How to leave Kentucky residency?

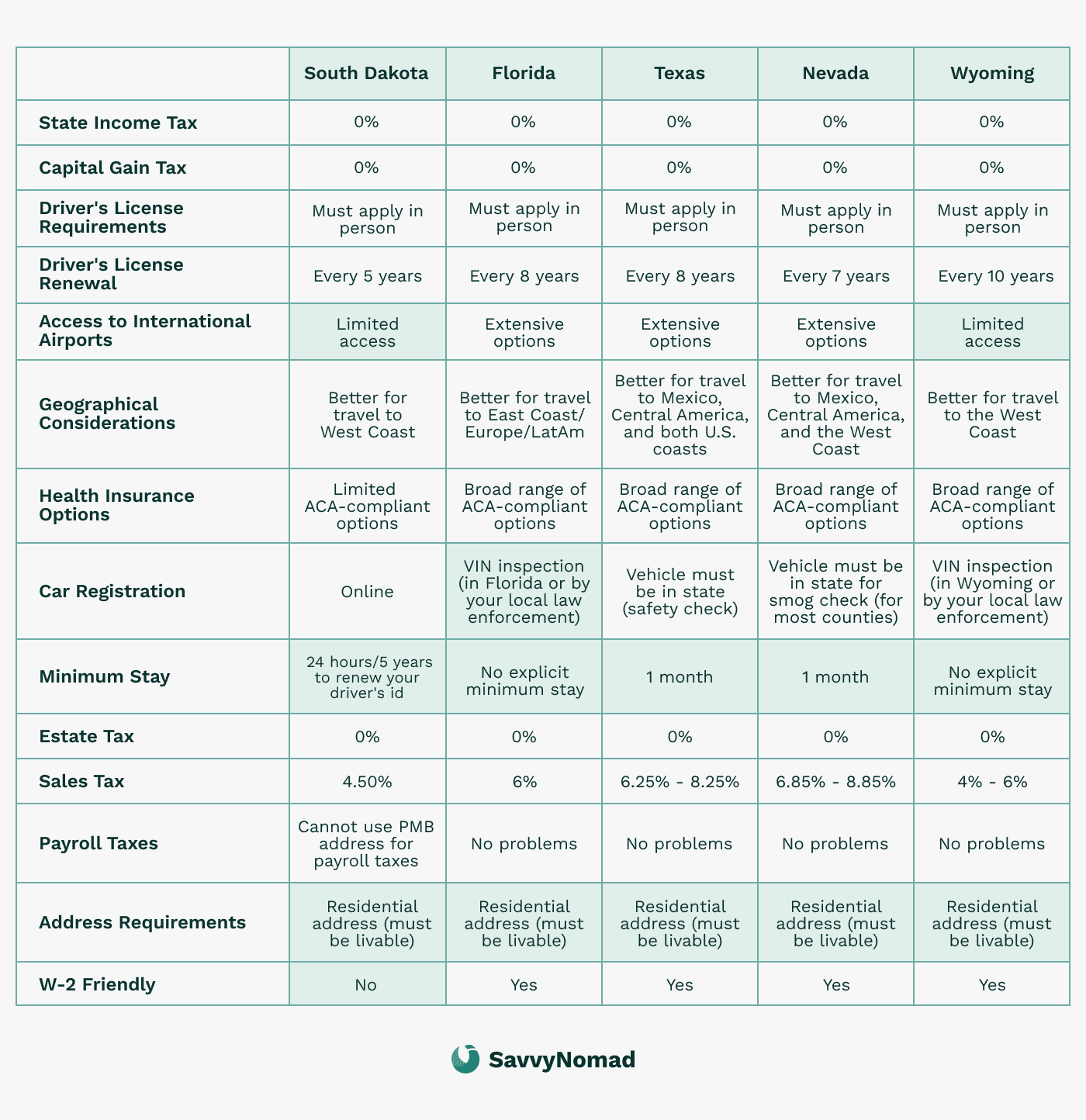

Leaving Kentucky residency can offer significant financial and lifestyle benefits, especially if you’re relocating for retirement, job opportunities, or lower taxes. Kentucky has a flat income tax rate of 5%, and as a resident, you are taxed on your worldwide income. For many, moving to a state with no or lower state income tax, such as Florida, Texas, or Nevada, can provide substantial savings.

Additionally, many people are choosing to leave Kentucky for warmer climates, better job prospects, or to be closer to family. Whether you are planning a move to reduce your tax burden or seeking new opportunities, understanding the steps to officially leave Kentucky residency is essential to avoid continued tax obligations.

By following these steps carefully, you can ensure a smooth transition to your new residency and minimize your tax liabilities.

Steps to leaving Kentucky residency

Step 1: Establish a new domicile

The first step in leaving Kentucky residency is to establish a new domicile in another state. This involves physically relocating and proving that your new state is your permanent home.

1) Establish new residency

- Secure a residential address: Start by finding a place to live in your new state. Whether you’re renting or buying, this serves as the foundation for your residency claim. For example, in Florida, homeowners may qualify for tax savings through the homestead exemption.

This can be especially useful for digital nomads and expats who want a Florida documentation footprint in a tax friendly state, while recognizing that the address itself does not guarantee any particular tax outcome or acceptance by every agency or institution.

- File a Declaration of Domicile: In states like Florida, you can file a legal document stating that your new state is now your permanent home, making it official.

Residency guides:

2) Relocate your belongings

Moving personal belongings to your new state is an important step to demonstrate your intention to live there permanently. This can include moving your household items, vehicles, and other significant possessions.

3) Spend time in your new state

The more time you spend in your new state, the stronger your claim to residency. Try to minimize your time in Kentucky during this transition, as spending too much time in your former state could raise questions about your new residency.

4) Transfer IDs and vehicle registrations

Update your driver’s license and vehicle registration to your new state. This is a clear and simple way to show that your new state is now your legal home.

5) Register to vote (if eligible)

Register to vote in your new state if you are eligible. Voter registration is a strong supporting indicator of residency, but it is considered together with many other facts and does not by itself determine your tax status. Do not forget to cancel your voter registration in Kentucky as well.

6) Update financial accounts

Notify your banks, credit card companies, and other financial institutions about your new address. This helps keep your official documents and accounts consistent with your new residency.

7) Notify your employer

Make sure your employer updates your payroll and tax withholdings to reflect your new state. This helps prevent Kentucky state income tax from continuing to be withheld after you move, although your actual Kentucky tax liability will still depend on your own filings and Kentucky’s rules.

By following these steps, you’ll create a strong foundation for proving your new residency and reducing the risk of being taxed by Kentucky after your move.

Step 2: Sever ties with Kentucky

Once you’ve established a new domicile, the next important step is to cut all significant ties with Kentucky. This ensures that Kentucky tax authorities won’t continue to treat you as a resident for tax purposes.

Here’s how to do it:

1) Close Kentucky financial ties

- Close local bank accounts: If you have any bank accounts in Kentucky, it’s a good idea to close them and move your funds to banks in your new state. This shows that your financial activities are no longer based in Kentucky.

- Cancel Kentucky voter registration: Make sure to cancel your voter registration in Kentucky and register to vote in your new state. Voting records are a key factor in determining residency.

- Update personal records: Update your address with the IRS, Social Security, and any other relevant entities. Keeping all personal and financial records in your new state helps solidify your move.

2) Sell or lease property

If you own property in Kentucky, selling it is one of the strongest indicators that you no longer intend to reside there. Alternatively, leasing the property on a long-term basis can also demonstrate that you do not maintain significant ties to the state.

3) Cancel local subscriptions/services

Cancel any memberships, subscriptions, or services connected to Kentucky, such as gym memberships, utilities, or local clubs. Maintaining these services may suggest you still have ties to the state.

4) Transfer healthcare and insurance

Find healthcare providers in your new state and ensure that your health insurance is updated to reflect your new residency. Transferring these essential services supports your claim of permanent residence in your new state.

Step 3: Time spent outside Kentucky

To avoid being taxed as a resident in Kentucky after your move, it is important to manage the amount of time you spend in the state and to end Kentucky domicile. Kentucky treats you as a resident if you are domiciled in Kentucky, or if you are not domiciled there but you maintain a place of abode in Kentucky and spend 183 days or more in the state during the tax year.

- What is the 183-day rule?: If you are not domiciled in Kentucky but you maintain a place of abode in the state and spend 183 days or more in Kentucky during the tax year, Kentucky will generally treat you as a resident for tax purposes. This can make you liable for Kentucky income tax on your worldwide income.

- Stay well under 183 days: To strengthen your nonresident position, you should aim to spend clearly fewer than 183 days in Kentucky each year and avoid maintaining a Kentucky place of abode after you move. A day is generally counted when you are physically present in the state at any time during that day, so even short visits can add to your total, and you should keep careful records of your travel.

Step 4: Kentucky-sourced income

Even after leaving Kentucky residency, you may still have tax obligations if you have income that originates from within the state.

Here’s how to handle Kentucky-sourced income after your move:

1) Ongoing tax responsibilities

If you continue to earn income from Kentucky, such as rental income, business profits, or wages, you will need to file non resident tax returns. These returns are structured so that only income from Kentucky sources is taxed, while income from outside Kentucky is handled under your new state and federal rules.

2) Rental or business income

If you own rental properties or businesses in Kentucky, the income generated will continue to be subject to Kentucky taxes even after you establish residency elsewhere. It is a good idea to work with a tax professional to handle the complexities of filing and to help you meet all of your tax obligations.