Is South Dakota still a good place to Domicile? [2024]

![Is South Dakota still a good place to Domicile? [2024]](/content/images/size/w1200/2024/02/DALL-E-2024-02-16-19.13.59---A-serene-landscape-representing-South-Dakota-as-a-digital-nomad-hub--featuring-a-minimalist-design.-The-image-showcases-a-virtual-office-setup-in-a-na.webp)

South Dakota, probably best known for Mount Rushmore (and being sparsely populated), has become more than just a flyover state. In recent years, it’s become a hotspot for digital nomads, expats, and RVers looking for a place to plant their legal roots and call home while they roam the globe.

But hold your horses!

2023 came with some pivotal changes to South Dakota's domicile-related laws and policies, making it critical for you, the frequent traveler, to stay informed.

In this guide, we'll dive into the heart of these changes and explore how they impact the digital nomad, expat, and van life communities. So, buckle up and get ready to navigate the new terrain of South Dakota's domicile landscape (sounds fun, right)!

TLDR:

- Tax planning complexity increases, and these changes pose challenges for digital nomads.

- Voting is no longer possible without a residential address.

- You cannot pay unemployment taxes (or claim unemployment benefits) using a private mailbox (PMB) as your South Dakota address.

- Consider alternatives, with Florida offering tax advantages and flexible residency requirements.

Background of South Dakota’s tax benefits

South Dakota became a top pick for digital nomads thanks to its tax-friendly environment and straightforward residency rules, making it an ideal choice for those leading a nomadic lifestyle.

The state even has a specific Residency Affidavit form designed to make things easier for nomads, expats, and RVers who are legally based in the state but spend little to no time there.

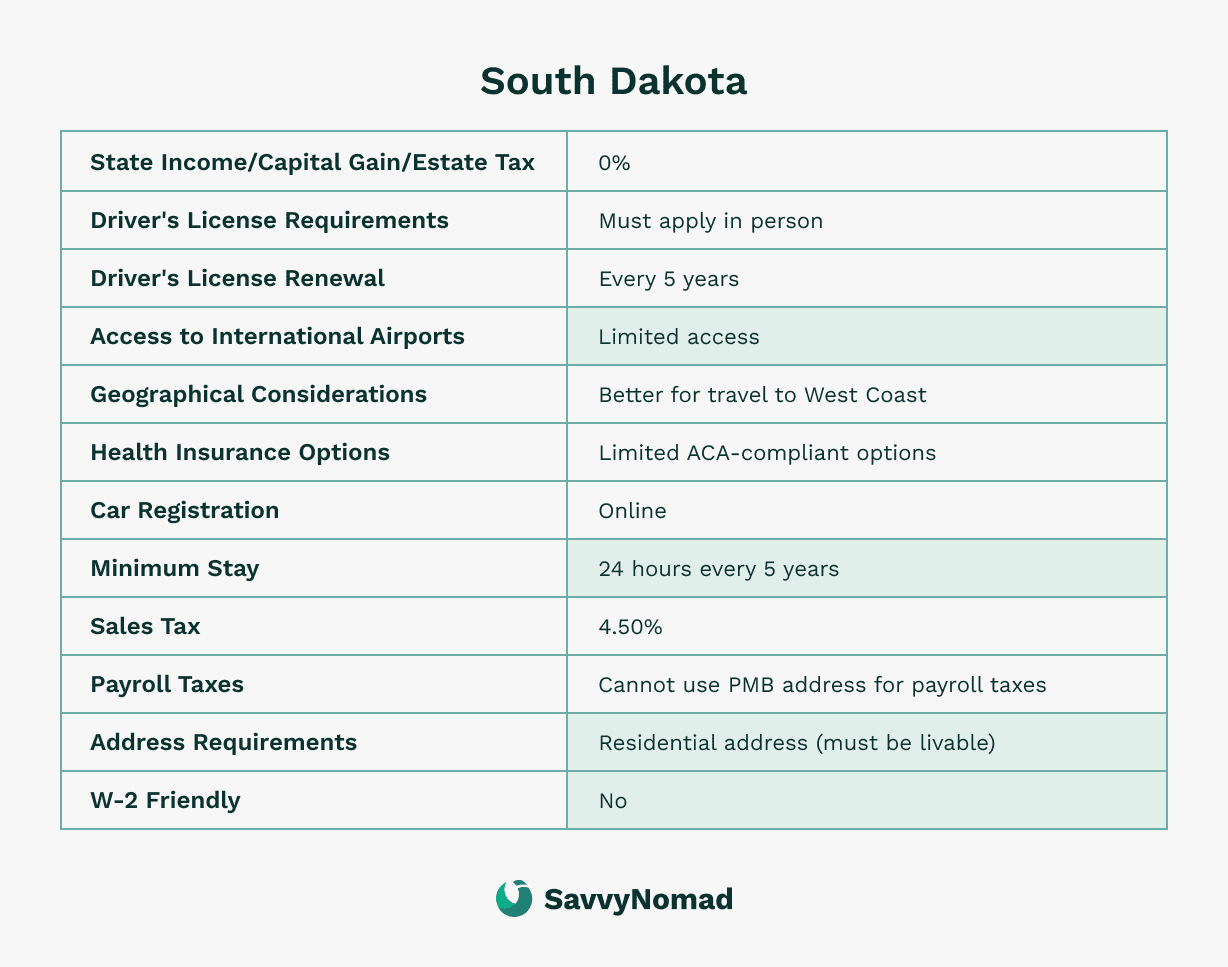

Here's why South Dakota stands out:

- No State Income tax

- No Inheritance or Estate Tax

- Minimal residency requirements (you need only spend one night there every five years to renew your South Dakota driver’s license)

- Easy vehicle registration: you can complete the whole process online and do not need to have your VIN verified in person.

Florida vs South Dakota:

However, be aware of recent policy changes:

- Voting Restrictions: South Dakota has implemented (hotly contested) measures preventing residents without a residential address from voting.

- Payroll Tax Changes: New policies mean personal mailbox addresses can't be used for payroll purposes, potentially affecting nomads, especially those who are W-2 employees.

2023 Domicile changes: overview

Now, let's delve into the changes that have reshaped South Dakota's domicile landscape in 2023, along with the context and reasons behind these big developments.

The Changes

In 2023, South Dakota’s legislature enacted a series of changes with far-reaching implications for digital nomads and expats. Under the new regulations, having a personal mailbox address alone is no longer sufficient to establish a domicile in South Dakota for various purposes, including voting and (sometimes) taxes.

Context and reasons

As South Dakota became an attractive option for remote workers and digital nomads, concerns arose about using personal mailbox addresses, which, while convenient for those on the move, could have unintended consequences. South Dakota is a particularly sparsely populated state. For one, this means that, in some districts, it’s possible for the absentee population (of nomads and RVers) to out-number (and out-vote) long-time residents.

To address these concerns, the state introduced measures to ensure that those claiming residency in South Dakota have a more substantial physical connection to the state. This includes having a lease, rental agreement, or deed to a physical property within South Dakota. In other words, having just a personal mailbox (PMB) is no longer enough, at least if you want to pay taxes and vote in South Dakota.

However, many claims that this change to who can and can’t vote is disenfranchising an entire population and is, therefore, unconstitutional.

In fact, this story has already played out in other states, like Florida, with the eventual victor being the nomads and RVers (this legal precedent is another reason to choose Florida over South Dakota as a nomad).

On top of the barriers to voting, you can no longer use a PMB address for payroll taxes either. The reason behind this one was clear: South Dakota didn’t want nomads and RVers who don’t spend time in the state to collect unemployment benefits from the state. In short, you can no longer pay unemployment taxes using a PMB address or claim unemployment benefits using a PMB.

Instead, payroll taxes (like unemployment tax) should be paid to the state "where the work was performed." In practice, that could mean paying unemployment taxes to dozens of different states if you work while on the move, not to mention work performed overseas. The only thing worse than the nightmare of paying unemployment taxes to so many states may be trying to collect unemployment from many states.

For some small lucky percentage of nomads, if your company has a legitimate presence in South Dakota (e.g., a headquarters), you still may be able to pay your unemployment taxes to South Dakota alone.

In this case as well, many argue that it would be better to simply allow nomads, expats, and RVers to pay unemployment taxes and, therefore, be eligible for unemployment benefits. However, South Dakota solved this whole problem with a blanket policy that disallows these frequent travelers to pay these taxes in the first place.

With all these changes in place, the state is primed to become a legal battleground for some time to come. In the meantime, nomads, expats, and RVers are flocking to states like Florida in droves.

Impact on digital nomads and expats

The changes in South Dakota's domicile rules have left a discernible mark on the digital nomad and expat community. Digital nomads, who thrive on flexibility and mobility, face new challenges in establishing South Dakota as their domicile.

Here's a breakdown of the effects:

- Increased Requirement for Physical Presence: The most significant change is the requirement for a heightened physical presence in South Dakota. Previously, a personal mailbox address sufficed as a residential address for many purposes, but now having a lease, rental agreement, or deed to a physical property within the state is technically required for many of the benefits of residency. This shift challenges the nomadic lifestyle, where individuals frequently move from place to place.

- Impact on Tax Planning: For digital nomads and expats who strategically chose South Dakota for its tax benefits, the new rules mean that they may want to reconsider their choice and may need to revise their tax planning. Establishing and maintaining a physical presence in the state might be at odds with their tax-saving strategies. At minimum, other states may offer the same tax benefits with much less hassle.

- Voting Restrictions: The changes also affect voting rights. Residents without a residential address may find themselves unable to vote in South Dakota. This could be significant for those who value civic participation and having their voice heard in politics. And yes, this includes national elections (e.g., voting for president).

Challenges introduced:

The challenges introduced by these new domicile rules are multifaceted:

- Logistical Challenges: Maintaining a physical address can be logistically challenging for digital nomads who frequently change locations. Finding and managing property in South Dakota might not align with their transient lifestyle. It can also increase the cost from $20-40/month for a PMB to several hundred dollars per month for an apartment they may never use.

- Tax Complexity: The new requirements complicate tax planning. Nomads who once benefited from South Dakota's tax advantages must navigate the fine line between domicile requirements and tax minimization strategies. Taking things literally by the book, this could mean paying unemployment taxes to a dozen states as you travel and work across the continental US.

While these changes are undoubtedly impacting digital nomads and expats, it's important to note that South Dakota is working to strike a balance between maintaining the integrity of its domicile system and accommodating the unique needs of this growing transient demographic.

In the following sections, we will explore potential solutions and alternatives for those affected by these changes and suggest how to adapt to the evolving domicile landscape of South Dakota.

Alternatives and solutions

For those affected by the recent domicile changes in South Dakota, it's time to explore alternatives and find practical solutions to navigate the evolving landscape. Here, we'll discuss how to adapt to and comply with (or entirely avoid) the new domicile rules. Additionally, we'll give Florida a closer look as a potential alternative.

Possible alternatives:

- Florida Domicile: Florida remains a strong alternative for digital nomads and expats seeking a tax-friendly domicile. While Florida has its own set of residency requirements, it may be a more accommodating option for those unable to meet South Dakota's new physical presence criteria.

- Residential Lease in South Dakota: If maintaining a physical presence in South Dakota is essential, consider renting or leasing a property within the state. This could fulfill the new domicile requirements while still allowing flexibility.

Adapting to the new domicile rules:

- Review and Update Documents: Ensure that your legal documents, such as your driver's license, voter registration, and tax filings, accurately reflect your domicile state and residential address.

- Stay Informed: Stay up-to-date with any further changes in domicile rules or requirements in South Dakota. Being informed is key to adapting effectively. There has been tremendous pushback against these new laws and policies, so revision is not out of the question in the coming months or years.

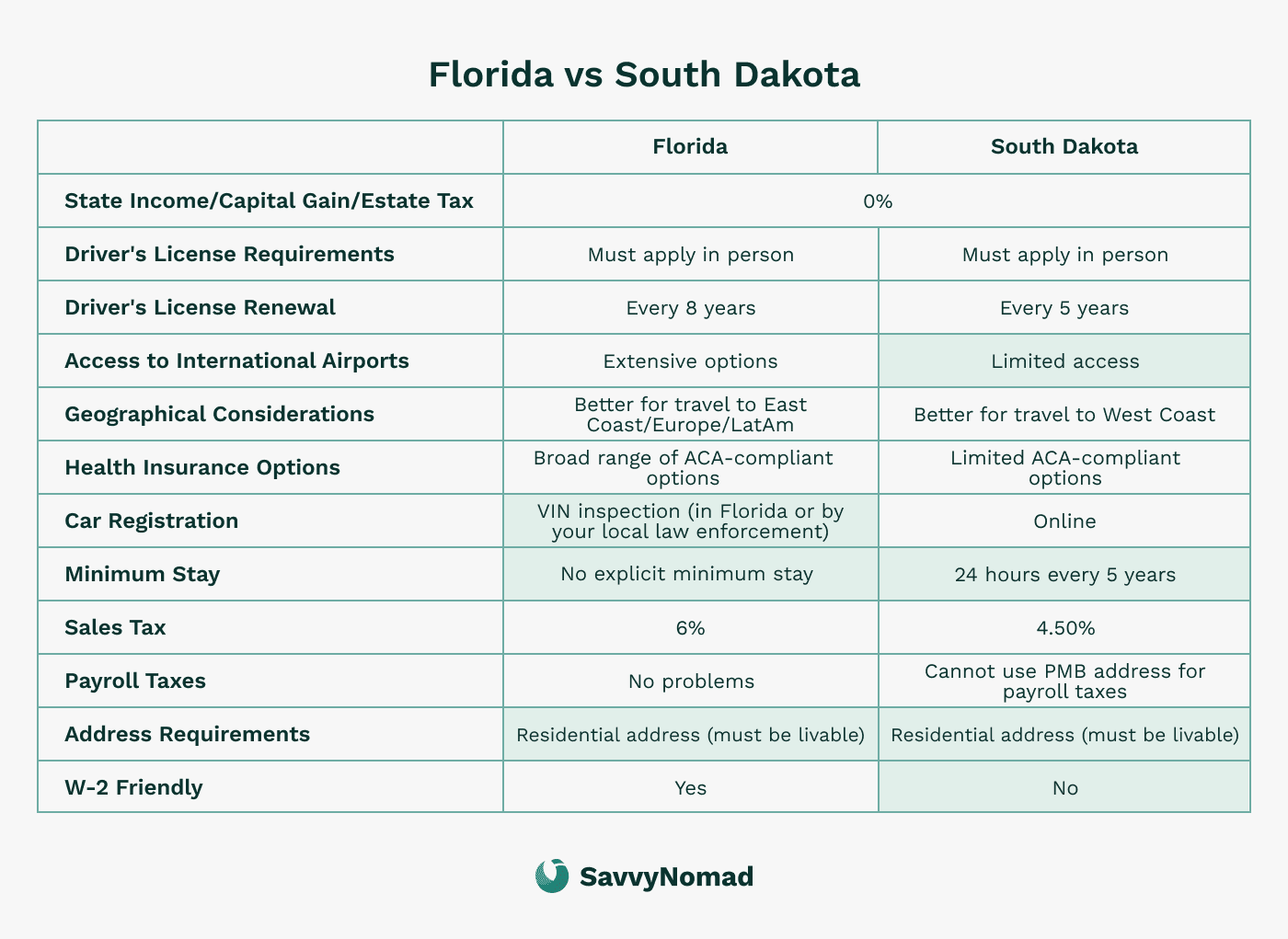

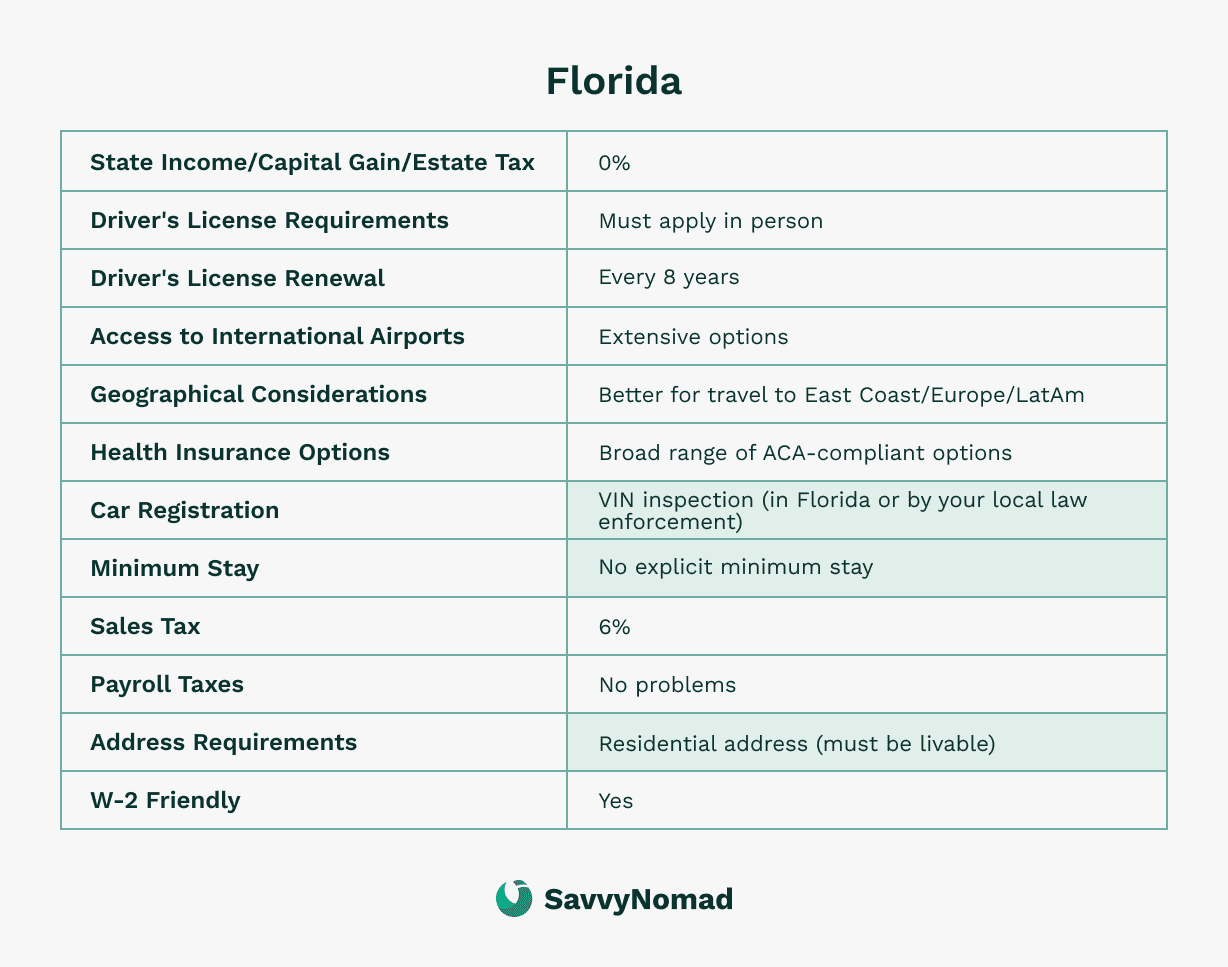

Considering Florida as an alternative

Florida is a compelling alternative to South Dakota for digital nomads and expats.

Some reasons to consider Florida include:

- No State Income Tax: Florida shares South Dakota's advantage of no state income tax.

- Flexibility: Florida's residency requirements may be more flexible for those who cannot meet South Dakota's new physical presence requirements.

- Geographical Convenience: Florida's location offers easy access to major cities and international travel hubs and is much closer to Europe.

- Health Insurance Options: Florida provides many health insurance options.

Conclusion

In summary, the 2023 domicile changes in South Dakota have significant implications for digital nomads and expats.

The key points to remember are:

- South Dakota now requires a stronger physical presence, which may challenge the nomadic lifestyle.

- Tax planning becomes more complex due to these changes.

- Your ability to vote may be affected if you lack a residential address.

Looking ahead, it's essential to adapt and consider alternatives. Florida, with its tax advantages and flexible residency requirements, stands out as a viable option.

In this evolving domicile landscape, staying informed and adaptable is the key to finding the right domicile that aligns with your lifestyle and financial goals.