establishing residency in a tax-free state before leaving the U.S., you may avoid paying state income taxes on retirement withdrawals in the future, provided your prior state no longer treats you as a resident. This can involve actions like obtaining a driver’s license, updating your permanent address, and, if you’re eligible, registering to vote in your new state. Voter registration is a supporting indicator of domicile, not determinative on its own.

- Benefits of No-Tax States for Expats: Without state income tax, your tax reporting is limited to federal requirements, reducing overall tax liabilities and compliance costs. This is a valuable move for long-term expats looking to keep their financial affairs simple and streamlined.

- Consider Domicile Services: Some expats use professional domicile services in tax-free states, which help them obtain a permanent U.S. street address for documentation and banking/brokerage verification, plus separate mail-handling options. A residential address can help many financial institutions meet their “know your customer” rules, but acceptance varies by institution and no specific outcome is guaranteed.

Expatriation considerations

If you’re considering renouncing U.S. citizenship, you may encounter special rules:

- Expatriation Tax: Under IRS Section 877A, covered expatriates must treat their IRA as liquidated before expatriation, resulting in taxes on gains. Proper tax planning can reduce the impact of this “exit tax” .

- Form W-8CE: This form, filed within 30 days of expatriation, informs your IRA administrator of your new status and helps define the tax treatment of your account post-expatriation.

Timing roth conversions for tax efficiency

If you’re considering a Roth conversion, doing so in a low-income year or during a market downturn can reduce your tax burden on the conversion amount. This strategy works well if your tax bracket is temporarily low, allowing you to pay less tax upfront on the rollover .

Rolling over a 401(k) to an IRA involves complex tax considerations that can impact your long-term retirement savings. In the next chapter, we’ll discuss how to accurately report a 401(k) rollover to the IRS as an expat, to stay compliant and reduce the risk of penalties.

Reporting a 401(k) rollover to the IRS as an expatriate

Once you’ve completed the rollover of your 401(k) into an IRA, it’s essential to report this transaction accurately to the IRS. While the rollover itself may not create an immediate tax liability (especially with a direct rollover), it must still be documented in your tax filings to stay compliant.

Here’s how to handle the paperwork and reporting requirements to avoid potential penalties.

Avoiding early withdrawal penalties

Early withdrawal penalties can be a significant setback for American expats trying to access their retirement savings. Understanding the rules and strategies to avoid these penalties is crucial for minimizing tax liabilities and maximizing retirement savings.

Understanding early withdrawal penalties

Early withdrawal penalties are typically 10% of the withdrawn amount, in addition to any applicable income tax. These penalties are designed to discourage individuals from accessing their retirement savings before age 59 1/2.

However, there are some exceptions to this rule, such as using the funds for a first-time home purchase or qualified education expenses. Knowing these exceptions can help you plan withdrawals more strategically and avoid unnecessary costs.

Strategies to avoid penalties

To avoid early withdrawal penalties, American expats can consider the following strategies:

- Wait Until Age 59 1/2: The simplest way to avoid penalties is to wait until you reach the age of 59 1/2 before making withdrawals from your retirement accounts.

- Qualified Expenses: Use the funds for qualified expenses, such as a first-time home purchase or qualified education expenses, which are exempt from early withdrawal penalties.

- Rollover to an IRA: Consider rolling over your retirement accounts to an IRA or another qualified retirement account. This can provide more flexibility and control over your funds.

- Roth IRA Conversion: Take advantage of the Roth IRA conversion rule, which allows for tax-free withdrawals after a five-year holding period. This can be particularly beneficial if you anticipate needing access to your funds before traditional retirement age.

By understanding and implementing these strategies, you can effectively manage your retirement savings and avoid the pitfalls of early withdrawal penalties.

Steps to report a 401(k) rollover to the IRS

- Complete the Rollover Process: Start by working with your 401(k) plan administrator to initiate a direct rollover to an IRA. This means funds are transferred directly to the IRA provider without passing through your hands, so the transaction remains tax-deferred.

An indirect rollover, where you receive the funds directly, should generally be avoided, as it can trigger a 20% withholding and strict 60-day redeposit requirement .

- Receive Tax Forms from Your Providers:

- IRS Form 1099-R: After the rollover, your 401(k) provider will issue Form 1099-R, detailing the amount distributed. For a direct rollover, the form should indicate that the distribution is non-taxable, often denoted by code “G.”

- IRS Form 5498: Your new IRA provider will send you Form 5498 in May of the following tax year, confirming the contribution amount rolled over. This form is informational and doesn’t need to be filed but should be kept for your records .

- File Required Tax Forms:

- Form 1040: Report the 1099-R distribution on your annual tax return (Form 1040). For a tax-free rollover, you’ll indicate a zero taxable amount on the form to reflect the transfer’s tax-deferred status.

- Form 8606: If you rolled over a traditional 401(k) into a Roth IRA, you’ll need to file Form 8606 to report the taxable amount of this conversion. This is crucial for documenting any taxes owed on the rollover amount .

- Monitor Additional Tax Obligations Abroad:

- Foreign Tax Credits: For U.S. expats in countries that tax IRA distributions, consider utilizing the foreign tax credit to reduce double taxation. This credit can offset U.S. tax liabilities if you’ve already paid foreign taxes on distributions.

- Local Tax Compliance: Check your country of residence’s tax treaty with the U.S. to see if it impacts how your IRA distributions are taxed locally. Some treaties provide exemptions or credits, which can help optimize your tax outcome.

- Seek Guidance from a Cross-Border Tax Advisor: Given the complexities of U.S. and foreign tax systems, working with a tax advisor who specializes in cross-border issues is recommended. They can help ensure compliance with both U.S. and local regulations, particularly if you face double taxation risks or are considering Roth conversions .

Common mistakes to avoid when reporting

- Overlooking 1099-R and 5498 Forms: Not accurately reporting these forms can lead to IRS inquiries or potential penalties. Keep copies of both for your records.

- Mishandling Indirect Rollovers: If you choose an indirect rollover, missing the 60-day redeposit window can result in the distribution being treated as a taxable event with penalties.

- Ignoring Local Tax Obligations: Expats often overlook how foreign tax laws might affect their IRA or 401(k) distributions. Failing to address this can lead to unanticipated tax liabilities abroad.

Contributing to a 401(k) or IRA while abroad – eligibility and considerations

As an American living abroad, contributing to a 401(k) or IRA offers a path to continued retirement savings, but certain eligibility requirements and international considerations apply. Contributing to these accounts can enhance financial security, but navigating U.S. tax laws and income limits is essential to avoid compliance issues.

Eligibility requirements for contributions

- Foreign Earned Income Exclusion (FEIE): Under current IRS guidance, you determine IRA contribution limits using compensation before the foreign earned income and housing exclusions. Excluded foreign earned income is added back when computing your IRA limits and related MAGI tests, so using the FEIE doesn’t automatically eliminate IRA eligibility. The interaction is technical, so expats should confirm their specific limits using IRS Publication 590-A or with a qualified advisor.

- Earned-compensation requirement: To contribute to a 401(k) or IRA, you must have “compensation” (earned income) that is includible in your gross income for U.S. tax purposes. This can come from U.S. or foreign sources—the key is that it counts as taxable compensation under IRS rules.

- 401(k) Contributions from U.S. Employers: If you’re working abroad but still employed by a U.S. company, you may be eligible to contribute to a 401(k), as long as your employer offers one. This is common among American expats working for U.S. multinationals or government contractors .

Choosing the right retirement account as an expat

- IRA Contribution Limits: For 2023, you can contribute up to $6,500 (or $7,500 if you’re over 50) to an IRA, as long as you have sufficient earned income. Traditional IRA contributions may be tax-deductible depending on your income, while Roth IRA contributions are made with after-tax dollars, allowing for tax-free withdrawals in retirement .

- 401(k) Contribution Limits: Contributions to a 401(k) are higher than IRAs, with limits set at $22,500 for 2023 (or $30,000 for those 50 and older). 401(k) plans also often include employer matches, which can boost your retirement savings even more.

Benefits and challenges of foreign pension plans

Some expats contribute to foreign pension plans as part of their host country’s tax system. While this can help increase retirement savings, there are potential complications for U.S. tax reporting:

- Double Taxation and Compliance: Contributions to foreign pensions are generally not deductible on U.S. tax returns, and growth within these accounts may be subject to U.S. taxation. Tax treaties with certain countries can provide relief, so check if your host country has an agreement with the U.S. that impacts your pension plan contributions.

- Reporting Foreign Pensions: Some foreign pensions require additional IRS forms, such as Form 3520 or Form 3520-A, which document foreign trusts. Failing to report these correctly can lead to significant penalties, so working with a tax advisor familiar with international tax compliance is advisable.

Managing retirement accounts from overseas

Once you’ve established your retirement accounts, managing them effectively from abroad becomes the next priority. Expats often face unique challenges, such as account access limitations and security considerations, which can complicate online management.

However, with the right strategies, you can keep your retirement accounts accessible and secure while navigating the additional restrictions some U.S. financial institutions may impose on overseas clients.

Maintaining access to the U.S.-based accounts

As a U.S. expat, maintaining continuous access to your retirement accounts can sometimes be tricky.

Here’s how to help you keep access to and manage your funds effectively:

- Set Up Reliable Online Access: Many 401(k) and IRA providers offer robust online portals where you can check balances, make contributions, or adjust investments. It’s wise to confirm that your provider’s online services are accessible from your country of residence, as some U.S. financial institutions block access from certain foreign locations due to security regulations .

- Use a Secure VPN for Access: Some expats encounter access restrictions on financial accounts due to their overseas IP addresses. A secure VPN can allow you to log in with a U.S.-based IP address, maintaining your account access while helping protect your data. Ensure that the VPN you choose has strong security features, as financial transactions require enhanced privacy.

- Stay Informed on Account Restrictions: Certain U.S. financial institutions enforce restrictions on overseas accounts. Fidelity, Vanguard, and Charles Schwab, for instance, often have policies regarding where clients can manage their accounts. Before moving abroad, confirm whether your provider has limitations for overseas clients, as this can affect your ability to perform transactions or add investments.

Handling limitations with U.S. custodians

Some U.S. retirement account providers restrict account access for clients living outside the country, limiting their ability to contribute or make changes to investments. Here’s how to navigate these restrictions:

- Consider Switching to an Expat-Friendly Provider: Some financial institutions, such as Charles Schwab and TD Ameritrade, offer expat-friendly services, allowing U.S. citizens abroad to continue managing their accounts. These institutions may also provide customer support geared toward the needs of expats .

- Use a Domicile Service for a Stable U.S. Address: Having a U.S. address on file is often a requirement for U.S.-based financial institutions. A domicile service can provide you with a permanent address in a tax-friendly state, which can help keep your account active and accessible.

Simplifying your retirement management

Managing multiple accounts can become challenging, particularly when you’re navigating different time zones and regulations. To streamline your finances:

- Consolidate Old 401(k) Accounts into an IRA: Rolling over any old 401(k) accounts into a single IRA not only simplifies account management but also expands your investment options and reduces the need to track multiple statements or contribution limits.

Automate Contributions and Rebalancing: Setting up automatic contributions and portfolio rebalancing can keep your retirement savings on track without requiring frequent manual adjustments. Many financial institutions offer automated tools for rebalancing based on your investment goals and risk tolerance.

Can I continue contributing to my IRA while living abroad?

Yes, if you have U.S.-sourced earned income or taxable foreign income not excluded by the Foreign Earned Income Exclusion. Excluded foreign income (under FEIE) does not count toward IRA eligibility.

What if my brokerage freezes my IRA account after I move abroad?

Choose an expat-friendly institution like TD Ameritrade, Charles Schwab, or Interactive Brokers. Maintaining a U.S. mailing address and using a VPN can also help prevent account freezes.

How can I access my U.S. retirement funds abroad?

Maintain a U.S. bank account to facilitate easy direct deposits from your retirement accounts. Periodically transfer funds overseas using a reputable currency transfer service to manage exchange rates effectively.

Do I need to file IRS forms even if I don't withdraw money from my 401(k) or IRA?

You must report distributions using Form 1099-R. If you have Roth conversions, file Form 8606. If you have significant foreign financial assets, including foreign retirement accounts, file Form 8938 and the FBAR (FinCEN Form 114).