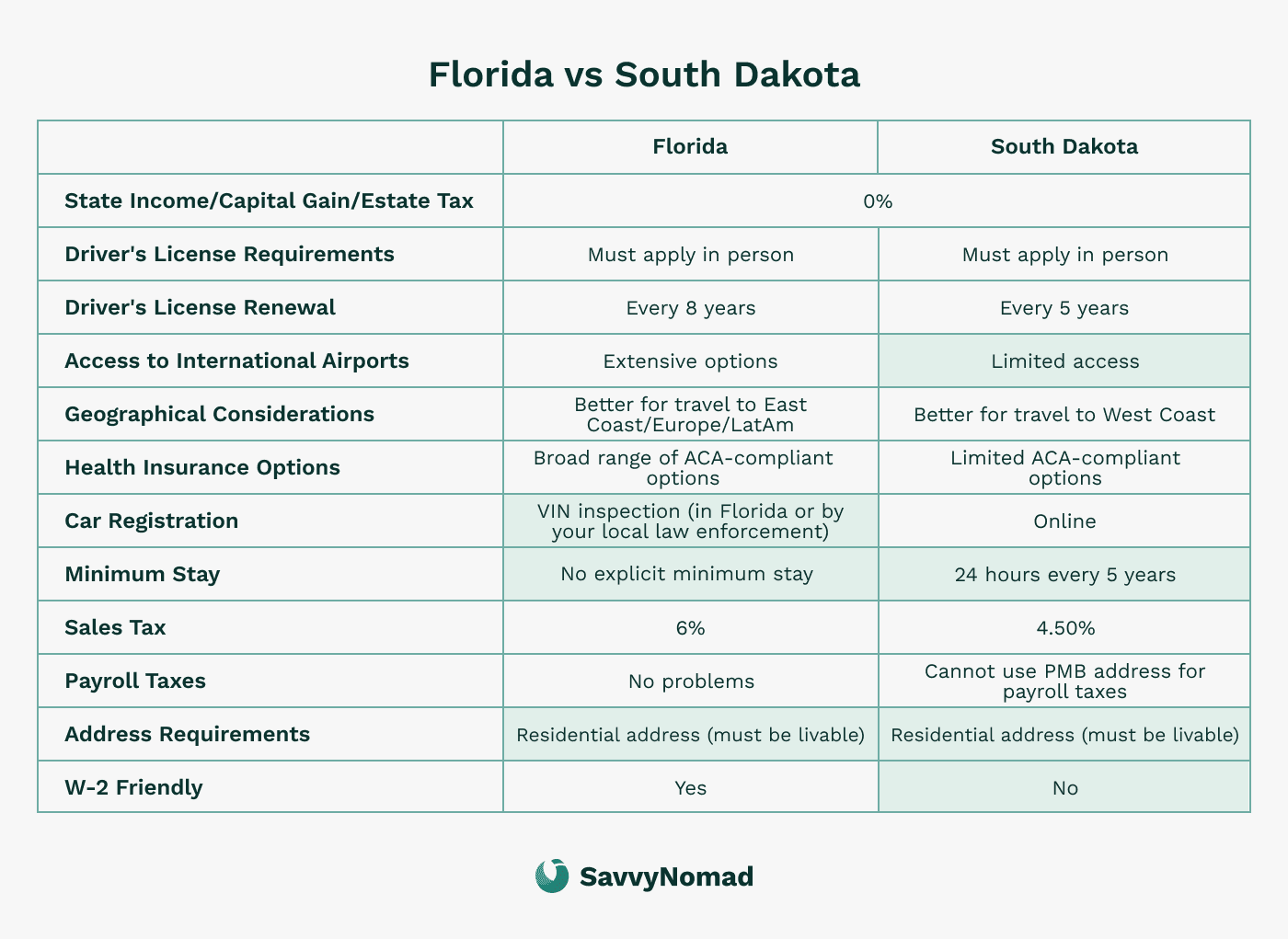

Florida vs South Dakota: Which domicile is right for me?

What does "domicile" mean for a digital nomad?

Domicile is often described as the place you "consider to be home." As a digital nomad, constantly on the move, you might feel you don't need a fixed “home."

However, think again if:

- You require an updated driver's license

- You wish to vote

- You need health insurance coverage

- You're looking to insure your equipment or vehicle

- You need a consistent bank account

- You're looking to file taxes…

So, how do I decide on the ideal state for me? Well, if you don't have any specific "home state," then you may want to consider selecting either South Dakota or Florida. Keep in mind, when you aren't on the move or traveling, this state should be your go-to spot for dentist appointments, hiring legal counsel, where you vote, and the home for future bank accounts.

South Dakota advantages

Easy minimum stay requirements

You only legally need to return to South Dakota one day every five years (though read further for why this may not be as good as it sounds). Florida doesn't have explicit requirements on the minimum stay duration to claim residency.

Lower sales tax

South Dakota has a lower state sales tax rate (currently around 4.2%) compared to Florida’s 6% state rate, although local add-on taxes in either state can change what you actually pay at the register. That said, as a digital nomad many of your purchases may fall subject to the state’s sales tax.

South Dakota disadvantages

You need to return one day every five years

However, a challenge arises with this extended absence. If you don't return for five years, it could be difficult to prove it's your "permanent base." If an individual previously resided in Minnesota, for instance, and tax authorities from that state challenge the switch to South Dakota, proving genuine relocation becomes vital. Simply cutting ties with the previous state isn't sufficient.

Demonstrating commitment to the new state, especially if there's a long absence since the initial registration, is critical. Otherwise, there is a risk of back taxes and penalties.

Problems with payroll

Unemployment taxes could be more difficult depending on your employer.

South Dakota recently started interpreting its unemployment rules differently, so you can’t use a Personal Mailbox (PMB) address for state unemployment taxes. South Dakota has no personal state income tax, so if you genuinely establish domicile there and properly exit higher-tax states, you may not have ongoing state income-tax filings—but using a PMB address by itself doesn’t automatically establish domicile, and other states can still treat you as a resident under their own rules.

Unemployment taxes generally have to be paid to the states where the work was actually performed or to the state where the company is headquartered.

Changing your address with your employer and collecting unemployment may not be straightforward due to the complex state system. This is relevant when choosing your domicile.

Limited access to international airports

Florida is more convenient if you spend a lot of time on the East Coast or in Europe.

Limited health insurance options

Florida has a wider range of ACA-compliant health insurance options than South Dakota.

As a digital nomad, you may need to consider selecting a state for domicile purposes, especially if you require an updated driver's license, wish to vote, need health insurance coverage, want to insure your equipment or vehicle, need a consistent bank account, or plan to file taxes.

South Dakota and Florida are two states to consider, each with its advantages and disadvantages. South Dakota has a low sales tax but requires a return every five years to prove genuine relocation, while unemployment taxes could be more difficult depending on your employer.