183 day rule in Florida explained

If you’ve ever looked into moving your residency to Florida, you’ve likely encountered endless talk about the “183-day rule.” It’s a confusing number thrown around by high-tax states eager to keep you on their tax rolls, but here’s the catch: Florida doesn’t use a “183-day rule” to determine residency. Instead, Florida focuses on your intent and objective ties to the state rather than a specific day-count.

In practice, there’s no statutory minimum-day requirement written into Florida’s residency rules. From day one, you can work to establish Florida as your domicile—your permanent home base—even if your actual time spent there is limited, as long as your actions and documentation genuinely support that intent. The key isn’t counting your Florida days; it’s avoiding 183 days or more in another state that might still consider you a resident for tax purposes.

That’s a big part of why Florida can work so well for expats, digital nomads, retirees abroad, and anyone who spends significant time outside of the U.S. This article will clearly explain how the infamous 183-day rule works, why Florida residency is so powerful, and exactly what you need to do to securely establish Florida as your domicile—without getting trapped by outdated residency myths.

Understanding the 183-Day rule in Florida: your legal 'home base'

To understand Florida residency clearly, you first need to grasp the meaning of domicile. Your domicile is your permanent home and permanent residence—the place you intend to return to, no matter how much you travel or move around temporarily.

Florida makes determining domicile straightforward by focusing on three clear elements:

Physical presence

Florida doesn’t demand extensive stays. Even brief, purposeful visits (such as opening a bank account, obtaining a driver’s license, or registering to vote) can suffice to demonstrate your commitment.

Paper trail

Establish tangible evidence of your Florida home—secure a residential lease or own property, get your driver’s license at the local tax collector's office, register your vehicle, and set up utilities under your Florida address. Official documents proving residency are essential.

Community ties

Build local connections. Examples include registering to vote, applying for Florida’s Homestead exemption (if you own property), setting up local healthcare providers, and joining community clubs or organizations. Joining local social organizations to strengthen community ties is also crucial.

By clearly establishing these factors, you create a solid legal foundation, proving your intent to permanently call Florida your home.

Statutory residency and the 183-day rule

Here’s where many people stumble: tax residency and statutory residency (often confused as “VC residency”) refer to ways high-tax states can claim you as their own, even if you’ve changed your domicile to Florida.

This is how it works:

- If you spend 183 days or more in a high-tax state and maintain a “permanent place of abode” there (a home, apartment, even a long-term Airbnb), that state can legally classify you as a resident and tax you accordingly.

- Importantly, the count is strict: partial days, travel days, doctor visits, or even brief stops can sometimes count towards that 183-day threshold.

But here’s the good news: Florida doesn’t have this statutory residency concept. Florida does NOT require you to spend any minimum number of days in-state. Once your domicile is established, Florida is your home immediately, even if your visits are short or infrequent.

However, the crucial point for expats, retirees, and nomads is clear:

Don’t accidentally spend 183 days or more in another U.S. state, or you risk losing the advantage of your Florida domicile.

In short: Keep an eye on your day-count elsewhere, not in Florida.

Why you can claim Florida from day 1

Unlike many other states, Florida allows you to establish legal residency and claim Florida residency immediately—no waiting period or day-count required. Here’s exactly how it works:

Intent

The moment you decide Florida is your permanent home and determine residency, you’ve already completed half the requirement. Intent is foundational, and filing a formal Declaration of Domicile (at your local county courthouse) makes this official.

Immediate action

From day one, you can take straightforward steps like signing a residential lease or purchasing property, obtaining a Florida driver’s license from your local tax collector's office, registering to vote, and opening local bank accounts.

Minimal presence needed

Florida has no fixed minimum-stay or day-count requirement written into its domicile rules, but physical presence is still one of the factors that courts and property appraisers look at when evaluating residency.

You can often spend relatively little time in Florida each year once your domicile is established, provided your overall pattern of behavior and documentation supports a genuine intent to treat Florida as your permanent home.

Ideal for expats, digital nomads, and retirees abroad

Florida’s flexible residency rules uniquely benefit those who spend significant time overseas, such as expats, digital nomads, and retirees living abroad:

Expats & digital nomads

Because you’re living primarily outside the U.S., you’re less likely to trigger residency elsewhere under typical 183-day tests in high-tax states. That can make Florida a very attractive domicile option.

You get the benefit of a stable U.S. home base without state personal income taxes or state-level day-count rules, while still needing to track your time carefully in any state you visit frequently.

Retirees abroad

Retirees spending the majority of their year in countries like Mexico, Portugal, or Costa Rica also benefit greatly. They can easily maintain their U.S. financial, healthcare, and voting connections through Florida without risking high-tax state claims.

Additionally, Florida’s lack of state income tax means there is no extra state tax on lottery winnings, so residents generally only face federal tax on those prizes—potentially a meaningful state-level savings compared with winners in states that do tax lottery winnings.

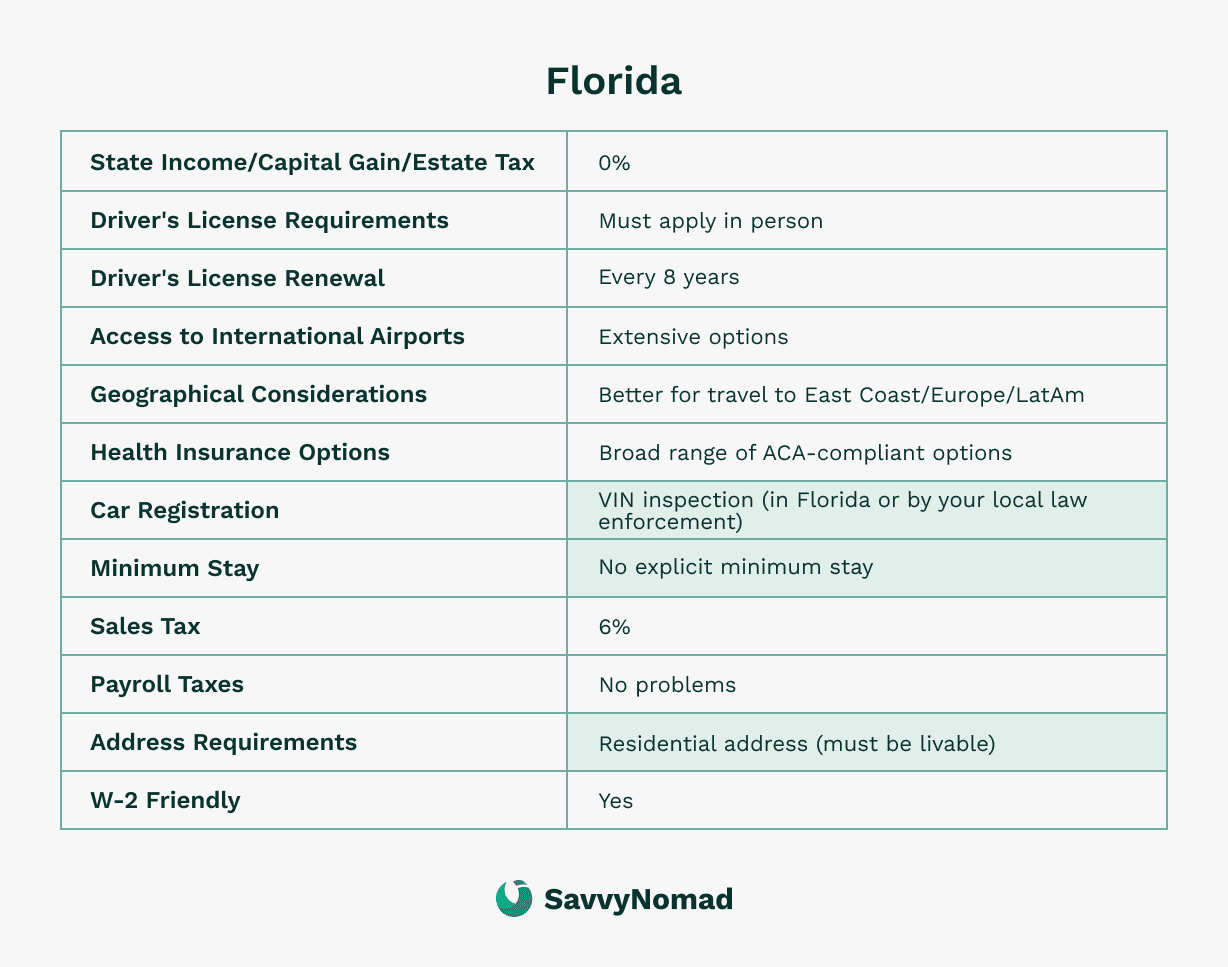

Why Florida is perfect

- Zero State Income Tax: Enjoy your pensions, retirement income, or foreign-earned income tax-free at the state level, thanks to Florida's favorable tax laws.

- Easy Administration: Quick driver license, voter registration, and property registration.

- Flexible Residency: No required minimum stay in-state.

In other words, Florida residency can work very well for a global lifestyle—clear rules, strong tax advantages at the state level, and relatively straightforward administration once your domicile is properly set up.

Steps to establishing domicile in Florida for tax purposes

Establishing a domicile in Florida involves several steps to demonstrate your intent to make the state your legal home.

While Florida evaluates residency holistically, certain actions are especially significant. According to Florida’s statutes, such as Fla. Stat. Ann. §196.015, actions like filing a Declaration of Domicile, obtaining a Florida driver’s license, registering your vehicle, and registering to vote are primary indicators demonstrating your intent to reside in Florida permanently.

It is also crucial to understand that even though Florida has no state income tax, residents still have tax obligations and must pay taxes accordingly.

It seems that addressing these steps explicitly and quickly strengthens your residency status, clearly differentiating your new domicile from your former state.

Here’s a structured breakdown of the process:

1) Secure a Florida address

The cornerstone of establishing a domicile is having a genuine Florida home base and address, typically through a leased or owned residence. For full-time travelers who don’t want or need a traditional apartment sitting empty, a specialized residential-address or domicile service can provide a bona fide Florida street address and mail handling that supports your documentation.

Make sure that any address you use is a true physical street address (not just a P.O. box) and that it’s suitable for the specific purposes you need—DMV, banks, voter registration, and so on—since different agencies apply their own rules.

Acceptance always depends on each institution’s rules, and the address by itself doesn’t guarantee residency status, tax outcomes, or approval by any particular third party.

2) Obtain a Florida driver’s license

It’s important to get a Florida driver's license or state ID. The act of surrendering your former state’s driver’s license is a simple yet significant outward demonstration of your intention to establish roots in Florida.

3) Register your vehicle(s) in Florida

If you own any cars or boats, registering them in Florida is crucial to demonstrate long-term intent to domicile. This step also requires obtaining new Florida vehicle insurance from a Florida-licensed insurance agent.

4) File a declaration of domicile

Filing a Florida declaration form (Florida Declaration of Domicile) in your new county is a recognized but not mandatory way to show your domicile has changed to Florida.

Signing this form (under oath, before a notary public) is especially beneficial when you want to establish Florida as your primary home for legal purposes, such as taxes and estate planning. It is essential to visit the local circuit clerk or the circuit court to submit this documentation or send it via mail, as the clerk plays a crucial role in verifying residency claims and facilitating the legal residency process.

5) Voter registration

Register to vote and register as a voter in Florida. This represents a significant step that demonstrates your intention and willingness to integrate into the state’s social and legal framework.

6) File IRS Form 8822

Finally, it is important to update your federal records by filing Form 8822 with the IRS.

This form officially notifies the IRS of your change of address, helping keep your state and federal documentation consistent and helping you continue to receive important correspondence about your federal taxes.

Additionally, keeping meticulous records, such as calendars and receipts, is essential to support your residency claims and comply with legal requirements.

Filing the form in a timely manner is crucial in affirming your new domicile for tax purposes.

7) Update financial accounts

Update the address on your bank and investment accounts, making them your new Florida address. Additionally, transferring your bank accounts to Florida-based institutions can reinforce your claim to Florida residency and demonstrate your commitment to the state. It is also important to have your credit card statements sent to your Florida address to support your residency claim, especially during audits where such documentation is scrutinized to verify ties to a previous state.

8) Maintain Florida as your primary place of residence

Florida has no clear-cut minimum number of days required to spend in the state to establish it as your domicile. However, designating it as your primary place of residence and principal establishment in third-party and official records reinforces your intention to make Florida your home going forward. It is also crucial to keep important documents, such as mortgage documents, insurance policies, and identification papers, in Florida to fulfill residency requirements.

How to cut ties with your old state

While establishing your Florida residency is straightforward, it’s equally critical to cut ties clearly and completely with your previous state. If you overlook this step, your former state might still consider you a resident, triggering unwanted taxes or even audits.

This is especially challenging for those relocating from high-tax states like New York, where proving a residency change can be complex and subject to scrutiny from tax authorities.

Here’s exactly how to avoid this:

1. Close or rent out your former home:

- Sell your property or establish a long-term lease to show you’ve fully transitioned to Florida.

- Owning a Florida homestead property can provide significant benefits, including tax exemptions that reduce taxable value and robust asset protection laws that safeguard personal wealth.

- Cancel any previous homestead exemptions or state-specific tax benefits.

2. Move vehicles & update registrations:

- Transfer your vehicle registration and driver’s license to Florida immediately. New residents must update their driver's license and vehicle registration within a specified timeframe to comply with legal requirements and avoid potential penalties.

- Remove any leftover registrations or parking permits from your previous state.

3. Update your address with all providers:

- Officially change your address for banks, insurance companies, healthcare providers, and professional services. Florida does not impose a separate state estate tax, which can be advantageous for many residents as part of their overall estate plan.

- Even minor details like Amazon Prime or Netflix billing addresses can matter in audits.

4. Sever community & professional ties:

- Cancel or transfer memberships at local clubs, gyms, or community groups from your old state.

- Move or deactivate professional licenses and registrations that link you strongly to your previous state.

5. File final tax returns:

- Submit a final resident tax return to your previous state, clearly marking your move date, and ensure you understand if you still need to pay state taxes on your income as a resident of your original state.

- Going forward, only file as a non-resident if you still generate income there.

Following these straightforward actions can help you build a strong factual record for your Florida domicile and may reduce the risk of residency audits and tax headaches, but no particular outcome is guaranteed and other states will still apply their own rules when reviewing your situation.