Do expats from Kentucky still need to pay state taxes?

When you move abroad, understanding your state tax obligations is crucial. Even if you no longer live in Kentucky, you might still have to pay Kentucky state taxes.

Our goal is to clarify the rules so you can avoid unexpected tax bills and stay compliant with Kentucky's tax laws. By the end of this article, you'll know what steps to take to change your residency and what types of income are still taxable by Kentucky.

TLDR:

To stop being taxed as a Kentucky resident on your worldwide income, you generally need to establish a new domicile elsewhere and sever most ties with Kentucky—such as selling property, transferring your driver’s license, and updating all personal documents. If you are eligible, you may also register to vote in your new state; voter registration is a supporting indicator of domicile, not determinative on its own.

Kentucky-sourced income, such as wages, business income, and rental income from Kentucky properties, remains taxable.

Non-compliance can lead to penalties, interest, audits, and legal actions.

Understanding Kentucky's tax residency rules

To determine if you need to pay Kentucky state taxes, you first need to understand the different residency statuses: Resident, Nonresident, and Part-Year Resident.

Resident

You are considered a resident if Kentucky is your permanent home (domicile). This includes situations where Kentucky was your last place of residency in the US and you haven't established a new domicile elsewhere.

Tax obligations

As a resident, you must pay state taxes on all your income, no matter where it is earned in the world.

To change this status, you need to take steps to establish a new permanent home in another state or country and sever ties with Kentucky.

This includes selling property in Kentucky, transferring your driver’s license, registering to vote in your new location, and showing intent to remain in your new domicile permanently.

Nonresident

You are a nonresident if you do not have a permanent home or significant presence in Kentucky.

Tax obligations

Nonresidents only pay taxes on income that comes from Kentucky sources. This includes wages from work performed in Kentucky, business income from activities conducted in the state, and rental income from property in Kentucky.

Part-Year Resident

If you moved to or from Kentucky during the tax year, you are a part-year resident.

Tax obligations

Part-year residents pay taxes on all income earned while living in Kentucky. For the part of the year when you are not a resident, you only pay taxes on income from Kentucky sources.

Domicile and its implications

Understanding your domicile is key to determining your tax obligations. Here’s a simple explanation and the steps you need to take if you’re considering changing your domicile to avoid Kentucky state taxes.

Your domicile is your permanent home—the place you intend to return to and stay. It’s not just a temporary residence but where you have substantial connections and intend to remain. Domicile impacts where you are considered a resident for tax purposes.

Your state of domicile has the right to tax your worldwide income, regardless of where you earn it. If Kentucky is your domicile, you must pay Kentucky state taxes on all your income, no matter where you live or work. To change this, you need to establish a new domicile in another state or country and show clear intent to make it your permanent home.

Here are some steps to help you:

- Sell Property: Sell any property you own in Kentucky.

- Transfer Driver’s License and Vehicle Registration: Get a driver’s license and register your vehicle in your new state.

- Register to Vote: Register to vote in your new state.

- Establish a New Domicile: Show that you intend to make your new location your permanent home.

What constitutes Kentucky-sourced income?

Understanding what constitutes Kentucky-sourced income is essential for nonresidents and part-year residents to accurately determine your tax obligations.

Kentucky-sourced income refers to any income derived from activities or assets located within the state.

Here are some key categories to consider:

- Wages and Salaries: Money earned for services performed in Kentucky.

- Business Income: Income from business activities conducted in Kentucky.

- Real Estate: Rental income from property located in Kentucky.

- Capital Gains: Profits from the sale of real estate or tangible property in Kentucky.

- Dividends and Interest: Dividends from Kentucky-based companies and interest earned from Kentucky financial institutions.

- Pensions and Retirement Plans: Retirement income from Kentucky institutions or for services performed in the state.

Why should Kentucky expats move domicile to a state with zero state income tax?

State income tax savings

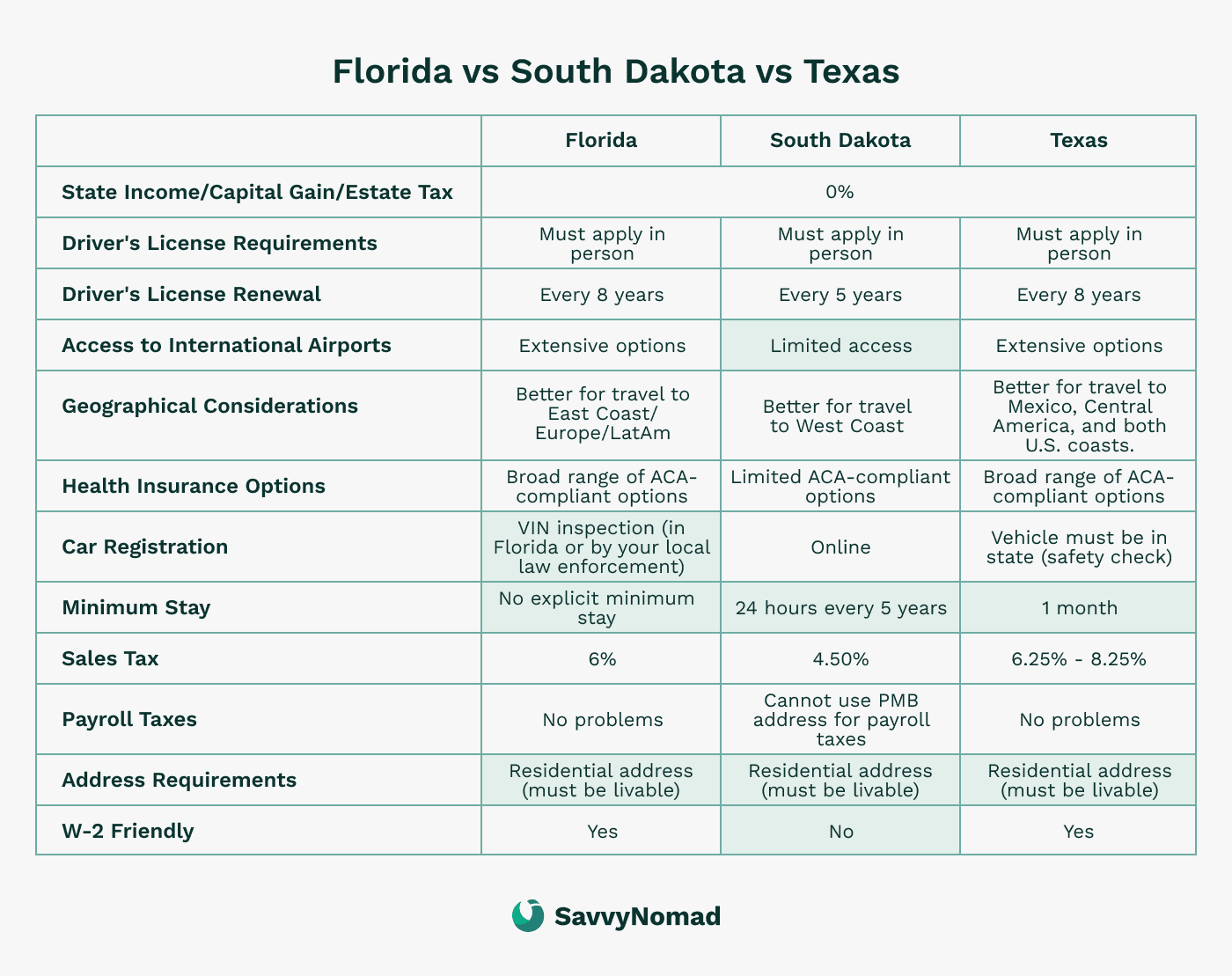

For retirees and high-income individuals from Kentucky, moving to states without income taxes such as Florida, Texas, or Nevada can offer significant financial advantages. Without the burden of Kentucky state income taxes, you can keep more of your earnings, allowing for greater investment opportunities or an enhanced lifestyle.

Inheritance tax benefits

States like Florida and Texas not only lack a state income tax but also do not impose state estate taxes. This can considerably reduce the tax burden on your estate, which may help more wealth be passed on to your heirs. This is especially advantageous for individuals from Kentucky with substantial assets who wish to maximize the inheritance for their beneficiaries.

Flexibility and mobility

Relocating your domicile from Kentucky to a no-income-tax state enhances your flexibility and mobility, allowing you to travel and live in various locations without worrying about high state tax bills. This is ideal for high-income earners from Kentucky with business interests in multiple states or countries and for retirees who desire to spend their later years exploring new places.

Moreover, the absence of state income taxes can simplify your tax filing process. In many cases you may only need to file federal taxes, reducing the complexity and potential for errors in your tax returns and making financial management more straightforward, though you could still have filing obligations in other states depending on your situation.

How to leave Kentucky tax residency?

Here are the key steps to help you transition:

1) Establish new residency

- Secure a Residential Address: Find a place to live in your new state or country. This address is a key factor in establishing your new domicile, together with your intent and other supporting ties.

The address is provided solely for documentary and correspondence purposes related to client-direct banking or brokerage verification; it is not for business registration, public listing, or general mail forwarding. Banks and state agencies make their own decisions, no specific outcome is guaranteed, and prior-state rules may still apply.

- File a Declaration of Domicile if required: Some states, like Florida, require a formal declaration to confirm your new domicile.

Reference guides may provide additional help for specific states:

2) Transfer IDs and registrations

Change your driver’s license and vehicle registration to your new state.

3) Register to vote (if eligible)

If you are eligible, you may register to vote in your new state. Voter registration is one supporting indicator of domicile, not determinative on its own. For eligibility and procedures, follow guidance from election officials in your new state.

4) Update documents

Update all personal identification documents, medical records, insurance policies, and financial records with your new address.

5) Notify your employer

Let your employer know about your move so that your payroll and tax withholdings reflect your new state. This can help shift some of your income classification away from being Kentucky-sourced.

6) Notify IRS

Inform the IRS of your address change using Form 8822. Extend this notification to all personal and professional entities.

7) Keep records

Keep receipts, bills, and legal documents related to your move to prove your new residency if needed.

8) Cut all ties with Kentucky

- Sell or Rent Out Property: If you own property in Kentucky, selling or renting it out can help sever ties with the state.

- Close Local Bank Accounts: Transfer or close bank accounts in Kentucky and open new ones in your new state of residence.

- Cancel Local Memberships: Cancel memberships in Kentucky-based clubs, organizations, and services.

9) Be prepared for audit

Be ready to provide proof of your move’s permanence. This includes all the documentation showing that you have established a new domicile and severed ties with Kentucky.

Tax benefits and exemptions for expats from Kentucky

Living abroad as an expat from Kentucky comes with various federal tax benefits and exemptions that can help reduce your overall tax burden.

Here are some of the key federal tax advantages available:

Foreign Earned Income Exclusion (FEIE)

The FEIE allows U.S. taxpayers living abroad to exclude a certain amount of their foreign-earned income from U.S. federal income tax.

For the tax year 2024, this exclusion amount is up to $126,500.

To qualify, you must pass either:

- Bona Fide Residency Test: You qualify if you are a resident of a foreign country for an uninterrupted period that includes an entire tax year.

- Physical Presence Test: You qualify if you are physically present in a foreign country for at least 330 full days during a 12-month period.

Foreign Tax Credit (FTC)

The FTC helps you avoid double taxation by allowing you to take credit for foreign taxes paid on income subject to U.S. federal tax.

This credit can significantly reduce your U.S. tax liability, especially if you reside in a country with high tax rates.

Foreign Housing Exclusion (FHE)

The FHE allows you to exclude certain housing expenses from your federal taxable income, including rent, utilities (excluding telephone), and other reasonable expenses related to housing abroad.

The amount you can exclude is limited to a base amount plus housing expenses exceeding 16% of the FEIE limit.

Filing Kentucky state taxes from abroad

When filing Kentucky state taxes from abroad, you need to determine which forms are applicable based on your residency status:

- Form 740: For full-year residents of Kentucky.

- Form 740-NP: For nonresidents and part-year residents to report income from Kentucky sources.

Deadlines and extensions

- General Deadline: The deadline for filing Kentucky state taxes is April 15, which aligns with the federal tax deadline. This is the due date for both filing your return and paying any taxes owed.

- Automatic federal extension (living abroad): U.S. citizens and residents who are living and working outside the U.S. on April 15 generally receive an automatic two-month extension to file their federal return (typically to June 15). This federal rule does not by itself change Kentucky’s original payment due date, and interest can still accrue on any unpaid tax from April 15.

- Kentucky extensions: If you receive a federal filing extension, Kentucky will typically honor that extension for your Kentucky return; otherwise you can request more time using Kentucky Form 740EXT. Under Kentucky regulations, an individual outside the United States who files an extension application can be granted up to 12 months to file, but this extends the time to file, not the time to pay, and interest still applies on late payments.

- Additional Extension: You can request a further extension by filing Form R-2868, Application for Extension of Time to File Kentucky Individual Income Tax Return, typically extending the deadline to October 15. This extension is for filing your return only, not for paying any taxes owed. Interest on any unpaid taxes will continue to accrue from the original April 15 deadline.

- Payment Deadlines: Regardless of filing extensions, any taxes owed must be paid by April 15 to avoid interest and late payment penalties. If you file an extension, make sure that your payment is postmarked by the due date to avoid additional charges.

Consequences of non-compliance with Kentucky state tax laws

- Late Filing Penalty: If you do not file your tax return by the due date, Kentucky imposes a penalty of 2% of the unpaid tax for each 30 days the return is late, up to a maximum of 20% of the unpaid taxю

- Late Payment Penalty: If you fail to pay your taxes by the due date, a penalty of 2% of the unpaid tax is assessed for each 30 days the tax remains unpaid, up to a maximum of 20%.

- Interest Charges: Interest is charged on any unpaid tax from the original due date until the tax is paid in full. The Kentucky Department of Revenue sets the interest rate annually.

Audits and Assessments

Kentucky may conduct residency audits to verify your residency status and check for proper tax compliance. During an audit, you must provide extensive documentation, such as proof of domicile and detailed financial records. Failure to provide adequate documentation can result in additional tax assessments and penalties.