How to optimize your U.S. Social Security and retirement accounts abroad?

For Americans living abroad, managing Social Security and U.S.-based retirement accounts can be complex. While enjoying new cultures and potentially lower costs of living, expats face challenges in cross-border finances.

This article outlines practical ways to manage Social Security benefits, tax obligations, and retirement accounts while living outside the U.S.

Eligibility and payments abroad

For U.S. citizens, eligibility to receive Social Security benefits generally remains intact while living in most foreign countries. However, there are a few countries—like Cuba and North Korea—where benefits cannot be sent directly. If you’re residing in one of these restricted countries, payments are held until you relocate to a country where benefits can be distributed.

To receive benefits as an expat, it’s also important to update the Social Security Administration (SSA) with your current address and follow any specific requirements, like responding to eligibility questionnaires they may send every one to two years. Missing these can lead to temporary payment suspensions until eligibility is verified.

Direct deposit options

Social Security payments can be deposited directly into either a U.S. or international bank account. Here are your options:

- Direct deposit to a U.S. bank account: This is often a reliable option, as U.S.-based banks are fully recognized by the SSA. You can then access the funds from your U.S. account abroad using ATMs, wire transfers, or other banking services, although some fees may apply.

- International direct deposit: If you live in a country that has an international direct deposit agreement with the U.S., you can have your Social Security payments sent directly to a local account in that country. This can help minimize currency exchange fees and delays, as funds are automatically converted to local currency upon deposit.

Strategies to minimize U.S. taxes on Social Security

Living abroad doesn’t exempt Social Security income from U.S. federal taxes. Here’s how you can keep more of your benefits:

- Managing combined income to reduce federal taxes: The IRS taxes Social Security benefits based on combined income (adjusted gross income + nontaxable interest + half of Social Security benefits). To minimize taxes, consider carefully planning other sources of income—such as IRA or 401(k) withdrawals—since high combined income could mean a larger portion of your benefits will be taxed. Keeping income below certain thresholds can help reduce the tax percentage on your benefits.

- Using the Foreign Tax Credit (FTC): If your Social Security benefits are taxed in your host country, the FTC allows you to offset U.S. tax liability on the same income. This credit is valuable in countries that tax U.S. benefits, as it reduces the impact of double taxation.

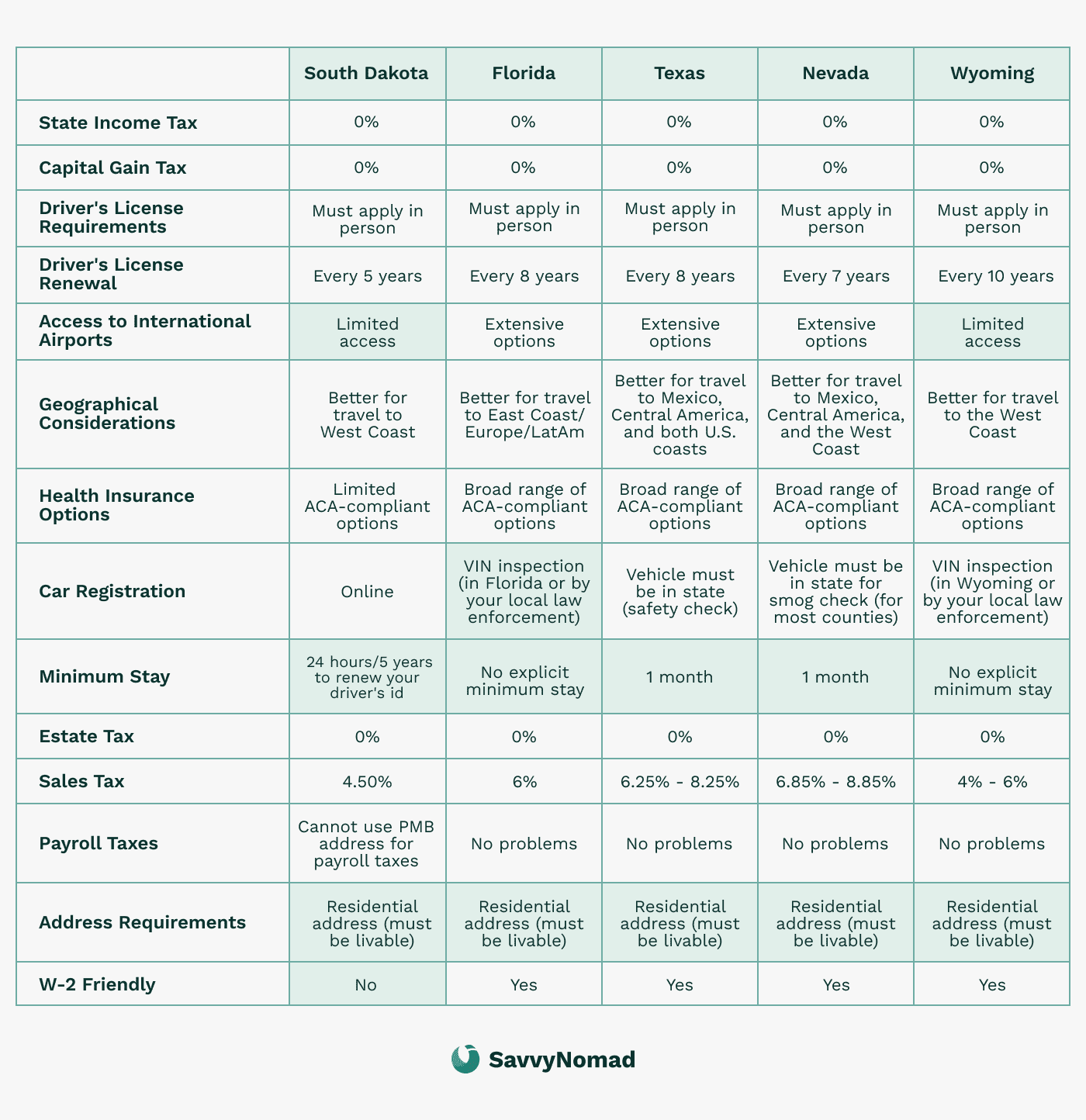

- Avoiding state taxes by establishing a no-income-tax domicile: Some U.S. states don’t tax Social Security benefits at all, while others do. If you’re moving abroad, it may be advantageous to establish your domicile in a no-income-tax state like Florida, Texas, or South Dakota before you leave. This helps avoid unnecessary state taxes and simplifies your U.S. tax obligations while living abroad.

Tax treaties and totalization agreements

- Tax treaties for reducing double taxation: The U.S. has tax treaties with many countries to prevent or reduce double taxation on Social Security benefits. These treaties typically specify whether benefits will be taxed by the U.S. or the host country, and some even offer full or partial exemptions from foreign taxes. Be sure to check whether your country of residence has a tax treaty with the U.S. that includes provisions on Social Security.

- Totalization agreements to avoid dual contributions: For expats working abroad, the U.S. has Totalization Agreements with 30 countries. These agreements allow you to pay into only one country’s Social Security system, which prevents dual contributions. Totalization Agreements are particularly useful if you work and earn income in your host country, as they clarify which country’s Social Security system you should contribute to and help you qualify for benefits by combining credits earned in both countries.

Here is the full list of countries with Totalization Agreements: Australia, Austria, Belgium, Brazil, Canada, Chile, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Japan, Luxembourg, Netherlands, Norway, Poland, Portugal, Slovak Republic, Slovenia, South Korea, Spain, Sweden, Switzerland, United Kingdom, Uruguay.

Managing U.S.-based retirement accounts from abroad

For U.S. citizens living abroad, managing retirement accounts like 401(k)s, IRAs, and Roth IRAs involves unique considerations for accessing funds, minimizing taxes, and handling foreign currency. By understanding withdrawal rules, tax implications, and currency strategies, expats can optimize their retirement savings and ensure financial security abroad.

Account types and withdrawals

Traditional IRAs and 401(k)s

These accounts offer tax-deferred growth, meaning you don’t pay taxes on contributions until you withdraw the funds. When living abroad, it’s essential to understand how withdrawals might impact your tax situation, especially if you have other income sources.

- Early withdrawal penalties: For traditional IRAs and 401(k)s, withdrawing funds before age 59½ generally results in a 10% penalty in addition to regular income tax. This penalty applies even if you’re living abroad, so it’s advisable to avoid early withdrawals whenever possible.

- Required minimum distributions (RMDs): Upon reaching age 73, you must begin taking RMDs from traditional IRAs and 401(k)s. Failing to meet RMD requirements can result in significant penalties, so planning for these distributions is crucial. For expats, coordinating RMDs with other income sources can help manage tax brackets and reduce overall tax exposure.

Roth IRAs

Roth IRAs provide tax-free withdrawals on qualified distributions, as contributions are made with after-tax income. For expats, Roth IRAs offer a tax-efficient way to access retirement funds, especially since qualified withdrawals (after age 59½ and holding the account for five years) are not subject to U.S. taxes. Roth IRAs can be particularly beneficial for those looking to minimize U.S. tax liabilities on retirement income .

Avoiding foreign country taxes on U.S. retirement accounts

- Leveraging tax treaties: Some countries have tax treaties with the U.S. that reduce or exempt U.S. retirement distributions from foreign taxation. For example, tax treaties with the U.K., Canada, and Japan often allow for favorable tax treatment on U.S. retirement income, either through lower tax rates or full exemptions. Reviewing the specific treaty provisions in your host country can clarify how withdrawals are taxed locally.

- Using the Foreign Tax Credit (FTC): If your host country taxes your retirement income, the FTC allows you to offset U.S. taxes based on the amount of foreign tax paid. By claiming the FTC on your U.S. tax return, you can reduce or eliminate double taxation on your retirement distributions, making it easier to retain more of your income.

Currency exchange and withdrawal strategies

- Managing currency exchange rates: Converting U.S. retirement income into a foreign currency can significantly impact your purchasing power. Monitoring exchange rates and timing withdrawals when the U.S. dollar is stronger can help maximize income. Some expats choose to stagger withdrawals or convert only a portion of their funds, allowing them to adjust to favorable exchange rates over time.

- Minimizing transfer and conversion fees: Transferring funds internationally can incur fees, especially when transferring directly from a U.S. retirement account to a foreign bank. Consider using international banking services or platforms like Wise (formerly TransferWise) or Revolut, which offer competitive conversion rates and lower fees, to reduce transaction costs. Converting only the amount needed for local expenses can also help limit conversion fees.

- Diversifying currency holdings: Maintaining some retirement funds in both U.S. dollars and the local currency can provide a buffer against unfavorable exchange rates. This dual-currency strategy allows you to access funds in whichever currency is more advantageous at the time, offering flexibility and stability in fluctuating markets.

Accessibility and account management abroad

- Overcoming brokerage limitations: Many U.S. brokerage firms restrict account services for expats, limiting trading activities or even closing accounts for those living outside the U.S. Working with expat-friendly brokerages or selecting online platforms that cater to non-U.S. residents can help maintain access to your retirement accounts and investment options.

- Alternative management options: For smoother account management, some expats work with financial advisors who specialize in cross-border planning. Advisors with expertise in expat finance can assist with tax-efficient withdrawal strategies, investment guidance, and compliance with both U.S. and foreign regulations, ensuring that your retirement funds are optimized according to your specific circumstances.

The importance of maintaining a U.S. residential address

For U.S. expats, keeping a U.S. residential address is more than just a formality. A valid address serves as a link to the U.S., supporting everything from tax filings to maintaining access to financial accounts. Here’s why a U.S. address is essential and some options for expats to establish one.

Why a U.S. address matters

- Social Security and Medicare communication: A U.S. address simplifies communication with the Social Security Administration (SSA) and Medicare. While it’s possible to receive SSA mail abroad, delays or errors are more likely, especially for eligibility questionnaires and other time-sensitive documents. Having a U.S. address helps ensure you receive updates promptly, avoiding service interruptions.

- Banking and financial account requirements: U.S. banks and financial institutions generally require account holders to maintain a U.S. residential address on file, especially under the Patriot Act regulations. Most banks don’t accept P.O. boxes or mail forwarding addresses for regulatory purposes, making a valid U.S. residential address crucial. Without it, expats might face account restrictions or even closures, impacting access to funds and banking services.

- U.S. tax filings and residency benefits: Maintaining a U.S. address supports filing U.S. taxes and ensures you receive IRS documents like tax refunds, notices, or other important updates. Additionally, a valid U.S. residential address can help in establishing domicile in a no-income-tax state, reducing state tax liabilities on retirement and Social Security income for expats.

Options for maintaining a U.S. address

- Domicile services: Services like SavvyNomad’s domicile support help expats establish and maintain an official address in a state with no income tax, such as South Dakota or Florida. These services provide a legitimate residential address that meets banking, IRS, and SSA requirements, ensuring compliance and reducing tax obligations while living abroad.

- Using family or friends’ addresses: Some expats opt to use a family member’s or friend’s address, which can be cost-effective. However, the main downside is the lack of formal proof of address, which is required for banks or financial institutions. This approach might be enough for basic mail forwarding but often falls short for regulatory requirements.

- Mail forwarding services: While traditional mail forwarding services can scan and send mail digitally, they generally don’t qualify as official residential addresses under IRS and banking regulations. Expats using forwarding services might encounter restrictions on financial services that require a verified U.S. address.

Avoiding pitfalls and tax traps

For U.S. expats, managing Social Security benefits and retirement accounts abroad can be complex, with potential tax and reporting pitfalls. Here are key areas to watch out for and strategies to help avoid common traps, from managing state tax residency to meeting foreign account reporting requirements.

State tax residency and its impact

- Establishing domicile in a no-income-tax state: When you live abroad, your U.S. state of residency still plays a role in your tax obligations. Some states continue to tax residents who move abroad, which can lead to state taxes on Social Security benefits and retirement income. To avoid these taxes, consider establishing domicile in a no-income-tax state—such as Florida, Texas, or Nevada—before you leave the U.S. This step reduces tax liabilities and simplifies filing requirements.

- Meeting domicile criteria: Establishing a new domicile requires proving a primary connection to the no-tax state. This can include obtaining a driver’s license, registering to vote, and maintaining a local address. Domicile services can help facilitate this process, especially for expats planning long-term or indefinite stays abroad.

Required Minimum Distributions (RMDs)

- Understanding RMD requirements: Traditional IRA and 401(k) account holders must start taking RMDs at age 73. These mandatory withdrawals are taxable as ordinary income, and missing the RMD deadline results in a 50% penalty on the required distribution amount. For expats, planning RMDs alongside other income sources, such as Social Security, can help manage tax brackets and reduce overall tax exposure.

- Coordinating RMDs with tax-efficient withdrawals: Some expats spread their RMDs over the year or combine them with other tax-efficient withdrawals to avoid pushing themselves into a higher tax bracket. Working with a financial planner familiar with RMDs can help develop a strategy that minimizes taxes while keeping you compliant.

Foreign Bank Account Reporting requirements (FBAR and FATCA)

- Filing requirements for foreign accounts: Expats with foreign financial accounts must file an FBAR (Foreign Bank Account Report) if the aggregate balance of their foreign accounts exceeds $10,000 at any point in the year. FBAR filing is separate from the U.S. tax return and must be submitted annually through the Financial Crimes Enforcement Network (FinCEN). Failing to file can result in steep penalties, so tracking account balances carefully is essential.

- FATCA reporting for higher balances: Under the Foreign Account Tax Compliance Act (FATCA), expats with higher foreign account balances may also need to file Form 8938 with the IRS. FATCA requires reporting of foreign financial assets, including bank accounts, stocks, and trusts. For most unmarried expats, reporting kicks in if foreign assets exceed $200,000 on the last day of the year or $300,000 at any point during the year.

- Keeping detailed records: To ensure compliance with FBAR and FATCA, maintain accurate records of all foreign account balances and related financial activity. This not only helps with annual reporting but also protects against potential audits or inquiries from the IRS.

Avoiding passive foreign investment company (PFIC) rules

- Understanding PFIC rules: The IRS has strict regulations around Passive Foreign Investment Companies (PFICs), which are foreign-based mutual funds, ETFs, or other pooled investments. For U.S. expats, holding PFICs can lead to highly unfavorable tax treatment, as gains are subject to complex calculations and higher tax rates. Avoiding PFICs or working with a tax advisor to manage any existing holdings can prevent these costly tax implications.

- U.S.-based investment alternatives: Rather than investing in foreign funds, consider U.S.-based investment options such as U.S. mutual funds or ETFs, which avoid PFIC treatment. Choosing IRS-friendly investment vehicles helps reduce tax burdens and keeps your portfolio compliant with U.S. tax laws.