Texas Residency: Benefits and Requirements

Hey there! Thinking about making Texas your new home sweet home? You're not alone! This big-hearted state isn't just about cowboy hats and barbecue – it's a hotspot for folks who live life on the go, like digital nomads, world travelers, and rockstar remote workers.

Why?

Because Texas is more than just friendly faces; it's got some serious perks for your wallet and peace of mind, too.

In this guide, we'll dive into what it means to call Texas your official stomping ground, all the cool stuff you get from it, and how to make it happen. And hey, we'll even do a little side-by-side with some other popular spots like Florida and South Dakota so you get the full picture.

Ready to find out why having a home base in Texas could be your next great move?

Let's roll!

What is Domicile, and why is it important?

Think of Texas as your trusty home base, the place where you hang your hat, even if you're off globetrotting or thriving in your work-from-anywhere job. It's not just about where you crash at night – it's about having a spot that the law recognizes as your own 'piece of' Texas turf.

Domicile is like your home field and, for our purposes here, Texas is the one we're rooting for. It's your permanent spot, the place you're tied to no matter where you jet off to.

Domicile state vs. Legal residence

If ‘domicile state' is your official home field, 'legal residence' is more like your temporary crash pad. This difference is important because it determines where, if at all, you must pay state taxes.

Tax implications

Taxes? In Texas, you can forget about state income tax. This is a big deal, especially if you're a high-earner.

Eligibility for state services

Even if you’re not always in Texas, being a legal resident means you’re still a member of the community, participating in both the responsibilities and benefits of being a Texas resident.

A court appointed legal guardian can significantly affect a minor's residency eligibility, particularly for tuition purposes and access to state services, by establishing the minor's domicile in Texas.

Legal rights and obligations

Your domicile state determines many of the rules you need to adhere to when it comes to all things legal. For example, upon death, Texas would be the state whose courts oversee your estate and probate process, which can affect how your assets are administered and how federal estate-tax rules interact with your plan. Texas itself does not impose a separate state estate or inheritance tax.

Getting the lowdown on what makes Texas your home base is key to taking full advantage of what this unique state offers. Understanding this stuff means you can make smart decisions and enjoy the full Texas experience, even if you're not putting boots on the ground all that often.

Benefits of establishing domicile in Texas

Hey, globe-trotters and high-flyers! Thinking about where to plant your roots while you conquer the world from your laptop? Let's talk about why Texas is the new 'it' place for savvy nomads and world citizens.

Here are the key benefits of making Texas your domicile:

Tax perks? Yeehaw!

How does keeping your hard-earned money sound? In Texas, there's no chunk of your income heading off to the state, which means more dough for your adventures or your piggy bank.

By moving from a high-tax state to Texas, you may eliminate state and, in some cases, local income taxes on your personal earnings, which can materially increase your after-tax income if you were previously subject to double-digit state and local rates.

• No corporate income tax

Running your empire from a hammock or a high-rise? Texas doesn’t levy a traditional corporate income tax, though many businesses are subject to a separate franchise (margin) tax on their Texas revenues. Depending on your structure and revenue, this can still mean a lighter overall state tax burden than in many high-tax states.

• No estate or inheritance tax

Got a treasure chest of assets? Pass it on to your descendants without the state dipping in. In Texas, what's yours stays in the family, no estate or inheritance taxes in sight.

• Sales-tax-focused system

Texas leans more on sales tax and less on income tax. The state sales-tax rate is 6.25%, and local jurisdictions can add up to 2% more, so your total rate will typically fall somewhere around 8% depending on where you shop. That structure shifts more of the tax burden to consumption rather than wages and salaries.

• No additional state tax on capital gains

And for the money maestros, Texas plays it cool with your investments — it doesn’t add a separate state tax on capital gains, so you only worry about federal capital-gains rules rather than an extra state layer.

Flexibility

• Ease of establishing residency

Establishing Texas residency is crucial for college admissions and eligibility for resident tuition rates, and Texas rolls out the welcome mat with a residency setup that’s almost as easy as ordering your favorite takeout online.

• Cost efficiency

From getting your paperwork to keeping your car legally on the road, Texas is all about keeping the costs down. That means more cash for living it up or tucking away for the future.

Texas residency requirements

Ready to hang your hat in Texas?

Here's the lowdown on locking in your Lone Star status.

1. Legal prerequisites:

- Intent to Establish Domicile: Prove you're not just here for the brisket. Get a Texas driver's license, register to vote, update your address to something in Texas to show you're serious and join a local church or synagogue, find a local health or golf club, or find a local cause to volunteer for.

- Physical Presence: You've got to spend some real time in Texas. No specific number of days, but enough to get a feel for those wide-open skies.

2. Timeframe:

- General Timeframe: Generally, you should stick around for about a month before you declare yourself a true Texan.

- Exceptions: If you're swapping a valid out-of-state license for a Texas one, you might be able to skip the 30-day wait.

3. Required documentation:

- Proof of Residency: Bring on the paperwork! Think vehicle registration, Texas ID, utility bills, or a lease with your new Texas address.

- Additional Documentation: In some cases, you might need to show where you work, where you've studied, or where you pay taxes to prove Texas is your home state.

4. Special considerations for digital nomads and expats:

- Flexible Documentation: If your home office is wherever you open your laptop, Texas will work with you on what counts as proof of Texas residency.

- Online Processes: Renewing your vehicle registration or your driver's license? Texas has you covered with online services.

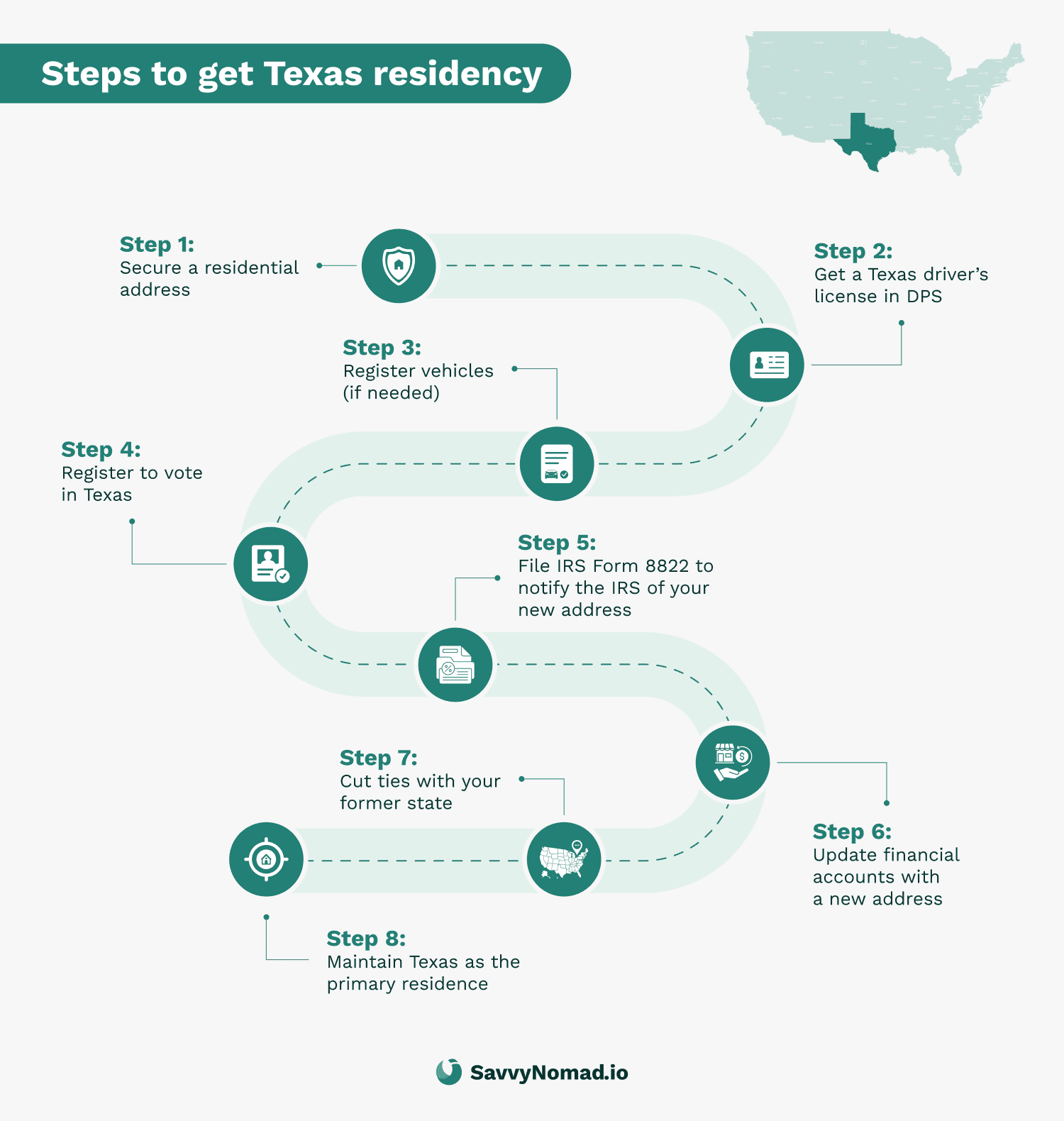

How to establish residency in Texas

1. Plan your stay

- Arrangement: Whether you're renting, buying, or going the trendy co-living route, get a place with your name on it in Texas.

- Documentation Preparation: Start putting together the ID, bank statements, and any other paperwork you'll need to show you're putting down roots in Texas.

- Timeline Planning: Texas wants you around for at least a month before you can say you're a local. Students, you've got a year-long date with Texas before you're official and can qualify for in-state tuition benefits.

2. Obtain a Texas address

- Secure a Physical Address: Lock down a place to call your own. Buy a little slice of Texas, or find a rental where you can hang up your 10-gallon hat.

- Update Your Mailing Address: Switch your mailing address pronto. The sooner you start getting mail with your name and Texas address, the better. It's solid proof for the residency checklist.

3. Gather necessary documentation

- Proof of Residency: Line up the usual suspects of paperwork: a voter registration card, your car's Texas registration, and proof you're insured to drive in the state.

- Additional Documentation: Sometimes you've got to show a bit more, like where you work, where you're paying taxes, or where you've been learning. Keep those docs handy too.

4. Department of Public Safety (DPS) visit

Head to the nearest Department of Public Safety office and apply for that Texas driver's license or ID card.

5. Register to vote

Show you’re all in on Texas decisions by registering to vote in Texas (if you’re eligible). This is an important way to participate in civic life and is a strong supporting indicator of Texas residency, but it’s considered along with many other factors and doesn’t, by itself, determine your tax status.

6. Vehicle registration (if applicable)

If you own a motorcycle, car, or boat, get it decked out with local plates.

7. File IRS Form 8822

This form officially notifies them of your change of address, helping keep your state and federal records consistent. If a student is claimed as a dependent on their parent's federal income tax return, the parent must establish domicile in Texas for the student to gain residency status.

8. Update your address with relevant entities

Tell your bank, your job, and anyone else who sends you important mail that you should be reached at your new Texas address.

9. Maintain records

File away every piece of paper that proves you’re a Texas resident. You’ll want that paper trail neat and tidy. Maintaining proper records is crucial for individuals, including international students, to gain resident status by meeting specific criteria.

Maintaining Residency Status

Maintaining residency status in Texas is crucial to keep enjoying all the perks that come with being a Texas resident, like resident tuition rates and access to state services.Once you’ve gone through the process of establishing domicile in Texas, it’s important to keep up with a few key actions to help you stay compliant.

Actions to help you stay compliant

To keep your Texas residency status in good standing, here are some key best-practices:

- Stay in Texas or Abroad: Keep physically residing in Texas with the intent to maintain your domicile there, or live full-time abroad while avoiding long stays that could cause another state to treat you as a resident. As a rule of thumb, many people try not to spend 183 or more days in any single other state, because some states use that threshold as one factor in deciding residency.

- File Taxes: File your federal income tax returns as a Texas resident. This helps solidify your claim to Texas residency for tax purposes.

- Vote in Texas: Once you establish residency and if you’re eligible, you’ll register to vote in Texas and can participate in state and local elections, further integrating you into the community.

- Update Your Address: Keep your address updated with all relevant entities, like banks and employers, to reflect your Texas residency.

- Keep Records: Maintain records of your residency, including proof of domicile and employment. This can include utility bills, lease agreements, and employment contracts.

Long-term residency considerations

Living in Texas comes with some long-term benefits and responsibilities. Here’s what you need to know:

- State Services: As a Texas resident, you’re eligible for state services, including healthcare and education.

- Financial Aid: Texas residents may be eligible for state-funded financial aid and scholarships, which can be a big help if you’re planning to attend college.

- Vehicle Registration: You’ll need to register your vehicles in Texas and obtain a Texas driver’s license. This is part of showing your commitment to living in the state.

Residency Eligibility through High School Graduation

Graduating from a Texas high school is another pathway to establishing residency in the Lone Star State. This method is particularly beneficial for students and international students looking to claim residency.

Impact on residency status

Establishing residency through high school graduation can significantly impact your status:

- Resident Tuition Rates: You’ll be eligible for resident tuition rates at Texas public colleges and universities, which can save you a lot of money.

- Financial Aid: You may also qualify for state-funded financial aid and scholarships, making higher education more affordable.

- Voting: Once you establish residency, you’ll need to register to vote in Texas and participate in state and local elections, further integrating you into the community.

By following these steps and understanding the long-term implications, you can successfully establish and maintain your Texas residency, enjoying all the benefits that come with being a part of this vibrant state.

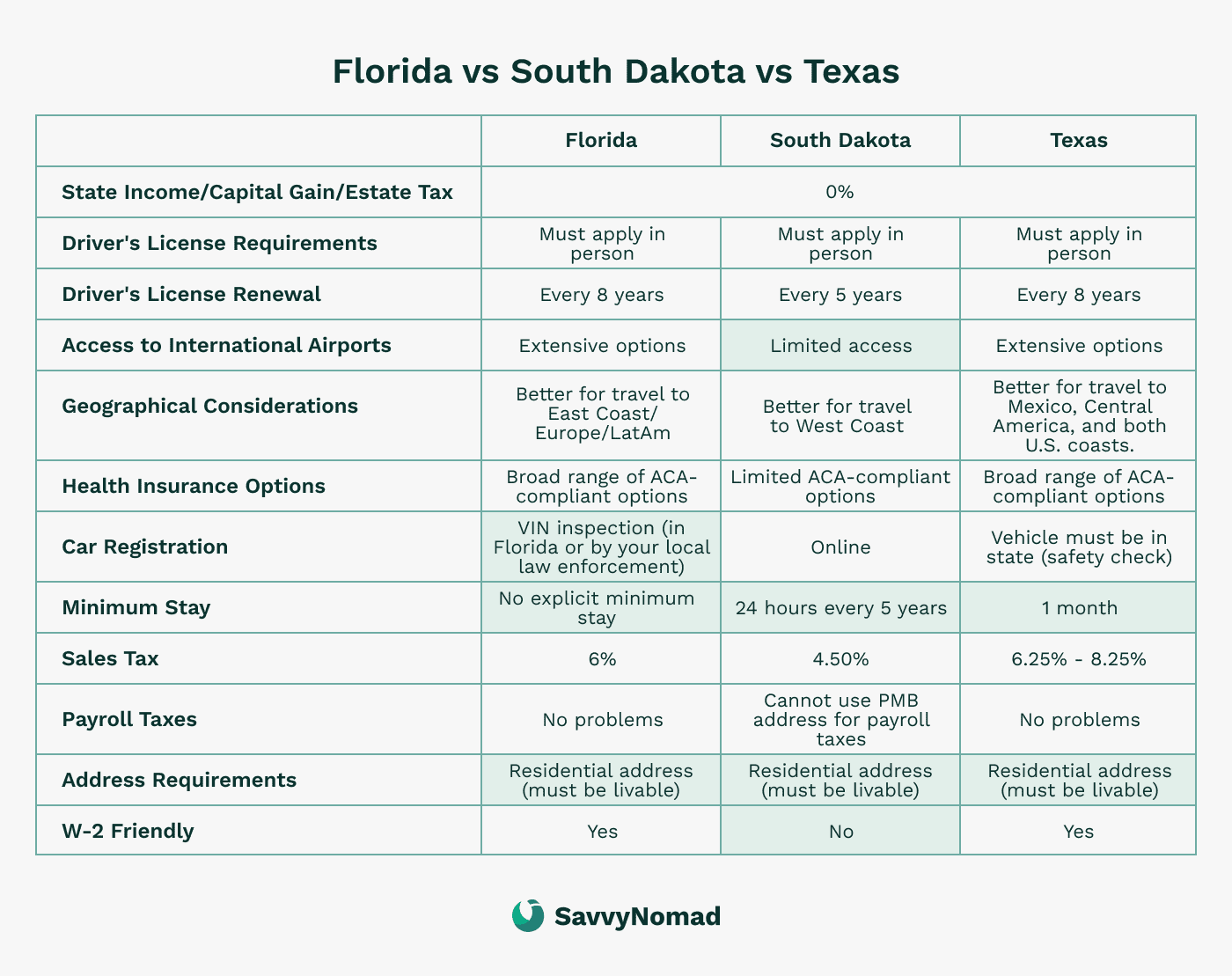

Comparison with Florida and South Dakota domiciles

When it comes to choosing a domicile for tax benefits, Texas, Florida, and South Dakota are often in the spotlight. Here's a side-by-side comparison to give you a clearer picture:

Tax benefits:

State income tax

All three states roll out the red carpet for your wallet by not dipping into your income. Whether you're a freelancer or running a corporation, you're off the hook for state income tax in Texas, Florida, and South Dakota.

Sales tax

- Texas starts with a 6.25% state sales tax. But depending on where you shop, local taxes might bump that number up a bit.

- Florida has a slightly lower state sales tax at 6%, but just like Texas, local areas could tack on extra.

- South Dakota boasts the lowest state sales tax of the trio at 4.5%, but again, local taxes could increase your checkout total.

Capital gain tax

If you're playing the long game with your investments, Texas, Florida, and South Dakota won't ask for more at tax time. Capital gains get the same no-state-tax treatment, with only federal taxes to consider.

Establishing residency:

General considerations

- Nomad-Friendly States: All three are a hit with roaming types like RVers and globe-trotting workers because they don't take a slice of your income in state income taxes.

- Common Steps: Whichever state you pick, you’ll be looking at similar steps: snagging a local address, getting that state ID or driver’s license, and setting up your mail so important documents reliably reach you.

Texas

- Get a Texas address, apply for a Texas ID, and let the state know you'll vote here.

- If you’ve got wheels, you’ll still need to register your vehicle in Texas, but as of January 1, 2025, most non-commercial vehicles no longer require an annual state safety inspection to complete registration. Some counties still require emissions testing, and commercial vehicles remain subject to inspections, so check the current rules for your vehicle type and county.

Florida

- Florida's list looks a lot like Texas'—address, ID, voter registration.

- Registering your car here might be kinder to your bank account than in South Dakota, and you can skip the vehicle inspection. Instead, all you need is your VIN and a physical inspection by a local police officer in your current county. Considering that this could save you a road trip across the country, it's well worth it.

South Dakota

- South Dakota now requires that you first obtain a residential address in the state and then spend one night in a hotel or campground in the state before applying for a South Dakota driver's license. You'll need a receipt from the hotel or campground that displays your name, and the names of everyone in your family seeking to establish South Dakota residency, and your South Dakota address.

- The fees for vehicle registration are fair, and you won't have to worry about inspections or emissions tests, which means no road trips and no VIN inspections.

FAQs

What are options for proof of residency in Texas?

To provide proof of residency in Texas, individuals must present two printed documents that contain their name and residential address in Texas, with at least one document verifying that they have lived in Texas for at least 30 days.

Acceptable documents include:

- Current deed, mortgage, or residential rental/lease agreement.

- Valid Texas voter registration card.

- Texas motor vehicle registration or title.

- Texas concealed handgun license or license to carry.

- Utility or residential service bill dated within 180 days.

- Selective Service card.

- Homeowner's or renter's insurance policy.

- High school, college, or university report card.

- Preprinted tax forms, financial statements, or government agency documents.

- Military or Veteran's Administration documents indicating address.

- Medical bills, hunting/fishing licenses, pay stubs, etc.

How does establishing a domicile in Texas impact my federal and state tax obligations?

Establishing a domicile in Texas can reduce your state tax obligations (think no state income taxes) , but your federal tax obligations are unchanged.

Are there any benefits in Texas for remote workers or digital nomads in terms of services or infrastructure?

Texas is big on tech and has a welcoming vibe for remote workers. Think co-working spaces and tech meetups galore, plus a business-friendly atmosphere.

What are the implications for my voting rights if I choose Texas as my domicile?

Planting your flag in Texas means you get to vote in Texas. Remember to update your registration and note that you won't be voting back in your old stomping grounds.

How does Texas handle driver's licenses for those not physically present year-round?

Even part-timers can get a Texas driver's license. Just make sure you've got a legit residential Texas address and keep up with any special rules for renewals.

Can I maintain my Texas domicile if I'm abroad for an extended period?

In many cases, yes. From a domicile perspective you can often keep Texas as your home base while you’re abroad, as long as you maintain clear ties to Texas (such as a residential address, records, and voter registration) and don’t establish a new domicile elsewhere. Other states and tax authorities will still look at your overall facts, so it’s wise to get individualized advice if you’ll be gone for a long period.

How often must I be in Texas to maintain my domicile status?

There’s no fixed day-count rule in Texas law for maintaining domicile. Instead, what matters is your overall pattern of life: where you keep your home, where you intend to return, and where your key ties are (ID, registrations, records, family, etc.). Many people aim to spend meaningful time in Texas each year, but the bigger point is showing that Texas — not another state — is your true long-term home.

Are there any Texas-specific health insurance considerations for remote workers or digital nomads?

Health insurance can be tricky, so look for plans tailored to folks who might be working from a hammock one day and a coffee shop the next.