Declaration of Domicile in Florida

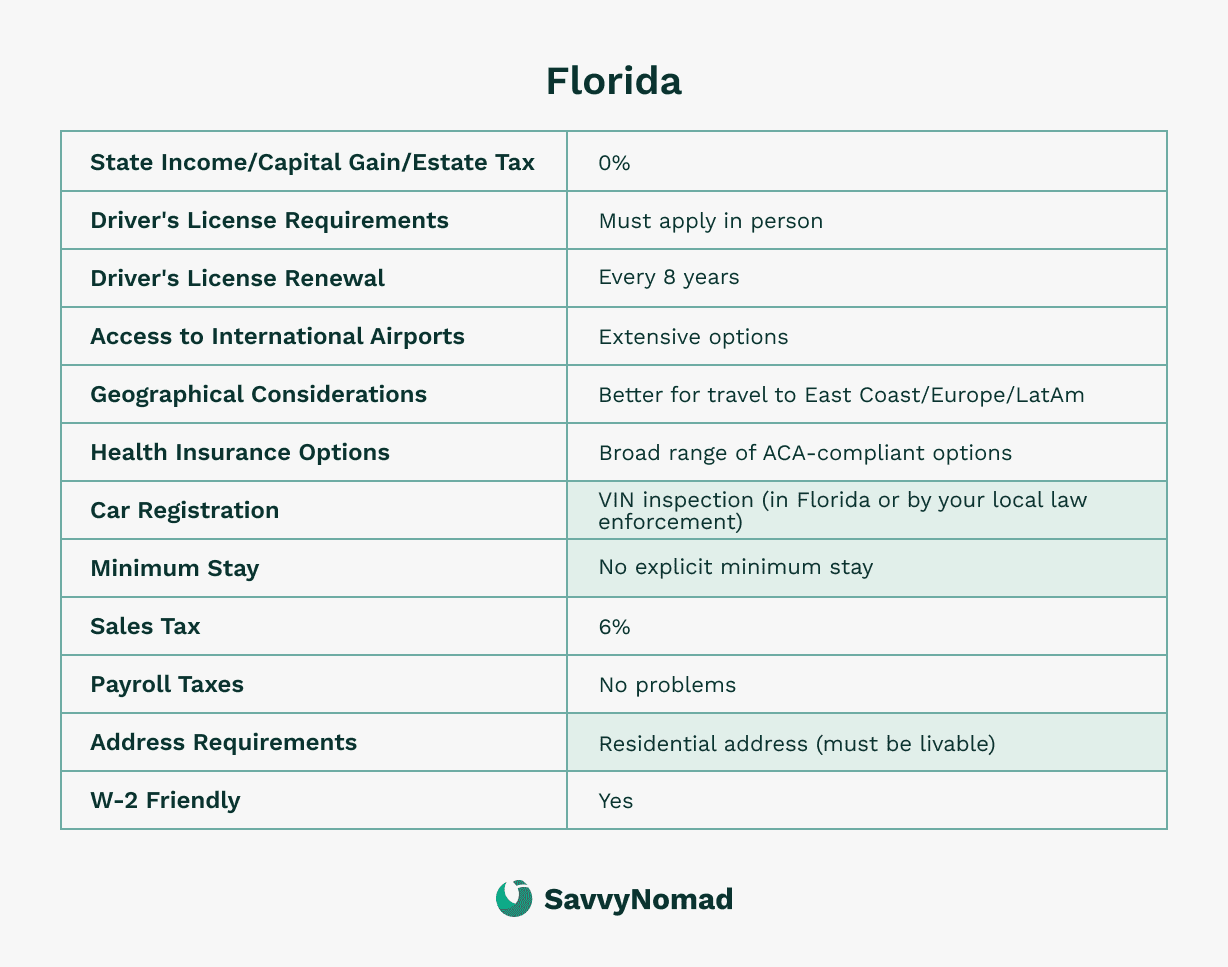

In today's world, savvy digital nomads and expats are constantly looking for strategies to enhance their lifestyles by optimizing their financial situations. Florida, South Dakota, Texas, and Nevada usually stand out as popular destinations for those aiming to balance relatively straightforward residency rules with a favorable tax environment.

This article digs into the intricacies of declaring a domicile (focusing on Florida, but much of the info is relevant across states) and how it can serve as one helpful step in legally establishing residency in a tax-friendly state—often one with no state personal income tax and no separate state estate or inheritance tax—potentially leading to meaningful tax and legal advantages depending on your individual circumstances.

What is a Declaration of Domicile?

Declaration of Domicile is a formal document that varies by county. You can find an example of it here.

It usually boils down to a brief statement of where your former residence was and where your new residence is, which is then notarized and filed with the Clerk of Court in your new county. This legal document also contains language stating that the content is truthful under threat of perjury.

While that may sound very intimidating, the Declaration of Domicile form is used routinely by nomads, full-time RVers, and full-time sailors to point to a specific location within, say, Florida or South Dakota, where they call their legal residence, given that all these classes of citizens travel so frequently.

For frequent travelers, it is common for your legal residence and “place you spend most of your time” not to be the same.

The Declaration of Domicile form is not merely a statement of intent; it is a legal affirmation, recorded with the local courthouse, that the individual’s primary and permanent residence has changed. This legal document can be a significant factor in establishing domicile, especially when combined with other evidence of your intent and ties to the state.

This is particularly valuable for those relocating from another state or country, aiming to solidify their residency status for various purposes, including legal, tax, and voting considerations. Moreover, for those who own multiple residences, the Declaration of Domicile can help distinguish which of these multiple residences is the primary residence (i.e., domicile), which determines in which state you are a taxable resident. The Declaration of Domicile helps establish Florida as one's permanent and principal home.

Your domicile is generally defined as the place where you live the majority of the year, but it’s not always so simple.

For example, if you live outside of the US most of the year but want to maintain your citizenship status, you, by necessity, need to have a domicile within one of the fifty states.

Fortunately, services like SavvyNomad can provide a bona fide residential U.S. street address in states like Florida and South Dakota, along with supporting documentation and mail handling for a predictable monthly fee.

These addresses are intended for documentary and correspondence purposes, and actual acceptance or tax treatment always depends on the rules applied by each agency, court, or financial institution.

Eligibility and requirements

Who can file a Declaration of Domicile form?

- Anyone residing in Florida with intent for permanent residence.

- Includes U.S. citizens and foreign nationals meeting residency criteria.

How do I get a Declaration of Domicile in Florida?

To declare domicile in Florida, individuals typically need to file a sworn Declaration of Domicile with the Clerk of the Court.

The specific requirements and process may vary by county but generally include the following:

- Completion of declaration: Use your county’s DoD form; it states that Florida is your permanent home and (if applicable) where you previously resided. SavvyNomad provides a county-ready template and, if you use our address service, a Florida residential street address to place on the form.

- Notarization: The completed form must be signed and notarized in the presence of a notary public or with online notarization tools.

- Submission and fees: The form and the required fees (typically paid by check) must be mailed to the correct office of the relevant county (usually the Clerk of Court’s office). The fees typically include a recording fee and additional charges for certified copies, payable by cash, credit card, check, or money order. Typically, total fees are under $15.

- Submission method: The completed and notarized form can be submitted in person or through mail to the appropriate county office. If submitted by mail, the document must be notarized before sending it. If you use an online notary, you typically can print the notarized form and mail it. It does not need to be sent directly to the county by the online notarization service you used.

It’s important to ensure the document is properly recorded with the appropriate government division.

It’s important to note that the specific requirements and procedures for declaring domicile may differ by county.

Therefore, you should refer to the resources provided by the Clerk of the Court in your respective county for detailed instructions and forms. The original recorded document will be returned after completion.

Key benefits of filing a Declaration of Domicile in Florida

Filing a Declaration of Domicile in Florida offers several advantages, particularly in the realms of taxation, estate planning, and legal obligations.

Below, we outline the significant benefits of that underscore the importance of establishing domicile in the Sunshine State.

Tax implications

- No State Income Tax: Florida is one of several states that do not levy a broad state personal income tax, which can provide substantial state-tax savings compared with higher-tax states, depending on your income mix and prior state of residence.

- Estate and Inheritance Tax Benefits: Florida does not impose estate or inheritance taxes, which can significantly affect wealth preservation and the transfer of assets to descendants, children, and heirs.

Estate planning and legal matters

- Clarification of Legal Status: Filing the Declaration of Domicile provides legal clarity on your domicile for estate planning purposes, helping to ensure that Florida's favorable laws apply to the individual's estate and assets.

- Homestead Exemption: Florida residents can apply for a Homestead Exemption, which can potentially save thousands of dollars in property taxes and protect the home from certain legal judgments.

Financial and legal considerations

- Asset Protection: Florida offers strong protections for the assets of domiciled residents, including the Homestead Exemption (mentioned above). This can safeguard your primary residence against creditors.

- Reduced Administrative Burden: Establishing a clear legal domicile in Florida can simplify tax filings and reduce the administrative burden of maintaining residency in multiple states.

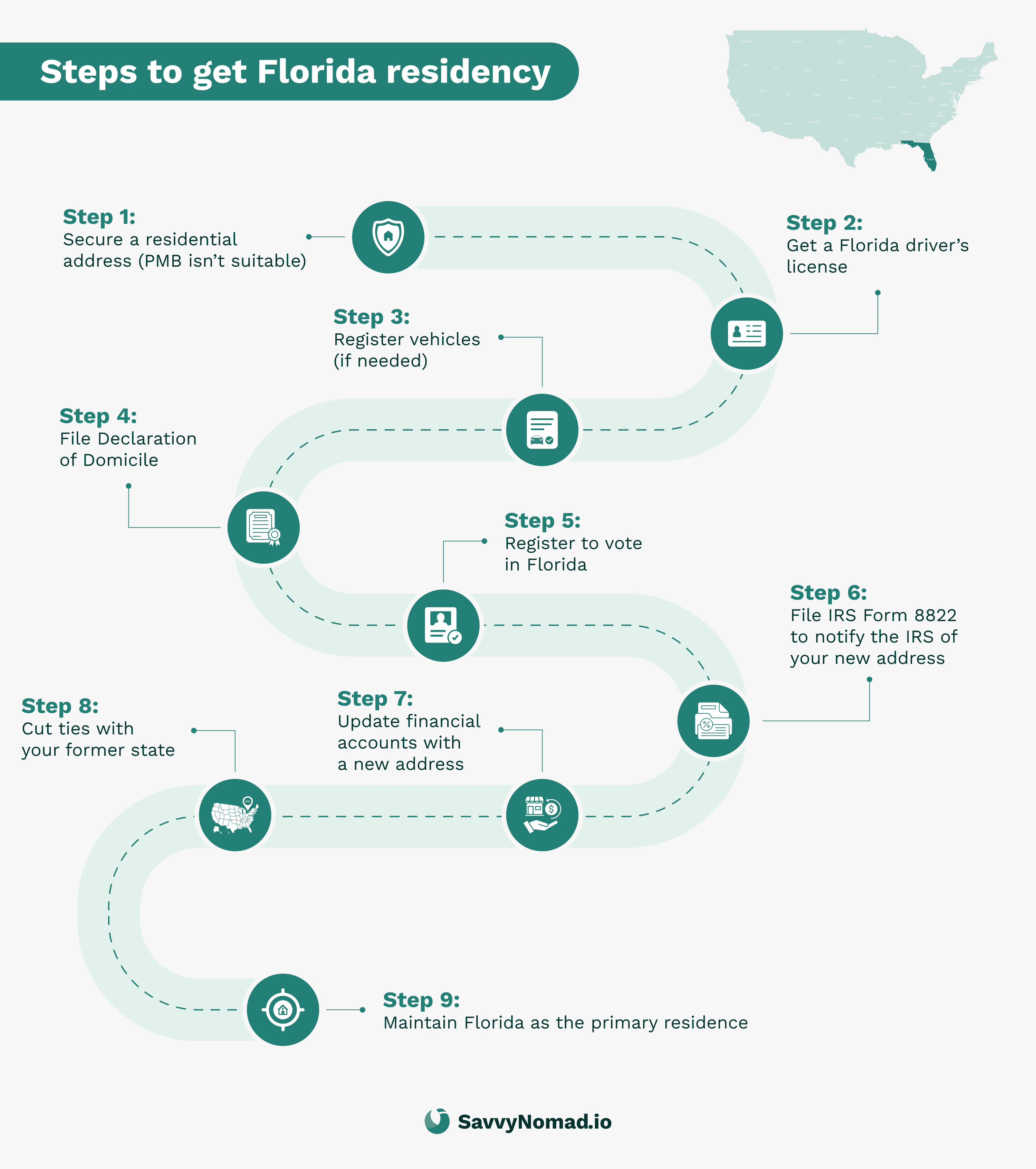

Steps to establishing domicile in Florida

Filing a Declaration of Domicile is just one step of many in establishing legal domicile in Florida.

Here's a structured breakdown of the entire process:

1) Secure a Florida address

The cornerstone of establishing a domicile is securing a residential address in Florida, either rented or owned. If renting an actual apartment or home to sit empty is beyond your means or feels like overkill, a residential-address or mail-forwarding service that also provides a bona fide Florida street address tied to a real dwelling can be a practical alternative for documentation purposes.

Make sure that any service you use can provide more than just a P.O. box or generic PMB (personal mailbox) designation and that its address format is acceptable for the types of records you care about (DMV, banks, voter registration, etc.).

If you don’t know, the company’s support staff should be able to answer this question for you. SavvyNomad, for example, can set you up with a Florida residential street address and mail services for a monthly fee; the address and documentation help support your domicile records, while final acceptance and tax treatment always depend on the decisions of state agencies, other states, and financial institutions.

2) Obtain a Florida driver’s license

It’s important to get a Florida driver's license or state ID. Surrendering your former state’s driver’s license is a significant public gesture that confirms your intent to make Florida your long-term domicile.

3) Register your vehicle(s) in Florida

If you own any cars or boats, registering them in Florida is very important to show intent to domicile in Florida. This step also means that you must get new Florida vehicle insurance.

4) File a declaration of domicile

Filing a Florida declaration form (Florida Declaration of Domicile) in your new county is a recognized but not mandatory way to show your domicile has changed to Florida. Signing this form is especially beneficial when you want to clearly establish Florida as your primary home for legal purposes, such as taxes and estate planning, or if you maintain multiple residences.

5) Voter registration

Register as a voter in Florida. This is a significant step that shows your intent and willingness to integrate into the state’s social and legal fabric.

From a residency and tax perspective, voter registration is a strong supporting indicator of Florida domicile, but it’s considered alongside many other factors and does not, by itself, determine your status.

This is a significant step that shows your intent and willingness to integrate into the state’s social and legal fabric.

6) Update financial accounts

Update the address on your bank and investment accounts, sending them to your Florida address.

7) Maintain Florida as your primary place of residence

While Florida doesn’t have any clear-cut statutory requirements for how many days you must be inside the state to qualify it as your domicile, maintaining it as your primary residence in third-party and official records shows a clear intent to keep Florida as your home base on a go-forward basis.

As a practical rule of thumb, spending more time in Florida than in any other single state is a good first step. Keep track with a calendar and keep receipts you can use to prove how many days you spent in Florida during the year.

Each step adds a new piece to the larger puzzle, demonstrating that while you travel around the country and wider world as a nomad, Florida is still where you call home. Although it requires time and resources, the benefits of a well-documented Florida domicile can be very worthwhile for many people.

FAQ

How do I prove my Domicile in Florida?

To help prove your domicile is in Florida, you can file a Declaration of Domicile with the clerk of court in the county where you maintain a physical residence. This document requires you to affirm under oath that Florida is your permanent home.

Supporting evidence such as a Florida driver's license, utility bills, and voter registration also help establish your physical presence and intent to maintain permanent residency in the state. Finally, you should also sever ties with your former state to the largest extent possible.

Should I file a Declaration of Domicile in Florida?

Filing a Declaration of Domicile in Florida is a significant step for individuals intending to establish residency in the state, especially for tax and estate planning purposes. The declaration is not mandatory for moving to Florida, but it can be beneficial for those seeking to benefit from the state's tax policies and sever ties with their former state for income and estate tax purposes.

While the Declaration is not the only factor in determining domicile, it can be strengthened by taking additional affirmative steps, such as obtaining a Florida driver's license, registering a vehicle in Florida, registering to vote, opening bank accounts, and securing a new mailing address in Florida.

Where do I get a Florida declaration of Domicile?

You can obtain a Declaration of Domicile form online from the website of the county in which you reside in Florida. Once completed, you submit this form to the clerk of court’s office. It's important to have the form properly notarized to be valid.

How long do you have to live in Florida to be considered a resident?

To be considered a resident of Florida, there is no set amount of time you need to live there.

What does it mean to be domiciled in Florida?

Being domiciled in Florida means that you have established the state as your permanent legal residence. In legal terms, it is where you intend to return to and remain, and it can have significant implications for taxation, estate planning, and your eligibility for state-specific benefits like the Homestead Exemption.