How to leave Maryland residency?

Maryland residents may choose to leave the state due to its relatively high tax burden and complex tax regulations. Maryland's state income tax rates are among the highest in the U.S., with rates reaching up to 5.75%, plus an additional local tax of up to 3.2%. This can place a significant financial strain on residents, particularly for those with higher incomes.

Furthermore, Maryland taxes its residents on worldwide income, meaning any earnings from abroad are still subject to state taxation.

Maryland's high tax rates and complex tax laws often require professional assistance. Rising living costs near Washington, D.C., high crime rates in areas like Baltimore, and long commutes due to traffic congestion drive residents to seek more affordable and safer environments.

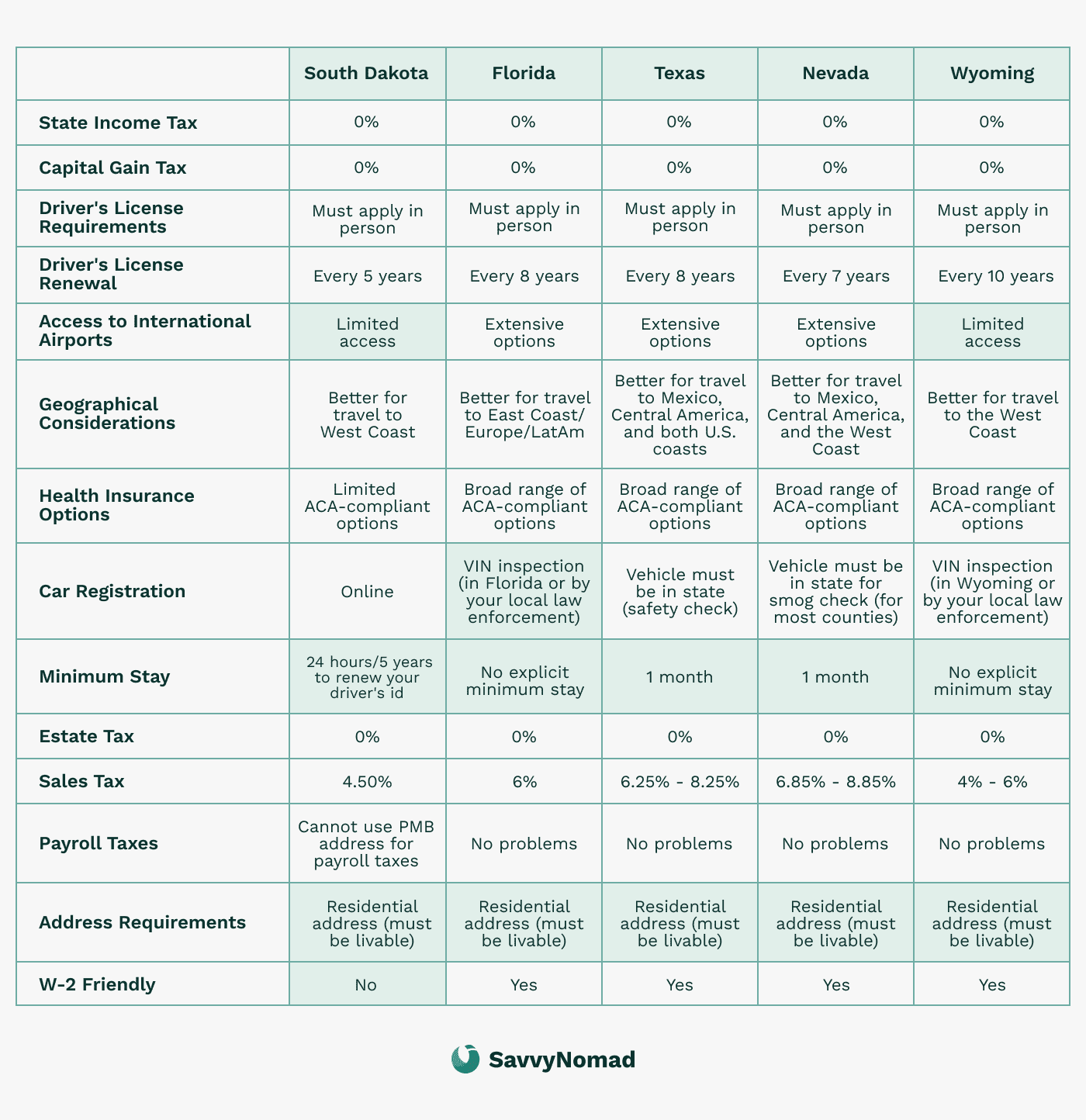

Moving from Maryland to a tax-friendly state can bring financial benefits for digital nomads, retirees, and those looking to optimize their tax obligations. Many individuals are choosing to relocate to states with no income tax, such as Florida or Texas, or those with simpler tax codes.

Understanding Maryland residency

Definition of Maryland residency

Maryland residency is defined as the state where an individual has their permanent home and intends to live indefinitely. To be considered a Maryland resident, you must demonstrate your intent to make Maryland your permanent home and reside in the state indefinitely.

This can be established by meeting certain criteria, such as maintaining a primary living quarter in Maryland, paying Maryland income tax, and possessing a valid Maryland driver’s license.

If Maryland is where you primarily live, work, and have your most significant connections, you are likely considered a resident for tax purposes.

Importance of establishing or leaving residency

Establishing or leaving residency in Maryland is crucial for various purposes, including in-state tuition, voting, and getting a driver’s license. Maryland law requires individuals to establish residency in the state to be eligible for in-state tuition, which can significantly reduce the cost of attending a university.

Additionally, establishing residency in Maryland can also impact your federal and Maryland law obligations, such as filing a Maryland resident tax return.

Conversely, leaving Maryland residency can relieve you from resident-level Maryland tax on worldwide income and may offer financial benefits if you move to a state with lower or no personal income tax. You’ll still owe Maryland tax on Maryland-sourced income (such as rental or business income in the state) even after you become a nonresident

Steps to leaving Maryland residency

Step 1: Establish a new domicile

1) Establish new residency

- Secure a residential address: Rent or purchase property in your new state.

- File a Declaration of Domicile: In states like Florida, you can file a Declaration of Domicile, which legally states your intent to make the new state your permanent home. This additional legal documentation can further solidify your residency status.

This can be especially useful for digital nomads or expats who want a simple Florida documentation footprint, but the address itself does not guarantee tax savings, residency treatment, or acceptance by any particular agency or institution.

Residency guides:

2) Relocate your belongings

Physically move your personal belongings to your new state. This includes household items, vehicles, and other personal possessions, which will demonstrate your intent to leave Maryland permanently.

3) Spend time in your new state

Ensure you spend the majority of your time in your new state to establish a clear presence and support your new domicile. For Maryland’s statutory-resident test, a key factor is whether you both (1) maintain a place of abode in Maryland for more than six months of the year and (2) are physically present in the state for 183 days or more. Staying under 183 days in Maryland and avoiding a long-term Maryland abode reduces the risk of being treated as a Maryland resident after you move.

4) Transfer IDs and vehicle registrations, including Maryland driver's license

Transfer your driver’s license and vehicle registration to your new state. This is a strong signal of your intent to leave Maryland.

5) Register to vote

Register to vote in your new state (if you’re eligible). Voting records are a strong supporting indicator of residency and this step is important in showing your new domicile, but voter registration is only one factor among many that states consider when determining tax residency.

6) Update financial accounts

Notify banks, credit card companies, and other financial institutions of your new address. This helps make sure your financial records consistently reflect your new state residency.

7) Notify your employer

Update your employer with your new address and work with them so that payroll and tax withholdings are aligned with your new state. This helps avoid confusion with tax filings.

Step 2: Sever ties with Maryland

To leave Maryland residency, it’s essential to sever as many significant ties with the state as practical. Doing so helps you rebut any presumption that you still treat Maryland as your home and provides evidence, if reviewed, that you no longer maintain Maryland residency.

1) Close Maryland financial ties

- Close Maryland bank accounts: Closing local bank accounts and transferring your funds to your new state helps demonstrate that your financial activity is no longer tied to Maryland.

- Cancel Maryland voter registration: Update your voter registration to your new state. Voting records are a strong indicator of residency, and keeping a Maryland registration could complicate your transition.

- Update personal records: Ensure that all personal records (with the IRS, Social Security, etc.) reflect your new address and state of residency. This is a critical step to show that you no longer reside in Maryland.

2) Sell or lease property

- Sell or lease your Maryland property: If you own property in Maryland, selling or leasing it is an important step in demonstrating that you no longer intend to reside in the state. If leasing, make sure it’s a long-term agreement to avoid any appearances of continued residency.

- Move personal belongings: Relocate your personal belongings to your new state to further support your permanent move.

3) Cancel local subscriptions/services

Cancel any Maryland-based memberships, subscriptions, or services, such as gym memberships or utilities. This removes ties to the state and further signals your intent to leave permanently.

4) Transfer healthcare and insurance

Establish care with new providers in your new state and update your health insurance policies to reflect this change. This is another step in proving your new domicile.

Step 3: Time spent outside Maryland

One of the most critical factors in leaving Maryland residency is the amount of time you spend in and out of the state after you move. Maryland’s tax authorities use a 183-day threshold, combined with whether you maintain a Maryland place of abode or domicile, to decide if you should still be classified as a resident for tax purposes.

183-Day Rule

- Stay under 183 days if you still have ties to Maryland: If you maintain a place of abode in Maryland for more than six months of the year and are physically present in the state for 183 days or more, Maryland can treat you as a resident (a “statutory resident”) and tax your worldwide income. Keeping your Maryland days below 183 and avoiding a long-term abode there, after you’ve established a new domicile elsewhere, significantly reduces that risk.

- Keep detailed travel records: Retain travel documents such as flight tickets, hotel receipts, and any other relevant records to prove your time spent outside Maryland. These documents will be critical if you are ever audited by Maryland tax authorities to determine your residency status.

Step 4: Maryland-sourced income

Even after you leave Maryland residency, you may still have tax obligations if you continue to earn income from Maryland sources. It’s important to understand how Maryland-sourced income will be taxed.

1) Ongoing Maryland income tax responsibilities

If you continue to earn income from Maryland (e.g., rental or business income), you will need to file non-resident tax returns. This ensures that while you report income generated in Maryland, you avoid residency-based taxation on your global income.

2) Rental or business income

Taxation of Maryland-sourced income: Income from Maryland-based rental properties or businesses remains subject to state taxes. Consult a tax professional to fully understand the tax obligations and ensure compliance as a non-resident.

By following these steps, you can more effectively sever ties with Maryland, establish and document residency in your new state, and manage your ongoing Maryland-sourced income obligations. Taken together, these actions can reduce the risk that Maryland continues to treat you as a resident for tax purposes and help you position yourself to benefit from the tax rules of your new state of residence, recognizing that final determinations always depend on your specific facts and on Maryland’s own review.