Do expats from Georgia still need to pay state taxes?

Navigating tax obligations can be complex for Georgia residents who move abroad. Understanding whether you still need to pay state taxes is crucial to avoid unexpected financial burdens and help you stay compliant with Georgia’s regulations.

Georgia's tax laws focus on residency and domicile, meaning you might still be considered a resident for tax purposes even after leaving the state. This guide will help you determine your tax responsibilities, define what constitutes Georgia-sourced income, and outline the steps to change your residency status.

TLDR:

If Georgia remains your domicile and you haven't established residency elsewhere, you are still considered a Georgia resident for tax purposes and must file state taxes on your worldwide income.

To stop being taxed as a Georgia resident on your worldwide income, you generally need to sever most ties with Georgia and establish domicile elsewhere—such as selling property, transferring your driver’s license, and updating personal documents. If you are eligible, you may also register to vote in your new state; voter registration is one supporting indicator of domicile, not determinative on its own.

Understanding Georgia's tax residency rules

To determine your tax obligations as an expat, it's essential to understand how Georgia defines tax residency.

Georgia categorizes individuals into three main groups based on residency status: residents, nonresidents, and part-year residents.

Each status carries distinct tax implications.

Resident

A resident is someone who considers Georgia their permanent home or maintains a significant presence in the state. Residents are required to pay state taxes on their worldwide income, regardless of where it is earned. Key factors influencing this status include:

- Permanent home in Georgia

- Physical presence in the state

- Intent to return to Georgia after any absence

Nonresident

Nonresidents are individuals who do not meet the criteria for being considered residents. They are only taxed on income that is sourced from Georgia.

For nonresidents, this includes income such as:

- Employment income from jobs performed in Georgia

- Business income from operations in the state

- Rental income from property located in Georgia

Part-Year Resident

Part-year residents are those who move to or from Georgia during the tax year. They are taxed on all income earned while they were residents and only on Georgia-sourced income during the periods they were nonresidents.

Establishing non-residency

If your last state of residence in the U.S. was Georgia and you now live full-time abroad, whether you need to pay Georgia state taxes depends on whether you have established non-residency in Georgia.

Here are the key points to consider:

- Sever ties with Georgia: This includes selling or renting out your Georgia home, obtaining a driver’s license in your new state, and, if you are eligible, registering to vote there. Voter registration is one supporting indicator of domicile, not determinative on its own. You should also avoid maintaining a permanent place of residence in Georgia. These actions help demonstrate that you have moved your domicile and do not intend to return to Georgia after any absence.

- Establish domicile in a new state: This involves obtaining a driver’s license in your new state and, if you are eligible, registering to vote there. These steps are strong supporting evidence of your intent to make the new state your permanent home, but domicile is determined based on your overall facts and ties rather than any single factor.

What constitutes Georgia-sourced income?

For nonresidents and part-year residents, understanding what constitutes Georgia-sourced income is essential to accurately determine your tax obligations. Georgia-sourced income refers to any income derived from activities or assets located within the state.

Here are some key categories:

Employment income

- Wages and salaries: Income earned from performing work or services within Georgia, regardless of where the employer is based.

- Self-employment income: Earnings from business activities conducted in Georgia, including freelancing and consulting services provided within the state.

Business income

- Operating income: Profits from businesses operating in Georgia, whether you own the business or are a partner in it.

- Partnership income: Your share of the earnings from partnerships doing business in Georgia.

Property income

- Rental income: Income from renting out property located in Georgia. This includes residential, commercial, and industrial properties.

- Sale of real estate: Capital gains from selling real estate situated in Georgia. This includes both direct sales and any proceeds from property exchanges.

Other income

- Investment income: Interest, dividends, and other investment returns from Georgia-based assets.

- Royalties: Payments received for the use of patents, trademarks, and other intellectual property used within Georgia.

Why should Georgia expats move domicile to a state with zero state income tax?

State income tax savings

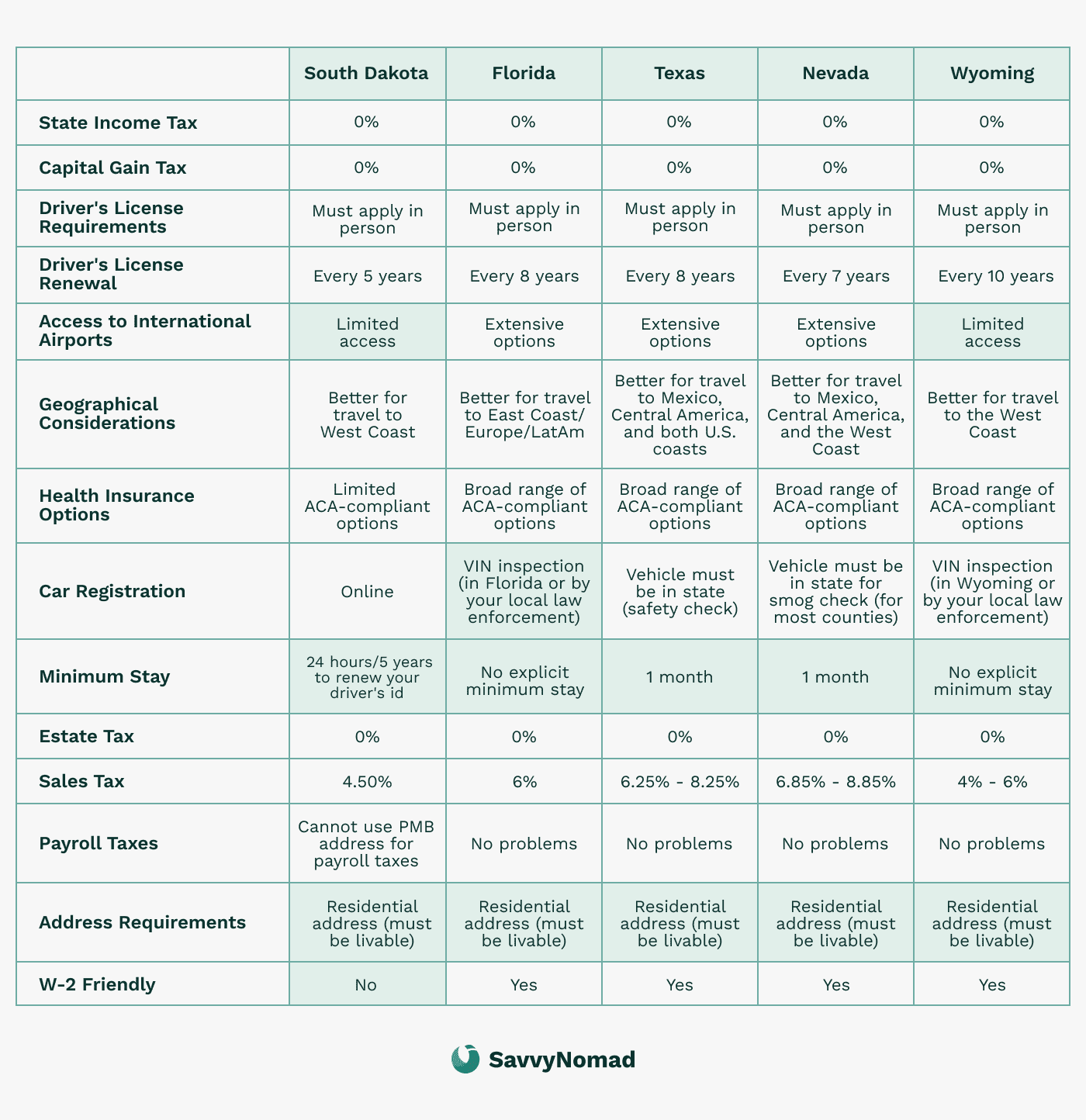

For retirees and high-income individuals from Georgia, moving to states without income taxes such as Florida, Texas, or Nevada can offer significant financial advantages. Without the burden of Georgia state income taxes, you may be able to keep more of your earnings after state taxes, allowing for greater investment opportunities or an enhanced lifestyle, depending on how fully you’ve exited Georgia under its residency rules.

Inheritance tax benefits

States like Florida and Texas not only lack a state income tax but also do not impose state estate taxes. This can considerably reduce the tax burden on your estate, which may help more wealth be passed on to your heirs. This is especially advantageous for individuals from Georgia with substantial assets who wish to maximize the inheritance for their beneficiaries.

Flexibility and mobility

Relocating your domicile from Georgia to a no-income-tax state enhances your flexibility and mobility, allowing you to travel and live in various locations without worrying about high state tax bills. This is ideal for high-income earners from Georgia with business interests in multiple states or countries and for retirees who desire to spend their later years exploring new places.

Moreover, the absence of state income taxes can simplify your tax filing process. In many cases you may only need to file federal taxes, reducing the complexity and potential for errors in your tax returns and making financial management more straightforward, though you could still have filing obligations in other states depending on your situation.

How to leave Georgia tax residency?

When you decide to move abroad or to another state, changing your Georgia residency status requires a series of deliberate steps to help make the transition as clear as possible.

Here’s a step-by-step guide to help you navigate this process:

1) Establish new residency

Secure a residential address in your new location. This is the first step in establishing your new domicile.

The address is provided solely for documentary and correspondence purposes related to client-direct banking or brokerage verification; it is not for business registration, public listing, or general mail forwarding. Banks and state agencies make their own decisions, no specific outcome is guaranteed, and prior-state rules may still apply.

Consider filing a Declaration of Domicile in the new state, which solidifies your intent to make it your permanent home. Reference guides may provide additional help for specific states:

2) Transfer IDs and registrations

Update your driver's license and vehicle registration as soon as possible to reflect your new residence. This helps in establishing your presence in the new state.

3) Register to vote (if eligible)

If you are eligible, you may register to vote in your new location. Voter registration is one supporting indicator of domicile—not determinative on its own—but it can help demonstrate your commitment to your new community.

4) Update documents

Make sure all personal documents, such as identification cards, medical records, insurance policies, and financial documents, are updated with your new address. It is crucial to maintain consistency in order to support your new residency status.

5) Notify your employer

Inform your employer about your change of residency, especially if it affects how your income is taxed, potentially changing its classification from "Georgia-sourced."

6) Notify IRS

Inform the IRS of your address change using Form 8822. Extend this notification to all personal and professional entities.

7) Keep records

Maintain detailed records of all your relocation actions, including receipts, bills, and legal documents. These records can be invaluable, especially if your residency status is questioned.

8) Be ready for audit

Be audit-ready with comprehensive proof of your move’s permanence.

Tax benefits and exemptions for Georgia expats

Living abroad as an expat from Georgia comes with various federal tax benefits and exemptions that can help reduce your overall tax burden.

Here are some of the key federal tax advantages available:

Foreign Earned Income Exclusion (FEIE)

The FEIE allows U.S. taxpayers living abroad to exclude a certain amount of their foreign-earned income from U.S. federal income tax.

For the tax year 2024, this exclusion amount is up to $126,500.

To qualify, you must pass either:

- Bona Fide Residency Test: You qualify if you are a resident of a foreign country for an uninterrupted period that includes an entire tax year.

- Physical Presence Test: You qualify if you are physically present in a foreign country for at least 330 full days during a 12-month period.

Foreign Tax Credit (FTC)

The FTC helps you avoid double taxation by allowing you to take credit for foreign taxes paid on income that is also subject to U.S. federal tax.

This credit can significantly reduce your U.S. tax liability, especially if you reside in a country with high tax rates.

Foreign Housing Exclusion (FHE)

The FHE allows you to exclude certain housing expenses from your federal taxable income, including rent, utilities (excluding telephone), and other reasonable expenses related to housing abroad. The amount you can exclude is limited to a base amount plus housing expenses exceeding 16% of the FEIE limit.

Filing Georgia state taxes from abroad

If you are a former Georgia resident now living abroad, filing your Georgia state taxes involves several critical steps to help you stay compliant and avoid penalties.

1. Determine your residency status

- Residents: If you are still considered a resident of Georgia, you must file a state tax return and report all income, regardless of where it is earned.

- Nonresidents: As a non-resident, you only need to report income that is sourced from Georgia.

- Part-Year Residents: If you moved in or out of Georgia during the tax year, you must report all income earned while a resident and Georgia-sourced income earned as a nonresident.

2. Identify Georgia-sourced income

- Employment Income: Wages or salaries earned from work performed in Georgia.

- Business Income: Earnings from business operations conducted within Georgia.

- Property Income: Rental income and proceeds from the sale of real estate located in Georgia.

3. Understand filing requirements

- Form 500: Georgia Individual Income Tax Return. This is the main form used to report your income, deductions, and credits.

- Additional Schedules: Depending on your situation, you may need to file additional schedules to report adjustments, credits, or other specific information.

4. Filing deadlines and extensions

- Standard Deadline: The standard deadline for filing Georgia state taxes is April 15th, aligning with the federal tax deadline.

- Georgia extensions: Georgia normally grants a six-month extension to file your Georgia return if you obtain a federal filing extension (Form 4868) or file Georgia Form IT-303. The extension applies to filing, not to payment—any Georgia tax owed is still due by the original April 15 due date to avoid interest and late-payment penalties.

- Automatic federal extension for expats: U.S. citizens and resident aliens who live and work outside the U.S. on April 15 generally receive an automatic two-month extension to file and pay their federal return (typically to June 15). This federal rule does not, by itself, change Georgia’s original payment due date.

5. Digital filing options

Georgia offers online e-filing services that simplify the tax filing process for expatriates. These digital platforms guide you through filing and are designed to help you meet Georgia’s requirements while reducing the risk of errors.

6. Paying estimated taxes

- Estimated Payments: If you anticipate owing taxes, you might need to make estimated tax payments throughout the year. This can help avoid penalties for underpayment when you file your tax return.

- Online Payments: Estimated tax payments can be made online through the Georgia Department of Revenue’s website, providing a convenient way to manage your tax obligations.

Consequences of non-compliance with Georgia state tax laws

Failing to comply with Georgia's state tax laws can result in various penalties and financial consequences.

Here are the key details you need to be aware of:

Financial penalties

- Late Filing Penalty: If you fail to file your tax return by the due date, Georgia imposes a penalty of 5% of the tax due for each month the return is late, up to a maximum of 25% of the tax due

- Late Payment Penalty: For taxes not paid by the original due date, there's a penalty of 0.5% of the unpaid tax per month, also capped at 25% of the total tax due.

- Negligent or Fraudulent Underpayment: If you underpay due to negligence, the penalty is 5% of the underpayment. For fraud, the penalty is 50% of the underpaid amount.

Interest charges

Accrued Interest: Interest on unpaid taxes accrues from the original due date until the tax is paid in full. The rate is the Federal Reserve prime rate plus 3%, adjusted annually.

Audits and assessments

The Georgia Department of Revenue may audit your tax returns to verify your residency status and check for compliance. Triggers include high income, significant changes in domicile, and large deductions. Adequate documentation, such as proof of residency change, income statements, and records of days spent in Georgia, is essential during an audit.

Impact on Credit

- Credit Score: Unpaid taxes and resulting collection actions can negatively impact your credit score, affecting your ability to secure loans, credit cards, and other financial services.

- Financial Stability: Collection actions and legal sanctions can disrupt your financial stability, making it difficult to manage your finances effectively.