How to leave New York residency?

New York is an iconic city, but its tax burden is heavy.

Living and tax obligations are costly. For frequent travelers, digital nomads, and those looking to leave the city, the tax system can be notoriously hard to break away from. Breaking the tax residency bond isn't just about moving away; it's about navigating the domicile and statutory residency tests.

This guide helps you master the nuances of tax residency and your journey toward tax savings.

TLDR:

Practically: move your home and primary stuff, switch your driver’s license, voter registration, vehicle & professional licenses, and change all addresses (employer, banks, insurers, DMV).

For taxes, in your move-out year file Form IT-203 (Nonresident & Part-Year Resident) and, if you also left NYC/Yonkers mid-year, attach Form IT-360.1 (Change of City Resident Status); in later years file only if you have NY-source income.

To avoid statutory residency, do not maintain a New York “permanent place of abode” for substantially all of the year (Audit Division treats this as >10 months) and keep NY days under 184—any part of a day counts, with narrow exceptions for transit and in-patient medical days; merely owning a place isn’t enough without a residential interest (per Gaied).

If you’re a former NY domiciliary living abroad, the 548-day foreign rule can deem you a nonresident if you meet all conditions. Keep meticulous, consistent proof (leases, utility closes, licenses, travel/day logs, cell-site records) to survive an audit.

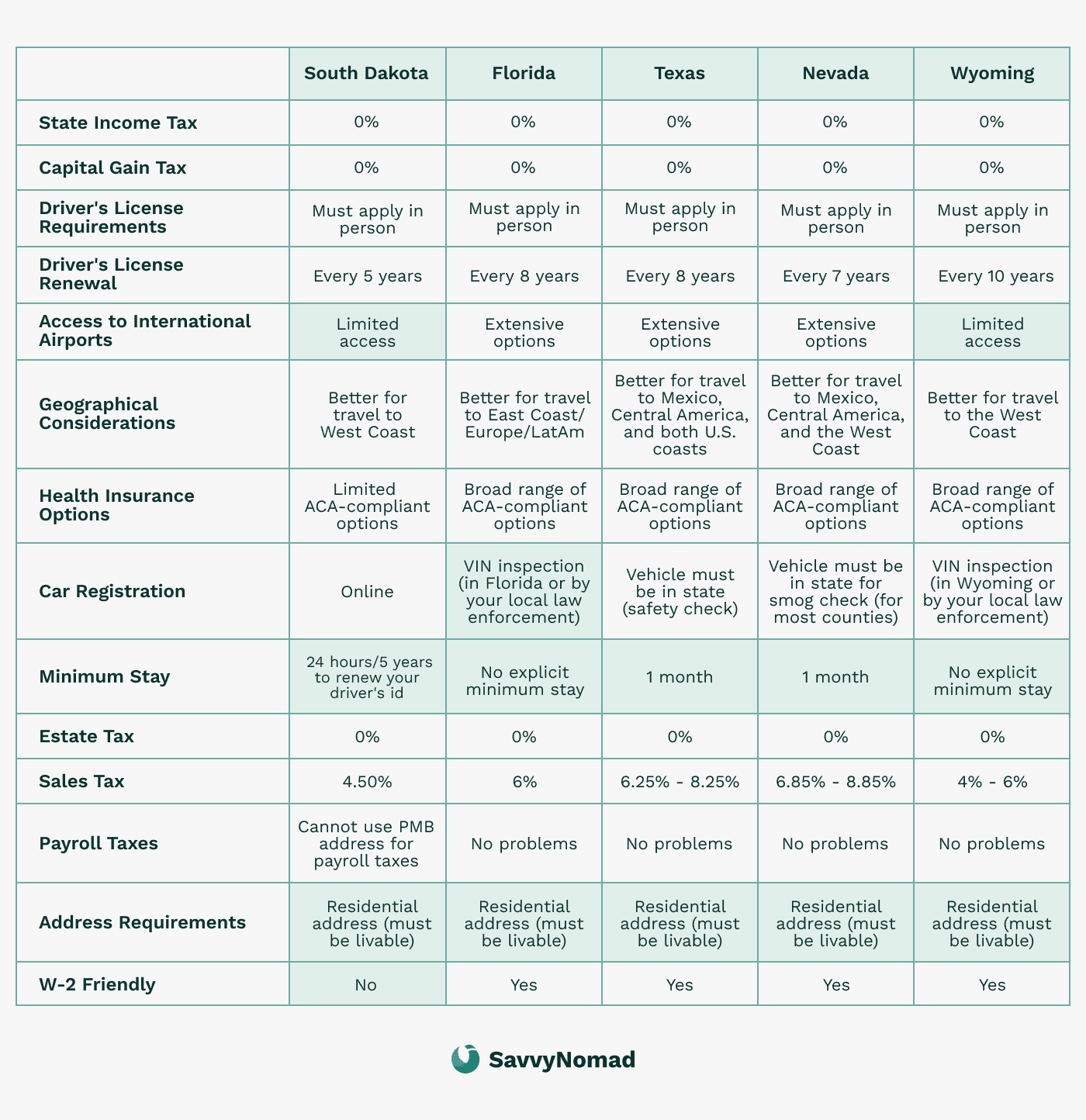

Choosing your destination: a home base for global living

In the life of a digital nomad, home is everywhere yet nowhere. Establishing a state domicile is nonetheless a requirement for a US citizen. That being the case, many nomads choose to plant their flag in places like Florida or South Dakota, states without an income tax, while their hearts and feet wander across continents.

With remote work and nomadism on the rise, strategically choosing your domicile can significantly reduce or even eliminate state personal income tax from certain states while you travel the world, depending on your facts and the states involved.

By planning your trips carefully and avoiding long stays (for example, 183 days or more) in any single high-tax state, you can often reduce the risk that multiple states claim you as a resident at the same time, though some states still look primarily at domicile rather than day-count alone.

Strategic disentanglement: the pre-departure checklist

Transitioning from New York to nomadic life is a surgical operation. It entails a blend of timing, choosing your new home base, and meticulous planning.

Timing your departure

Exit New York at year’s end to curtail your tax presence. This move should coincide with the tax calendar to reduce obligations in your departure year. If you stay in New York until April, you must pay New York state income tax until April. That said, changing your domicile on January 1 is a red flag – not many people are moving on New Year’s Day.

If you’re moving abroad: NY’s 30-Day & 548-Day safe harbors (temporary nonresident only)

New York offers two narrow safe harbors that can treat a former domiciliary as a temporary nonresident without ending domicile—useful for defined foreign assignments:

- 30-Day Rule: In the tax year, (1) no PPA in NY at any time; (2) you do maintain a PPA outside NY for the entire year; and (3) you spend ≤30 days in NY.

- 548-Day foreign-assignment Rule: Across 548 consecutive days, (1) you’re in foreign countries ≥450 days; (2) you (and spouse/minor children) are in NY ≤90 days; and (3) in the short portion of the tax year at the beginning and end of that 548-day window, your NY days don’t exceed the pro-rated limit tied to 90/548. Both rules demand tight record-keeping (contracts, housing, day logs, passport stamps). These are not domicile changes; for long-term/indefinite moves, ending NY domicile in another U.S. state (e.g., Florida) is usually simpler to defend than claiming foreign domicile.

Selecting a new domicile another U.S. state vs. a foreign country

When you’re leaving New York, you have two defensible paths: (A) establish domicile in another U.S. state or (B) establish domicile in a foreign country. Both can work, but the burden of proof, paperwork, and audit risk differ meaningfully. Use the copy below verbatim.

Domicile in another U.S. state (often simplest to defend)

This is usually the cleanest, fastest, and lowest-risk route for long-term nomads and remote founders.

What “good facts” look like

- Primary home secured in the new state (deed or a 12-month+ lease). Move your near-and-dear items (sentimental belongings, primary wardrobe, key equipment) there.

- No Permanent Place of Abode in NY (end your NY lease/ownership; shut off utilities; remove storage that functions like an abode).

- All legal ties moved: new-state driver’s license, voter registration, vehicle registration/insurance, health/dental providers, pet registration, professional licenses.

- Financial life moved: banks, brokerages, credit cards, insurance policies, billing addresses, Amazon/Apple/Google accounts, payroll/HR profile—all updated to the new state.

- Work & community footprint: coworking, clubs, church/synagogue, gym, volunteer work, packages/mail—in the new state.

- Day-count discipline: keep NY days ≤183 per tax year (any part of a day counts); keep an easy, consistent day log.

Filing posture

- Move year: part-year NY resident return (resident through your move-out date), then resident of your new state (if applicable).

- After the move: file nonresident NY only if you have NY-source income.

Why auditors accept this more readily

Standards are familiar and evidence is abundant; there’s no immigration bureaucracy, and consistency across IDs, banks, and housing is straightforward to show.

How SavvyNomad makes Florida domicile straightforward

If you want a turnkey path, SavvyNomad can handle the paper trail and proofs New York auditors expect when you switch to Florida domicile:

- Florida residential address in your name (suitable for banks, DMV, and official mail).

- Declaration of Domicile (Florida) — prepared and coordinated for filing at the county level.

- Proof-of-address kit for banks and the DMV, including a lease and a utility bill in your name.

- Consistent banking/DMV documentation using your Florida address for driver’s license, vehicle registration, and account updates.

This bundles the most time-consuming steps (address, domicile filing, and acceptable proof docs) so your move is easy to document and audit-defensible.

Domicile in a foreign country (doable, but higher burden and scrutiny)

Choose this when you’re truly emigrating (e.g., multi-year residence permit, foreign spouse/family, foreign employment or a business you operate in-country).

What you need to make it stick

- Right to reside: long-term visa/residence permit; local tax ID issued.

- Long-term housing: deed or 12-month+ lease; utilities in your name.

- On-the-ground ties: local bank accounts, phone number, healthcare enrollment, school/daycare for dependents, clubs/associations, vehicle license, local insurance.

- Work/economic center: foreign employment contract with work location abroad, or foreign business registration and regular operations in the country.

- Admin consistency: shipping address, billing, subscriptions, and routine life admin in the foreign country (avoid defaulting to a NY or random U.S. address).

- Translations & tie-outs: keep translated copies of key documents and a short memo that ties each item to the domicile factors (intent, home, active ties, time).

Common pitfalls

- Month-to-month Airbnbs and no long-term lease/deed.

- No immigration status beyond tourist stays.

- Payroll still pointing to U.S. locations; banks and insurers left at NY addresses.

- Frequent NY visits plus lingering NY abode (fails both intent and statutory tests).

Important nuance on NY “safe harbors” abroad

- NY’s 30-Day and 548-Day foreign-assignment rules can treat you as a temporary nonresident if you meet every condition (and document meticulously).

- These do not change domicile. They’re best for defined employer assignments, not indefinite nomadism.

Which should you pick?

- Pick another U.S. state (e.g., Florida) if your move is indefinite and you want the lowest audit friction. You’ll still be free to spend long stretches abroad, but your domicile evidence stays simple and U.S.-based.

- Pick foreign domicile if your life is truly centered abroad (residence permit, long-term housing, family, work, and community all in one country) and you’re ready to carry a heavier documentation burden.

Assessing ties to New York

Catalog what anchors you to New York: property, businesses, community ties. These are the threads you'll need to sever or untangle.

Planning your move

Transition domiciles very thoughtfully. Draft a timeline for a gradual shift from New York to your new state.

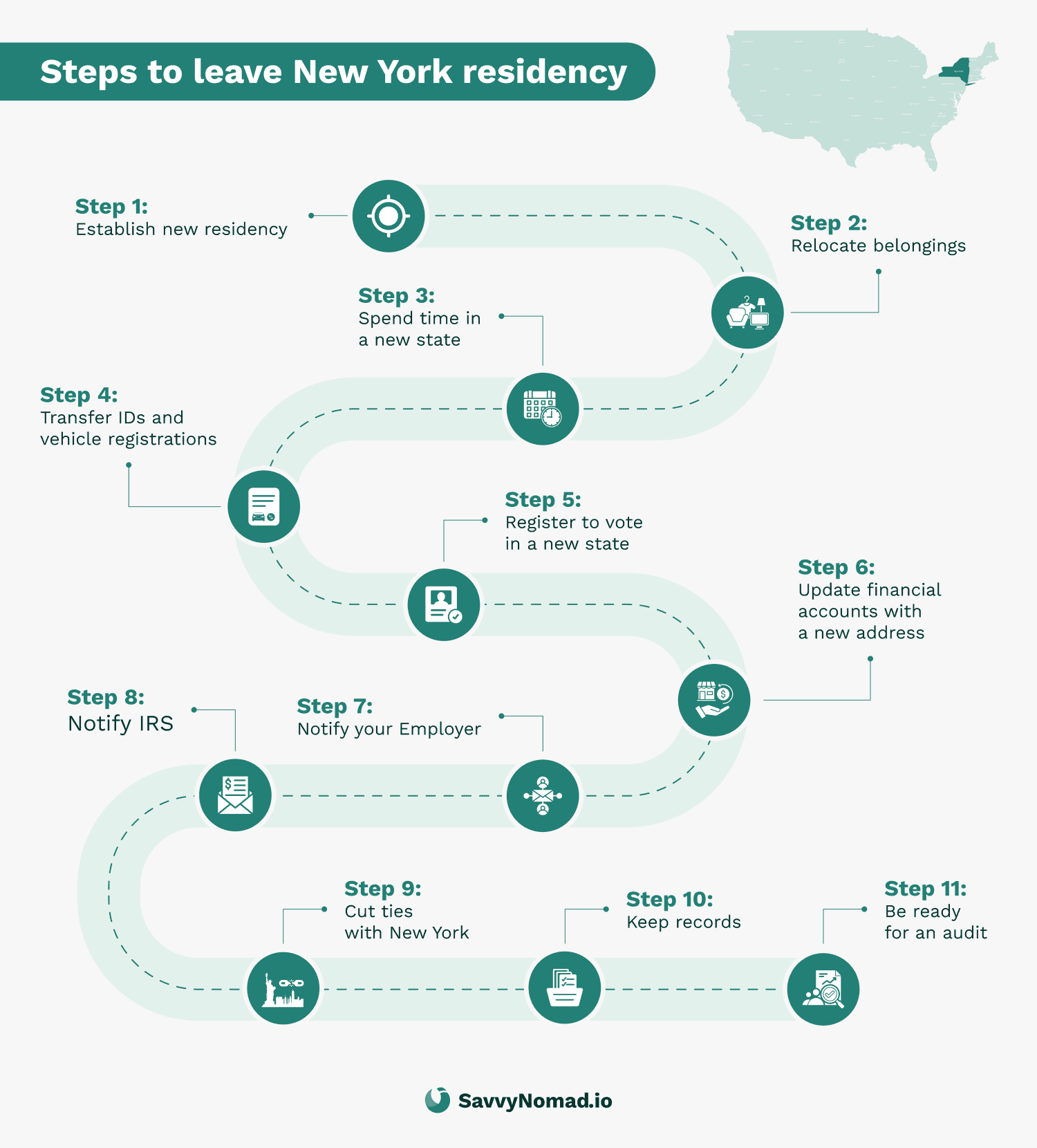

How to leave New York state residency?

Changing your New York State residency involves several calculated steps to ensure a clear-cut transition.

1) Establish new residency

Secure a residential address in the new state. If you buy a home, you may want to look into available property tax credits, like Florida’s homestead exemption. You may want to consider filing a Declaration of Domicile with the state, as suggested in Savvy Nomad’s domicile guides.

2) Relocate your belongings

Move any valuable possessions out of New York and document the process. Receipts and records are key proof of your relocation efforts. Always remember that the burden of proving when New York was no longer your residence for tax purposes will be on you.

3) Spend time in your new state

The more time you spend in your new state, the better. While many nomads drop in just long enough to get their driver’s license, the more time you can truly make your new domicile home, the easier it will be to show that New York is no longer your home.

4) Transfer IDs and registrations

Promptly update your driver's license and vehicle registration.

5) Register to vote

Voter registration in your new state.

6) Integrate into the community

Engage in local activities and memberships, and establish relationships with professionals (doctors, dentists, lawyers, financial advisers) in your new locale to solidify your residency status.

7) Update documents

Ensure that all identification, medical, insurance and financial documents reflect your new address.

8) Notify your employer

Inform the IRS of your new address using Form 8822. Extend this notification to all personal and professional entities.

9) Notify IRS

Inform the IRS of your address change using Form 8822. Extend this notification to all personal and professional entities.

10) Keep records

Keep one organized bundle you could upload in minutes:

- Travel & presence: passport stamps, boarding passes, itineraries, a simple daily NY day log.

- Housing evidence: new-state lease/deed; proof you gave up any NY PPA (sale/lease termination, utilities off).

- Employment/location: employment contract or employer letter stating where you work; payroll/location metadata.

- Life ties moved: driver’s license, voter registration, insurance, banks/brokers, IRA/401(k) mail, billing—all to the new state.

- Tie-out memo: a 1-page index that ties each document to the relevant NY domicile and statutory residency factors.

11) Acknowledge key factors

New York considers multiple factors for domicile status, including home, time spent in each location, business ties, location of valuables, and family location. Make sure you feel confident of as many of these as you can.

12) Anticipate an audit

Expect requests for passport stamps, day-count proof, employer verification, and housing status.

Auditors apply the statutory residency test strictly: >183 days is resident status if you maintained a NY PPA for “substantially all” of the year (use >10 months as the practical audit threshold for 2022+).

Keep your bundle consistent with your tax returns and account profiles.

Navigating New York tax implications

As you leave New York, its tax implications are part of your journey. Understanding New York's 'Statutory Resident' rules and the management of New York-source income is crucial for a hassle-free financial shift.

The statutory resident rule

The statutory resident rule is pivotal for those with a home in New York who spend more than183 days in the state. Even if you are domiciled elsewhere, you may face full resident taxes.

Part-year residency and tax filing

The first year you leave, you’ll likely file as a part-year resident, paying taxes on all income earned while residing in New York and only on New York-source income thereafter. A tax professional can help you determine which, if any, of your income streams are “New York-sourced.”

Handling New York-source income

New York taxes income from business activities or property within the state, even after you move. This includes income from entities like S corporations that are located in New York.

The “Teddy Bear” test

Another unique way that New York determines domicile is through the location of sentimental belongings. Where you keep items of personal importance can influence the state’s perception of your true home base.

Strategic considerations

Post-move, it's strategic to limit your time in New York, especially if you still own or rent property in New York. If the property is owned, renting it out can evidence a shift from personal use to an investment, indicating a genuine change in residency.

Post-Move challenges: navigating the aftershocks

Transitioning to a new state residency is not without its potential reverberations. Being prepared for these is key to navigating the post-move landscape smoothly.

Prepping for the possibility of a residency audit

In the event of an audit, be ready with:

- Precise logs of your locations throughout the year, backed by supporting documents.

- Document your move, including contracts with movers (if available) and evidence of establishing utility service at your new residence and ending utility services at your former residence.

- Proof of the relocation of personal and valuable items.

- Verify new ties in your destination state, like property ownership and local involvement.

To bolster your case:

- Maintain thorough and detailed records of your presence in and out of New York.

- A proactive and detailed approach to documentation and establishing ties in your new state is your best defense against the complexities of a residency audit and the challenges that follow a move.

- Assemble proof of your new domicile status through updated voter and vehicle registrations and housing deeds or leases.

- Update financial records to reflect your new home state, including the transition of bank accounts.

- Transition away from New York-based services, favoring professionals (including doctors and dentists) in your new state, and keep records of these changes.

FAQ

What triggers a NY residency audit?

New York residency audits can be triggered by high income, a change in domicile or statutory residency, or many people moving out of the state. Residence audits often launch with a questionnaire arriving in the mail requesting proof of your address.

Does New York use the 183-day rule?

Yes, per tax year. You’re a statutory resident if you (1) maintain a NY PPA for substantially all of the year and (2) spend 184 or more days in NY in that same year. (Any part of a day counts.)

What is the 30-day rule in New York?

Yes, per tax year. You’re a statutory resident if you (1) maintain a NY PPA for substantially all of the year and (2) spend 184 or more days in NY in that same year. (Any part of a day counts.)

What is NYC’s residency test?

The New York City residency test uses two main criteria: the Domicile Test and the Statutory Residency Test. Under the Domicile Test, an individual is considered a New York City resident for tax purposes if they are domiciled in New York City or maintain a permanent place of abode there and spend more than 183 days there.

The Statutory Residency Test, on the other hand, deems an individual a resident if they maintain a permanent place of abode in the city for substantially all of the year and spend more than 183 days in New York City.

What is the 548-Day foreign-assignment safe harbor?

If you’re assigned full-time abroad for 548 consecutive days, with ≥450 foreign days, ≤90 NY days in that span (and a pro-rated NY-day cap in the short periods at the beginning and end), NY treats you as a temporary nonresident for that period. It doesn’t end domicile.

Expect heavy emphasis on records (contracts, housing, day logs, passport stamps).

Does New York credit foreign income taxes if I’m still a NY resident?

NY’s resident foreign-tax credit is Canada-only (generally national/provincial income taxes) and follows strict “no double-benefit” and documentation rules (proof of payment, foreign return/assessment, translations, and a tie-out to your NY return).

Why are New Yorkers leaving?

New Yorkers might choose to leave the city for a variety of economic, lifestyle, and personal reasons.

Here's a consolidated list:

- High Taxation: The high tax rates in New York City and New York State, including income, property, and sales taxes, can be a significant factor, especially for those in higher income brackets and businesses looking for a more favorable tax climate.

- Cost of Living: New York City’s high cost of living, including expenses for housing, food, utilities, and transportation, can be prohibitive for many. Compared to the national average, the cost of living in New York City is significantly higher.

- Housing Market: The competitive and expensive housing market makes it difficult for individuals and families to find affordable living spaces, pushing them to look elsewhere.

- Quality of Life Issues: Some residents find the city's dense population, noise, pollution, and fast-paced lifestyle challenging and prefer a quieter or different living environment.

- Employment Opportunities: Despite the city's vast job market, the competitive nature of job opportunities and the possibility of better prospects or a lower cost of living elsewhere can motivate a move.

- Remote Work: The rise of remote work options has given people the flexibility to live outside of New York City, allowing a search for places with more space and a lower cost of living while maintaining their current jobs.

- Safety Concerns: Perceptions of safety and actual crime rates in certain areas can influence decisions to move, especially among families looking for a safer environment.

- Seeking a Different Lifestyle: Individuals may leave New York City in search of a different pace of life, including quieter suburban areas, access to nature, or regions with a different climate.

- Retirement: Retirees often look for more affordable, peaceful places to live where their retirement savings can go further, prompting moves out of the city.

- Family Reasons: Personal reasons, such as being closer to family or starting a family in a place perceived as more conducive to raising children, can also be a deciding factor.

- Space and Comfort: The desire for more living space, both indoors and outdoors, can lead people to leave the crowded city for suburban or rural areas.

Do I have to file an NY state tax return as a nonresident?

Nonresidents must file a New York state tax return if they receive income from New York sources during the tax year.

A NY state tax return is necessary if you have New York-sourced income and your New York adjusted gross income exceeds your New York standard deduction, or if you wish to claim a refund of New York taxes withheld. Additionally, claiming nonresident status requires caution if you maintain a second home in New York.

Can you leave residency and come back?

Leaving New York residency and returning involves documenting your break from residency via a tax return, specifically Form IT-203, as a part-year resident.

The state considers several factors to determine residency, including domicile status, maintaining a permanent place of abode, and presence in the state for more than 183 days.

To reestablish residency, you must demonstrate a permanent move back to New York, considering factors like the location of your home, family, business, time spent, and where you keep important possessions.

Do you have to pay NY taxes if you live out of state?

If you live out of state but have income from New York sources, such as services performed in New York, rent from real estate, or the sale or transfer of real estate located in New York, you are still required to pay New York state taxes on that income.

This necessitates filing a New York state tax return even if you are a nonresident. Nonresidents who work for New York City may need to file a special form (NYC-1127) if they are employees of the city but live outside the five boroughs.

Moreover, employers outside of New York who withhold New York state taxes for the convenience of the employee are subject to New York's withholding tax requirements.

What is the difference between a New York resident and a part-time resident?

A New York State resident for tax purposes is someone whose domicile is in New York or someone who maintains a permanent place of abode in New York and spends 184 days or more there during the tax year.

A part-year resident, however, is someone who moves to or from New York during the year and, therefore, meets the criteria for being a resident or nonresident for only part of the year. Essentially, the difference lies in the duration and permanence of their stay and where they consider their permanent home to be.

How does the IRS verify primary residence?

The IRS verifies primary residence status by looking for evidence of where you live during most of the year.

This can be a house, co-op, apartment, houseboat, mobile home, or trailer with a fixed address. Your primary residence is where you spend the majority of your time, receive mail, and have government IDs registered. Factors can include where you work, where you vote, where you bank, where you pay utilities, and where your children attend school.

Additionally, your primary residence is where you're likely to get tax benefits such as mortgage interest deductions and capital gains tax exclusions on the sale of the home.