Bona fide residence test: Guide for expats and digital nomads

The Bona Fide Residence Test is a set of rules used by the U.S. government to determine if you qualify as a bona fide resident of a foreign country.

This test helps U.S. citizens and residents who live abroad reduce their U.S. tax obligations by proving they truly live in another country.

By qualifying, you can take advantage of the Foreign Earned Income Exclusion, which allows you to exclude a certain amount of your foreign earnings from your taxable income. This can lead to substantial tax savings and make your life abroad more affordable.

TLDR:

Proper documentation, like lease agreements and utility bills, is essential.

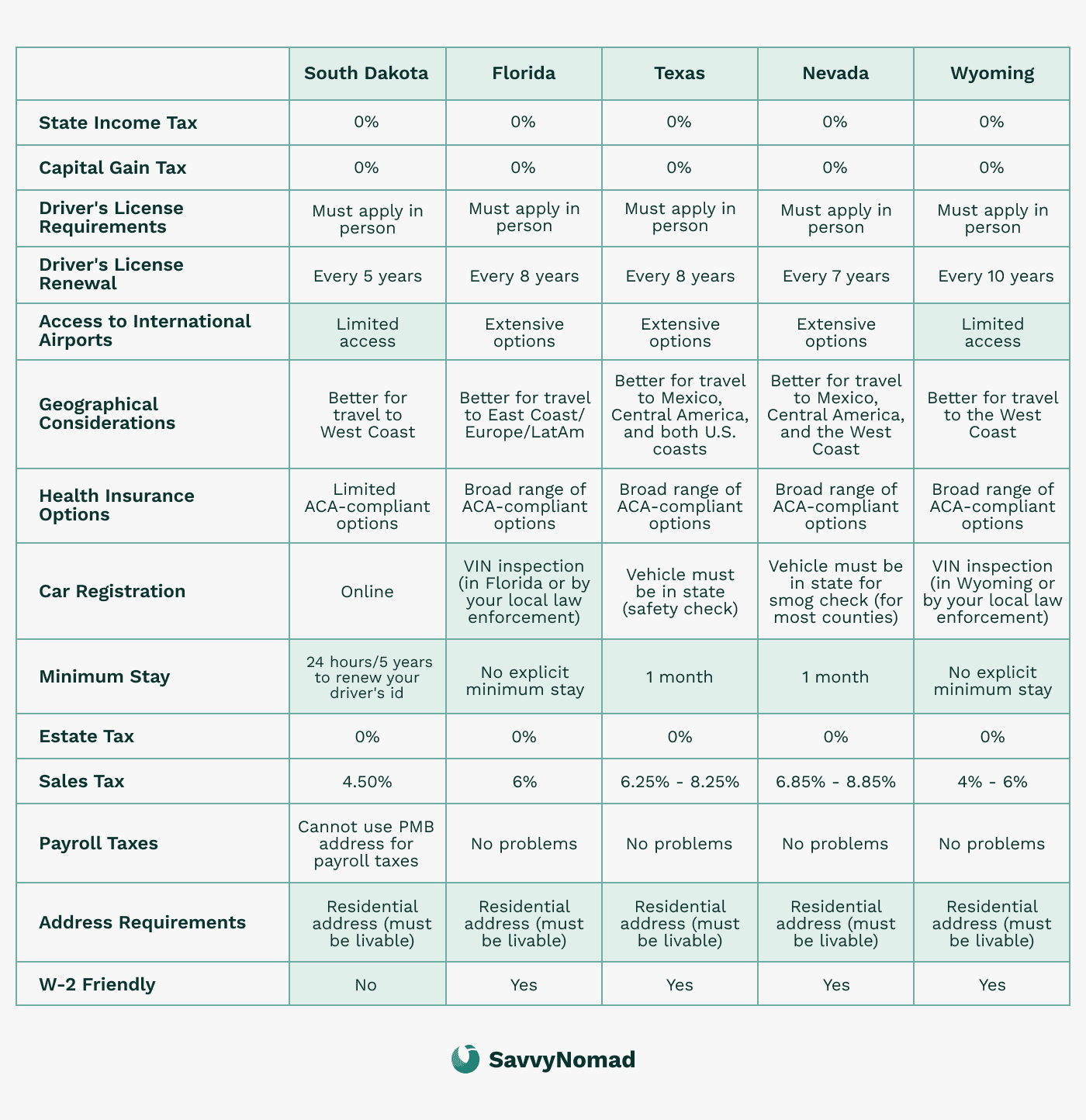

Consider domiciling in states like Florida, Texas, or South Dakota. This move can help you avoid state income taxes and keep more of your hard-earned money.

Understanding the Bona Fide Residence Test

The Bona Fide Residence Test determines if you truly live in a foreign country.

To qualify, you must:

- Live in a foreign country for an uninterrupted period that includes an entire tax year.

- Show that you intend to make the foreign country your home for the foreseeable future.

- Establish a residence that you plan to keep for a long time.

Key differences from the Physical Presence Test

While the Bona Fide Residence Test is based on your intention to live abroad, the Physical Presence Test is simpler and only looks at the number of days you spend outside the U.S.:

- Bona Fide Residence Test: Focuses on your long-term residence and ties to a foreign country.

- Physical Presence Test: Requires you to be physically present in a foreign country for at least 330 full days during a 12-month period.

Benefits of qualifying for the Bona Fide Residence Test

Qualifying for the Bona Fide Residence Test can offer significant tax advantages:

- Foreign Earned Income Exclusion (FEIE): You can exclude a portion of your foreign earnings from U.S. income tax.

- Foreign Tax Credit (FTC): You may be able to reduce your U.S. tax liability with credits for taxes paid to foreign governments.

- Lower State Taxes: If you use domicile services to establish your residence in a state with no income tax, you can also save on state taxes.

Tax implications

Impact on federal U.S. taxes

When you qualify as a bona fide resident of a foreign country, you can significantly reduce your U.S. tax liability. This is primarily achieved through the Foreign Earned Income Exclusion (FEIE) and the Foreign Tax Credit (FTC).

Foreign Earned Income Exclusion (FEIE)

The FEIE allows you to exclude a certain amount of your foreign earned income from U.S. taxes. For the tax year 2023, the exclusion amount is up to $120,000. To qualify for the FEIE, you must meet either the Bona Fide Residence Test or the Physical Presence Test.

Foreign Tax Credit (FTC)

If you pay taxes to a foreign country, you can claim a credit against your U.S. tax liability using the Foreign Tax Credit. This credit helps to avoid double taxation on the same income.

Depending on which provides the most tax benefit, you can choose between the FEIE and the FTC, but you can't use both on the same income.

Reporting requirements

To claim the FEIE, you need to file Form 2555 along with your U.S. tax return. This form requires detailed information about your foreign-earned income, housing expenses, and residency status. For the FTC, you must file Form 1116. Both forms require accurate and comprehensive records to support your claims.

Reduce state income taxes

Domicile services can help you establish residency in a state with no state income tax, such as Florida or South Dakota. By doing so, you can avoid paying state income taxes on your earnings.

Here’s how domicile services assist:

- Proof of Residency: They help provide the necessary documentation, such as lease agreements and utility bills, to prove your residency in a tax-friendly state.

- Mail Forwarding: They offer mail forwarding services, ensuring you have a reliable address in your domicile state.

- State Identification and Voter Registration: These services assist you in obtaining a state ID or driver’s license and registering to vote, further solidifying your residency claim.

Eligibility criteria

Establishing a bona fide residence in a foreign country

To qualify for the Bona Fide Residence Test, you need to establish a real, permanent home in a foreign country.

This means you have to live there for an extended period and make it your primary place of residence.

You should get involved in the local community, and it should feel like home, not just a temporary place.

Duration of stay requirements

You must live in the foreign country for an uninterrupted period that includes an entire tax year (January 1 to December 31).

However, short trips back to the U.S. or other countries are allowed as long as you plan to return to your foreign home.

The role of intent and continuity

Intent and continuity are crucial. You must show that you intend to live in the foreign country indefinitely. This means you have no plans to move back to the U.S. in the near future.

Continuity means you maintain your foreign residence over time without significant breaks.

Examples of situations that qualify and do not qualify

Qualifying situations:

- You move to France, rent an apartment, enroll your kids in school, and get a local job.

- You relocate to Japan for a long-term work assignment and integrate into the local community.

Non-qualifying situations:

- You travel to various countries, staying a few months in each, without establishing a permanent home.

- You live in a foreign country for a short-term project and plan to return to the U.S. soon after.

Documentation and record-keeping

Proper documentation and record-keeping are crucial to passing the Bona Fide Residence Test.

Here’s what you need to know:

Essential documents to retain

To prove your bona fide residence, you should keep the following documents:

- Lease or Rental Agreements: These show where you live in the foreign country.

- Utility Bills: These demonstrate that you are maintaining a home.

- Bank Statements: Statements from a local bank can help establish your ties to the country.

- Employment Contracts: If you work abroad, these documents show your commitment to staying in the country.

- School Records: If you have children, their school records can further support your case.

- Permanent Residency Visa: If applicable, this can be strong evidence of your intent to reside in the foreign country.

Tips for effective record-keeping

Here are some tips to make record-keeping easier:

- Organize Digitally: Use cloud storage to keep all your documents in one place and easily accessible.

- Keep Copies: Make digital copies of all important documents.

- Regular Updates: Update your records regularly to ensure you have the latest documents.

- Label Clearly: Label your documents clearly with dates and descriptions to make them easy to find.

Handling multiple countries of residence

If you live in more than one country during the year, here’s how to manage your documents:

- Separate Folders: Keep separate folders for each country’s documents.

- Consistent Documentation: Maintain consistent records for each place you reside.

- Track Dates: Note the dates of your stays in each country to show continuous residence.