Best tax software for American expats

Living abroad is exciting, but U.S. taxes can still follow you! As an American, you’re required to file a tax return no matter where you live, but it doesn’t have to be hard.

Managing financial accounts is crucial for expats, as the IRS can track these accounts through the Foreign Account Tax Compliance Act (FATCA). Ensuring compliance with U.S. tax obligations is essential to avoid potential penalties for not reporting foreign financial accounts.

This guide will help you compare tax software options for expats, highlighting essential features and tips that may help you save on federal and state taxes while abroad.

Let’s get started!

TL;DR:

Use Expatfile when you’re a typical expat deciding between FEIE (2555) and FTC (1116) and you don’t need a state return. It’s fast, affordable, and covers the main individual forms (freelance, investments, rentals), but no state filing and no heavy international forms (PFICs, 5471, etc.). If you formally change domicile to a zero-income-tax state such as Florida, Expatfile can function as a neat all-in-one federal solution—once any prior-state filing obligations are resolved.

Choose MyExpatTaxes if you need state returns, want built-in FBAR + FATCA, and might touch PFIC (8621) or foreign corporation (5471) filings via add-ons/Premium. It’s a particularly comprehensive DIY option in this roundup, with upgrade paths (Reviewed/Premium) and a Streamlined package for catch-up years. If you haven’t moved your domicile to Florida—or you have more complex assets—it’s often the more conservative DIY choice.

Pick TopTax only if you’re FEIE-only (1040 + 2555), price is king, and you’re fine with federal-only. There’s no FTC, no state returns, and no complex international forms; Schedule C is limited to countries with a Totalization Agreement. Also note a reliability caveat: we encountered maintenance/downtime during testing, so confirm availability before relying on it near a deadline.

If you need FTC or state filing, use one of the two options above.

Federal taxes for expats

Even while living abroad, U.S. citizens are required to file a federal tax return with the IRS. Federal taxes for expats can be intricate, but using tax software designed specifically for expats can simplify the process.

These specialized programs help you navigate the complexities of expat taxes, including the Foreign Earned Income Exclusion (FEIE) and the Foreign Tax Credit (FTC).

By leveraging these tools, you can ensure compliance and potentially reduce your overall tax liability.

Key features to consider in tax software for expats

Finding the right tax software is about more than just convenience—it’s about choosing one that meets your specific needs as an expat.

Tax authorities, such as the IRS, are crucial in monitoring compliance with expat tax regulations through mechanisms like the Foreign Account Tax Compliance Act (FATCA) and international cooperation to exchange information.

Here are a few key features to keep in mind:

Foreign Income and Tax Credit options

Look for software that supports expat-specific options like the Foreign Earned Income Exclusion (FEIE) and the Foreign Tax Credit (FTC). These credits and exclusions can help reduce or even eliminate your U.S. tax liability on foreign income.

FBAR and FATCA reporting

If you have foreign financial accounts, you’ll likely need to report them to the U.S. Treasury Department by filing the Foreign Bank Account Report (FBAR) or report under FATCA. The best software will have these forms built-in so you don’t miss any critical reporting requirements.

State tax filing options

If you still have ties to a U.S. state, you might need to file state taxes. Some software includes options to handle specific state requirements, saving you from any surprises.

Ease of use and customer support

A user-friendly platform and solid customer support make a huge difference. Look for software that’s easy to navigate and has expat-specific support if you need extra help.

Cost and affordability

Different software options come at different price points. Compare costs to see what fits your budget—some platforms even offer basic features for free!

Integrations and automation

Features like international bank integrations, automatic currency conversion, and multi-currency support can make filing a lot easier for expats.

3 best tax software for American expats

Navigating taxes as an expat is much easier with software designed for international requirements. Here’s a look at three leading options for U.S. expats, covering their strengths, weaknesses, and pricing to help you choose what fits your situation.

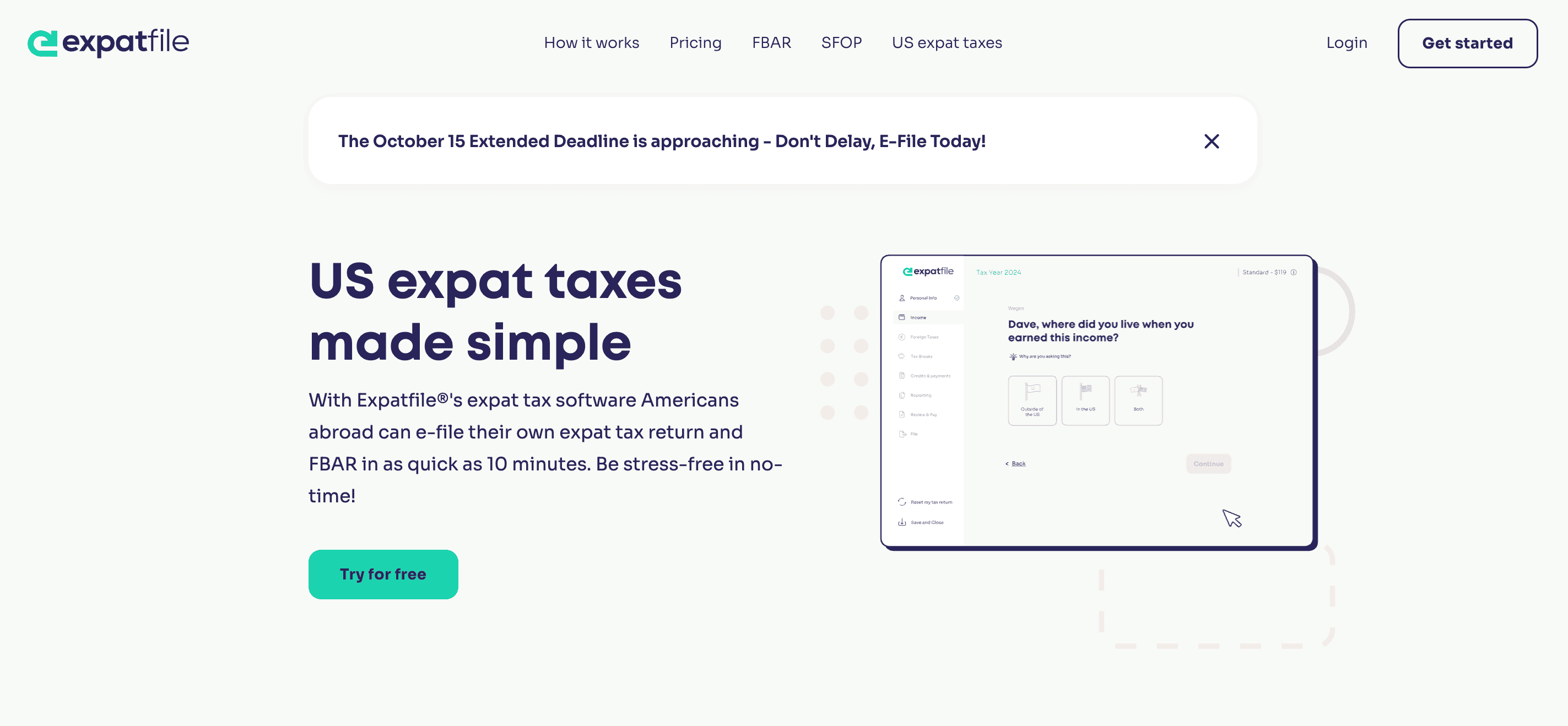

Expatfile

Expatfile is one of the most popular DIY tax tools built specifically for Americans abroad. It shines for straightforward expat cases—foreign salary, freelance income, investments—and it offers a clean online workflow with direct IRS e-file.

What Expatfile covers

On the expat side, Expatfile takes care of the essentials. It fully supports the Foreign Earned Income Exclusion (Form 2555), including housing benefits, and the Foreign Tax Credit (Form 1116).

If you’re unsure which path saves you more, the software includes an optimizer that runs both FEIE and FTC to nudge you toward the lower-tax option. It also generates treaty disclosure statements (Form 8833) when needed and handles FATCA reporting (Form 8938) at the higher tiers.

For core U.S. filing, Expatfile handles the entire Form 1040 with IRS e-file, plus the usual supporting schedules. That means Schedule 1–3, Schedule B (foreign bank account questions included), Schedule C and SE for freelancers, Schedule D and 8949 for capital gains (including crypto), and even complex add-ons like the Alternative Minimum Tax (Form 6251), the Net Investment Income Tax (Form 8960), and retirement-related forms like 8606 and 5329.

If you have rental property, the Investor plan supports Schedule E, at least for basic rental and royalty income. Extensions are built in, too—you can file Form 4868 directly from the platform.

Where Expatfile falls short

There are some clear limitations. Amended returns (Form 1040-X) aren’t available in the DIY version, though you can get them if you upgrade to the Unlimited professional plan. Schedule F for farming and Form 9465 for payment plans aren’t included.

One crucial limitation: Expatfile does not prepare state tax returns. For expats who still maintain ties to high-tax states like California or New York, that can be a problem. One common way to simplify this is to formally change your domicile to a zero-income-tax state such as Florida.

Once you’ve established Florida residency and resolved any prior-state filing obligations, you may no longer have ongoing state filing requirements, and Expatfile can then function as a straightforward federal-only solution for many expats. Prior-state rules may still apply, and you should confirm your situation with a qualified professional.

And while it covers straightforward rental property, there’s no explicit support for complex K-1s from partnerships.

Most importantly for expats with business or investments abroad, Expatfile does not handle the big international reporting forms. PFIC reporting (Form 8621), foreign corporation filings (Form 5471), foreign partnership filings (Form 8865), disregarded entities (Form 8858), and newer forms tied to GILTI, FDII, or transition tax simply aren’t available.

If you own a foreign company or hold certain types of funds, this isn’t the right software for you.

Key features

- Supports Foreign Earned Income Exclusion (FEIE) and Foreign Tax Credit (FTC).

- Automatic FBAR Filing: Easily file your Foreign Bank Account Report directly with FinCEN.

- Instant IRS feedback and approval status for peace of mind.

Pricing

- Standard Plan: $119 per return, covering basic federal filing with FBAR support.

- Premier Plan: $159 per return, designed for self-employed expats or those with refundable credits like the Child Tax Credit.

- Investor Plan: $199 per return, which includes features for those with investment income.

- Unlimited Plan: $499 per return, offering unlimited support and dedicated tax expert assistance.

Pros

- Affordable and easy to use, designed specifically for expats.

- Covers both FEIE (Form 2555) and FTC (Form 1116), with an optimizer to pick the best outcome.

- Handles a wide range of standard forms and schedules (1040, C, D, SE, E for rentals, AMT, NIIT, etc.).

- Includes FATCA reporting (Form 8938) and treaty statements (Form 8833).

- Option to add expert review or upgrade to Unlimited professional service.

- Supports FBAR filing as an add-on.

Cons

- No state tax returns — unless you’ve moved your domicile to a zero-tax state like Florida, in which case this is no longer an issue.

- Amended returns (1040-X) are only available via upgrade, not DIY.

- No support for PFICs, foreign corporations, partnerships, or other complex international forms (8621, 5471, 8865, 8858, etc.).

- Rental property supported, but K-1s and more complex Schedule E scenarios not fully covered.

MyExpatTaxes

If you want broad DIY coverage with clear guidance, MyExpatTaxes is the all-rounder in our lineup. It supports both main expat approaches—Foreign Earned Income Exclusion (Form 2555) and the Foreign Tax Credit (Form 1116)—and wraps them in calculators and helpful prompts.

It’s also one of the few DIY tools in this price tier that handles state returns, advanced asset reporting, and even some complex international add-ons.

Key features

- Support for FEIE and FTC, covering essential expat deductions and credits.

- Multi-currency support for expats with income in multiple currencies.

- User-friendly, with simple questions guiding users through the filing process.

What it covers

MyExpatTaxes takes care of your Form 1040 and the main supporting schedules most expats need. Freelancers and contractors can file Schedule C and SE, investors get coverage for capital gains, dividends, and crypto through Schedule D and Form 8949, and landlords can include rental income with Schedule E.

The platform also supports child credits, retirement plan adjustments, AMT, and the Net Investment Income Tax. Extensions and amended returns are both available if needed.

For expat-specific requirements, the software handles both the Foreign Earned Income Exclusion (Form 2555) and the Foreign Tax Credit (Form 1116), including carryovers.

It also covers FATCA reporting (Form 8938) and can generate treaty disclosures when required. Currency conversions are built in, and it offers a dedicated workflow for the FBAR (FinCEN 114) with digital filing.

If you only need to submit an FBAR in a given year, there’s even a streamlined “FBAR-only” option.

Beyond the basics

Where MyExpatTaxes stands out is in areas most DIY platforms avoid. It offers a path to file PFIC reporting (Form 8621) as an add-on, and even allows for foreign corporation filings (Form 5471) under its Premium tier. This means that if you hold certain foreign investments or own a company abroad, you can still use MyExpatTaxes instead of immediately moving to a full CPA engagement.

State taxes

Unlike many expat-focused tools, MyExpatTaxes also prepares state tax returns. That’s useful if you still have ties to a state like California or New York. But if you want to simplify things long-term, a common strategy is to change your domicile to a zero-income-tax state such as Florida.

Once you’ve made Florida your official state of residence and addressed any prior-state filing obligations, you may be able to use MyExpatTaxes primarily for federal returns going forward. Prior-state rules may still apply, so confirm your specific situation with a qualified professional.

Pricing

- Pricing starts around $175 for the base plan, $315 for Reviewed, and $575 for Premium, with add-on fees for things like PFIC forms or additional state returns.

- FBAR-only filing is available for about $59 per year, and the Streamlined package runs about $875.

Pros

- Broad coverage of expat essentials plus state returns.

- Handles freelance income, investments, rentals, and amended returns.

- Built-in FBAR filing and FATCA reporting.

- Options for PFICs and foreign corporations that most DIY tools exclude.

- Transparent tiered pricing with support options.

Cons

- No automatic FEIE-vs-FTC optimizer (you’ll need to run the calculator).

- Costs add up if you need PFIC or corporate filings.

- Some advanced treaty or multi-country features aren’t as detailed as a CPA.

TopTax

If your situation is truly simple and cost is the priority, TopTax markets itself as one of the cheapest ways to file a federal expat return that uses the Foreign Earned Income Exclusion (Form 2555). It’s a streamlined, “get in, get out” tool for 1040 + 2555 filers, with IRS e-file, mobile apps (iOS/Android), and live chat + email support.

What it covers

TopTax is built for the classic FEIE scenario: you earn wages or self-employment income abroad and plan to exclude it with Form 2555. The selling point is the flat price and a quick federal e-file path.

There’s a mobile-first flavor here—handy if you want to snap through your return on a phone rather than on a laptop.

- Federal return (Form 1040) + FEIE (Form 2555): supported at a flat $67.

- Self-employment (Schedule C & SE): limited; TopTax indicates support only when there’s a Totalization Agreement with your country (i.e., U.S. Social Security coordination), otherwise not supported.

- Support channels: live chat and email are offered.

- Upgrade path: there is a full-service option via ExpatTaxOnline if you outgrow DIY.

Limitations

TopTax keeps costs low by narrowing scope.

If any of the items below apply to you, you’ll likely need a different tool or a professional:

- No Foreign Tax Credit (Form 1116). There’s no FTC support and no FEIE-vs-FTC optimizer, so if you pay foreign income taxes and might benefit from credits instead of exclusion, this isn’t the right fit.

- No state tax returns. TopTax is federal only. If your former state still treats you as a resident (California, New York, etc.), you’ll need a separate state solution.

- No complex international forms. PFIC reporting (Form 8621) isn’t supported. Neither are entity forms like 5471 (foreign corporations), 8865 (foreign partnerships), or 8858 (foreign disregarded entities).

- Limited after-filing support. TopTax’s policies indicate no post-submission IRS advocacy, very limited refunds, and no accuracy guarantee. If you want year-round notice support or audit-prep assurances, look elsewhere.

- Our domicile tip: If you’re a true long-term expat, one possible strategy is to formally change your domicile to Florida (a zero-income-tax state). With Florida residency established—and assuming you don’t have source-state income or other filing triggers—you may not have ongoing state returns, and you can often rely on TopTax’s federal-only workflow. Prior-state rules may still apply, so check with a qualified professional before changing your filing pattern.

Who TopTax is best for

- You’re a straightforward FEIE filer with foreign wages (or very simple self-employment covered by a Totalization Agreement).

- You don’t need FTC, state returns, PFIC, or foreign entity reporting.

- You value mobile apps and a very low price over bells, whistles, and hand-holding.

Pricing

$67

Pros

- Ultra-low price for 1040 + 2555 (FEIE).

- IRS e-file, mobile apps, and quick setup.

- Live chat + email support.

- Upgrade path exists (full-service via ExpatTaxOnline).

Cons

- No FTC (Form 1116) and no FEIE-vs-FTC optimizer.

- No state returns (federal only) — unless you’ve moved your domicile to Florida, this can be a deal-breaker.

- No PFIC (8621) and no foreign entity forms (5471/8865/8858).

- Schedule C only in limited situations (Totalization Agreement required).

- No accuracy guarantee, limited refunds, no IRS advocacy post-filing.

- Availability concern: recent maintenance/downtime meant we couldn’t complete a hands-on test.

How to save on taxes as an American expat

Saving on taxes as an expat often comes down to using key tax credits, exclusions, and smart strategies for managing state residency. Here’s how:

State taxes

Moving domicile to a no-tax state

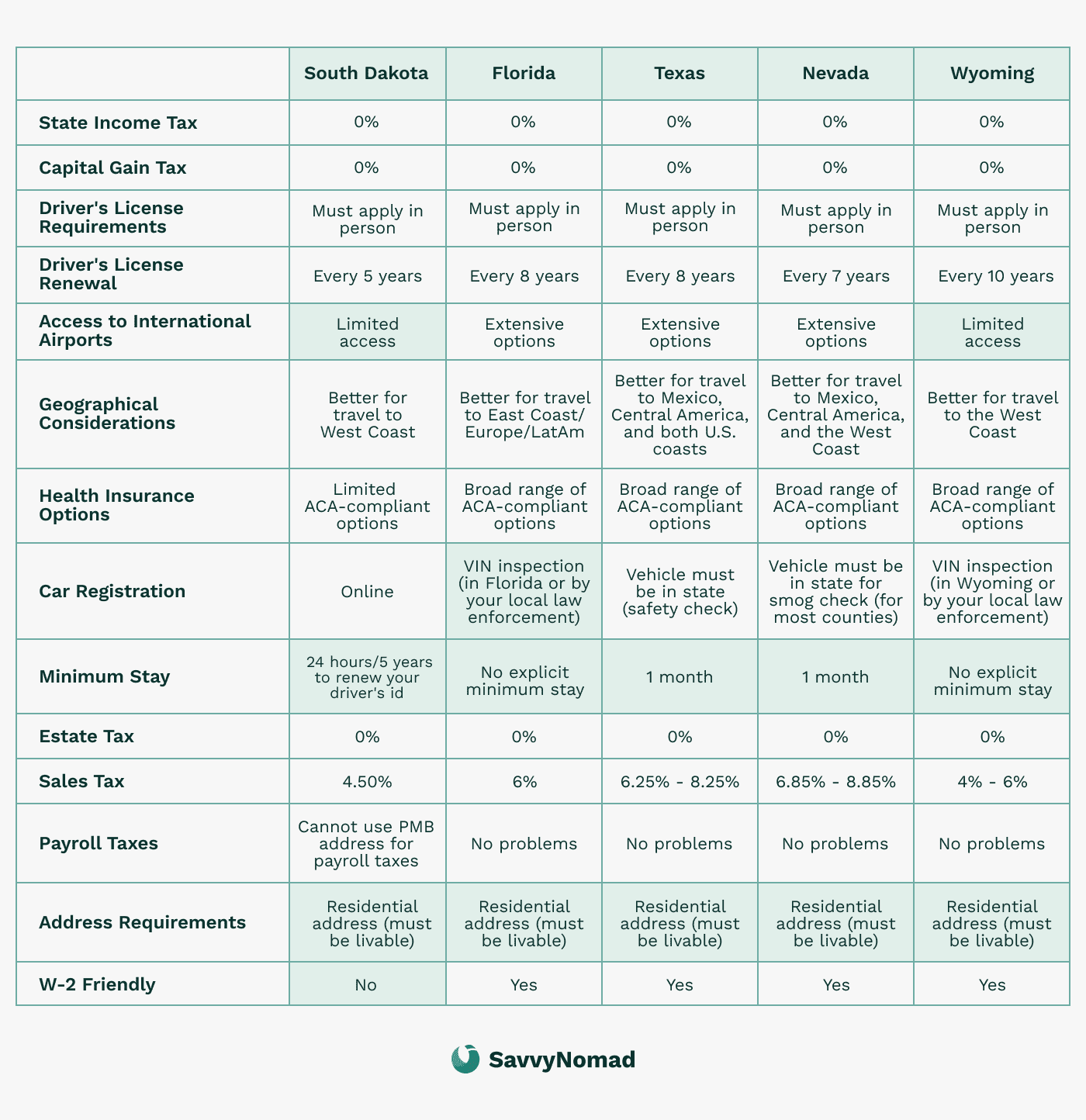

Shifting your state residency to a tax-free state like Florida, Texas, or Nevada may reduce—or in some cases eliminate—state income taxes, depending on the state’s rules and your specific ties.

SavvyNomad, for instance, helps expats and nomads prepare Florida domicile filings and assemble supporting proof for establishing domicile in no-income-tax states. Banks and state agencies make their own decisions. No outcome is guaranteed, and prior-state rules may still apply.

Cutting ties to high-tax states

To avoid state tax obligations, expats should carefully manage any lingering connections, such as property ownership or driver’s licenses, in high-tax states.

Taking advantage of these strategies and, where appropriate, working with services like SavvyNomad may help some expats lower their overall state-tax exposure while living abroad. Results vary based on individual circumstances, and no tax savings are guaranteed.

Federal taxes

Foreign Earned Income Exclusion (FEIE)

The FEIE lets you exclude a certain amount of foreign income, which can reduce your U.S. tax liability. To qualify, you’ll need to meet residency or physical presence requirements.

Foreign Tax Credit (FTC)

This provides a dollar-for-dollar tax credit for foreign taxes paid, helping offset U.S. taxes on foreign income.