How to leave Indiana residency?

If you’re considering leaving Indiana residency, whether it’s to save on taxes, relocate for a new job, or enjoy a different lifestyle, it’s important to understand the process. Indiana has its own tax rules, and leaving the state involves more than just moving physically.

You’ll need to take specific steps to show that you’ve made another state your permanent home, which can help you avoid being taxed by Indiana.

Whether you’re a retiree looking for warmer weather, a digital nomad seeking a more tax-friendly state, or just someone looking for a fresh start, this guide will walk you through the process of leaving Indiana residency.

Step 1: Establish a new domicile

The first and most important step in leaving Indiana residency is to establish a new domicile in another state. This means not only physically moving but also showing that you intend to make your new state your permanent home. Here’s how to get started:

Here’s how to do it:

1) Establish new residency

- Secure a residential address: Finding a place to live in your new state is the foundation for proving your new residency. You can either rent or buy, but having a permanent address is key. If you’re moving to a state like Florida, you might be eligible for benefits like the homestead exemption, which can help reduce property taxes.

- File a Declaration of Domicile: In states like Florida, you can file a legal document stating that your new state is now your permanent home, making it official.

Residency guides:

2) Relocate your belongings

Moving your personal items to your new home, like furniture, vehicles, and other essentials, is a solid indicator that you’ve moved for good.

3) Spend time in your new state

The more time you spend in your new state, the better. It reinforces that you are truly living there. Be mindful to limit the time you spend in Indiana during this period, as too many visits back could complicate your residency status.

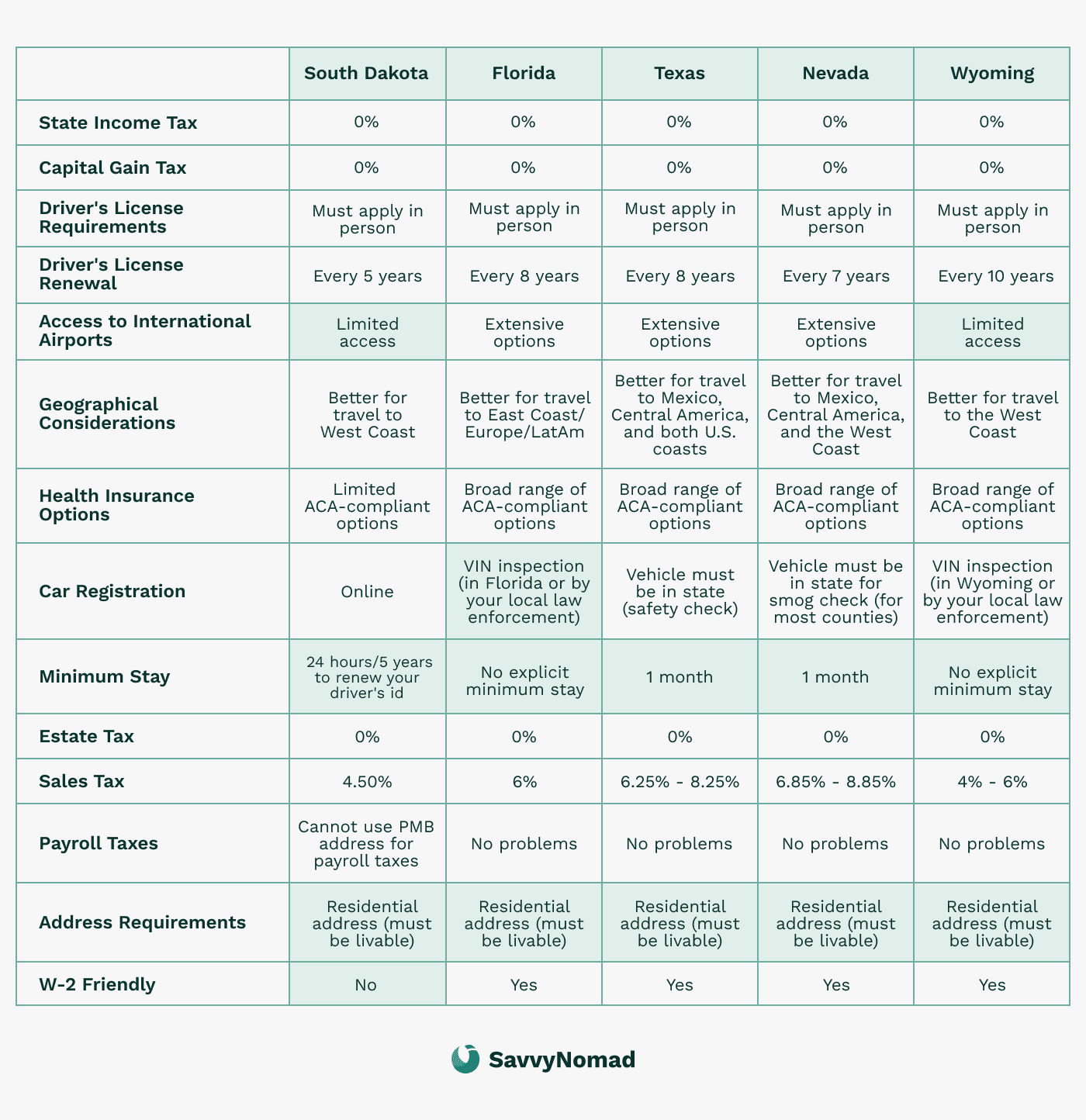

4) Transfer IDs and vehicle registrations

Make sure to update your driver’s license and vehicle registration to your new state. This is a strong signal that your primary residence is no longer in Indiana.

5) Register to vote

Registering to vote is another great way to show your commitment to your new state. Voting records are one of the key factors that tax authorities look at when determining residency.

6) Update financial accounts

Notify your banks, credit card companies, and other financial institutions about your new address. This ensures all your official documents and accounts reflect your new residency.

7) Notify your employer

If you’re working, make sure to let your employer know about your new address so that your payroll and tax withholdings reflect your new residency. This will help ensure that Indiana doesn’t continue to withhold taxes unnecessarily.

Step 2: Sever ties with Indiana

Once you’ve established a new domicile, the next step is to cut significant ties with Indiana to avoid being considered a resident for tax purposes. This involves not only physically moving but also updating all aspects of your life to reflect your new home state.

Here’s what you need to do:

1) Close Indiana financial ties

- Close local bank accounts: If you have any Indiana-based bank accounts, it’s a good idea to close them or transfer your funds to a bank in your new state. This shows that your financial activity is now rooted in your new residence.

- Cancel Indiana voter registration: Make sure you cancel your voter registration in Indiana and register to vote in your new state. Voting records are often used to determine residency.

- Update personal records: Update your address with the IRS, Social Security, and any other relevant entities. Keeping all personal and financial records in your new state helps solidify your move.

2) Sell or lease property

If you own property in Indiana, selling or leasing it out can help demonstrate that you no longer plan to live there. Long-term leases show you don’t have personal access to the property, which helps prove you’ve moved.

3) Cancel local subscriptions/services

Cancel or transfer any Indiana-based services, like gym memberships or utility services, to your new state. Keeping them active may suggest you still have ties to Indiana.

4) Transfer healthcare and insurance

Start using healthcare providers in your new state and update your health insurance records to reflect your new address. This is another way to show that your day-to-day life is centered in your new location.

Step 3: Time spent outside Indiana

To ensure that Indiana no longer considers you a resident for tax purposes, it’s important to limit the time you spend in the state. Indiana uses the 183-day rule to determine if someone is a statutory resident for tax purposes. Properly managing your time and documenting it is crucial for successfully leaving Indiana residency.

Here’s how to ensure that you aren’t classified as an Indiana resident:

183-day rule

- Stay under 183 days: Indiana’s tax authorities consider you a resident if you spend 183 days or more in the state during a calendar year. To avoid being classified as a resident, you should spend fewer than 183 days in Indiana each year. This includes any visits back to Indiana, so plan your travel carefully.

- Maintain travel records: It’s crucial to maintain detailed records of your time spent outside Indiana, such as flight tickets, hotel receipts, or any other documents that can prove you were not in the state. These records will be useful if tax authorities ever question your residency.

Step 4: Indiana-sourced income

Even after you leave Indiana residency, you may still have tax responsibilities for any income generated within the state.

Here’s how to manage Indiana-sourced income after your move:

1) Ongoing tax responsibilities

If you continue to earn income from Indiana (such as rental income, business profits, or wages), you’ll need to file non-resident tax returns. Non-resident tax returns ensure that only income earned from Indiana sources is taxed, while the rest of your income remains untaxed by Indiana.

2) Rental or business income

If you own rental properties or a business in Indiana, the income they generate will still be subject to Indiana state taxes, even after you move. Make sure you consult a tax professional to ensure compliance and proper tax filing for any Indiana-sourced income.