Moving from New Jersey: Guide to leaving residency in 2025

Many New Jersey residents are thinking about abandoning their New Jersey residencies and for good reason. There are several benefits to leaving New Jersey, such as saving money on taxes and enjoying a better lifestyle. By moving to a state with no state income tax, you may be able to keep more of your hard-earned money, depending on your overall situation.

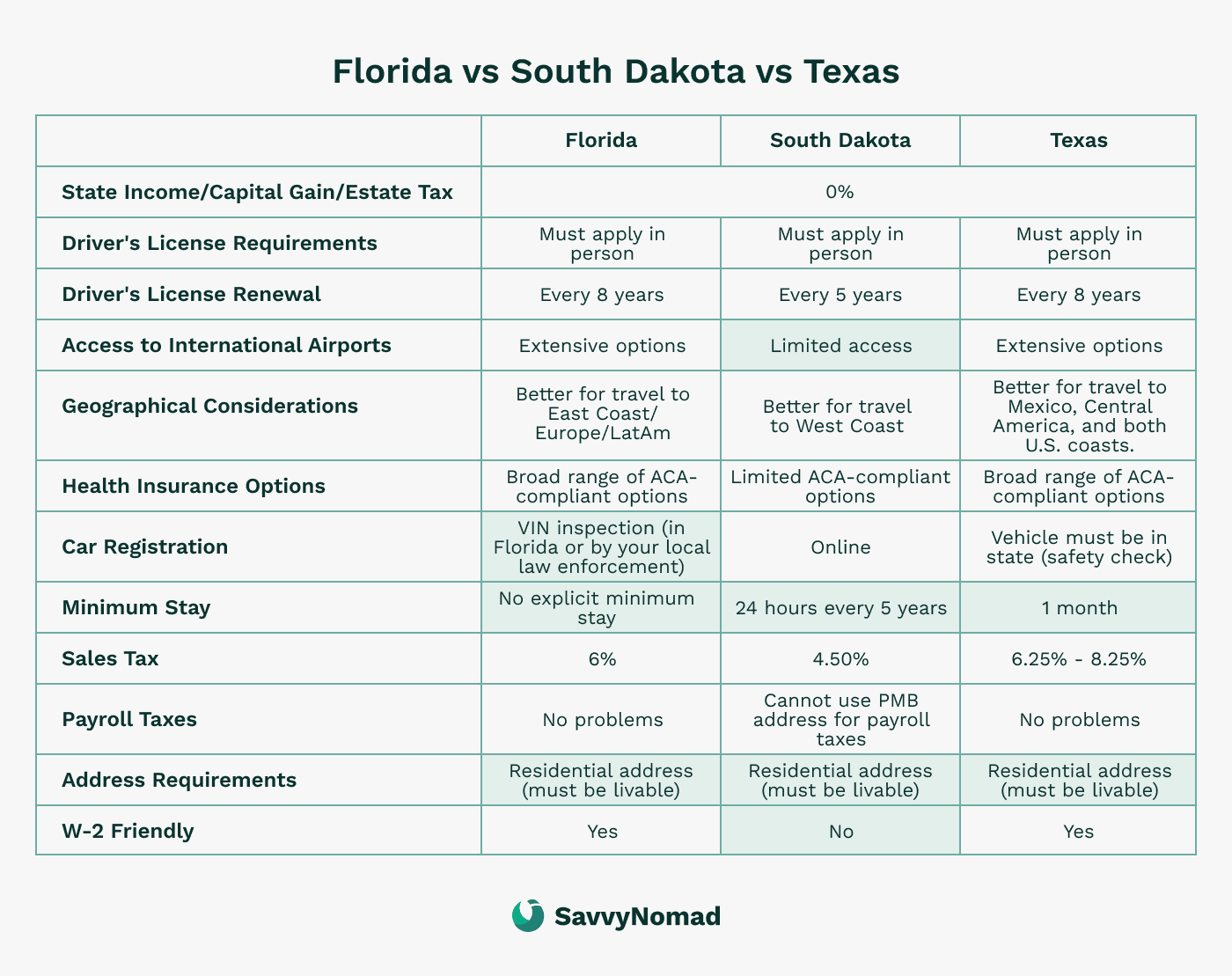

In recent years, a growing number of individuals, families, and even expats (people living outside their home country) are relocating from New Jersey to other states, whether in search of more opportunities or to save on taxes by relocating to states, like Florida or South Dakota, with no state income tax.

The Jersey Shore's picturesque beaches and outdoor recreational opportunities add to the state's appeal for both residents and visitors.

These states offer not only financial benefits but also warm weather, beautiful scenery, and a relaxed way of life.

This guide will help you understand the steps you need to take to leave New Jersey behind and become a legal resident of a tax-friendly state.

New Jersey residency rules

Definition of New Jersey residency

New Jersey residency is determined by domicile and physical presence.

You are considered a resident of New Jersey if New Jersey is your domicile or if you maintain a permanent home in New Jersey and spend more than 183 days in the state during the year

What is domicile?

Domicile is the place you consider your permanent home.

Your domicile is the main place you live and intend to return to after temporary absences, such as a vacation or business trip.

Factors that determine your domicile include:

- Intent: To where you plan to return after temporary absences and to remain permanently.

- Voter registration (if you are eligible): Where you are registered to vote. It is one supporting indicator of domicile, not determinative on its own. For eligibility and procedures, consult election officials in the relevant state.

- Driver’s License and Vehicle Registration: Where your driver’s license is issued and your vehicle is registered.

- Family Ties: Where your family lives and where you keep your most important possessions.

- Bank Accounts: The location of your bank accounts.

Permanent home

A permanent home is your principal residence, maintained on a permanent basis. This is the home you live in most of the time and plan to keep long-term.

Temporary homes, such as those used for short-term job assignments, do not count as permanent homes.

Part-Year residents

If you moved into or out of New Jersey during the year, you are considered a part-year resident.

As a part-year resident, you may need to file a resident tax return to report the income received during the time you lived in New Jersey.

Part-Year resident and nonresident

If you change your domicile and meet the definition of a resident or nonresident for only part of the year, you are a resident for part of the year (part-year resident) and a nonresident for the rest of that year (part-year nonresident).

If you received income from New Jersey sources as both a resident and a nonresident, you must file both a NJ-1040 (resident) and a NJ-1040NR (nonresident).

Examples

- Example 1: A single taxpayer was a resident of California for 10 months and a resident of New Jersey for two months. They are subject to tax on the income received during the two months they were a New Jersey resident if their total yearly income (earned in both California and New Jersey) exceeds the New Jersey filing threshold.

- Example 2: A single taxpayer was a New Jersey resident from January through September 30, then moved to Florida. They must file a part-year resident return to claim a refund of any New Jersey income tax withheld while a New Jersey resident (from January through September).

Steps to terminating New Jersey residency

1) Establish new residency

Secure a residential address in your new state. If you buy a home, you may want to look into available credits, such as Florida’s homestead exemption. You may also consider filing a Declaration of Domicile with the state, as suggested in SavvyNomad’s domicile guides.

Any potential tax benefits depend on your overall situation; banks and state agencies make their own decisions, prior-state rules may still apply, and no outcome is guaranteed.

2) Relocate belongings

Physically move your personal belongings to your new state of residency. This helps demonstrate your intent to establish a permanent home in the new state.

3) Spend time, and make connections, in your new state

The more time you spend in your new state, the better. While many nomads simply drop in just long enough to get their driver’s license, the more you truly make your new domicile home, the easier it will be to show that New Jersey is no longer your home. Find new doctors, dentists, and veterinarians (the deciding factor in one court case), and join clubs and service organizations in your new state.

4) Transfer IDs and vehicle registrations

Transfer your driver’s license and vehicle registration to your new state. This is a clear indicator of your intent to establish permanent residency in the new state.

5) Register to vote in a new state (if eligible)

If you are eligible, you may register to vote in your new state of residency. Voter registration is a supporting indicator of domicile—not determinative on its own—and can help demonstrate your commitment to being part of your new community and state. For questions about eligibility and the registration process, consult election officials in your new state.

6) Update financial accounts

Update your address with all financial institutions, including banks, credit card companies, and investment accounts. This ensures all your financial records reflect your new residency status.

7) Notify your employer

Notify your employer of your change in address and residency. Ensure your payroll and tax withholdings are updated to reflect your new state of residence.

8) Notify IRS

Notify the IRS of your change in address by filing IRS Form 8822. This ensures that your federal tax records are updated and that you receive any important correspondence at your new address.

9) Cut ties with New Jersey

Take steps to cut all ties with New Jersey. This includes:

- Selling or renting out your New Jersey property.

- Closing bank accounts in New Jersey.

- Transferring memberships and subscriptions to your new state.

10) Keep records

Keep detailed records of your move and actions taken to establish residency in your new state. This includes leases, utility bills, any voter-registration records (if you are eligible to vote), and other documentation that supports your residency claim.

11) Be ready for an audit

Be prepared to provide evidence of your new residency if questioned by New Jersey tax authorities. Maintain a file of all relevant documents to demonstrate your intent and actions in establishing residency in the new state, and a calendar of the days you spent in New Jersey and in your new state of residence.

New Jersey exit tax

The “Exit Tax” refers to the payment required when selling a home in New Jersey and moving out of state. It is a prepayment of the state income tax on the sale of real property by nonresidents.

This tax ensures that New Jersey collects taxes owed on any capital gain generated by the sale of the property.

How it works and impacts property taxes

Withholding requirement:

- When selling your home, you are required to withhold 2% of the sale price or the net gain, whichever is higher.

- This amount is paid to the New Jersey Division of Taxation at closing.

Purpose:

- The withholding acts as a prepayment of the income tax that may be due on the capital gain from the sale.

- It prevents individuals from avoiding state taxes by moving out of state before paying taxes on the gain.

Filing for a refund

Eligibility for Refund:

- If the amount withheld exceeds your actual tax liability, you can file for a refund.

- To do this, you need to file a New Jersey nonresident tax return.

Required Forms:

You will need to complete and submit specific forms to claim your refund, including:

- GIT/REP-1: Nonresident Seller’s Tax Declaration.

- GIT/REP-2: Nonresident Seller’s Tax Prepayment Receipt.

- NJ-1040NR: New Jersey Nonresident Income Tax Return.