Do expats from Indiana still need to pay state taxes?

Understanding state tax obligations is crucial for Indiana residents who move abroad to avoid unexpected financial burdens. Even after relocating, certain conditions may still require you to pay Indiana state taxes.

This article will help clarify whether expatriates from Indiana need to continue paying state taxes, depending on their residency and domicile status.

TLDR:

If Indiana remains your domicile and you haven’t clearly established residency somewhere else, you will generally still be treated as an Indiana resident for tax purposes and may have to file Indiana returns on your worldwide income.

To reduce the chance that Indiana continues to treat you as a resident, you typically need to both establish a new domicile and substantially reduce your ties to Indiana (for example, moving your home, updating IDs, and changing voter registration). No single step guarantees a particular result, and outcomes always depend on your specific facts and Indiana law.

Understanding Indiana's tax residency rules

Resident

A resident is someone whose permanent home, or domicile, is in Indiana. This means that Indiana is the state you consider your permanent home, the place you intend to return to after any periods of absence.

As a resident, you are taxed on your worldwide income, regardless of where it is earned. This includes income from all sources, both within and outside of the United States.

Nonresident

A nonresident is an individual who does not maintain a domicile or significant presence in Indiana. For nonresidents, Indiana taxes only the income that originates from Indiana sources.

This includes wages earned while working in Indiana, business income from operations within the state, and rental or sale income from property located in Indiana.

Part-Year Resident

Part-year residents are individuals who moved to or from Indiana during the tax year. If you changed your permanent home from Indiana to another location, or vice versa, during the year, you fall into this category.

Part-year residents are taxed on all income earned while they were residents of Indiana and only on Indiana-sourced income during the periods they were nonresidents. This means you must carefully allocate income based on your residency status throughout the year.

Domicile and tax liability

Indiana and establishing residence elsewhere is not sufficient to change domicile.

The individual must also intend to remain in the new state and take steps to establish it as their new domicile.

What constitutes Indiana-sourced income?

Understanding what constitutes Indiana-sourced income is essential for nonresidents and part-year residents to accurately determine your tax obligations. Indiana-sourced income refers to any income derived from activities or assets located within the state.

Here are some key categories to consider:

- Wages and Salaries: Money earned for services performed in Indiana.

- Business Income: Income from business activities conducted in Indiana.

- Real Estate: Rental income from property located in Indiana.

- Capital Gains: Profits from the sale of real estate or tangible property in Indiana.

Why should Indiana expats move domicile to a state with zero state income tax?

State income tax savings

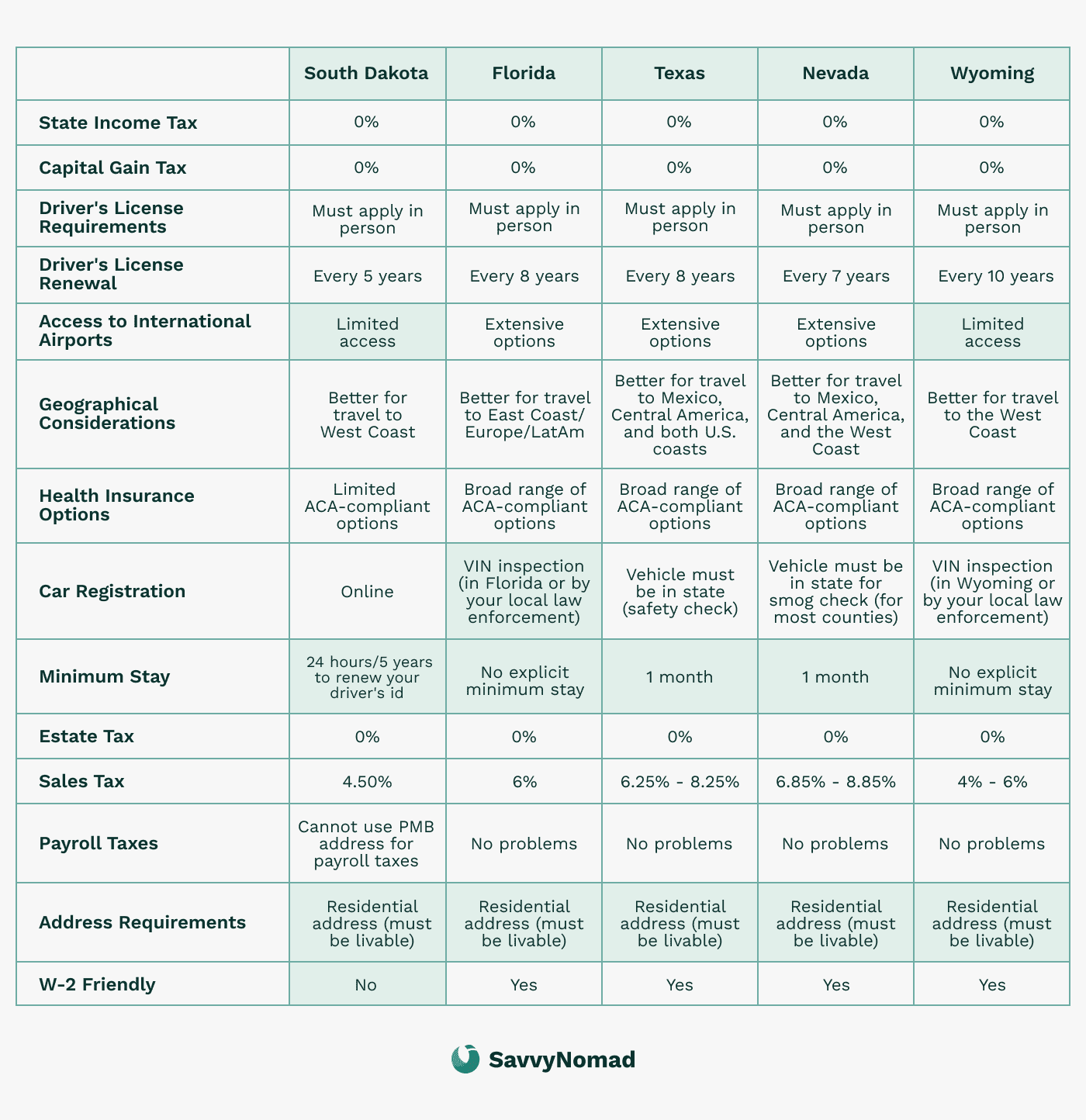

For retirees and high-income individuals from Indiana, moving to states without income taxes such as Florida, Texas, or Nevada can offer significant financial advantages. Without the burden of Indiana state income taxes, you can keep more of your earnings, allowing for greater investment opportunities or an enhanced lifestyle.

Inheritance tax benefits

States like Florida and Texas not only lack a state income tax but also do not impose state estate taxes. This can considerably reduce the tax burden on your estate, ensuring that more wealth is passed on to your heirs. This is especially advantageous for individuals from Indiana with substantial assets who wish to maximize the inheritance for their beneficiaries.

Flexibility and mobility

Relocating your domicile from Indiana to a no-income-tax state can enhance your flexibility and mobility, and may reduce exposure to high resident-state income tax bills. This can be attractive for people with income and investments spread across multiple states or countries.

In many cases, having a domicile in a no-income-tax state may simplify your U.S. tax picture because there is no resident-state income tax on worldwide income. However, you could still need to file in other states or countries depending on where you work, own property, or have business ties, so your actual filing footprint will always depend on your situation.

How to leave Indiana tax residency?

When moving abroad or to another state, changing your Indiana residency status requires deliberate steps to ensure a clear transition.

Here’s a step-by-step guide to help you navigate this process:

1) Establish new domicile

Secure a residential address in your new location. This is the first step in establishing your new domicile.

Having a Florida address by itself does not establish Florida tax residency or guarantee any banking, immigration, or tax outcome; prior-state rules may still apply, and banks and state agencies make their own decisions.

Consider filing a Declaration of Domicile in the new state, which solidifies your intent to make it your permanent home. Reference guides may provide additional help for specific states:

2) Transfer IDs and registrations

Update your driver’s license and vehicle registration as soon as possible to reflect your new residence. This helps in establishing your presence in the new state.

3) Register to vote (if eligible)

If you’re eligible, you may register to vote in your new state and update any prior registration. Voter registration is just one supporting indicator of domicile and not determinative on its own. For eligibility and procedures, always consult the official election authorities in that state.

4) Update documents

Ensure all personal documents such as identification cards, medical records, insurance policies, and financial documents are updated with your new address. This consistency is crucial for proving your new residency status.

5) Notify your employer

Inform your employer about your residency change. This is particularly important if your move affects how your income is taxed, potentially shifting some of it away from being classified as "Indiana-sourced."

6) Notify IRS

Inform the IRS of your address change using Form 8822. Extend this notification to all personal and professional entities.

7) Keep records

Maintain detailed records of all your relocation actions, including receipts, bills, and legal documents. These records can be invaluable, especially if your residency status is questioned.

8) Anticipate an audit

Be audit-ready with comprehensive proof of your move’s permanence.

Tax benefits and exemptions for Indiana expats

Living abroad as an expat from Indiana comes with various federal tax benefits and exemptions that can help reduce your overall tax burden. Here are some of the key federal tax advantages available:

Foreign Earned Income Exclusion (FEIE)

The FEIE allows U.S. taxpayers living abroad to exclude a certain amount of their foreign-earned income from U.S. federal income tax.

For the tax year 2024, this exclusion amount is up to $126,500.

To qualify, you must pass either:

- Bona Fide Residency Test: You qualify if you are a resident of a foreign country for an uninterrupted period that includes an entire tax year.

- Physical Presence Test: You qualify if you are physically present in a foreign country for at least 330 full days during a 12-month period.

Foreign Tax Credit (FTC)

The FTC helps you avoid double taxation by allowing you to take credit for foreign taxes paid on income that is also subject to U.S. federal tax.

This credit can significantly reduce your U.S. tax liability, especially if you reside in a country with high tax rates.

Foreign Housing Exclusion (FHE)

The FHE allows you to exclude certain housing expenses from your federal taxable income, including rent, utilities (excluding telephone), and other reasonable expenses related to housing abroad. The amount you can exclude is limited to a base amount plus housing expenses exceeding 16% of the FEIE limit.

Indiana’s interaction with federal expat rules

Indiana begins its calculation of taxable income from your federal adjusted gross income (AGI). In practice, that means if you are still treated as an Indiana resident and you properly exclude foreign earned income under the federal Foreign Earned Income Exclusion (FEIE), that excluded income is generally not pulled back into Indiana taxable income. Residency status still controls whether Indiana is taxing your worldwide income at all.

Indiana also allows a limited resident credit for certain foreign income taxes paid to another country. In some situations, if the same income is taxed by both Indiana (while you are an Indiana resident) and a foreign jurisdiction, a state-level foreign tax credit may reduce Indiana tax on that double-taxed income. The tax must be a net income tax, the same income must be taxed by both jurisdictions, and documentation is critical; credits are usually capped at the Indiana tax on that income and can be reduced if you also claim a federal foreign tax credit on the same dollars.

These rules are highly technical, so most expats work with a qualified tax professional to model how federal exclusions and credits interact with Indiana’s resident-state rules.

Filing Indiana state taxes from abroad

Determine residency and identify Indiana-sourced income

The first step to file Indiana state taxes abroad is to determine your residency status and identify any Indiana-sourced income.

Evaluate your ties to Indiana, such as property ownership, business interests, or familial relationships, to understand your residency status. Review your income sources to determine which portions are considered Indiana-sourced.

Indiana-sourced income includes wages earned while working in Indiana, business income from operations within the state, and rental or sale income from property located in Indiana.

Required forms

Filing your Indiana state taxes from abroad involves completing the appropriate forms based on your residency status:

- Form IT-40: Indiana Full-Year Resident Individual Income Tax Return. This form is for individuals who are considered full-year residents of Indiana and must report all income, regardless of where it is earned.

- Schedule IT-40PNR: Indiana Part-Year or Full-Year Nonresident Individual Income Tax Return. This form is for part-year residents or full-year nonresidents who need to report Indiana-sourced income and income earned during their period of residency in Indiana.

Deadlines and extensions

It is essential to adhere to the deadlines and understand the available extensions to avoid penalties:

- Standard Deadline: The standard deadline for filing Indiana state taxes is generally April 15 (or the next business day if it falls on a weekend/holiday).

- Extensions: If you obtain a federal extension of time to file, Indiana generally grants you a corresponding extension to file your Indiana return, but you still must meet Indiana’s payment rules. If you do not have a federal extension, you can request an Indiana extension directly (for example, by filing the state’s extension form or using the online portal).

- Payment Due: Any Indiana tax you owe is still generally due by the original April deadline. Paying after that date can trigger interest and, in some cases, penalties, even if your filing deadline is extended.

How to file taxes from abroad

Filing Indiana state taxes from abroad involves several steps to ensure compliance:

1. Gather necessary documentation:

- Collect all relevant tax documents, including W-2s, 1099s, and records of Indiana-sourced income.

- Maintain records of your residency status, such as proof of domicile, and any documents that establish your ties to Indiana.

2. Choose a Filing Method:

- Online Filing: Indiana offers an online filing system, INfreefile, for eligible taxpayers. This convenient option allows you to file your state taxes electronically from anywhere in the world.

- Mail Filing: If you prefer to file by mail, download the necessary forms from the Indiana Department of Revenue’s website. Complete the forms and mail them to the address listed on the instructions.

3. Utilize e-file services

Many third-party tax software programs support Indiana state tax filings and can guide you through the process of filing from abroad.

These programs often include e-file options and can help ensure your return is accurate and complete.

4. Payment of taxes

- If you owe taxes, you can make payments online through the Indiana Department of Revenue’s e-services portal. This portal allows for secure online payments using a bank account or credit card.

- Alternatively, you can mail a check or money order with your tax return. Ensure that your payment is postmarked by April 15 to avoid late payment penalties.

Consequences of Non-Compliance with Indiana State Tax Laws

Non-compliance with Indiana tax laws can result in various severe penalties and repercussions. Understanding these consequences is crucial to avoiding significant financial and legal troubles.

Financial Penalties

Late filing and payment penalties:

- If you fail to file your tax returns on time, Indiana imposes a late filing penalty. This can be as high as 5% of the unpaid tax for each month the return is late, up to a maximum of 25% of the unpaid tax.

- Late payment penalties are also significant. If you do not pay your taxes by the due date, a penalty of 1% of the unpaid tax is levied for each month the payment is late, up to a maximum of 12%.

Interest charges

Unpaid taxes accrue interest from the original due date until the taxes are paid in full. The interest rate is set annually by the Indiana Department of Revenue and can significantly increase the total amount owed.

Legal sanctions

Indiana can pursue criminal charges for severe cases of tax evasion. This can include intentional income underreporting, non-disclosure of foreign assets, and fraudulent tax returns. Convictions for tax evasion can result in imprisonment, in addition to hefty fines.

Collection actions

For unpaid taxes, Indiana can take various collection actions, including:

- Wage Garnishments: Withholding a portion of your wages to cover the unpaid taxes.

- Bank Levies: Seizing funds directly from your bank accounts.

- Property Liens: Placing a lien on your property, which can affect your ability to sell or refinance it.

Audits and Assessments

Indiana may conduct residency audits to verify your residency status and ensure proper tax compliance. During an audit, you must provide extensive documentation, such as proof of domicile and detailed financial records. Failure to provide adequate documentation can result in additional tax assessments and penalties.