Tax breaks for American digital nomads and expats

Ah, the open skies — with a laptop and a drive to explore, digital nomads and expatriates venture out, combining adventure with the mundane task of earning a living. Part of that practical need is, of course, dealing with taxation.

The U.S. is the only country that taxes based on citizenship – regardless if you didn’t even set foot on U.S. soil all year. This creates a complex terrain that you, as an American nomad or expat, must navigate, regardless of where your wanderlust took you that year.

In this guide, we provide essential tips and tools to help modern travellers complete their most boring adventure to date: saving thousands on their tax bill while remaining fully compliant with US tax law.

So grab your compass as we get into the dense forest of tax obligations, seeking to uncover the fiscal treasures buried within.

Tax implications for digital nomads and expats

Wherever digital nomads and expats go, they bring with them a tether that stretches way back to the shores of the United States: the U.S. tax system. As mentioned: a fun fact is that the US, unique among the nations, taxes its citizens on worldwide income irrespective of where they earn it, a reality that digital nomads and expats must deal with if they wish to maintain their US passport and citizenship.

Some countries, like Bulgaria, have a “flat tax,” which means they tax all residents 10% of their income regardless of how large that income is. Others, like Portugal, present a progressive tax rate that scales from 14.5% to 48%, depending on income and residency status. Other countries, for better or worse, don’t even tax income.

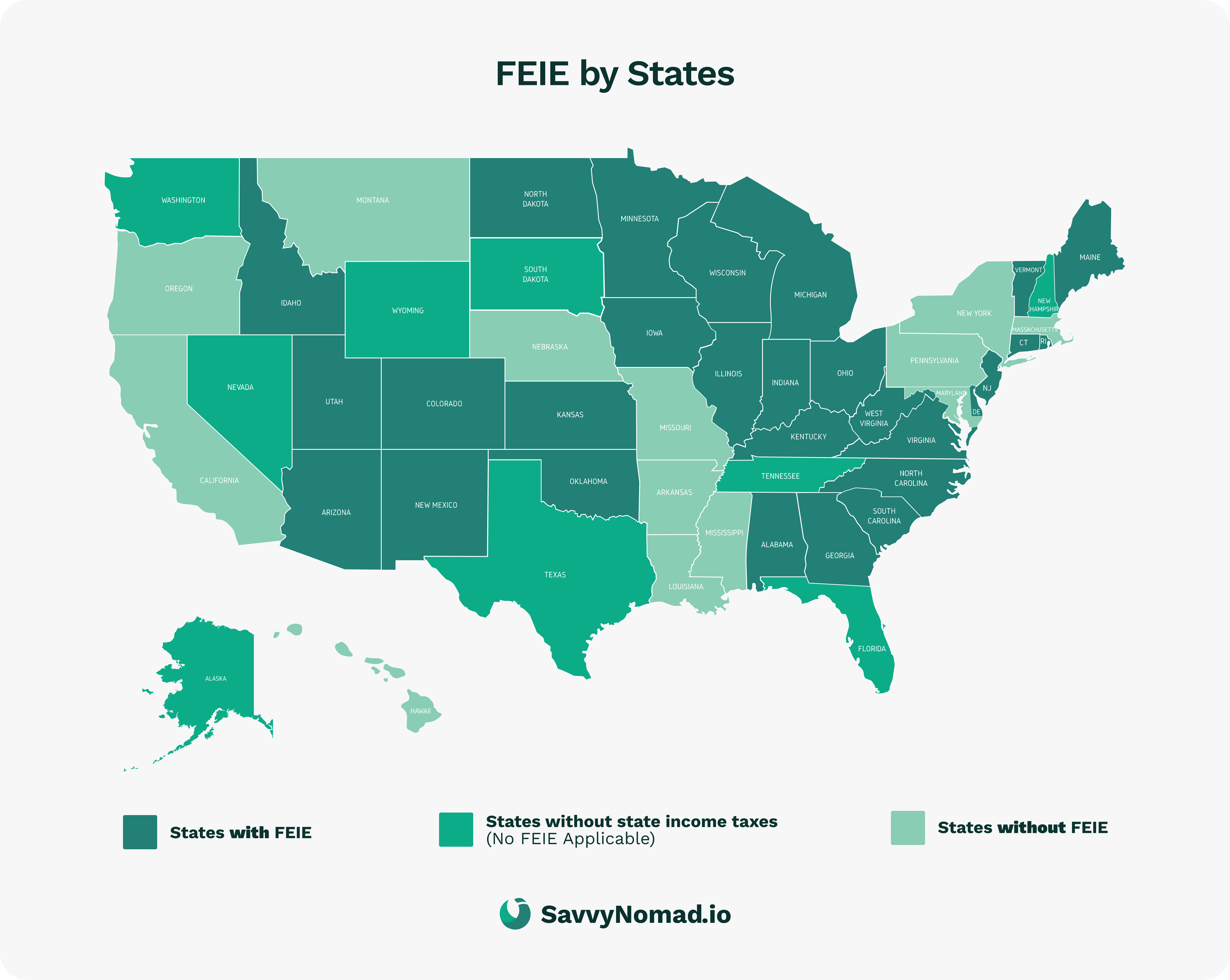

To complicate your US income taxes more, the state you choose as your domicile (your “home state”) carries tremendous weight. Much like picking the right country to travel to, picking the right US state to officially call home (called “establishing domicile”) can lead to massive savings (5-20% of your entire annual income) if done in a tax-friendly state.

States like South Dakota, Texas, and Florida are often the chosen sanctuaries for nomads, offering a blend of no-state income taxes coupled with nomad-friendly policies that include accessible mail-forwarding services.

The savvy nomad, armed with knowledge, can navigate through the thickets of tax laws and find incredible savings, which can be stored away to accrue compound interest or used immediately to drastically increase the travel budget.

Tax benefits and breaks

Just as every cloud has a silver lining, so does the US tax law. Historically, these benefits have only been utilized by the ultra-wealthy, who leverage vacation and travel to save massively on income tax; however, with a burgeoning class of nomads, these tax breaks are finally being used by the common man and woman.

Foreign Earned Income Exclusion (FEIE)

For American expats and digital nomads who spend over 330 days per year abroad, the Foreign Earned Income Exclusion (FEIE) offers a significant opportunity to reduce U.S. tax obligations.

Eligibility criteria

To qualify for the FEIE, you must meet specific criteria:

- Tax home in a foreign country: Your tax home must be in a foreign country. This is generally where your main place of business or employment is located.

- Physical Presence Test: This requires you to be physically present in a foreign country or countries for at least 330 full days during any consecutive 12-month period.

- Bona Fide Residence Test: Alternatively, you can qualify if you are a bona fide resident of a foreign country for an uninterrupted period that includes an entire tax year.

Important considerations

- Income from U.S. companies: Even if you receive income from a U.S. company, it can still be considered foreign-earned income if you meet the FEIE eligibility criteria (i.e., you worked for and earned the income outside the US). This is crucial for many digital nomads who work remotely for U.S. clients or employers.

- Exclusions and deductions: Besides the FEIE, you can also claim the Foreign Housing Exclusion or Deduction for certain housing costs incurred abroad.

- Self-employment income: The FEIE applies to gross income for self-employed individuals. Note that U.S. self-employment taxes, including Social Security and Medicare taxes, may still apply.

- Filing requirements: Filing a U.S. tax return is mandatory if your income exceeds the IRS threshold, regardless of your eligibility for the FEIE.

Digital nomad perspective

Digital nomads should know the FEIE's applicability based on their global mobility. U.S. Social Security taxes are still applicable if you do not reside in a country with a U.S. totalization agreement.

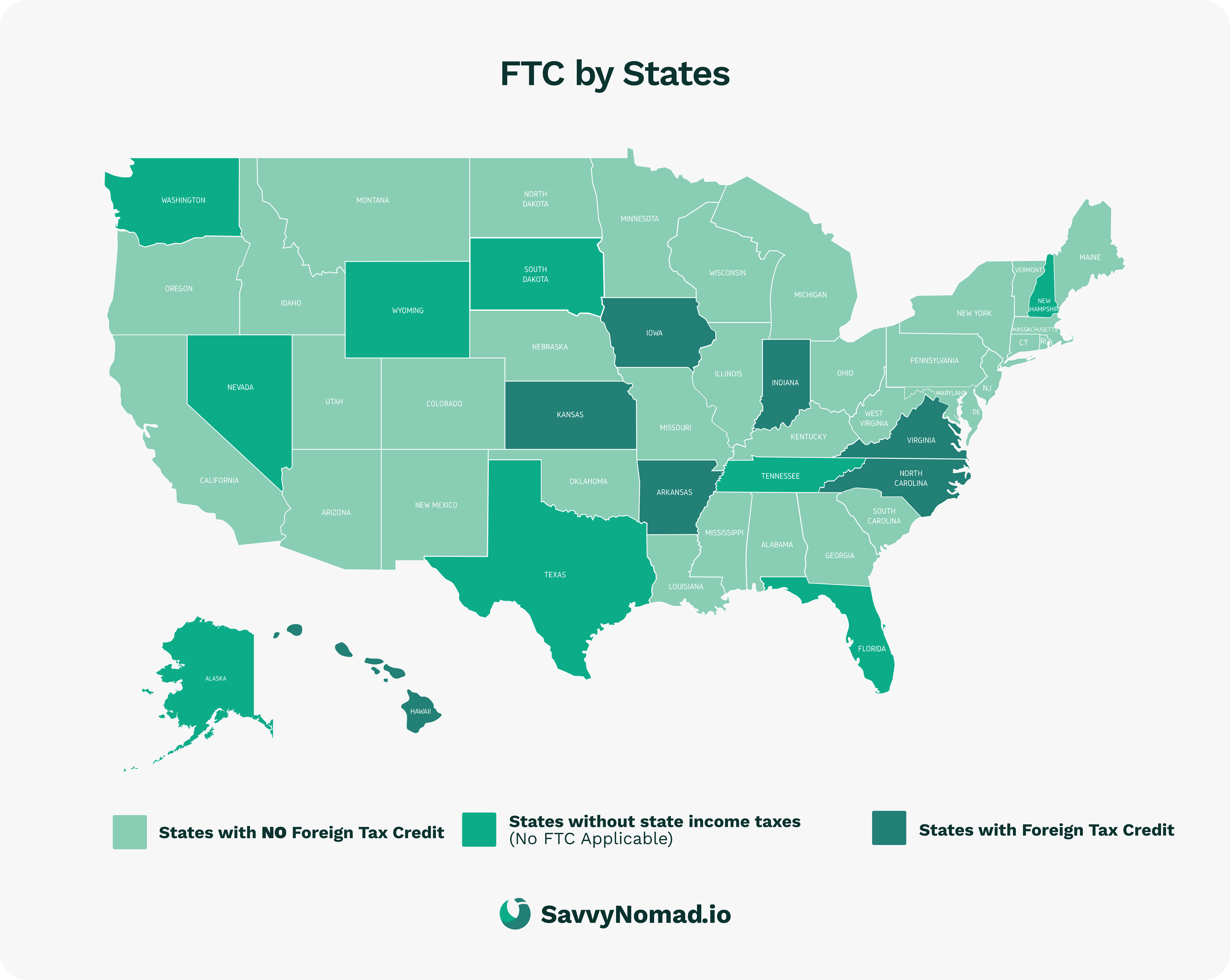

Foreign Tax Credits (FTC)

To effectively leverage the FTC, U.S. expats and digital nomads must also understand its eligibility criteria.

A summary of the eligibility criteria is as follows:

- Foreign income: The FTC only applies to income earned outside the US. Like the FEIE, this income can be from an American-based company as long as it was earned outside the US.

- Tax payment: The income you earn must be subject to tax by a foreign government.

- Legitimate tax liability: The foreign tax paid must (obviously) be a legal and actual tax liability.

- Type of tax: The tax should be an income tax or the equivalent in your country of residence.

Application of the FTC

Claiming the FTC involves filing IRS Form 1116 with your U.S. tax return. This allows the offset of U.S. tax liabilities with taxes paid to foreign governments. Your tax professional will know the deets.

Coordinating FTC with FEIE

Utilizing the FTC alongside the FEIE requires some strategic planning, as income excluded under FEIE cannot be considered for the FTC.

Limitations and considerations

- The FTC is limited to the amount of U.S. tax attributable to foreign income.

- It doesn’t cover all foreign taxes, and specific rules govern its application.

Implications for digital nomads

For digital nomads working in countries with high tax rates, understanding and applying the FTC correctly can significantly impact overall tax obligations.

Self-employment tax

Working for yourself has a lot of pros; unfortunately, it has some cons too. For one, your taxes get more complicated. Currently, self-employment tax sits at 15.3%, comprised of 12.4% for social security and 2.9% for Medicare, on all the earnings of freelancers and small business owners, regardless of where the income was earned. That means if you earned your self-employment income working on your laptop from a Parisian cafe, you are paying US federal income tax on it.

However, tax professionals have designed many ways to minimize this tax obligation, like establishing your company as an S-corp and paying yourself as an employee. This generally leads to significantly less self-employment taxes overall.

SECA (Self-Employed Contributions Act) Tax

For contractors, there is something called SECA that mandates the collection of taxes in 1099 scenarios, similar to the tax withheld from the pay of most wage earners. This is a tax situation many digital nomads may find themselves dealing with.

Foreign Housing Exclusion (FHE)

The Foreign Housing Exclusion (FHE) is a significant tax benefit for U.S. expats and digital nomads living abroad. It allows a portion of their housing expenses to be excluded from taxable income, thereby reducing their U.S. tax liability.

Here’s an exploration of the Foreign Housing Exclusion, uncovering its benefits as a treasure for American expatriates and digital nomads:

- Understanding the exclusion: The Foreign Housing Exclusion aims to decrease a taxpayer's liability by allowing certain housing expenses to be deducted from taxable income. It's a provision created by the IRS to offset the costs associated with living overseas.

- Eligibility criteria: The FHE is especially beneficial for those expats and digital nomads whose income exceeds the limit for the Foreign Earned Income Exclusion (FEIE), which varies by tax year ($126,500 for 2024). By utilizing the FHE, individuals can avoid double taxation and reduce the amount owed to the IRS.

- Calculation of the exclusion: The exclusion amount is determined based on a formula: Housing expense limitation (which is 30% of the FEIE) minus the Base housing cost (16% of the FEIE) equals the Maximum housing exclusion. For instance, in 2024, the calculation would be ($126,500 * 0.3) - ($126,500 * 0.16) = $17,710 (maximum exclusion amount).

- Claiming the exclusion: To claim the FHE, individuals must have qualifying housing expenses that exceed a base amount, determined as 16% of the FEIE for the year. Any qualified housing expenses over this base amount might be eligible for US tax exemption, but there's a limit to how much can be deducted.

Establishing tax residency and qualifying for tax breaks

Many nomads, expats, and RVers know how to establish their residency to unlock the advantageous tax breaks strategically. That said, establishing tax residency requires following certain procedures and adhering to the laws of the land.

Physical Presence Test (PPT) and Bona Fide Residence Test (BFRT)

To qualify for the Foreign Earned Income Exclusion (FEIE), you must pass one of two important tests: the Physical Presence Test or the Bona Fide Residence Test. The Physical Presence Test is often the easier one for full-time nomads to pass. It requires you to spend more than 330 full days in foreign lands within a consecutive 12-month period, either commencing or concluding in the tax year in question.

That said, particularly relevant for full-time liveaboards is that the days spent in international waters do not count towards the 330-day tally.

On the other hand, the Bona Fide Residence Test requires you to be a bona fide resident of a foreign country for, at minimum, an uninterrupted tax year, with no immediate plans of returning to the U.S

The 183-day rule in other countries

Venture beyond the U.S. shores, and you may encounter the 183-day rule, a common threshold in many countries to determine tax residency. This rule states that if you spend 183 days or more in a country within a tax year, you may be deemed a tax resident of that country.

Navigating tax treaties and avoiding double taxation

While most citizens don’t need to concern themselves with tax treaties between nations, digital nomads and expats need to study which treaties affect them.

Understanding tax treaties

Tax treaties are bilateral agreements that show how taxation works between the United States and other countries. Their purpose is both to prevent double taxation and also promote economic cooperation between nations. Getting the benefits of a tax treaty means filling out additional tax forms. These treaties lay down the rules of which country has the right to tax a particular asset or income stream. They're designed to protect expats and dual citizens while providing other tax benefits along the way.

Impact on tax liability

These tax treaties often reduce tax liabilities by providing relief from double taxation and establishing clear rules for determining which country has the taxation rights. For instance, if a tax treaty stipulates a lower withholding tax rate on certain types of income, structuring your ventures tax-efficiently can help you benefit from these provisions.

Claiming treaty benefits

Claiming the benefits of a tax treaty takes a small amount of effort and time, and it generally involves filing IRS Form 8833 with your U.S. tax return.

Relief from double taxation

Tax treaties typically provide benefits in one of two ways: the exemption method or a tax credit. Under the exemption method, the income or assets taxed in one country may be exempt from taxation in the other, while the tax credit mechanism allows one country to provide a credit for the taxes paid to the other, reducing the overall tax liability in that country.

Mutual Agreement Procedures (MAP)

Sometimes disputes arise from the interpretation or application of a tax treaty. The MAP provides a mechanism to resolve such issues, involving a negotiation process between the tax authorities of the countries involved to eliminate double taxation or ensure the correct allocation of taxing rights. This is only required in rare instances.

FAQ

Do digital nomads pay US income tax?

Yes, digital nomads are required to pay U.S. income tax. Some key points regarding taxation for digital nomads in the U.S. include:

- U.S. citizens, regardless of where they are located, are obligated to pay taxes on all income earned domestically and internationally. This includes digital nomads who might work remotely while traveling around the U.S. or abroad.

- Self-employed digital nomads might face higher self-employment taxes than those employed by a company. However, there are often creative ways to minimize this tax liability, and self-employed individuals have more freedom to implement these solutions.

Where do I pay taxes if I work remotely and travel?

Tax obligations for U.S. expats and digital nomads can get complex due to the interplay of U.S. tax laws and the tax laws of the countries they find themselves in. Here's a simplified breakdown of where you might pay taxes if you work remotely and travel:

U.S. tax obligations:

- U.S. citizens must report worldwide income to the IRS, regardless of where they live or work.

- Tax benefits like the Foreign Earned Income Exclusion (FEIE) and Foreign Tax Credit (FTC) can help mitigate U.S. tax liability.

Host country tax obligations:

- Tax laws vary by country. Some countries may tax income earned within their borders, while others may have tax treaties with the U.S. to avoid double taxation.

- The 183-day rule is common in many countries; spending 183 days or more in a country within a tax year could make you a tax resident of that country.

State taxes:

You may be subject to state income taxes based on your previous state of residency or where you've spent the most time, although some states like Florida, South Dakota, and Texas have no income tax.

Self-employment taxes:

Self-employed digital nomads are subject to additional self-employment taxes.

Tax treaties:

The U.S. has tax treaties with many countries to avoid double taxation. These treaties can reduce tax rates on certain types of income and provide credits for foreign taxes paid.

How much can I write off for travel?

The ability to write off travel expenses for U.S. expats and digital nomads largely hinges on the Internal Revenue Service (IRS) definition of a "tax home" and the nature of the travel in question and, of course, if you are self-employed. As a self-employed nomad or expat, some of your travel expenses could be necessary for your business to generate revenue and therefore open to write-offs. Here's a breakdown based on the information gathered:

IRS definition of tax home:

The IRS defines a tax home as the area where you principally work, not where you live. If you leave your tax home for a business trip and return to it, you can potentially deduct travel expenses like gas, lodging, and flights.

Criteria for deducting travel expenses:

- The IRS has a three-factor test to determine your tax home:

- You perform part of your business in the area of your main home.

- You have living expenses at your main home that you duplicate because your business requires you to be away from that home.

- You haven't abandoned the area of your historical place of lodging, or you have family members living at your main home, or you often use that home for lodging.

- Satisfying two or three of these factors can potentially allow you to deduct travel expenses.

Types of deductible travel expenses for digital nomads:

Common deductible travel expenses include airfare, lodging, and meals incurred while traveling for business purposes.

Special circumstances:

There could be certain scenarios where digital nomads can write off housing costs as a business expense, like staying in an Airbnb for extended periods for work-related purposes.

Transforming business travel expenses into tax savings:

Digital nomads operating small businesses can potentially transform business travel expenses into noticeable tax savings, for instance, by attending conferences, meeting clients, or exploring new market opportunities.

Can you deduct expenses for working remotely?

Yes, often you can deduct certain expenses for working remotely, especially if you are self-employed, a digital nomad, or an expat. Here's a detailed breakdown:

Home Office Deduction:

- You may be eligible to claim the IRS Home Office Deduction if you are self-employed and use part of your home exclusively and regularly for your business. This includes American expats and digital nomads working from home.

- There are two methods to calculate the home office deduction:

- The Simplified Method allows a deduction of $5 per square foot of the home used for business, up to a maximum of 300 square feet, resulting in a maximum deduction of $1,500.

- The Regular Method involves calculating the percentage of your home used for business and applying that percentage to home expenses like mortgage interest, insurance, utilities, and depreciation.

Work-related expenses:

Expenses incurred in the course of earning income are deductible. For digital nomads, this can include the cost of computer equipment, software, internet service, and other tools necessary for work.

Self-employed deductions:

Self-employed individuals, including digital nomads and expats, are generally eligible for a variety of tax breaks, including deductions for office supplies, software, and business insurance.

Record-keeping:

It's crucial to keep detailed and accurate records of all work-related expenses. This will be essential for calculating deductions and for substantiating the expenses in case of an IRS inquiry.

Consult a tax professional:

As always, taxes can be complex. Consulting with a tax professional, especially one familiar with the tax issues facing digital nomads and expats, is always a good idea.

Check IRS guidelines:

The IRS provides guidelines on what types of expenses are deductible and how to claim these deductions. Checking the latest IRS publications or consulting with a tax professional can provide clarity on these issues.

Conclusion

There is always more to cover when it comes to tax laws, especially for nomads and expats (especially if you’re self-employed). That said, there are rapidly diminishing rewards. As long as you cover the highlights covered in this guide, you’ll be in a pretty good spot. On top of that, if you are self-employed, it’s always a good idea to consult a tax professional, as there is a good chance they will save you a lot more money than they cost.

Recommendations for American digital nomads and expats

Establishing tax residency in tax-friendly states or nations, understanding and leveraging tax credits and treaties, and seeking the guidance of seasoned tax professionals are important steps in navigating complex tax policies. Employing these strategies can lead to reduced tax liabilities and a smoother voyage through the fiscal seas.