U.S. Travel Statistics (2025)

Travel has always been an important part of life for many Americans, whether for work, adventure, or simply taking a break from daily routines.

In 2025, travel trends continue to evolve as people explore new destinations, adapt to changing prices, and embrace technology to make their trips easier.

U.S. domestic travel in 2025

Domestic travel in the U.S. has reached new heights in 2025, surpassing pre-pandemic levels. Americans are traveling more frequently, spending more, and prioritizing road trips, family vacations, and flexible getaways.

Despite economic uncertainties, 70% of Americans plan to maintain or increase their travel activities this year, and demand for flights, hotels, and rental cars remains high.

Record-breaking domestic travel volumes

Domestic travel in the U.S. continues to thrive, setting new records in 2024 and maintaining momentum into 2025.

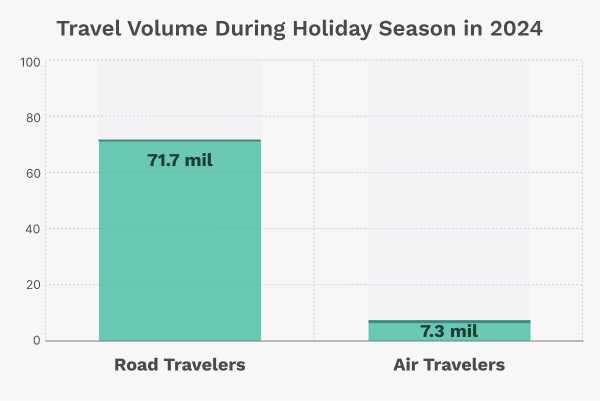

- Holiday travel boom: More than 119 million Americans traveled 50+ miles during the 2024 holiday season, breaking the all-time record set in 2019.

- Thanksgiving surge: In November 2024, a record 80 million Americans traveled for the holiday, with 71.7 million driving—the highest road travel volume ever.

- Overall trip frequency: The average American took three domestic trips in 2024, spending around $4,600 per traveler.

How much are Americans spending on travel?

The U.S. travel and tourism market was valued at $2.36 trillion in 2024, with projections expecting it to reach $3.1 trillion by 2034.

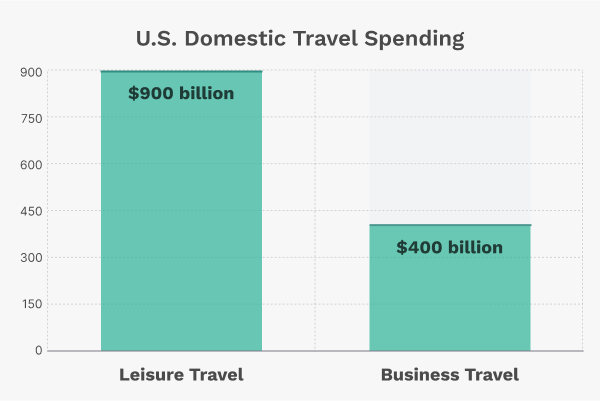

- Total domestic travel spending: $1.3 trillion in 2024, an increase from $1.2 trillion in 2023.

- Leisure travel dominates: Americans spent over $900 billion on leisure travel in 2024.

- Inflation's impact: 44% of travelers opted for destinations closer to home due to rising costs, but overall travel demand remained strong.

Top travel trends in 2025

Americans are changing how and why they travel. The biggest trends shaping domestic tourism this year include:

- Road trips are #1 – Driving remains the most popular way to travel, with 9 in 10 holiday travelers hitting the road.

- Slow travel & longer stays – More people are opting for extended vacations, especially remote workers blending work and leisure.

- Multi-generational travel – Family reunions and group vacations are more popular than ever.

- Microcations – Short getaways (3–4 days) are gaining traction as travelers maximize PTO.

- Off-season travel – Americans are booking trips outside peak seasons to avoid crowds and save money.

- Tourism strategy aims – National strategies are aimed at increasing international visitor numbers and revenue, particularly in response to the significant losses incurred during the pandemic, emphasizing targeted goals for the industry’s resurgence.

Air travel is soaring

Demand for flights in 2025 is higher than ever, driving up airline profits.

- Record passenger numbers: TSA screened 39 million passengers during the 2024 holiday season, marking an all-time high.

- Rising airfare costs: U.S. airfares increased at the fastest rate in 21 months as demand surged.

- Airline profits up: The International Air Transport Association (IATA) predicts a 15% rise in net profit per passenger in 2025.

Where are Americans traveling in 2025?

Domestic travel hotspots remain largely the same, but some destinations are growing in popularity.

Top U.S. cities for domestic travel

- Orlando, FL – America's #1 vacation destination (Disney World, Universal Studios).

- New York City, NY – The most visited city for holiday travel and events.

- Las Vegas, NV – Continues to attract huge numbers for entertainment and casinos.

- Los Angeles, CA – A major hub for cultural and outdoor attractions.

- Phoenix, AZ – Rising in popularity, especially for winter getaways.

Looking ahead: what's next for U.S. travel?

2025 is shaping up to be another record-breaking year for U.S. domestic travel. Travelers are prioritizing experiences, flexibility, and affordability, while airlines, hotels, and rental services are adapting to meet demand.

- More travelers than ever: 70% of Americans plan to maintain or increase travel this year.

- Travel spending will continue growing, projected to exceed $3 trillion by 2034.

- New trends like slow travel, bleisure, and microcations will shape the way people explore.

U.S. international travel statistics (2024–2025)

- Record-Breaking Outbound Travel: In 2024, U.S. citizens embarked on approximately 108.8 million international trips, surpassing pre-pandemic levels and reflecting a robust recovery in global travel.

- Inbound Tourism Statistics: The recovery of the U.S. tourism industry post-pandemic is evident in the inbound tourism statistics. Key metrics such as the number of international arrivals and the spending behaviors of inbound visitors highlight significant economic impacts. Comparisons to pre-pandemic levels show ongoing trends and efforts to regain previous visitor numbers.

- Projected Growth: The upward trend is expected to continue, with outbound tourism from the U.S. projected to reach a value of $412.26 billion by 2034, indicating sustained growth in international travel spending.

- Recovery of the Outbound Tourism Market: The outbound tourism market has shown remarkable recovery post-pandemic. Statistics reveal that American travelers are spending more and participating in international travel at higher rates. Predictions indicate continued growth, underscoring the value of the outbound tourism market.

Top destinations for U.S. travelers

- Neighboring Countries Lead: Mexico and Canada remain the top international destinations for U.S. travelers due to geographic proximity and ease of access. In 2023, approximately 20.5 million Americans visited Canada, while Mexico welcomed about 11.3 million U.S. tourists.

- European Destinations: Europe continues to attract a significant number of U.S. travelers. In 2023, approximately 20.2 million American tourists visited European countries, with the United Kingdom, France, and Italy among the top destinations.

Leisure vs. business travel trends

- Leisure Travel Dominates: The majority of U.S. international trips are for leisure purposes. In 2024, 90% of Americans planned to take a trip, with 85% traveling out of state and 38% intending to travel internationally.

- Rise of “Workcations”: A notable trend is the increase in “workcations,” where individuals combine work and vacation. In 2024, 1 in 5 Americans planned to take a workcation, with Gen X and millennials leading this trend.

Economic impact of international travel

- Outbound Spending: According to recent tourism statistics, Americans’ spending abroad has seen significant growth. In 2023, U.S. residents spent $215.4 billion on international travel, indicating strong demand and a robust economy. These statistics highlight key metrics and trends within the travel industry, showcasing overall growth and recovery from the pandemic, as well as spending patterns among different traveler demographics.

- Inbound Tourism Growth: The United States experienced a surge in international visitors, with 66.5 million arrivals in 2023, a 31% increase from the previous year. This influx contributed substantially to the U.S. economy, with tourists spending an average of $4,000 per visit, totaling $155 billion in travel spending.

Post-pandemic travel recovery trajectory

- Global Tourism Rebound: International tourism has made a remarkable recovery, with an estimated 1.4 billion tourists traveling globally in 2024, reaching 99% of pre-pandemic levels. The tourism sector faced significant financial losses during the pandemic and is a notable contributor to global greenhouse gas emissions. However, as travel trends begin to stabilize post-pandemic, there is anticipated growth in tourism revenues, particularly in the U.S.

- U.S. Travel Projections: The U.S. travel industry is poised for continued growth, with total travel spending projected to reach $1.35 trillion in 2025, a 3.9% increase from the previous year. This growth is driven by resilient consumer spending, sustained business investment, and major events promoting international visits.

Business and corporate travel in 2025

Business travel is back, and it's evolving. After years of disruption, corporate travel spending is projected to hit $1.48 trillion globally in 2024, finally surpassing pre-pandemic levels. In the U.S., companies are sending employees on the road again, with business travel spending expected to grow by 4% in 2025, reaching $316 billion.

However, this recovery looks different from the past—companies are prioritizing ROI-driven trips, sustainability, and employee well-being, while flexible work arrangements are reshaping travel needs.

Business travel spending is rebounding

- Global spending is on track to exceed $1.48 trillion in 2024, with projections of $2 trillion annually by 2028.

- The U.S. leads the market, with business travel spending already 7% above 2019 levels in 2023.

- Real growth remains slow—while nominal spending is rising, inflation-adjusted business travel won't fully recover until after 2028.

- Despite this steady recovery, companies remain cautious. 73% of corporate travel managers expect budgets to grow in 2024, but many are prioritizing cost-effective trips and alternative meeting solutions like virtual conferences.

New corporate travel policies

1. Cost-conscious travel planning

Companies are closely managing budgets, focusing on essential trips that deliver clear business value. This means:

- Fewer, but longer trips – employees are combining multiple meetings into single trips to maximize value.

- More approvals for travel – stricter internal policies ensure trips align with company goals.

- Remote meetings replacing routine travel – many internal check-ins and smaller meetings remain virtual.

2. Green business travel

Sustainability is now a key factor in travel decisions:

- Companies are setting emissions reduction targets, aiming to cut business trips by 10–20%.

- More organizations are prioritizing direct flights, rail travel, and eco-friendly hotels.

- Sustainable aviation fuel (SAF) investments and carbon offset programs are growing as part of corporate travel strategies.

3. Employee well-being and travel flexibility

With employee preferences shaping policies, businesses are:

- Allowing more bleisure trips – two-thirds of travelers extend work trips for personal leisure.

- Focusing on traveler well-being, ensuring manageable schedules, health support, and better accommodations.

- Offering work-from-anywhere perks, enabling employees to mix remote work with travel.

How remote and hybrid work is reshaping business travel

The rise of remote and hybrid work is fundamentally changing corporate travel:

- Fewer traditional business trips – many office-to-office visits have been replaced by virtual meetings.

- More travel for team-building and strategy sessions – remote employees travel for in-person collaboration.

- An increase in regional travel – employees now take more trips within driving distance instead of flying cross-country.

- Instead of frequent, routine travel, companies are investing in purpose-driven trips—focusing on events, conferences, and client-facing meetings.

Where are business travelers going?

The top U.S. cities for business travel in 2025 include:

- New York City, NY – financial and corporate headquarters hub.

- Chicago, IL – a major convention and trade show city.

- Boston, MA – a leader in finance, education, and biotech.

- Dallas, TX – growing tech and corporate business center.

- Washington, D.C. – the center of government and policy-related travel.

Beyond the usual hubs, emerging business destinations include Orlando, Nashville, Charlotte, and Denver, which are attracting more conferences and corporate events.

For international business travel, the top destinations remain:

- London, UK – the go-to business hub for transatlantic travel.

- Tokyo, Japan – key for finance and tech industries.

- Frankfurt, Germany – a European financial center.

- Singapore – Asia's fastest-growing business hub.

The rise of bleisure travel

A major shift in business travel is the blending of work and leisure, also known as bleisure travel.

- 66% of corporate travelers extended business trips for leisure in 2023.

- Employees increasingly use vacation days alongside work trips, or bring family along.

- Workcations—where employees work remotely from a travel destination—are becoming more common.

Companies are adjusting policies to allow for this shift, clarifying expense guidelines for leisure extensions while recognizing that flexible travel improves employee satisfaction.

Business travel trends in airlines and hotels

Airlines adapting to corporate travel needs:

- Premium travel demand is back – business and first-class bookings are 99% recovered to pre-pandemic levels.

- Airfare price stabilization – after sharp increases in 2022, business-class fares are rising only 1–3% annually in 2025.

- Sustainability pressure – companies are favoring airlines investing in sustainable aviation fuel (SAF) and lower emissions.

Hotels shifting to meet business traveler expectations

- More boutique and extended-stay options – travelers want unique stays rather than generic business hotels.

- Sustainable lodging is a priority – companies increasingly choose hotels with eco-certifications.

- Work-friendly amenities – hotels are improving Wi-Fi, workspace design, and wellness facilities for corporate guests.

Airline and transportation statistics in the U.S. (2025)

The U.S. travel industry has entered a new phase of expansion, with air travel exceeding pre-pandemic levels, high-speed rail projects gaining momentum, and alternative transportation options evolving.

While airlines face challenges from rising airfares and capacity constraints, budget airlines are continuing to expand, and rideshare services are integrating electric vehicles into their fleets.

How many flights are U.S. travelers taking?

U.S. air travel demand is at an all-time high, with both domestic and international flights surpassing pre-pandemic levels:

- Domestic flights: U.S. travelers took approximately 16.8 million domestic flights in 2024, nearly matching 2019's 17 million flights.

- International flights: International travel surged by 27.9% in 2023, outpacing domestic growth. Airlines increased capacity on long-haul routes, making 2024 a record-breaking year for international departures.

- Total U.S. airline passengers: U.S. carriers transported approximately 819 million domestic passengers in 2023, setting the stage for an even higher total in 2025.

With both business and leisure travel rebounding, 2025 is projected to be another record-setting year for U.S. airlines.

Busiest U.S. airports in 2025

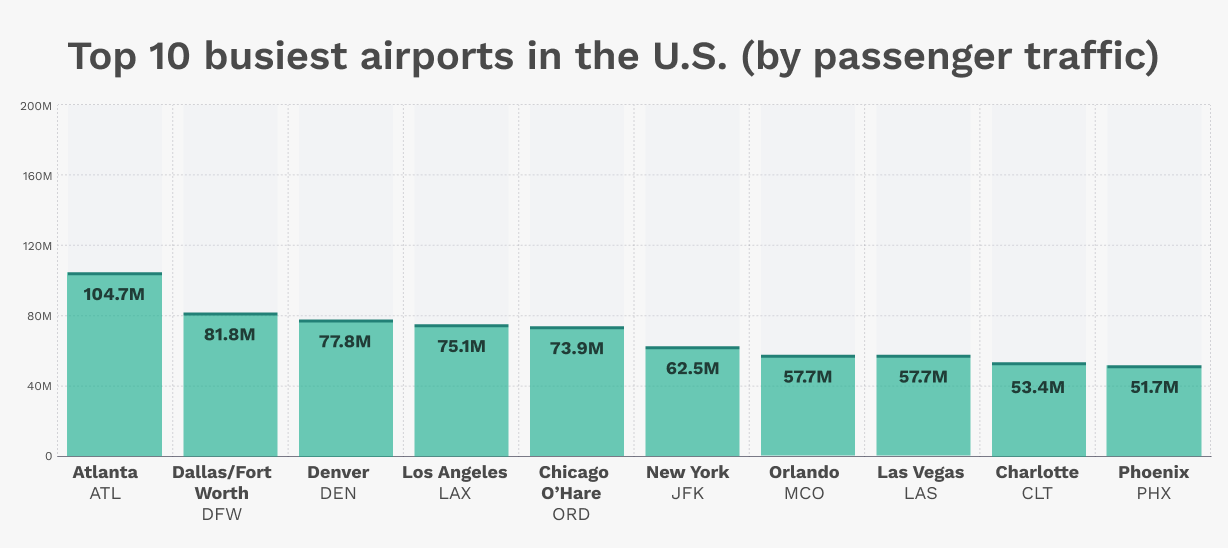

The largest U.S. airports have fully recovered and are handling record-breaking passenger volumes.

Top 10 busiest airports in the U.S. (by passenger traffic):

Top 10 busiest airports in the U.S. (by passenger traffic):

1. Atlanta (ATL) – 104.7 million passengers

2. Dallas/Fort Worth (DFW) – 81.8 million

3. Denver (DEN) – 77.8 million

4. Los Angeles (LAX) – 75.1 million

5. Chicago O'Hare (ORD) – 73.9 million

6. New York JFK (JFK) – 62.5 million

7. Orlando (MCO) – 57.7 million

8. Las Vegas (LAS) – 57.7 million

9. Charlotte (CLT) – 53.4 million

10. Phoenix (PHX) – 51.7 million

Regional trends:

- The Sun Belt is growing: Airports in Texas, Florida, and Arizona are seeing rapid growth due to population shifts and business relocations.

- Coastal gateways remain dominant: New York, Los Angeles, and Miami handle the majority of international traffic, particularly to Europe and Latin America.

- Infrastructure expansions are happening nationwide: DFW launched a $9 billion expansion, and several major airports are modernizing to accommodate more passengers.

Airfare trends: are flights getting more expensive?

Yes—but not as dramatically as in previous years.

- Airfares increased by 7.1% from 2024 to 2025, outpacing inflation but moderating compared to 2022's steep price hikes.

- Domestic airfares remain elevated, particularly on high-demand routes, due to airline capacity constraints.

- International fares are dropping—flights to Europe (-6%), Asia (-11%), and South America (-4%) are more affordable as airlines restore more long-haul flights.

- Budget airlines are helping keep prices competitive, especially in leisure markets.

Overall, air travel is still cheaper than historical averages when adjusted for inflation, despite recent increases.

Budget airlines vs. full-service carriers

Budget airlines continue to expand aggressively, increasing their share of the market.

- Low-cost carriers (LCCs) now account for ~11% of U.S. domestic air traffic, up from 6% a decade ago.

- New budget airlines like Avelo and Breeze are adding routes to secondary airports and underserved cities.

- JetBlue's acquisition of Spirit Airlines (pending approval) could reshape the ULCC landscape, blurring the lines between budget and full-service carriers.

- Legacy airlines (Delta, United, American) are focusing on premium offerings and international expansion to differentiate themselves from budget competitors.

Rental cars and rideshare trends

Rental cars: prices stabilizing, but still high

- After skyrocketing prices in 2021–22, rental car costs have leveled off but remain ~35% higher than 2019 levels.

- EV adoption is slow—Hertz announced plans to sell off 30,000 electric vehicles due to lower-than-expected demand.

- Rates are expected to gradually decline as rental fleets return to pre-pandemic levels.

Rideshare: booming again, with a push for electric vehicles

Uber and Lyft have fully recovered, with ride volumes exceeding pre-pandemic levels.

- Uber reported a record 9.4 billion trips in 2023, and electric vehicle (EV) adoption is accelerating.

- Uber and Lyft plan for 100% EV rides by 2030, with EV usage growing rapidly in California and major metro areas.

- For travelers, Uber and Lyft fares remain higher than in 2019, but increased driver supply has helped stabilize costs.

Hotel and accommodation statistics in the U.S. (2025)

The U.S. hotel and lodging industry has made a full recovery from the pandemic and is now setting new records in revenue, occupancy, and traveler demand.

While traditional hotels still dominate, vacation rentals like Airbnb and Vrbo have expanded their market share, and travelers are showing increased interest in boutique hotels, eco-lodges, and unique stays.

However, inflation has impacted pricing, making accommodations more expensive and pushing many travelers to seek budget-friendly alternatives or rely more on hotel loyalty programs to maximize value.

Hotel occupancy rates: near full recovery

- After years of fluctuating demand, U.S. hotel occupancy rates have nearly returned to pre-pandemic levels.

- 2024 hotel occupancy rate: 63.6%, just below the 2019 peak of 65.9%.

- Total hotel demand in 2023 surpassed pre-pandemic levels, with 1.3 billion room nights sold, showing that hotels are fuller than ever, even if occupancy percentages remain slightly below peak.

Why is occupancy still slightly below 2019 levels?

- More hotel supply: New hotels have been built, increasing the number of available rooms.

- Changes in business travel: Some corporate travel has not fully returned, as companies embrace virtual meetings and hybrid work models.

- Competition from vacation rentals: More travelers are opting for Airbnb and Vrbo, cutting into traditional hotel occupancy.

- However, hotel revenue is higher than ever, driven by record-breaking average daily rates (ADR) and increased traveler spending.

Airbnb and vacation rentals continue to grow

- Vacation rentals have grown significantly in market share, with Airbnb and Vrbo capturing a 15% share of U.S. lodging in 2024, nearly double the 8% share in 2018.

- The U.S. vacation rental market was worth ~$64 billion in 2023, reflecting travelers' preference for home-like stays.

- There are now 2.4 million vacation rental listings across the U.S., showing a surge in supply to meet demand.

- In mid-2023, short-term rental stays were up 24% year-over-year, while hotel demand was flat (0% growth)—demonstrating the rapid rise of vacation rentals.

Why are travelers choosing vacation rentals?

- More space, kitchens, and flexibility—ideal for longer stays and families.

- The rise of ‘bleisure travel' (business + leisure)—remote workers are extending stays in vacation rentals for work-from-anywhere flexibility.

- Unique and local experiences—Airbnb's “unique stays” category (tiny homes, treehouses, houseboats) grew 123% from 2020 to 2024.

How hotels are responding

Hotels are fighting back by improving their offerings, focusing on service, loyalty perks, and amenities. Many hotel brands are also lobbying for stricter short-term rental regulations in major cities, arguing that vacation rentals increase housing costs for locals.

Despite this competition, hotels still make up 85% of U.S. lodging revenue, proving they remain the dominant choice for most travelers.

1. Boutique hotels are booming

- The global boutique hotel market grew 6.6% from 2023 to 2024, reaching $93.8 billion.

- Travelers—especially Millennials and Gen Z—prefer personalized, design-driven experiences over large, corporate hotels.

- Major hotel brands are launching soft-brand collections (such as Marriott's Autograph Collection or Hilton's Curio Collection) to capture this trend.

2. Sustainability is a priority

- 78% of travelers prefer eco-friendly accommodations.

- Hotels are highlighting sustainability efforts (solar power, reducing plastic, locally sourced food) to attract eco-conscious guests.

- Green-certified hotels and eco-lodges are becoming mainstream, with many travelers willing to pay extra for sustainable stays.

3. Unique accommodations (glamping, treehouses, tiny homes) are in high demand

- Airbnb's unique stays category has grown 123% in listings since 2020.

- The glamping market in the U.S. was worth $560 million in 2023 and is expected to double to $1.3 billion by 2029.

- Luxury outdoor experiences are attracting travelers who want nature without sacrificing comfort.

Inflation is making hotels more expensive—but travelers are adapting

Rising costs have significantly impacted hotel pricing over the past few years:

- Hotel room rates in 2024 are 22% higher than in 2019, with the average daily rate (ADR) reaching $160 per night.

- Revenue per available room (RevPAR) hit an all-time high in 2023, meaning hotels are making more money than ever despite slightly lower occupancy rates.

How travelers are responding to rising hotel costs

- Shorter trips—some travelers are reducing trip length to save money.

- Switching to budget-friendly hotels—extended-stay hotels have the highest occupancy rate (~74%), as they offer kitchen amenities and lower nightly costs.

- More travelers are using hotel loyalty programs to offset high prices with free nights and perks.

Pricing transparency is becoming more important

Travelers are demanding clearer pricing—hidden fees (like resort fees or Airbnb cleaning fees) are facing consumer backlash.

Airbnb now displays total price upfront, and some hotels are bundling fees into base prices to improve transparency.

Loyalty programs are shaping traveler choices

Hotel loyalty programs are stronger than ever and play a key role in where travelers choose to stay.

- Loyalty members now account for 59% of all hotel room nights.

- Hilton Honors reached 133 million members in 2024, a 15% increase year-over-year.

- Marriott Bonvoy had ~169 million members as of early 2022 and continues to grow.

How loyalty programs influence traveler behavior

- Loyalty members spend 22% more per stay and stay 28% longer than non-members.

- 62% of Marriott and Hilton's room nights come from loyalty members—proving that rewards programs drive repeat business.

- Point redemptions reached a record $1.1 billion in 2023, showing that travelers are using their rewards more than ever.

Why?

- Free nights, upgrades, and perks offset rising hotel costs.

- Travelers feel invested in hotel brands once they accumulate points.

- Corporate travelers stay within one brand to maintain elite status.

Travel spending & economic impact in the U.S.

The U.S. tourism and travel industry is thriving, with Americans spending record amounts on travel both domestically and internationally. Despite rising costs, demand remains strong, making the travel and tourism sector a key driver of the U.S. economy. From hotel stays to flights, dining, and entertainment, travel-related spending is fueling job creation, generating tax revenue, and supporting businesses nationwide. The gradual rebound in international arrivals and employment levels further underscores the significance of this industry to the overall economic recovery post-pandemic.

How much are Americans spending on travel?

Americans are spending more on travel than ever before:

- $1.3 trillion was spent on domestic travel in 2023, surpassing pre-pandemic levels.

- $215.4 billion was spent by U.S. travelers abroad, 17% above 2019 levels.

- $213.1 billion was spent by international visitors in the U.S., up 29% from 2022 but still 11% below 2019 levels.

For the first time in years, Americans are spending more on travel abroad than the U.S. is bringing in from foreign tourists, leading to a $2.3 billion travel trade deficit. This reflects a surge in Americans traveling overseas while inbound international tourism is still recovering.

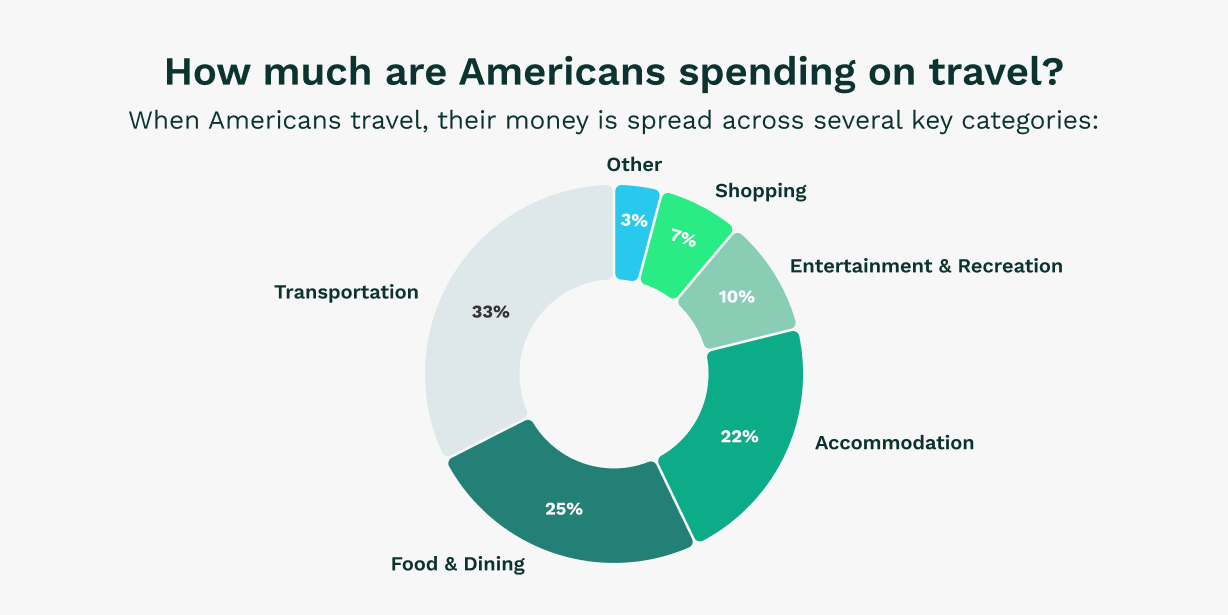

Where does the money go?

When Americans travel, their money is spread across several key categories:

- Accommodation (22%) – Hotels, motels, vacation rentals, and campgrounds.

- Food & Dining (25%) – Restaurants, bars, and groceries.

- Transportation (33%) – Flights, rental cars, ride-shares, gas, and public transport.

- Entertainment & Recreation (10%) – Theme parks, concerts, outdoor activities, and tours.

- Shopping (7%) – Souvenirs, clothing, and retail purchases.

- Other (3%) – Travel insurance, agents, and incidental costs.

Travel spending trends in top destinations

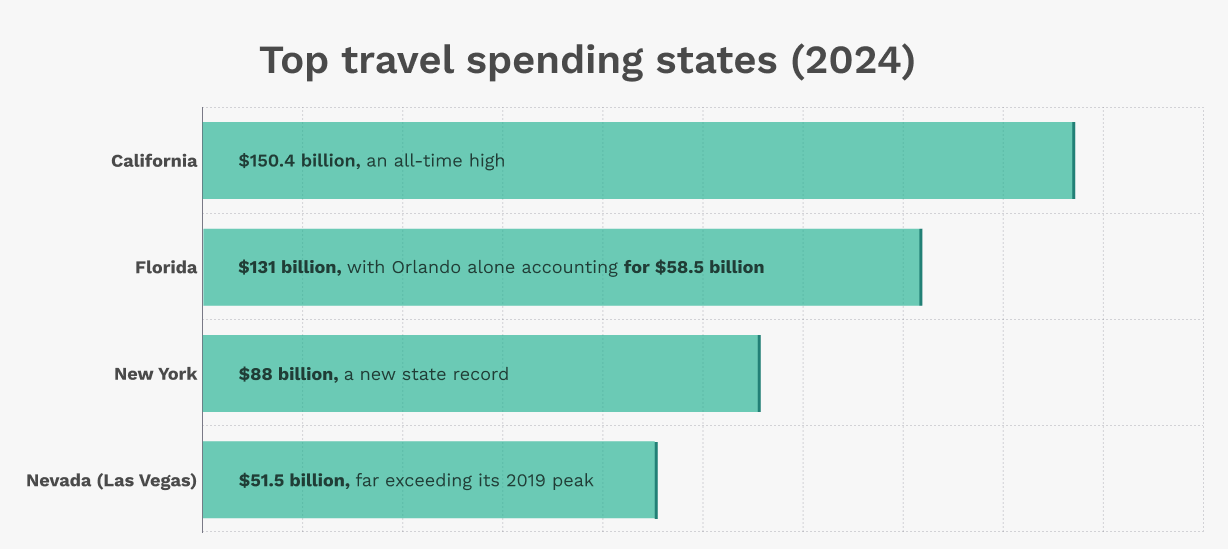

Major tourism hubs are seeing record spending, with Florida, California, and New York leading the way.

Top travel spending states (2024):

- California – $150.4 billion, an all-time high.

- Florida – $131 billion, with Orlando alone accounting for $58.5 billion.

- New York – $88 billion, a new state record.

- Nevada (Las Vegas) – $51.5 billion, far exceeding its 2019 peak.

- Hawaii – High per-trip spending, fueled by longer stays and high-end tourism.

Regional trends:

- Florida's tourism boom is generating $36.9 billion in tax revenue and supporting 2.1 million jobs.

- California's tourism industry generated $12.7 billion in tax revenue and employs 1.16 million people.

- Las Vegas visitor spending has skyrocketed, breaking all previous records.

How does today's travel spending compare to pre-pandemic levels?

- Total travel spending has surpassed 2019 levels in dollar terms, but inflation has played a role in the increase.

- Domestic leisure travel is fully recovered and now exceeds 2019 levels.

- Business travel is still lagging, at 81% of pre-pandemic levels, due to virtual meetings and corporate budget cuts.

- International inbound tourism is at 84% of 2019 levels, still climbing back from the pandemic downturn.

- Outbound travel (Americans going abroad) has grown the fastest, exceeding 2019 spending by 17%.

While travel is thriving, the landscape has shifted. Leisure travel is booming, while business and international tourism are still catching up.

How inflation is impacting travel budgets

Rising costs have made travel more expensive, with prices for flights, hotels, and dining significantly higher than before the pandemic.

- Hotel prices are 22% higher than in 2019, with an average daily rate of $160 per night.

- Airfare increased sharply in 2022, then stabilized in 2023–24, but remains 5–10% higher than pre-pandemic prices.

- Gas prices remain 14% above 2019 levels, impacting road trips.

- Food and restaurant prices have risen 3–5% annually, increasing overall trip costs.

How travelers are adjusting to higher costs:

- Shorter trips – Many are reducing vacation length to manage budgets.

- Budget-friendly travel – More travelers are choosing economy hotels and extended stays to save money.

- Loyalty programs – Travelers are redeeming more points to offset high prices.

- Smarter spending – A YouGov survey found travelers are spending more on food and experiences but cutting back on shopping and transportation costs.

Travel's impact on the U.S. economy

The travel industry is a major economic engine, contributing $2.8 trillion to the U.S. economy and supporting 15 million jobs.

How travel fuels the economy:

- 2.5% of U.S. GDP comes from travel-related spending.

- 15 million jobs are directly or indirectly supported by travel.

- $180 billion in tax revenue is generated annually from travel spending.

- 1 in 10 U.S. jobs are tied to the travel industry.

Why travel matters:

- Job Creation – The travel industry employs millions of Americans in hotels, airlines, restaurants, and attractions.

- Local Impact – Tourism taxes help fund public services, infrastructure, and community programs.

- Trade Balance – Travel is one of America's largest service exports, bringing billions in foreign spending into the U.S.

Without tourism, tax burdens would be higher for U.S. residents – in Florida alone, tourism taxes save each household $1,900 per year.

Sustainable travel

The tourism industry is undergoing a significant transformation as it shifts towards more sustainable practices. This change is driven by a growing awareness of the environmental impact of travel and a desire to promote and preserve local culture. In 2025, sustainable travel is not just a trend but a necessity, with 83% of global travelers believing it is vital to incorporate sustainable practices into their travel plans.